|

1.

CENTRAL AND WEST AFRICA

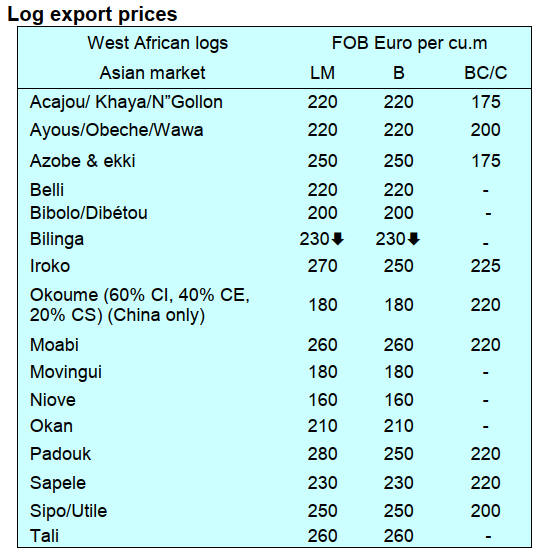

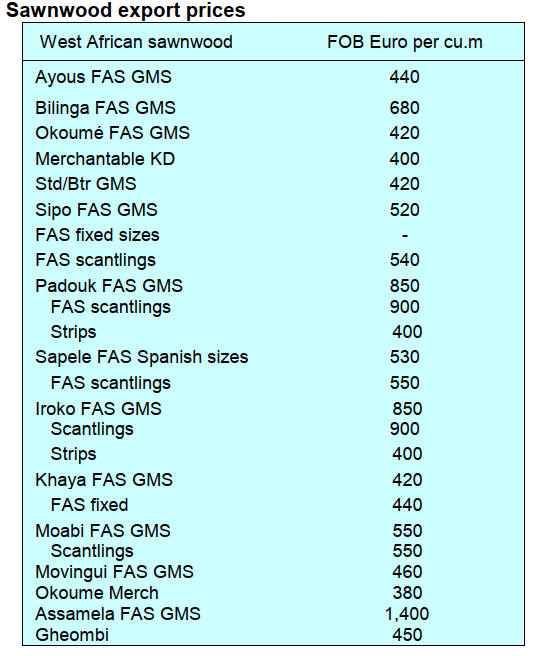

Little advantage in lowering prices in a dull market

At the end of May demand for West African timber

remained subdued according to producers. There has been

an effort to raise buyer interest through lowering FOB

prices but producers know, having once reduced prices it

is very difficult to raise them especially as demand is

likely to remain quiet. A sharp fall in demand for okan has

been observed.

Markets in the Philippines and the Middle East countries

continue to absorb steady volumes with Philippine buyers

being particularly active for okoumé and dabéma and

Middle East importers maintain stable orders for iroko and

redwoods. Demand in these two markets helps offset the

downturn in Chinese and European consumption but it is

not enough to halt the rise in sawnwood stocks held by

millers in the region.

European demand for tropical timber has stayed muted

since early spring and now, as the holiday season arrives

some importers are requesting delayed shipment until

August to avoid incurring extra port charges if they do not

clear imports, a particular problem at Antwerp and Le

Havre Ports during the summer lull, they say. With the

holiday period approaching across Europe few expect any

significant uptick in demand before the autumn.

Cameroon

It is reported that there are no unexpected challenges

facing the timber industry as the weak level of demand has

become the norm. The rain season is approaching and the

first downpours have already been recorded. Producers

comment that “except for election talk” the forestry and

transport ministries remain quiet.

An article on the businessincameroon.com website says

timber production in Cameroon is set to grow in 2025

even though the country has been tightening taxes on

wood exports for several years.

The Central Bank of Central African States (BEAC)

forecasts a national output of 5.22 million cubic metres for

the year, up from 5.19 million in 2024.

This rise in production is expected despite Cameroon’s

increasingly strict tax policy on the forestry sector. The

government says the goal of these higher taxes is to

discourage raw and semi-processed wood exports and to

promote value-added processing inside the country. To

support this strategy, Cameroon is also offering tax breaks

on wood processing equipment, at the same time the

government has set aside two industrial zones dedicated to

wood processing.

See: https://www.businessincameroon.com/public-

management/0505-14638-cameroon-s-timber-output-projected-

to-rise-in-2025-despite-higher-export-taxes

Gabon

The new government has been active in reviewing logistic

issues. Up-country roads continue to deteriorate under

persistent rains hampering haulage. Rail services were

recently disrupted due to another derailment. It has been

reported that SETRAG, the railway operator, plans a

multi-year programme to begin using concrete sleepers.

Producers are awaiting the long two-month dry season set

to begin in June. Meanwhile, forestry inspectors have

stepped up audits of concessions, sawmills and transport

corridors in Libreville and around Nkok.

Republic of the Congo

Congo’s timber sector remains quiet with many Chinese

and Malaysian sawmills operating on a single shift. Some

mills have ceased operations. The government continues

to promote tertiary processing. There has been some

investment in added value processing but there are

challenges meeting the quality and specification

requirements in some demanding markets. Some

producers are targeting domestic consumption and

regional markets for their processed products.

EUDR - export risk ranking of countries

The European Commission has published the ranking of

countries according to their assessed level of risk under the

EUDR.

See: https://green-forum.ec.europa.eu/deforestation-regulation-

implementation/eudr-cooperation-and-partnerships/country-

classification-list_en

There has been some early reaction to the rankings and

commentaries can be found at:

https://www.atibt.org/en/news/13641/eudr-commission-

publishes-first-country-benchmarking-list

also

https://www.nadar.earth/media/eudr-country-benchmarking

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in the Republic of Congo and Gabon.

See: https://www.itto-

ggsc.org/static/upload/file/20250519/1747635226558660.pdf

2.

GHANA

Primary wood products dominate exports

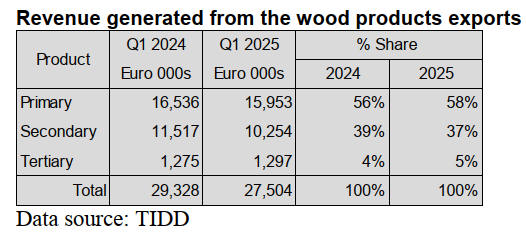

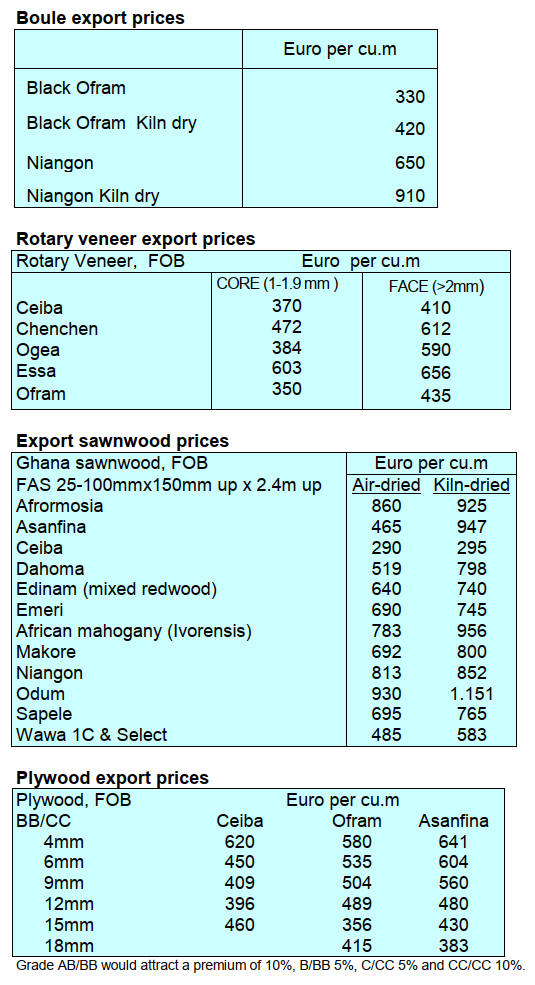

Ghana’s first quarter 2025 wood products statistics

published by the Timber Industry Development Division

(TIDD) of the Forestry Commission (FC) show that

primary, secondary and tertiary products accounted for

71%, 27% and 2% respectively of the total wood exports

(57,843 cu.m).

For the same period in the previous year the corresponding

figures for these products were primary (65%), secondary

(33%) and tertiary (2%) of the total volume of wood

products exported (64,701 cu.m).

Comparatively, Ghana exported lower volumes of all these

three classes of wood products during the first three-

months of 2025 compared to the same period last year.

The decline in exports was particularly sharp for air-dried

sawnwoodr (-13%), plywood (-88%), rotary veneer (-

11%) and plywood to the regional market (-28%).

The export revenue for the period totalled Eur 27.50

million in 2025 compared to the Eur 29.33 million in

2024, a 10% drop in volume and a nearly 6% decline in

value.

Primary wood products comprising air-dried sawnwood,

billets, teak logs, air-dried boules, kindling, poles and

rollboard earned Eur15.95 million from 41,052 cu.m of the

total wood products export between January and March

2025. The figures indicated decreases of almost 4% in

value and a decrease of 1% in volume, when compared to

the primary wood products export figures recorded for

January-March 2024.

Secondary wood products which included kiln-dried

sawnwood and boules, veneers, plywood and briquettes

earned Eur 10.25 million from a total volume of 15,493

cu.m in the first quarter 2025. Compared to the previous

year’s figures of 21,403 cu.m valued at Eur11.52 million

this showed a decrease of 11% in value and a decrease of

28% in volume.

Tertiary Wood Products (TWP) were mainly mouldings

and dowels and these earned Eur1.30 million from 1,298

cu.m of the total exports in the January-March 2025

period. Moreover, the figures indicate an increase of 2% in

value but a decrease of 5% in volume respectively as

compared to the tertiary wood products export of 1,366

cu.m valued at Eur 1.28 million in January to March 2024.

Of the total exports, the respective market shares for Asia,

Europe and Africa were 69%, 14% and 9% with the

balance going to the United States and Middle East

countries.

Neighbouring African countries have been the major

consuming markets for Ghana’s plywood exports with

Togo and Burkina Faso topping the list accounting for

64% of the total plywood exports to African countries.

Ghana to issue first FLEGT license

At a meeting with the European Union Ambassador to

Ghana, Irchad Razaaly, the Minister for Lands and Natural

Resources, Emmanuel Armah-Kofi Buah, reaffirmed

Ghana’s commitment to strengthening its longstanding

partnership with the European Union particularly in

sustainable forest governance.

According to the Minister, Ghana is on track to issue its

first Forest Law Enforcement, Governance and Trade

(FLEGT) License by 30 June 2025. He noted this

milestone will make Ghana the first country in Africa and

the second in the world to accomplish this achievement.

The Minister expressed gratitude to the EU for its

continued support to Ghana’s natural resources and

environmental sector and looked forward to a stronger and

more fruitful partnership in the years ahead.

He urged the EU to consider assistance in developing

large-scale commercial plantations and the Tree for Life

Reforestation Initiative and logistical support in the

ongoing fight against illegal mining, land reclamation,

restoration of polluted water bodies.

As part of its preparation for FLEGT licensing the

Forestry Commission convened a meeting with key

industry players to discuss and prepare them for

implementation of the FLEGT licensing and their role in

the timber value chain to ensure smooth transition.

Stakeholders were taken through presentations on the

overview of the FLEGT licensing regime; the legal

requirements and compliance under the Timber Resource

Management and Legality Licensing Regulations, 2017

(LI 2254); guidelines for export permits and license

issuance and application.

See: https://fcghana.org/fc-convenes-meeting-with-industry-

players-on-flegt-license-issuance/

Review of VAT system almost completed

The Acting Commissioner General of the Ghana Revenue

Authority, Anthony Kwasi Sarpong, has disclosed that the

review process of the country’s current Value Added Tax

(VAT) regime has progressed steadily and is well far

advanced and findings and recommendations will soon be

submitted to the Minister of Finance.

Speaking to journalist and IMANI Ghana on “Resetting

Ghana’s Revenue mobilisation”, the Commissioner

General expressed optimism that the new system will

improve the country’s tax-to-Gross Domestic Product

(GDP) ratio.

In his 2025 budget statement the Minister of Finance, Dr.

Casley Ato Forson, signaled government’s intention to

conduct a comprehensive review expected to simplify the

VAT payment, boost domestic revenue mobilisation and

increase the tax-to-GDP ratio for the short to medium

term.

See: https://www.myjoyonline.com/review-of-ghanas-vat-

regime-almost-ready-gra/

Producer Price Index (PPI) drops

The year-on-year producer price inflation (PPI) in ex-

factory prices for all goods and services declined to 18.5%

in April 2025 from 24.4% in March 2025.

With the recent appreciation of the Ghana Cedi industry

players are hopeful this will deliver some macro-economic

stability. The Association of Ghana Industries (AGI) has

said that the appreciation of the cedi was a positive

development because it would impact in the confidence in

the economy.

Speaking at the 9th Ghana CEO Summit under the theme,

“Leading Ghana’s Economic Reset: Transforming

Business and Governance for a Sustainable Futuristic

Economy”.

President Mahama reiterated his government’s

commitment to fiscal prudence and urged businesses to

reflect price adjustments as a necessary complement to

Government efforts aimed at consolidating economic

recovery.

See: https://thebftonline.com/2025/05/27/maintaining-fiscal-

discipline-remains-top-priority-mahama/

and

https://www.bog.gov.gh/wp-content/uploads/2025/05/MPC-

statement-May-2025.pdf

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Ghana.

See: https://www.itto-

ggsc.org/static/upload/file/20250519/1747635226558660.pdf

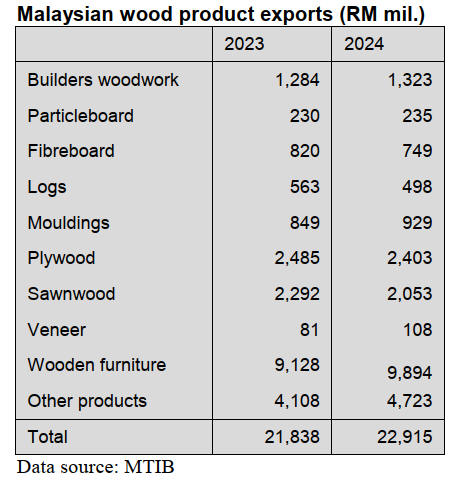

3. MALAYSIA

GDP growth forecast 4.4 per cent

MIDF Research considers domestic demand will continue

to be the key driver of Malaysia’s economic growth in the

first quarter of 2025 underpinned by steady growth in

private consumption and a sustained rise in the services

sector.

A healthy labour market, employment growth with high

labour force participation, increased tourist arrivals (and

spending) will be positive fundamentals supporting

Malaysian growth.

See: https://www.thestar.com.my/business/business-

news/2025/05/16/gdp-growth-forecast-for-1q25-seen-at-44

Importers rush secure furniture as tariffs loom

US buyers of Malaysian furniture have asked that the

products be sent to them before July in view of the

uncertainty over US tariffs according to the Malaysian

Furniture Council.

“Our customers in the United States have asked us to ship

as much as possible during the 90-day (tariff) suspension

window, ideally before July,” said Matthew Law the

Council’s Deputy President. He added that currently the

US imposes different tariff rates on Malaysia’s main

competitors: Vietnam, Cambodia and Indonesia. Amid

these upheavals US demand has begun to decline signaling

a market slowdown.

According to an Investment, Trade and Industry Ministry

report on the first quarter of 2025, Malaysia faces a 24%

US tariff, well below Vietnam, Cambodia and Indonesia.

It said Malaysia’s furniture industry stands to gain from

shifting US trade patterns with lower tariffs making its

products more appealing to US importers.

In the furniture sector the government will tighten

enforcement to prevent Malaysia from being used as a

trans-shipment hub for timber and wood products

originating from countries with higher US tariffs.

The president of the Small and Medium Enterprises

Association Malaysia, William Ng, said the higher tariffs

on furniture imports from Vietnam, Cambodia and

Indonesia have opened up a “real and timely opportunity”

for Malaysian SMEs to grow their presence in one of the

world’s largest furniture markets.

Adding, to fully leverage this we need better marketing

support, faster access to trade finance and streamlined

logistics to meet increased demand.

Despite the improved competitive position, Ng pointed out

that local furniture manufacturers continue to grapple with

rising operational costs, including labour, raw materials

and energy. He also stressed the need to strengthen

upstream integration within the industry, noting that

Malaysia still imports significant timber and necessary

inputs.

See: https://www.thestar.com.my/news/nation/2025/05/13/rush-

for-furniture-as-tariffs-loom

Malaysian Wood Expo

The Malaysian Wood Expo (MWE) is back with its 3rd

Edition from 10 to 11 November 2025 at the Malaysia

International Trade and Exhibition Centre (MITEC).

The Malaysian Wood Expo (MWE) is a wood expo

organised by the Malaysian Timber Council (MTC). Since

its inception in 2019 the MWE has gained a reputation as a

premier platform for global players to connect and create

new business opportunities. MWE last year recorded 3,000

trade visitors from 50 countries to its 120 exhibitors.

See: https://www.malaysianwoodexpo.com.my/ .

Carbon recognised as a forest product

Sarawak continues to strengthen its commitment to

climate change mitigation by engaging Native Customary

Rights (NCR) landowners as strategic partners in the

implementation of sustainable forest carbon activities.

According to a Sarawak Forest Department Director, Datu

Hamden Mohamad, community participation is essential

for effective forest carbon management, with Native

Customary Rights lands serving not only as cultural

heritage assets but also as vital sources of livelihood and

identity.

“NCR land holds great potential in contributing to global

efforts to reduce carbon emissions.

“Active involvement from local communities can bring

long-term economic returns while preserving the

environment,” he said. He added, “Sarawak has taken

legislative steps to formalise this strategy by amending the

Forests Ordinance 2015 to recognise carbon as a forest

product”.

See:

http://theborneopost.pressreader.com/article/281698325660046

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Malaysia.

See: https://www.itto-

ggsc.org/static/upload/file/20250519/1747635226558660.pdf

4.

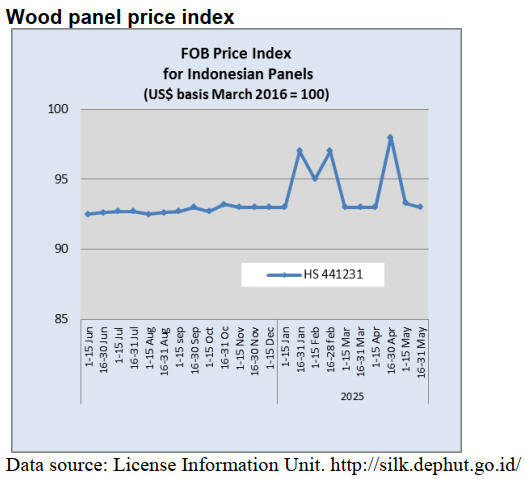

INDONESIA

Boosting exports - mandatory SVLK

requirement

removed on furniture and crafts

The Minister of Trade, Budi Santoso, announced that the

government will remove the mandatory requirement for V-

Legal documents for furniture and crafts in order to

expand export growth. He clarified that the V-Legal

requirements, which relate to wood product export

licenses, will no longer be mandatory except for certain

countries such as European Member States and the United

Kingdom.

The Minister emphasised that removing the V-Legal

requirement is intended to facilitate the export process for

furniture and crafts especially those from small and

medium size enterprises thereby relieving them of SVLK

costs.

"This change will prevent SMEs from being burdened by

extra costs and lengthy processing times. It will enhance

our efficiency and competitiveness, allowing us to better

compete with countries like Vietnam," he added.

See: https://www.antaranews.com/berita/4848845/pemerintah-

dongkrak-ekspor-furnitur-lewat-dengan-tidak-wajib-v-legal

and

https://www.cnbcindonesia.com/news/20250521181700-4-

635122/mendag-pengusaha-sepakat-ekspor-furnitur-kerajinan-

tak-wajib-svlk

Diversification of products for export to Japan

Japan is a major market for Indonesian processed wood

products. To strengthen this trade the Indonesian Embassy

in Tokyo, along with the Indonesian Forestry Community

Communication Forum (FKMPI), organised a Business

Forum on Forest Product Trade.

Indroyono Soesilo, Chairman of FKMPI, emphasised the

crucial role of the Indonesian Legality and Sustainability

Verification System (SVLK) in enhancing Indonesia's

standing in the international market for wood products.

Indroyono mentioned that exports to Japan are primarily

panel products, paper, furniture, wood chips and wood-

working items which earned around US$300 million in

2024. "There is a need to diversify processed wood

products to expand the export market to Japan," he said.

In terms of furniture products, Veronica Rebekka

Anggraini, a representative of the Board of Directors of

the Indonesian Furniture and Craft Industry Association

(HIMKI), views Japan as a promising market for

continued growth.

She explained "Japan ranks second among Indonesia's

furniture export destinations with a value of US$24.67

million in 2024". During this forum a Memorandum of

Understanding (MOU) was signed between Indonesian

businesses actors and their Japanese partners concerning

the supply of wood pellet products.

See: https://forestinsights.id/diversifikasi-produk-kayu-olahan-

untuk-perkuat-pasar-ekspor-ke-jepang/#

EC classifies Indonesia as ‘Standard Risk’

The European Commission has published risk categories

that will guide EU import requirements under the EU

Deforestation Regulation (EUDR). Indonesia has been

placed in the Standard Risk Category.

As a result of this classification, Indonesia's exports of

commodities such as palm oil, wood products, cocoa and

rubber to the European Union will face lighter

requirements than some other countries under the EUDR.

On 22 May 2025, the European Commission adopted

an Implementing Regulation classifying countries under

the EU Deforestation Regulation (EUDR) into three risk

categories: low, standard or high risk.

Four countries have been designated as "high risk":

Belarus, Myanmar, North Korea and Russia. 140 countries

have been classed low risks, including all EU Member

States, the UK, the U.S., Canada, China, Japan, Australia

and South Africa.

This classification determines whether operators can

benefit from simplified due diligence obligations under

Article 13 EUDR and the level of annual compliance

checks to be conducted by supervisory authorities on

imports and exports of EUDR-relevant commodities

(cattle, cocoa, coffee, oil palm, rubber, soya and wood)

and derived products.

The risk classification system will allow EU Member State

Competent Authorities to define and plan their annual

compliance checks, namely 1% for low-risk countries, 3%

for standard risk countries and 9% for high-risk countries

as part of a risk-based approach.

See: https://green-forum.ec.europa.eu/deforestation-regulation-

implementation/eudr-cooperation-and-partnerships/country-

classification-list_en

and

https://www.msn.com/id-id/ekonomi/peraturan-keuangan/lolos-

dari-aturan-super-ketat-uni-eropa-kategorikan-indonesia-

berisiko-standar-dalam-eudr/ar-

AA1FkbTm?ocid=BingNewsVerp

Indonesia introduces its carbon trading potential to

Japan

The Indonesian Forestry Entrepreneurs Association

(APHI) is intensifying efforts to mitigate the impacts of

climate change by introducing Indonesia’s huge potential

for tropical forest-based carbon trading at this year’s

World Expo Osaka, Japan.

In a business forum attended by stakeholders from the

public and private sectors from both countries, APHI

presented the government’s flagship programme, the Food

and Land Use Coalition (FOLU) Net Sink 2030, which

targets the forestry and land use sectors to become net

emission absorbers by 2030.

On that occasion, the implementation of the Mutual

Recognition Arrangement (MRA) between Indonesia and

Japan was also discussed which would allow cross-country

recognition of carbon certification. This is intended to

create opportunities for Japanese investors in nature-based

carbon projects such as peat restoration and mangrove

rehabilitation.

See: https://en.antaranews.com/news/354785/indonesia-

introduces-its-carbon-trading-potential-to-japan

Semarang furniture exports to the US

Furniture products were recently shipped from Semarang,

Central Java to the United States according to the website

of the Indonesian Ministry of Trade Ministry. An export

ceremony was led by the Deputy Minister of Trade, Dyah

Roro Esti. She offered her appreciated for these expors

which contributed to the increase in Indonesian furniture

exports.

The Deputy Minister also remarked that the US has been

the main export destination for Indonesian furniture

exports over the past decade. This achievement, she added,

needed to be maintained considering the global economy

being uncertain as well as the challenges of US tariffs.

See: https://www.rri.co.id/bisnis/1522013/semarang-exports-usd-

120k-furniture-to-the-us

Primary forest loss fell in 2024

Indonesia's primary forest loss declined by 11% in 2024

compared to 2023. This trend differs from the global

situation which has seen a record increase in forest loss.

According to the World Resources Institute (WRI) Global

Forest Watch report, drawing on data from the University

of Maryland's Global Land Analysis and Discovery

(GLAD), approximately 6.7 million hectares (ha) of

primary rainforest were lost worldwide in 2024.

In Indonesia, the total area of primary forest loss in 2024

is estimated at 260,000 ha. a decrease from 290,000 ha in

2023. The WRI report indicates that most of the primary

forest loss in Indonesia occurred near logging concessions,

oil palm plantations, small-scale agriculture and mining

areas.

Some provinces, including Sumatra, specifically Aceh,

Bengkulu and South Sumatra as well as Papua

experienced minimal increases in their loss rates.

Additionally, some primary forest loss was noted in

several protected areas such as Kerinci Seblat National

Park, Tesso Nilo and the Leuser ecosystem in Aceh.

See:https://hijau.bisnis.com/read/20250521/651/1878934/hutan-

primer-indonesia-yang-hilang-turun-11-pada-2024.

Ministry of Forestry clarification on forest areas for

food

The Ministry of Forestry has emphasised that the plan to

open 20.6 million hectares of land for the food security

project will be executed in stages. Ruandha Sugardiman,

Senior Advisor to Indonesia's Folu Net Sink 2030

Working Team at the Ministry of Forestry clarified that

the areas designated for food land will consist of non-

productive forests.

Ruandha assured that primary forests would not be

converted for food or energy purposes. He stated that

some of the land designated for this project consists of

secondary forests. If any new land is to be opened from

productive forests, Ruandha noted that the clearing would

not exceed 5% of the total productive forests in Indonesia.

The government has confirmed that it will conduct a

environmental impact analysis and that it is committed to

achieving net zero deforestation. Therefore, when there is

forest clearing for agricultural land there will be a

corresponding commitment to replanting in other areas.

See: https://nasional.kontan.co.id/news/kemenhut-rencana-

pembukaan-20-juta-ha-hutan-untuk-pangan-dilakukan-secara-

bertahap

Bracing for forest fires ahead of dry season

With some regions already experiencing wildfires the

government is intensifying efforts to mitigate the risk of

forest and land fires as the country is expected to shift to

the dry season in the coming weeks.

The Meteorology, Climatology and Geophysics Agency

(BMKG) recently forecasted that most regions across the

country will enter the dry season between April and June,

with its peak expected to fall in August, exacerbating the

risk of wildfire.

See: https://www.thestar.com.my/aseanplus/aseanplus-

news/2025/05/18/indonesia-braces-for-forest-and-land-fires-

ahead-of-dry-season#goog_rewarded

5.

MYANMAR

Myanmar targets US$33 billion in foreign trade

Myanmar’s foreign trade is expected to reach US$33 bil.

in the financial year 2024-2025. External trade amounted

to over US$25.79 bil. as of 12 March this year or 78% of

the trade target according to the Vice-Chair of the National

Export Strategy Public-Private Export Promotion

Committee.

On conclusion of the 2020-2025 National Export Strategy

period, the Vice Chair asked officials to develop plans to

adapted to current situations and amend projects for the

next five-year National Export Strategy (2026-2030).

See- https://www.gnlm.com.mm/myanmar-targets-us33b-in-

foreign-trade-for-fy2024-2025/?utm_source=chatgpt.com

UN Warns - Deepening economic collapse and

humanitarian crisis

The United Nations has issued a stark warning over

Myanmar’s accelerating economic and humanitarian

collapse amid intensifying armed conflict and systemic

human rights abuses.

In a new report released by the Office of the UN High

Commissioner for Human Rights, Commissioner, Volker

Türk, described the situation as an “increasingly

catastrophic human rights crisis,” marked by widespread

violence, atrocities and the breakdown of basic public

services.

According to the report more civilians were killed in 2024

than in any previous year since the 2021 military coup. In

Rakhine State, the Arakan Army (AA) has gained control

over most of the region, displacing tens of thousands.

Rohingya civilians remain caught in the crossfire,

suffering killings, torture, arbitrary arrests and the

destruction of entire villages. Some Rohingya armed

groups have reportedly joined the broader conflict.

The violence has had a cascading impact on Myanmar’s

already fragile economy. The country has lost an estimated

US$93.9 billion since the coup. The GDP is not expected

to return to pre-pandemic levels until at least 2028. Key

indicators Inflation has soared and the kyat has

depreciated by 40%. Over half the population now lives

below the poverty line and food insecurity is widespread,

with prices for essentials continuing to climb.

Despite targeted international sanctions, the military

retains control over state-owned enterprises, the central

bank, and major revenue streams in the extractive sector.

The junta has used forced currency conversions, import

controls and repression of informal money transfers to

preserve its financial grip.

As Myanmar’s conflict deepens, the UN urges the global

community not to look away. Without coordinated

humanitarian aid and a path toward accountability, the

country risks further descent into entrenched violence,

economic ruin and State collapse.

See- https://news.un.org/en/story/2025/05/1163706

ASEAN Summit - calls for ceasefire and dialogue

At the recent ASEAN Summit regional leaders pushed for

renewed efforts toward peace and stability in Myanmar’s

ongoing political crisis and humanitarian disaster.

The ASEAN statement says, “We (ASEAN) remain

deeply concerned over the escalation of conflicts and the

deteriorating humanitarian situation in Myanmar, further

compounded by the impact of the 7.7-magnitude

earthquake that struck central Myanmar on 28 March

2025. We are committed to assisting Myanmar in finding a

peaceful and durable solution to the ongoing crisis. We

reiterate that the Five-Point Consensus remains the main

reference to address the political crisis in Myanmar, and it

should be implemented in its entirety to help the people of

Myanmar achieve an inclusive and durable peaceful

resolution that is Myanmar-owned and Myanmar led, thus

contributing to peace, security and stability in the region”.

ASEAN leaders expressed “deep concern” over the

escalating violence in Myanmar, urging all parties

involved, including Myanmar Government and opposition

armed groups, to extend the current temporary ceasefire

and initiate inclusive national dialogue.

See: https://asean.org/wp-content/uploads/2025/05/FINAL-

ASEAN-Leaders-Statement-on-an-extended-and-expanded-

ceasefire.pdf

Power crisis solution

Myanmar is signaling interest in reviving the long-stalled

Myitsone Dam project as the country grapples with

worsening electricity shortages. At a recent cabinet

meeting Senior General, Min Aung Hlaing, acknowledged

that current electricity production covers less than half of

national demand.

He attributed the ongoing power crisis to the suspension of

large-scale hydropower projects initiated over a decade

ago specifically referencing the US$3.6 billion Myitsone

Dam.

See- https://thediplomat.com/2024/05/is-myanmars-junta-about-

to-revive-a-controversial-dam-project/?utm_source=chatgpt.com

6.

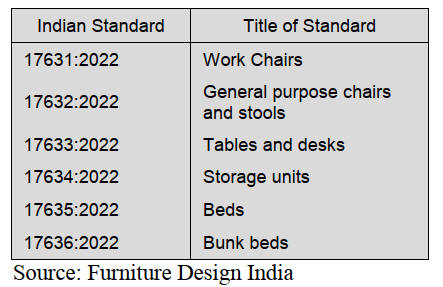

INDIA

QCO on furniture begins

February 2026

Announcing the enforcement of a mandatory BIS-QCO on

Furniture, in exercise of the powers conferred by section

16 of the Bureau of Indian Standards Act, 2016 (11 of

2016), the Bureau of Indian Standards has made a

dispensation of Statutory order S.O. 801 (E) entitled

Furniture Quality Control 2025. This was published on 13

February 2025 and will come in effect after 12-months

from the date of publication of the notification.

Goods or articles which shall conform to the

corresponding Indian Standards are specified as:

According to PlyReporter, Chintan Parekh, Secretary of

the Association of Furniture Manufacturers and Traders

(AFMT) asserted, “Although industry is bracing itself for

impending QCO on furniture stakeholders are

apprehensive about its repercussions on the design

quotient because it may limit the viability of certain

furniture design in the domestic market”.

See:https://www.furnituredesignindia.com/articles/90910/govt-

announces-mandatory-qco-bis-on-furniture-w-e-f-13th-feb-2026

and

https://www.instagram.com/p/DGGGpwvB4pB/

and

https://plyreporter.com/article/154008/govt-announces-

mandatory-qco-bis-on-furniture-wef-13th-feb-2026

Furniture exports – 60% wooden furniture

In its promotion of IndiaWood scheduled for 26 February -

2 March 2026 at the Bangalore Exhibition Centre there is

a focus on the potential for expanded Indian furniture

exports.

The promotion text stated “with robust export potential

and modernisation of manufacturing, India's woodworking

enterprises can strengthen their standing among the

world's furniture manufacturers”.

Nearly 60% of India's overall furniture export sector is

made up of wooden furniture.

The most popular exports from India are statues or

complex designs or art pieces. Because the timber sector

has a significant export potential updating the technology

adopted will aid expansion. In India, domestic demand for

furniture is expanding, which is boosting the organised

industry.

"International Furniture Park"- strengthening India's

export potential

An "International Furniture Park" at Tuticorin is an export

oriented initiative aimed at driving the industrial growth of

the southern regions of the State.

The Tamil Nadu government has signed memorandums of

understanding for 24 projects and is aiming for exports of

US$100 billion by 2030. The Micro, Small and Medium

Enterprises Trade and Investment Promotion Bureau (M-

TIPB) of the Tamil Nadu government has signed an

agreement with Flipkart/Walmart to promote e-commerce

among MSMEs in the state through a supplier

development programme.

M-TIPB and the Indo-German Chamber of Commerce

have signed a Memorandum of Understanding to facilitate

engagement between MSMEs in the state and enterprises

in Germany. For MSMEs in the state, the MoU will

enhance links, interaction, technology partnership

programmes and export prospects.

Key factors for the growth of the furniture sector in India

could be considered as improved supply management, cost

minimisation, brand creation and customisation options.

See:

https://indiawood.com/industryupdate2022.aspx?pressid=pressR

e30

Residential property market transitioning

A report by PropTiger has suggested India's residential

property market is transitioning from a phase of rapid

post-pandemic growth to a more balanced and sustainable

trajectory. While prices continue to rise year-on-year the

pace of growth has moderated in recent quarters.

The shift toward moderation became evident from the

third quarter 2024. Between the final quarter of 2024 and

early 2025 prices in most cities either held steady or

posted low single-digit gains. The stabilisation phase can

be attributed to multiple factors such as a more discerning

buyer base and continued but rationalised investor interest

and supply being adjusted to real demand rather than

speculative pushes.

"With prices plateauing in many cities and rising modestly

in others, developers are likely to respond with more

calibrated launches. This, in turn, will help maintain

momentum while avoiding overheating in the sector,"

noted the PropTiger report.

See: https://www.business-standard.com/finance/personal-

finance/india-s-housing-market-is-not-crashing-but-definately-

cooling-here-is-why-125050700677_1.html

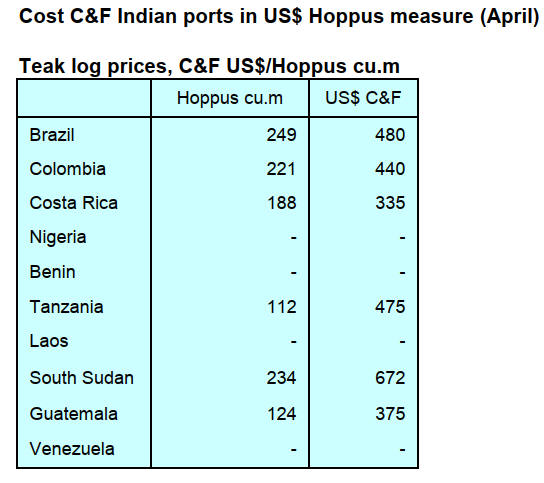

Joint State private sector teak initiative

The Jharkhand State Pollution Control Board (JSPCB) will

promote teak plantations in rural Jharkhand in the

upcoming monsoon season to promote sustainable

development. As part of the initiative, teak saplings will be

planted in the backyards of rural households.

This initiative will be taken under JSPCB’s zero carbon

emission policy under which industrial units operating in

the State will support the households in maintaining the

saplings and receive carbon credits.

The JSPCB discussed the initiative with industry

stakeholders and the industries will provide financial

assistance, saplings and technical guidance to the

household for planting and maintaining the teak trees and

create a record of the saplings to be planted.

The trees planted under the initiative will be geo-tagged

and reported to a designated site of the JSPCB in a

specified format for ease of recording and keeping track of

the plants and their growth. The sites will be geo-tagged

by the industry in collaboration with JSPCB to track and

monitor the progress of the project.

See: https://timesofindia.indiatimes.com/city/ranchi/jspcb-eyes-

teak-plantation-to-reduce-carbon-

emission/articleshow/118564722.cms#:~:text=Ranchi%3A%20T

he%20Jharkhand%20State%20Pollution,the%20backyards%20of

%20rural%20households.

7.

VIETNAM

Wood and Wood Product (W&WP) trade

highlights

The Vietnam Customs Department has reported W&WP

exports in April 2025 earned US$1.45 billion, down 2%

compared to March 2025 but up 5% compared to April

2024. Of the total WP exports accounted for US$978

million, down 4% compared to March 2025 but up 3%

compared to April 2024.

In the first 4 months of 2025 W&WP exports totalled

US$5.4 billion, up 10% over the same period in 2024 of

which WP exports fetched US$3.7 billion, up 9% over the

same period in 2024.

Vietnam’s W&WP exports to the Japanese market in April

2025 amounted to US$181.7 million, up 44% compared to

April 2024. In the first 4 months of 2025 W&WP exports

to the Japanese market totalled US$690.4 million, up 27%

over the same period in 2024.

In April 2025 W&WP imports into Vietnam were valued

at US$247 million, down 6% compared to March 2025 but

up 6% compared to April 2024. In the first 4 months of

2025 W&WP imports into Vietnam totalled US$915.1

million, up 19% over the same period in 2024.

Vietnam's tali wood imports in April 2025 were reported

at 23,800 cu.m, worth US$8.7 million, up 5% in volume

and 5% in value compared to March 2025.

However, compared to April 2024, the value of imports

decreased by 44% in volume and 44% in value. In the first

4 months of 2025 Vietnam’s imports of tali were117,100

cu.m, worth US$42.5 million, up 24% in volume and 18%

in value compared to 2024.

Imports of raw wood (logs and sawnwood) from the US to

Vietnam in March 2025 reached 68,730 cu.m with a value

of US$29.97 million, up 13% in volume and 20% in value

compared to February 2025, an increase of 0.5% in

volume and an increase of 1% in value over the same

period in 2024.

In the first 3 months of 2025 imports of raw wood from

the US totalled 191,470 cu.m with a value of US$78.65

million, up 34% in volume and 28% in value over the

same period in 2024.

W&WP exports from Vietnam to the UK market in April

2025 brought in about US$ 21.8 million, up 11%

compared to April 2024. In the first 4 months of 2025, the

W&WP exports to the UK market earned US$81.5

million, up 11% over the same period in 2024.

Vietnam’s imports of poplar in April 2025 totalled 26,700

cu.m, worth US$11.2 million, down 7% in volume and

down 6% in value compared to March 2025. Compared to

April 2024 imports decreased by 4% in volume and

increased by 8% in value.

In the first 4 months of 2025 imports of this item

accounted for 99,400 cu.m, worth US$39.9 million, down

5% in volume and up 2% in value over the same period in

2024.

Imports of raw wood materials from the EU in March

2025 amounted to 67,060 cu.m, with a value of US$22.63

million, down 13% in volume and 6% in value compared

to February 2025 but an increase of 52% in volume and

46% in value over the same period in 2024.

In the first quarter of 2025 imports of raw wood from the

EU were 198,260 cu.m with a value of US$63.95, up 48%

in volume and 47% in value over the same period in 2024.

Vietnam classified as a "low risk" for EUDR

On 22 May 2025 the European Commission (EC)

announced the country risk classification list under the

EUDR.

See: https://green-forum.ec.europa.eu/deforestation-

regulation-implementation/eudr-cooperation-and-

partnerships/country-classification-list_en

According to the country risk classification list published

by the European Commission Vietnam is categorised as a

"low risk" country.

Vietnam Wood Industry in 2025 - trends, challenges

and opportunities

Vietnam’s wood industry has evolved rapidly, becoming

one of the most significant players in global wood

production and export. The country has built a reputation

for producing high-quality timber, furniture and wood

products. The Vietnamese wood industry continues to

thrive, with new trends, policies and opportunities shaping

its future.

A recent article explores the latest developments in

Vietnam’s wood sector highlighting trends, challenges and

the potential for global buyers and investors. Highlights

from the article are provided below.

The Vietnam wood industry benefits from robust trade

relationships with key global markets. The United States

remains one of Vietnam’s largest buyers of wood

products, contributing significantly to the export value.

Other important markets include the European Union and

Japan, where demand for sustainably sourced wood is

growing. Vietnam’s ability to diversify its export markets,

including newer partners in Asia and the Middle East,

enhances its position in the global wood industry.

The Vietnam wood industry has also been adapting to

changing global trade dynamics. In response to the U.S.

tariffs on certain products from Vietnam, many

manufacturers are turning to American timber as a means

to mitigate the impact of these tariffs. By incorporating

American timber into their production processes, these

businesses can avoid the higher tariffs and maintain a

competitive edge, especially in the U.S. market.

Environmental responsibility is now at the forefront of

the Vietnam wood industry. Many manufacturers are

shifting to sustainable sourcing practices, prioritising

Forest Stewardship Council (FSC)-certified timber. This

move not only helps protect forest resources but also

aligns with buyer requirements from Europe, the U.S., and

other eco-conscious markets.

The adoption of technology is accelerating across

the wood manufacturing sector in Vietnam. Automation,

CNC machines and digital design tools are being

implemented to improve precision, reduce waste and

increase production efficiency. This modernisation

supports large-scale orders and enhances product

customisation.

Vietnamese manufacturers are no longer just fulfilling

orders, they are becoming strategic partners in product

development. Original Equipment Manufacturing (OEM)

and Original Design Manufacturing (ODM) services are

expanding rapidly in the Vietnam wood industry allowing

international brands to co-develop unique wood products.

The Vietnam wood industry in 2025 is being shaped not

only by market trends but also by important shifts in

government policies and international trade regulations.

In early 2025, the U.S. government imposed retaliatory

tariffs on various Vietnamese exports due to trade

imbalances. However, these tariffs specifically target

industries that rely heavily on imported raw materials.

Fortunately, the Vietnam wood industry particularly

segments that use American timber, has been exempt from

these penalties. Manufacturers that source raw wood

directly from the U.S. are able to continue exporting with

little to no additional duties offering a unique advantage in

this complex trade environment.

To support continued growth, the Vietnamese government

has introduced favorable policies for the wood processing

industry. These include tax incentives for eco-friendly

production, reduced import duties for machinery and raw

materials and support for enterprises seeking FSC

certification. Several provinces, such as Binh Duong and

Dong Nai, are offering special investment zones for wood

manufacturers with streamlined procedures and land rental

incentives. These measures reinforce the government’s

long-term commitment to boosting the Vietnam wood

industry.

Despite strong growth and global recognition the Vietnam

wood industry faces several challenges that may affect its

long-term competitiveness. Vietnam’s domestic forest

resources are limited and the country depends heavily on

imported raw timber, especially from the U.S., Africa and

South America. This reliance exposes the Vietnam wood

industry to risks such as price fluctuations, transportation

delays and stricter import regulations.

As demand for Vietnamese wood products grows, so does

the need for skilled labour. However, the industry is

struggling to attract and retain a trained workforce. Rural-

urban migration, an aging labour pool and rising wage

expectations are placing pressure on wood manufacturers

to invest in automation and worker training programmes.

For small and medium-sized enterprises the rising labour

cost is particularly challenging.

Sustainable manufacturing is no longer optional in

the wood export industry in Vietnam. However, meeting

environmental standards, carbon neutrality and legal

timber sourcing involves significant costs and

administrative effort. For small businesses, this can be

financially burdensome even though they are increasingly

required by major import markets. Failure to comply may

limit market access, especially to the EU and North

America.

The article concludes “The Vietnam wood industry in

2025 stands at the crossroads of innovation, opportunity,

and global competitiveness. With increasing demand for

sustainable wood products, strong government support,

and advanced manufacturing capabilities, Vietnam has

solidified its position as a leading supplier in the global

market. While challenges like raw material dependency

and regulatory compliance remain, they are outweighed by

the immense potential for international buyers, investors

and partners.

For businesses seeking reliable, eco-conscious and cost-

effective wood sourcing, Vietnam continues to be a top

destination worth serious consideration”.

See: https://thanhtungthinh.com/vietnam-wood-industry-in-2025/

W&WP import duties on wood products removed

Import duties on several wood products imported from the

US were removed as of 31 March ahead of the US

government announcement of reciprocal tariffs. The most

striking move, however, was the removal of import duties

on wood and wood products.

The Vietnam Timber and Forest Products Association

(Viforest) and the Handicraft and Wood Industry

Association of Ho Chi Minh City (HAWA) had previously

recommended revising the import tariffs on US wood

products to minimise risk of potential retaliatory tariffs by

the US.

The quick response from Vietnam has won approval from

industry leaders. A HAWA leader told the Thanh Nien

newspaper that the tax cuts were a "swift, positive and

timely" move, showcasing Vietnam’s goodwill. In reality,

the trade relationship between Vietnam and the US in

wood and wood products is mutually beneficial, with

Vietnam being both a leading supplier of timber and wood

products for the US and an important importer of similar

items from the US.

According to Viforest in recent years the import value has

grown rapidly. In 2024 Vietnam spent US$316.3 million

on US wood imports, a 32% increase in quantity and over

a 34% rise in value compared to 2023. Vietnam is now the

second-largest consumer of US wood in Asia and the

fourth-largest globally.

The Government’s decision to reduce import taxes is part

of broader efforts to encourage US imports and reduce the

trade imbalance between the two countries.

Representatives of Vietnam and the US have been

engaging in frequent talks to discuss new trade measures

and fine-tune policies to mitigate any potential tariff risks.

Alongside these tax cuts, Vietnam has also approved

agreements to allow US companies to operate in the

country. Notably, US tech giant SpaceX has received

approval for the pilot deployment of its Starlink satellite

internet service in Vietnam.

See: https://en.vietnamplus.vn/vietnam-cuts-import-taxes-on-

key-goods-ahead-of-us-tariff-announcement-post312690.vnp

Industry responds flexibly to US tariff threats

While the US has temporarily suspended enforcement of

countervailing duties and the Vietnamese Government is

pushing for diplomatic negotiations the wood industry in

the Southeastern region has devised flexible response

plans. Businesses are shifting production strategies and

exploring alternative markets in an effort to cushion the

impact from the country’s primary export destination, the

US.

In the neighboring Province of Dong Nai industry players

are even more concerned. With the US signaling a tariff

rate of 49% companies are bracing for diminished

competitiveness and surging costs which are expected to

drastically reduce orders.

To adapt, many firms are optimising processes, sourcing

alternative materials, transitioning to smart manufacturing

models, investing in technology and pivoting to renewable

wood products to reduce reliance on the US market.

See: https://wtocenter.vn/german-market/news/27832-

southeastern-regions-wood-industry-responds-flexibly-to-us-

tariff-threats

8. BRAZIL

Mato Grosso do Sul State a leader in the

‘Green

Economy’

The forestry sector has been a key driver of economic

development in the State of Mato Grosso do Sul. Between

2010 and 2024 the area of planted forests in the State

increased from 341,000 hectares to over 1.6 million

hectares.

The region, known as the “Pulp Valley,” comprises nine

municipalities which account for almost 90% of

roundwood production for pulp. Mato Grosso do Sul State

is currently the second-largest producer of roundwood for

the pulp and paper industry and consumes around 24% of

Brazil’s pulp production.

The sector contributed 18% to the State’s industrial GDP,

with exports surpassing US$1.49 billion in 2023 with

China being the main market.

According to the State Secretariat for Environment,

Development, Science, Technology and Innovation

(Semadec), the state has attracted BRL125 billion in

investments since 2015 consolidating the forestry sector as

one of the main drivers of growth. The sector has gained

new momentum with the announcement of the first soluble

pulp mill to be built by Bracell in Bataguassu.

See: https://www.remade.com.br/noticias/20718/setor-florestal-

transforma-mato-grosso-do-sul-em-potencia-verde

Livestock-Forestry model with Tectona grandis

Embrapa Agrossilvipastoril, located in the State of Mato

Grosso, has launched what is termed the Bacaeri- BoiTeca

(Cattle/Teak) system, an integrated crop-livestock-forestry

system (integração lavoura-pecuária-floresta – ILPF)

which combines cattle farming with the cultivation of

teak.

This model, says Embrapa Agrossilvipastoril, enables the

sustainable intensification of agricultural production,

diversifies farmers’ income and promotes environmental

benefits. The system integrates teak planting in alternating

rows combined with cattle grazing on pastures.

While the trees grow (for approximately 20 years until

harvest), livestock production continues normally ensuring

a steady income. During the first 10 to 18 months, when

cattle are temporarily removed from the area it is possible

to harvest for silage and hay or restore forage.

Forest management includes systematic pruning and

thinning to ensure high-quality timber and adequate light

penetration for pasture growth. Embrapa’s research shows

that tree shading improves thermal comfort for the animals

leading to greater weight gain, better immunity and

improved reproductive performance.

The system has been technically validated in several

Technological Reference Units in Mato Grosso, especially

at Fazenda Bacaeri which gave the system its name. The

average initial investment is R$3,200.00/ha with partial

returns starting in the 8th year from livestock production

and teak thinning. The highest revenues are generated

from the final harvest of the trees, between the 18th and

25th years.

For the system´s success rigorous technical planning is

essential including the definition of tree spacing,

nutritional and phytosanitary management, weed control

and fire prevention. Specialised technical assistance is

indispensable to ensure operational efficiency and the

quality of forest products throughout the entire production

cycle.

In addition to its economic viability, the BoiTeca System

offers significant environmental benefits. It contributes to

carbon sequestration and reduces methane emissions per

unit of meat produced, while also reducing pressure on

native forests.

The system is aligned with the guidelines of the National

Program for the Conversion of Degraded Pastures into

Sustainable Agricultural and Forestry Production Systems

and can be associated with environmental certifications

such as Carbon-Neutral Beef (CNB) and Low-Carbon

Beef (LCB).

See: https://www.embrapa.br/busca-de-noticias/-

/noticia/100314382/novo-sistema-produtivo-integra-pecuaria-de-

corte-com-plantio-de-teca

Export update

In April 2025 Brazilian exports of wood-based products

(except pulp and paper) increased 4% in value compared

to April 2024, from US$306.5 million to US$317.7

million.

Pine sawnwood exports increased 19% in value between

April 2024 (US$48.7 million) and April 2025 (US$58.0

million). In volume, exports increased 13% over the same

period, from 219,100 cu.m to 247,600 cu.m.

Tropical sawnwood exports increased 41% in volume,

from 23,900 cu.m in April 2024 to 33,700 cu.m in April

2025. In value, exports increased 19% from US$10.1

million to US$12.0 million over the same period.

Pine plywood exports increased 22% in value in April

2025 compared to April 2024, from US$67.9 million to

US$82.8 million. In volume, exports increased 31% over

the same period, from 197,700 cu.m to 259,600 cu.m.

As for tropical plywood, exports increased in volume 23%

and in value 7%, from 2,600 cu.m and US$ 1.5 million in

April 2024 to 3,200 cu.m and US$1.6 million in April

2025.

As for wooden furniture, the exported value increased

from US$45.5 million in April 2024 to US$48.7 million in

April 2025, an increase of 7%.

Global maritime freight in 2025

The global maritime transport situation in 2025 has been

marked by high volatility, directly affecting logistics costs

and the predictability of international trade operations. The

imposition of new tariffs by the US resulted in a steep

drop in volumes shipped from China to the US.

In Brazil the situation at ports is concerning. Terminals in

the South and Southeast regions are facing significant

logistical bottlenecks, particularly in the handling and

return of empty containers.

Delays at trans-shipment ports in the Caribbean have also

affected the schedules of carriers operating through South

America.

Against this background companies have been advised

intensify their logistics planning through strategic

measures such as enhancing logistical planning,

diversifying supplier bases, using alternative transport

modes, leveraging ‘Less than Container Load’ shipments

(where multiple shippers combine smaller shipments into a

single container) and strengthening partnerships with

reliable logistics operators.

See: https://woodflow.com.br/blog/pressao-no-frete-maritimo-

global-como-enfrentar-2025

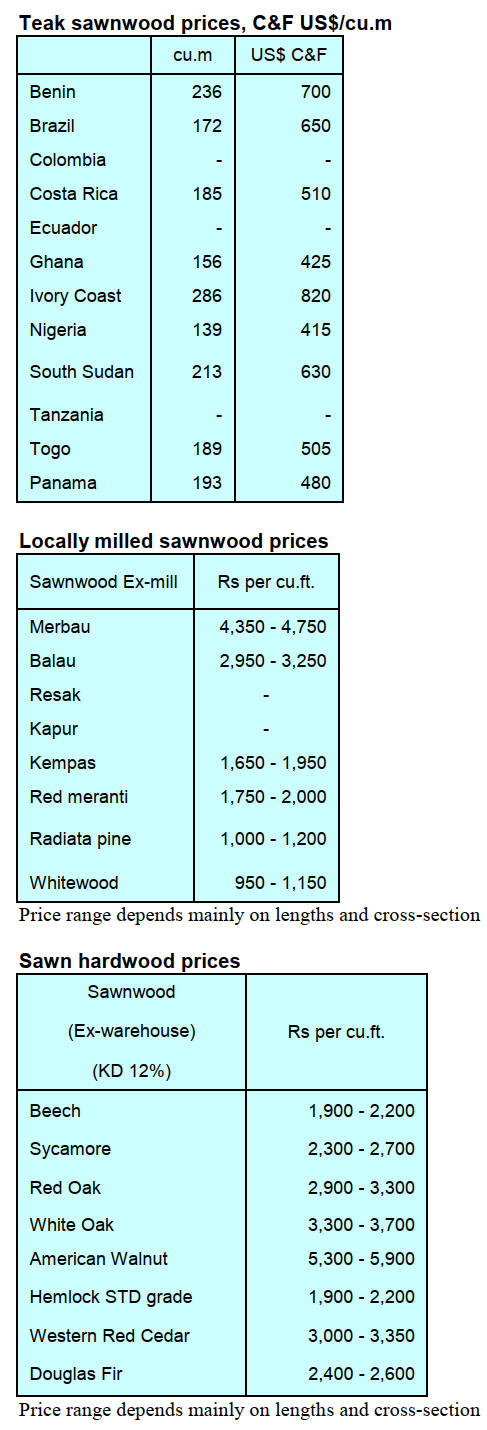

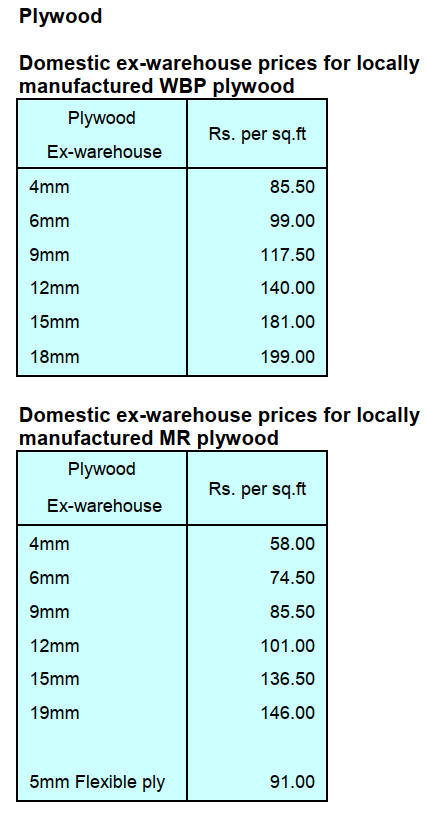

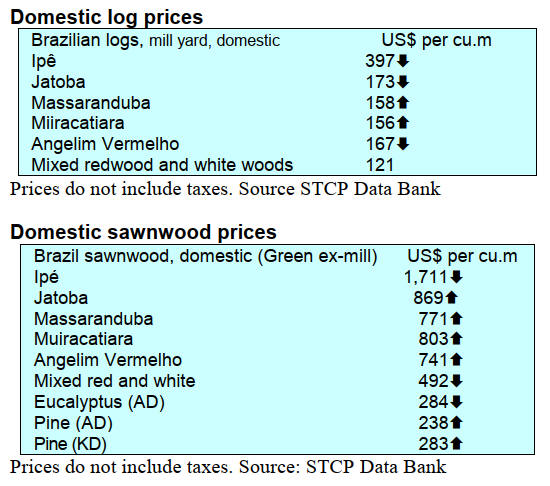

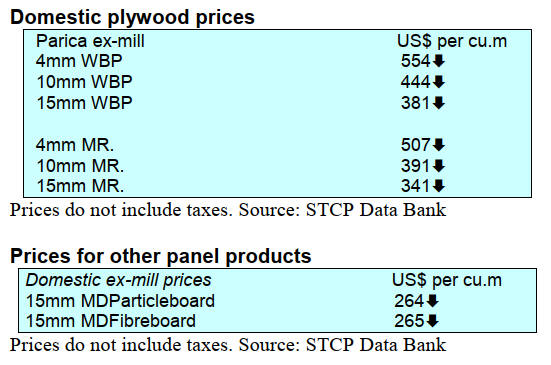

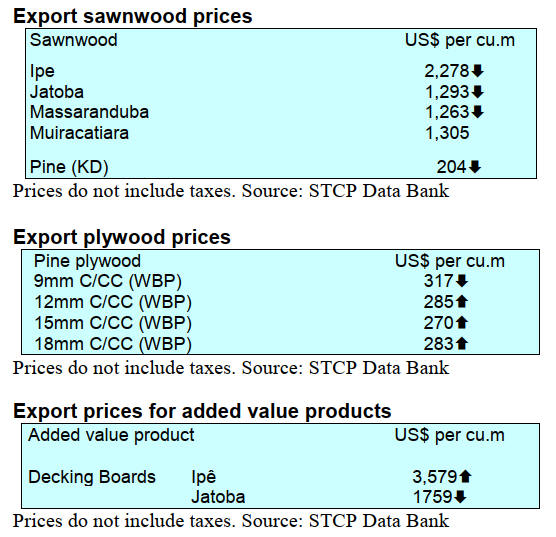

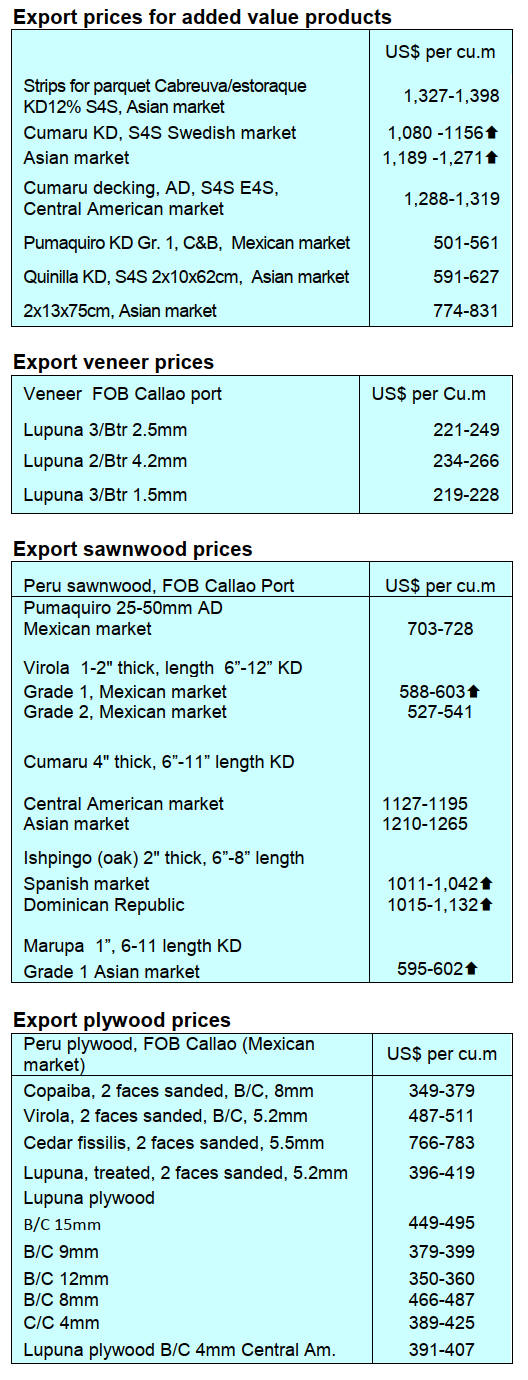

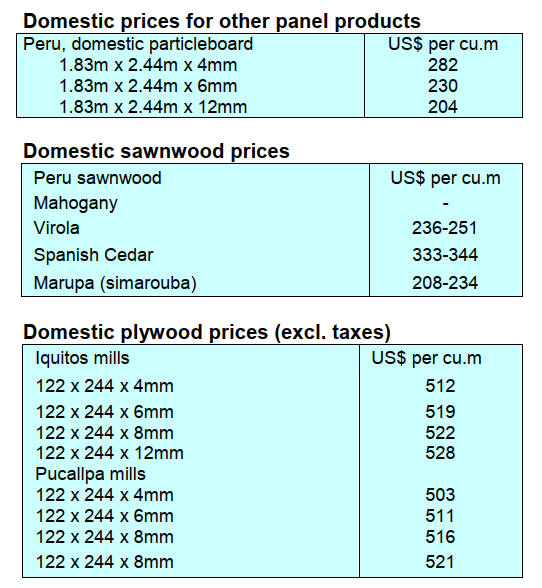

Export prices

Average FOB prices Belém/PA, Paranaguá/PR,

Navegantes/SC and Itajaí/SC Ports.

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

See: https://www.itto-

ggsc.org/static/upload/file/20250519/1747635226558660.pdf

9. PERU

First quarter export

earnings disappoint

The Center for Global Economy and Business Research of

the CIEN-ADEX Exporters Association reported the value

of shipments of wood products for finishing and

construction totalled US$4.3 million during the first three

months of 2025 representing a decrease of 29% compared

to the same month in 2024 (US$20.2 million). According

to figures from the ADEX Data Trade Trade Intelligence

System products included sawnwoor (US$6.8 million),

semi-manufactured products (US$2.3 million) firewood

and charcoal (US$2.2 million), furniture and parts

(US$1.2 million) and construction products (US$1.1

million).

The leading export destination was the Dominican

Republic with shipments worth US$3.9 million, an almost

30% increase compared to the previous year. Vietnam

followed with US$2.3 million, a doubling compared to

2024, Mexico with US$1.9 million, a decrease of 16%, the

United States with US$1.8 million, a decrease of 36%.

Rounding out the top 5 markets was France with sales of

US$988,000, a decrease of 63%.

Five year strategy to boost forestry sector

At the Executive Committee for the Development of the

Forestry Sector the Forest and Wildlife Resources

Oversight Agency (OSINFOR) and the National Forest

and Wildlife Service (SERFOR) presented a strategy for

coordinating their efforts with regional forestry and

wildlife authorities, with the aim of strengthening state

policies and inter-institutional work that promote forest

sustainability and the economic and social development.

This strategy was developed within the framework of the

Inter-Institutional Cooperation Agreement between

OSINFOR and SERFOR which was renewed for the third

time in February 2025.

The Executive Board for the Development of the Forestry

Sector was created in 2017, through Ministerial Resolution

No. 347-2017-EF/10, with the purpose of identifying

barriers that limit the growth of the forestry sector and

proposing solutions through legal reforms.

See: https://www.gob.pe/institucion/osinfor/noticias/1166128-

osinfor-y-serfor-presentan-estrategia-para-impulsar-el-desarrollo-

del-sector-forestal-en-cinco-anos

To ensure sustainable management of forest and wildlife

resources the Regional Government of Loreto is

promoting forest zoning with technical assistance from the

National Forest and Wildlife Service (SERFOR) through

ts Sustainable Productive Forests Program (BPS).

Daniel Rivera, Executive Coordinator of SERFOR's

Sustainable Productive Forests Program said “we have

provided professionals specialised in forest zoning and

geographic information systems as well as equipment with

workstations, ArcGIS licenses and an interactive display

to optimise this process in Loreto”.

See: https://www.gob.pe/institucion/serfor/noticias/1177614-

gore-loreto-y-serfor-avanzan-en-zonificacion-forestal-para-

proteger-bosques

Planting 5 million trees across six regions of Peru

More than 50 forestry organisations have begun planting

nearly five million trees as part of an initiative is promoted

by the National Forestry and Wildlife Service (SERFOR)

through its Sustainable Productive Forests Program (BPS).

The Executive Coordination of the BPS Program reported

that 313 hectares of forest plantations have been planted to

date and that within three years, the 5,300 hectares

committed by the 50 organisations will be achieved.

This initiative involves an investment of US$12.2 million

and will benefit more than 7,700 families in the regions of

Ancash, Cajamarca, Huánuco, Junín, Pasco, and San

Martín.

See: https://www.gob.pe/institucion/serfor/noticias/1167053-con-

el-apoyo-del-serfor-mas-de-50-organizaciones-siembran-5-

millones-de-arboles-y-generan-empleo-en-seis-regiones-del-peru

|