Japan

Wood Products Prices

Dollar Exchange Rates of 25th

June

2025

Japan Yen 144.40

Reports From Japan

Business sentiment turns negative – first

time in 5

months

A government survey shows that business sentiment at

major Japanese firms has turned negative for the first time

in five quarters. This comes amid concerns about the

impacts of new US tariffs. A negative result indicates that

a majority of companies feel business conditions have

worsened. About 11,000 companies responded to the

quarterly survey by the Finance Ministry and the Cabinet

Office.

The index for manufacturers stood at minus 4.8, marking a

second straight quarter with a negative figure. However

the index is projected to swing to positive territory in the

July to September period as robust demand in the chip

sector and brisk inbound tourism will likely push it up.

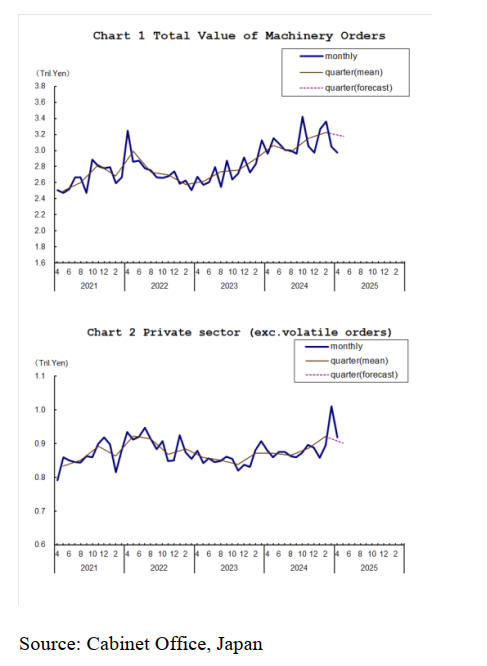

The total value of machinery orders received by top

manufacturers operating in Japan decreased 2.3% in April

from the previous month on a seasonally adjusted basis.

Private-sector machinery orders, excluding those for ships

and those from electric power companies, decreased a

seasonally adjusted by 9.1% in April.

See: https://www3.nhk.or.jp/nhkworld/en/news/20250612_B4/

Japan not in a good position to absorb energy shocks

Japan’s economy is particularly vulnerable to conflicts in

the Middle East and the current crisis comes at a time

when Japan is not in a good position to absorb energy

shocks. According to the Petroleum Association of Japan,

about three-quarters of the country's crude oil imports are

shipped via the Strait of Hormuz and recently Iran

threatened to close the strategic passage.

Yuki Togano, a researcher at the Japan Research Institute,

has been reported as saying “a large portion of crude oil

and gas is transported through this strait, so any disruption

would hinder energy procurement and cause prices to

increase sharply."

Bank of Japan concerned on outlook for the economy

Bank of Japan (BoJ) governor, Kazuo Ueda, has expressed

concern on the outlook for the Japanese economy

following US tariff hikes saying downside risks now

"exceed" upside ones for both growth and prices. At a

press conference after the BoJ ended its recent two-day

meeting Ueda also said the Bank will continue raising

interest rates as needed but added, "overseas trade policies

pose a downside risk."

He warned that the economic impact of tariffs may

intensify later this year, saying the duties on the auto

sector, one of Japan's major exports are likely to affect

how the central bank proceeds with its monetary policy.

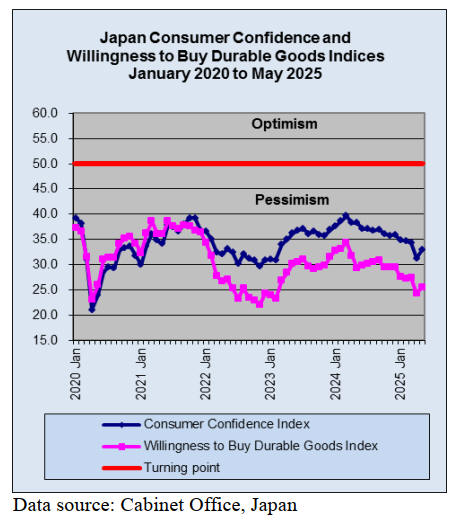

Japan's economy shrank an annualised real 0.2% in the

January-March period, the first contraction in a year,

underscoring that domestic demand was sluggish even

before US tariff threats took full effect.

Core consumer prices, meanwhile, rose 3.5% from the

previous year in April increasing at the fastest pace in

more than two years against a backdrop of rising material

costs and surging rice prices.

See:

https://mainichi.jp/english/articles/20250617/p2g/00m/0bu/0490

00c

New economic policy focused on wages

The Japanese government adopted a policy focused on

wage increases which includes a target of approximately

1% ‘real’ pay growth annually over five years to

encourage consumer spending. Japan's inflation-adjusted

wages have been mostly negative in recent years failed to

keep pace with rising prices, particularly for food and

energy. The result dampened private spending which

accounts for more than half of the country's GDP.

Despite calls from opposition parties for tax cuts to spur

consumption the government aims to support disposable

income through "pay growth rather than tax reductions" in

a bid to avoid a potential decline in state revenues.

See:

https://www.ntv.co.jp/englishnews/articles/2021t12x02i5e64aszil

.html

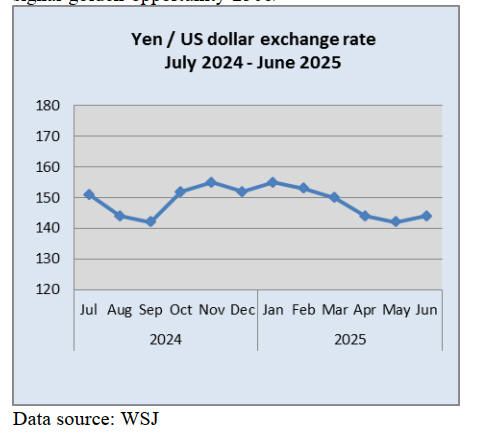

Yen likely to strengthen more

Recent discussion at the Bank of Japan's (BOJ)

highlighted the debate between caution and those pushing

for aggressive rate hikes to combat inflation. If the hawks

prevail then investors will rethink their exposure to yen-

denominated assets. The yen has already surged 8% year-

to-date and is likely to advance further. So far this year

consumer prices grew more than 2% for the first time in

decades and wage growth was positive. The hawks in the

BoJ argue the risk of inflation reversing is small given

rising rent, public service costs and food prices such that

rate normalisation is possible.

See: https://www.ainvest.com/news/yen-turn-japan-rate-hikes-

signal-golden-opportunity-2506/

Property values rising

Japan's real estate market is currently experiencing a

period of growth, with land prices rising and property

values increasing, particularly in urban areas. However,

the market also faces challenges, including a high number

of vacant homes and a shrinking population.

Japan embraces timber for large structures

Wooden architecture in Japan is evolving. Previously used

primarily for low-rise buildings, timber is being used to

construct taller and larger structures. As the country aims

to cut carbon emissions by 60% by 2030 and reach net

zero by 2050, wood is re-emerging as a green alternative

to steel and concrete.

Kengo Kuma used certified wood from all 47 prefectures

in Japan for his iconic National Stadium, the main venue

of the 2020 Tokyo Olympics. This year, another global

event features its own wooden superstructure. The

pavilions of the Expo 2025 in Osaka are surrounded by a

20 metre high ring that is two kilometers in circumference.

Designed by Sou Fujimoto, the ring incorporates wood

from the Fukushima areas hit hardest by the 2011

earthquake, tsunami and nuclear disaster.

In Yokohama, Port Plus is Japan’s first all-timber fire-

resistant high-rise building. The columns are said to be fire

resistant for up to 3 hours. Earthquake resistance is also a

common point of contention for wooden buildings but Port

Plus achieves high seismic performance by incorporating a

earthquake isolation technology.

See: https://metropolisjapan.com/why-wooden-architecture-is-

making-a-comeback-in-japan/

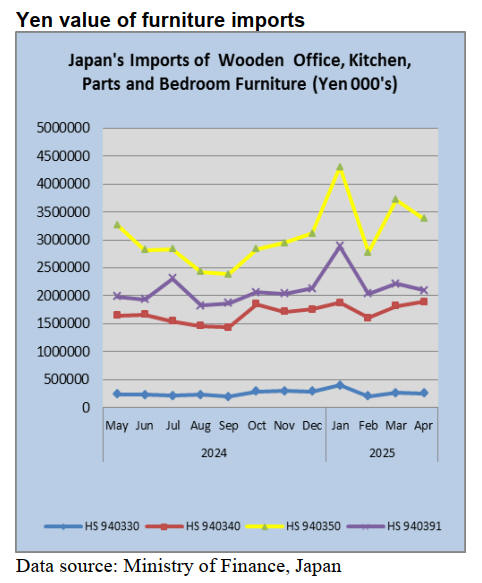

Wooden furniture import update

In Japanese culture there is a long held appreciation of

wooden furniture, valuing its natural beauty,

craftsmanship and connection to nature. This appreciation

is reflected in both traditional and modern Japanese homes

where wooden furniture is often seen as a way to add

‘warmth’, elegance and a sense of harmony to living

spaces. Japanese design philosophy often emphasises

harmony with nature and wood embodies this connection.

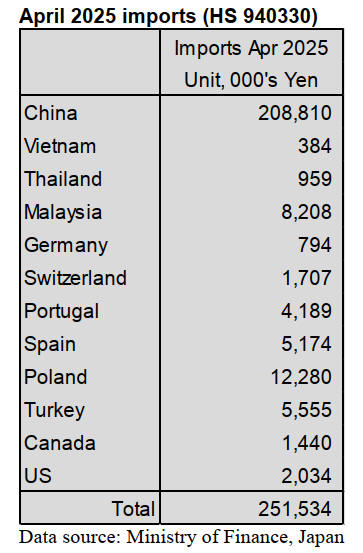

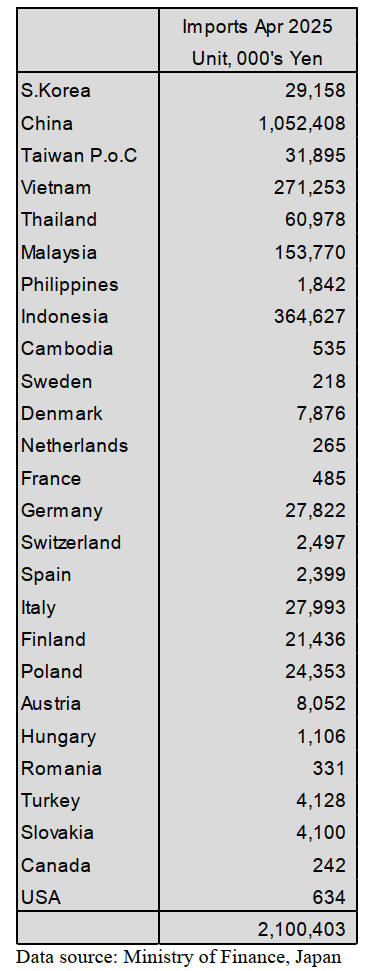

April wooden office furniture imports (HS 940330)

In April shippers in China accounted for 83% of Japan’s

imports of wooden office furniture (HS 940330) the other

two significant sources were Poland (5%, up from a month

earlier) and Malaysia (3%, down from a month earlier).

These three shippers accounted for over 90% of April

arrivals. The other source of wooden office furniture

imports was EU member countries (around 9%) with the

balance coming from Canada and the US.

Year on year, the value of Japan’s imports of wooden

office furniture in April was down 8% and compared to

the value of March arrivals there was little change.

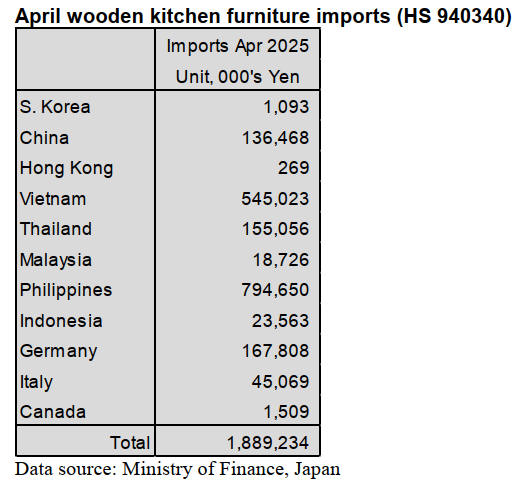

April wooden kitchen furniture imports (HS

940340)

As in previous months imports of wooden kitchen

furniture (HS 940340) were dominated by shippers in the

Philippines and Vietnam which together accounted for

over 70% of the value of April.

Shippers in the Philippines accounted for around 42%% of

total arrivals in April, down from a month earlier. Imports

from shippers in Viet Nam accounted for a further 29%

also down slightly month on month. The other shippers of

note in April were Thailand, China and Germany which

together accounted for around 24% of the value of

HS940340 imports.

April arrivals from China were around 7% higher than

in

March. April shipments of wooden kitchen furniture

surged, lifting Germany to the third highest monthly

shipper. Compared to a year earlier the value of April

2025 imports were up 22%, marking a further increase in

the value of arrivals since February this year.

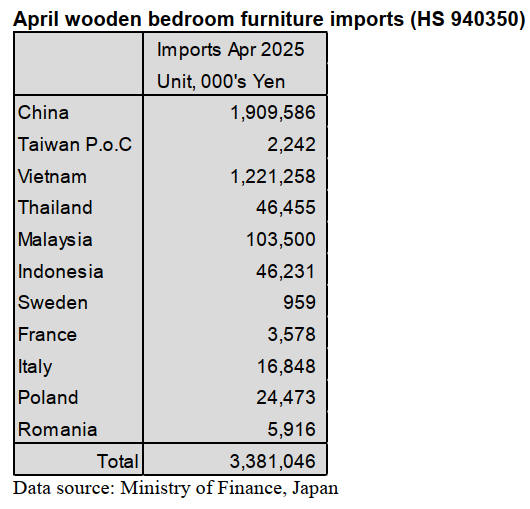

April wooden bedroom furniture imports (HS 940350)

From the start of 2025 the comparative monthly values of

imports of wooden bedroom furniture have been unusually

erratic compared to previous years. The average value of

arrivals of HS 940350 in the first four months of 2025 is

significantly higher than the average for the last four

months of 2024 and was above the average reported in the

first four months of 2024.

The top two shippers of (HS 940350) to Japan in April

2025 were China (56%) and Vietnam (36%), both down

slightly from a month earlier. Malaysia was the other

shippers of note in April accounting for a 3% share of the

value of imports. While the value of April arrivals of HS

940350 were at around the same levels as in April 2024

there was a 9% decline compared to a month earlier.

April wooden furniture parts imports (HS 940391)

After the January surge in the value of wooden furniture

parts (HS 940391) the value of monthly shipments has

steadied.

The value of April 2025 imports was almost the same as in

April 2024 but compared to a month earlier March 2025

the value of imports dropped around 5%.

Shippers in China, Indonesia and Viet Nam accounted for

most of Japan’s imports of wooden furniture parts (HS

940391) in April 2025.

Of the total value of HS 940391 imports 50% was

delivered from China (48% in March) 17% from Indonesia

(unchanged from March), 13% from Viet Nam 11% in

March) and Malaysia which captured a 7% share of the

value of April imports.

The value of imports of HS 940391 from Italy dropped

further in April. In contrast, shippers in Finalnd, Poland

and Austria shipped more in April than seen over the past

months.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Exports of Japanese cedar structural lumber

The Japan Wood Products Export Association announced

on May 22, 2025 that the American Lumber Standard

Committee (ALSC) approved the design strength of

Japanese cedar 2×4 structural lumber on April 3, 2025.

This marks the second approval, following the

certification of Japanese cypress in April last year. The

groundwork for exporting key domestic lumber products

to the U.S. market is steadily advancing.

Japan has adopted a policy to strengthen export promotion

for agricultural, forestry, and fishery products. In the

forestry sector, it is laying the groundwork for exporting

value-added products such as fencing materials, decking

materials, and structural lumber for buildings, alongside

other key wood products.

The Forestry Agency and the Ministry of Agriculture,

Forestry, and Fisheries launched multiple subsidy

programs in fiscal year 2021. The Japan Wood Products

Export Association served as the application window,

leading to the selection of projects such as strength testing

for Japanese cedar and cypress structural lumber.

Sumitomo Forestry to begin producing SAF feedstock

Sumitomo Forestry Co., Ltd. in Tokyo Prefecture and

Rengo Co., Ltd. in Osaka Prefecture plan to establish a

joint venture by December to produce bioethanol, a

feedstock for sustainable aviation fuel (SAF), using wood

scraps and other construction waste.

The joint venture aims to establish mass production

technology early, targeting an annual commercial

production of 20,000 kiloliters of wood-based bioethanol

by 2027.

The two companies have signed a basic agreement on

business and capital partnership for the bioethanol project

and will continue discussions. However, details of the

joint venture have not yet been disclosed.

The production of bioethanol will utilize technology from

Biomaterial in Tokyo Co., Ltd. in Fukuoka Prefecture, a

subsidiary of Rengo specializing in research and

development of biomass-based chemical products.

The bioethanol production facility will be constructed

within the premises of Taiko Paper MFG Ltd. in Shizuoka

Prefecture, a subsidiary of Rengo that specializes in

packaging paper production and recycling.

Sumitomo Forestry will collect construction waste from its

housing construction sites in Shizuoka Prefecture and

nearby regions and supply CORSIA-certified waste chips

to Taiko Paper MFG.

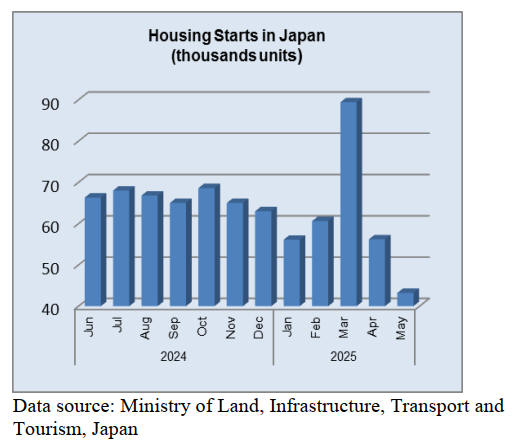

Plywood

Domestic softwood plywood lacks strong market

movement, particularly through the lumber and

construction channels, while demand from precutting

plants remains stable.

The rush of orders before the implementation of

revised

building regulations in April led to an increase in housing

starts in March, contributing to a rise in orders at precut

factories.

The price of 12 mm 3 x 6 domestic softwood structural

plywood increased slightly in May in the Tokyo

metropolitan area rising to ¥1,080– 1,100 per sheet,

delivered to wholesalers, up ¥10–20 from the previous

month.

Major domestic plywood manufacturers argue that

production remains unprofitable and have announced

plans for another ¥50 increase in June.

Imported South Sea plywood saw a decline in shipments

to the Kanto region in May, but the market has yet to

experience extreme shortages. Despite the strengthening

yen, ongoing price increases in Malaysia— particularly for

12mm plywood— indicate a potential for further price

hikes. The price of 12 mm 3 x 6 painted formwork

plywood is ¥1,850 per sheet delivered to wholesalers.

Standard formwork plywood is ¥1,550 per sheet.

Structural plywood is ¥1,550 per sheet. 2.5 mm plywood

is ¥780 per sheet. 4mm plywood is ¥930 per sheet, and

5.5mm plywood is ¥1,100 per sheet.

Malaysian plywood manufacturers in Sarawak continue to

push for higher prices due to rising log costs, increased

minimum wages, and a stronger local currency.

Some contracts in May saw a price increase of US$10 per

cubic metre (C&F).

Meanwhile, in Indonesia, shortages in falcata and natural

wood logs are driving calls for price hikes, though the

current price levels remain stable. 12 mm 3 x 6 painted

formwork plywood is US$590–US$600 per cbm, C&F.

Standard formwork plywood is US$500-510. Structural

plywood is US$510–520. 2.4 mm plywood is US$970.

3.7mm plywood is US$880, and 5.2mm plywood is

US$850, with some lower prices observed.

|