Japan

Wood Products Prices

Dollar Exchange Rates of 15th

Apr

2025

Japan Yen 143.52

Reports From Japan

Tariffs could inflict serious blow to Japanese

industries

The combination of additional automobile tariffs and the

reciprocal tariffs imposed by the US could inflict a serious

blow to Japanese industries. Japanese companies are

scrambling to discuss measures against the tariffs but

handling the situation will not be easy as reviewing

production systems is not a simple task.

Ken Kobayashi, chairman of the Japan Chamber of

Commerce and Industry, expressed strong concerns over

the additional 25% tariffs imposed on automobiles. “The

automobile industry is underpinned by wide reaching

supply chains. I am concerned that (the additional tariffs)

will have an enormous impact on the Japanese economy as

a whole through decreases in orders, investment and

employment,” he said.

The automobile industry employs 5.5 million people in

Japan, which also includes such firms as parts companies,

so there are concerns that the tariffs will have impact on

related industries.

The tariffs cover a wide range of items, including

construction machinery and agricultural, forestry and

fishery products, with exemptions placed on such items as

pharmaceutical products and semiconductors. The

Japanese government plans to increase exports of

agricultural, forestry and fishery products and food to 5

trillion yen in 2030 but the target will be difficult to

achieve if exports to the United States slow down.

See:

https://japannews.yomiuri.co.jp/business/companies/20250404-

246973/

Soaring prices keeps ‘real’ wages on the decline

Japan's inflation-adjusted wages fell for the second month

in February as price increases outweighed pay raises. The

Ministry of Labour data show that real wages were down

1.2% from the same month last year. Officials noted that

soaring prices kept real wages on the decline.

Workers in February earned an average of 289,562 yen,

including base pay and overtime. That's up 3.1% year on

year in yen terms and marks an increase for the 38th

month in a row.

See: https://www3.nhk.or.jp/nhkworld/en/news/20250407_B4/

Government to offer aid to Japan-based exporters

The Ministry of Trade has indicated it plans to offer aid to

Japan-based exporters amid concern that US tariffs will

hurt their business. The ministry set up a task force to

implement easier loan terms and develop other policies to

help affected exporters.

Loans to struggling businesses will be offered with easier

requirements under the Ministry plan. State-run financial

institutions such as Japan Finance Corporation will

provide the lending. The ministry also plans to set up

about 1,000 inquiry counters across Japan including at its

bureaus and state-run financial institutions.

The Minister of Trade, Muto Yoji, reiterated that the

government continues to seek an exemption from the new

tariffs and will work to protect industries.

See: https://www3.nhk.or.jp/nhkworld/en/news/20250404_B1/

Bank of Japan welcomes strengthening of the yen

New US tariffs may delay but not halt the Bank of Japan's

plan to raise interest rates further as policymakers seek to

avoid renewed yen falls that would worsen inflationary

pressures.

The US decision to impose a 25% levy on auto imports

and a reciprocal 24% tariff on other Japanese goods, will

deal a huge blow to the export-heavy economy with

analysts predicting the higher duties could knock up to

0.8% off economic growth.

See: https://www.reuters.com/markets/rates-bonds/trump-tariffs-

may-delay-wont-derail-japan-rate-hikes-2025-04-04/

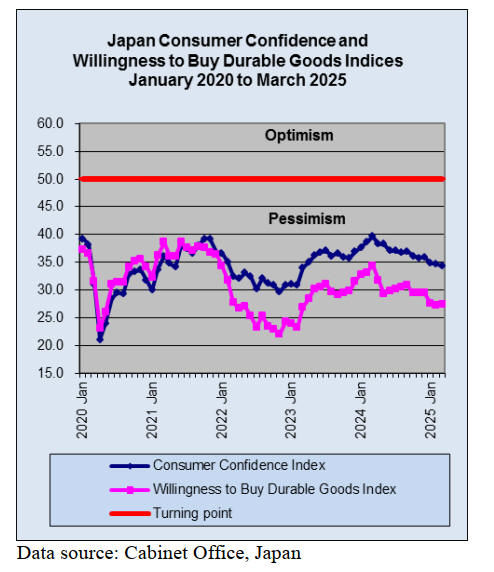

Households cut back on spending

In February Japanese households cut back on spending as

inflation remained high. The Ministry of Internal Affairs

reported household outlays, adjusted for inflation, declined

0.5% in February from a year earlier.

Consumer spending accounts for more than a half of the

economy and is a key component of GDP that is

monitored closely by Bank of Japan. Inflation has stayed

at or above the BoJ’s target for almost three years, sapping

spending power and the latest tariffs from the United

States are now expected to weaken the economy further.

Calls are growing in Japan for a major economic stimulus

package that includes adjustments to the consumption tax

cut in order to cushion any negative impact to the Japanese

economy from US tariffs.

With food prices still rising even ruling party officials

have started to discuss a consumption tax cut as a key

policy especially in light of the upcoming election for the

the upper chamber of the country's parliament.

See:

https://www.japantimes.co.jp/news/2025/04/06/japan/politics/co

nsumption-tax-cut/

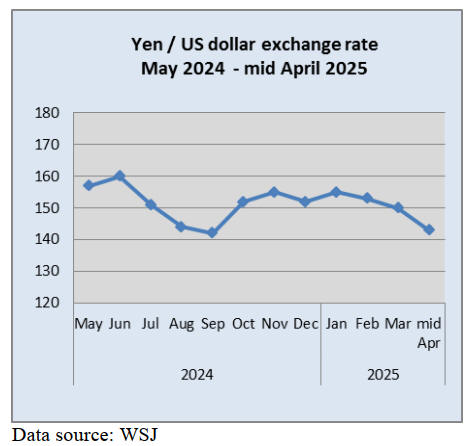

Yen at strongest level in six months

Concern over a global economic slowdown from wide-

ranging US reciprocal tariffs led to a rapid appreciation of

the yen in md April. The yen appreciated to the mid-145

range against the dollar mid month taking Japan's currency

to its strongest level in about six months on concerns

about a US economic slowdown.

The world's largest wooden structure

Expo 2025 Osaka, Kansai, Japan will run 13 April to 13

October. The six month event is being held in Yumeshima

(Konohana Ward, Osaka). The ‘Grand Ring’, a wooden

structure, symbolises this Expo’s theme, ‘Designing

Future Society for Our Lives,’ and has attracted

considerable attention.

This massive, ring-shaped structure with a circumference

of about two kilometres covers an area of approximately

60,000 square metres and stands between 12 and 22

metres in height. Such a large-scale structure made of

wood has generated significant interest.

The centerpiece of the 2025 Expo, the Grand Ring, has

been recognised by Guinness World Records as the

world's largest wooden structure. Sou Fujimoto, the

architect responsible for the design of the Grand Ring and

the Expo Site Design Producer, commented “when

creating the overall concept for the Expo site, we proposed

and developed the theme of ‘Unity in diversity’ while

designing the venue.

See: https://www.gov-

online.go.jp/hlj/en/february_2025/february_2025-05.html

and

https://www.expo2025.or.jp/en/news/news-20250304-02/

Tighter of overtime rules drive up contruction costs

regulations

According to the Real Estate Economic Institute the

national average price of newly built condominiums in

2024 was 60.82 million yen (approx. US$405,000),

topping 60 million yen for the first time since statistics

began in 1973. Prices have risen for eight consecutive

years.

One factor behind the price increases is surging

construction costs. Along with material prices remaining

high, the "2024 problem," referring to the strengthening of

overtime regulations in the construction industry, has

exacerbated labour shortages and labour costs are expected

to continue to climb.

The Japan Residential Property Price Index (set at 100 in

2010), which indicates national real estate price trends,

shows that both condominiums and detached homes have

been rising in price in recent years but that the increase in

condominiums is more pronounced.

Positive assessment of regional economies

In mid-April the Bank of Japan (BoJ) maintained its

economic assessments for all nine regions of the country,

even as US tariffs are threatening to impact the economic

outlook.In its quarterly report on regional economies, the

BoJ said the nine regions were either "recovering

moderately," "picking up" or "picking up moderately

although some weakness had been seen in part," using the

same expressions as in the previous assessment in January.

The wide-ranging US tariffs will "put downward pressure"

on the Japanese and global economies, Bank of Japan

Governor Kazuo Ueda said Friday.

See:

https://www.boj.or.jp/en/research/brp/rer/data/rer250407.pdf

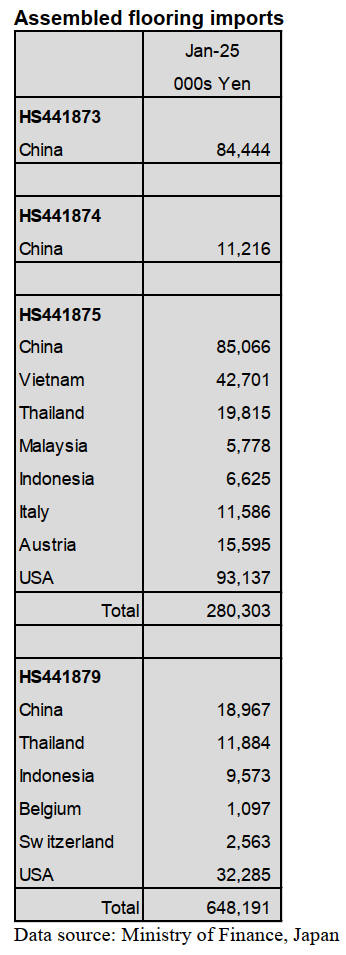

Import update

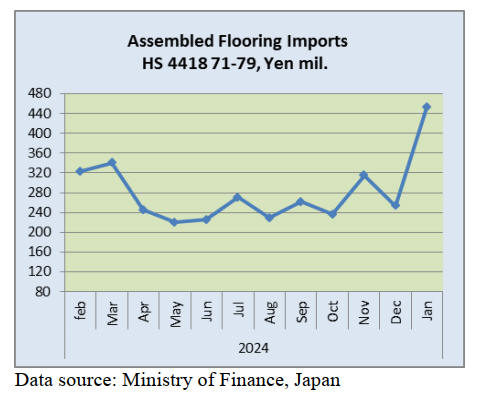

Assembled wooden flooring imports

The value of Japan’s January 2025 imports of assembled

wooden flooring HS441871-79 were over 60% higher than

in January 2024 and over 60% compared to December

2024. The last time the value of imports was so high was

in June 2022.

The main category of assembled flooring imports in

January 2025 was HS441875, accounting for 62% of the

total value of assembled flooring imports compared to the

59% share reported in December. Of HS441875 imports,

33% was provided by shippers in the US, 30% by shippers

in China and 9% by shippers in Vietnam. The sudden rise

in imports of HS441875 from the US taking to top spot in

terms of the value of imports was a surprise especially as

US deliveries exceeded those from China.

The three other sources of assembled flooring (HS441875)

in January were Thailand, Austria and Italy.

The second largest category in terms of value in January

2025 was HS441873 all of which was shipped from China.

In January HS441873 accounted for 19% of all HS441873

arrivals. The third largest category in value terms was

HS441879 (17%).

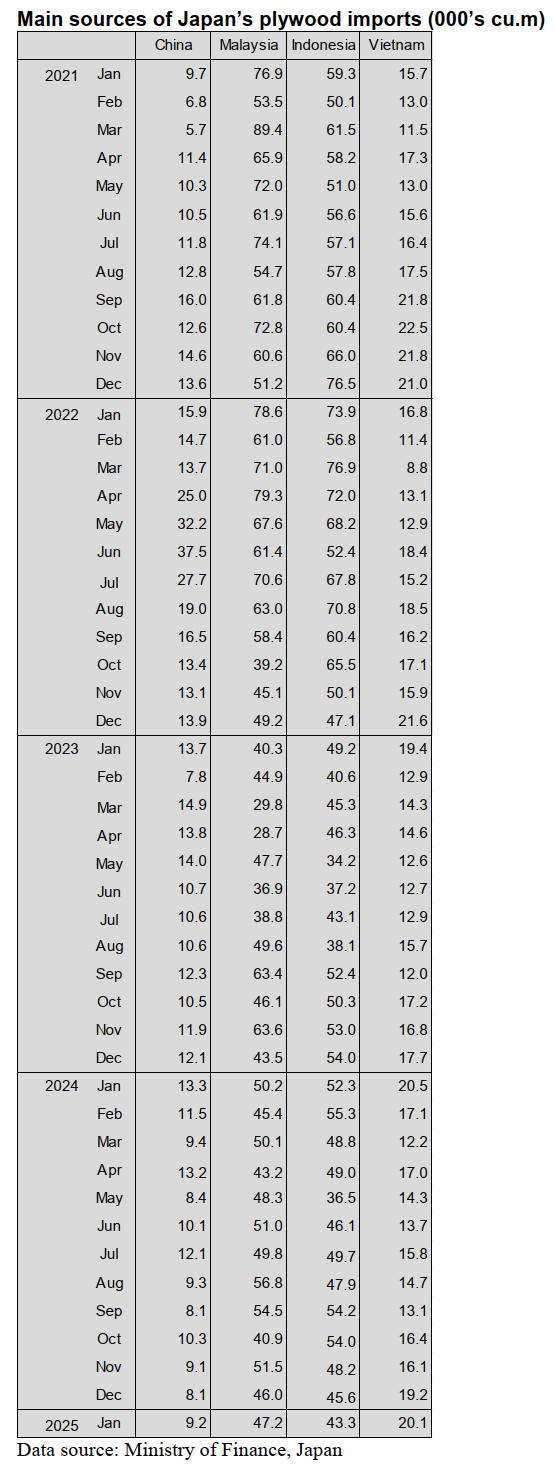

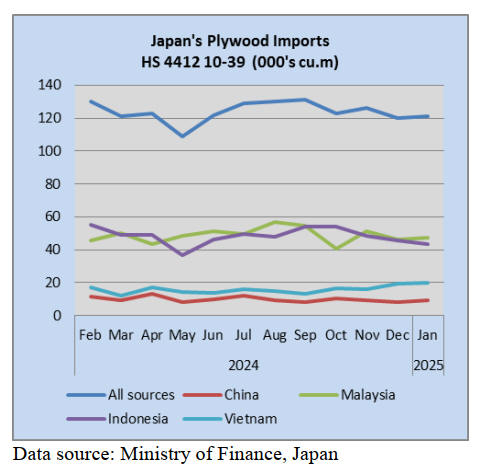

Plywood imports

The very quiet market for plywood in Japan in January

2025 was refleected in the volume of imports. Year on

year the volume of imports was down 12% and compared

to December there was little change. Malaysia and

Indonesia were, as usual, the top suppliers in January

2025. Arrivals from Malaysia were up slightly while

arrivals from Indonesia were at around the same volume as

in December 2024.

In January 2025 all the main shippers recorded a decline in

the volume of shipments except shippers in Vietnam were

the volmes in January were around the same level as in

December 2024. The volume of January 2025 plywood

imports (441210-39) was 121,161 cu.m.

As in previous months, of the various categories of

plywood imported in January 2025 HS441231 was the

largest (84% of total imports) followed by HS441233

(7%). Malaysia and Indonesia accounted for most of the

HS441231 arrivals in December.

Small volumes of HS441239 and HS441234 arrived in

Japan during January from a wide range of suppliers

including Latvia, Chile, the Philippines, Taiwan P.o.C and

New Zealand.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Imported wood fuel in 2024

Import of wood pellet in 2024 is more than 2023 and of

PKS is less than last year. Total volume of wood pellet

and PKS is 8,814,103 tonnes, 1.4 % more than last year.

Volume of wooden pellet in 2024 is 638,931 tonnes, 10.0

% more than 2023 and it is 577,557 tonnes increased. The

reason for the increase is that the volume of South Asian

wooden pellet rises from the previous year.

Vietnamese wooden pellet is 3,315,260 tonnes, 27.4 %

more than last year. Canadian wooden pellet is 1,166,602

tonnes, 26.3 % less and American wooden pellet is

1,118,215 tonnes, 11.5 % less than 2023.

On the other hands, Malaysian wooden pellet is 403,069

tonnes, 74.7 % more, Indonesian wooden pellet is 314,895

tonnes, 372.9 % more and Thai wooden pellet is 35,077

tonnes, 349.2 % more than last year. Australian wooden

pellet is 23,961 tonnes, 51.3 % less than last year.

Total volume of PKS in 2024 is 2,433,172 tonnes, 15.7 %

less than 2023. Indonesian PKS is 1,876,999 tonnes, 16.0

% less and Malaysian PKS is 534,406 tonnes, 16.7 % less

than the previous year. However, Thai PKS is 21,767

tonnes, 108.7 % more than last year.

Revised Clean Wood Act

The revised Clean Wood Act will come into effect in

April, 2025. As illegal logging is being eradicated

worldwide, Japan has also been working on this issue. The

main change to the revised Clean Wood Act is that a

business person, who involves wood industry, will be

required to verify legality.

The current Clean Wood Act is that the forest business

owners are obligated to make efforts to cut down trees

legally. The third party organization registers the forest

business owners to use more legal woods.

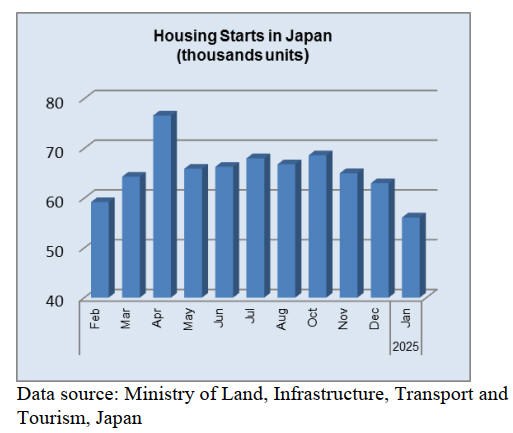

Volume of composite wood flooring in 2024

The production and sales volume of composite wood

flooring in 2024 do not exceed the result of 2023. The

sales volume decreases for three years in a row. The

reasons are the low new starts and a decrease in floor

areas. The production is 4.4 % less and the sales volume is

5.7 % less than last year. The starts in 2024 are 3.4 % less

than 2023.

The production at the first half of 2024 is 6.8 % less and

the sales volume at the first half of 2024 is 7.7 % less than

the same period last year. However, demand for composite

wood flooring rose at the second half of 2024.

The production of LL45, which is the classification of

sound insulation, is 1,976,000 tsubo, 2.5 % more and the

sales volume is 1,997,000 tsubo, 1.5 % more than the

previous year. One of the reasons for the increase in LL45

production is that some building material companies had

market development of sound insulation for apartment

buildings through the COVID-19.

|