|

1.

CENTRAL AND WEST AFRICA

Regional up-date

Cameroon

Mills that were required to cease operations because of

non-compliance under CFAD regulations have mostly

returned to full production under rigorous forestry

oversight.

Some say the lower labour costs, port efficiency and the

plentiful log sources gives operators in Cameroon an

advantage over its neighbours. While general labour is

available, there remains a shortage of skilled technicians

which continues to challenge sawmill and logging

operations, prompting calls for expanded vocational

training and reconsideration of the limit on foreign

workers.

Rail services on the Douala–Ngaoundéré line remain

reliable, say operators, with no major disruptions reported.

Operators continue to use both rail and road transport to

reach Douala and Kribi Ports. Douala Port has seen a

slight uptick in organisational efficiency but it is reported

vessels face a five to seven day wait to berth.

It has been observed that container vessels enjoy priority

which sometimes extends delays for timber carriers. Kribi

Port continues to handle mostly containerised exports,

including increasing sawnwood volumes from northern

Congo.

Producers in Cameroon say order levels are steady across

traditional markets though volumes remain modest.

China’s demand is very weak, while enquiries from the

Middle East have improved with renewed interest in iroko,

sapelli and other redwoods. Producers are optimistic that

Cameroon’s adherence to legal requirements, combined

with lower costs compared with Gabon and Congo,

improve competitiveness.

Gabon

The new government has taken office. The most

significant government shuffle saw Henri-Claude Oyima,

Chairman and CEO of the Gabonese International Bank

BGFI, appointed as Minister of Finance and Economy.

The domestic media says Oyima wants to remain at the

helm of BGFI. General Maurice Ntossui Allogo retains the

forests and water portfolio. Ambitious proposals to tap

carbon-credit revenues are circulating as the government

faces difficulty in financing its extensive infrastructure

projects.

As the rainy season persists the timber sector and the

country at large awaits a two-month dry window

beginning in June to ease transport and harvesting

operations. In the GSEZ log park at Bigein it is said

around 20,000 cu.m of okoumé peeler logs are currently

stocked ready for delivery to mills.

It is understood SETRAG, the national railway operator,

has requested financial support from the African

Development Bank to restore tracks and bridges on the

Libreville–Franceville line.

Power outages have eased slightly. Residents say there is

now typically one scheduled blackout on weekdays

compared to the previous twice‐daily schedule. The

floating power barges have improved overall grid

reliability but businesses remain on guard for unscheduled

interruptions.

Owendo Port is operating under normal conditions, though

a two-to-three-day berth backlog remains typical in part

because of the length of some vessels which occupy a

quay space that could otherwise handle two shorter ships.

Unskilled labour shortages continue and mill owners have

petitioned the government for additional expatriate worker

permits. Gabonese technicians are scarce despite the

presence of a technical school in the GSEZ. Observers say

local workers overwhelmingly prefer civil‐service roles to

forestry or mill work.

Republic of the Congo

Producers say operations are muted because of sluggish

global demand. Veneer mills are said to be negotiating

with European buyers despite stiff competition from

Gabonese products.

Okoume sawn timber continues to ship out to the

Philippines while sapelli, sipo and other redwoods serve

traditional markets in Europe and the Middle East. The

southern forests will soon enter a two-month dry spell

though the north may already be encountering the onset of

its wet season.

No new forestry regulations have been introduced.

Enforcement of CITES continues to tighten with exporters

reporting lengthened documentation time-lines.

Producers express cautious optimism that flexible log

export quota management and stable port operations will

support gradual recovery. However, global market

headwinds, particularly in China and Europe, continue to

dampen growth prospects.

2.

GHANA

New Forestry Commission Board inaugurated

The Minister for Lands and Natural Resources, Emmanuel

Armah Kofi Buah, has officially sworn-in the new board

for the Forestry Commission of Ghana.

According to the Minister the inauguration marks a

significant milestone in the sustainable management of

Ghana’s forest and wildlife resources ensuring that both

current and future generations continue to benefit from

them.

At the official swearing-in ceremony the Minister tasked

them with the responsibility to lead, direct and oversee the

activities of the Commission. He emphasised the major

threats facing the nation’s forests include illegal mining

(galamsey), illegal logging, wildfires and other harmful

activities.

“These challenges not only degrade our ecosystems but

also threaten the livelihoods of communities that depend

on these natural resources,” he stated.

The Board Chair, Prof. Martin Oteng-Ababio, pledged the

team’s commitment to support the Chief Executive and

management in addressing key internal and external

challenges and to reposition the Forestry Commission as a

robust and efficient agency.

He affirmed his commitment to lead with integrity and

build institutional resilience, ensuring that Ghana’s forest

and wildlife resources serve both present and future

generations.

The members of the new Board included Dr. Hugh A.

Brown, Chief Executive of the FC, Kumbun Na Yiri II

(National House of Chiefs), Richard Duah Nsenkyire

(Timber Trade and Industry), Tetteh-Hevy Oman (Wildlife

Trade and Industry), Dr. Abukari Nantgmah Attah (Ghana

Institute of Professional Foresters), Dominic Kwasi

Nyanzu (Non-governmental organisation in Forest and

Wildlife Management), Surveyor Raphael Hokey Esq.

(Lands Commission). The others are Brig Gen (Rtd) Dr.

Albert Kabenlah Adu, Nana Kojo Toku and Mavis

Kuukua Bissue, MP, persons with financial, commercial

and managerial experience nominated by the Minister.

See: https://fcghana.org/fc-board-inaugurated/

Timber exports dip but business still good in Asian

markets

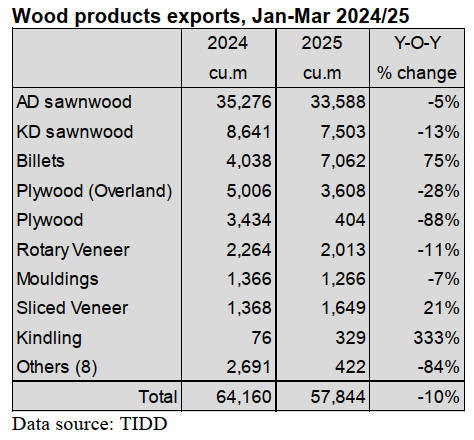

The volume of wood products exported from Ghana in the

first quarter of 2025 totaled 57,844 cu.m, 10% lower than

in the corresponding quarter in 2024. The receipts totalled

Euro27.50 million which was a decrease of 6% over that

in the first quarter of the previous year.

For the 3-months period, products that recorded significant

increases in volumes year-on-year were kindling (+333%),

billets (+75%) and sliced veneer (+21%).

Air-dried sawnwood was the leading product shipped

during the first quarter. The product accounted for 58%

and 50% of the total export volume and value respectively

for the period in 2025. While for the same period in 2024,

the product accounted for 55% in volume (35,276 cu.m)

and 50% in value.

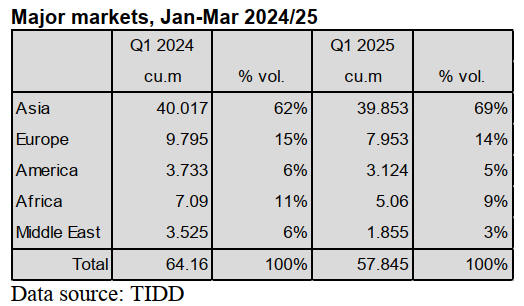

The data showed that, business in the Asian markets was

still good as total wood products accounted for 68.9% of

the total export volume in 2025 as against 62.4% achieved

for the same period in 2024.

Exports to Asian markets for the period January-March

2025 earned the country Eur 15.91 million (58% of the

total) from a volume of 39,853 cu.m, representing a

modest increase in value but a decline in volume.

Compared to the same period in 2024 the total revenue

was Eur15.73 million from 40,017 cu.m.

Air-dried sawnwood, billets and sliced veneer produced

from teak, denya, wawa, ceiba, cedrela, gmelina, odum,

koto/kyere, dahoma and Chenchen were some of the main

products exported.

Strategy to export competitiveness

The President, John Dramani Mahama, has disclosed that

his administration, through the Accelerated Export

Development Programme (AEDP), is implementing an

ambitious strategy to significantly boost Ghana’s export

competitiveness under the African Continental Free Trade

Area (AfCFTA).

In a national address to mark his first 120 days in office

the President stated that the AEDP aims to triple the

number of Ghanaian firms certified under AfCFTA’s

Rules of Origin, scale up export readiness training

particularly for youth and women and expand the

country’s reach into new continental markets while

deepening existing trade partnerships.

The President assured the nation of his commitment to

deliver tangible results to drive the nation from gloom to

bloom, make corruption unattractive and punish those that

steal from the public purse.

According to IMANI Africa’s independent assessment of

the Mahama administration’s 120-Day Social Contract

with Ghanaians, has shown early energy with good

progress. But IMANI flags critical gaps in fiscal

discipline, policy design and long-term economic impact.

(IMANI, Center for Policy & Education a Think Tank based in

Ghana)

Some flagship initiatives, such as Adwumawura (a

flagship initiative by the Government of Ghana to create at

least 10,000 sustainable youth-led businesses annually)

and the 24-Hour Economy are active but risk becoming

costly without clear returns.

The assessment recommended an urgent focus on linking

flagship programmes to economic productivity, reforming

SOEs and strengthening procurement, modernising

revenue systems and embedding institutional

accountability into delivery.

See: https://www.graphic.com.gh/news/general-news/ghana-

news-mahama-fulfils-72-120-day-pledge.html

and

https://mcusercontent.com/ecdb99e358564505c615d47c1/files/7

b77decd-aee2-0fc8-fb18-

87b4dbd22908/Assessment_of_President_Mahama_rsquo_s_120

_Day_Social_Contract.pdf

Local currency gains strength

The local currency has seen some stability against major

international currencies as it has been steady at around

GHS15.50 to the US dollar. But in the first week of May

2025 it surged to GHS13.10 to record its strongest level in

a year.

The currency stability has been attributed to several

factors which include US$2.3 billion in gold exports, an

increase in cocoa export receipts totalling US$835 million

in 2025 against US$639 million in 2024 and the

weakening of the US dollar.

On the domestic side, the government has taken steps to

restore investor confidence as it has resisted high-interest

rate bids in the treasury bill market, signalling a tougher

stance on debt accumulation.

Meanwhil, the Ghana Union of Traders’ Associations

(GUTA) has called on traders in the Small Medium

Enterprise category to cut prices in response to the recent

appreciation of the cedi. GUTA appealed to the trading

community to reflect the currency gains in their pricing.

According to GUTA the cedi has made “significant gains”

against major trading currencies and wants traders to act

quickly to translate this into some relief for ordinary

Ghanaians.

See: https://www.myjoyonline.com/explainer-why-the-cedi-is-

gaining-ground/

and

https://www.myjoyonline.com/adjust-prices-with-immediate-

effect-guta-to-traders-as-cedi-gains-strength/

3. MALAYSIA

Ministry sole issuer of Certificates of Origin

The Ministry of Investment, Trade and Industry (Miti)

will, with immediate effect, be the sole issuer of

Certificates of Origin (CoO) for exports to the US. This

move comes as Malaysia works to prevent illicit trans-

shipment through Malaysia. Issuance of such certificates

by business councils, chambers or associations appointed

by Miti has ceased. The move tightens the control over the

documents that prove the origin of goods for customs or

trade requirements.

The decision follows reports that certain exporters may

have used Malaysia as a trans-shipment hub to bypass US

tariffs on third-country goods. The extent of Malaysia’s

involvement in trans-shipment activities is still being

quantified but Miti is taking back the power to issue CoOs.

Miti said it will also enhance audits on applicants of

certificates of origin, investigate and take the necessary

action in collaboration with the Royal Malaysian Customs

Department to curb any offences.

Exporters are said to be unsure if the criteria for getting a

certificate of origin have changed after the Ministry of

Investment, Trade and Industry (Miti) took over as the

sole issuer replacing chambers of commerce.

See:

https://ceomorningbrief.theedgemalaysia.com/article/2025/0952/

Home/2/753968

and

https://theedgemalaysia.com/node/754504

FSC to maintain association with Samling

In October 2022 a coalition of organisations including

SAVE Rivers, GCRAC (Gerenai Community Rights

Action Committee), KERUAN Organisation, The Borneo

Project and Bruno Manser Fund submitted a complaint to

the Forest Stewardship Council’s (FSC) against Samling

Global Limited. The allegations made by the complainants

alleged unacceptable activities according to FSC´s Policy

for Association.

In a press release of 25 April FSC announced that, based

on the recommendation of a panel of independent experts

who assessed available evidence related to the Policy for

Association case against Samling and reported findings to

the FSC International’s Board of Directors. It was decided

to maintain association with Samling Global Limited

provided they fulfil conditions to verify and address

potential environmental and social harms caused in their

forest operations.

The Forest Department in Sarawak welcomed the Forest

Stewardship Council’s (FSC) recent decision.

See: https://fsc.org/en/newscentre/integrity-and-disputes/fsc-

decides-to-maintain-conditional-association-with-samling

and

https://www.theborneopost.com/2025/05/10/sarawak-forest-dept-

welcomes-fscs-conditional-continuation-with-samling-group/

Major player exits timber business

WTK Holdings Bhd, one of the ‘big six’ groups of timber

companies in Sarawak, is exiting the timber business and

according to the domestic press will shift its focus to more

commercially sustainable and profitable business

segments. The local media has reported the group aims to

prioritise its plantation and food operations.

See: https://www.thestar.com.my/business/business-

news/2025/04/30/wtk-disposes-of-timber-subsidiary-for-

rm235mil

Tallest tropical tree

Sabah forest is home to the world’s tallest tropical tree

species, locally known as ‘Seraya Kuning Siput’.

Known as ‘Menara’ in Malay (meaning tower), it stands at

a record-breaking height of 100.8 m (328 feet), making it

not only the tallest tropical tree but the third tallest tree in

the world, after the Coast Redwood (Hyperion) in

California, measuring 116 m and the Tibetan Cypress

(102.3 m) in China.

See: https://www.theborneopost.com/2025/05/04/worlds-tallest-

tropical-tree-species-iconic-natural-wonder-of-sabah/

4.

INDONESIA

Export Benchmark Price (HPE) May 2025

The following is a list of Wood HPE from 1to 31 May

2025.

Processed wood (prices per cu.m)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1,000 sq.mm to

4,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all

four

sides so that the surface becomes even and smooth of

Merbau wood with the provisions of a cross-sectional area

of 4000 sq. mm to 10,000 sq.mm (ex 4407.11.00 to ex

4407.99.90) = US$1,500/cu.m

See: https://jdih.kemendag.go.id/peraturan/keputusan-menteri-

perdagangan-republik-indonesia-nomor-592-tahun-2025-tentang-

harga-patokan-ekspor-dan-harga-referensi-atas-produk-

pertanian-dan-kehutanan-yang-dikenakan-bea-keluar

Furniture manufacturers request review of new

quarantine rules

The Indonesian Furniture and Craft Industry Association

(Himki) has called on the government to delay the

implementation of a new policy from the Indonesian

Quarantine Agency as it could negatively affect the export

of furniture and craft industry products.

Himki Chairman, Abdul Sobur, expressed concern that the

new regulation introduces complicated procedures and risk

export delays. He believes these issues could undermine

the competitiveness of Indonesian products in the global

market.

Sobur stated "ironically, this regulation contradicts the

national initiative to boost creative industry exports. We

question the rationale behind this regulation as it does not

consider the unique characteristics of the furniture and

craft industry”.

He added "we believe that implementing this regulation

without a specific mechanism for finished goods is an

unfair policy. It equates creative industry products with

raw materials which could potentially undermine the

contribution of the sector to the national creative economy

sector."

See: https://www.msn.com/id-id/berita/other/produsen-mebel-

desak-pemerintah-evaluasi-aturan-baru-karantina-yang-hambat-

ekspor/ar-AA1DQcIl?ocid=BingNewsVerp

Furniture producers target nontraditional markets

Indonesian furniture producers are actively seeking to

penetrate new markets in Central and Eastern Europe even

though recent tariff changes in the United States do not yet

impact them.

Expanding into non-traditional markets is essential to

anticipate future geopolitical dynamics particularly as the

United States currently represents the primary market for

Indonesian furniture accounting for approximately 53% of

total exports.

To support this market diversification Indonesian furniture

was showcased at the HOMEDesign 2025 exhibition at the

Hungexpo Budapest Congress and Exhibition Centre in

Budapest.

Suci Mahanani, the Head of the Indonesian Trade

Promotion Center in Budapest, noted this event is

Hungary's largest retail exhibition for furniture, household

appliances, accessories and home decoration products.

See: https://koran-jakarta.com/2025-04-22/meskipun-tak-kena-

tarif-resiprokal-as-produk-furnitur-ri-bidik-pasar-nontradisional

In related news, the Ministry of Industry is actively

encouraging small and medium-sized industries in the

furniture sector to expand their markets to Middle Eastern

countries. This initiative includes facilitating exhibitions,

providing mentoring and organising business matching

events.

Reni Yanita, the Director General of Small, Medium and

Miscellaneous Industries at the Ministry of Industry, stated

that the national furniture industry has significant potential

for growth.

Bayu Fajar Nugroho, the Director of Small and Medium

Industries for Food, Furniture and Building Materials,

emphasised the importance of market diversification to

enhance the resilience of the national industry. He noted

that Middle East countries have a significant demand for

furniture products.

See: https://koran-jakarta.com/2025-05-04/dukung-perluasan-

pasar-kemenperin-pacu-ikm-furnitur-ekspansi-ke-timur-tengah

Market diversification pursued to expand exports

Deputy Minister of Trade Dyah Roro Esti Widya Putri

emphasised that export market diversification is a

government strategy to expand trade reach not merely a

response to United States tariff policy.

The Deputy Minister affirmed that the government

continues to expand cooperation through several trade

agreements such as the Comprehensive Economic

Partnership Agreement (CEPA) and Free Trade

Agreements with various countries. Putri remarked that

target markets include Australia, South Korea, African and

the Middle East countries where the aim is to open market

access for Indonesian products with high competitiveness.

See: https://en.antaranews.com/news/352953/market-

diversification-pursued-to-expand-export-reach-ministry

Forestry professionals advance sound forest

management

Indonesian forestry professionals, government officials

and journalists were recently in the United States

participating in the US Department of State’s International

Visitor Leadership Program (IVLP) on “Improving Forest

Management.”

The programme promotes sound forest governance and

community-centered conservation practices which

contribute to economic prosperity. Participants engaged

with US experts and counterparts across government,

community organisations, academia and the private sector

to explore innovative forest management policies, land-use

strategies, and efforts to balance environmental protection

with economic development.

“The United States is proud to partner with Indonesia in

advancing forest practices that drive shared prosperity,”

said US Embassy spokesperson Jamie Ravetz.

See: https://id.usembassy.gov/indonesian-forestry-leaders-visit-

the-united-states-to-advance-sustainable-forest-management/

Ministry of Forestry ends illegal harvesting operations

The Ministry of Forestry has ended 55 unpermitted

activities or businesses operating in forests as part of its

forest area control operations this year aimed at protecting

of the river basins.

The regulation of forest areas is particularly focused on the

upstream regions of river basins (DAS) as a measure to

prevent further forest degradation. The Directorate

General of Forestry Law Enforcement is committed to

preserving forests through various effective and

sustainable law enforcement strategies.

See: https://koran-jakarta.com/2025-05-06/55-usaha-dan-

kegiatan-kehutanan-tanpa-izin-akhirnya-disegel

Indonesia adopts ILO OSH Standards for forestry

sector

The media report Indonesia is the first country in the

world to adopt and adapt the Occupational Safety and

Health (K3) Code in the forestry sector prepared by the

International Labor Organization (ILO).

This achievement was marked by the official launch of the

national translation and adaptation of the ILO Code on

Forestry OSH in Jakarta. Dida Mighfar Ridha an adviser

to the Minister of Forestry said that the launch of the

Forestry Sector K3 Guidelines is expected to be the

starting point for the transformation of forestry to be safer,

healthier and more sustainable.

Secretary General of the Federation of Indonesian Forestry

and Timber Workers Unions (KAHUTINDO), Rulita

Wijayaningdyah, emphasised that the forestry sector is

considered high risk for work-related accidents.

KAHUTINDO, together with the global affiliate Building

and Wood Workers International (BWI) actively

participated in the formulation of the revised ILO Forestry

OSH Code.

See: https://forestinsights.id/indonesia-jadi-negara-pertama-

adaptasi-kaidah-k3-ilo-di-sektor-kehutanan/#

Boosting ties with nations affected by smoke

Coordinating Minister for Political and Security Affairs,

Budi Gunawan, reported that the ministry is strengthening

relations with countries affected by smoke from forest and

land fires in Indonesia. According to Gunawan smoke

from forest fires in Indonesia has disturbed people's

activities in neighbouring countries.

The majority of the smoke comes from areas that are often

subject to forest fires such as Riau, Riau Islands, Aceh,

Central Kalimantan and Jambi. A task force is conducting

mitigation efforts before the areas prone to forest fires

enter the long dry season.

See: https://en.antaranews.com/news/353365/forest-land-fire-ri-

boosts-ties-with-nations-affected-by-smoke

Carbon exchange transaction valued at IDR77.91

Billion

PT Bursa Efek Indonesia (IDI) reported that since its

launch on 26 September 2023 to 17 April 2025 the value

of carbon trading transactions on the Indonesia Carbon

Exchange (IDX Carbon) reached IDR 77.91 billion with a

total volume of carbon trading transactions reaching

1,598,703 tCO2e.

The president director of PT Bursa Efek Indonesia (IDX),

Iman Rachman, said that the total number of users of

exchange services increased to 111 users as of 17 April

2025.

See: https://voi.id/en/amp/477336

5.

MYANMAR

Bago Yoma forests threatened

A frontier-myanmar article has a story captioned “The fate

of Bago Yoma is threatened by the armed conflict” in

which it is written “illegal logging in the Bago Yoma

mountain range seemed to have surged since 2021”.

In May 2016 the National League for Democracy

government imposed a one-year moratorium on logging

throughout Myanmar. The suspension was extended to 10

years to 2026 in the Bago Yoma because the range was

particularly hard hit by deforestation.

The article claims “armed groups on both sides of the

conflict are reportedly involved, either through direct

logging, toll gate collection or permitting operations”.

See: https://www.frontiermyanmar.net/en/logged-out-conflict-

drives-deforestation-in-bago-mountains/

Foreign Investment declined

It has been reported that foreign investment in Myanmar,

which has been declining year by year since 2021 totalled

only US$690 million in the 2024-25 fiscal year that ended

on 31 March. Of the 12 investment sectors, only seven

received investment, including agriculture, livestock,

manufacturing, energy, oil and gas, transportation and

services.

The oil and gas sector received the most followed by

manufacturing, transportation and communications and

services.

Of the 14 countries that invested in Myanmar, Singapore

invested the most with US$460 million followed by China

(US$94 million), Thailand (US$46 million) and Hong

Kong ( US$30 million).

See: https://burmese.dvb.no/post/702938

Post-earthquake economic reality

The magnitude 7.7 earthquake that struck central

Myanmar on 28 March left a trail of destruction across

Mandalay, Sagaing, and Naypyidaw.

The disaster has crippled Myanmar’s economy,

devastating Mandalay’s industrial zones and supply

chains. Damaged infrastructure, including roads, bridges

and a key Sagaing-Mandalay bridge, has restricted access

to Mandalay’s river port disrupting agricultural logistics.

The earthquake’s fallout is forecast to exacerbate poverty,

inflation and result in a decline in exports.

The SAC’s reliance on a multiple exchange rate system

risks further economic distortion, while strict import

licensing hampers recovery efforts. Domestic insurers, hit

by sanctions and limited reinsurance, face challenges,

leaving reconstruction costs largely on citizens due to low

insurance coverage.

See - https://www.scmp.com/week-

asia/opinion/article/3309792/how-myanmars-devastating-

earthquake-threatens-leave-lasting-economic-scar

6.

INDIA

Sawnwood and veneer

prices edge up

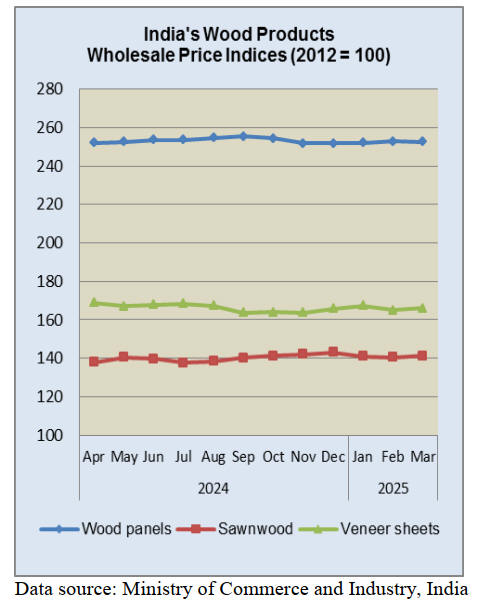

The annual rate of inflation based on the all India

Wholesale Price Index (WPI) was 2.05 in March. The

positive rate of inflation in March was primarily due to

increase in prices of manufactured food products, other

manufacturing, food articles, electricity and manufacture

of textiles.

The index for manufacturing rose to 144.4 in March from

143.8 in February. Out of the 22 NIC two-digit groups for

manufactured products, 16 groups saw an increase in

prices, 5 groups a decrease and 1 group no change.

Some of the important groups that showed month on

month increases in price were manufacture of basic

metals, food products, other transport equipment, other

manufacturing and machinery and equipment. The indices

for sawnwood and veneers rose in March from a month

earlier.

Some of the groups that saw a decrease in prices were

manufacture of textiles, chemicals and chemical products,

computers, electronic and optical products; printing and

reproduction of recorded media and furniture.

India/ New Zealand FTA negotiations

The New Zealand Trade Minister, Todd McClay, has

reported a government delegation visited India to begin

free trade negotiations. The Minister said “following

significant engagement over the past month, the first in-

person round of negotiations towards a comprehensive

India-New Zealand free trade agreement will take place”.

The New Zealand Timber Industry Federation (NZTIF)

has signaled its support for the proposed NZ-India Free

Trade Agreement saying “the Federation is excited by the

possibilities that exist for New Zealand Radiata sawnwood

in India”.

The NZTIF has identified that, at present, sawnwood

exports to India from New Zealand are negligible, totalling

just NZ$10 mil. over the last 5 years. Sawn softwood

imports into India from other countries shows a different

picture.

The NZTIF notes India is one of the largest importers of

timber globally with a significant demand for various

types of wood products and imports from various

countries including Malaysia, Germany as well as from

teak producing countries. The woodworking industry in

India is one of the fastest-growing sectors, with a growing

demand for wood and wood products.

In a statement the NZFIF says “we consider it important

that, to best capture the maximum value from NZ, a real

emphasis needs to be placed on the qualities of NZ

Radiata including it’s treatability, ease of working and

importantly sustainability of NZ resource. It is vital that

Radiata is marketed as a timber that “covers all bases”

from high end finishing to construction and packaging.

See: https://www.nztif.co.nz/news/nztif-strongly-supports-

nz-india-free-trade-agreement

Kerala – particleboard production hub

Kerala has emerged a particleboard manufacturing hub in

India according to an article in the March PlyReporter

magazine. In the last quarter of the 2025 financial year

four new manufacturing lines commenced commercial

production adding approx. 1,000 cubic metres per day to

capacity in the State.

Two new particle boards lines have been commissioned in

Kannur district of Kerala. Particleboard from Kerala

serves the entire southern India market.

7.

VIETNAM

Wood and Wood Product (W&WP) trade

highlights

According to statistics provided by Vietnam Office of

Customs the W&WP exports in April 2025 reached

US$1.4 billion, an increase of 3% compared to April 2024.

Of which WP exports contributed US$964 million, up

2.7% compared to April 2024.

In the first four months of 2025 W&WP exports totalled

US$5.3 billion, an increase of 9% over the same period in

2024. Of which WP exports alone, fetched US$3.6 billion,

up 9% compared to the same period in 2024.

Viet Nam’s W&WP exports to the EU in April 2025 were

valued US$54 million, up 23% compared to April 2024. In

the first four months of 2025 exports to the EU have been

estimated at US$215 million, an increase of 4% compared

to the same period in 2024.

Raw wood (logs and sawnwood) imports in April 2025

reached 631,000 cu.m valued at US$195.6 million, an

increase of 8% in volume and 10% in value compared to

March 2025 and up 39% in volume and 28% in value

compared to April 2024.

In the first four months of 2025 raw wood imports stood at

2.09 million cu.m, valued at US$647.3 million, up 38% in

volume and 29% in value compared to the same period in

2024.

Vietnam’s export of handicraft products in March 2025

amounted to US$94.40 million, an increase of 36%

compared to February 2025 and up 4.5% compared to the

same period in 2024. In the first three months of 2025

export of handicrafts reached US$260.10 million, an

increase of 2.5% compared to the same period in 2024.

Vietnam’s NTFP exports in March 2025 reached

US$78.44 million, an increase of 39% compared to

February 2025 and up 6% compared to the same period in

2024. In the first three months of 2025, exports of these

products contributed US$209.18 million, up 4% compared

to the same period in 2024.

Promoting transparency and restructuring production

in the timber industry

In the context of possible imposition of reciprocal tariffs

by the US businesses are gently trying to assess the impact

on exports to the US. Promoting the application of

technology to optimise production processes, control

quality, trace the origin of raw materials and manage input

factors are emerging as key solutions for enterprises in the

wood industry.

According to the Ministry of Agriculture and Environment

the US remains the largest consumer of Vietnamese wood

and wood products representing 53% of total exports.

Binh Dinh Province is home to more than 300 wood-

processing enterprises with major export products

consisting of indoor and outdoor furniture, wood pellets

and woodchips. In 2024, wood exports to the US brought

in US$604 million and accounted for 35% of the

Province’s total trade. Following the news of potential

reciprocal duties some US customers have asked to

renegotiate existing orders and temporarily suspended the

signing of new contracts.

Similarly, Bac Kan Province has 22 export enterprises.

Two of these export directly to the US which accounts for

55% of their total output.

A report assessing the impact on Bac Kan’s export

businesses to the US indicates that if a 46% reciprocal

duty were applied it would have a direct effect not only on

those companies exporting to the US but also on

businesses involved in the export supply chain.

The industrial growth rate in Bac Kan is forecast to fall by

around 1–2% in 2025 with wood export revenue declining

by US$8–10 million. Some companies may be forced to

reduce their workforce which could affect local social

welfare.

According to Dinh Lam Sang, Deputy Director of the Bac

Kan Department of Industry and Trade, the 90-day

suspension of tariff imposition by the US provides

opportunities for businesses to have more time to adjust

their operations and prepare response measures. It is also a

valuable opportunity to lay the groundwork for negotiating

long-term trade agreements and for seeking to diversify

export markets.

However, some businesses have expressed concern over

the difficulty of market redirection. Each export product

line is backed by its own production system and shifting to

new markets involves more than just trade promotion or

finding new orders. It also requires significant financial

investment in production lines.

Tran Quoc Bao, from Thien Loc Import-Export Company

remarked that, while switching markets is a sound

strategy, it is not easily executed. The US currently

accounts for nearly 70% of Viet Nam’s total wood export

value. Only about 10% of businesses are capable of

shifting to alternative markets.

“A 10% tax rate is bearable if both sides share the risk

equally but any higher rate could force factories to shut

down. We may have to consider switching production to

serve domestic consumption in order to maintain stable

livelihoods for over 100 workers,” Bao explained.

Several localities are currently implementing plans to

work with export companies on solutions to boost trade

promotion and expand market access to the EU, Japan, the

Republic of Korea and Southeast Asia. At the same time

they are helping businesses access capital to maintain

production and expand domestic sales.

Many have proposed that the Government adopt both

immediate and long-term comprehensive measures to

support businesses with legal procedures, trade defense

investigation dossiers in English (as required by the US)

and strengthen support for provincial enterprises in

promoting exports to alternative markets.

Ngo Sy Hoai, Vice Chairman and Secretary-General of the

Viet Nam Timber and Forest Products Association, noted

that Vietnamese exports to Japan have traditionally

consisted of wood chips and some types of panel products.

Given the current pressure from the US Vietnamese wood

enterprises should now explore the potential to export

indoor furniture suitable to Japanese consumer

preferences. As for China, with its population of 1.4

billion, Viet Nam’s exports have mostly focused on wood

chips for paper production. However, if we work hard we

could still find outlets for certain products, said Hoai. The

Republic of Korea offers logistical advantages with a

relatively short sea transport distance and strong trade

relations. Yet, Vietnamese companies have so far mostly

supplied low-cost wood pellets and plywood to this

market.

Even the EU, with 27 member states and covered by the

EVFTA, wood products export accounts for only 3–4% of

Viet Nam’s total wood exports.

Some other markets, such as Russia, the Middle East and

countries within ASEAN also need to be studied, opened

up and activated. These markets still hold untapped

potential that Vietnamese wood exporters must seize to

compensate for the substantial gap that may arise from US

tariff policies.

In addition, wood and forest product exporters must

prepare full legal documentation to prove the legal origin

of their timber materials. It is essential to maintain

transparency in the production process and raw material

sourcing. At the same time, businesses should research to

change the structure of raw materials sources and

production structure and make a shift to domestic

plantation wood materials to minimise dependence on raw

materials and semi-finished products from outside the

country.

See: https://en.nhandan.vn/promoting-transparency-and-

restructuring-production-in-wood-industry-post147806.html

Forestry sector to revise regulations to address

challenges and streamline governance

Land allocation policies have brought about positive

changes in forest protection and forestry development and

have helped to mobilise social resources, especially local

communities, to join state forestry companies in

management efforts.

However, policy implementation has also exposed

significant gaps and limitations, particularly in land and

forest management.

The forestry sector in Vietnam is looking to develop a

decree aimed at amending current regulations and

resolving issues, particularly those related to governance

at both the central and local levels, while addressing

difficulties in the field.

According to the Ministry of Agriculture and

Environment, after 30 years of implementing land

allocation policies, forestry companies across the country

have placed nearly 460,000ha, equivalent to about 27% of

the total area, under management.

Deputy Minister of Agriculture and Environment Nguyễn

Quốc Trị said that of the nearly 460,000ha allocated by

forestry companies, 68% was allocated under Decree

01/CP, which pertains to land allocation for agricultural,

forestry and aquaculture production by State-owned

enterprises.

Additionally, 29% of the land was allocated under Decree

135/2005/NĐ-CP.

Just 3% of the allocated land was governed by Decree

168/2016/NĐ-CP, which regulates land allocation for

forests, orchards and water surface areas within the

authority of special-use forest management boards,

protective forests and one-member limited liability

forestry companies owned by the State.

The Ministry’s representative said that land

allocation has

brought about positive changes in forest protection and

forestry development.

However, the policies' implementation has exposed some

problems.

This led to a decision by the Politburo in December 2024

to issue Conclusion 103-KL/TW, which directs further

improvements to institutional frameworks, especially legal

documents concerning land use, public asset management

and the swift restructuring and modernisation of

agricultural and forestry companies.

A report by the Vietnam Association for Agricultural

Economics and Rural Development titled 'The study and

evaluation of the current status and proposed solutions for

allocating forest land in forestry companies' also stated

that, while land allocation has played a crucial role in

greening barren lands, the implementation process has

revealed several issues.

The Vice President of the Association, Nguyễn Văn Tiến,

said that under Decree 135/2005/NĐ-CP, households are

allowed to build homes for forest supervision and

temporary shelters for storing equipment.

However, the management of allocated areas by forest

management units has been lax, leading to unauthorised

land use changes and construction of buildings.

Moreover, there is no legal framework specifying how to

handle violations by communities, groups or households

engaged in forest protection activities when such

infractions occur on allocated land.

The lack of clear guidelines for managing assets on the

land such as crops, homes and temporary structures when

contracts are terminated or land is reclaimed also remains

a significant issue.

Proposals for improvement

In light of these challenges the Association has called for

the Government to revise the policy on forest and forestry

land allocation. It recommends revisions should allow

companies that have received land leases to independently

implement business measures in accordance with legal

provisions.

The relevant authorities could also strengthen inspection,

monitoring and guidance on land use management, the

issuance of land use certificates and the development of

management plans for forestry companies’ land, especially

when the land is returned to local communities. Such plans

should address the land needs of minorities, ensuring

social security and welfare.

Hà Công Tuấn, former Deputy Minister of Agriculture and

Rural Development, stressed the importance of shifting the

focus of forest allocation policies from social welfare to

economic development ensuring the protection of forest

workers' rights and improving the management of forest

resources.

Director of the Forestry and Forest Protection Department,

Trần Quang Bảo, said that this year the forestry sector will

focus on researching and drafting an inclusive decree that

revises existing laws to address the challenges within the

sector.

The proposals are expected to contribute to refining the

policy framework, improving land management and

enhancing the sustainable development of Việt Nam's

forestry sector in the near future.

See: https://vietnamnews.vn/environment/1716999/forestry-

sector-to-revise-regulations-to-address-challenges-and-

streamline-governance.html

8. BRAZIL

Low efficiency of regional timber sector

highlighted

During the 4th Amazon Seminar the National Institute for

Amazonian Research (INPA) presented the results of the

National Institutes of Science and Technology (INCT)

Amazon Timber Project focusing on applied innovations

and institutional partnerships aimed at addressing the

challenges faced by the region's timber industry.

The project highlighted the low efficiency of the regional

timber sector which utilises less than 30% of the log

volume, resulting in losses exceeding 60%. It was reported

that the Forest Management Laboratory (LMF) has been

developing and applying technologies such as remote

sensing, drone and algorithms for mapping, monitoring

and optimising logging and processing.

The LMF has also been working on sustainable

alternatives for the use of forest residues with applications

in civil construction and the furniture industry. One

notable development is the production of interactive

panels structured with cross-laminated doweled wood

(PLCC), similar in concept to cross-laminated timber

(CLT), using lesser-known Amazonian timber species.

At the ecosystem level INPA highlighted the development

of statistical models for estimating biomass and carbon

stocks with a 5% margin of error based on the felling and

weighing of more than 500 trees. Forest inventories are

being conducted for continuous monitoring of carbon

sequestration.

These ecosystem service-related studies aim to align with

sustainable forest management to add greater value to

timber and support global climate modeling. The

integration of science, technology and education reaffirms

the institution’s commitment to the sustainability of the

Amazon.

See:

https://www.yumpu.com/pt/document/read/70417637/florestal-

273web

Unblocking approval processes for forest management

plans

The Center for Timber Producing and Exporting Industries

of Mato Grosso State (CIPEM) and the Brazilian Institute

for Environment and Renewable Natural Resources

(IBAMA) held a meeting in Cuiabá to discuss ways to

improve the approval processes for Sustainable Forest

Management Plans (SFMP) involving CITES-listed

species such as Ipê (Handroanthus spp.), Cumaru

(Dipteryx spp.) and Cedro (Cedrela odorata).

According to the National Forum on Forest-Based

Activities (FNBF) Normative Instructions (IN) No.

28/2024 and No. 5/2025 established criteria considered

overly strict halting forest management operations and

raising concerns within the export sector.

One of the key issues addressed was the challenge posed

by the application of these Normative Instructions which

introduced demanding requirements for the management

of CITES-regulated species.

The FNBF considered the initial demands unfeasible

which has led to the paralysis of several management

processes. In response, CIPEM, FNBF and other industry

associations have been negotiating adjustments with

IBAMA.

The expectation is that reviewed pocesses will be released

following alignment between the State environmental

agency (SEMA) and IBAMA thus avoiding negative

social and economic impacts.

The meeting also emphasised the need to standardise

technical criteria between Federal (IBAMA) and State

environmental agencies (SEMA-MT) including alignment

on the application of concepts such as Annual Production

Unit (UPA), Work Unit (UT) and parameters like Rarity

Index and the Volumetric Yield Coefficient (CRV).

IBAMA reaffirmed that evaluations should be based on

the UPA and Annual Operating Plan (POA), with Work

Units serving only as technical calculation reference.

Additionally, there was concern about Normative

Instruction No. 19/2024, which makes the approval of

SFMP conditional on full validation of the Rural

Environmental Registry (CAR). This could jeopardise

forest operations even in States that have made significant

progress in CAR analysis, such as Mato Grosso.

Another issue reported was the inconsistency between the

Federal (SINAFLOR) system and State systems resulting

in the denial of export licenses at ports due to missing

authorisations (Autex/Rautex) within SINAFLOR. CIPEM

formally requested that IBAMA refrain from rejecting

processes outright and instead issue pending status

notifications while awaiting system corrections.

CIPEM and FNBF continue to monitor the negotiations

closely and emphasise the importance of effective

institutional coordination to ensure legal certainty,

expedite administrative procedures, maintain sustainable

forest production, preserve jobs and uphold socio-

environmental commitments in Mato Grosso.

Further technical meetings between SEMA and IBAMA

are scheduled to address both regulatory and operational

adjustments.

See: https://noticiaexata.com.br/geral/cipem-e-ibama-buscam-

destravar-processos-de-manejo-florestal-em-mato-grosso/

Wood panel exports increased in 2024

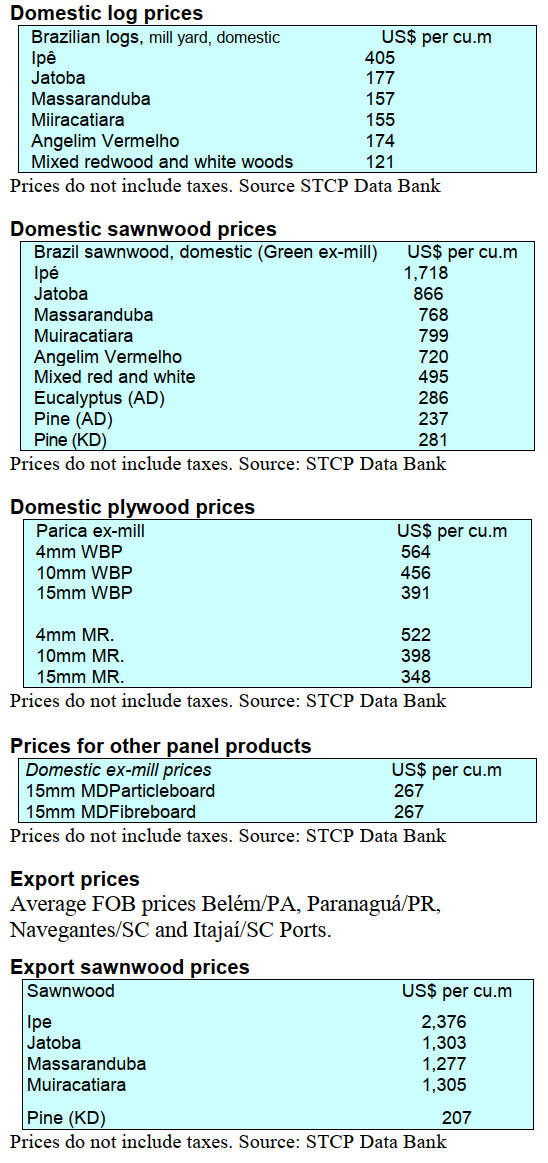

The Brazilian planted forest sector showed a strong export

performance in 2024 according to the Brazilian Tree

Industry (Ibá) with a record trade surplus of US$15.7

billion, representing growth of 23.5% compared to 2023.

According to Ibá, in 2024 the main products that recorded

increased exports were wood-based panels, up by 37%

(US$409 million), followed by plywood (+23%; US$793

million) and paper (+5%; US$2.5 billion). Pulp, the

sector's main export product, ended 2024 with a 33%

increase (US$10.6 billion).

In terms of production Brazil achieved record figures in

2024 reaching 25.5 million tonnes of pulp (a 5.2%

increase) and 11.3 million tonness of paper (+4.6%).

Wood panel exports totalled 1.4 million cu.m marking a

significant growth of 39%, while domestic demand rose to

8.3 million cu.m an increase of 16%.

The forest sector accounted for 4.7% of Brazil’s total

exports (up 1% compared to 2023) and represented 9.5%

of the country's agribusiness exports (up 1.9% from 2023).

Key international markets also showed strong

performance: China imported US$4.8 billion (+21%),

Europe US$3.6 billion (+45%) and North America US$3.5

billion (+24%).

In 2024, China increased its imports of the three leading

export products from Brazil compared to the previous

year: pulp (+21%), paper (+63%) and wood panels

(+94%). In North America, overall imports increased by

approximately 24%, with wood panels standing out with a

57% rise. However, the bulk of the trade value came from

pulp shipments, which totaled US$1.7 billion, a 40%

increase over 2023.

See: https://emobile.com.br/site/industria/vendas-externas-de-

paineis-alcancam-us-409-milhoes/

Amazon Network for Integrated Fire Management

In April the 2nd Regional Meeting of the Amazon

Network for Integrated Fire Management (RAMIF) was

held in Quito, Ecuador. The initiative, led by the Amazon

Cooperation Treaty Organization (ACTO), aims to

advance the harmonisation of regional strategies for the

prevention, monitoring and suppression of wildfires while

strengthening technical and institutional cooperation

among Amazonian countries.

Brazil was represented by the Brazilian Institute for

Environment and Renewable Natural Resources (IBAMA)

through its National Center for the Prevention and

Suppression of Forest Fires (Prevfogo) which shared

Brazil’s experience in forest fire prevention, monitoring

and firefighting.

During the event, the eight member countries (Bolivia,

Brazil, Colombia, Ecuador, Guyana, Peru, Suriname and

Venezuela) presented an overview of their recent actions

related to Integrated Fire Management (IFM), exchanged

best practices and identified concrete opportunities for

collaboration.

The meeting’s key outcome was the development of a

shared operational understanding among Amazonian

nations aimed at harmonising emergency response

protocols for forest fires and enhancing technical and

institutional exchanges.

At the national level, RAMIF is coordinated by the

Brazilian Cooperation Agency (ABC) with the

involvement of the Ministry of the Environment and

Climate Change (MMA), the Chico Mendes Institute for

Biodiversity Conservation (ICMBio) and IBAMA

demonstrating Brazil’s interinstitutional and integrated

approach to environmental policy and its commitment to

sustainable solutions for the Amazon.

See: https://www.gov.br/ibama/pt-

br/assuntos/noticias/2025/brasil-reforca-alianca-amazonica-em-

defesa-das-florestas

9. PERU

Forest Certification

Peru - new board members

appointed

During an Extraordinary General Assembly of Associates

of Forest Certification Peru (CFPeru) three new board

members were appointed for the period 2025-2027. Those

elected were Yolanda Ramírez, Miriam Matorela and

María Trujillo.

CFPeru reaffirmed its commitment to promoting

responsible forest management that guarantees

environmental sustainability, social well-being and

economic viability.

FSC Peru strengthens capacity on the new forest

management standard in Ucayali

FSC Peru held a workshop "Updating and Capacity

Building on the New Forest Management Standard for

Peru". This was held at the facilities of CITE Forestal

Pucallpa in collaboration with the CITE Forestal Pucallpa.

The event brought together 22 representatives of certified

forestry companies and others potentially interested in

adopting this certification as well as regional authorities

such as OSINFOR and the Ucayali Forestry Department.

The training developed the ten principles of the FSC

standard, highlighting crucial topics such as legal

compliance, labor rights, indigenous rights, community

relations, forest benefits, environmental impacts,

management planning, monitoring, conservation of high-

value forests and forest management activities.

New technologies to identify species

As part of its commitment to more accurate and evidence-

based monitoring, OSINFOR trained fifteen specialists in

the use of new technologies to identify wood species.

Thanks to the collaboration with CITEmadera y del

Mueble, a decentralised body of the Instituto Tecnológico

de la Producción (ITP), the technical team strengthened

skills in the use of the Xylotron system, the DART-

TOFMS methodology and the visual recognition of

species through their anatomy.

The training sessions for OSINFOR technical staff focused

on the advantages, scope and limitations of the Xylotron, a

computer vision tool that compares microscopic images of

wood with a database to determine the species and the

DART-TOFMS, a mass spectrometer that chemically

analyses a small sample and provides accurate results,

even for processed wood.

These tools are especially relevant in contexts where

traditional methods do not provide sufficient elements to

confirm the identity of the forest resource. In the

monitoring processes carried out by OSINFOR the results

obtained with these technologies can be used as scientific

evidence to address forest law violations.

As part of the training practical sessions were also held to

recognise ten Peruvian wood species through their visible

anatomical characteristics, a fundamental skill in the field

when specialized equipment is unavailable.

See: https://www.gob.pe/institucion/osinfor/noticias/1164433-

nuevas-tecnologias-respaldan-labor-del-osinfor-para-verificar-la-

legalidad-de-la-madera

Assessing rate of illegal logging

In a joint effort, the Regional Forest and Wildlife

Development Management (GERFOR) and the Forest and

Wildlife Resources Oversight Agency (OSINFOR) have

begun assessing the rate of illegal logging that occurred in

2024. This important input aims to generate information to

understand the dynamics of timber supply and demand

from the forest to the initial processing, strengthen its

traceability, identify areas and modalities of access to

forest resources at greatest risk and thus provide evidence

to improve decision-making in forest management in the

region.

The OSINFOR and GERFOR technical teams will

continue implementing the work plan to deploy field

measurements based on the data and records obtained

during 2024. This process will be key to strengthening the

regional government's capacities and in moving toward

more transparent, efficient and coordinated forest

management.

See: https://www.gob.pe/institucion/osinfor/noticias/1161977-

loreto-inicia-primera-medicion-del-indice-y-porcentaje-de-tala-y-

comercio-ilegal-de-madera-como-medida-para-fortalecer-la-

gestion-forestal

An intercultural tool to prevent forest fires

As part of the Second Regional Meeting of the Amazon

Network for Integrated Fire Management (RAMIF),

organised by the Amazon Cooperation Treaty

Organization (ACTO), the Forest and Wildlife Resources

Oversight Agency (OSINFOR) of Peru presented the

Forest Backpack for Forest Fire Prevention, an educational

and intercultural tool that promotes integrated and

sustainable forest management.

During his presentation, OSINFOR's Director of Forest

and Wildlife Capacity Assessment and Development

explained that the Forest Backpack seeks to strengthen the

capacities of indigenous, peasant and rural communities

through a participatory, visual and fun methodology

adapted to diverse cultural contexts.

The tool was recognised as a replicable best practice by

delegations from several Amazonian countries.

See: https://www.gob.pe/institucion/osinfor/noticias/1158815-

osinfor-presenta-herramienta-intercultural-para-prevenir-

incendios-forestales-ante-ocho-paises-de-la-red-amazonica

|