Japan

Wood Products Prices

Dollar Exchange Rates of 25th

May

2025

Japan Yen 142.85

Reports From Japan

Economy contracted faster than forecast

New economic data shows stagnant consumption and a

decline in exports. Japan's economy contracted at a faster

pace than expected in the first quarter of 2025 according to

date from the Cabinet Office. GDP contracted by 0.2%

compared to the previous quarter, the first quarterly drop

since the January-March period in 2024. However,

compared with the same quarter in the previous year, the

economy shrank by 0.7%, much steeper than the forecast

0.2% contraction.

The decline was largely due to a fall in exports which are a

significant driver of the Japanese economy. Data shows

international demand was waning even before US tariff

threats. On 2 April the US declared a 24% tariff on

Japanese goods. It also declared an additional 25% levy on

cars. The US is the largest market for Japan's auto

industry.

The Japanese government is negotiating a trade deal with

the US but policymakers are reportedly frustrated as the

US statements and proposals keep changing. Analysts

point out that the Japanese economy has been vulnerable

for some time as an aging population is driving up welfare

spending and there is a growing labour shortage.

Reuters news agency has reported a senior economist at a

major research institute saying “Japan's economy lacks a

driver of growth given weakness in exports and

consumption. It's very vulnerable to shocks such as one

from US tariffs". He added "the possibility of the economy

entering a recession cannot be ruled out."

See: https://www.dw.com/en/japans-economy-shrinks-more-

than-expected/a-72561544

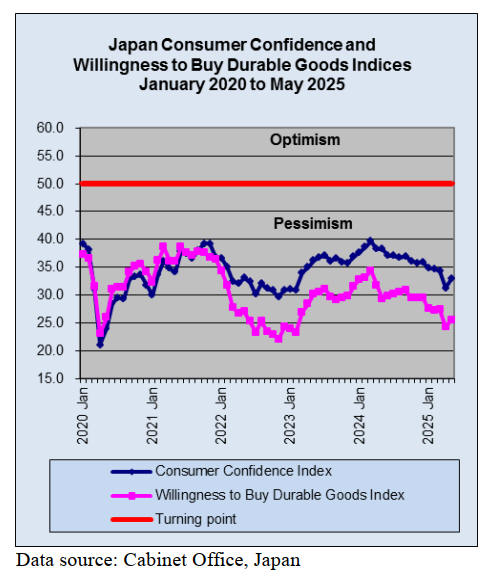

Wage growth not keeping up with price increases

The Chief Economist at Mizuho Research and

Technologies is quoted by the Japan Times as saying

inflation in Japan might be tougher to tame than expected,

putting real wage growth at risk and possibly becoming a

drag on much-needed household consumption.

He added, “Japan struggled with deflation for decades and

kept interest rates at or near zero for years to get prices

rising again. They are now increasing and are becoming an

issue for workers who are finding their wages barely

growing or actually declining month to month on a real

basis”.

See:

https://www.japantimes.co.jp/business/2025/02/07/economy/japa

n-inflation-risk/

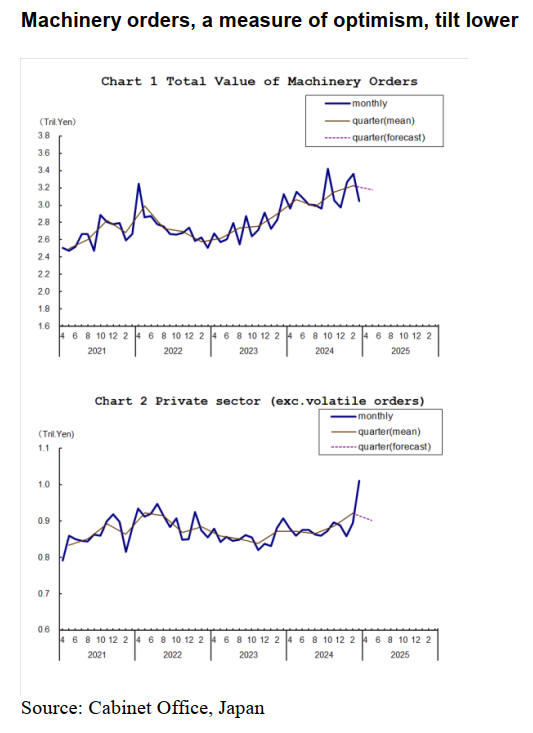

The total value of machinery orders received by 280

manufacturers operating in Japan decreased by 9.4% in

March from the previous month on a seasonally adjusted

basis. Machinery orders are an indicator of businesses

sentiment. In the first quarter 2025 orders increased by

2.4% compared with the previous quarter.

Private-sector machinery orders, excluding volatile ones

for ships and those from electric power companies,

increased a seasonally adjusted by 13% in March and rose

by 4% in the first quarter. In the April-June period the

total amount of machinery orders is expected to decline

and private-sector orders, excluding volatile ones, are also

expected to fall from the previous quarter respectively.

Non-manufacturers' sentiment remains positive

In the most recent Bank of Japan ‘Tankan Survey’ (April

2025) business sentiment among large Japanese

manufacturers weakened slightly. On the other hand, non-

manufacturers' sentiment remained positive primarily due

to robust inbound tourism and progress in passing on

rising costs. The manufacturing sector faces challenges.

Subsidies cut – household costs rise

Japan's core consumer prices in April climbed 3.5% year

on year, the fastest pace in more than two years. The rise

was driven by reduced government utility subsidies and

surging rice prices. The April increase in the core

consumer price index (which excludes volatile fresh food)

followed a 3.2 % rise in March and was the largest since

January 2023. Inflation has been well above the Bank of

Japan's 2% percent target since April 2022.

See:

https://mainichi.jp/english/articles/20250523/p2g/00m/0bu/0120

00c

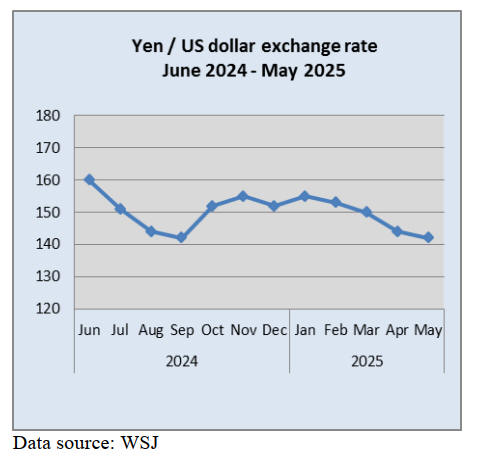

US and Japan agree - dollar-yen exchange rate reflects

fundamentals

The Japanese Minister of Finance, Katsunobu Kato and

US Treasury Secretary Scott Bessent, discussed currency

issues during the ongoing bilateral tariff negotiations with

both sides agreeing that the dollar-yen exchange rate, at

present, reflects economic fundamentals and the yen's

weakness against the dollar should no longer be an issue in

the tariff talks.

It has been reported that during the recent meeting Kato

said he expressed concern about the impact on the global

economy and financial markets of the uncertainty created

by the US administration's tariffs proposals saying using

tariffs to deal with trade imbalances is inappropriate.

See:

https://mainichi.jp/english/articles/20250522/p2g/00m/0bu/0070

00c

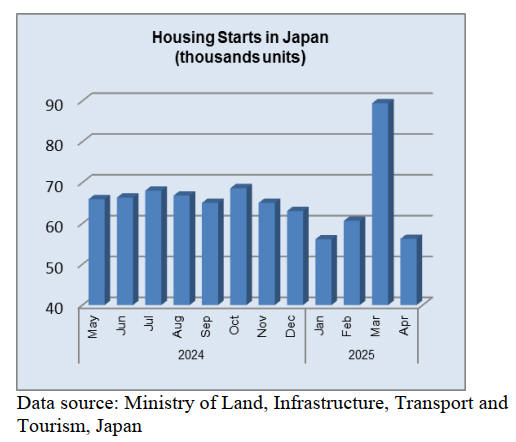

Rental homes becoming more expensive

In March every year many companies relocate there

workers and this period sees a surge in activity as both

companies and individuals prepare for these moves. This

practice is especially common among large corporations,

government departments and professionals in industries

such as finance, manufacturing and consulting.

Employees moving often receive assistance with

relocation costs but the high demand during this period

means moving services, rental prices and even temporary

accommodation options become more expensive and

difficult to book. For those relocating for work, early

planning is essential to avoid last-minute price surges and

limited housing options.

See: https://e-housing.jp/post/understanding-japans-moving-

season

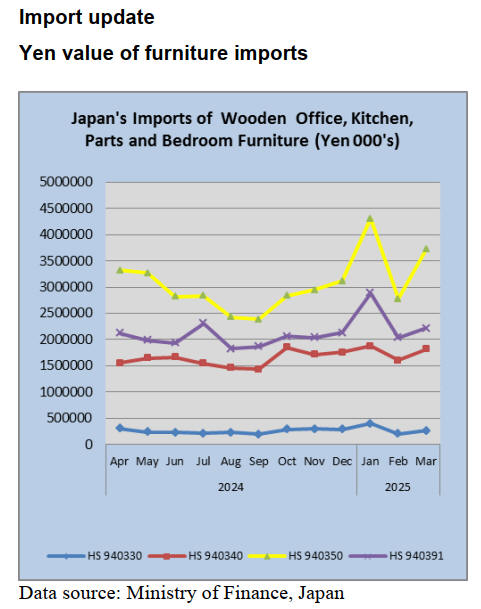

Caution, the reason for the March surge has not yet

been

identified. A reporting error cannot be ruled out.

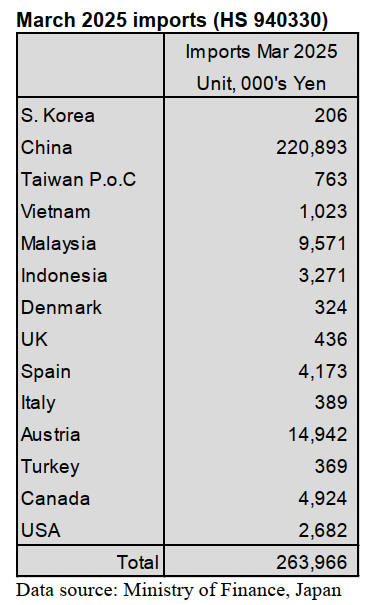

March wooden office furniture imports (HS

940330)

In March shippers in China accounted for 84% of Japan’s

imports of wooden office furniture (HS 940330), up 30%

on February. The other main source in March was Austria

which accounted for 6% of total HS 940330 imports, a

record high for Austria. The value of arrivals of wooden

office furniture from Malaysia in March were little

changed from the previous month while the value of

arrivals from Indonesia cashed 65%.

Year on year, the value of Japan’s imports of wooden

office furniture in March was little changed while,

compared to a month earlier ther was a 29% rise in the

value of imports.

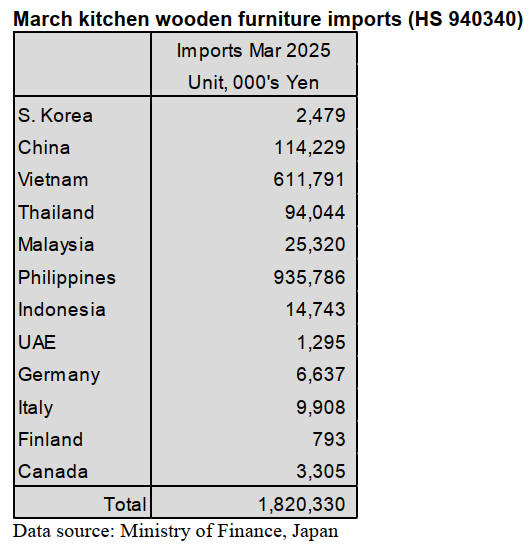

March wooden kitchen furniture imports (HS

940340)

In March 2025 the combined value of shipments of

wooden kitchen furniture (HS 940340) from the

Philippines and Vietnam accounted for over 80% of

Japan’s imports of HS 940340. Shippers in the Philippines

accounted for around 51% of total imports of wooden

kitchen furniture in March with Viet Nam accounting for a

further 32%, up 43% from February.

T he other shippers of note in March were China and

Thailand which together accounted for around 11% of the

value of HS940340 imports. March arrivals from China

were almost 80% higher than in February and arrivals

from Thailand were up 45% month on month.

Compared to a year earlier the value of March 2025

imports was little changed year on year however, the value

of March imports was up 14% compared to February.

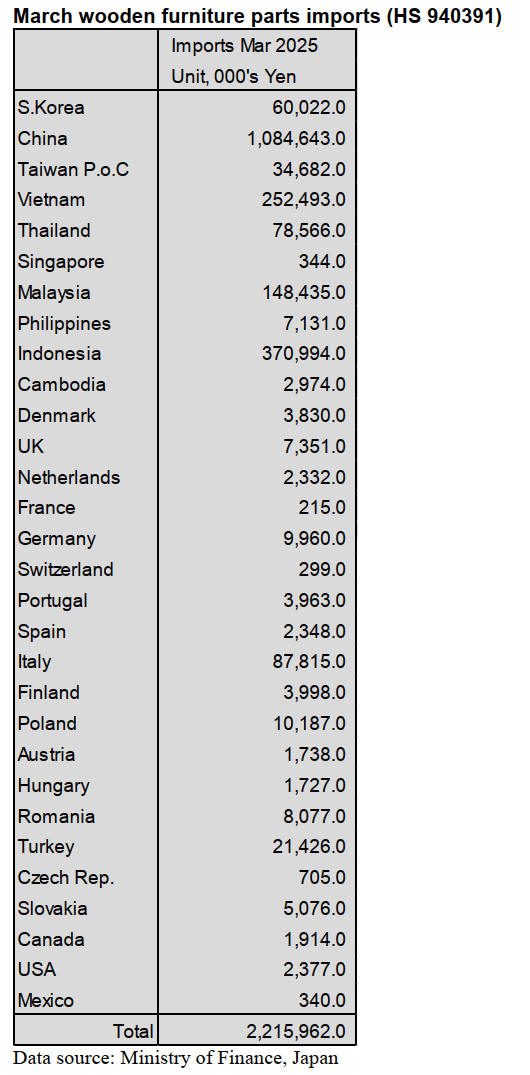

March wooden furniture parts imports (HS 940391)

Shippers in China, Indonesia and Viet Nam accounted for

most of Japan’s imports of wooden furniture parts (HS

940391) in March 2025. Of the total value of HS 940391

imports 48% was delivered from China (up 24% mom)

17% from Indonesia and; 11% from Viet Nam.

The value of imports of HS 940391 from Italy, a major

supplier in February, dropped 42% in March 2025

compared to a moth earlier.

The value of March 2025 imports was almost the same as

in March 2024 but compared to a month earlier March

2025 imports rose 9%.

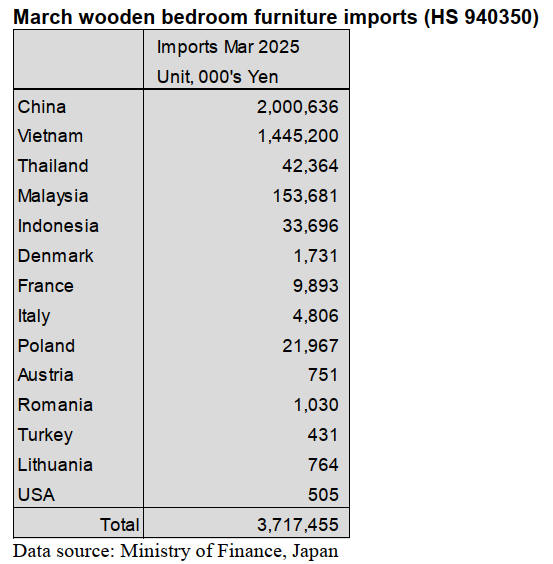

March wooden bedroom furniture imports (HS 940350)

The top two shippers of wooden bedroom furniture (HS

940350) to Japan in March 2025 were China (54%) and

Vietnam (39%). Malaysia was the other shippers of note in

March securing a 4% share of the value of imports.

March arrivals from China increased month on month by

40% with increase of over 40% from both Vietnam and

Malaysia.

Compared to March 2024 there was little change in the

value of imports in March 2025, however, there was a

major correction as March 2025 import values surged

compared to a month earlier bring the average import

value for February and March in line with the upward

trend seen in previous months.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Orders for house builders

The orders at many major housing companies and house

builders in March, 2025 exceed the orders of March, 2024.

One of reasons of exceeding the last year’s results is that

the price for per house is higher than last year. Also, the

companies ran promotions at the beginning of this year

and it appears that early sales activities, conducted with an

eye on the legal system reforms starting in April 2025,

may have contributed to securing orders.

The housing market is shrinking and it is difficult to

interpret the recovery of major companies' orders as a

market trend.

The orders for apartment buildings at some companies are

strong. Depending on the project, some negotiations that

were delayed from February to March due to winter

weather factors appear to have been finalized. As for

detached houses, market outlook differs between

companies.

Some companies have successfully driven sales through

proactive marketing efforts. The orders for renovations are

still firm. The application process for renovations of

existing homes under the Housing Energy Efficiency 2025

Campaign began on March 31, 2025. Moving forward,

renovation proposals utilizing subsidy programs are

expected to become increasingly active.

Cedar logs for China

The export price of Japanese cedar logs to China is

weakening. For Japanese cedar logs of 8 cm bigger, the

price is around $113, C&F per cbm, approximately $7

lower than at the end of last year. The background of

Trump administration in the U.S. imposing an additional

10% tariff on China on February 4 and another 10% on

March 4, caused a significant slowdown in purchasing

after the Lunar New Year.

Due to the ongoing appreciation of the yen, exporters have

fallen into unprofitability, and the export volume is highly

likely to shift towards a decline in the future.

The log price remains unchanged at around 12,000 yen,

delivered to export port per cbm. The freight rate for a

small vessel with a capacity of 2,800 cmbs is around

US$50,000 per ship. The price has fallen from the year-

end level of US$60,000, but with the yen appreciating

from around 153 yen per dollar at the end of the year to

approximately 143 yen per dollar, export costs remain just

underUS $120, leading to a deficit equal to the price

decline.

The port inventory of Japanese cedar logs at Taicang Port,

Jiangsu Province, China reportedly decreased from around

170,000 cbms in mid-March to below 140,000 cbms,

which is believed to have led to a decline in exports from

Japan.

1630,000 cbms of logs were exported to China from Japan

last year and it was 15.6 % more than 2023. The export

volume reached a record high. The export volume in

January to February, 2025 is 278,559 cbms and it is 35.8%

more than the same period last year.

Domestic lumber and logs

Domestic lumber continues to be in a tight supply-

demand balance. Kanto region, inventory of small sized

whitewood lumber at Tokyo port has been declining. Most

of studs braces have been purchased precutting plants. As

a result, prices have risen further enhancing the price

advantage of cedar. Inquiries to cedar studs are still strong.

The price of cedar stud for precutting plants is 60,000–

63,000 delivered per cbm. There is not enough cypress

lumber delivered from Kyusyu region to Kanto region.

The price of cypress sill for precutting plants is increasing

slightly. At the same time, demand for B-grade cedar

posts, foundation, and cedar studs with price advantages

has been increasing month by month. A-grade lumber

remains at high price levels as they need to align with the

lower price range of imported materials.

The price of cypress log in the northern part of Kanto

region and Chugoku region continued declining. Cedar

logs for a post is 13,600 yen, delivered per cm in the

northern part of Kanto region. This is 2,000 yen less than

last month. In Kyushu region, it costs 16,000 yen,

delivered per cbm and it costs 14,5000 yen, delivered per

cbm in Tohoku region.

Cypress log for a post in Chugoku region is 25,000 yen,

delivered per cbm and for a sill is 23,000 yen, delivered

per cbm. This is 1,000 – 2,000 yen more than the previous

month. Cypress log for a sill in the northern part of Kanto

regions is 24,000 yen and it is 23,800 yen in Shikoku

region. The price of a cypress log is 6,000 yen more than

last year. The price of a cedar log in the northern part of

Kanto region is around 1,000 yen less than last year.

Special feature

In 2024, the total value of U.S. lumber imports was

approximately 3.5 trillion yen, with 49% of the imports

coming from Canada. Following Canada, China accounted

for 8% of U.S. lumber imports in 2024, while Brazil,

Chile, and Vietnam each accounted for 7%. Japan's lumber

exports to the U.S. totaled 5.1 billion yen in 2024,

accounting for only 0.2% of total U.S. imports.

Additionally, a certain amount of processed wood

products destined for the U.S. are included in exports via

China.

The U.S. has designated certain exclusion items, including

pharmaceuticals, semiconductors, and timber such as logs,

lumber, plywood and wooden boards. For highly

processed wooden products like wooden fixtures, specific

exemptions apply, while other less-processed timber

products remain subject to the current tariff rates. Given

the relatively small trade volume, the direct impact on

forestry product transactions between Japan and the U.S.

is expected to be limited.

However, what kind of repercussions will Japan face due

to trade friction between the U.S. and Canada, and how

will the intensification of trade friction between the U.S.

and China impact the global economy? There are concerns

about how China's suspension of U.S. log imports, which

effectively serves as a retaliatory measure, will impact

major timber-producing countries such as New Zealand.

In 2024, the total U.S. trade deficit amounted to $1.2117

trillion, with China accounting for over 20%

(approximately US$245.4 billion). Mexico and Vietnam

followed as major contributors to the deficit."

In the timber and wood products sector, China imported

US$1.628 billion worth of goods from the U.S., while its

exports to the U.S. amounted to US$2.944 billion. As a

result, the U.S. recorded a trade deficit of US$1.316

billion. It cannot be simply determined from the data of

both countries, but the proportion of timber-related trade

in the U.S.-China trade deficit is only 0.5%.

However, on March 4, China announced a ban on

imported logs from the U.S., citing concerns over insect

damages. It is a retaliatory measure against the high tariffs

imposed by the United States.

The top imported timber in China consists of radiata pine

logs from New Zealand, which make up 49.6% of total log

imports, and sawn timber from Russia, accounting for

45.8% of total sawn timber imports.

Both categories together represent nearly half of China's

total timber imports. Imports from the United States rank

second for logs and fourth for sawn timber.

China has stopped importing logs from the United States,

leaving the key question of where to source alternative

timber. radiata pine from N Z and Australia, where

friendly relations have been restored, are viable

alternatives. It will be interesting to see how much Japan's

softwood log exports can grow in the timber import

market. China’s domestic timber demand, its role as an

export hub for the United States, and currency exchange

rate trends are all key factors to watch.

For China, securing hardwood is likely a bigger challenge

than sourcing softwood. China exports a range of wood-

based products to the United States, including furniture,

parquet flooring, fixtures, home equipment, and picture

frames. These wood-based exports make up 85% of the

total export value.

China has become one of the world's largest plywood

exporters. In 2024, China's plywood exports totaled cbms,

which is 2.8 times Japan's total domestic and imported

supply. China exported 308,000 cbms plywood to China

and this is 2.4 % of all plywood exports. China exported

plywood to the U.K. the most and it was 784,000 cbms but

it is still 6.1 % of all plywood exports.

Japanese logs

The impact of Trump-era tariffs on log exports primarily

affects local manufacturers in China who process Japanese

cedar logs and export them to the United States. Recent

log export performance remains strong, with total exports

in January–February 2025 reaching 302,000 cbms,

marking a 31% increase year-over-year.

Notably, 90% of these exports are destined for China.

However, some Chinese manufacturers have reportedly

put their orders for Japanese cedar logs on hold.

China's halt on log imports from the U.S. has heightened

expectations for NZ radiata pine, which remains a major

source of imported logs. As a result, Japanese cedar logs

have also seen increased interest from buyers looking for

alternative supplies.

The tariff on wood exports from China to the United

States has increased from 25% to 45% as of March.

However, cedar fencing materials have been granted an

exemption from reciprocal tariffs. Additionally, highly

processed wooden products such as wooden fixtures are

subject to reciprocal tariffs. If these wood exports from

China to the U.S. decline, there is a possibility that Japan's

log exports to China could also slow down.

|