US Dollar Exchange Rates of

25th

Feb

2025

China Yuan 7.28

Report from China

Decline in 2024 sawnwood imports

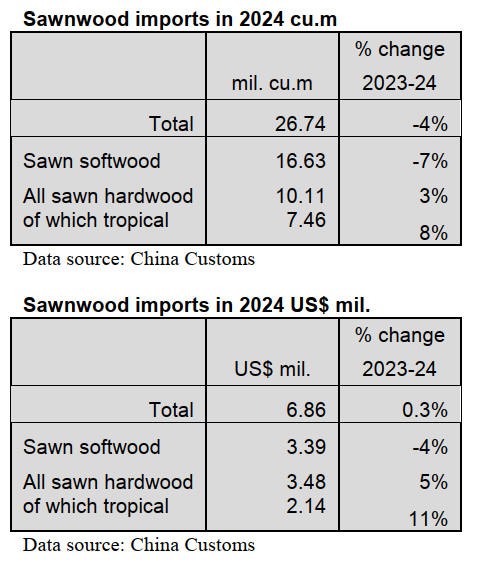

According to data from China’s Customs, 2024 sawnwood

imports totalled 26.74 million cubic metres valued at

US$6.86 billion, a year-on-year decrease of 4% in volume

but an increase 0.3% in value on 2023. The average price

for imported sawnwood in 2024 was US$257 per cubic

metre, a year on year increase of 4%.

Of total sawnwood imports, sawn softwood imports fell

7% to 16.63 million cubic metres, accounting for 62% of

the national total. The proportion of sawnwood imports

fell about 3 percentage points year on year. The average

price for imported sawn softwood was US$204 per cubic

metre in 2024, up 4% year on year.

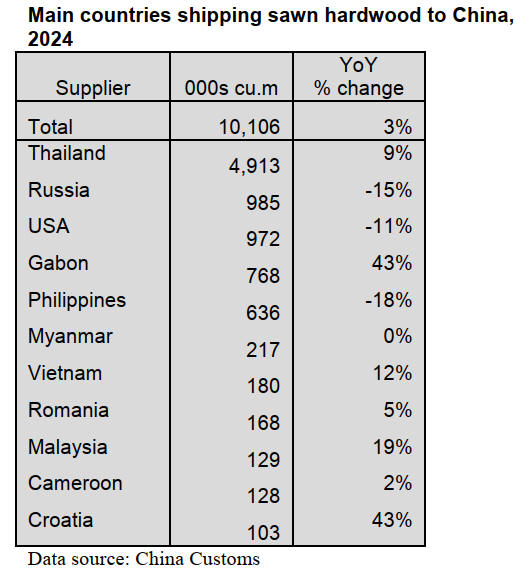

Sawn hardwood imports totalled 10.11 million cubic

metres valued at US$3.48 billion, a year on year increase

3% in volume and 5% in value on 2023. The average price

for imported sawn hardwoods was US$344 per cubic

metre, a year-on-year increase of 2% year on year.

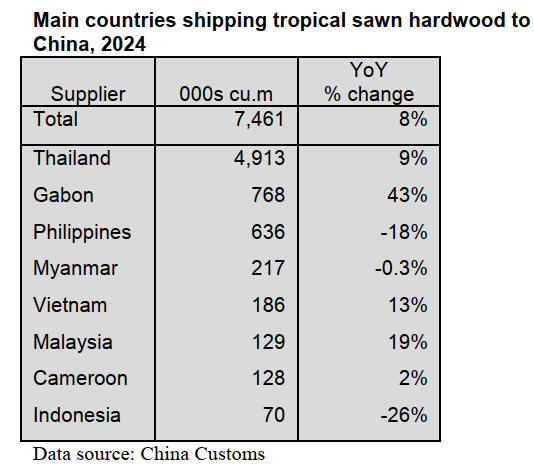

Of total sawn hardwood imports, tropical sawn hardwood

imports were 7.46 million cubic metres valued at US$2.14

billion, a year-on-year increase of 8% in volume and 11%

in value and accounted for about 28% of the national total,

up 3 percentage points on 2023 level. The average price

for imported tropical sawn hardwood was US$287 per

cubic metre, up 3% year on year.

Reasons for decline in China's sawnwood imports

The main reason was the reduction in domestic demand.

China’s Real Estate Production Index increased from

October 2024 but remained sluggish which slowed

construction and manufacturing industries leading to a

decline in demand for sawnwood.

China's sawnwood output from domestic resources

increased and the level of self-sufficiency improved such

that dependence on imported sawnwood declined. The

output of China's sawnwood has shown a steady growth in

recent years.

According to statistics from the National Bureau of

Statistics, China's sawnwood production was about 85

million cubic metres in 2018 and this increased to about

90 million cubic metres in 2019.

Although sawnwood output fluctuated in 2020 as a result

of the pandemic it remained at about 90 million cubic

metres. Sawnwood production further increased to about

100 million cubic metres in 2021 with economic recovery.

China's sawnwood production reached about 110 million

cubic metres, a record high in 2022. China's sawnwood

production in 2023 is also as high as 80 million cubic

metres.

In addition, China has promoted the use of alternative

materials and implemented the "bamboo instead of wood"

policy, reducing the demand for sawnwood.

Another reason for the decline was that the price for

imported sawnwood rose.

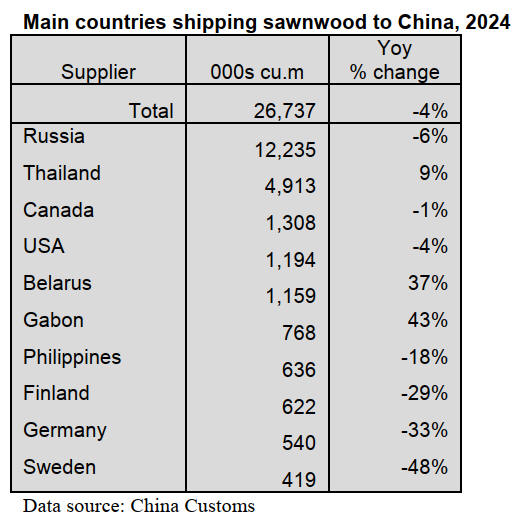

Decline in sawnwood imports from Russia

China Customs data shows Russia was the largest supplier

of sawnwood imports in 2024 but imports from Russia

dropped 6% to 12.23 million cubic metres and accounted

for 46% of the national total. The value of imports was

US$2.603 billion, down 2% on 2023. The average price

for imported sawnwood from Russia in 2024 was US$213

per cubic metre, a year on year decline of 7%.

The decline in China's imports of sawnwood from Russia

was because of weak domestic demand and because of a

diversification of supplying countries in order to reduce

dependence on a single country. China's sawnwood

imports from Belarus and Gabon increased significantly

by 37% and 43% respectively in 2024.

China’s sawnwood imports from Thailand rose to 4.913

million cubic metres valued at US$1.247 million, up 9% in

volume and 15% in value on 2023. The average price for

imported sawnwood from Thailand in 2024 was US$254

per cubic metre, a year on year increase of 2%.

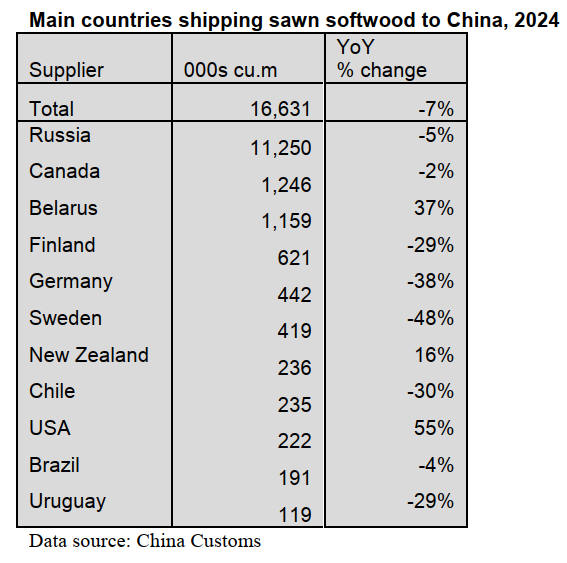

Growth in sawn softwood imports from Belarus

According to China Customs sawn softwood imports from

Belarus rose 37% to 1.159 million cubic metres in 2024.

Belarus sawn softwood had a price advantage in the

international market due to low production costs and

competitive pricing to attract Chinese buyers. The average

CIF price of sawn softwood imports from Belarus in 2024

was US$191 per cubic metre, while the average CIF price

of imported sawn softwood from Russia is US$207 per

cubic metre.

With the promotion of the Belt and Road Initiative the

logistics and transportation possibilities between China

and Belarus have improved reducing transportation cost

thus making the import of sawnwood from Belarus

economically viable.

China’s sawn softwood from New Zealand and USA also

grew 16% and 55% respectively. In contrast, China’s sawn

softwood imports from the other main suppliers dropped

in 2024.

Rise in sawn hardwood imports from Thailand

China’s sawn hardwood imports from Thailand, as the

largest supplier, continued to rise and grew 9% to 4.913

cubic metres in 2024, accounting for 49% of the national

total. China's sawn hardwood imports from Thailand are

mainly rubberwood and China's imports of sawn

rubberwood continue to grows.

Because of its good characteristics Thai rubberwood is

widely used in furniture, wooden doors, bathroom

cabinets, floors, kitchenware and custom homes in China.

Thailand's wood processing industry has improved in

terms of technology, product quality and supply stability

and China's demand for high-quality sawn rubberwood is

high.

Economic cooperation between China and ASEAN

countries has deepened, the integration of regional supply

chains has accelerated and Thailand, as a member of

ASEAN, has become a reliable supplier to China.

Russia and USA still are the second and third largest

suppliers of China’s sawn hardwood imports and

accounted for 9.7% and 9.6% respectively but fell 15%

and 11% respectively in 2024.

Rise in sawn tropical hardwood imports

China’s sawn tropical hardwood imports in 2024 were

7.46 million cubic metres valued at US$2.14 billion, a

year on year increase of 8% in volume and 11% in value

and accounted for about 28% of the national total, up 3

percentage points on 2023.

China's imports of sawn tropical hardwood from Gabon

have increased significantly, jumping from the third

largest supplier to the second largest supplier, replacing

the Philippines.

Gabon was the second supplier of China’s sawn tropical

hardwood imports in 2024 and sawn hardwood imports

from Gabon rose 43% to 768,000 cubic metres, but

decrease 11% to 636,000 from the Philippines on 2023.

The top three countries supplied 85% of China’s sawn

tropical hardwood requirements in 2024, namely Thailand

(66%), Gabon (10%) and the Philippines (9%).

The main reasons for the increase in China's tropical sawn

hardwood imports in 2024 were as follows.

With an improvement in China's economy the construction

industry and furniture manufacturing industry picked up

and the demand for sawnwood is increased, especially for

high-quality tropical sawn hardwood.

In response to anticipated demand and possible or price

fluctuations, Chinese companies have increased

inventories and reserves of tropical sawn hardwood.

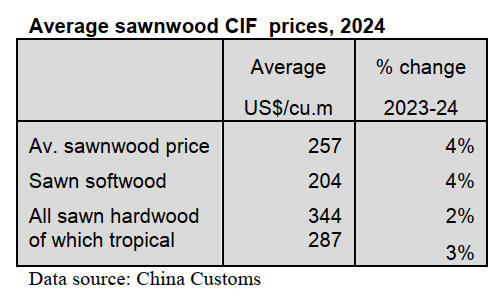

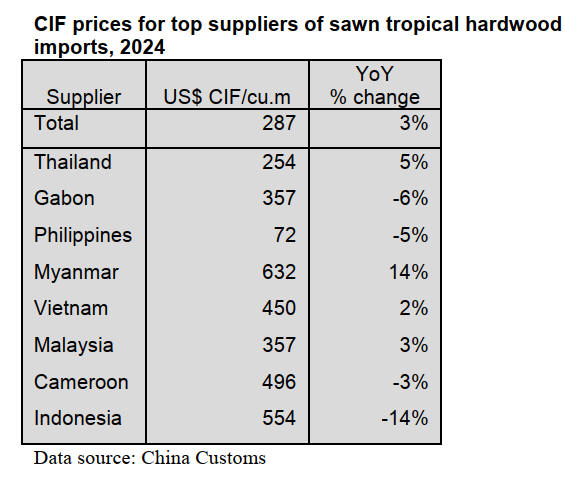

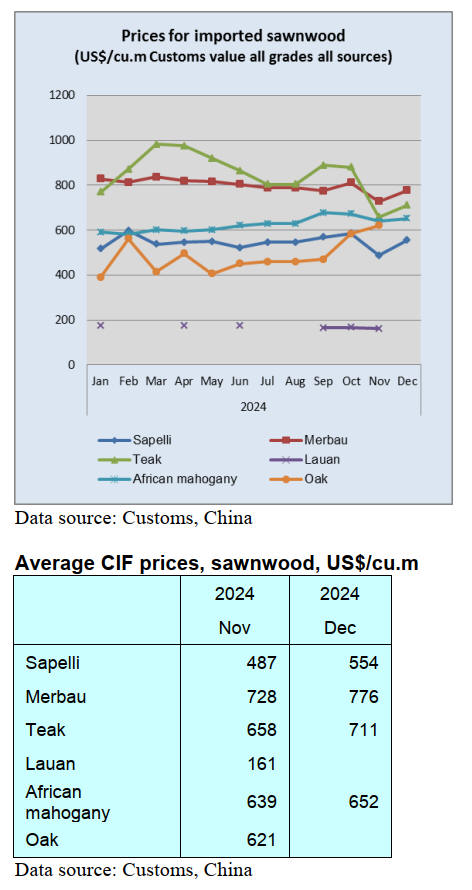

Rise in CIF prices for sawn tropical hardwoods

The average price for imported sawn tropical hardwood

was US$287 per cubic metre in 2024, up 3% year on year.

The CIF prices for the top suppliers of tropical sawn

hardwood imports, Thailand, rose 5% year on year, in

contrast, prices in Gabon and the Philippines declined 6%

and 5% respectively in 2024.

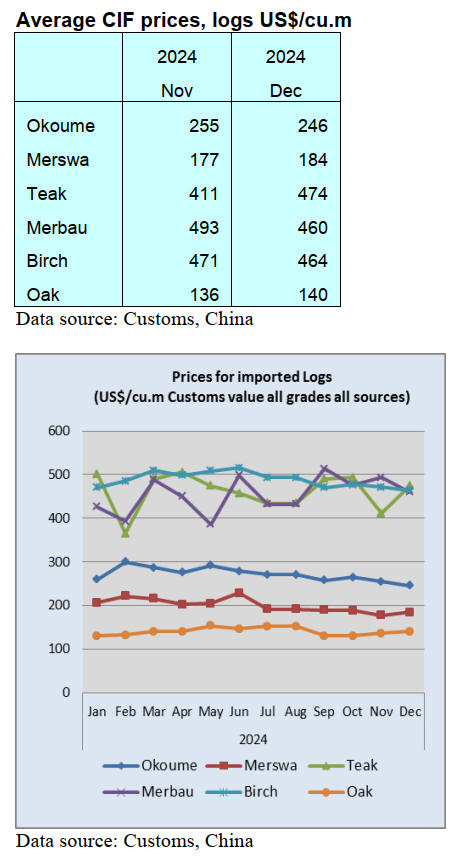

GGSC report for January 2025

In 2024, China’s wood and wood product imports

amounted to 74 million cubic metres, a year-on-year

decrease of 4.4%. The import value stood at US$13

billion, down 1.53% year-on-year. In terms of species

hardwood logs included oak, beech, okoumé and merbau

and the main hardwood sawnwood species were

rubberwood, beech and ash with Thailand being the largest

supplier of tropcal sawn hardwood.

In January the Ministry of Commerce and other agencies

jointly issued a notice on implementing the home

improvement and kitchen and bathroom renovation

initiative for 2025. Focusing on a green, smart and senior-

friendly direction the policy supports consumers in

purchasing materials and items for old house renovations,

partial kitchen and bathroom upgrades and home

modifications for the elderly. During the Chinese New

Year holiday, this policy boosted sales of building and

decoration materials as well as other home renovation-

related products by 15.5% year-on-year.

Recently, the National Forestry and Grassland

Administration, along with the National Development and

Reform Commission and four other agencies, issued the

medium and long-term Plan for Natural Forest

Conservation and Restoration. The Plan requires that by

2035 natural forest conservation and restoration will be

complete with the total area of natural forests maintained

at around 2.58 billion mu (approximately 172 million

hectares) and significant improvements in forest quality

observed.

In January 2025 the GTI-China index registered 39.5%, a

decline of 10.3 percentage points from the previous

month. It has been below the critical value (50%) for 3

consecutive months indicating that the business prosperity

of the timber enterprises represented by the GTI-China

index shrank from the previous month and the degree of

contraction was increased.

The primary reason for this decline was the impact on

business activity of the traditional Chinese New Year

festivities, during which Chinese timber enterprises

temporarily suspended production and operations.

As for the twelve sub-indices, three indices (purchase

price, delivery time and market expectation) were above

the critical value of 50% while the remaining nine indices

(production, new orders, export orders, existing orders,

inventory of finished products, purchase quantity, import,

inventory of main raw materials and employees) were all

below the critical value.

Compared to the previous month the indices for purchase

price and market expectation increased by 4.6-13.1

percentage points and the indices for production, new

orders, export orders, existing orders, inventory of finished

products, purchase quantity, import, inventory of main raw

materials, employees and delivery time declined.

See: https://www.itto-

ggsc.org/static/upload/file/20250221/1740123021422119.pdf

|