|

1.

CENTRAL AND WEST AFRICA

Cameroon

Unseasonal heavy rains have swept across Cameroon far

earlier than expected triggering widespread transport

delays. Travel restrictions on key laterite roads are slowing

truck movements creating log and sawnwood stockpiles at

mills, an unwelcome burden in already sluggish markets.

The Chinese market remains a challenge say producers.

Duties on African timbers have reportedly been removed

but exporters report no surge in orders and business

sentiment is low. Only high‐value species such as Azobé,

Ovangkol and Okan continue to keep a handful of mills

running buoyed by modest enquiries from Europe and the

Middle East.

Douala Port is said to be severely backlogged with ships

waiting sometimes a week to berth and with this comes

substantial demurrage charges. Opeations at Kribi Port are

said to be steady but Kribi handles a smaller volume than

Douala. Containers remain available but shipping delays

are squeezing export timelines.

Gabon

Unverified reports say Gabon’s industry association,

UFIGA, has lodged a request with both the Forestry and

Transport ministries to address inadequate rail wagon

allocations for wood product transport. Priority remains

with manganese shipments, forcing sawmills to contend

with severe backlogs.

With unexpected rains now extending into northern

provinces, laterite road repairs remain on hold. A round

trip from Makokou or Okondja to Libreville can now take

up to a week, leading many truckers to refuse to haul and

mills to amass timber stocks.

Producers say market demand remains muted with the

exception of Azobé shipments to the Netherlands,

Ovangkol and Béli to China and Okoumé to the

Philippines. Padouk exports to Belgium ‘limp’ along

under CITES‐related documentation delays.

Following government intervention, SEEG’s power cuts

have ceased entirely. In mid month the Ministry

summoned SEEG’s board and mandated the final

installations on the two Turkish powerships. Since then,

Libreville has enjoyed uninterrupted electricity service.

Republic of Congo

Southern Congo has entered its dry season, though

northern areas under Cameroon’s rain belt still experience

intermittent showers. Harvesting remains constrained by

low international demand and veneer mills, bound by

long‐standing contracts, operate on a single shift.

Transport to Pointe-Noire via the Maloukou corridor is

unchanged. River transport operations feed rail or road

movement of timber with no new disruptions reported.

Port operations at Pointe-Noire continue smoothly despite

occasional vessel backlogs.

Timber exports are steady but limited by existing quotas

and CITES restrictions. Overall production and shipments

remain subdued in line with the broader market downturn.

The latest edition of the Republic of Congo's APV-FLEGT

newsletter (January-February-March 2025) focuses on the

issue of supplying the local market with timber,

highlighting the launch of the Private Sector Support

Project – Domestic Timber Market (ASP MIB Congo).

The aim is to strengthen the structure, competitiveness and

sustainability of the domestic timber sector in the Republic

of Congo. It is part of a drive to formalise a sector that has

remained informal for too long, despite its important

economic role.

ATIBT reports that in the editorial of the newsletter, the

National FLEGT Focal Point, Théophile Ntiakoulou

Loulébo, emphasises that this project responds to a long-

standing concern of the Congolese government, identified

in particular in the 2020 Forest Code, to improve the

supply of processed wood for the domestic market and to

better regulate artisanal practices.

See: https://apvflegtcongo.com/

and

https://www.atibt.org/en/news/13655/the-domestic-timber-

market-mib-project-featured-in-the-republic-of-congo-apv-flegt-

newsletter

Central African Republic

The correspondent reports only six timber operators

remain active in the Central African Republic. They are

trucking high-value redwood logs overland to Bertoua,

Cameroon and onward (1,200 km) to Douala for export.

ATIBT has reported on the joint initiative of the African

Forest Forum (AFF) and the Center for Development and

Environment (CDE) at the University of Bern

themed: “The AfCFTA and intra-African timber trade for

inclusive green growth.” a collaborative online event from

30 June 30 to 11 July 11 2025.

Stakeholders from across Africa will have the opportunity

to explore the intersection of the African Continental Free

Trade Area (AfCFTA), intra-African timber trade and

green growth strategies. The discussions aim to strengthen

collaboration and policy alignment in support of

sustainable and inclusive development across the

continent.

See: https://www.atibt.org/en/news/13652/community-of-

practice-afcfta-and-intra-african-timber-trade-a-collaborative-

online-event-from-june-30-to-july-11-2025

and

https://afforum.org/events/community-practice-afcftas-role-

promoting-sustainable-intra-african-timber-trade-inclusive

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in the Republic of Congo and Gabon.

See: https://www.itto-

ggsc.org/static/upload/file/20250616/1750055807148798.pdf

2.

GHANA

Billet exports double, India accounts for most

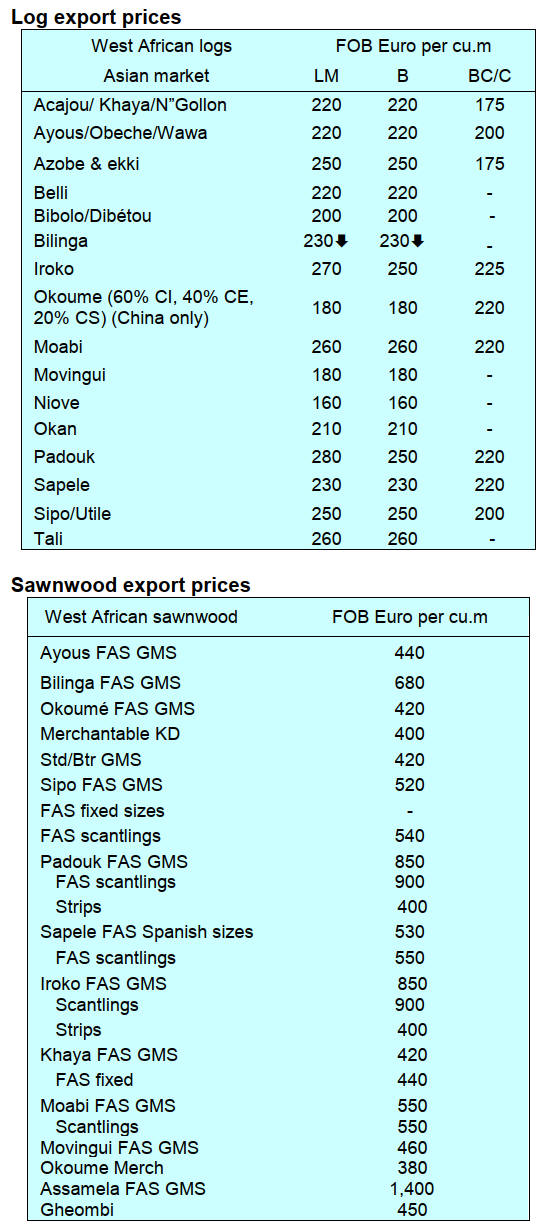

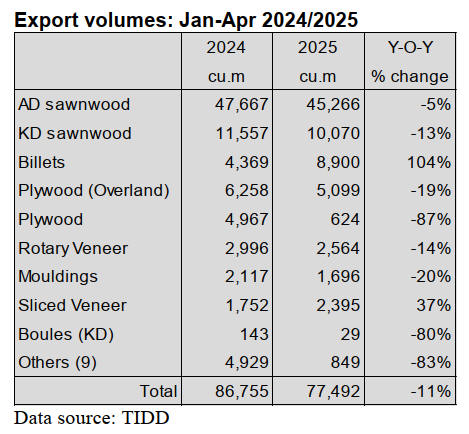

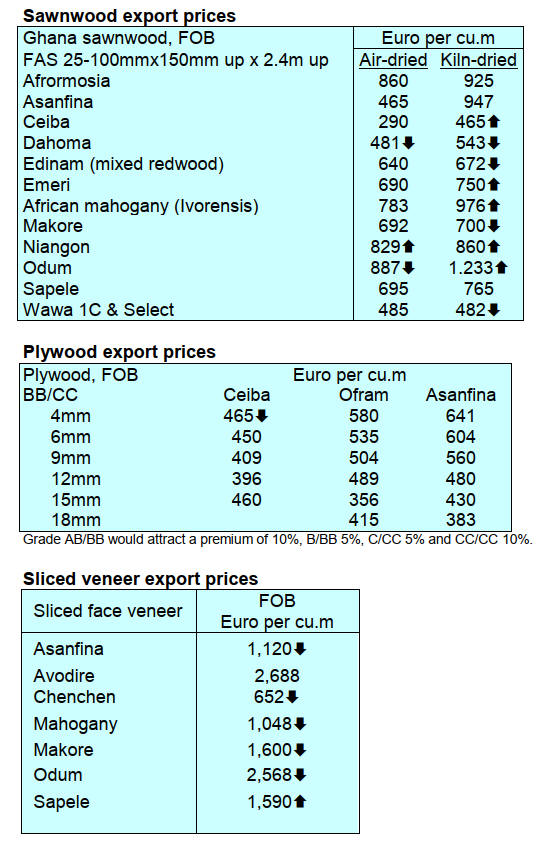

The Timber Industry Development Division (TIDD) of the

Forestry Commission (FC) report for the first four month

of this year showed that Ghana’s timber and wood product

exports for the period were 47,492 cu.m. and earned

Eur86.76 million.

A total of eighteen different wood products contributed to

exports. The table below shows product details for the first

four months of 2025 compared to the same period in 2024.

Exports of billet accounted for 12% (8,900 cu.m) of the

total export volume for the period against 5% (4,369 cu.m)

recorded in 2024 representing a doubling of export

volumes.

Billet exports along with air-dried sawnwood (58%), kiln

dried sawnwood (13%), plywood to the regional market

(6%) and rotary veneer (3%) accounted for 92% of the

total export volume for 2025 (77,492 cu.m). For the same

products last year, the volume was 86,755 cu.m.

Revenue from the country’s wood product exports for the

four-months period totalled Eur36.49 million. The table

below shows the breakdown of products receipts with

billets recording a significant increase of 107% to Eur2.72

million.

In 2025 India accounted for a significant 8,854 cu.m of the

total Billet export volume with Barbados accounting for

46 cu.m. The major species for billet were teak and

gmelina accounting for 86% and 14% respectively. The

average unit price of billets registered an almost 2%

increase from Eur301/cu.m in January-April 2024 to

Eur306/cu.m in the same period of 2025.

Ghana-China Business Summit 2025

A Ghana-China Business Summit 2025 was held in Accra

bringing together over 90 Chinese investors and key

stakeholders to explore opportunities for industrial growth

and partnerships between the two nations. The Association

of Ghana Industries (AGI) was in attendance with key

executives including Dr. James Asare-Adjei, past

president of AGI and Mr. Eric K. Defor, Chairman of the

AGI Construction Sector.

During the summit, the government’s Chief of Staff,

Julius Debrah assured Chinese participants that Ghana

welcomes supports and will assist in establishing

manufacturing plants.

AGI members who participated in the event engaged

directly with Chinese investors on opportunities in

pharmaceuticals, real estate, agribusiness and

manufacturing exploring potential collaborations and joint

ventures.

With bilateral trade between Ghana and China exceeding

US$9.5 billion in 2024, the summit aimed to catalyse joint

ventures, market expansion strategies and knowledge

transfer initiatives positioning Ghana as a strategic entry

point for Chinese investment into West Africa.

See: https://agighana.org/ghana-china-business-summit-2025-

opens-with-strong-calls-for-collaboration-and-industrial-

transformation/

Tree nursery to produce indigenous seedlings

The biggest indigenous tree nursery facility in Africa has

been inaugurated at Bassengele, a farming community in

Bibiani Anhwiaso- Bekwai Municipality in the Western

North Region of Ghana.

The facility, which has the capacity to produce 5 million

indigenous seedlings annually, features a cutting-edge

irrigation system with almost half a million dollars’ worth

of investment committed. Among the indigenous

commercial tree species targeted are mahogany, wawa,

amire and odum.

The company, in partnership with the Forestry

Commission as part of its long-term commitment, hopes to

restore 2,000 hectares of degraded land this year, with 350

hectares expected to be restored in June 2025 as part of the

Tree for Life initiative championed by President John

Dramani Mahama.

See: https://fcghana.org/fc-ce-lauds-rainforest-builder-ghana-for-

inaugurating-africas-largest-native-tree-species-nursery/

Seaports to run 24-hour service

Ghana’s ports of Takoradi and Tema are soon to

implement a 24-hours service following President John

Dramani Mahama’s initiative of a broader national

strategy to stimulate economic activity through continuous

production and trade.

The announcement comes ahead of the official rollout of

the country’s 24-hour economy policy. The President

described the policy as a “game-changing strategy” aimed

at unlocking Ghana’s economic potential, particularly in

export-oriented sectors.

Ghana’s wood product exports by sea go through both the

Takoradi and Tema Ports where the TIDD has offices for

the final inspection of these wood products.

See: https://thebftonline.com/2025/06/12/mahama-declares-july-

1-start-for-24-hour-economy/

Ghana’s intra-Africa exports reached US$4.8 bil. in

2024

Ghana accounted for nearly 6% of the intra-African trade

in 2024 solidifying its position as one of the continent’s

top trading economies. This was revealed in the 2024

Africa Trade Report released on the sidelines of the 32nd

Afreximbank Annual Meetings in Abuja, Nigeria.

The figure represents a marginal increase over Ghana’s

share in 2023 and includes both exports and imports with

other African countries. According to the report, Ghana’s

total exports to Africa reachedUS$4.8 billion in 2024, up

from US$3.5 billion the previous year.

Ghana’s wood product exports to African countries

accounts for around 10% of the total export volume. This

places Africa at the third largest market destination after

Asia and Europe. Of the total volume exported to Africa,

more than 70% goes to the regional ECOWAS (Economic

Community of West Africa States) markets.

See: https://media.afreximbank.com/afrexim/African-Trade-

Report_2024.pdf/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Ghana.

See: https://www.itto-

ggsc.org/static/upload/file/20250616/1750055807148798.pdf

3. MALAYSIA

Uncertain times ahead

Malaysia’s trade performance is expected to remain steady

in the near term supported by exports ahead of potential

US tariff hikes and continued diversification in export

markets. Economists caution on the outlook for the second

half of the financial year 2025.

Bank Muamalat Malaysia Chief Economist, Afzanizam

Abdul Rashid, is reported as saying Malaysia’s trade

remained robust in May building on April’s strong

momentum. In April total trade rose 18.2% year-on year

with both exports and imports posting strong double-digit

increases for the month. Exports expanded by 16% and

imports were up by 20%.

Afzanizam noted that the 90-day pause in US tariff hikes

had led to front-loading behaviour among Malaysian

exporters.

The sharp surge in exports to the US (up 46% YoY in

April) and Taiwan P.o.C (up 45%) suggests strategic

acceleration of shipments ahead of potential trade policy

changes.

See: https://www.thestar.com.my/business/business-

news/2025/06/20/uncertainty-to-cloud-2h25-trade-

performance#goog_rewarded

Could timber exports may gain a competitive edge in

the US?

Malaysia’s timber exports may gain a competitive edge in

the US market due to higher tariffs imposed on regional

rivals such as Vie Nam and Indonesia. Viet Nam, a

leading furniture exporter in the region faces tariffs as high

as 46% compared with Malaysia’s levy of 24% according

to Wan Tarmeze, Director of Forest Products Division,

Forest Research Institute Malaysia (FRIM).

The US is the largest buyer of Malaysian furniture

accounting for over half of furniture exports. The tariffs

announced inApril have been paused for 90 days until

early July and may be paused further.

On the challenges faced by the timber industry Wan

Tarmeze said Malaysia’s furniture sector primarily relies

on processed wood rather than solid timber, with wood-

based materials accounting for up to 85% of inputs in the

furniture/ industry.

When asked how Malaysia can position itself as a high-

value timber exporter rather than a volume exporter, he

said the shift ultimately depends on the industry “This has

been a long-standing conversation as Malaysia is still

heavily reliant on the original equipment manufacturer

(OEM) model, manufacturing wood products for others

without having its own strong, internationally recognised

brands.

OEM refers to manufacturing products for other brands,

whereas original brand manufacturers (OBM) involve

developing and marketing products under one’s own brand

name. Wan Tarmeze said that despite the government’s

repeated calls for the industry to move from being OEMs

to OBMs, the shift has yet to happen.

See:

http://theborneopost.pressreader.com/article/282149297287449

Tawau Port congestion

Sabah Timber Industries Association (STIA) has called for

an assurance from the Sabah State government that it will

address the Tawau Port congestion that began in April.

STIA President, Tan Peng Juan, said STIA members,

especially exporters, are demanding proactive steps and

backup plans to resolve existing issues at the port to

prevent future recurrences of port congestion.

Tan had likened the recent Tawau Port congestion incident

to a ‘time bomb’ as the same problem could happen when

one of the port’s two cranes break down again.

On 10 May it was reported that a total of 200 containers

with wood products were stranded at the Tawau Port due

operational problems. STIA members faced shipment

delays, incurred demurrage fees and extra container rental

costs. The delays for over a month had significantly

affected logistics efficiency which caused setbacks for

businesses reliant on timely cargo processing.

See: https://www.dailyexpress.com.my/news/260704/no-tawau-

port-repeat-please/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Malaysia.

See: https://www.itto-

ggsc.org/static/upload/file/20250616/1750055807148798.pdf

4.

INDONESIA

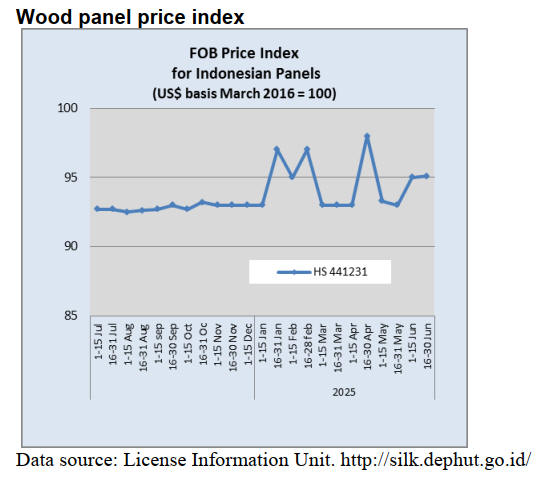

Anti-dumping/subsidy investigation on

plywood

The Ministry of Trade (Kemendag) is fully supporting

Indonesian businesses facing anti-dumping and anti-

subsidy investigations by the US Department of

Commerce regarding hardwood and decorative plywood

exports. Kemendag will assist Indonesian entrepreneurs in

preparing their defence and completing questionnaires.

Around one-third of Indonesia's hardwood and decorative

plywood production is exported to the US.

See: https://www.antaranews.com/berita/4905025/kemendag-

bela-pelaku-usaha-ri-hadapi-penyelidikan-kayu-lapis-di-as

and

https://www.trade.gov/commerce-initiates-antidumping-duty-

and-countervailing-duty-investigations-hardwood-and-decorative

Premier woodworking and furniture for Jakarta

For the first time major international trade fairs; Interzum

Jakarta, IHFI and IFMAC/WOODMAC will be held

concurrently in Jakarta at JIExpo Kemayoran 24-27

September.

This collaborative effort aims to create a comprehensive

platform for the entire woodworking and furniture industry

value chain. The goal is to foster a connected and mutually

reinforcing industrial ecosystem, facilitating cross-sector

collaboration from raw materials and technology providers

to component suppliers and interior design solutions.

See: https://wartaekonomi.co.id/read571342/southeast-asias-

premier-woodworking-furniture-manufacturing-industry-hub-

akan-digelar-di-jakarta

Industry needs machinery upgrades

To raise the quality and competitiveness of Indonesia's

furniture and wood products machinery upgrades are

crucial. Jimmy Chandra, Deputy Chairman for R&D and

Regulations at the Indonesian Sawmill and Woodworking

Association, emphasised that investing in advanced

machines and technologies is the only way to achieve

efficiency and improve product quality.

Chandra also stressed the importance of Indonesian

industry players not just hosting exhibitions but also

actively participating in international events. He urged the

Indonesian government to provide subsidies or support for

local companies to showcase their products on the global

stage similar to the support provided by some other

countries.

He added Indonesian wood product manufacturers are

urging the government to lower import duties on

production machines. According to Chandra the industry

faces challenges due to limited technological utilisation

while other countries are using more efficient, modern

machinery.

Chandra specifically requested a 20% reduction on import

duties for the latest generation of production machines. He

stressed that modernising production machinery is

essential for the woodworking industry to be more

competitive in international markets.

See: https://www.medcom.id/ekonomi/bisnis/GNGz86xK-

pelaku-industri-furnitur-membutuhkan-pembaruan-mesin

and

https://www.tribunnews.com/bisnis/2025/06/19/pemerintah-

perlu-turunkan-bea-masuk-mesin-produksi-untuk-genjot-daya-

saing-industri-kayu-olahan.

Ministry acknowledges Indowood Expo 2025 a boost

for exports

The Ministry of Industry has praised the Indonesia

Forestry and Woodworking Machinery Expo (Indowood

Expo) 2025 as a vital initiative to bolster national wood

industry exports and drive innovation.

Putu Juli Ardika, Director General of Agro Industry at the

Ministry of Industry, said that the Expo provides an

important platform for the development of Indonesia's

woodworking machinery and equipment industry as well

as the expansion of the domestic furniture market.

Ardika also pointed to a rising Industrial Confidence Index

(IKI) which hit 52.11 in May 2025 underscoring the need

for continuous efforts to sustain and improve export

performance. He concluded that the Indowood Expo is

a strategic platform crucial for supporting the growth of

Indonesia's wood industry.

See: https://jatim.antaranews.com/berita/935261/kamenperin-

apresiasi-penyelenggaraan-indowood-expo-2025

and

https://www.jawapos.com/ekonomi/016164492/nilai-ekspor-

produk-kayu-indonesia-tembus-usd-32-miliar-indowood-expo-

2025-dorong-industri-perkayuan-naik-kelas

Increased scrutiny of permits amid mining concerns

The Indonesian Ministry of Forestry is increasing its

oversight of forest area use permit (PPKH) holders,

particularly in light of heightened environmental concerns

surrounding mining activities in Raja Ampat, Southwest

Papua. Director General of Law Enforcement, Dwi

Januanto Nugroho, emphasised the need to improve

supervisory business processes for issued permits.

The recent public outcry over nickel mining in the

ecologically vital Raja Ampat islands presents an

opportunity for the ministry to ensure good governance.

See: https://en.antaranews.com/news/359097/ri-govt-bolsters-

scrutiny-of-forest-area-use-permit-holders

Indonesia champions indigenous rights

Indonesia is a strong advocate for indigenous peoples'

rights in the context of climate change actively

participating in the Facilitative Working Group on Local

Communities and Indigenous Peoples Platform (FWG

LCIPP).

Yuli Prasetyo Nugroho, from the Ministry of Forestry,

highlighted Indonesia's consistent engagement with FWG

LCIPP since its inception. Recently, Indonesia showcased

its Customary Forest Programme in Germany detailing

achievements since 2016. This programme involves 156

Indigenous Law Communities managing 332,505 hectares

of customary forests across 19 provinces and 41

districts/cities.

During the LCIPP Annual Dialogue, Indonesia

underscored the profound connection of its indigenous

peoples (Masyarakat Hukum Adat) to natural resources.

The Ministry emphasised the crucial role of customary

forests in both local development and broader climate

change initiatives, recognising that these communities

maintain their identity and contribute significantly to

forest management despite evolving socio-economic

landscapes.

See: https://en.antaranews.com/amp/news/360993/indonesia-

advocates-indigenous-communities-progress-at-fwg-lcipp

SFM and digitalisation cooperation with Finland

The Papua Provincial Administration recently met

with Finnish Ambassador to Indonesia, Jukka-Pekka

Kaihilahti, to discuss potential cooperation on SFM and

digitalisation.

Ambassador Kaihilahti highlighted Finland's strong

emphasis on environmental sustainability and expressed

hope that collaboration in these areas could be realised in

Papua. He reiterated Finland's commitment to

strengthening ties with Indonesia, particularly in

telecommunications, forestry and digitalisation, which are

also priorities for Papua.

Acting Regional Secretary of Papua, Suzana D. Wanggai,

welcomed Finland's interest especially concerning

environmental preservation, digitalisation and approaches

that respect indigenous values.

See: https://en.antaranews.com/news/360717/papua-explores-

cooperation-in-forest-management-with-finland

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Indonesia.

See:https://www.itto-

ggsc.org/static/upload/file/20250616/1750055807148798.pdf

5.

MYANMAR

6.

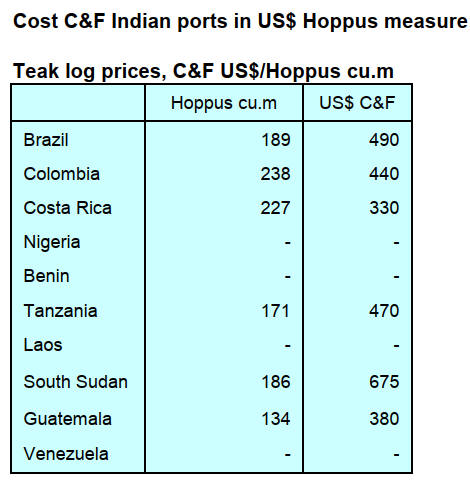

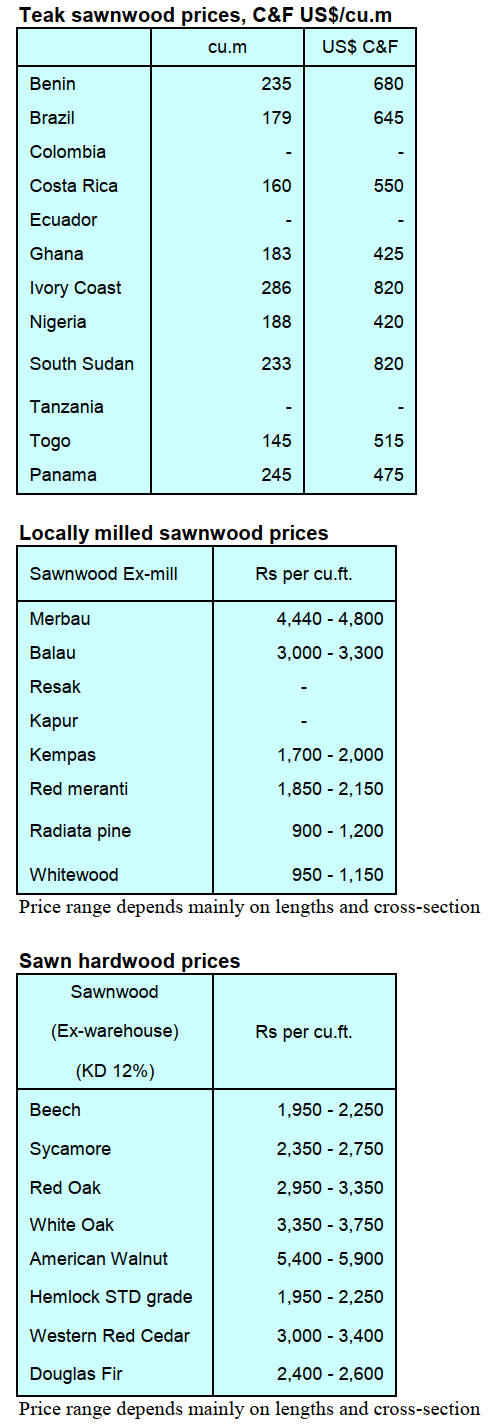

INDIA

Manufacturing emerging as

attractive sector for

investors

In a special report, S&P Global says India’s manufacturing

sector is emerging as an increasingly attractive destination

for investors as the country makes progress in

competitiveness and is making its manufacturing sector

more attractive to global investors.

The report also highlights that over the past three decades

its core sectors, manufacturing, agriculture and services

have grown in step with demographic shifts and structural

changes and will see demand grow as the economy

advances. The latest report from S&P Global comes after

India’s manufacturing sector expanded at its fastest pace

in 10 months in April, driven by strong demand and a

sharp rise in output.

“An analysis of S&P Global Market Intelligence’s index

over time indicates that India has made notable progress in

enhancing its competitiveness and making its

manufacturing sector more attractive to investors” the

report said.

See: https://www.spglobal.com/en/research-insights/special-

reports/india-forward/india-manufacturing-opportunity-amid-

global-trade-uncertainty

New Zealand trade mission

New Zealand’s Minister of Forestry, Todd McClay,

revealed that reciprocal trade missions with India this year

are expected to promote New Zealand's forestry systems

and sustainable management practices.

He added "the outbound mission is aimed at strengthening

trade links, deepening industry ties and unlocking greater

value for both countries” New Zealand's wood exports to

India surged from US$9.5 million in 2023 and are forecast

to reach US$76 million this year.

See: https://www.rnz.co.nz/news/indonz/564363/todd-mcclay-

unveils-two-way-forestry-trade-missions-with-india

Outdated property Registration Act to be replaced -

will drive sector growth

The Central Government has introduced a draft

Registration Bill, 2025, a long anticipated development in

India’s property registration framework. Replacing the

outdated Registration Act of 1908, this bill aims to bring

clarity, efficiency and transparency to real estate

transactions through digitilisation and legal reforms.

The Registration Bill 2025, says the press, has the

potential to make transactions regarding the Indian real

estate sector, faster, secure and more transparent. In

addition, it is claimed the Bill lays the groundwork for

deeper investment and innovation in Indian real estate.

The most exciting part is the vision of interconnected

digital property registers linking registration data with land

records, municipal databases and financial institutions

which will assist developers.

See: https://housing.com/news/centre-releases-draft-of-the-

registration-bill-to-overhaul-property-registration/

7.

VIETNAM

Wood and Wood Product (W&WP) trade

highlights

According to the Viet Nam Customs Department W&WP

exports in May 2025 reached US$1.4 billion, down 2.5%

compared to April 2025, but up 5% compared to May

2024. WP exports accounted for US$995.5 million, up 2%

compared to April 2025 and up 13% compared to May

2024.

In the first 5 months of 2025 W&WP exports totalled

US$6.8 billion, up 9% over the same period in 2024. WP

exports alone fetched US$4.7 billion, up 10% over the

same period in 2024.

W&WP exports to China in May 2025 valued at US$137.7

million, down 36% over the same period in 2024. In the

first 5 months of 2025 W&WP exports to China stood at

US$707.3 million, down 20% over the same period in

2024.

In May 2025 exports of kitchen furniture earned US$121

million, up 2% compared to May 2024. In the first 5

months of 2025 exports of kitchen furniture brought in

about US$545 million, up 3% over the same period in

2024.

In May 2025 W&WP imports to Viet Nam amounted to

US$301 million, up 22% compared to April 2025 and up

16% compared to May 2024. In the first 5 months of 2025,

Viet Nam spent US$1.2 billion for W&WP imports, up

18% over the same period in 2024.

Viet Nam's pine imports in May 2025 were 100,300 cu.m,

worth US$21.1 million, up 20% in volume and 22% in

value compared to April 2025 and an increase of 18% in

volume and an increase of 13% in value compared to May

2024. In the first 5 months of 2025, imports of pine stood

at 367,500 cu.m, worth US$76.1 million, up 16% in

volume and 10% in value over the same period in 2024.

Viet Nam’s imports of raw wood (logs and sawnwood)

from ASEAN countries in May 2025 reached 79,000 cu.m,

with a value of US$22.5 million, up 5% in volume and 6%

in value compared to April 2025 bringing the total volume

of raw wood imported from ASEAN countries in the first

5 months of 2025 to 361,880 cu.m, with a value of

US$101.86 million, down 7% in volume and down 6% in

value over the same period in 2024.

Viet Nam/US promote sustainable timber trade and

legal supply chains

The US remains Viet Nam’s largest market and accounted

for 55% of the country's total wood product exports in

2024. Key products included wooden furniture, plywood,

doors and handicrafts.

Enterprises and associations in the timber industry have

emphasised the need to increase imports of US legal

timber for processing and re-export as a way to ensure

sustainable timber trade and legal supply chains.

Speaking at a workshop on Viet Nam/US timber and wood

products trade held on 24 June by the Department of

Forestry and Forest Protection under the Ministry of

Agriculture and Environment, Viet Nam’s leading timber

associations and Forest Trends, Vice Chairman and

Secretary General of the Viet Nam Timber and Forest

Products Association (VIFOREST) Ngo Sy Hoai said that

in 2024 Viet Nam exported wood and wood products

worth US$9 billion to the US, up 24% year-on-year.

Viet Nam imported US$316.36 million worth of timber

from the US in 2024, up 33% year-on-year, and accounted

for 11% of Viet Nam's total wood imports. The top three

imported items were sawnwood, logs and veneer.

Hoai stressed that US regulations such as the Lacey Act,

require wood imports to be legal and traceable. Exporters

must comply with documentation requirements including

export certificates and self-certification of origin.

Viet Nam has banned natural forest logging since 2014,

focusing instead on sustainable plantation forestry. The

country now relies mainly on 3 million hectares of planted

forests, mainly acacia and eucalyptus and 1 million

hectares of rubberwood plantations.

Until now, 700,000 ha of commercial forests in Viet Nam

have been certified. Viet Nam aims to reach 70% certified

plantation coverage by 2030.

Imports of tropical timber into Viet Nam have dropped

significantly from over 2 million cubic metres in 2015 to

700,000 cubic metres in 2024.

Viet Nam’s Timber Legality Assurance System

(VNTLAS), which was developed under a voluntary

partnership agreement (VPA) between the European

Union and Viet Nam on forest law enforcement

governance and trade (FLEGT), was launched in 2020 and

updated in 2024.

Hoai highlighted that Viet Nam has become one of the top

suppliers of timber to the US and one of the largest

importers of US wood. He said both sides have strictly

followed regulations including the Lacey Act and

effectively resolved trade disputes such as the US Section

301 investigation. He called for continued collaboration to

promote legal, sustainable and mutually beneficial timber

trade between the two countries.

At the workshop, Director of the Department of Forestry

and Forest Protection, Tran Quang Bao, revealed that new

regulations, including those related to business

classification, traceability of forest products, geographical

zoning are expected to be issued.

The regulations will help develop a transparent digital

transformation system, meeting the requirements of

traceability, Bao said.

He noted that his Department is ready to accompany

associations and businesses to assure international partners

that Viet Nam is a tropical country but has stopped

commercial harvesting in natural forests. Viet Nam does

not use wood material from natural forests for export and

is completely transparent in the supply chain and legal

system.

See:https://en.Viet Namplus.vn/Viet Nam-us-promote-

sustainable-timber-trade-legal-supply-chains-

post321542.vnp?utm_source=chatgpt.com

Digital transformation boosts transparency

At the Viet Nam/US Wood Trade Dialogue held in Hanoi,

industry representatives agreed on the need to increase

imports of raw wood from the US for processing and re-

export to the US and other markets. Industry

representatives and associations agreed to enhance

international cooperation to improve the reputation of Viet

Nam’s timber sector while ensuring transparency and

compliance with legal frameworks across the supply

chain.

Hoai affirmed that Viet Nam is emerging as a top supplier

of wood and wood products to the US and one of the

largest consumers of US wood. Laws such as the Lacey

Act are strictly observed by both sides. Viet Nam has

made sustained efforts to deal with concerns over legality

and sustainability.

The wood trade between the two countries not only

delivers significant economic value but also offers added

benefits: US consumers gain more access to high-quality,

legally sourced, reasonably priced products.

To Xuan Phuc, Director of the Forest Policy Trade and

Finance Program at Forest Trends stated that several

misconceptions about Viet Nam’s wood sector persist.

First, while some believe Viet Nam imports high-risk

timber for re-export most imports serve the domestic

market and import volumes have dropped significantly.

Second, Viet Nam is not a trans-shipment hub for China’s

wood supply. Annual wood imports total only about US$1

billion, with higher-risk items (e.g., panels and furniture)

accounting for just US$200–300 million.

Third, the view that Viet Nam’s export growth threatens

its forest resources is inaccurate. The country has closed

natural forests and does not use domestic natural timber

for exports. Exported products are primarily made from

plantation timber, rubber wood or legally sourced imports

from positive geographic regions.

Phuc urged relevant agencies to actively share information

to deepen accurate understanding of the sector’s role,

thereby mitigating risk and expanding markets. Authorities

and industry associations should shift their approach by

engaging more directly with export markets and

environmental organisations, while joining international

associations to strengthen Viet Nam’s global wood

industry presence.

See: https://english.vov.vn/en/economy/digital-transformation-

boosts-transparency-supports-Viet Nam-us-wood-trade-

post1209559.vov?utm_source=chatgpt.com#google_vignette

Viet Nam’s wood industry in 2025 - navigating

challenges and seizing opportunities

Viet Nam’s wood industry is a vital component of the

nation’s economy, consistently ranking among the top

exporters. The sector is evolving, focusing on sustainable

practices and value-added products, while also navigating

challenges such as trade tensions and tariffs.

With a commitment to sustainability and growing

capabilities, Viet Nam’s wood industry is poised for

continued growth and innovation in the years to come.

Viet Nam’s wood product portfolio is expanding beyond

traditional offerings to include value-added, eco-friendly

items. While wooden furniture remains dominant,

comprising around 60% of the country’s wood export

value Viet Nam is also becoming a key supplier of

processed wood boards such as plywood and MDF,

construction components and bioenergy products

including wood pellets and chips.

The wood industry in Viet Nam is supported by a robust

manufacturing base composed of both domestic leaders

and foreign-invested enterprises. In 2024, the number of

new foreign direct investment (FDI) projects in the wood

industry increased by 7% and total capital inflows grew by

over 73%t year-on-year.

Much of this investment focused on upgrading to digital

machinery and installing facilities powered by clean

energy.

Viet Nam’s manufacturing is regionally distributed with

the southeastern provinces, including Ho Chi Minh City,

Binh Duong and Dong Nai, forming the industrial

backbone. These areas benefit from proximity to Cat Lai

and Cai Mep–Thi Vai ports, strong logistics infrastructure

and access to skilled labour.

In contrast, the north-central provinces of Nghe An and

Thanh Hoa are emerging as forest-rich zones for timber

cultivation and primary processing thanks to the growth of

FSC-certified plantations and government-backed

afforestation programmes.

A key development this year was the implementation of

a 46% reciprocal tariff by the U.S. on selected Vietnamese

wood products. The move, triggered by concerns about

trans-shipped Chinese goods, has significantly disrupted

trade relationships and created uncertainties for exporters.

To counteract this, the government has prioritised:

strengthening traceability systems through blockchain-

based verification; expanding timber imports from the US,

totalling US$316.36 million in 2024, a 33% increase from

2023, to ensure clear product origin; andnegotiations with

U.S. officials to prevent further escalation, particularly

concerning compliance with the Lacey Act and anti-

dumping regulations.

These efforts have helped maintain Viet Nam’s reputation

as a compliant and high-quality exporter but the long-term

solution lies in diversification and innovation.

Strategic diversification and future opportunities

Viet Nam’s wood industry is rapidly diversifying in both

markets and product segments. Digitalisation is

accelerating. Many companies are utilising virtual

showrooms, AR-enabled customisation tools,

and blockchain logistics platforms to connect with global

customers and enhance transparency.

Viet Nam’s wood industry has evolved rapidly becoming

one of the most significant players in global wood

production and trade. With over 14 years of experience the

country has built a robust reputation for producing high-

quality timber, furniture and wooden products.

The Vietnamese wood industry continues to thrive, with

new trends, policies and opportunities shaping its future.

This article explores the latest developments in Viet

Nam’s wood sector, highlighting trends, challenges and

the potential for global buyers and investors.

Challenges Facing Viet Nam’s Wood Exporters in 2025

Despite strong growth and global recognition, the Viet

Nam wood industry faces several challenges that may

affect its long-term competitiveness.

raw material shortages and import dependency

labor shortages and rising wages

environmental regulations and certification costs

global competition

trade disputes and geopolitical uncertainty

Opportunities for global buyers and investors

While the Viet Nam wood industry faces challenges it also

presents promising opportunities for foreign investors,

importers and wholesale buyers. In 2025, Viet Nam

remains one of the most attractive sourcing hubs for wood

products in Asia thanks to its skilled craftsmanship,

competitive pricing and favorable trade agreements along

with the country being :

a strategic sourcing hub for sustainable wood

products

a low cost, high-quality manufacturing base

strong government support and trade agreements

The Viet Nam wood industry now stands at a crossroads

of innovation, opportunity and global competitiveness.

With increasing demand for sustainable wood products,

strong government support and advanced manufacturing

capabilities, Viet Nam has become a leading supplier in

the global market.

See: https://thanhtungthinh.com/Viet Nam-wood-industry-in-

2025/

8. BRAZIL

Commercial strategies for the furniture

sector

The furniture manufacturing sector is undergoing major

transformation driven by technological advancements and

significant shifts in consumer behavior. A digital presence

is no longer a competitive differentiator but a basic

requirement directly impacting on how furniture is offered

and this demands a consistent multichannel approach from

companies.

Sales through online market places have consolidated as a

strategic channel due to their broad reach and logistical

infrastructure but they require competitive pricing, good

customer service and operational efficiency.

At the same time e-commerce platforms are gaining

ground growing through investments in technology, 3D

product visualisations and personalised customer service

channels which assist in building customer loyalty.

Physical stores, in turn, have evolved into experience and

customer engagement spaces that complement the digital

customer journey. Consumers seek to test furniture, assess

materials and experience ergonomics firsthand.

The trend toward customisation and on-demand

production driven by the use of artificial intelligence (AI)

for layout simulations and product personalisation is also

reshaping both the production and sales chains.

Companies investing in an omni-channel model, where

customers move seamlessly between physical and digital

environments, are achieving results.

This approach allows, for instance, a consumer to view a

product in-store, complete the purchase online and have

the furniture delivered at home with real-time tracking.

Furthermore, behavioral and preference data analysis has

also become an essential tool for identifying the most

strategic sales channels. By collecting and interpreting

browsing information, purchase history and social media

interactions, companies can offer better aligned with

customer expectations and run more effective marketing

campaigns.

In short, adapting to these models is no longer just a trend

but a competitive necessity for the furniture sector.

Companies that successfully integrate technology,

customer experience and logistics efficiency will be better

positioned to face market challenges and respond

sustainably to evolving consumer demands.

See: https://www.moveisdevalor.com.br/portal/vender-moveis-

em-2025-exige-ajuste-as-novas-dinamicas-do-consumo

Programme for the silviculture of native species

In the face of global crises such as biodiversity loss and

climate change, nature-based solutions could account for

up to 30% of the required mitigation efforts.

Brazil, home to one of the world’s richest biodiversity and

backed by a solid foundation of technical and scientific

expertise accumulated over decades, has the opportunity to

establish itself as a global forest power.

Over the past 15 years private investments have emerged

in commercial-scale silviculture of native tree species

involving a range of species adapted to different biomes.

In 2023 the first step was taken toward the establishment

of a Research and Development Program for the

Silviculture of Native Species (PP&D-SEN), with the

support of the Brazilian Coalition on Climate, Forests and

Agriculture, the Southern Bahia Science and Technology

Park (PCTSB), and the Bezos Earth Fund.

The silviculture of native species can contribute to the

successful implementation of various public policies,

government plans and national programs such as the

National Plan for Native Vegetation Recovery (Planaveg),

the National Plan for the Conversion of Degraded Pastures

(PNCPD), the Low-Carbon Agriculture Plan (ABC+), the

Sustainable Forest+ Programme and various State Plans

for Native Vegetation Recovery, among others.

Brazil holds a valuable genetic heritage and strong

potential to drive sustainable value chains while promoting

social inclusion. To achieve this, public policies, financial

incentives, legal certainty and effective coordination

between government, the private sector, academia and

civil society are essential.

See: https://globorural.globo.com/opiniao/noticia/2025/06/brasil-

uma-nova-potencia-florestal-em-construcao.ghtml

Export update

In May 2025, the Brazilian exports of wood-based

products (except pulp and paper) decreased 12% in value

compared to May 2024, from US$334.6 million to

US$294.9 million.

Pine sawnwood exports decreased 13% in value between

May 2024 (US$64.1 million) and May 2025 (US$55.7

million). In volume, exports decreased 13% over the same

period, from 271,300 cu.m to 236,100 cu.m.

Tropical sawnwood exports increased 41% in volume,

from 23,900 cu.m in May 2024 to 33,700 cu.m in May

2025. In value, exports increased 44% from US$23.9

million to US$33.7 million, over the same period.

Pine plywood exports decreased 13% in value in May

2025 compared to May 2024, from US$76.4 million to

US$66.2 million. In volume, exports decreased 3% over

the same period, from 217,100 cu.m to 209,800 cu.m.

As for tropical plywood, exports decreased in volume 20%

and in value 27%, from 3,500 cu.m and US$ 2.2 million in

May 2024 to 2,800 cu.m and US$1.6 million in May 2025.

Wooden furniture exports increased from US$54.6 million

in May 2024 to US$55.1 million in May 2025, an increase

of 1%.

Wood product exports drive cargo throughput at

Paranaguá Port

In May 2025 TCP (Paranaguá Container Terminal)

recorded the highest monthly container traffic of the year

reaching 141,788 TEUs, an increase of 3,303 TEUs

compared to the previous record in March. This growth

was primarily driven by export volumes, with the timber

sector accounting for 10,432 TEUs handled during the

month.

The Terminal authorities attribute these successive records

registered this year to TCP´s commitment to operational

and logistics solutions aligned with the clients´ needs.

TCP’s investment in infrastructure has been instrumental

in meeting growing market demand. To support this

growth and ensure smooth operations TCP completed an

investment of approximately BRL.5 million in April to

improve the pre-gate area.

Another important improvement was the investment in the

gate complex which increased the hourly vehicle

appointment capacity from 50 to 150 vehicles per hour

representing a significant advancement in operational flow

and efficiency.

According to TCP, these measures aimed to keep pace

with growing demand from Brazil’s leading export

sectors, including agribusiness and timber industries.

See: https://newspulpaper.com/exportacoes-madeira-

impulsionam-recorde-tcp-2025/

Forest traceability for EUDR compliance

The European Union Deforestation Regulation (EUDR)

establishes requirements for the export of forest-based

products to Europe, aiming to ensure that they are not

associated with illegal deforestation.

During the APRE (Paraná Association of Forestry-Based

Companies) members' meeting held at the end of May the

Forest Trackt platform, developed by Resource Wise, was

presented as a technological solution to meet the EUDR

traceability requirements which will come into effect in

January 2026.

Forest Trackt enables end-to-end traceability from forest

origin to destination and is integrated with the VeriForest

platform and offering low cost, easy deployment and

audit-ready documentation. The solution covers products

such as sawnwood, wood pellets and pulp.

This platform has been under development since 2023, in

collaboration with multinational forest companies it has

already undergone operational testing across different

segments of the forest-based industry. The solution

operates in an integrated manner with Orbis' VeriForest

platform. Its structure enables capture, processing and

consolidation of critical information required by the

EUDR including proof of legal production in the country

of origin; mandatory geolocation of harvested areas with

geospatial polygons of forest stands.

Also execution of a robust due diligence process covering

data collection, risk assessment and implementation of

mitigation measures; registration of the compliance

statement in the European Union Information System (EU

IS) prior to export or commercialisation.

See: https://apreflorestas.com.br/noticias/solucao-para-

rastreabilidade-florestal-exigida-pela-uniao-europeia-e-

apresentada-as-associadas-na-reuniao-tecnica-mensal/

and

https://www.resourcewise.com/solutions/eudr-compliance-forest-

trackt

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

See: https://www.itto-

ggsc.org/static/upload/file/20250616/1750055807148798.pdf

9. PERU

Exports at US$21.1

million through April 2025

Shipments of wood products totalled US$21.1 million

during the first four months of 2025 representing a

decrease of 21% compared to the same month in 2024

according to the Center for Global Economy and Business

Research of the CIEN-ADEX Exporters Association.

According to figures from the ADEX Data Trade

Intelligence System exports included sawnwood (US$9.8

million), semi-manufactured products (US$4.1 million),

firewood and charcoal (US$2.8 million), furniture and

parts (US$1.5 million) and construction products (US$1.4

million).

The leading destination was the Dominican Republic, with

shipments totalling US$5.7 million, a 44% increase

compared to the previous year. Viet Nam followed with

US$2.8 million. a 105% increase compared to 2024,

Mexico with US$2.7 million, a decrease of 7%, the United

States with US$2.6 million, a decrease of 31% and closing

the top 5 market was France where exports of US$1.6

million represented a decrease of 59%.

Bosques Amazónicos lists its shares on the Lima

Stock Exchange

Bosques Amazónicos - BAM, a Peruvian company located

in the Ucayali Amazon region specialising in nature-based

solutions, forest conservation, commercial reforestation

and the generation of high-integrity carbon credits

celebrated its listing on the Lima Stock Exchange (BVL)

in early June."This milestone represents the culmination of

almost two decades of work, vision and commitment to

private investment and technology applied to nature,

consolidating BAM as one of the first NatureTechs in

Latin America to achieve this level of projection," said the

Chairman of the Board of BAM.

See: https://www.bosques-amazonicos.com/blog/en/bam-joins-

the-forum-the-route-to-promote-issues-and-issuers-in-the-capital-

markets/

OSINFOR celebrated 17th anniversary

On its 17th anniversary, the Forest and Wildlife Resources

Oversight Agency (OSINFOR) presented an overview of

the progress made in forest oversight, the development of

innovative platformmes that promote information

transparency and capacity-building efforts linked to

oversight.

During a presentation, the head of OSINFOR emphasised

the importance of reflecting on the context of climate

variability that affects health, food production and water

supplies.

In this context, he highlighted the fundamental role of the

Amazon forests which cover nearly 60% of the national

territory as carbon sinks and climate regulators.

“Well-managed forests represent an opportunity to boost

the economy, generate employment and improve the

quality of life for our population,” he stated.

The executive director of the National Forest and Wildlife

Service (SERFOR) emphasised that effective governance

is essential for the advancement of the forestry sector. In

this regard, he highlighted that the strategic compass

promoted by OSINFOR is a key tool for coordinating

efforts and working with a shared vision toward a common

goal.

The president of the Amazon Regional Association

indicated that they are working to provide legal security to

indigenous communities so they can protect their

territories from illegal logging and develop their local

economies while conserving their forests. He also

indicated that the use of certified wood and the formation

of MSMEs are being promoted.

See: https://www.gob.pe/institucion/osinfor/noticias/1195314-

osinfor-cumple-17-anos-con-avances-clave-para-la-

conservacion-de-los-bosques-del-peru

Peru hosts regional workshop on forest statistics for

South America

With the participation of representatives from thirteen

South American countries a Regional Workshop on Forest

Statistics was held in Lima 24 June. The workshop was

organised by the Ministry of Agrarian Development and

Irrigation (MIDAGRI) through the National Forestry and

Wildlife Service (SERFOR) in coordination with the

International Tropical Timber Organization (ITTO) and

the Food and Agriculture Organization of the United

Nations (FAO).

The event aimed to strengthen the technical capacities of

participating countries for the collection, analysis and

reporting of forestry sector statistics through the use of the

Joint Forest Sector Questionnaire (JFSQ) an international

tool designed by FAO, ITTO, Eurostat and the Economic

Commission for Europe (ECE).

The workshop included technical sessions, debates, panels

with representatives from the productive sector, field visits

and exchanges of experiences. Among the topics covered

was the harmonisation of statistical concepts, the

identification of barriers and opportunities and the use of

data in the formulation of sustainable forest policies.

The participating countries included Argentina, Bolivia,

Brazil, Chile, Colombia, Ecuador, Guyana, Paraguay,

Peru, Suriname, Trinidad and Tobago, Uruguay and

Venezuela.

See: https://www.gob.pe/institucion/serfor/noticias/1193748-

midagri-peru-es-sede-del-taller-regional-de-estadistica-forestal-

para-america-del-sur

|