|

Report from

Europe

EU tropical wood imports at historic low in 2024

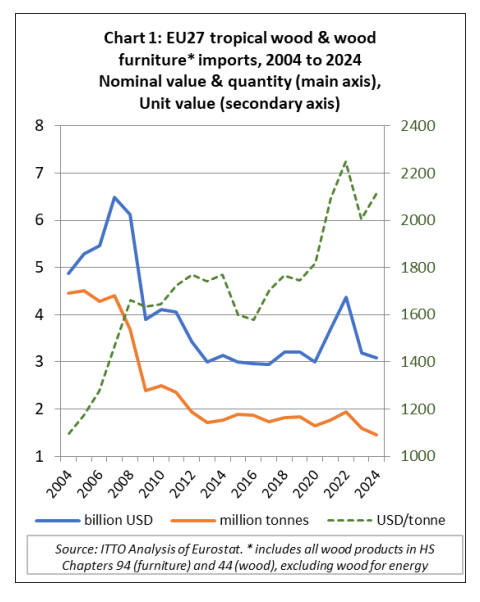

In 2024, the EU27 imported 1.46 million tonnes of tropical

wood and wood furniture products with a total value of

US$3.09 billion, respectively 8% and 3% less than the

previous year.

In quantity terms, this is the lowest level of imports of

these products ever recorded since the EU was first formed

(as the EEC) in 1957. It is also 19% below the average for

the pre-pandemic 2013-2019 period when imports were

static at a historically low level.

EU27 import value of tropical wood and wood furniture

products last year was only slightly above the annual

average of US$3.06 billion during the 2013-2019 period.

When account is taken of inflation, import value last year

was more than 15% below the pre-pandemic level (Chart

1).

Nominal unit prices (not adjusted for inflation) for tropical

wood and wood furniture imported into the EU increased

again in 2024 after falling the previous year from record

levels achieved during the pandemic.

The average price per tonne of all EU27 tropical wood and

wood furniture imports fell from a record high of

US$2250 per tonne in 2022 to US$2005 per tonne in 2023,

before rebounding to US$2116 per tonne last year. This

was partly owing to inflation and partly to a shift in the

tropical wood product groups imported into the EU last

year with relatively higher value finished furniture and

joinery products performing better than sawnwood,

mouldings and logs.

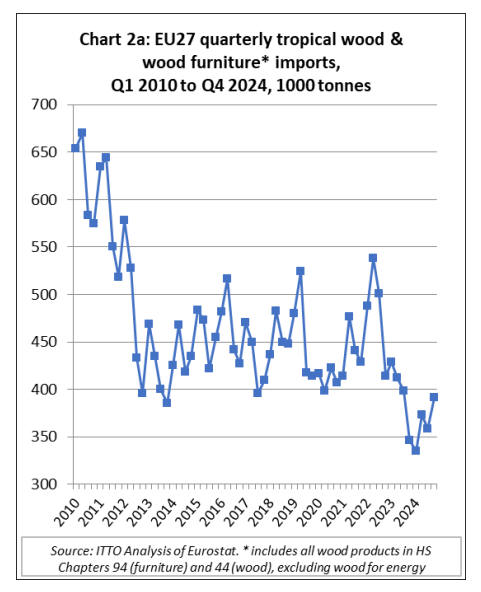

Quarterly data provides some slight grounds for optimism

that the market may have hit bottom at the end of last year.

Total EU27 imports of tropical wood and wood furniture

of 391,200 tonnes in the fourth quarter of 2024 were up

9% compared to the previous quarter and up 13%

compared to the same quarter in 2023. Nevertheless,

import tonnage during the last quarter of 2024 still fell

below quarterly trade figures typical during the pre-

pandemic 2013-2019 period (Chart 2a above).

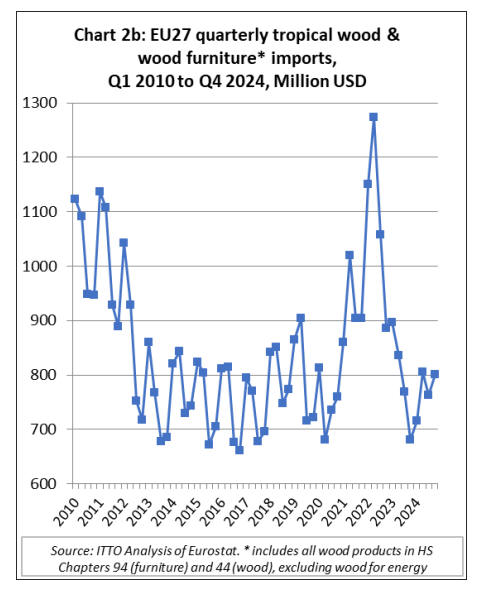

The trade figures look healthier when considered in value

terms. EU27 import value of tropical wood and wood

furniture in the fourth quarter of 2024 was US$800

million, 5% more than the previous quarter and 18% up on

the same quarter in 2023. In value terms, imports during

the last quarter of 2024 were more closely aligned with

those of the pre-pandemic 2013-2019 period (Chart 2b).

European economy stagnates, says the Economist

A recent article in the Economist under the heading

“Europe has no escape from stagnation”, suggests that

even optimistic growth forecasts for the region in 2025

“barely go beyond 1%” and asks the question “where is

growth supposed to come from?”. The short answer is not

particularly encouraging:

“Europe’s ageing population is not as innovative as it once

was, dampening productivity. The global economy will no

longer support Europe’s export-led approach. Investment

requires confidence in the future. Consumers are fearful,

with many choosing to keep money in the bank. The ECB

remains busy fighting inflation and governments are

avoiding difficult reforms for fear of a populist backlash.”

The Economist goes on to elaborate on a few of these

points and, in doing so, finds just a few crumbs of

comfort. It is noted, for instance, that as inflation subsides,

the European Central Bank (ECB) can return to

stimulating the economy with lower interest rates.

ECB policymakers have already cut their main rate from

4% in June last year to 2.75% and markets expect rates to

fall to 2% by the year’s end. But the Economist is

pessimistic that there will be scope to reduce interest rates

so drastically as inflation is still quite high, at 2.5% a year.

Similarly, the Economist points to a robust rise in

European pay packets, which should boost consumer

spending. However, such spending is still hampered by

low consumer confidence. The euro-zone household

savings rate, which before the covid-19 pandemic was

typically around 12%, is now above 15%. Consumer

sentiment has recently dropped again, to below its long-

term average. There are still a lot of nervous consumers

around.

At the same time, opportunities for European

manufacturers to boost growth by expanding sales

overseas are now tightly constrained by intense

competition from China which, according to the

Economist, is “hellbent on exporting its manufacturing

surplus to the world, rather than buying more from

Europe”. Meanwhile, the new US administration is intent

on reducing its trade deficit and threatening to impose

swingeing tariffs on its major trade partners. This in turn

could push more goods from China and elsewhere into

Europe, while restricting European exports to the US.

The EU is trying to counter these tendencies with renewed

efforts to formalise free trade agreements, notably with the

Mercosur group of countries, India, Malaysia, Indonesia

and the Philippines.

Another potential boost to European economic growth,

according to the Economist, could yet come from greater

government spending, although only in a few countries.

The greatest potential may be in Germany, where there is a

need for greater public investment and funds available

which the next government could make use of after the

forthcoming election. Elsewhere opportunities for public

investment are limited. Italy must cut spending to stabilise

its debt, while France must do so to bring down an outsize

deficit.

The Economist notes that European leaders now pin much

hope on supply-side reforms, to simplify regulation,

remove single-market barriers and knit together capital

markets.

Far-reaching proposals for such reforms were set out in a

report by Mario Draghi, a former president of the ECB,

published in September last year. But it remains to be seen

just how far and fast European leaders will be able to

implement these proposals.

No end to decline in Eurozone construction activity,

on-going now for 33 months

Weakness of the EU construction sector continues to be a

particularly significant drag on EU demand for all timber

products. Forward-looking indices suggest that EU

construction activity will continue to decline.

The HCOB Eurozone Construction PMI Total Activity

Index, a seasonally adjusted index tracking monthly

changes in total industry activity, posted 42.9 in December

and 45.4 in January, both well below the boundary line (at

50) separating growth from contraction. The latest

downturn extends the current sequence of falling activity

to 33 months.

The only good news is that the decline in January 2025

was the softest since February 2023.

According to HCOB, the negative trends reflected further

declines in Germany and France. Italian firms saw activity

rise for the second successive month, though the rate of

growth was only marginal.

Lower output was broad-based in nature across the three

monitored sectors covered by the report. Housing activity

saw the most pronounced decrease, though falls in

commercial and civil engineering activity were also

relatively sharp.

See: https://www.hcob-bank.com/en/insights/pmi/

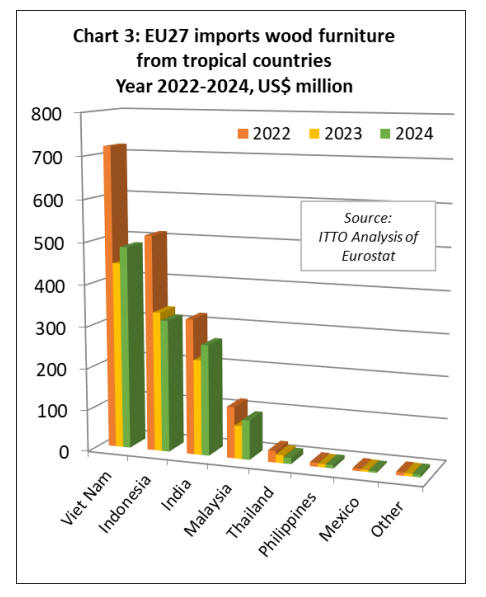

Recovery in EU27 tropical wood furniture imports in

2024

The EU27 imported 285,500 tonnes of wood furniture

from tropical countries with a total value of US$1193

million in 2024.

Import quantity and import value were up 7% and 6%

respectively during the year. In 2024, EU27 import value

of wood furniture increased from Vietnam (+9% to

US$484.9 million), India (+16% to US$264.5 million),

Malaysia (+19% to US$94 million), and the Philippines

(+3% to US$8.3 million).

However, import value fell from Indonesia (-6% to

US$315.5 million), Thailand (-25% to US$14.4 million),

and Mexico (-15% to US$3.9 million).

EU27 wood furniture imports from all other tropical

countries were negligible during the year (Chart 3, left).

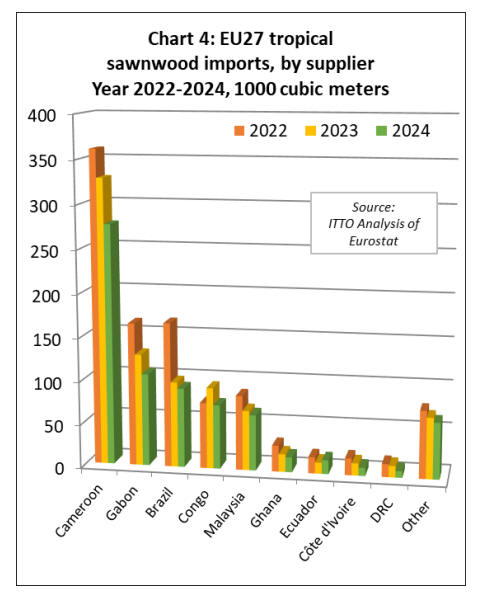

EU27 imports of tropical sawnwood decline 14% to

lowest level ever in 2024

The EU27 imported 726,900 cu.m of tropical sawnwood

in 2024, 14% less than the previous year and the lowest

level ever recorded. This is only the second time in history

that EU imports of tropical sawnwood have fallen below

800,000 cu.m (the only other was in the first year of the

pandemic in 2020 when imports were 784,000 cu.m).

Import value of this commodity was US$680.8 million in

2024, 13% less than the previous year.

Tropical sawnwood imports declined from nearly all

leading supply countries during the year including

Cameroon (-16% to 276,800 cu.m), Gabon (-18% to

106,300 cu.m), Brazil (-7% to 91,200 cu.m), Republic of

Congo (-21% to 73,800 cu.m), Malaysia (-7% to 64,100

cu.m), Ghana (-16% to 17,200 cu.m), Côte d’Ivoire (-34%

to 9,300 cu.m), the Democratic Republic of Congo (-42%

to 7,600 cu.m), Suriname (-20% to 7,200 cu.m), Indonesia

(-4% to 6,300 cu.m), and the Central African Republic (-

56% to 5,600 cu.m).

Sawnwood imports from Ecuador bucked the overall

downward trend during the year, at 16,000 cu.m, up 25%

compared to 2023. Imports from Vietnam also increased,

by 53% to 6,600 cu.m (Chart 4).

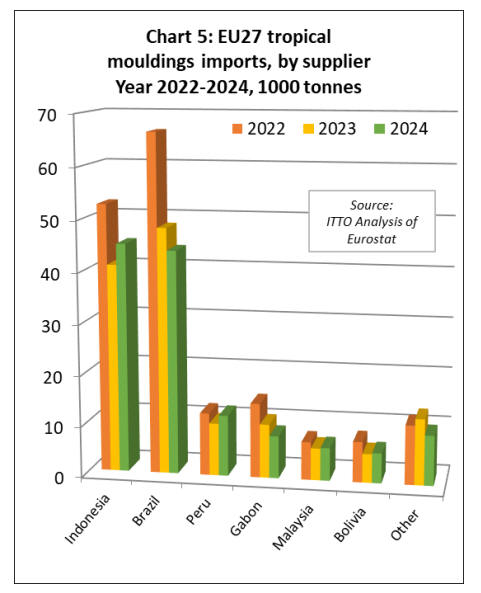

The EU27 imported 131,300 tonnes of tropical

mouldings/decking in 2024, 3% less than in the previous

year and another record low. Import value of this

commodity was down 10% to US$232.3 million during

the year.

The decline was driven by a fall in imports from Brazil (-

9% to 43,900 tonnes) and Gabon (-21% to 8,300 tonnes).

Imports increased during the year from Indonesia (+10%

to 45,000 tonnes), Peru (+16% to 11,900 tonnes),

Malaysia (+3% to 6,500 tonnes), and Bolivia (+4% to

5,900 tonnes) (Chart 5).

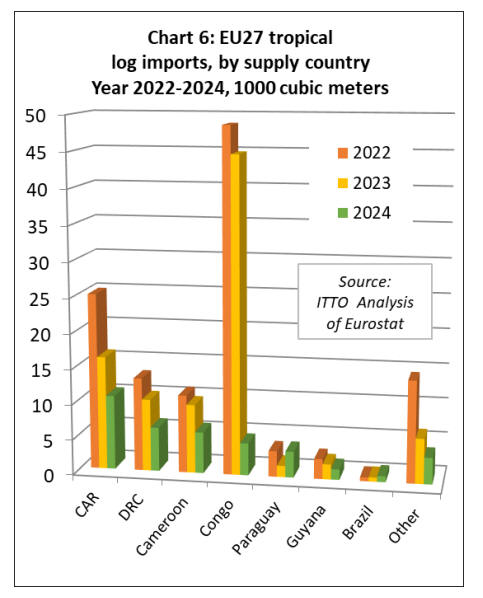

The EU27 imported 37,000 cu.m of tropical logs with a

total value of US$21.9 million in 2024, respectively 60%

and 62% less than in the previous year. The decline was

driven mainly by policy measures in Central Africa to

curtail log exports in the last two years.

In 2024, EU27 imports of logs were down from the

Central African Republic (-34% to 10,500 cu.m), the

Democratic Republic of Congo (-39% to 6,200 cu.m),

Cameroon (-40% to 5,800 cu.m), and the Republic of

Congo (-90% to 4,600 cu.m).

Imports also fell from Guyana (-30% to 1,500 cu.m), but

there was an increase from Paraguay (+132% to 3,700

cu.m) and Brazil (+43% to 900 cu.m) (Chart 6, left).

Patchy performance for tropical veneer, plywood and

joinery in the EU last year

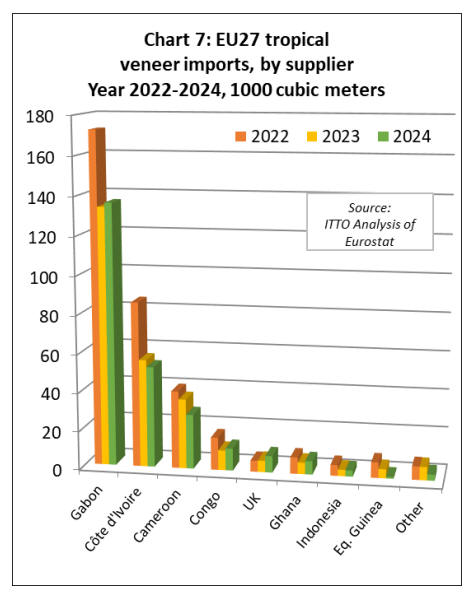

The EU27 imported 250,700 cu.m of tropical veneer with

a total value of US$171.2 million in 2024, both down 5%

compared to the previous year.

Imports of tropical veneer from Gabon, by far the largest

supplier of this commodity to the EU27, were 136,000

cu.m in 2024, 2% more than in the previous year.

Tropical veneer imports also increased last year from the

Republic of Congo (+12% to 11,500 cu.m), the UK (+45%

to 8,600 cu.m), and Ghana (+16% to 7,000 cu.m).

However, these gains were offset by falling imports from

Côte d'Ivoire (-6% to 52,300 cu.m), Cameroon (-22% to

28,200 cu.m), Indonesia (-5% to 3,200 cu.m), and

Equatorial Guinea (-81% to 900 cu.m) (Chart 7).

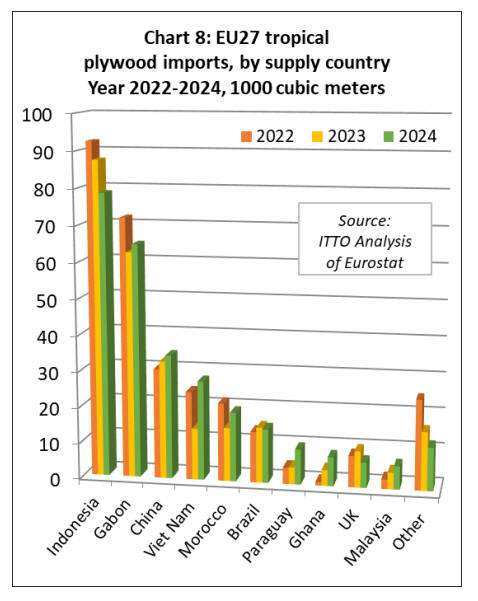

The EU27 imported 283,200 cu.m of tropical plywood

with a total value of US$205.7 million in 2024, both up

6% compared to 2023. Imports fell 10% to 78,600 cu.m

from Indonesia, which nevertheless remained the leading

supplier of tropical plywood to the EU last year.

Imports from Brazil were also down, by 3% to 15,000

cu.m, while indirect imports via the UK fell 31% to 7,000

cu.m. However, these losses were offset last year by rising

imports from Gabon (+4% to 64,800 cu.m), China (+5% to

34,500 cu.m), Vietnam (+93% to 27,600 cu.m), Morocco

(+29% to 19,300 cu.m), Paraguay (+110% to 9,800 cu.m),

Ghana (+84% to 8,100 cu.m), and Malaysia (+39% to

6,400 cu.m) (Chart 8).

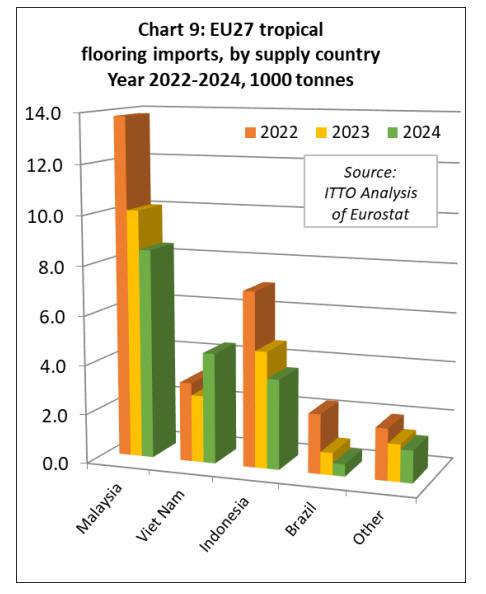

The EU27 imported 18,400 tonnes of tropical wood

flooring with a total value of US$48.4 million in 2024,

down 8% and 16% respectively compared to the previous

year.

Imports of 8,500 tonnes from Malaysia were 16% less

than in 2023. Flooring imports also fell from Indonesia (-

23% to 3,600 tonnes) and Brazil (-45% to 500 tonnes).

However, flooring imports increased sharply from

Vietnam in 2024 (+65% to 4,500 tonnes) (Chart 9).

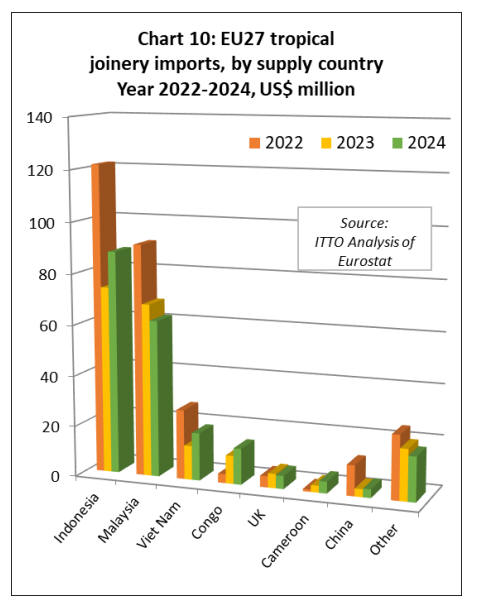

The value of EU27 imports of other joinery products from

tropical countries - which mainly comprise laminated

window scantlings, kitchen tops and wood doors – was

US$213.5 million in 2024, 8% more than the previous

year.

Import quantity was up 14% to 91,600 tonnes during the

year. Import value increased 19% to US$87.9 million from

Indonesia and was up 40% to US$18.8 million from

Vietnam.

Imports from China, which fell sharply in 2023, recovered

some lost ground in 2024, rising 8% to US$3.4 million.

Starting from a small base, EU import value of laminated

joinery products also continued to increase from Central

African countries last year, including from the Republic of

Congo (+28% to US$14.2 million) and Cameroon (+69%

to US$4.6 million).

However last year imports of joinery products fell 9% to

US$61.8 million from Malaysia. Indirect imports from the

UK also fell, by 7% to US$5.2 million. (Chart 10).

|