|

1.

CENTRAL AND WEST AFRICA

Tariff shock waves

The president of the African Development Bank said an

onslaught of tariffs by the United States will send "shock

waves" through African economies, warning of reduced

trade and higher debt-servicing costs.

Arfica.com has quoted Ecobank CEO, Jeremy Awori, as

urging African nations to boost intra-continental trade to

cushion the impact of US tariffs which threaten many of

the continent’s economies.

The US is Africa’s fourth-largest trading partner and as

such the new tariffs could have a disproportionate impact

on the continent as they undermine demand for the

continent’s exports.

Awori called for accelerated implementation of the

African Continental Free Trade Area (AfCFTA), removal

of non-tariff barriers and more local value addition to raw

materials as a means of weathering the effects of US tariff

realignment and earlier announced aid cuts that could push

millions of people into extreme poverty.

See: https://africa.com/228500-2/

Regional update

Cameroon

Road and rail operations to Douala and Kribi Ports are

reported as generally stable and container availability

remains good with sufficient empty containers in stock.

Northern Cameroon has experienced severe flooding (with

considerable damage to housing and infrastructure

reported) but the weather has not significantly disrupted

operations in the south.

Gabon

The domestic press has quoted the Ministry of Economy

as saying in the fourth quarter of 2024 the timber industry

recorded a sharp decline marked by a 6.6% drop in the

composite index for sectoral activities compared to the

previous quarter.

This slowdown, says the press, was mainly due to

insufficient log supplies and weakening Chinese demand.

The sawmill production index posted a 5.3% quarter-on-

quarter decline for the third consecutive quarter fueled by

a sparse order book as well as operational constraints

including frequent power outages.

The veneer production index was down 4% compared to

the previous quarter. The plywood production index

recorded the sharpest decline, -24% compared to the third

quarter of 2024. This decline was explained by electricity

shortages and log availability. However, for the year

plywood production showed a notable increase of 27%.

It is reported that in Nkok’s Special Economic Zone

around 50% of Indian veneer peeler mills have closed

because of a lack of orders from their regular customers.

See: https://www.lenouveaugabon.com/fr/agro-bois/1104-20542-

bois-le-gabon-enregistre-un-repli-de-6-6-de-l-activite-au-4e-

trimestre-2024

Republic of the Congo

Operators report logging operations continue without

major disruption and road and rail transport to Douala Port

remain open with no recent changes in fees or tolls

reported.

Operations remain steady though rains and poor roads

continue to be problematic. In general, prices for some

timber species (iroko, padouk and okan) have increased

slightly but overall business remains quiet.

Chinese engagement in railway, road, housing and mining

projects continues to expand and was bolstered by the

recent visit by China’s Finance Minister. These

investments may improve local infrastructure.

ATIBT publishes guide on tropical wood structures

The ATIBT has published a guide on African tropical

timber structures. ATIBT says the guide is a response to

requests from project owners, mainly architects, who want

to use tropical woods in public contracts due to their

particular performance but who faced difficulties in

drafting the specifications of special technical clauses.

Another objective of the guide says ATIBT is to support

and promote the certification process for sustainable forest

resource management.

See: https://www.atibt.org/files/upload/technical-

publications/guide_de_performance_des_ouvrages_africains/ATI

BT-GUIDE-DE-PERFORMANCE-DES-OUVRAGES-EN-

BOIS-V6.pdf

2.

GHANA

Revision of timber stumpage fees

The Forestry Commission (FC) has concluded

negotiations to increase stumpage fees starting with an

increase of 30% of the legally mandated fee as of 2 April

2025 to be gradually increased to 70% over the next two

years. This was agreed in collaboration with

representatives from the Traditional

Authorities/Landowners, the Ministry of Lands and

Natural Resources (MLNR), the Office of the

Administrator of Stool Lands (OASL) and the Timber

Industry.

Ogyeahoho Yaw Gyebi II, Omanhene of the Sefwi

Anhwiaso Traditional Area and President of the National

House of Chiefs said after the meeting he praised all

parties who attended for the peaceful and collaborative

atmosphere of engagement which resulted in the positive

outcome to the interest of all stakeholders.

The Chief Executive of the Forestry Commission, Dr.

Hugh C.A. Brown, extended his appreciation to all

stakeholders for prioritising the review. He emphasised the

importance of stumpage fees in supporting the

Commission, the traditional authourities and for national

development. He also highlighted the legal requirement

for periodic fee reviews, against macro-economic factors.

There were concerns on the current stumpage calculations

which puts Timber Utilization Contract (TUC) holders at a

disadvantage regardless of market conditions.

The chair suggested that the Forestry Commission and the

timber industry engage the government on a stumpage

formula to implement a new law that would benefit all

stakeholders.

See: https://fcghana.org/timber-stumpage-fees-revised/

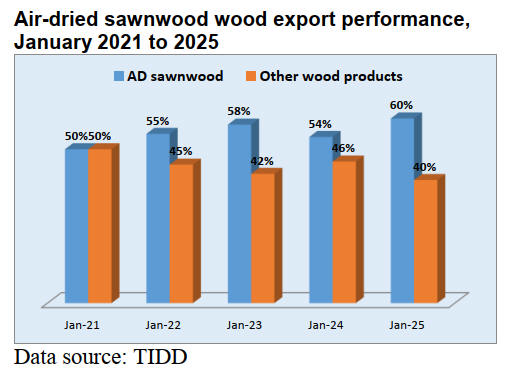

Air dried sawnwood exports number one

Data from the Timber Industry Development Division

(TIDD) industry report published for January 2025

showed that air-dried sawnwood accounted for 60%

(12,440 cu.m) of the total export volume for the period

(20,594 cu.m)– to maintain its lead as the top wood

product exported.

Sawnwood exports registered a 6% volume growth when

compared to the same period in January 2024. For the

period 2021 to 2025 data also showed that the volume of

air-dried sawnwood exports accounted for at least 50% of

the total volume of timber and wood exports shipped each

year. Kiln-dried sawnwood took the second position to air-

dried during the 5-years period, accounting for an average

of 15% of the total export volumes with billet and

plywood taking the third position.

The reason for the performance of the air-dried sawnwood

export volumes compared to kiln-dried, could be attributed

to the fewer facilities of the latter and the high energy cost

associated with kiln-drying.

Fifty (50) registered exporters contributed to the total

export volume of the product (12,440cu.m.) for the period.

Species that went into the production of sawnwood

included teak, denya, kako/ekki, niangon, dahoma, ananta,

essa/celtis, odum and dahoma.

While the major market for sawnwood was Asia (India,

85% and Vietnam, 8% twelve other countries accounted

for 7% of the total volume.

For the period in 2025, air-dried sawnwood product

accounted for 52% of export receipts (Eur 5.10 million)

compared to 4.73million in the previous year.

US 10% tariff - call for strengthening local content

policy

The 10% across the board tariff on all Ghanaian exports to

the US is anticipated to have a dire impact on Ghana’s

future commodities trade including wood products.

The president of the Association of Ghana Industries

(AGI), Dr. Humphrey Ayim-Darke, has cautioned that the

weak implementation of the country’s local content policy

has left the economy vulnerable to external shocks such as

the new US tariff on Ghanaian exports.

On its website the policy think tank IMANI Africa -

Ghana says it sees the action by the US as an opportunity

for the country and recommended that Ghana expand its

trade partners beyond the US to build the leverage to

export the same commodities to other markets during such

crisis.

It further stated that strengthening Ghana’s regional value

chains under the African Continental Free Trade Area

(AfCFTA) is very crucial. The statement added that by

that Ghana can create more demand for local goods and

reduce its vulnerability to external shocks such as the

recent tariffs.

The report also emphasised that Ghanaian exporters must

improve product quality, branding and packaging to

differentiate their goods in competitive markets. Exports

to the US have been increasing in both volume and value

for the last few years.

See: https://imaniafrica.org/2025/04/criticality-analysis-of-

economic-issues-31st-march-to-5th-april-2025/

and

https://thebftonline.com/2025/04/10/u-s-tariffs-a-wake-up-call-

for-africas-economic-self-reliance-afcfta-chief/

90% plus businesses are in the informal sector

According to a Ghana Statistical Service (GSS) survey

(Ghana 2024 Integrated Business Establishment Survey)

92% of businesses in Ghana are in the informal sector.

This was disclosed by (the then) government Statistician,

Professor Samuel Kobina Anim, who indicated that these

informal businesses were identified as entities which fail

to keep any formal book-keeping accounts. The report

revealed that during the period 2014-2024 over 1.2 million

businesses were established with most of these recording

low revenues annually.

The GSS identified that at least 55% of large-sized and

medium-sized privately owned establishments are in the

formal sector. Timber processing companies fall into the

medium-sized establishments which are largely privately

owned .

See: https://www.myjoyonline.com/92-3-of-businesses-in-

ghana-remain-informal-gss/

and

https://www.myjoyonline.com/ghanas-economy-estimated-at-

gh%c2%a21-17trn-gss/

3. MALAYSIA

Discussions on measures to withstand tariff storm

Like many other countries the recently introduced tariffs

by the United States have dominated the news headlines

and also the focus of the business community. In 2024,

Malaysia’s timber exports to the United States were

RM198.65 bil out of a total export of RM 1,508 bil.

Key measures to help Malaysia withstand the global tariff

storm from the United States are being discussed by the

Ministry of Investment, Trade and Industry (Miti).

Among the measures being explored are possibly

diversifying Malaysia’s current trade and investment

interests as well as strengthening the country’s supply

chains.

Miti also said the government would continue to engage

with the United States by leveraging its influence in the

Malaysian-US Trade and Investment Framework

Agreement. Malaysia, as the chair of ASEAN, will also

engage in discussions with several member states of the

bloc to reach a collective approach.

See:

https://www.thestar.com.my/news/nation/2025/04/04/measures-

to-help-malaysia-weather-trump-tariff-storm-being-discussed-

says-miti?gsid=11efc45a-0e05-47d7-8d64-58dcf2acab09

US importers ask for delayed furniture shipments

The furniture industry has been advised to delay shipments

to the United States following the imposition of a 24%

tariff by the US government. The Malaysian Furniture

Council’s deputy president, Matthew Law, said this signi-

ficant tariff has resulted in some manufacturers postponing

shipments due to the prevailing market uncertainty, “some

US customers have requested us to temporarily hold off on

shipments” he said.

He added “the situation remains unpredictable and it is

unclear how much of this cost will be passed on to

consumers as manufacturers may absorb some of the

impact of duties. ”

The United States is a crucial market for Malaysian

furniture accounting for 60% of the country’s exports as of

February 2025.

Steve Ong Yeou Huan, president of the Federation of

Johor Furniture Manufacturers and Traders Associations,

confirmed that several American clients have requested

furniture exporters to temporarily suspend shipments to

the United States.

“Some furniture export orders are currently on hold due to

the uncertainties surrounding the new tariffs,” he said. He

added “although the 24% tariff imposed on Malaysia is

lower than that for some other countries, clients may

eventually shift their production to nations with even

lower tariffs which would undermine Malaysia’s

competitiveness.”

See:

https://www.thestar.com.my/news/nation/2025/04/08/furniture-

shipments-to-us-put-on-hold-for-now

All forest workers must be certified

The Sarawak Timber Association (STA) has called on its

members to accelerate the training of their forest workers

to ensure compliance with the Forests (Trained Workmen)

Rules, 2015. STA chairman, Henry Lau, said all forest

workers must undergo training and obtain Forest Worker

Certificates to support sustainable forest management

(SFM).

According to Lau, these certificates are now mandatory for

license renewals and approvals for the Permit to enter

Coupe, as required by the Director of Forests. Lau also

highlighted that, since the skills sets offered by the STA

Training Co Ltd (STAT) were registered with the Human

Resources Development Corporation, members should

take advantage of STAT’s training provider status.

Looking ahead, Lau said STAT planned to expand its

training programmes significantly in the coming years to

offer more opportunities for skill development to meet

evolving industry standards and regulatory requirements.

See:

https://theborneopost.pressreader.com/article/281560886598209

AI tool contributes to forest assessment

Telekom Research & Development Sdn Bhd (TM R&D), a

subsidiary of The Multimedia University (MMU) was

recognised at the Malaysia Technology Excellence

Awards 2025 in the AI - Environmental Services category.

This recognition celebrates a breakthrough in Smart

Forestry AI Tools Enhancement which contributes to

forestry assessments and advances biodiversity

conservation in Malaysia.

The AI-powered solution, launched in 2024, utilises a

mobile app that captures tree images and calculates tree

diameters (DBH) without the need for additional

equipment or reference objects. This innovation

significantly reduces the time taken for data collection.

See: https://www.mmu.edu.my/2025/04/tm-rd-wins-malaysia-

technology-excellence-award-for-ai-powered-smart-forestry-

innovation/

4.

INDONESIA

Export Benchmark Price (HPE) April 2025

The following is a list of Wood HPE from April 1 to April

30, 2025.

Processed wood (prices per cu.m)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1,000 sq.mm to

4,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth of

Merbau wood with the provisions of a cross-sectional area

of 4000 mm2 to 10000 mm2 (ex 4407.11.00 to ex

4407.99.90) = US$1,500/cu.m

See: https://jdih.kemendag.go.id/peraturan/keputusan-menteri-

perdagangan-republik-indonesia-nomor-446-tahun-2025-tentang-

harga-patokan-ekspor-dan-harga-referensi-atas-produk-

pertanian-dan-kehutanan-yang-dikenakan-bea-keluar-1

Furniture entrepreneurs voice concerns on US tariff

policy

Abdul Sobur, Chairman of the Indonesian Furniture and

Craft Industry Association (HIMKI), expressed concern

that the reciprocal tariff policy implemented by the US

will significantly impact the furniture and craft industries

in Indonesia.

According to the list released by the US government

Indonesian export products to the US (until the latest

changes) faced a reciprocal tariff of 32%. Sobur explained

that the immediate effect will be felt on furniture and

crafts being shipped to the US, particularly those departing

before April 9 and thereafter.

He said "53% of our exports go to the United States while

the remaining products are sent to Europe and other Asian

countries. Any goods currently en route or just departed

would be as the shipping time is approximately one

month. By the time they arrive the pricing structures will

have changed."

Any increase in tariffs would lead to a decline in exports

of furniture and crafts from Indonesia to the US. The US

market may shift to countries offering similar products at

lower prices. "Indonesian forest products and furniture

exported to the US will incur higher costs, this is

significant and will likely reduce the competitiveness of

Indonesian furniture products in the US", Sobur

concluded. In related news, the Indonesian Furniture and

Craft Association (Asmindo) has highlighted the possible

adverse effects of import tariff proposed by the United

States.

Asmindo pointed out that the US accounts for 60% of

Indonesia's total furniture exports, around US$2.2 billion.

Any introduction of these new tariffs, according to

Asmindo Chairman, Dedy Rochimat, would result in a

decline in the competitiveness of Indonesian furniture

products in the American market. "This decline in utility

will ultimately lead to a reduction in the workforce," Dedy

stated.

See: https://www.cnnindonesia.com/ekonomi/20250404141758-

92-1215816/53-persen-ekspor-ke-as-pengusaha-mebel-was-was-

kebijakan-tarif-trump.

Assessing impact of US tariffs

Indonesia's Coordinating Minister for Economic Affairs,

Airlangga Hartanto, said that the imposition of US

reciprocal tariffs will have a significant impact on several

export sectors. Airlangga said that the Indonesian

government would immediately take strategic steps to

mitigate the negative impact on the economy.

According to him, the US reciprocal tariffs will have a

significant impact on Indonesia's exports to US

competitiveness. Indonesia's main exports to the US are

electronics, textiles and textile products, footwear, palm

oil, rubber, furniture, shrimp and marine fishery products.

Airlangga said the government will continue to

communicate with the US government at various levels

and will send a high-level delegation to Washington.

See: https://rri.co.id/en/business/1432760/govt-to-calculate-

impacts-of-us-reciprocal-tariff-minister

Indonesia to boost US imports

Indonesia plans to boost imports from the US in an effort

to narrow the trade deficit.. Coordinating Minister for

Economic Affairs Airlangga Hartarto explained that the

decision is part of ongoing negotiations and said "we will

increase the volume of purchases so the US$18 billion

trade deficit can be reduced."

See: https://en.tempo.co/read/1994262/indonesia-to-boost-u-s-

imports-to-offset-trade-gap-as-32-tariff-looms

Minister seeks collaboration to end poverty

Social Affairs Minister, Saifullah Yusuf, has invited

Forestry Minister, Raja Juli Antoni, to support poverty

elimination through community empowerment

programmes run by the Ministry of Forestry. "We want

these (vulnerable, poor and extremely poor) groups to be

empowered by programmes of ministries such as the

Ministry of Forestry" Minister Yusuf said.

He added that the Ministry of Forestry can empower

residents living around forest areas to reduce poverty. "We

can select residents living around forests and they can

carry out forest-based economic activities.

See: https://en.antaranews.com/news/350061/minister-seeks-to-

collaborate-with-forestry-minister-to-end-poverty

Forest monitoring Ap to strengthen traceability

Indonesia's vast forests present significant challenges for

monitoring. To address this Kaoem Telapak has launched

a forestry monitoring application Ground-truthed.id

(GTID).

This application is designed to assist in monitoring and

tracing products including those from forestry, agriculture

and plantations that are subject to the EUDR. This

application can be accessed via the web and Android

devices to collect and manage forestry monitoring data

from civil society groups, indigenous peoples and local

communities.

The aim of GTID is to enhance transparency,

accountability, and advocacy efforts in the fight against

illegal logging, deforestation, land grabbing, and

environmental injustice.

See: Ground-truthed.id

Indonesia and Australia to develop furniture industry

skills

The Ministry of Industry is ramping up efforts to boost the

performance of Indonesia’s domestic furniture industry,

aiming to strengthen its contribution to national GDP and

expand export markets. The Kendal Polytechnic signed a

Memorandum of Understanding (MoU) with CAD+T

Australasia Pty Ltd and Pradita University to improve

skills in the furniture sector.

See: https://www.rri.co.id/internasional/1434312/indonesia-

australia-develop-digital-talent-for-furniture-industry

5.

MYANMAR

Myanmar reeling from multiple crises

The Myanmar state television reported that the death toll

from the earthquake near Mandalay had, as of 11 April,

surpassed 3,000 with around 4,500 people being injured.

Although the recent earthquake did not cause significant

physical damage to the export sector as key industries,

such as wood processing and garment manufacturing are

mainly in Yangon where the tremors were mild, however,

indirect impacts are inevitable. The most visible impact in

Yangon is power shortages with the rotational supply of 4-

hour on and 8-hour off.

TMyanmar says the country is reeling from overlapping

crises; political turmoil, economic stagnation and recurring

natural disasters. The World Bank had already projected a

meager 1% economic growth for the fiscal year ending

March 2025, down from an average of 6% annually

between 2011 and 2019, a period of democratic hope and

poverty reduction. Analysts warn that the earthquake’s

fallout could push growth into negative territory.

See- https://www.worldbank.org/en/country/myanmar/overview

ASEAN mobilises disaster fund

The ASEAN Disaster Management and Emergency Relief

Fund has been activated to support Myanmar following

the devastating 7.7 magnitude earthquake. ASEAN

Secretary-General Dr. Kao Kim Hourn said the regional

bloc is now shifting its focus toward long-term recovery

efforts.

"This reflects the collective commitment among ASEAN

member states to respond to humanitarian crises in the

region," said Kao. The earthquake, which killed over

3,000 people and caused widespread damage across

Myanmar, also triggered tremors felt in Thailand and

Laos.

The Malaysian Prime Minister, Datuk Seri Anwar

Ibrahim, urged ASEAN to deepen its engagement with

Myanmar, emphasising the importance of adhering to

humanitarian principles and the five-point consensus

framework.

See -

https://www.bernama.com/en/news.php?id=2410893 and https://

www.bernama.com/en/news.php?id=2411187

December election confirmed

Myanmar Government has reaffirmed its commitment to

holding a general election in December, despite the

challenges in the aftermath of the devastating earthquake

in March. This announcement was published in the state-

run Global New Light of Myanma.

See - https://thediplomat.com/2025/04/myanmar-juntas-affirms-

december-election-despite-earthquake-chaos/

Multi-exchange rate system questioned

Critics are saying some economic policies adopted by the

State Administration Council (SAC) may have violated

Myanmar’s international economic obligations. One of the

most significant violations of its international economic

obligations is the adoption of a multiple exchange rate

system. These rates are set by administrative diktat and do

not reflect market conditions.

Through the Central Bank of Myanmar, the SAC has

access to 25% of export earnings from most exporters at

the official rate of 2,100 MMK to a US dollar, about half

the market rate. Recent IMF guidelines require that the

effective exchange rate be no more than plus or minus 2%

lowere than the theoretical reference price.

See- https://fulcrum.sg/myanmars-military-regime-is-violating-

its-international-economic-obligations/

6.

INDIA

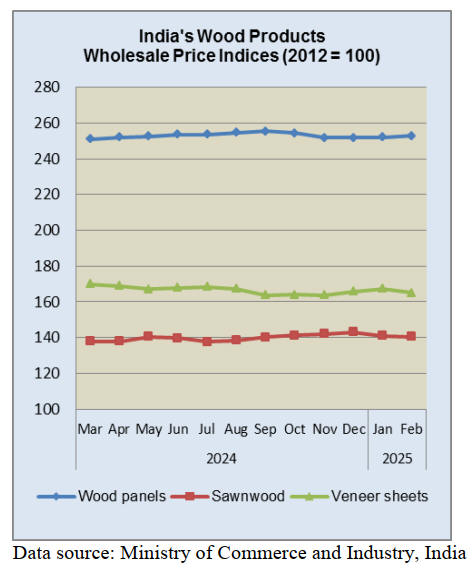

Pause in sawnwood price

increases

The annual rate of inflation based on the all India

Wholesale Price Index (WPI) was 2.38 in February. The

positive rate of inflation was primarily due to increases in

prices of manufacture of food products, food articles, other

manufacturing, non-food articles and textiles.

The index for manufacturing increased to 143.8 in

February from 143.2 in January. Out of the 22 NIC two-

digit groups for manufactured products, 17 groups

witnessed an increase in prices, 2 groups witnessed a

decrease in prices and 3 groups saw no change in prices.

Some of the important groups that showed month on

month prices increases were ‘other‘ manufacturing,

manufacture of food products, basic metals, other non-

metallic mineral products and chemicals and chemical

products.

Some of the groups that saw a decrease in prices were

manufacture of wood and of products and leather products.

See: https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Panel industry had a tough final quarter

Plyreporter has said the Indian wood panel industry

witnessed a tough final quarter in the 2024-2025 financial

year mainly due to a liquidity crunch, payment delays and

introduction of the new Quality Control Order (QCO) on

panel products.

The correspondent reports imports of panel products such

as MDF, plywood, Blockboard, particleboard and doors

stopped because of the QCO.

Strong demand for new homes

Housing demand in India is expected to grow further due

to budget tax incentives and a recent interest rate cut, says

CREDAI in a press release. CREDAI points out demand

for housing continues to be strong and is expected to grow

further on the back of tax incentives offered in the budget

and a recent intersst rate cut, said the CREDAI president.

In a recent interview the CREDAI president asserted that

there are no signs of demand slowdown in the Indian

housing market, rather it will continue to rise in the long-

term horizon. However, he said there could be an impact

in some markets that are "over-heated" but overall at pan-

India level there are no concerns at all.

According to a CREDAI study average housing prices

across the top eight markets in India witnessed a 10%

YoY rise during the last quarter of 2024 led by healthy

demand momentum and positive market sentiment.

Average house prices have been rising for the past 16th

consecutive quarters starting 2021.

While affordable housing segment will continue to form

the bulk of housing sales, demand within luxury and ultra-

luxury segments can amplify further in 2025. Movement

in these segments is likely to drive average housing prices

up across most major residential markets of the country in

the next few quarters. Overall unsold inventory continued

to decline for the fourth consecutive quarter and dropped

5% annually during Q4 2024 backed by healthy demand.

In related news, in April the Reserve Bank of India (RBI)

recently cut interest rates from 6.25% to 6%, a second cut

since February when rates were brought down after nearly

five years. The RBI also lowered its growth projections for

this year from 6.7% to 6.5%.

Analysts point out the RBI shifted its monetary policy

stance to "accommodative" from "neutral", which means

that the central bank would be more open to cutting rates

in the future to stimulate a slowing economy.RBI

governor, Sanjay Malhotra, said in a speech "concerns on

trade frictions are coming true and unsettling the global

community” adding that headwinds from disruptions to

trade would continue to pose challenges for the economy.

See: https://www.credai.org/media/view-details/545

and

https://economictimes.indiatimes.com/industry/services/property-

/-cstruction/housing-demand-strong-prices-to-grow-this-year-at-

more-than-inflation-rate-credai-prez-boman-

irani/articleshow/119072779.cms?from=mdr

Rupee depreciation a problem for importers

The Indian rupee’s performance in 2024 was a problem for

importers. By year end the rupee had depreciated by

approximately 3% against the US dollar the

implications of which were far-reaching.

In 2025 India’s trade deficit widened, putting pressure on

the rupee as the country spent significantly more on

imports than it earned from exports. To make matters

worse, foreign institutional investors withdrew from

Indian equity markets between October and

December. This lead to a sharp demand for the dollar and

further weakened the rupee to an all-time low of 87.3

against the US dollar.

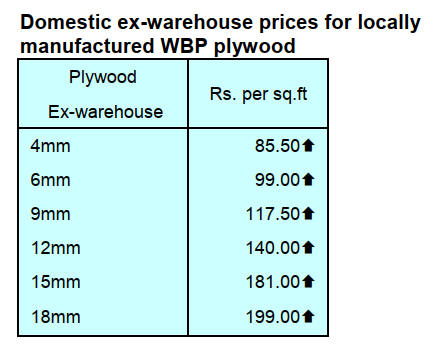

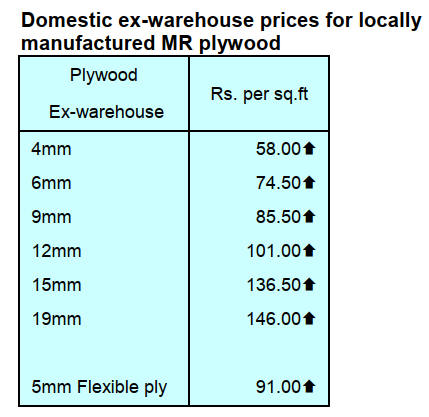

Plywood

The recently announced price increases have now been

introduced.

7.

VIETNAM

Wood product exports surged in March

It is estimated that Vietnam’s W&WP exports in March

2025 reached US$1.5 billion, an increase of 46%

compared to February 2025 and an increase of 15%

compared to March 2024. Of this WP exports contributed

US$1.01 billion, up 52% from February 2025 and up 13%

from March 2024.

For the first three months of 2025 total W&WP exports

recorded US$3.95 billion, up 12% over the same period in

2024. Of which WP exports accounted for US$2.67

billion, up 11% over the same period in 2024.

W&WP exports to the US in March 2025 fetched US$764

million, up 46% from February 2025 and up 9% from

March 2024.

For the first three months of 2025 total exports to the US

reached US$2.07 billion, up 9% over the same period in

2024.

Vietnam's exports of office furniture in March 2025

amounted to US$27.7 million, an increase of 32% from

February 2025 and an increase of 15% from March 2024.

For the first three months of 2025 exports of office

furniture earned US$78.5 million, up 22% over the same

period in 2024.

Vietnam's W&WP imports in March 2025 were valued at

US$260.0 million, up 25% from February 2025 and up

35% from March 2024.

Vietnam's imports of oak in March 2025 were 41,300

cu.m, worth US$24.4 million, an increase of 24% in

volume and 25% in value compared to February 2025 and

up 20% in volume and 19% in value compared to March

2024.

For the first three months of 2025 imports of W&WP

totalled 96,200 cu.m worth US$57.4 million, up 30% in

volume and 34% in value compared to the same period in

2024.

Vietnam enterprises seek immediate aas well as long-

term solutions

The new tariff policy that the United States announced for

products imported from Vietnam will have a significant

impact on Vietnamese enterprises, particularly those that

are heavily reliant on the US market, especially the timber

sector.

Timber industries are responsible for a substantial portion

of Vietnam's exports and the any change in import taxes

are viewed with concern. Anticipating potential risks,

Phung Quoc Man, Chairman of the Handicraft and Wood

Industry Association of Ho Chi Minh City (HAWA),

stated that HAWA conducted a survey of 50 exporters.

The aim was to gather information, ideas and proposals

from enterprises in order to identify the most effective

solutions to support them in the short and long term.

The United States is the primary market for 52% of the 50

enterprises in the survey and this market accounts for more

than 50% of their export revenue.

Businesses anticipate that the implementation of

countervailing duties by the United States could result in

an immediate decrease in order volumes and a reduction of

new orders from customers according to the survey.

The supply chain has been severely disrupted as a result of

numerous clients' requests for delayed

shipments. Simultaneously, price pressures are increasing

as consumers are requesting price reductions. Despite the

fact that input and labour costs have not decreased this

imposes additional responsibilities on suppliers to ensure

the stability of prices.

Businesses now have to deal with the issue of excessive

inventories as a result of their inability to export products

which has resulted in financial strain and a decrease in

profitability. Many companies have been forced to shut

factories or suspend production, resulting in job losses and

severely impacting workers’ incomes.

In terms of long-term challenges, timber industry

businesses caution that the negative impact will be even

more pronounced if this tax rate continues to be applied

for an extended period. One of the primary hazards that

Vietnamese enterprises may encounter is the loss of

market share and the resulting decline in competitiveness

in comparison with countries such as Thailand, Malaysia

or Mexico.

The competitive advantage of Vietnamese wood products

is declining as a result of the excessively high tariffs.

Consequently, customers are likely to relocate their

sourcing to countries with reduced tariffs, thereby

reducing Vietnam's primary export markets.

This not only reduces revenue but also makes it difficult to

sustain existing markets, forcing companies to seek out

new markets,a costly and time-consuming process.

Furthermore, businesses are being compelled to restructure

their production models in response to substantial cost

pressures. This not only results in instability but also

diminishes profit margins and even poses a bankruptcy

risk for numerous small and medium-sized enterprises.

Shifting markets to mitigate dependence on the US

In an effort to mitigate dependence on the US market,

numerous wood industry enterprises affiliated with

HAWA have proactively transitioned to alternative

markets including Japan, Australia, Europe and

Canada. In order to sustain production and stimulate

growth certain enterprises are also actively pursuing new

partners and customers to replace US buyers.

In addition to market diversification, businesses are also

striving to reduce production costs by enhancing labour

efficiency and sourcing more cost-effective raw materials

to reduce the overall price of products. At the same time,

many enterprises are placing greater emphasis on

enhancing design and product quality to create

differentiation and increase added value.

Nevertheless, not all enterprises have established specific

strategies. Some enterprises are still unprepared, as they

have been entirely dependent on the US market. They are

currently awaiting official updates from government

authorities or feedback from customers.

Enterprises are advocating for the Vietnamese government

to ramp-up negotiations with the US in order to mitigate

duties.

A gradual and reasonable tariff reduction roadmap, in

conjunction with the reduction of export and import tariffs

on American wood materials, would provide businesses

with additional time to adjust to the new business

environment.

"Enterprises also hope that the government will consider

and promote policies to help balance the trade relationship

between Vietnam and the US. Reducing export tariffs on

wood products and increasing financial support for

exporters are crucial measures to help them weather this

difficult period.

HAWA has requested assistance in the form of legal

consultation and information to address the current

situation," said Phung Quoc Man.

See: https://vietnamagriculture.nongnghiep.vn/wood-enterprises-

seek-market-shift-d747048.html

Vietnam’s wood exports surged in early 2025 but face

mounting headwinds

Continuing the growth seen in 2024, Vietnam's wood

exports reached US$3.95 billion in the first quarter of

2025 marking a 12% year-on-year increase. March exports

alone accounted for an estimated US$1.5 billion in wood

and wood product exports.

The United States is Vietnam’s largest export market for

wood and wood products, making up 53% of total exports.

Japan and China followed, accounting for 13% and 11%

respectively. Despite this robust performance, the wood

sector continues to grapple with considerable challenges.

A large proportion of Vietnam’s wood businesses are

small and medium-sized enterprises (SMEs), many of

them family-run operations. These firms are particularly

vulnerable to market fluctuations and often struggle with

the modernisation of production and processing

technologies.

Supply-side constraints also persist

Vietnam lacks a stable domestic supply of large-diameter

wood forcing companies to rely heavily on imports.

This dependency not only inflates production costs but

also diminishes the competitiveness of Vietnamese wood

products in global markets.

Additionally, while demand remains steady in core export

destinations, Vietnam’s wood exports remain overly

concentrated in a few key markets. Such market

dependence poses long-term risks, especially amid

ongoing global geopolitical uncertainty.

US tariffs threaten industry outlook

Ngo Si Hoai, Vice President and Secretary-General of the

Vietnam Timber and Forest Product Association

(Viforest), recently addressed the mounting challenges

enterprises face and urged businesses to prepare for

market headwinds.

In 2025, Vietnam’s agriculture sector aims to generate

US$18 billion in wood and wood product exports, up

US$2 billion from the previous year. The US is the main

target market for much of this growth however, the tariff

policy casts a shadow over these ambitious goals.

The stakes are especially high for the wood sector which

generates the largest trade surplus among Vietnam’s

agricultural exports to the US.

Over the past four years US imports of Vietnamese wood

products has consistently ranged from US$7–9 billion

annually, accounting for over 50% of Vietnam’s total

wood exports. In contrast, Vietnam imports only around

US$300 million in wood products from the US annually.

The sudden announcement of a 46% tariff, nearly double

the 25% that was anticipated shocked the industry.

Compounding the issue is an ongoing investigation under

Section 232 of the U.S. Trade Expansion Act of 1962

which assesses whether wood imports pose a threat to

national security. While this probe has yet to result in new

duties, the possibility remains.

In the short term, Hoai advises Vietnamese businesses to

ship goods before any final ruling or tariff enforcement,

aiming to minimise losses and to re-evaluate operations.

Broader market strategy needed

One of the key strategies being pursued by Vietnam’s

agriculture ministry is to prove the complementary not

competitive nature of US and Vietnamese agricultural

products including wood. This argument is central to

ongoing trade negotiations.

At a recent meeting with the US Ambassador, Vietnam’s

Minister of Agriculture and Environment, Do Duc Duy,

emphasised that the two countries' agricultural exports are

mutually supportive and should not be seen as adversarial.

He also affirmed Vietnam’s openness to importing more

US agricultural goods.

To that end, Viforest, in coordination with local trade

associations, exporters and relevant ministries is preparing

to participate in upcoming hearings. Their goal: to

demonstrate that Vietnam-US wood trade is mutually

beneficial and poses no threat to the US domestic industry.

Still, Hoai cautioned that diplomacy alone may not suffice

“We need to do more than just talk. The key now is for

Vietnamese agencies and enterprises to consider

increasing imports of US wood products such as

sawnwood, logs and veneer in order to rebalance trade and

underscore the benefits of cooperation.”

Another critical area is raw material sourcing. To build a

strong and competitive wood industry capable of meeting

international demand businesses must invest in

sustainable, legal timber supplies with forest management

certification. This is essential not only for increasing

export orders but also for meeting the country’s broader

sustainability goals.

See: https://antidumping.vn/vietnams-wood-exports-surge-in-

early-2025-but-face-mounting-headwinds-n28621.html

FDI firms play significant role in Vietnam's wood

industry

Foreign direct investment (FDI) businesses have played a

significant role in Vietnam's wood industry, one of the

country's biggest export earners. A 2024 report on FDI

activities in Vietnam's wood industry showed that last

year, the number of new FDI projects in the industry

increased by 73% in terms of investment capital year-on-

year according to a report released by Forest Trends, the

Vietnam Timber and Forest Products Association

(VIFOREST) and local timber associations.

Companies from mainland China led both in number of

new projects and share purchases. Out of 61 new projects

invested by 16 countries and territories, 25 were of

mainland China. Projects focused on wood processing,

including products such as beds, cabinets, tables, chairs

and sofas. Taiwan P.o.C followed with five new projects

worth US$129.62 million.

The report anticipated that in 2025 the Vietnamese wood

industry will continue to witness a shift in investment

across regions and countries globally with growing

importance of the FDI sector's role as manufacturers seek

to diversify risks and seize opportunities in new markets.

Industry experts noted that the substantial increase in FDI

activity highlights the growing prominence of Vietnam’s

wood industry, especially in view of the impact of U.S.

policies in the next four years. Experts from Forest Trends

stated that amid escalating trade wars due to new US

import tax policies and corresponding retaliatory measures

from trade partners the trend of increasing FDI in

Vietnam’s wood industry is inevitable.

See: https://theinvestor.vn/fdi-firms-play-significant-role-in-

vietnams-wood-industry-research-d14816.html

8. BRAZIL

Native forest restoration in Brazil

The new National Plan for Native Vegetation Restoration

(Planaveg) launched by the Ministry of Environment and

Climate Change (MMA) presents a strategy to restore 12

million hectares of native vegetation by 2030 in line with

Brazil's commitment under the Paris Agreement.

According to Planaveg 2025-2028, the proposal combines

four cross-cutting strategies, monitoring, support for the

production chain, financing and research, alongside

specific implementation arrangements aimed at restoring

native vegetation in permanent preservation areas, legal

reserves, restricted-use areas, public lands and low-

productivity rural properties.

A study published in Biological Conservation identified 76

million hectares of priority areas for restoration across the

six Brazilian biomes, based on biodiversity and ecological

connectivity criteria.

A study highlights that restoring just 30% of these priority

areas could increase available habitat for native species by

up to 10% and enhance habitat connectivity by 60%.

In the Atlantic Forest the loss of mature forests between

2010 and 2020 totaled more than 186,000 hectares with

73% of this loss occurring on large private properties. The

analysis, based on remote sensing and geospatial data,

revealed weaknesses in enforcement and significant

anthropogenic pressures on the biome including within

protected areas.

The findings emphasise the need for integrated public

policies, grounded in robust scientific data, to guide large-

scale ecological restoration efforts focused on ecosystem

resilience, biodiversity conservation and climate change

mitigation.

In related news, the National Bank for Economic and

Social Development (BNDES) and Petróleo Brasileiro

S.A. (Petrobras) have established an unprecedented

partnership through the ProFloresta+ program.

This focuses on ecological restoration of degraded areas in

the Amazon and the promotion of the carbon credit

market.

The initiative targets the restoration of up to 50,000

hectares of native forest and an estimated sequestration of

15 million tons of carbon, representing one of the largest

restoration-based carbon credit acquisition programs in the

country.

In its initial phase the programme will purchase up to 5

million carbon credits over an area of approximately

15,000 hectares, with investments exceeding R$450

million solely for restoration and generating around 4,500

jobs. The programme aims to make reforestation

economically viable by strengthening the ecological

restoration sector and establishing technical and legal

benchmarks for the market.

See: https://www.maisfloresta.com.br/pesquisa-aponta-areas-

prioritarias-para-restauracao-da-vegetacao-nativa-do-brasil/

See: https://www.maisfloresta.com.br/bndes-e-petrobras-firmam-

parceria-para-reflorestar-a-amazonia-e-fortalecer-o-mercado-de-

creditos-de-carbono/

Assessing impact of US tariff changes

The imposition of a minimum tariff of 10% on Brazilian

products by the United States government has raised

significant concerns in the forest sector of Paraná State. As

the US is the primary destination for Paraná's timber

product exports such as plywood, sawnwood and pine

framing the measure could undermine the competitiveness

of the local industry.

Last year, the Southern states (Paraná, Santa Catarina and

Rio Grande do Sul) exported a total of US$1.37 billion in

wood products to the US representing over 85% of Brazil's

total timber sector exports according to the American

Chamber of Commerce for Brazil (Amcham).

The Organization of Cooperatives of the State of Paraná

(Ocepar) also highlights that other sectors such as coffee,

iron and steel, may be affected. Nevertheless, the

Federation of Agriculture of the State of Paraná (FAEP)

sees potential opportunities for Brazil to gain access to

new markets amid the restructuring of global trade.

While FAEP is awaiting the official details of the US

decision it is already engaging with the federal

government coordinating action aimed at mitigating the

impact on the timber industry. The United States is the

main export destination for Paraná's wood and any tariff

barriers would represent a significant challenge to

maintaining employment in the sector.

See: https://apreflorestas.com.br/noticias/taxacao-dos-eua-

industria-florestal-do-parana-analisa-riscos-de-perda-de-

mercado-e-aumento-nos-custos-de-producao/

Value of profiled wood exports plunging

Profiled wood, Para state´s main export product saw a

64% drop in export value. The timber sector in the State is

facing a challenging scenario. Although the exported

volume grew by 18% in the first two months of 2025

compared to the same period in 2024 when 41,400 tonnes

were exported generating approximately US$21.1 million,

the total export value dropped by nearly 40%.

This decline primarily affected profiled wood, the state´s

main export product, which saw a 64% drop in export

value. Contributing factors include fluctuations in

international demand, growing pressures for

environmental certifications, and changes in trade policies

in foreign markets.

According to Aimex (Associação das Indústrias

Exportadoras de Madeiras do Estado do Pará) the sector's

main challenge lies in obtaining environmental export

licenses from the Brazilian Institute of Environment and

Renewable Natural Resources (IBAMA) for species such

as Ipê, Cumaru and Cedro.

The recent requirement for CITES and LPCO (Export

Licensing Document) authorisations has led to delays in

trade of legally produced timber. This has resulted in the

retention of hundreds of containers at ports and company

yards which has compromised logistics efficiency and is

resulting in financial losses. Aimex has called on IBAMA

to implement a more efficient system for processing

licenses.

Timber industry leaders have raised concerns on the

excessive bureaucracy and lack of institutional capacity in

IBAMA. The local timber sector remains attentive shifts in

the global market and reinforces its commitment to high-

quality and sustainable production practices. However, the

sector warns that without immediate action, the

competitiveness of Brazilian timber will continue to

decline in relation to international competitors.

See: https://www.oliberal.com/economia/setor-madeireiro-do-

para-tem-queda-de-40-nas-exportacoes-e-busca-estrategias-para-

se-fortalecer-1.931839

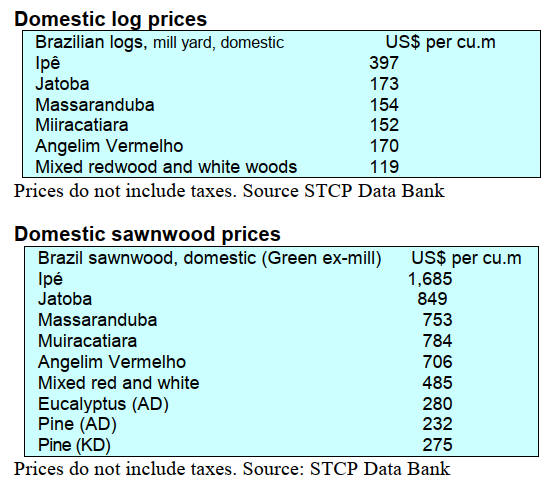

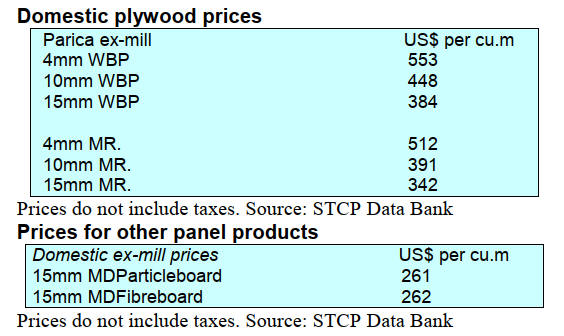

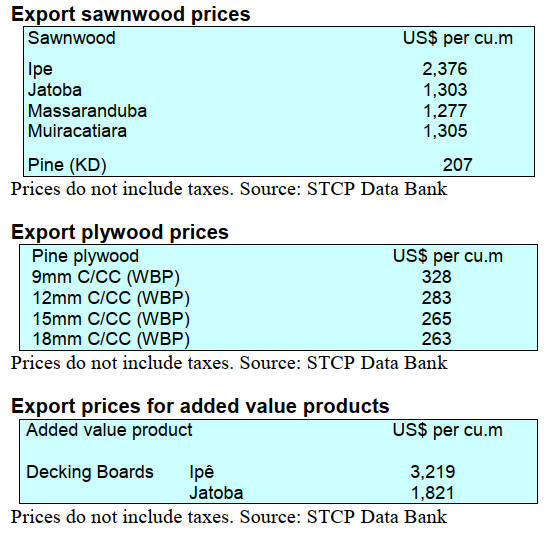

Export prices

Average FOB prices Belém/PA, Paranaguá/PR,

Navegantes/SC and Itajaí/SC Ports.

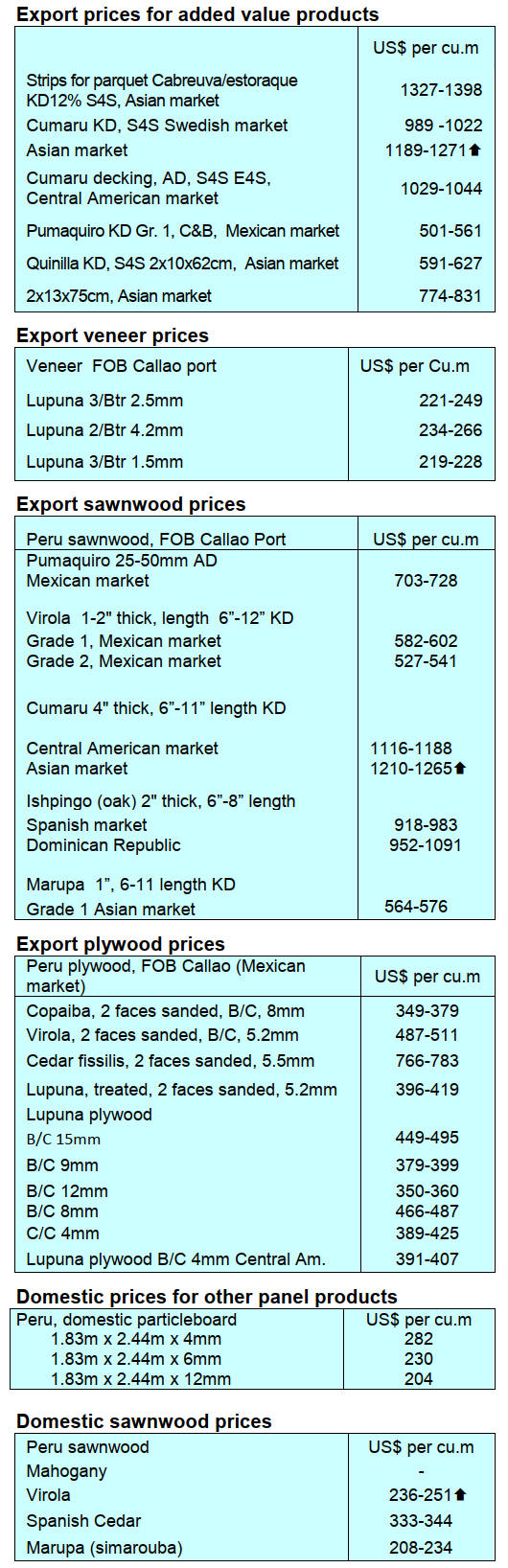

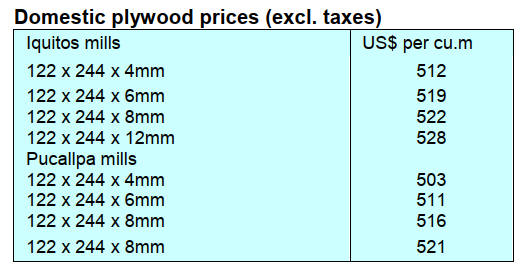

9. PERU

Exports of shihuahuaco

impacted by CITES

The inclusion of the Shihuahuaco and Tahuari timber

species in Appendix II of CITES announced in 2022 and

made official in November 2024 has had a significant

impact on the export of shihuahuaco one of the most

widely used timber species in the joinery sector, said Erik

Fischer Llanos, president of the Timber and Wood

Industries Committee of the Association of Exporters

(ADEX).

CITES Appendix II includes species that, while not

necessarily in danger of extinction, could become so if

their trade is not properly regulated. In the case of Peru,

Article 46 of the Forestry and Wildlife Law establishes

inspection of 100% of the more than 9,000 registered

shihuahuaco trees adding an additional layer of control to

their commercialisation.

“Based on technical evidence, this CITES decision was

made without solid evidence, with alterations in official

information and without conclusive evidence that the

species was in danger of extinction. This has caused

uncertainty and jeopardised the sustainability of formal

forestry activities”, warned Fischer Llanos.

Forestry sector stakeholders meet with government

authorities

The Ucayali Forest Producers Association participated in

the second session of the Executive Committee for the

Development of the Forestry Sector sponsored by the

Ministry of Economy and Finance.

The meeting was held to promote agreement that

strengthen the sector's competitiveness and define

strategies to ensure the legal origin and controlled

movement of timber in Peru, said its president, Luis López

Panduro.

This meeting was attended by SERFOR, the Ucayali

Regional Government, the San Martín Regional

Government, the Specialized Environmental Prosecutor's

Office (FEMA), OSINFOR, the Ministry of the

Environment, the Ministry of Production of Peru, the

ADEX Exporters Association, the National Society of

Industries and other national institutions.

"It is hoped that, based on the recommendations made by

the country's forest producers and the commitments made

at the meeting conditions will be created to boost timber

exports”, López Panduro concluded.

Ucayali producers committed to sustainability

In the Ucayali Region 45 forest concessionaires reaffirmed

their commitment to the sustainable management of the

Amazon forests. After successfully completing the five-

year audit conducted by the Forest and Wildlife Resources

Supervisory Agency (OSINFOR), these producers can

request an extension of their forest concessions for a

period of up to 20 years.

This achievement was possible thanks to the positive

reports provided by OSINFOR and the collaborative work

with the Ucayali Regional Forestry and Wildlife

Management Office.Initiatives such as this strengthen

forest governance in the Peruvian Amazon and reaffirm

the importance of working toward the sustainability of

natural resources.

See: https://www.gob.pe/institucion/osinfor/noticias/1141588-

productores-forestales-de-ucayali-renuevan-su-compromiso-con-

la-sostenibilidad

|