|

Report from

North America

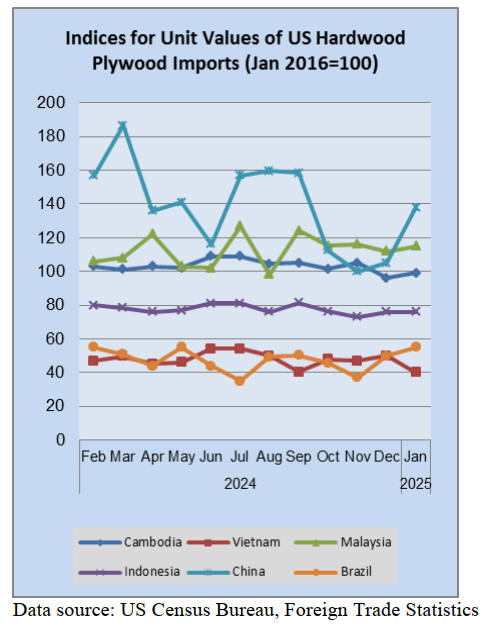

Hardwood plywood imports at highest in more than a

year

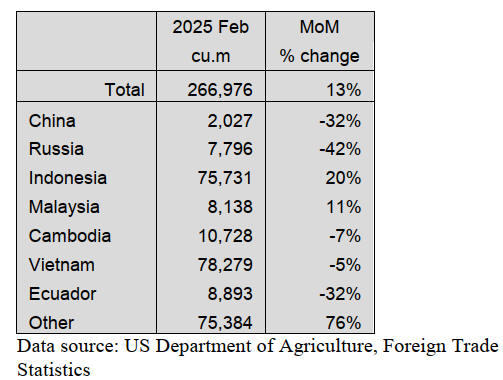

US imports of hardwood plywood rose 13% in February

with the volume at its highest in more than a year. At

266,976 cubic metres, hardwood plywood imports were a

healthy 36% above February 2024 totals.

The rise was fueled by a 20% gains in imports from

Indonesia for the month. Imports from Indonesia were

41% better than last year in the first two months of the

year. Imports from most other key trading partner

countries are behind last year’s pace in volume while total

imports are up 4% over 2024 for the year so far.

Imports of sawn tropical hardwood flat

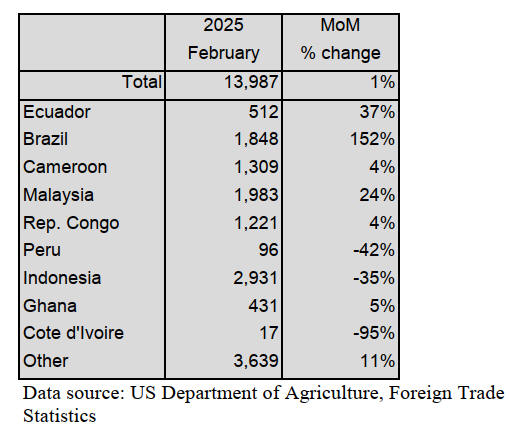

US imports of sawn tropical hardwood showed little

movement in February, rising 1% from the previous

month. At 13,987 cubic metres the volume was 14% lower

than in February of last year.

Imports from Indonesia fell 35% in February, receding

from a very strong January, while imports from Brazil

rebounded somewhat from a dismal January, rising 152%.

Despite the gains imports from Brazil were still less than

half the volume they were in February 2024 and are down

71% for the first two months of the year.

Imports of Mahogany and Ipe both fell by just under one

third in February while Cedro imports fell by more than

two thirds. Import volumes for the first two months of the

year are down sharply for most tropical hardwoods, while

Teak (up 222%) and Meranti (up 69%) have shown

considerable gains. Total imports of sawn tropical

hardwood were down 14% versus last year through

February.

Canadian imports of sawn tropical hardwood fell 9% in

February but remain well above last year’s volume.

Imports for February were 82% higher than in February of

last year. Strong gains in imports from the US and Bolivia

mitigated declines in imports from Congo and Cameroon.

Veneer imports rebound

US imports of tropical hardwood veneer surged 20% in

February, bouncing back from a 34% fall the previous

month. On a percentage basis, imports from many top

trading partners continue to be irregular from one month to

the next.

Imports from India fell 59% and imports from Italy fell

83% in February while imports from China and Cote

d’Ivoire both rose more than 50%. Despite the month-to-

month volatility total imports for the first two months of

the year are nearly even with last year at US$4.2 million.

Flooring imports cool

US imports of hardwood and assembled flooring panels

cooled in February after posting strong numbers in

January. February Imports of hardwood flooring showed a

22% decline from the previous month as imports from

China dropped by a steep 44%.

Imports from Malaysia fell by 20% while imports from

Indonesia slid 7%. Total imports for the month fell 15%

short of last February’s total. Despite the decline, the

year-to-date total for 2025 is ahead of 2024 due to the

strong January figure. Imports of assembled flooring

panels declined by 12% in February. However, at US$29.4

million, imports were 18.5% higher than the previous

February despite the slide.

A 24% increase in imports from Canada made up

somewhat for declines of 51% from Indonesia and

Thailand and a 42% drop in imports from both China and

Brazil. After the first two months of the year, total imports

of assembled floor panels for 2025 are outpacing last year

by 29%.

Moulding imports slump

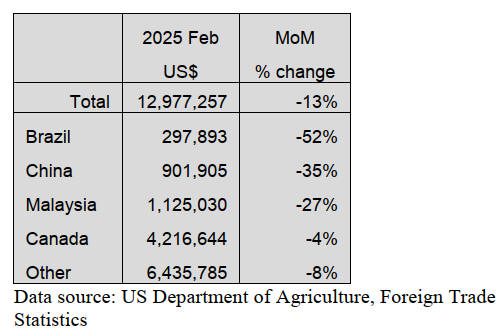

US imports of hardwood moulding fell by 13% as imports

from all top trading partners slumped. At just under

US$13 million the import level was better than last

February’s by 12%.

While imports from top trading partner Canada slid by

only 4%, imports from other major trading nations fell

more sharply. Imports from Brazil plunged 52%, while

imports from China fell 35% and imports from Malaysia

slipped 27%. However, due to January’s strong numbers,

imports from all top importing countries remain well

ahead of last year’s pace and total imports are up 29%

over last year through the first two months of the year.

US wooden furniture imports take a hit

US imports of wooden furniture fell 11% in February,

ending a three-month streak of gains. At nearly US$1.68

billion, imports were 4% lower than last February as

imports slowed from all major trading nations. Imports

from China and Malaysia both fell 15% in February,

imports from Indonesia slid 13% and imports from

Vietnam slowed by 9%. Despite the setback, total imports

of wooden furniture are up 2% from last year through the

first two months of the year.

See: https://usatrade.census.gov/index.php?do=login

January residential furniture orders a mixed bag

New residential furniture orders dropped 3% in January

compared to the same period in 2024, according to the

March issue of Furniture Insights. Yet, despite the overall

decline, two-thirds of respondents reported seeing

increased orders.

Compared to December figures, January new orders were

up 2%, although that could be due to some seasonality

from the holiday break noted Mark Laferriere, assurance

partner at Smith Leonard, the accounting and consulting

firm that produces the monthly report.

January shipments were up 4% compared to 2024 figures,

and up 8% compared to December 2024. Consistent with

new orders, shipments in January 2025 were also up for

approximately two-thirds of the participants compared to

January 2024, Laferriere said.

Tariffs, both existing and potential, continue to impact

American business and spending, making projections

difficult, Laferriere said. "so I’ll stick to what we do know,

which is that consumer confidence declined for a fourth

consecutive month as concerns grew about labour market

conditions and stock market volatility (seemingly hitting

consumers in both the low-end and high-end of the

market, which, as a leading economic indicator ,could be a

signal of trouble ahead at least until some of the current

uncertainty is resolved.”

See:

https://www.woodworkingnetwork.com/furniture/january-

residential-furniture-orders-mixed-bag-smith-leonard

and

https://www.smith-leonard.com/2025/03/03/february-

2025-furniture-insights/

Lumber excluded in US tariff plan

After repeatedly saying that the US didn't need Canadian

lumber and numerous repeated threats to add to import

taxes to a big chunk of US wood supply, lumber has been

left out of the US tariff blitz.

When President Trump announced reciprocal tariffs on a

list of dozens of countries, lumber, composite wood panels

and related products and other USMCA-compliant goods

from Canada and Mexico were exempted.

Trump, who said he had the authority to issue the

sweeping round of tariffs against its global trading

partners under the International Emergency Economic

Powers Act of 1977 (IEEPA), said the plan imposes 10%

tariffs on goods imported into the US from most of the

world's remaining countries. These tariffs went into effect

April 5.

In addition to the base tariff, Trump proposed additional

reciprocal tariffs on a country by country basis, which he

has since paused until early July.

According to Annex II released by the White House, many

wood and wood-related products, including specific

species, plywood, MDF, OSB and other engineered woods

are exempted. Still, the tariffs will "undoubtedly raise

some construction costs, according to a statement from the

National Association of Home Builders (NAHB).

According to a report in the Washington Post the broad

tariffs Trump announced Wednesday will add about

US$6,400 to the cost of building an average house.

See:

https://www.woodworkingnetwork.com/news/woodworking-

industry-news/trump-excludes-lumber-massive-tariffs-plan

and

https://www.whitehouse.gov/wp-

content/uploads/2025/04/Annex-II.pdf

Home furnishings sector braces for impact from tariffs

The latest round of tariffs proposed by US President,

which includes double-digit levies on many of the United

States’ leading trading partners, will have a very

significant impact on 70% of home furnishings-related

businesses according to a Strategic Insights survey.

The survey of more than 420 home furnishings retailers,

manufacturers/suppliers, interior designers and industry

allies, revealed few believe they will avoid the impact of

tariffs, with another 23% saying it will be somewhat

significant. Of the remaining 7%, just 1% said there will

be no fallout.

Additionally, 69% of respondents view the tariffs as a

long-term situation lasting six months or more. Among

those within the 31% seeing a shorter-term duration for

tariffs, some say there will be positive negotiations

between the United States and other countries soon.

In the face of new tariffs 27% plan to raise prices

immediately, while nearly as many (26%) will hike prices

only on new orders and new business. A little more than

one-third (36%) are taking a wait-and-see approach to

price increases.

Among those enacting or anticipating increases, 41%

estimate they would hike prices by 11% to 20%, while

another 28% forecast bumps of 21% to 30%. Meanwhile,

nearly 14% would go as high as between 41% and 75%.

No product sector within the home furnishings universe

will be immune to the impact from tariffs but the survey

takers singled out case goods to be the most impacted with

63% citing both bedroom furniture and dining furniture,

followed by accent furniture (56%) and home office

furniture (50%).

Upholstered goods are also high on the impact list with

49% mentioning motion upholstery and 42% stationary.

At 22%, the mattress category was considered the least

impacted by tariffs.

See: https://www.furnituretoday.com/tariffs/home-furnishings-

industry-braces-for-very-significant-long-duration-impact-from-

tariffs-exclusive-survey/

US to increase logging in national forests to boost

timber production

On 4 April US Secretary of Agriculture, Brooke Rollins,

issued a Secretarial Memo to establish an "Emergency

Situation Determination" on 112,646,000 acres of National

Forestry System (NFS) land. The memo comes on the

heels of an Executive Order to expand American timber

production by 25%. It will empower the US Forest Service

to expedite work on the ground and carry out authorised

emergency actions to “reduce wildfire risk and save

American lives and communities.”

See: https://www.usda.gov/about-usda/news/press-

releases/2025/04/04/secretary-rollins-announces-sweeping-

reforms-protect-national-forests-and-boost-domestic-timber

and

https://www.msn.com/en-us/news/news/content/ar-

AA1CmNtw?ocid=BingNewsVerp

|