|

Report from

North America

Anticipating tariffs - imports of tropical timber rose in

March

With the threat of impending trade tariffs looming imports

of tropical hardwood and related products rose

significantly in March as US merchants increased

inventories. Imports of hardwood plywood surged by 30%

in March, imports of hardwood moulding rose 26% and

imports of hardwood flooring and assembled flooring

panels both rose more than 20%.

US imports of sawn tropical hardwood rose 12% and

imports of wooden furniture edged up by 2%. Not every

product area saw a gain as US imports of tropical

hardwood veneer fell 11%.

While imports from most trade partners rose, imports from

China fell notably. US imports of furniture from China fell

19% in March, hardwood mouldings fell 47%, hardwood

veneer fell 40%, assembled floor panels fell 62% and

hardwood flooring fell 23%.

While the volume of hardwood plywood imported by the

US from China rose in March, dollars spent on those

imports fell 3% from the previous month. This echoed the

current overall decline in US imports from China.

The share of US imports from China in the first quarter of

the year fell to the lowest in over 20 years as the high

tariffs on Chinese goods clamped down on trade. Imports

from China reached US$102.7 billion in the first three

months of the year that puts the share of imported goods

from China at just 11% in the first quarter, down sharply

from over 22% seven years ago.

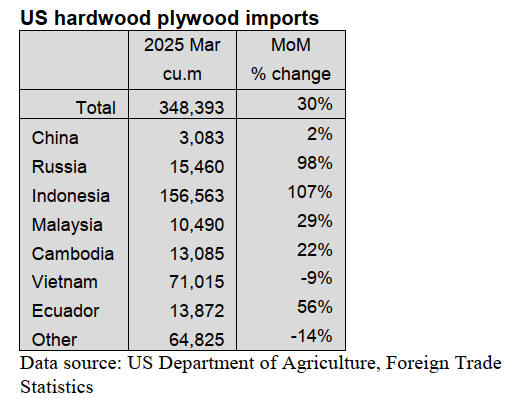

US hardwood plywood imports soar

US imports of hardwood plywood surged by 30% in

March with volume reaching a 20-month high. At 348,393

cubic metres, March imports were 51% higher than last

March and were the highest since June 2023.

Imports from Indonesia more than doubled from the

previous month and hit their highest level in over 10 years.

Imports from Indonesia were up 85% over last year

through the first quarter of the year.

Imports from Russia are also doing well this year, almost

doubling in March and up 32% for the first quarter. Total

US imports of hardwood plywood are ahead of 2024

volume by 19% through the first three months of the year.

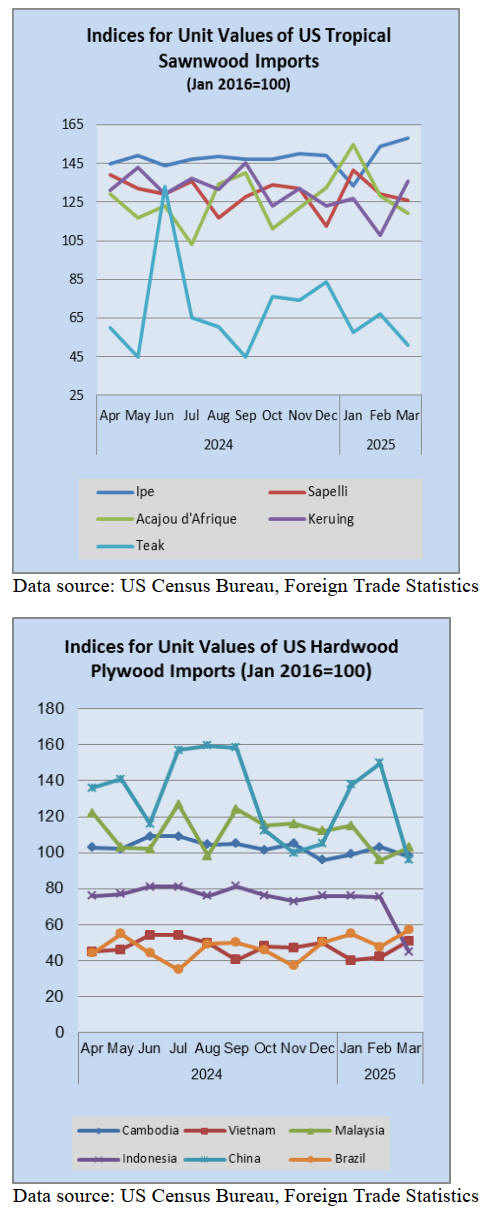

Sawn tropical hardwood imports rise, Canadian

imports fall sharply

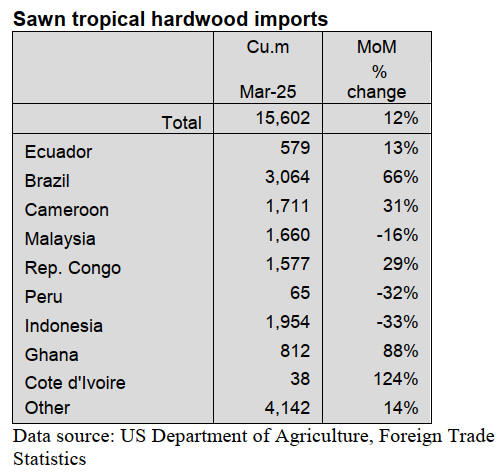

US imports of sawn tropical hardwood rose 12% in

March, rising to their highest level of the year so far. At

15,602 cubic metres, the volume was 11% higher than in

March of last year. Imports from Brazil, which have been

sluggish in recent months, rose 66% in March to reach

more traditional levels. Despite the gain, imports from

Brazil, a top trading partner, were down 56% for the first

quarter.

Imports of nearly every type of tropical hardwood showed

healthy gains for the month as imports of Teak, Meranti

and Padauk all greatly outpaced last year’s volume for the

first quarter of the year. Despite the March gains, total

imports of sawn tropical hardwood are down 7% versus

2024 through the first quarter.

Canadian imports of sawn tropical hardwood plunged 42%

in March as imports from Cameroon, Brazil and Bolivia

all fell sharply. Imports for the month were 39% below

those of the previous March yet first quarter imports still

managed to beat last year’s pace by 15% due to strong

numbers in January and February.

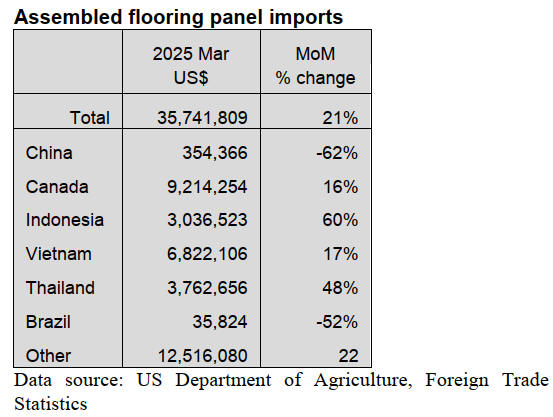

Assembled flooring panels set monthly record -

hardwood flooring imports jump 20%

Monthly imports of assembled flooring panels surpassed

USUS$35 million for the first time in March as imports

soared 21% from the previous month. At USUS$35.7

million, imports for the month were 53% higher than the

previous March total and bettered the previous high from

June 2022 by more than USUS$1 million.

Imports from Indonesia and Thailand increased sharply

while imports from chief trading partners Canada and

Vietnam also showed significant gains. With the surge,

total imports for the first quarter ended up 37% ahead of

2024 figures.

US imports of hardwood flooring made a similar gain in

March, rising 20% and rebounding from a disappointing

February. Despite the recovery, the monthly total was 11%

below imports from March 2024.

Imports from Malaysia rose 87% for the month and are up

189% for the first quarter of the year while imports from

top trade partner Indonesia rose 30% in March and are up

10% for the quarter.

However, imports from Brazil fell 72% in March and are

behind last year by 57% for the first three months of the

year. Through the first quarter, total imports of hardwood

flooring are down 3% from last year.

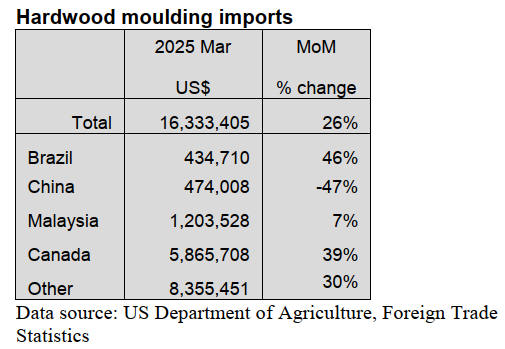

Hardwood moulding imports leap 26%

US imports of hardwood mouldings rose 26% in March to

their highest level since June 2022. At USUS$16.3

million, imports for the month were 27% higher than for

the previous March.

Imports from top-supplier Canada rose 39% in March

while imports from Brazil grew by 46%. Imports from

China, which had been strong the first two months of the

year, fell by 47% in March. Total imports are up 28% over

last year through the first quarter.

Veneer imports fall

US imports of tropical hardwood veneer fell 11% in

March as the source for veneers continues to fluctuate

greatly among trading partners from month to month.

Imports from Italy grew 34-fold from the previous month

to their highest level in two years while imports from

China, Ghana and Cote d’Ivoire all fell by more than 40%.

Despite the volatility among suppliers, total import

spending has been relatively stable. Imports for the month

were 1% higher than for March 2024 and through the first

quarter of the year, total imports of tropical hardwood

veneer by the US are just about even with 2024—up by

less than 1%.

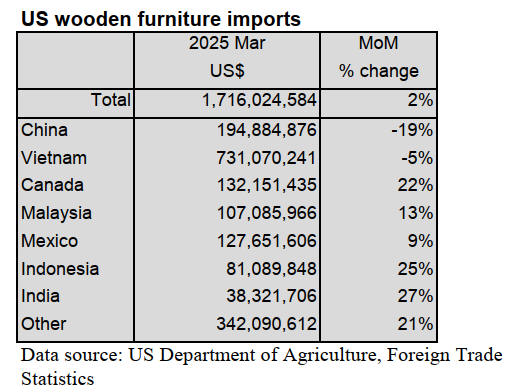

US wooden furniture imports rise

US imports of wooden furniture rose 2% in March,

rebounding from a more than 10% decline in February. At

over US$1.7 billion, imports were 2% higher than last

March.

Imports from Canada, Indonesia and India all rose more

than 20% while imports from top trading partner Vietnam

fell 5%. Through the first quarter of the year, total imports

of wooden furniture remain 2% ahead of last year.

Residential furniture orders rise for second straight

month

New residential furniture orders were up 2% compared to

January, which in turn were up 2% over December figures,

according to the April issue of Furniture Insights.

However, compared to February 2024, new orders were

down 5% according to Mark Laferriere, assurance partner

at Smith Leonard the accounting and consulting firm that

produces the monthly report. New orders are down 4% for

the year-to-date, compared to last year. February

shipments were down 5% compared to 2024 figures, and

down 8% compared to January, although Laferriere noted

it could be a function of February being a shorter month.

Shipments are flat for the year-to-date compared to 2024

figures.

On a seasonally adjusted basis, sales at furniture and home

furnishings stores in March were down 0.1% compared to

February, but up 7.7% from March 2024. Year to date on a

non-adjusted basis, sales were up 4.9%, according to the

April Furniture Insights.

Sharing his thoughts following the April High Point

Market furniture industry trade show, Laferriere said,

"Expectations were understandably tempered coming in,

but most people we spoke with were pleasantly surprised.

Tariffs were obviously a huge topic of conversation, but

some said it still felt like a 'normal' market, with others

saying it was one of their best in recent years due in part to

exciting new introductions and/or new opportunities with

retailers exploring their domestic versus import options.

While traffic was reported to be down (particularly

international), those who were there seemed ready to do

business."

See: https://www.smith-leonard.com/2025/05/05/april-2025-

furniture-insights/

|