US Dollar Exchange Rates of

25th

May

2025

China Yuan 7.19

Report from China

Decline in China’s sawnwood imports

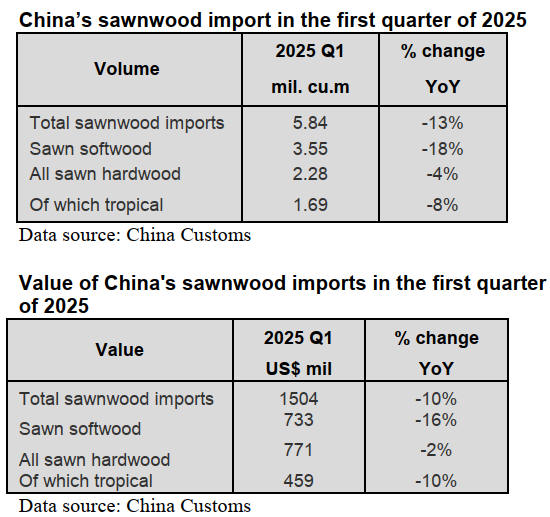

According to China Customs, sawnwood imports in the

first quarter of 2025 totalled 5.84 million cubic metres

valued at US$1.504 billion, down 13% in volume and 10%

in value compared to the first quarter of 2024. The average

price for imported sawnwood was US$258 (CIF) per cubic

metre, up 4% over the same period of 2024.

Of total sawnwood imports, sawn softwood imports

dropped 18% to 3.55 million cubic metres and accounted

for 61% of the national total. The average price for

imported sawn softwood rose 3% to US$206 (CIF) per

cubic metre over the same period of 2024.

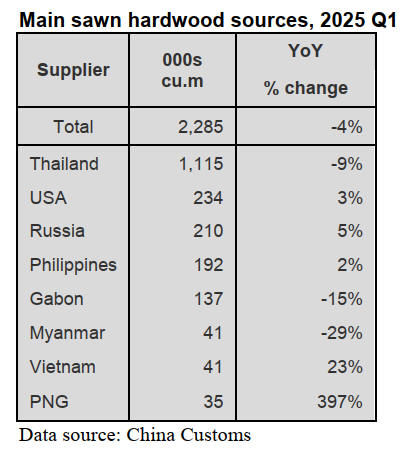

Sawn hardwood imports dropped 4% to 2.28 million cubic

metres, accounting for 39% of the national total. The

average price for imported sawn hardwood increased 1.3%

to US$337 (CIF) per cubic metre over the same period of

2024.

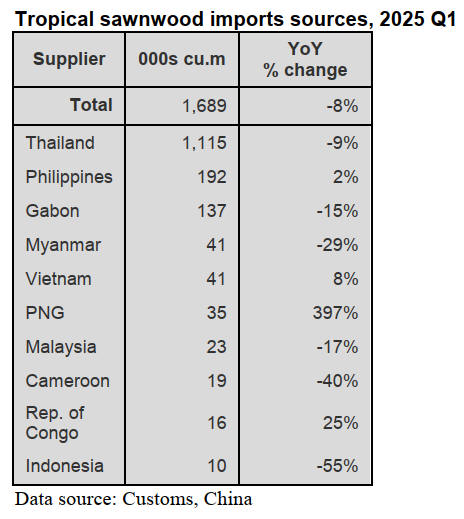

Of total sawn hardwood imports, tropical sawnwood

imports were 1.69 million cubic metres valued at US$459

million CIF, down 8% in volume and 10% in value from

the same period of 2024 and accounted for 29% of total

sawnwood import volumes. The average price for

imported tropical sawnwood was US$272 CIF per cubic

metre, down 3% from the same period of 2024.

Decline in sawnwood imports from top suppliers

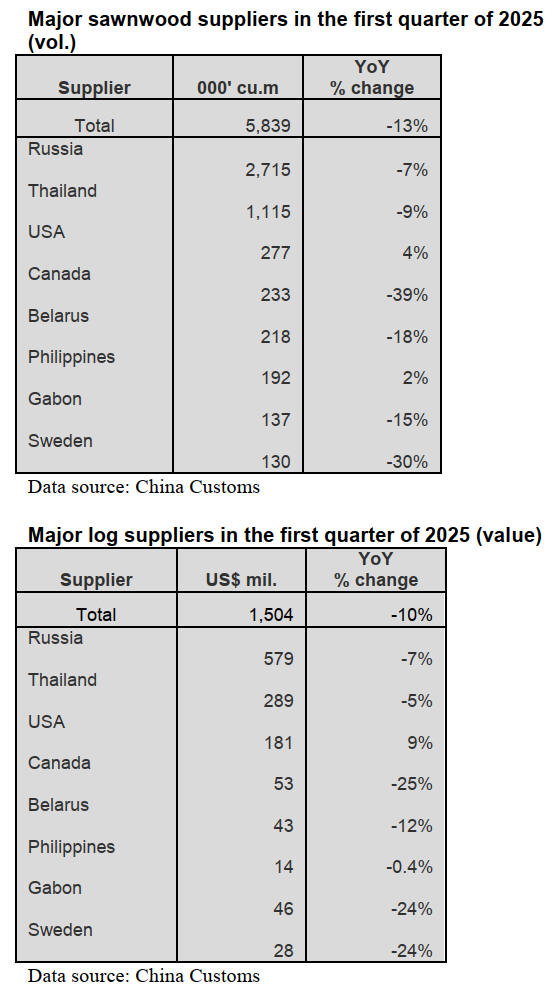

Russia was the largest supplier of China’s sawnwood

imports in the first quarter of 2025. The proportion of

China’s sawnwood imports from Russia accounted for

46% of the total sawnwood import volume.

Thailand was the second largest supplier of China’s

sawnwood imports in the first quarter of 2025. The

proportion of China’s sawnwood imports from Thailand

accounted for 19% of the total sawnwood imports volume.

China’s sawnwood imports from the two top countries,

Russia and Thailand, accounted for 65% of the national

total in the first quarter of 2025.

China’s sawnwood imports from Russia and Thailand fell

7% and 9% respectively in the first quarter of 2025. In

addition, China’s sawnwood imports from the top

suppliers, such as Canada, Belarus, Gabon and Sweden

reduced 39%, 18%, 15% and 30% respectively in the first

quarter of 2025.

All of the above-mentioned declines directly resulted in

the large decline of the total sawnwood imports over the

same period of 2024. Although China's sawnwood imports

from the United States and the Philippines have increased

(4% and 2% respectively) this failed to reverse the

downward trend of China's sawnwood imports in the first

quarter of 2025.

The reasons for the significant decline in China's

sawnwood imports are numerous such as the tariff friction

between China and the United States, the introduction of

stricter production standards by the European Union, the

impact of the adjustment of the origin policy in Southeast

Asia along the supply chain.

Also sharp fluctuations in international transportation

costs have led to an increase in sawnwood prices

internationally and raised the costs of China's sawnwood

imports.

Due to the weakness of China's real estate market the

willingness for development and investment is sluggish

and as a result the domestic demand for sawnwood is

weak. In the first quarter of 2025 the newly started

construction area of houses in China decreased by 24%

year-on-year.

The investment and demand in major sawnwood

consumption sectors such as construction and furniture

manufacturing decreased, resulting in a significant

reduction in China's sawnwood imports.

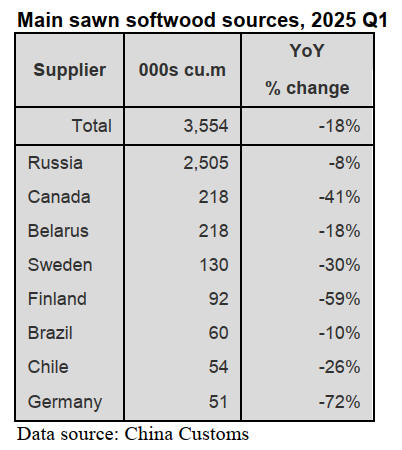

Main sawn softwood sources, first quarter of 2025

China’s sawn softwood imports from all of the top

suppliers fell at fast rates in the first quarter of 2025 which

resulted in the larger decline of the total sawn softwood

imports over the same period of 2024. China’s sawn

softwood imports fell 18% largely in the first quarter of

2025.

Russia is still the largest supplier for China’s sawn

softwood imports. 70% of China’s sawn softwood is from

Russia but sawn softwood imports from Russia fell 8% to

2.505 million cubic metres in the first quarter of 2025.

China’s sawn softwood imports from Canada, Belarus,

Sweden, Finland, Brazil, Chile and Germany decreased

41%, 18%, 30%, 59%, 10%, 26% and 72%% respectively

in the first quarter of 2025.

Surge in sawn hardwood imports from PNG

Thailand is the largest supplier of China’s sawn hardwood

imports. Nearly 50% of China’s sawn hardwood imports

are from Thailand but China’s sawn hardwood imports

from Thailand dropped 9%, which directly resulted in the

decline of the total sawn hardwood imports in the first

quarter of 2025. In addition, China’s sawn hardwood

imports from Gabon and Myanmar dropped 15% and 29%

respectively in the first quarter of 2025.

In contrast, China’s sawn hardwood imports from the

USA, Russia, the Philippines and Vietnam grew 3%, 5%,

2% and 23% respectively in the first quarter of 2025. It is

worth noting that the volume of sawn hardwood imports

from Papua New Guinea surged nearly 400% in the first

quarter of 2025.

Decline in tropical sawnwood imports

China’s tropical sawnwood imports fell 8% to 1.689

million cubic meters in the first quarter of 2025. The top

three suppliers for China’s tropical sawnwood imports

were Thailand (66%), the Philippines (11%) and Gabon

(8%). 86% of China’s tropical sawnwood imports were

from these three countries in the first quarter of 2025.

China’s tropical sawnwood imports from Thailand, the

largest supplier, fell 9% in the first quarter of 2025, which

directly resulted in the decrease of the national total

tropical sawnwood imports in the first quarter of 2025. In

addition, China’s tropical sawnwood imports from Gabon,

Myanmar, Malaysia, Cameroon and Indonesia dropped

15%, 29%, 17%, 40% and 55% respectively in the first

quarter of 2025.

In contrast, China’s tropical sawnwood imports from the

Philippines, Vietnam and the Republic of Congo grew 2%,

8% and 25% respectively in the first quarter of 2025.

The volume of China’s tropical sawnwood imports has not

increased despite the reduction in prices in the first quarter

of 2025.

The export volume from Thailand, as a traditional tropical

sawnwood supplier, declined while emerging suppliers

such as the Philippines, Vietnam and PNG have shown

growth. This reflects that China's sources of tropical

sawnwood are gradually diversifying.

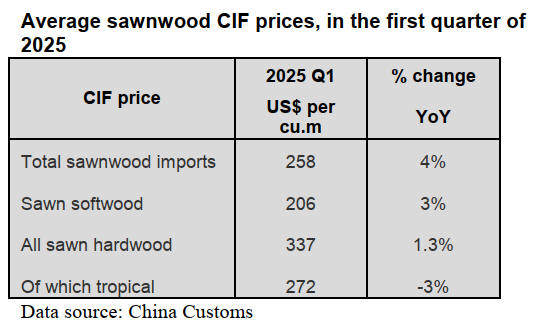

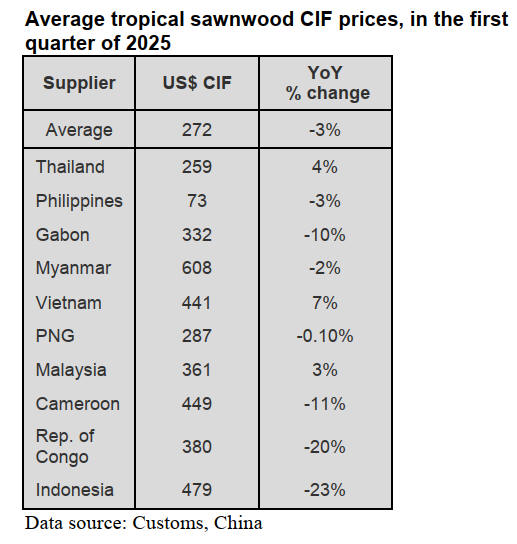

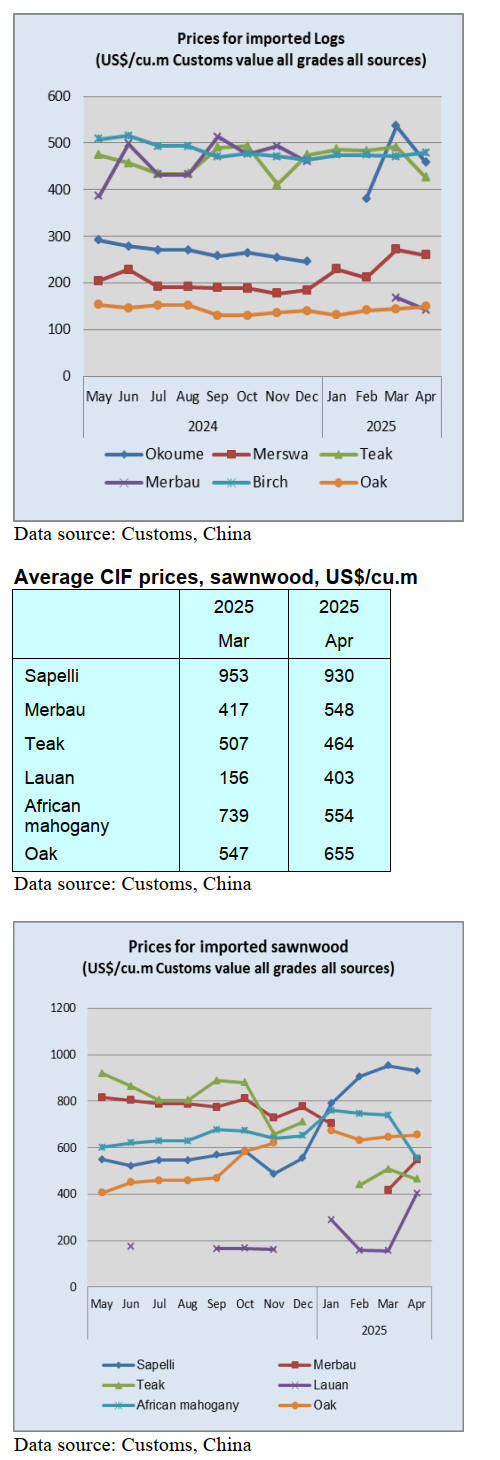

Decline in average CIF price for tropical sawnwood

imports

The average CIF price for China’s tropical sawnwood

imports in the first quarter of 2025 declined by 3% to

US$272 per cubic metres over the same period of 2024.

The CIF price for China's tropical sawnwood imports from

Thailand in the first quarter of 2025 rose 4% which is one

of the main reasons for the decrease in the volume of

tropical sawnwood imports from Thailand over the same

period of 2024.

The CIF price for China’s tropical sawnwood imports

from the Philippines fell 3% which is one of the main

reasons for the increase of China’s tropical sawnwood

imports from the Philippines in the first quarter of 2025.

The CIF price for China’s tropical sawnwood imports

from Gabon, Cameroon, the Republic of Congo and

Indonesia dropped 10%, 11%, 20% and 23% respectively

in the first quarter of 2025. In contrast, the CIF price for

China’s tropical sawnwood imports from Vietnam and

Malaysia rose 7% and 3% respectively in the first quarter

of 2025.

Frequent changes in US tariffs increase uncertainty

According to a press conference held by the China Council

for the Promotion of International Trade (CCPIT) a recent

survey conducted by the CCPIT among over 1,100 foreign

trade enterprises nationwide revealed that the frequent

changes in US tariff policies had significantly increased

uncertainty, making it difficult for businesses to make

long-term plans.

As a result, nearly 50% of the enterprises indicated that

they would reduce their business with the US.

Meanwhile, 75% of the enterprises planned to expand into

emerging markets to compensate for the decreased exports

to the US.

China's wood production rises in first quarter

At a press conference held by China’s Ministry of Natural

Resources it was reported that in the first quarter of 2025

China's wood production reached 25.1741 million cubic

metres marking an increase of 8% year-on-year.

According to customs data, from January to March 2025

China’s cumulative import volume of logs and sawnwood

was 13.906 million cubic metres, down by 11% compared

to the same period last year and the import value was

approximately 20.5 billion yuan, a decrease of 9% year-

on-year.

During the same period, China’s export value of furniture

and parts earned 114.46 billion yuan marking a decline of

7% compared to the same period in 2024.

April GTI-China index

In April 2025 the GTI-China index registered 54%, a

decrease of 4.0 percentage points from the previous month

and has been above the critical value (50%) for 2

consecutive months indicating that the business prosperity

of timber enterprises represented by the GTI-China index

expanded from the previous month.

In April China's timber market was at the traditional peak

season and the timber sector was generally on an upward

trend with production volume and both domestic and

international orders continued to rise.

As for the twelve sub-indices, ten indices (production,

new orders, export orders, existing orders, inventory of

finished products, purchase quantity, purchase price,

employees, delivery time and market expectations) were

all above the critical value of 50%, while the remaining

two indices (imports and inventory of main raw materials)

were below the critical value.

Compared to the previous month the indices for export

orders, inventory of finished products and delivery time

increased and the indices for production, new orders,

existing orders, purchase quantity, purchase price, imports,

inventory of main raw materials, employees and market

expectation declined.

See: https://www.itto-

ggsc.org/static/upload/file/20250519/1747635226558660.pdf

|