|

1.

CENTRAL AND WEST AFRICA

Production disrupted by heavy rain

Industries in the region are experiencing significant

disruptions due to heavy rains, especially in Cameroon,

the Central African Republic (CAR) and northern Congo.

These adverse weather conditions have led to a serious

reduction in timber production with sawmill operations

being severely scaled back.

In Gabon and Congo, the rains have exacerbated the

deterioration of road infrastructure. In contrast, the

Republic of Congo has an advantage with most of its main

roads paved with tarmac from north to south facilitating

better movement of goods.

Transportation has become increasingly challenging,

especially on laterite roads that are still under repair. The

persistent rains are expected to continue for the next

couple of months further hindering production and

logistics in the region.

Coincidentally, the reduction in production comes when

demand in major markets is slow. There are reports of

large stocks of timber at Zhangjiagang Port as construction

activities in China have slowed down. Demand in niche

markets in China, such as for Azobe tabletops which were

once significant, are slowing down.

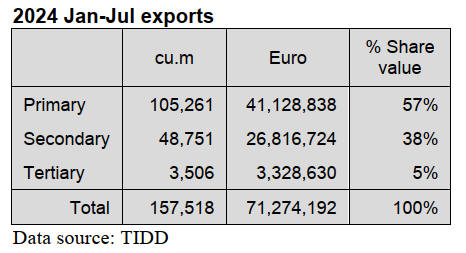

In Europe, demand for redwoods like Sapelli and Sipo

remains minimal. Sapelli prices are facing stiff

competition from lower-priced alternatives making it

difficult for exporters to maintain market share.

Exports to the Middle East continue but overall demand is

weak. Demand for Okoume in the Philippines appears to

have picked up.

Domestic markets in Cameroon, Gabon and the Republic

of Congo are currently purchasing Okoume of local

quality at around 160,000 FCFA per cubic metre

(approximately €243) ex-yard. However, high operational

costs are squeezing profit margins.

Gabaon NKOK Free Zone operators involved in the

peeling industry are purchasing peeler quality Okoume

logs at 65,000 FCFA delivered to the factory. Given the

high costs of felling, operations and transportation

producers are incurring losses.

Many Chinese mills are now focusing on processing local

species such as Okoume, Dabema, and Bilinga. The local

timber markets are predominantly controlled by traders

from Lebanon and West African countries like Mali.

There is currently little demand for redwoods like Sapelli,

Kossipo, Tiama and Sipo, except for specialised projects.

Exports of Sipo and Sapelli to Europe are minimal but

small shipments continue to the Middle East.

Government authorities in Cameroon and Gabon have

intensified checks on illegal logging activities.

Inspections have led to the identification of illegal

operations and some companies have been stopped from

operating pending payment of heavy fines.

This crackdown aims to regulate the industry and promote

sustainable practices. The Republic of Congo is noted as

being well organised in this regard with strict enforcement

and regulation of the timber industry.

Gabon

Harvesting and Production

Okoume timber maintains stable demand in the local

industry with preparations underway for the coming rainy

season affecting road conditions and prompting

stockpiling efforts.

Some factories in Nkok are operating at 50% capacity due

to a lack of customers and competition from Chinese

products made from logs sourced from Equatorial Guinea

and the Republic of Congo.

Operators in special economic zones, particularly the

Nkok zone in Gabon, are facing significant operational

challenges due to inconsistent electricity supply. Frequent

and unexpected power outages disrupt the functioning of

machinery, presses and kiln-drying chambers, leading to

production delays and financial losses.

Despite promises from the electricity provider, Société

d'Énergie et d'Eau du Gabon (SEEG), to resolve these

issues within a week, operators remain frustrated. The

unreliability of electricity supply hampers productivity and

affects the overall efficiency of timber processing

facilities.

Significant infrastructure projects

Studies are underway for a second railway track from the

Bélinga site to Mayumba Port near the Congo border,

involving the construction of a new deep-sea port. Chinese

funding is expected for these projects following

commitments made during the recent China-Africa

meeting in Beijing.

A South African/Australian company is studying a rail

track from Koulamoutou (southeast Gabon) to

Owendo/Libreville, though this remains in the planning

phase.

Cameroon

Challenging transportation

Heavy rains have been observed across Cameroon. The

main road to Sangmélima, a crucial route for timber

transport, is currently under repair by Chinese construction

teams. However, progress is being hampered by

continuous rains.

Railways are operating without major disruptions

providing an alternative means of transport where feasible.

In the northern regions of Cameroon severe flooding has

been reported, similar to neighboring Chad, resulting in

casualties and significant damage to housing and

infrastructure.

Sawmills have accumulated sufficient stock to maintain

operations until December when the dry season is

expected to return. Markets in the Middle East remain

stable, with consistent demand for timber products. The

Philippines also continues to show strong demand,

providing a valuable export destination for Cameroonian

timber.

Port activities in Douala and Kribi are functioning

normally. Douala handles both imports and exports of

general goods while Kribi focuses mainly on container

exports, including sawn timber from northern Congo.

Order levels are generally stable to low, varying by

species. Demand for redwoods and Ayous is decreasing.

Enquiry levels are stable with a lead time of one to two

months. Demand from China remains very low reflecting

broader market trends and economic conditions. The

Middle East market is said to be improving.

The government has implemented strict regulations to

ensure legal compliance in the timber industry.

Companies are now required to provide complete legal

documentation, including forestry and tax certificates for

each consignment.

Congo

Rains to continue until December

Harvesting activities in the Republic of Congo continue

but are affected by the rainy season. These disruptions are

expected to ease by December when the dry season

begins, typically lasting six months..

Trucking operations face some disturbances due to

ongoing road repairs. Port Access: Northern Congo

operations are exporting logs through the Port of Douala in

Cameroon although deliveries are falling. There are no

issues with container availability or stuffing operations,

facilitating smooth export processes.

Enquiries remain stable. The Philippines has resumed

purchases of Okoume sawn timber. There are functioning

niche markets in China but current prices are not meeting

suppliers' expectations.

Shift from Kevazingo to Ovangkol and Amazakoué

The Chinese timber industry appears to have shifted its

focus from Kevazingo to alternative species such as

Ovangkol and Amazakoué. This transition has led to

widespread harvesting of these species across the region

such that the market is oversupplied causing prices to

decline.

There are currently no suitable replacement species for

Azobé and Okan which are highly valued for specific

applications.

These hardwoods are specialised for large structural

components typically measuring 20 x 20 cm with lengths

of 5 to 8 metres. Sawmills favor these dimensions for

recovery sections due to their efficiency and yield.

Production of smaller, pointed squares in dimensions such

as 6 x 6 cm, 7 x 7 cm, and 4 x 4 cm is also limited.

Demand for these sizes is seasonal, declining during

autumn and winter as outdoor activities like gardening

decrease.

Some factories in Gabon and Cameroon have started

producing ‘damwand’ planks, planed timber sections

featuring tongue and groove profiles. This product

diversification caters to specific market niches and adds

value to the timber exported from the region.

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in the Republic of Congo and Gabon.

See: https://www.itto-

ggsc.org/static/upload/file/20240929/1727586546173092.pdf

2.

GHANA

Government to stop mining in forest reserves

The government has presented to Parliament an

instrument to revoke the Environmental Protection

(Mining in Forest Reserves) Regulations 2023 – LI 2462

which regulated mining in forest reserves..

This was one of organised labour demands when it

signaled its intention to strike over the negative impact of

‘galamsey’. The website of Asaaseradio in Accra has

published a copy of the government instrument.

In accordance with article 11(7) of the Ghana constitution

the Instrument comes into effect after 21 sitting days of

Parliament unless the votes of two-thirds of members of

parliament annul the instrument.

Following a meeting between organised labour and

government on 8 October the President, in a letter dated 9

October addressed to the leadership of organised labour,

outlined the various measures to address their concerns on

galamsey.

See: https://www.asaaseradio.com/government-revokes-mining-

in-forest-reserves-law-l-i-2462/

In related news, the Ghana National Association of Small-

Scale Miners (GNASSM) has announced a major

collaboration with the government to intensify efforts in

combating illegal mining and safeguarding the nation’s

vital natural resources.

This partnership aims to protect river bodies and forest

reserves and marks a new chapter in the fight against

environmental degradation caused by illegal mining.

During a press conference the GNASSM revealed that the

government has agreed to deploy specially trained

wardens and the navy to work alongside the association's

task force. These teams will patrol areas classified as "red

zones" which are particularly vulnerable to the destructive

effects of illegal mining to ensure that Ghana’s forests and

water bodies are protected.

See: https://www.graphic.com.gh/news/general-news/govt-

partners-with-small-scale-miners-to-protect-ghanas-rivers-and-

forest-reserves.html

and

https://3news.com/news/government-suspends-enforcement-of-l-

i-2462-on-mining-in-forest-reserves/

Livelihood support to forest fringe communities

The Ministry of Lands and Natural Resources, on behalf

of the Forestry Commission, has signed a Letter of Intent

with the Government of the United Arab Emirates (UAE)

for a grant of US$30 million. The grant will provide

additional and alternative livelihood support to forest

fringe communities as an incentive for them to engage in

enhanced forest protection, forest restoration and

reforestation.

This forms part of efforts by the Government of Ghana to

achieve the biodiversity and climate objectives under the

Resilient Ghana Package launched at COP28 in Dubai last

year.

The Minister for Lands and Natural Resources, Samuel

Abu Jinapor, who signed on behalf of Ghana, reiterated

the government’s commitment to developing strategies to

restore habitats, protect endangered species and promote

resilient ecosystems.

In 2022, at COP27 in Sharm El Sheikh, Egypt, the Ghana

President and the then UK Prime Minister, Rishi Sunak,

launched the Forest and Climate Leaders’ Partnership

(FCLP) as a new political forum that brings governments

and partners to work together to implement solutions that

reduce forest loss, increase restoration and support

sustainable development.

Subsequently at the COP28 in Dubai, Ghana launched her

Resilient Ghana Package for nature, climate and people

under the FCLP.

The Resilient Ghana package includes an integrated

system-wide suite of interventions to help halt and reverse

forest loss while delivering sustainable development and

promoting inclusive rural transformation.

See: https://fcghana.org/ghana-secures-30m-uae-grant-for-

forest-conservation/

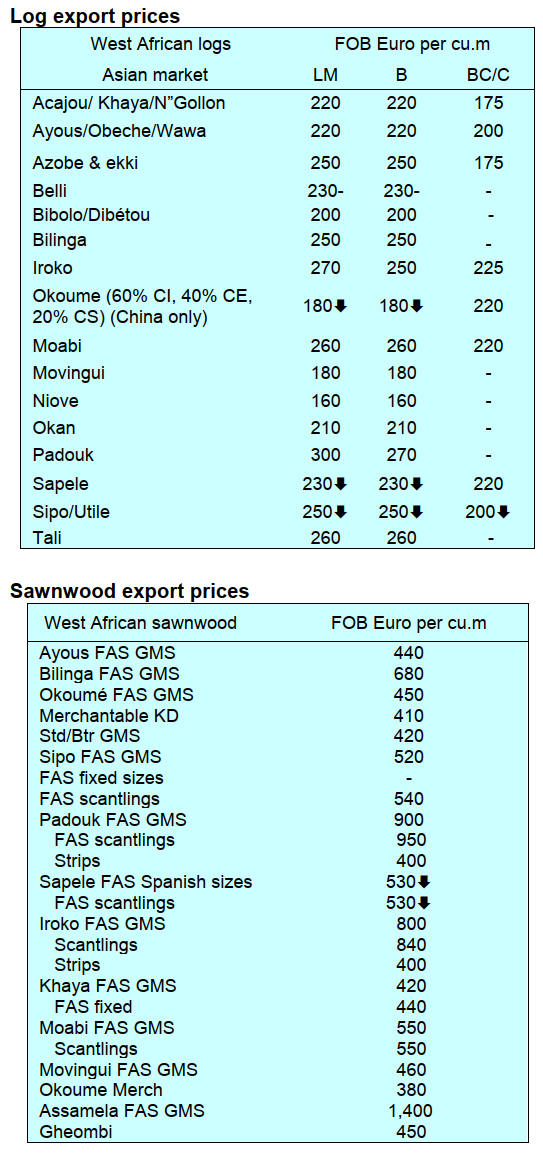

Primary products - largest share of exports

According to the Timber Industry Development Division

(TIDD) of the Forestry Commission (FC), revenue from

the export of primary products accounted for more than

57% (Eur41.13 million) of the total wood export trade for

the year to July (Eur71.27 million). This was followed by

secondary wood products (SWP) and tertiary wood

products with 38% and 5% respectively.

Compared to the same period in 2023; primary, secondary

and tertiary wood products export receipts accounted for

56%, 38% and 6% as shown in table below;

Primary products comprised billets, air-dried boules,

kindling, air-dried sawnwood, kiln-dried sawnwood for

the regional market, rollboard and teak logs. These

products earned Eur41.128,838 from a volume of 105,261

cu.m of the total export of wood products between January

and July 2024.

The figures indicated a decrease of 10% in volume and a

decrease of 9% in value respectively when compared to

the timber export figures for the same period in 2023.

Secondary wood products, which comprised kiln-dried

boules, briquettes, kiln-dried sawnwood, plywood, rotary

veneer and sliced veneer, generated Eur26,816,724 from a

volume of 48,751 cu.m for the same period. Compared to

the figures for the same period last year there was a

decrease of 14% in volume and a decrease of 15% in

value.

The report also showed that tertiary wood products,

mainly mouldings, contributed Eur3,328,630 from the

volume of 3,506 cu.m to the total wood products export

from January - July 2024. The current year’s figures

indicated a decrease of 34% in volume and a decrease of

28% in value against those for January - July 2023.

Utility tariffs rise

The Public Utilities Regulatory Commission (PURC) has

announced an upward adjustment to utility tariffs with

electricity prices to rise by 3.02% and water tariffs by

1.86%.

The changes come as part of the regulator’s routine

quarterly review designed to reflect shifts in key economic

indicators, including the US$/Cedi exchange rate, inflation

and natural gas costs.

See: https://www.graphic.com.gh/news/general-news/purc-

announces-3-02-hike-in-electricity-tariffs-1-06-in-water-tariffs-

effective-october-1.html

Rate cut for commercial banks

The Monetary Policy Committee (MPC) of the Bank of

Ghana (BoG) has cut the rate at which it lends to

commercial banks by 200 basis points to 27% from 29%.

Dr. Ernest Addison, Governor of the BoG and Chairman

of the committee, noted that the action was influenced by a

favorable economic outlook.

He further explained that since the first quarter of the year

headline inflation has declined for 5 consecutive months.

He added that core inflation has also declined.

The Association of Ghana Industries (AGI), which has

been engaging government on promoting a conducive

business environment for competitive production of goods

for both local and the international markets, has not yet

commented on these announcements.

See: https://www.myjoyonline.com/monetary-policy-committee-

cuts-lending-rate-significantly-to-27-percent/

Ghana’s intra-African exports

In 2023 Ghana ranked the fourth African country with the

biggest intra-African exports on the continent, with

exports valued at US$6.02 billion of the total intra-African

exports.

South Africa leads with total intra-African exports valued

at US$29.61bil. followed by Cote d’Ivoire and Egypt with

intra-African trade exports value of US$11.38bil. and

US$6.61bil. respectively.

See: https://media.afreximbank.com/afrexim/African-Trade-

Report_2024.pdf

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Ghana.

See: https://www.itto-

ggsc.org/static/upload/file/20240929/1727586546173092.pdf

3. MALAYSIA

EUDR compliant plywood

According to the Sabah Forestry Department the State has

exported a 45 cubic metre shipment of what has been

called ‘EUDR-compliant’ plywood to Poland. The raw

material was said to be responsibly sourced from Sapulut

Forest Development, a Sustainable Forest Management

License Agreement licensee under the Sabah State

Government’s jurisdiction and the oversight of the Sabah

Forestry Department.

Frederick Kugan, Chief Conservator of Forests for the

Sabah Forestry Department said “through compliance with

the EUDR we are not only enhancing the credibility of

Sabah’s timber products but also contributing to global

efforts in combating deforestation and climate change”.

“Our success in delivering the first EUDR-compliant

shipment to Europe amid ongoing debates over the

regulation is a reflection of our dedication to preserving

our natural resources and advancing Sabah’s forestry

sector”, he said.

To demonstrate its commitment to sustainability Sabah has

developed the Sabah Timber Legality Assurance System

(Sabah TLAS), a mandatory third-party audited system

that ensures legality and transparency across the entire

timber supply chain.

See:

http://theborneopost.pressreader.com/article/281513641586292

Borneo Forestry Cooperative

The Borneo Forestry Cooperative (BFC) was founded in

2009 by Sabah Softwoods and Asian Forestry Company

(Sabah) in collaboration with Boden and Associates Ltd.

The BFC serves as a collaborative platform bringing

together industry leaders to drive innovation in plantation

management.

From an informal cooperative the BFC has evolved into a

Malaysian registered company, BFC Research and

Development Sdn Bhd. During a Management Open Day

the work at Sapulut Forest Development (SFD) was

highlighted.

SFD has planted over two million fast-growing trees,

including Laran and Red Mahogany species. At the open

day managers from SFD said the Malaysia’s timber

industry needs innovative approaches to reduce reliance on

natural forests.

See: https://www.dailyexpress.com.my/news/242786/two-

million-fast-growing-trees-planted-in-sapulut/

World Bank raises growth forecast

The World Bank has upgraded Malaysia's economic

growth forecast to 4.9% in 2024 from its initial 4.3%

forecast set in April according to Apurva Sanghi, its lead

economist for Malaysia.

He said both domestic and external factors back the

upgraded growth forecast as the global economy is doing

much better than expected six months ago.

On the domestic front, he said the positive economic

momentum, political stability and an increasingly

conducive policy environment that boosts and mobilises

more investments have contributed to the upgraded growth

projection.

See: https://www.thestar.com.my/business/business-

news/2024/10/08/world-bank-upgrades-malaysia039s-growth-

forecast-to-49-in-2024

Kenaf - appealing to smallholders

The kenaf industry needs more government support to

accelerate its growth and attract more smallholders to

engage in its cultivation which could significantly

contribute to the national economy, according to Deputy

Plantation and Commodities Minister Chan Foong Hin.

He noted that although kenaf is relatively new compared

to other commodities, its unique qualities such as the short

three-month cultivation cycle make it appealing to

smallholders.

Chan emphasised that government assistance is crucial as

the Ministry aims to establish an ecosystem where every

industry would have its own upstream, midstream and

downstream sectors.

In 2023, the market value of kenaf products reached

RM8.88 million, an increase of almost 60% compared to

2022. As of the second quarter of 2024 the market value of

kenaf products has reached RM6.28 million, marking a

74% year on year increase.

See:

http://theborneopost.pressreader.com/article/282256670889138

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Malaysia.

See: https://www.itto-

ggsc.org/static/upload/file/20240929/1727586546173092.pdf

4.

INDONESIA

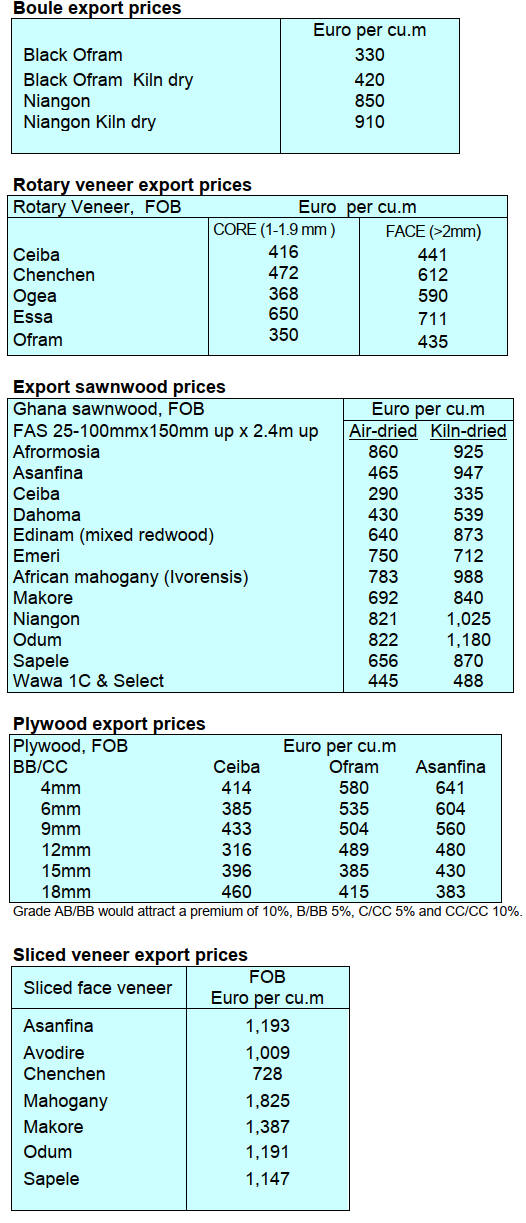

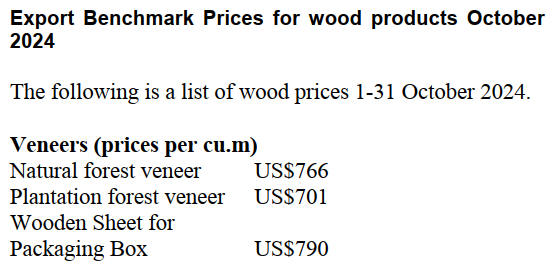

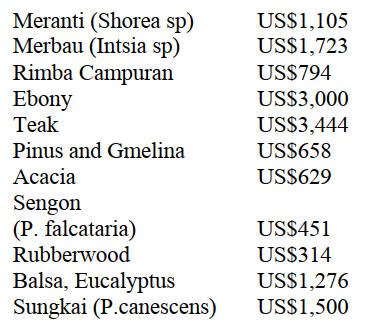

Processed wood (prices per cu.m)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1,000 sq.mm to

4,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth of

Merbau wood with the provisions of a cross-sectional area

of 4,000 sq.mm to 10,000 sq.mm (ex 4407.11.00 to ex

4407.99.90); US$1,500/cu.m

See :https://jdih.kemendag.go.id/peraturan/keputusan-menteri-

perdagangan-nomor-1329-tahun-2024-tentang-harga-patokan-

ekspor-dan-harga-referensi-atas-prdouk-pertanian-dan-

kehutanan-yang-dikenakan-bea-keluar

Boosting exports of sustainable forest products

The Ministry of Environment and Forestry is continuing

its efforts to increase the export value of responsibly and

sustainably produced forest products.

Ristianto Pribadi, Director of Forest Product Processing

and Marketing Development in the ministry stated that

efforts to boost export value will be accompanied by

measures to enhance product value in the domestic market,

thereby promoting the downstream processing of forest

products.

"The success of sustainable forest management depends

on all parties involved in the wood product supply chains

until they reach consumers. To this end, it is crucial to

improve traceability, efficiency and the preservation of

raw material sources," he said.

He explained that modernising equipment in the forest and

wood product processing industry can increase the value

of the raw materials used and reduce production waste.

He urged the forestry sector to innovate in addressing

global challenges, particularly those related to greenhouse

gas emissions.

In related news, the Director of Forest Products

and

Plantation Industry in the Ministry of Industry

(Kemenperin), Setia Diarta, revealed that wood processing

mills in Indonesia use mostly imported machinery which

could create opportunities for local companies to

manufacture machinery possibly through joint ventures

with overseas manufacturers. She anticipates that through

collaboration between Indonesia and China there can be

technology transfer.

See: See: https://www.antaranews.com/berita/4357103/klhk-

pameran-manufaktur-furnitur-dukung-modernisasi-hasil-hutan

and

https://www.antaranews.com/berita/4357571/kemenperin-akui-

mesin-pengelolaan-kayu-masih-gunakan-mesin-impor

Forestry sector under performing

Sudarsono Soedomo, Professor of forestry at the Bogor

Agricultural Institute (IPB) pointed out that there has been

limited investment in the forestry sector which hinders

future prospects. According to him, out of the total

domestic Investment between 2020-2022, which amounted

to IDR3,256 trillion, the forestry sector only managed to

attract investments of IDR28 trillion. Out of the total

Foreign Direct Investment of IDR50,267 trillion in 2023

only IDR96 trillion was invested in the forestry sector.

"The small investment is inversely proportional to the vast

forestry area. Of the total land area in Indonesia, 2/3 is

forest area," said Sudarsono Soedomo in a statement. He

added; the natural forest industry is shrinking while the

development of plantation forests is progressing very

slowly. Forests account for 2/3 of the land but the forestry

sector contributes less than 1% to the GDP".

See: https://www.liputan6.com/bisnis/read/5714923/investasi-

sektor-kehutanan-melempem-dalam-2-tahun-pengamat-fakir-

investasi?page=3

and

https://kumparan.com/kumparanbisnis/guru-besar-ipb-soroti-

sektor-kehutanan-ri-masih-minim-investasi-23cj79tNSIZ/full

Responses to delay in EUDR implementation

The Indonesian government has called for the revision of

the European Union Deforestation Regulation (EUDR).

Airlangga Hartarto, the Coordinating Minister for

Economic Affairs, said that Indonesia has a number of

concerns regarding the regulation including the

requirement for Indonesia to provide detailed geo-location.

In addition, Indonesia has expressed its concern to the EU

on the so-called country rating approach.

In related news, Hartarto invited all ASEAN member

countries to unite in responding to global sustainability

policies which tend to be discriminatory. Airlangga

conveyed this at the 24th ASEAN Economic Community

Council – AECC Ministerial Meeting.

In the midst of increasing global attention to the

impact of

the implementation of the EU Deforestation Regulation

(EUDR), which has the potential to disrupt manufacturing

production and hamper trade in wood, plant and

plantation-based products, Indonesia continues to strive to

build networks and gather support.

See: See: https://en.antaranews.com/news/328251/indonesia-

pushes-for-revision-of-eu-deforestation-regulation

and

https://asiatoday.id/read/indonesia-galvanizes-asean-collective-

against-eudr-implementation

The Association of Indonesia Forest Concession Holders

(APHI) sees the postponement of the European Union

Deforestation Regulation (EUDR) until 2026 as an

opportunity to prepare its members for the Regulation.

APHI has urged the government to advocate for SVLK as

the primary instrument to address the EUDR and bolster

its position in the European Union market. "The

government must persist in advocating for SVLK as a

recognised tool for the European Unionmarkets in the

context of the EUDR," he added.

APHI has urged member companies to engage in

extensive consultations with the government to ensure

compliance with all EUDR requirements. This

consultation is crucial for the Indonesian forestry industry

to establish operational standards that align with the

regulations set to take effect in 2026.

See: https://industri.kontan.co.id/news/strategi-aphi-menghadapi-

penundaan-kebijakan-eudr

Abdul Sobur, Chairman of the Indonesian Furniture and

Craft Industry Association (HIMKI) also said the

postponement of the implementation of the EUDR

provides an opportunity for the furniture and craft industry

in Indonesia to prepare and that the Indonesian furniture

industry is making significant efforts to align its supply

chain with the traceability and sustainability standards

outlined in the EUDR.

"However, small and medium enterprises (SMEs) face the

biggest challenge as they still struggle to access

traceability technology and encounter high verification

costs," Abdul stated.

See: https://industri.kontan.co.id/news/menilik-kesiapan-industri-

mebel-dan-kerajinan-hadapi-kebijakan-eudr

EUDR stalling conclusion of IEU-CEPA

The Indonesia-European Union Comprehensive Economic

Partnership Agreement (IEU-CEPA) continues to face

significant hurdles with the EUDR emerging as a major

stumbling block according to Djatmiko Bris Witjaksono,

Director General of International Trade Negotiations at the

Ministry of Trade.

While progress has been made on issues such as tariff

reduction, trade facilitation, investment and transparency,

policy-related hurdles—especially those stemming from

the EUDR—have significantly delayed the negotiation

process. Despite 19 rounds of talks over nine years, the

previously set September 2024 target for IEU-CEPA

completion passed without agreement, Witjaksono said.

See: https://jakartaglobe.id/business/ongoing-eu-demands-lead-

to-ieucepa-delayed-again-says-trade-minister

In related news, Shinta Kamdani, the chairwoman of the

Indonesian Employers Association (Apindo) has said

Indonesia will likely lose billions in exports if it cannot

close the overdue deal with the European Union. She

added that the lack of the trade pact could affect the

attractiveness of Indonesian goods in the European market

and the US$1.6 billion export trade with the EU is at risk.

The trade loss would be equivalent to around 12% of

Indonesia’s total exports to the EU. In the long run, we

might even lose our trade surplus with the EU,” Shinta

told reporters in Jakarta on Friday.

See: https://jakartaglobe.id/business/indonesia-can-lose-16-

billion-without-eu-trade-pact

Social forestry raises income for 1.4 mlllion families

The government's social forestry programmes have

increased the income of families living near forests

according to Minister of Environment and Forestry Siti

Nurbaya. She stated that the social forestry programmes

cover 8 million hectares with around 1.4 million families

having access to them. These programmes have increased

family monthly incomes to around Rp2.3 million

(approximately US$152).

The Norwegian Ambassador to Indonesia, Rut Kruger

Giverin, expressed appreciation for the Indonesian

government's efforts to reduce the impact of deforestation

and environmental pollution through various initiatives,

including social forestry.

She emphasised the importance of developing the social

forestry programme in Indonesia,as it is considered to

have gained attention at the global level.

See:https://wartaekonomi.co.id/read545675/klhk-klaim-

perhutanan-sosial-tingkatkan-pendapatan-masyarakat-sekitar

5.

MYANMAR

Currency appreciation

In foreign currency markets the US dollar was trading at

4,500 kyats per dollar in October. In response to a growing

foreign exchange crisis the State Administration Council

(SAC) mandated that exporters exchange their foreign

exchange earnings at a rate of 2,100 kyats per US dollar.

The amount that had to be exchanged was first 35% later

adjusted 25% of total export earnings.

The Central Bank of Myanmar is actively managing the

dollar' exchange rate however, due to ongoing instability

in the country, analysts believe the strength of the kyat is

unlikely to improve in the long term as the export sector

has suffered leading to a decline in foreign earnings.

Last year the dollar was exchanged at between 3,300 and

3,400 kyats, stabilising around 3,500 at the end of the

year. However, at the beginning of 2024 the dollar began

to strengthen reaching 3,800 kyats. This upward trend

continued culminating in a price of 7,000 kyats by August.

See: https://burmese.dvb.no/post/672194

More pressure on Myanmar migrant workers

Myanmar has implemented new restrictions on migrant

workers, exacerbating an already difficult situation for

those seeking work overseas. Many workers attempted to

travel with a tourist visa but were denied departure at

Yangon International Airport. The Authorities are now

enforcing stringent checks on outbound travelers requiring

them to provide return tickets, hotel bookings and proof of

sufficient funds targeting those suspected of intending to

work abroad.

This crackdown comes as the government seeks to collect

taxes from migrant workers and stem the tide of

emigration amidst ongoing conflict, economic collapse

and a military conscription drive. Between January 2022

and July 2023 it has been estimated some 2 million people

have left Myanmar with many more likely crossing

borders illegally.

In related news, a Thai member of Parliament said

Thailand needs to reform its policies regarding the influx

of refugees from Myanmar. He advocates registering the

estimated 6 million Myanmar migrants in Thailand to

grant them legal status, access to education and the ability

to work. This recognition could help improve living

conditions for refugees.

See: https://www.frontiermyanmar.net/en/blocking-the-exits-

myanmar-junta-turns-the-screws-on-migrant-workers/

New policy approach by ASEAN countries

Prime Minister, Senior General Min Aung Hlaing,

expressed the country's desire to reset relations with all

ASEAN Member States as they prepare for the 18th

ASEAN Navy Chiefs’ Meeting. He met ASEAN Navy

Chiefs in Myanmar and reiterated Myanmar's commitment

to upholding the ASEAN spirit and maintaining

constructive ties with member nations.

In related news, Malaysia's Foreign Minister Datuk Seri

Mohamad Hasan has been reported as saying the crisis in

Myanmar has become a pressing issue for ASEAN with

millions displaced and ongoing human rights concerns and

stressed the need for implementation of the Five-Point

Consensus Plan.

Thailand’s foreign ministry spokesperson, Nikorndej

Balankura, announced plans for an "informal consultation"

among ASEAN members in December to seek solutions,

emphasising a desire for political resolution while

coordinating efforts within the ASEAN framework.

See - https://elevenmyanmar.com/news/senior-general-min-aung-

hlaing-emphasizes-commitment-to-strengthening-relations-with-

asean

and

https://www.msn.com/en-us/news/world/asean-holds-summit-in-

laos-as-thailand-floats-new-plan-for-myanmar-crisis/ar-

AA1rVPXZ?ocid=BingNewsVerp

6.

INDIA

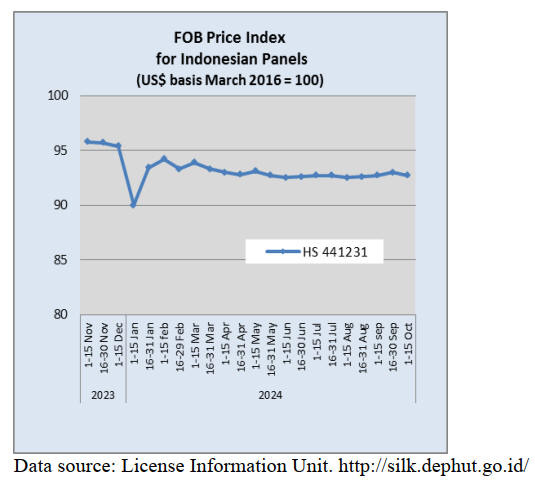

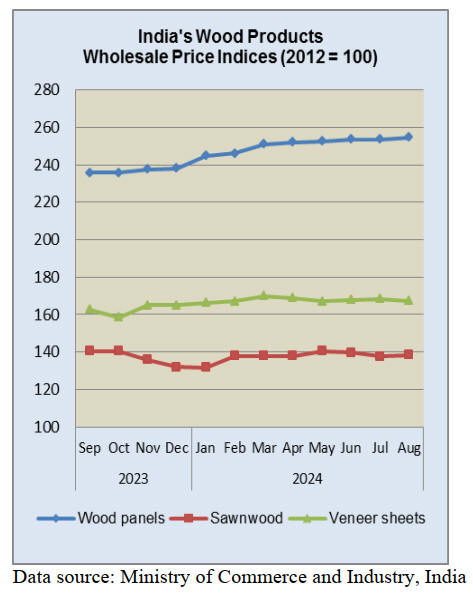

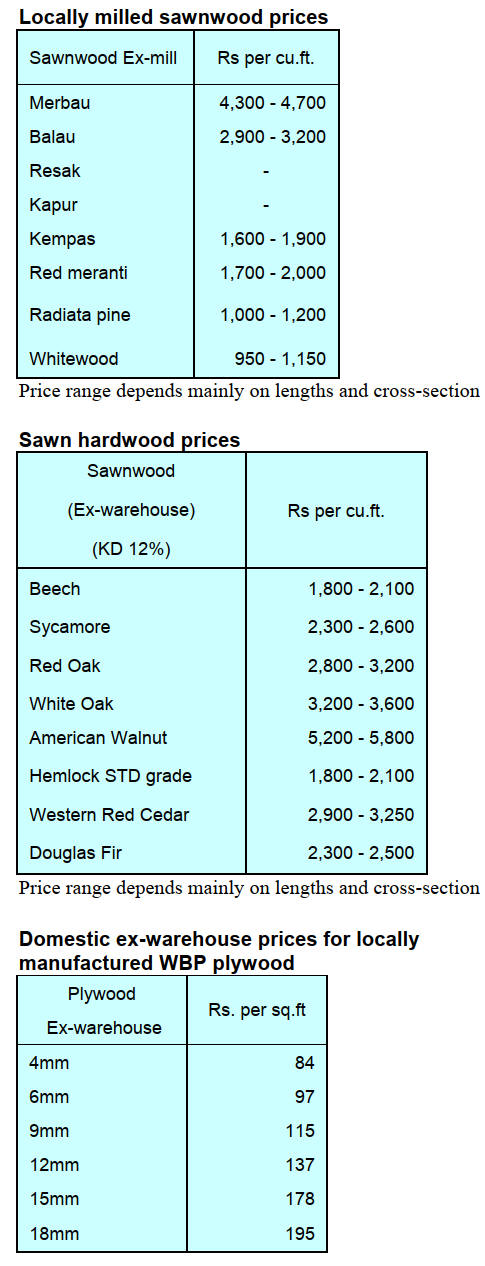

Wood panel price index

tilts higher

The annual rate of inflation based on the India Wholesale

Price Index (WPI) was 1.31% for August 2024. The rate

of inflation in August was primarily due to increase in

prices of food articles, processed food products, other

manufacturing, manufacture of textiles and manufacture of

machinery & equipment etc.

Out of the 22 NIC two-digit groups for manufactured

products, 12 groups saw an increase in prices, 7 a decrease

and 3 groups saw no change in prices. Groups for which

month on month price increases were reported were

manufacture of food products, fabricated metal products

except machinery and equipment, motor vehicles, trailers

& semi-trailers, machinery and equipment, paper and

paper products. The indices for wood panels and

sawnwood rose in August.

Some of the groups for which declines were reported were

manufacture of basic metals, other manufacturing, other

non-metallic mineral products, chemicals and chemical

products and textiles. In August the price index for

veneers declined.

See: https://eaindustry.nic.in/pdf_files/cmonthly.pdf

India needs 3 mil. ha. of forest plantations

Several recent reports point to a looming wood shortage in

many countries and India is one. At the recently concluded

Matecia Exhibition the supply of raw material for the

woodbased panel sector was discussed. It was suggested

that for the Indian wood panel industry to be raw material

self-sufficient over 3 million ha. of plantations would be

needed.

The September issue of Ply Reporter provides a

commentary on the issue and highlights presenations by

panel manufacturers and analystys including Rajesh Jha

Regional Manager ITC Limited, Ajay Thakur, Scientist E,

Forest Research Institute (FRI) and J.K. Jain Vice-

President Greenply Industries.

In related news, Century Plyboards has announced it plans

on expanding plywood production capacity by around

30% in the next 12-15 months. The Hindu Businessline

says the company currently has an annual production

capacity of 339,600 cubic metres adding Century

Plyboards has around an 8% of the ‘organised‘ market

segment.

The Hindu Businessline quotes an executive from the

company as saying “Two-three years ago, the bulk of the

raw materials used to come from domestic agro-forests but

demand has outstripped supply“.

See; https://www.thehindubusinessline.com/companies/century-

plyboards-to-expand-plywood-production-capacity-by-

30/article68630958.ece

and

https://www.facebook.com/plyreporter/posts/pfbid02bcaEzwNxE

p4TjKgRmNrHA8rafs6azXU8h3aiDWuweXr47m8fbMprsW9Fg

PMqgwbl?locale=en_GB

Launch of US$1 bil. affordable housing fund

Nikkei Asia has reported Indian investment company

HDFC Capital, a subsidiary of the country's largest private

bank and a World Bank Group unit will launch a US$1

billion fund in early 2025 to promote the building of

affordable housing for the middle classes.The World Bank

Group's International Finance Corporation (IFC) will offer

up to US$150 million to the fund which will focus on

investing in green loans and other instruments issued by

Indian developers of green residential housing.

See: https://asia.nikkei.com/Business/Finance/India-s-

HDFC-Capital-to-launch-1bn-affordable-housing-

fund?utm_campaign=GL_asia_daily&utm_medium=email

&utm_source=NA_newsletter&utm_content=article_link

&del_type=1&pub_date=20241003193000&seq_num=21

&si=fe0afe7c-532b-443e-bd57-30a8db100322

7.

VIETNAM

Wood and wood product (W&WP) trade

highlights

Statistics from Vietnam’s General Department of

Customs reveals that W&WP exports to the US in

September 2024 reached US$712 million, down 17%

compared to August 2024 but up 15% compared to

September 2023. In the first 9 months of 2024 Vietnam’s

W&WP exports to the US totalled US$6.5 billion, up 25%

over the same period in 2023.

In September 2024 bedroom furniture exports

fetched US$162 million, up 23% compared to September

2023. In the first 9 months of 2024 exports of bedroom

furniture contributed US$1.48 billion to export earnings,

up 28% over the same period in 2023.

Vietnam's W&WP imports in September 2024

amounted to US$265 million, down 2% compared to

August 2024 but up 40% compared to September 2023. In

the first 9 months of 2024 W&WP imports totalled

approximately US$2.06 billion, up 28% over the same

period in 2023.

Vietnam’s NTFP exports in September 2024

decreased for the 3rd consecutive month reaching US$60

million, down 10% compared to August 2024 but still up

13% over the same period in 2023. In the first 9 months of

2024 NTFP exports contributed US$605 million, up 12%

over the same period in 2023.

Wood and NTFP exports - double digit growth

According to Department of Forestry (Ministry of

Agriculture and Rural Development) with an average

export value of wood and non-timber forest products

reaching nearly US$1.4 billion/month exports of wood and

forestry products in the first 9 months of 2024 are

estimated at US$12.15 billion, up 17% over the same

period in 2023.

Out of which, wood products reached US$7.84 billion, up

21% over the same period in 2023, raw wood US$3.533

billion, up 13% over the same period in 2023 and non-

timber forest products US$777 million, up 4% over the

same period in 2023.

On other hand, imports of wood and wood products in the

first 9 months of the year are estimated at US$2 billion, up

25 over the same period in 2023. The trade surplus in the

first 9 months of 2024 is estimated at US$10.1 billion. It is

expected that export earnings from wood and forest

products in 2024 will meet set target.

In the first 9 months of 2024, except for S. Korea and

Japan, the other major consumer markets maintained quite

strong growth. For example the United States reached

US$5.9 billion, accounting for 54%, up 25% over the

same period in 2023 followed by China with US$1.3

billion and Europe with US$630 million each increasing

by over 20% compared to the same period in 2023.

Major challenges in international markets

According to Trieu Van Luc, Deputy Director of

Department of Forestry, currently some of Vietnam's main

wood product export markets (EU, US, Japan, South

Korea) still face economic difficulties; product protection

policies, strict implementation of regulations on illegal

wood exploitation, reduction of greenhouse gas emissions,

regulations on deforestation and forest degradation of

European Union (EUDR), anti-dumping and anti-subsidy

investigations of the US and South Korea.

The world situation continues to face geopolitical risks,

complex and unpredictable economic fluctuations,

increasing risk and uncertainty factors. In addition the

impact of high sea freight rates leading to an increase in

prices of imported raw wood (some imported wood

increased by 40% compared to 2023), is causing

production costs to rise while importers require a

reduction in prices.

The refund of value-added tax (VAT) for enterprises

producing wood chips and plywood products still faces

many difficulties because verification procedures for

forest owners takes a lot of time.

In addition, there are difficulties in damage caused by

storm No.3. This storm caused severe damage to property,

crops, livestock and socio-economic infrastructure, in

which forestry production sector also suffered great

damage. An area of nearly 170,000 hectares of planted

production forests was damaged which will significantly

reduce the source of raw materials for the wood processing

industry. Many wood and forestry production and export

establishments in northern mountainous provinces were

damaged and need to be repaired.

In order to achieve the export target for wood and forest

products in 2024 of US$15.2 billion, of which wood and

timber products are over US$14.2 billion an increase of

about 6% in exports is required compared to 2023.

Trieu Van Luc said that entire forestry sector is currently

focusing on overcoming consequences caused by storm

No.3 promptly supporting units and enterprises in forestry

production, wood processing and export of damaged forest

products to quickly stabilise production.

The Department will deploy solutions according to the

direction of the Prime Minister in Official Dispatch

No.470 dated May 26, 2023 on continuing to resolutely

and effectively implement tasks to remove difficulties for

production and business of enterprises and people.

See:

https://asemconnectvietnam.gov.vn/default.aspx?ZID1=8&ID8=

139310&ID1=2

Need to establish forest carbon standards

On the morning of 3 October the Department of Forestry,

in collaboration with the Association of Agricultural and

Rural Development Economics, organised a Workshop

“Forest Carbon - Potential to Create New Financial

Sources for Forest Protection and Development” with

sponsorship from Forest Trends and UK PACT.

The workshop attracted the participation of about 150

direct delegates and nearly 250 online connections

nationwide.

In his opening speech, Associate Professor Dr. Tran

Quang Bao, Director of the Department of Forestry, said

that forestry is currently the only sector with the potential

for negative net emissions thanks to the process of forest

protection and development and the support of

international partners. However, the forest carbon market

in Vietnam is still in its early stages, facing many

difficulties and challenges.

Recently, Vietnam received US$51.5 million from the

World Bank for successfully capturing 10.3 million tonnes

of CO2 in 6 provinces in the North Central region.

Currently the Ministry of Agriculture and Rural

Development is completing the dossier to submit to the

Prime Minister for consideration and negotiation and

signing the Emission Reduction Purchase Agreement for

11 provinces in the Central Highlands and South Central

region with the Forestry Finance Enhancement

Organisation (Emergent).

"The forest carbon market has the potential to generate

large revenues for forestry helping to support forest

protection, create jobs, increase income for local people

and at he same time protecting and improving

environmental quality said Bao, He admitted, however,

that financial resources for forestry activities are still

insufficient meeting only a small part of actual needs.

The Forestry Department also identified 7 essential tasks

to promote market development and commercialisation of

forest carbon credits:

(1) Review and update the nationally determined

contribution in the forestry sector;

(2) Study the potential and allocate quotas for emission

reduction and carbon sequestration from forests to

localities;

(3) Perfect the policy and institutional framework on the

transfer and financial management of revenue from forest

carbon credits;

(4) Develop Vietnam forest carbon standards,

methodology for calculating emission reduction results

and a system for measuring, reporting and appraising the

amount of emission reduction and increased carbon

sequestration of forests; guide the development and pilot

implementation of several potential projects;

(5) Disseminate and enhance capacity for stakeholders on

forest carbon;

(6) Continue to implement the Emission Reduction

Payment Agreement with the World Bank; advising on

negotiations, signing and implementing the Emission

Reduction Trading Agreement for the Central Highlands

and South Central regions with the Emergent

Organization;

(7) Strengthening cooperation, mobilizing international

resources and the private sector.

For localities the Director of the Forestry Department

proposed proactively mobilising and integrating legal

resources to reduce emissions and increase forestry

absorption in the province while calling for the active

participation of relevant parties to promote the sustainable

development of the forest carbon market.

"The cooperation and commitment of all relevant parties

will be the decisive factor for the success of the forestry

sector in the new context," Bao said.

See: https://vietnamagriculture.nongnghiep.vn/urgently-build-

forest-carbon-standards-in-vietnam-d402299.html

8. BRAIL

Promoting good practices in wood sample

collection

The First Meeting of Tree Identifiers, held in the

municipality of Alta Floresta in the state of Mato Grosso,

in the Amazon region brought together 40 professionals to

strengthen forest management and promote good practices

in botanical and wood sample collection.

The event was organised by the Center for the Wood

Producers and Exporters Industries of the State of Mato

Grosso (CIPEM) and the State Department of

Environment (SEMA), in partnership with local

universities.

SEMA stressed the importance of ensuring the

sustainability of biodiversity and accuracy of forest

inventories, guaranteeing security and efficiency in the

licensing process as well as preserving and conserving the

environment.

The Federal Rural University of the Amazon (UFRA)

emphasised the collective benefits for the timber sector

and society as it brings together research and educational

institutions for those involved in licensing process,

accreditation and inspection agencies such as SEMA and

entrepreneurs in the timber industry. The National Institute

of Amazonian Research (INPA) emphasised that the

correct identification of timber species is essential for

sustainable forest production.

The meeting was considered a milestone for forest

activities and botanical research in the region, promoting

interaction among experts and strengthening forest

management practices.

See: https://cipem.org.br/noticias/identificacao-de-arvores-

comerciais-da-amazonia-e-fortalecida-em-evento-inedito-em-

mato-grosso

Paraná wooden house programme

The government of the State of Paraná in southern Brazil

signed a protocol to develop a programme for building

sustainable wooden houses for families in vulnerable

situations in rural areas including low-income families,

indigenous communities and quilombola communities.

The initiative, developed in partnership with Águia

Florestal and the Paraná Association of Forest-Based

Companies (APRE), will use Cross Laminated Timber

(CLT) technology.

The project aims to promote social development combined

with sustainability by utilising state-managed planted

forests to reduce carbon emissions and foster the bio-

economy. The houses will be built with wood sourced

from reforestation areas managed by the Department of

Agriculture which were previously underutilised.

The State of Paraná has 33,000 hectares of planted forests

and accounts for 55% of Brazil's pine wood production,

leading the country's exports of plywood, wood-based

panels and wooden frames. The programme seeks, not

only to reduce the housing deficit in rural areas, but also to

highlight the importance of sustainable forestry practices

in combating climate change and promoting local

economic development.

See: https://apreflorestas.com.br/noticias/parana-lanca-programa-

para-construir-casas-sustentaveis-com-madeira-e-atender-

pessoas-em-vulnerabilidade/

Debate on timber export routes and logistics solutions

in Mato Grosso

The State of Mato Grosso is the second largest producer of

products from native timber species in Brazil with more

than half of its municipalities engaging in forest-related

activities for their socio-economic development.

In 2023, 75 of the 142 municipalities in the State produced

2.1 million cubic metres of roundwood, valued at R$498.1

million according to the Brazilian Institute of Geography

and Statistics (IBGE).

Additionally, exports of local forest products generated

US$47.1 million between January and August according

to the Ministry of Development, Industry, Commerce and

Services (MDIC).

A recent forest sector unions (Associations) meeting

discussed options to improve international timber trade

including the analysis of new port routes based on a

technical and economic feasibility study. Timber

industries in the state of Mato Grosso face export

challenges due to delays in containers clearance caused by

the lack of IBAMA (Brazilian Institute of Environment

and Renewable Natural Resources) technicians at

maritime ports.

CPEM asserts these port inefficiency continues to affect

timber exporting industries even after the end of the

national strike by IBAMA employees which lasted 40

days this year, resulting in losses for exporters due to the

backlog of halted shipments.

CIPEM also criticised the charging of port fees during the

strike period. FIEMT (Federation of Industries of Mato

Grosso) representatives said it is essential to diversify

transportation logistics to improve and speed-up the flow

of products from the State of Mato Grosso as well as to

expand export routes.

The study presented by FIEMT suggested using the Dry

Port of Cuiabá to shorten the time it takes to obtain

approval from regulatory agencies and the time it takes to

ship goods, as well as utilising rail transport to the Port of

Santos as a logistical solutions.

The forest sector stands out in terms of exports from

municipalities in Mato Grosso State. In the Juína

municipality exports of sawnwood generated US$241,000,

accounting for 33% of the total municipality’s export

earnings in the first eight months of 2024. In Colniza

municipality native timber species represents 90% of

exports, totaling US$7.2 million over the same period.

Aripuanã municipality achieved US$8.91 million in sales

of profile wood, representing 12% of the municipality's

exports and Juara municipality also exported sawnwood,

totaling US$164,000 in the first eight months of this year.

See: https://cipem.org.br/noticias/setor-florestal-de-mt-debate-

novas-rotas-de-exportacao-e-solucoes-logisticas

Strategies in preparation for compliance with the

EUDR

Prior to the announced delay in EUDR implementation

ABIMCI (Brazilian Association of Mechanically

Processed Timber Industry) participated in a meeting of

the Coalition on Sustainable Timber, composed of main

timber-producing countries.

The objective was to align strategies regarding the

European Union Regulation on Deforestation-Free

Products (EUDR)

During the meeting discussions focused on the

expectations and challenges related to the new regulation.

The European information system (platform) is currently

in a testing phase by some European stakeholders. More

training sessions are scheduled for October 2024.

However, there are significant uncertainties and a lack of

clear information from European authorities on the

implementation of the EUDR.

The meeting determined that EU member states have

different levels of strictness concerning how the EUDR

will be enforced and operationalised.

The coalition is preparing a document to be submitted to

the European Commission requesting revisions to certain

terms.

ABIMCI continues to closely monitor communications

from the Commission to ensure proper understanding of

the new rules and the operationalisation of the platform.

See: https://abimci.com.br/

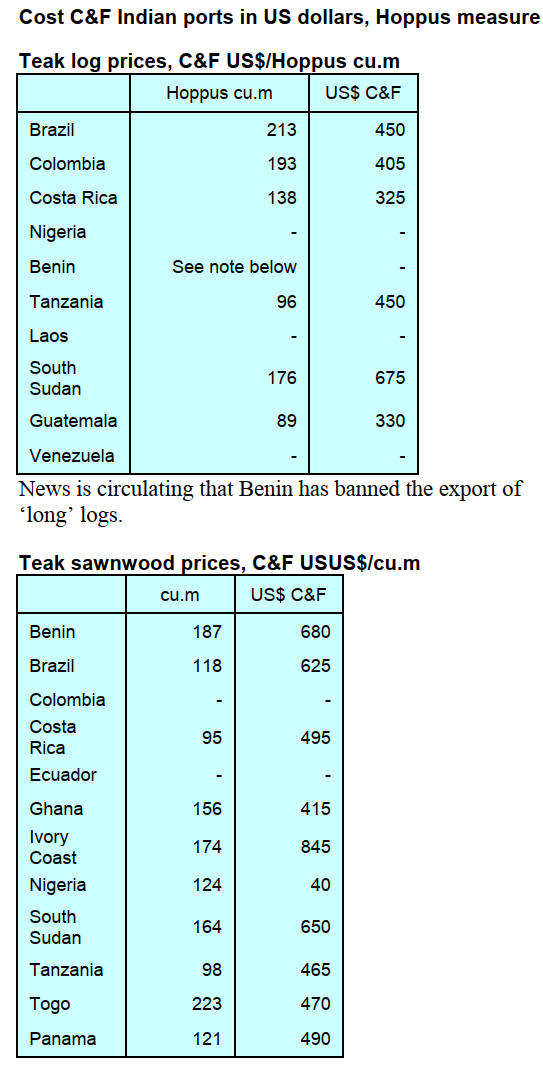

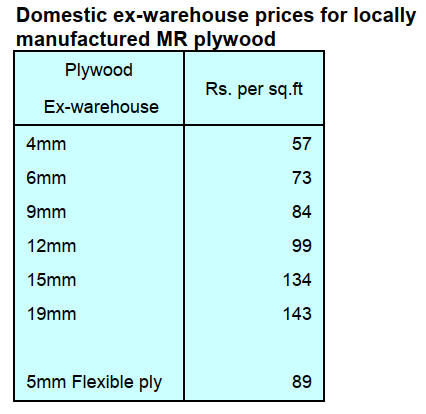

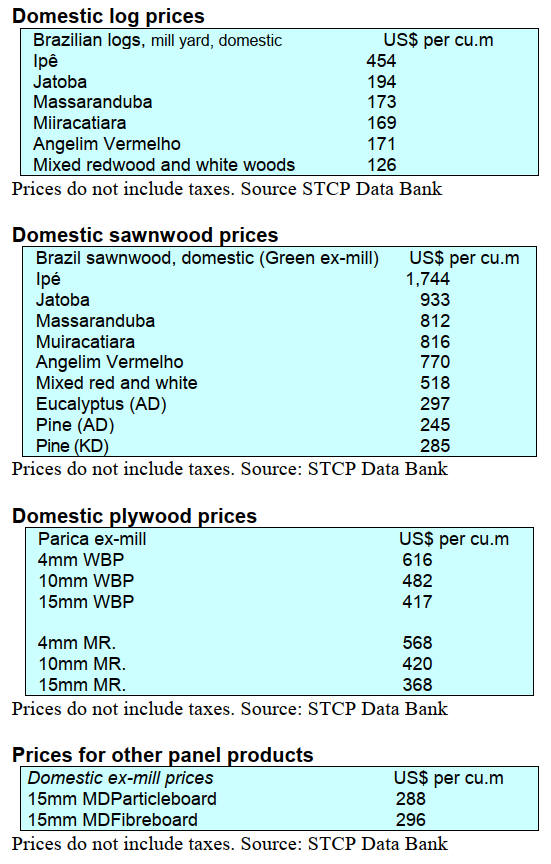

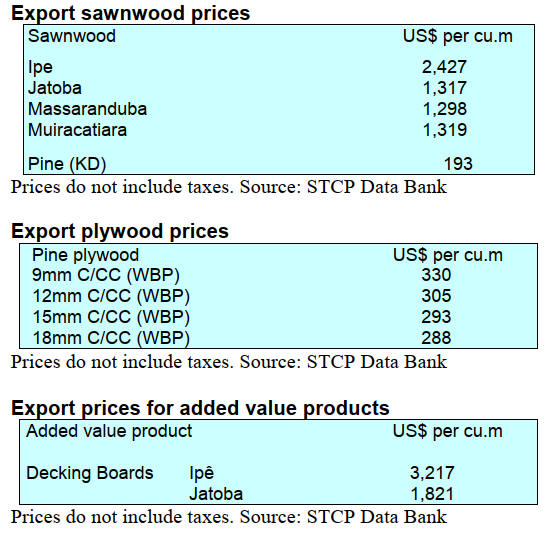

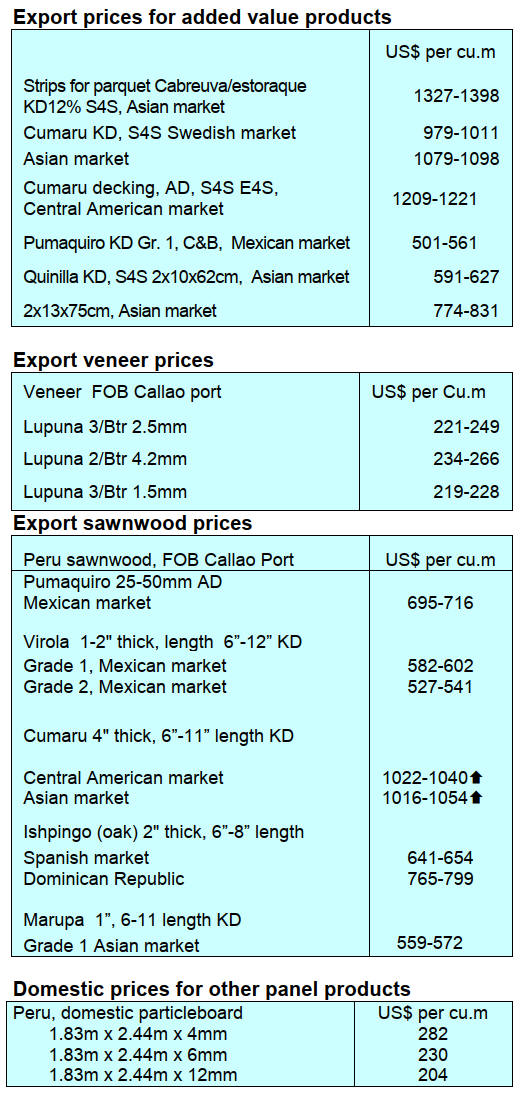

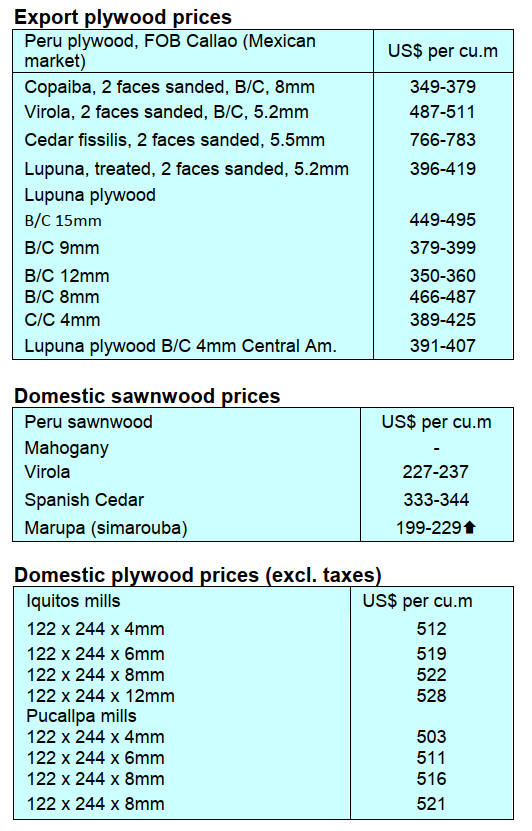

Export prices

Average FOB prices Belém/PA, Paranaguá/PR,

Navegantes/SC and Itajaí/SC Ports.

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Brazil.

See: https://www.itto-

ggsc.org/static/upload/file/20240929/1727586546173092.pdf

9. PERU

ADEX hosts IX

International Forestry Convention

The Association of Exporters (ADEX) held its IX

International Forestry Convention in early October at its

offices in Lima. The event focused on analysing policies

that promote a sustainable forestry industry, sharing

successful forest management experiences and identifying

investment opportunities. Recent policies and regulations

affecting the wood industry were examined and business

opportunities at the market and product level were

addressed.

In addition, networks and collaboration between

government entities, non-governmental entities,

international cooperation agencies and the private sector

were promoted. During a specialised workshop on

requirements for the acceptance of tropical wood under the

United States building code was held.

Sawn tropical hardwood the top export item

ADEX has reported between January and August 2024

Peru's wood product exports reached US$54.7 million, a

drop of 21% compared to the US$69.3 recorded in the

same period of the previous year.

The ADEX report says in the first eight months of this

year the most important item was "other sawn tropical

wood" worth US$11.4 million (-32% year on year).

This was followed by followed by "profiled wood except

ipé" (US$11.1), "other sawn or rough-cut wood" (US$6.3

million), "molded wood of tropical wood" (US$3.8

million) and "other longitudinally profiled wood" (US$2.6

million).

The main destinations were France (US$9.2 mil.), the

United States (US$8.7mil.), Dominican Republic

(US$7.3mil.), China (US$7.2mil.) and Mexico

(US$6.2mil.). Vietnam, Denmark, Belgium, Chile and

Germany completed the top ten export destinations.

Species with potential for promotion in the US

The president of the Committee of Wood and Wood

Industries of ADEX, Erik Fischer Llanos, reported that

they are seeking to promote the export of a greater variety

of Peruvian wood species to the United States targeting the

construction sector.

Fischer Llanos said “This is a new approach. Today there

are buildings with 15 or 18 floors made of wood so this

material has taken on an important new role. The forest

species Aguano Masha, Capirona, Huayruro, Machimango

Colorado, Mashonaste, Palisangre and Pumaquiro have

captured the interest of the US Forest Service, he added.

Fisher mentioned that wood is gaining more and more

followers in the United States and is an alternative

material to cement. Year after year, larger projects appear,

one of them is the Ascent tower in Wisconsin, a 25-story,

86 metre construction that houses apartments, a pool,

shops and other amenities.

During the ADEX Convention representatives of the US

Forest Service-USAID spoke about the requirements for

the entry of wood into the United States building code and

explained the procedures that companies must comply

with.

Fisher Llanos commented that in meetings held with

representatives of the US Forest Service-USAID, they

referred to the advances, challenges and opportunities

generated by the development of the Peruvian national

industry with a view to projecting itself to the North

American market.

Fischer highlighted Peru's progress in terms of forest

governance, with special mention done by the Agency for

the Supervision of Forest Resources and Wildlife

(Osinfor) on the control and administration of resources.

Strengthen the fight against illegal logging

The Permanent Multi-sectoral Commission against Illegal

Logging (CMLTI) and the Amazon Regional Association

(MRA) signed an intergovernmental agreement to

strengthen the fight against illegal logging and associated

trade in the Amazon. The agreement marks a milestone in

the collaboration between national and regional

authorities, as it aligns efforts to strengthen forest

management.

The Agreement promotes a transparent and

sustainable

forest market by providing traceability for wood products

ensuring that they come from legal sources.

See: https://www.gob.pe/institucion/osinfor/noticias/1037818-

comision-multisectorial-y-mancomunidad-regional-amazonica-

firman-un-acuerdo-por-los-bosques-para-fortalecer-la-lucha-

contra-la-tala-ilegal

|