|

Report from

North America

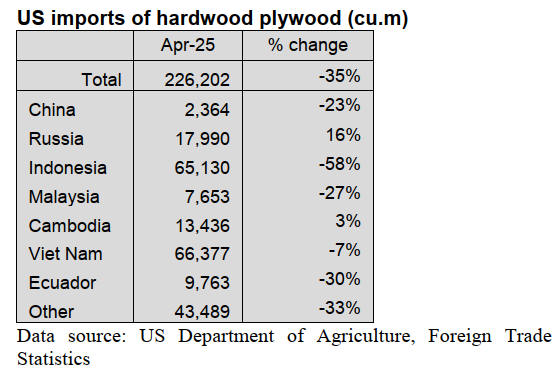

Hardwood plywood imports drop 35%

After surging in March, US imports of hardwood plywood

plunged 35% in April to their lowest level of the year. At

226,202 cubic metres, April imports were 6% lower than

in April 2024.

Imports from Indonesia, the top trading partner so far this

year, fell sharply, down 58% from March’s 10-year high.

Imports also fell markedly from Ecuador (down 30%),

Malaysia (down 27%) and China (down 23%).

Despite the pullback, total US imports of hardwood

plywood are ahead of 2024 volume by 13% through April.

Imports of sawn tropical hardwood cool; Canadian

imports rebound

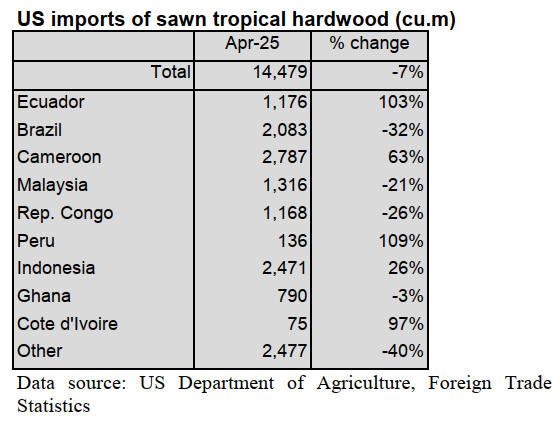

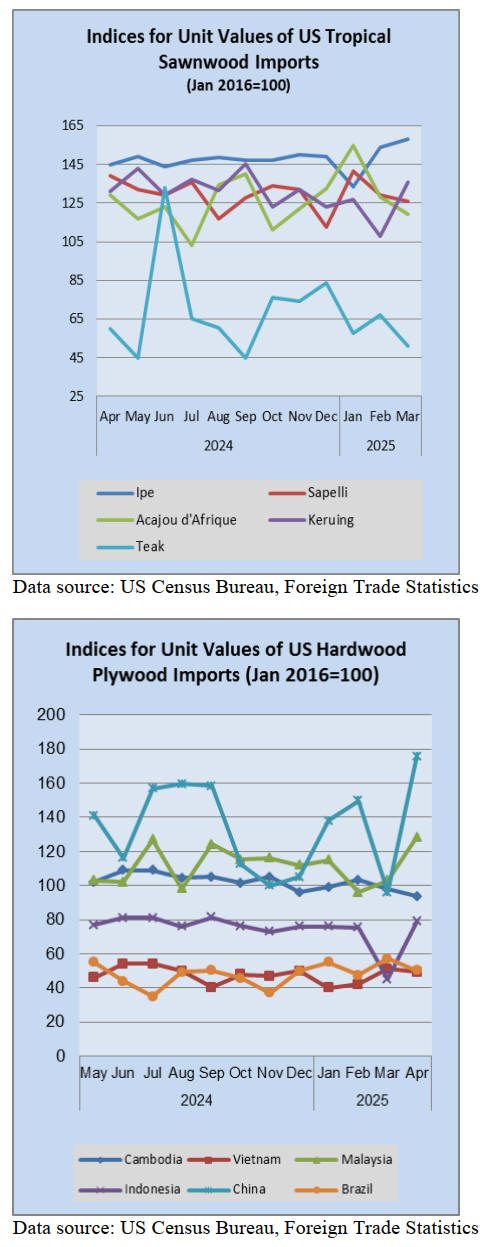

US imports of sawn tropical hardwood fell 7% in April

retreating after a March surge. At 14,479 cubic meters,

import volume was down 9% from last April’s level.

Imports from Brazil, the top trading partner last year,

disappointed again, falling 32% for the month and now

down 58% year to date versus last year. Imports from

Congo (Brazzaville) and Malaysia also fell more than 20%

in April. Imports from this year’s top supplier, Indonesia,

continued their ascent, rising 26% in April. Imports of

Sapelli plunged 32% in April and are down 12% for the

year so far. Total imports of sawn tropical hardwood into

the US are down 7% from last year through April.

Conversely, Canadian imports of sawn tropical hardwood

rebounded sharply from a weak March, improving by 63%

in April. April imports were up 8% from the previous

April as imports from Brazil, Bolivia, Congo (Zaire) and

Congo (Brazzaville) all soared.

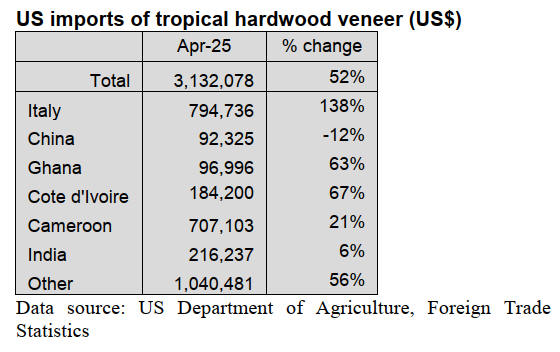

Veneer imports leap

US imports of tropical hardwood veneer climbed 52% in

April as imports from key trading partners surged. Imports

from Italy led the way, rising by 138% from the previous

month while imports from Ghana jumped 63% and

imports from Cote d’Ivoire rose 67%. At more than

US$3.1 million, the April total surpassed April 2024’s

figure by 37%. Due to the impressive April gain, total

imports of tropical hardwood veneer are now up 10% over

last year after being virtually even a month ago.

Moulding imports dip

US imports of hardwood moulding fell 9% in April after

reaching a two-year high in March. A 23% decline in

imports from Canada, by far the top US trading partner,

triggered the loss. Imports from other chief supplying

nations—Malaysia, China and Brazil—not only remained

strong but rose sharply. Despite the downturn, moulding

imports for April were still 27% higher than April of last

year while year-to-date imports are up 28% versus 2024

through the first four months of the year.

Hardwood flooring and assembled flooring panels

retreat

US imports of assembled flooring panels fell from the all-

time high set in March, retreating by 11% in April. Still,

the US$31.8 million in April imports remained 27%

higher than that of the previous April. Imports from top

trader Canada fell 27% while imports from Indonesia and

Viet Nam also moved downward. Imports from both

Brazil and China more than doubled. With the exception

of Brazil, imports for the year so far are up sharply from

all major trading partners and are 34% ahead of last year

through April.

US imports of hardwood flooring also fell 11% in April. A

more than four-fold increase in imports from Brazil helped

allay downturns in imports from China (down 59%),

Malaysia (down 28%), and Indonesia (down 12%). To

date, total imports of hardwood flooring are off by 4%

from last year.

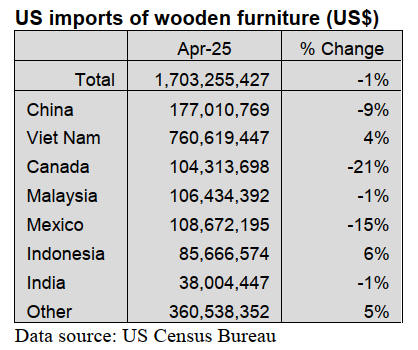

US wooden furniture imports from Canada hit 3-year

low

US imports of wooden furniture fell 1% in April on

declining imports from Canada, Mexico and China.

Despite the dip, the US$1.7 billion in imports for the

month was 8% higher than in April 2024.

Imports from Canada fell to their lowest level since

February 2021 on a monthly decline of 21%. Imports from

both Canada and Mexico are down 9% year to date while

imports from China are off by 16%.

These losses have been mitigated somewhat by increased

imports from Viet Nam and Indonesia, which both saw

April gains in the 5% range. Total imports of wooden

furniture are up 4% over last year through April.

Residential furniture orders continue their slow rise

New residential furniture orders rose for a third straight

month in March, according to the May issue of Furniture

Insights new orders were up 1% in March compared to

February and were also up 1% compared to March 2024.

However, year to date through the first quarter of 2025,

new orders are down 2% compared to 2024.

Shipments were up 1% in March 2025 compared to March

2024. Shipments were up 6% compared to February,

which was likely a function of the prior short month (when

down 8% versus January). Through March, shipments

remain flat compared to 2024.

See: https://www.smith-leonard.com/2025/05/30/may-2025-

furniture-insights-2/

USDA invests US$200M to expand timber production

The US Department of Agriculture (USDA) announced a

US$200 million investment to implement its National

Active Forest Management Strategy, an initiative aimed to

increase timber harvest, improve forest health and

productivity, reduce wildfire risk and support rural

prosperity in forest communities.

According to the USDA, the strategy supports President

Trump’s Executive Order: Immediate Expansion of

Timber Production, by streamlining burdensome

regulations, leveraging emergency authorities, and

expediting project approvals, ensuring faster access to

critical timber resources. Increasing the use of long-term

contracts to carry out these projects, the strategy envisions

a more stable supply of wood products, healthier forests,

and stronger rural economies.

This work to increase domestic timber harvests

implements the USDA’s memorandum to the Forest

Service to take immediate action in support. In response,

the Forest Service has committed to increasing timber

harvest on national forests by 25%, with an overall goal of

4 billion board feet harvested annually by fiscal year 2028.

While little in the way of specifics was released,

Agriculture Secretary Brooke Rollins said that the agency

will use tools like Good Neighbor Authority to support

efforts to work across jurisdictions and property lines to

improve forest health and grow economies in communities

nationwide.

See:

https://www.woodworkingnetwork.com/news/woodworking-

industry-news/usda-invests-200m-expand-timber-production

US Congress considers enacting tax credit for

purchasing American hardwood products

US Senator Cindy Hyde-Smith of Mississippi introduced

legislation June 5 to allow consumers to claim a tax credit

for purchasing solid American hardwood products for their

homes. The Solid American Hardwood Tax Credit Act

would allow individual taxpayers to include American-

manufactured solid hardwood products as qualified home

energy efficiency improvements under the Energy

Efficient Home Improvement Credit.

The credit would apply to any flooring, paneling,

millwork, cabinetry doors, cabinetry facing, window, or

skylight, comprised of deciduous trees grown and

processed in the United States.

“This bill is designed to support the domestic hardwood

industry and the jobs it provides while making American-

made hardwood products more affordable for families,”

Hyde-Smith said.

Despite the significance of the forestry sector to

Mississippi’s economy, the state’s hardwood industry has

been affected by a severe national decline. The domestic

hardwood-grade lumber market has fallen from 6.5 billion

board feet to less than 2 billion board feet in the past 26

years.

The bill falls in line with a March executive order issued

by President Trump, which called for the immediate

expansion of American timber production and tasked the

secretaries of Interior and Agriculture to craft legislative

proposals to improve timber production and forest

management.

Hyde-Smith’s legislation is the Senate companion bill to a

House bill (HR.3322) introduced in May. The National

Hardwood Lumber Association supports the legislation.

See:

https://www.woodworkingnetwork.com/news/woodworking-

industry-news/senate-companion-legislation-provides-tax-

credits-hardwood-purchases

|