|

Report from

North America

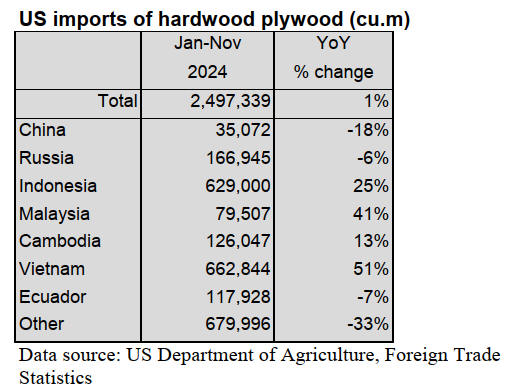

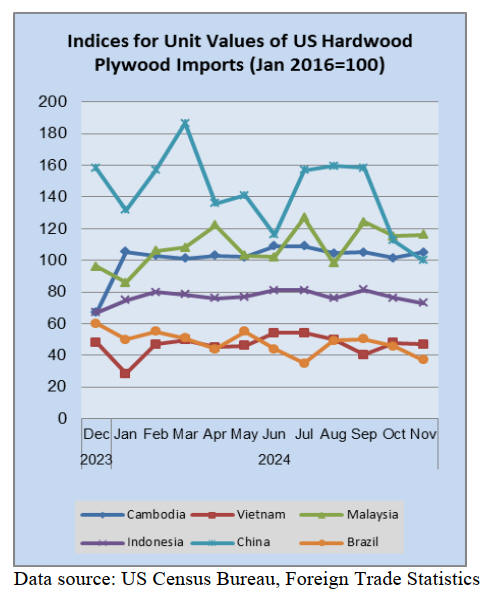

Hardwood plywood imports surge

US imports of hardwood plywood surged 21% in

November to their highest volume since January. The

255,173 cubic metres of plywood imported in November

was, however, 7% less than that of the previous November

Imports from several countries showed marked

improvement with imports from China up 51%, imports

from Malaysia up 40% and imports from Vietnam and

Indonesia both up 28%.

Indonesia and Vietnam are the top suppliers for the year

by far and imports from both countries grew sharply in

2024. Imports from Vietnam for the year to date are up

51% through November while imports from Indonesia are

up 25%. The total volume of US hardwood plywood

imports for 2024 is up 1% from last year as of November.

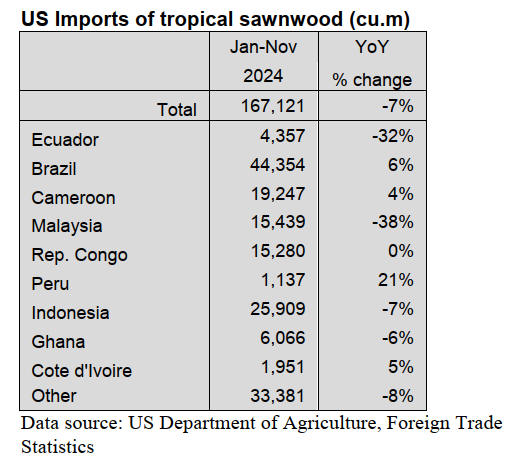

Sawn tropical hardwood imports rally

US imports of sawn tropical hardwood leapt 25% in

November, furthering a recovery from a weak autumn

market. The 17,038 cubic metres imported in November

accounted for the second-best volume month of the year

and was 42% higher than that of November 2023.

Imports from Brazil and Ghana both more than doubled

from the previous month while imports from Malaysia

rose 81%. Imports from Malaysia were their strongest this

year in November but have been lagging for most of 2023,

down 38% from last year for the year so far. Total US

imports of sawn tropical hardwood are down 7% versus

last year through November.

Canadian imports of sawn tropical hardwood fell 2% from

the previous month. Despite the slip, imports remain at a

high level and were 38% higher than those of November

2023.

A massive increase in imports from Congo (Brazzaville)

of 635% made up for significant drops in imports from

several countries including Brazil, Cameroon, Bolivia and

Malaysia. As of November, Canada’s total imports of

sawn tropical hardwood remain ahead of 2023 by 39%.

Veneer imports plunge

US imports of tropical hardwood veneer plunged 22% in

November to their lowest level since February. With the

drop, imports for November were 41% lower than in

November 2023.

Imports from Cote d’Ivoire fell 72% to a two-year low

while there were even steeper declines in imports from

Ghana (down 86%) and China (down 96%).

A 52% increase in imports from Cameroon helped

mitigate some of the loss. Total US imports of tropical

hardwood veneer were down 18% versus last year through

to November.

Hardwood flooring imports jump

US imports of hardwood flooring climbed 24% in

November on strong gains in imports from Malaysia and

Brazil. Imports for the month were 14% higher than the

previous November.

Imports from Brazil climbed 54% to their highest level

since 2021 while imports from Malaysia more than

doubled from the previous month. For the year so far,

imports from Brazil are more than double what they were

in 2023. Total imports of hardwood flooring for are down

11% year to date versus last year.

US imports of assembled flooring panels dropped 5% in

November but remain well ahead of last year’s pace. At

US$30.7 million, imports for November were a healthy

24% higher than the previous November.

Imports from China, Vietnam and Thailand all fell by

about 20% in November, while imports from Canada (up

7%) and Indonesia (up 11%) showed gains. Total US

imports of assembled flooring panels were up 36% over

last year through to November.

Moulding imports continue to slide

US imports of hardwood moulding fell for a second

straight month in November after reaching a two-year high

in September. Imports dipped 5% from October to

November but still held on to a level 34% higher than a

year ago.

A 9% drop in imports from leading trade partner Canada

fueled the slip while imports from Brazil remained weak.

Imports from China and Malaysia showed impressive

gains. Total US imports of hardwood molding remained

up 28% versus 2023 through November.

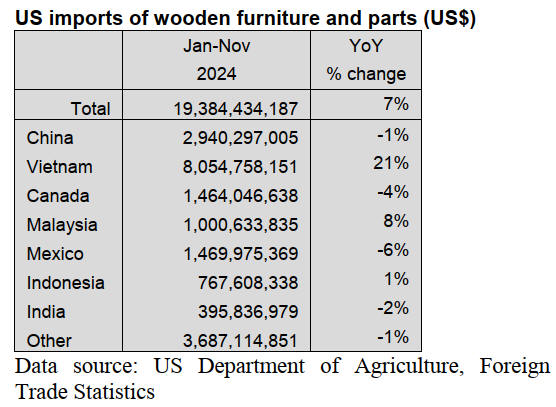

Wooden furniture imports falter

US imports of wooden furniture dropped 5% in November

after two months of solid gains. Despite the setback, at

US$1.8 billion, imports for the month were 6% higher

than the previous November total.

Apart from a small gain in imports from China, imports

fell from all major trading partners with imports dropping

12% from both Canada and Mexico and imports from

Indonesia falling 18%. Total imports of wooden furniture

for the year were ahead of 2023 by 7% through November.

October residential furniture orders flat, modest

optimism for 2025

New residential furniture orders were essentially flat in

October compared to 2023 figures, putting an end to five

straight months of year-on-year declines according to the

December issue of Furniture Insights.

However, new orders were down 2% compared to

September 2024 figures and were flat for the year-to-date

noted Mark Laferriere, assurance partner at Smith

Leonard, the accounting and consulting firm that produces

the monthly report. October shipments were down 5%

compared to 2023 figures, but up 4% from September

2024. Year to date through October 2024, shipments were

down 7% compared to 2023.

See: https://www.woodworkingnetwork.com/furniture/october-

residential-furniture-orders-flat-modest-optimism-2025

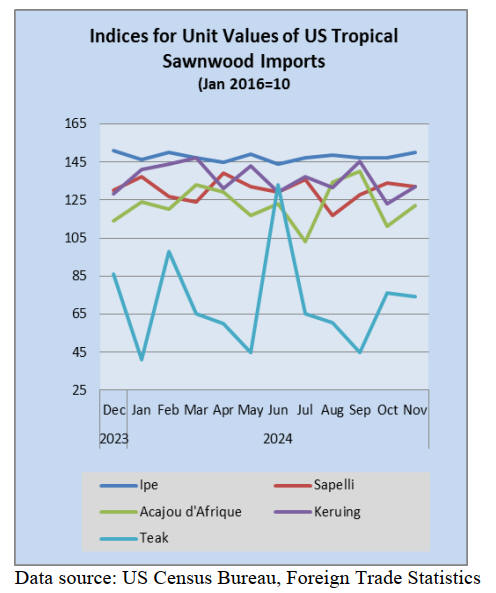

Note: the doubling of the unit value for teak may be a statistical

error. Use with caution.

|