Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Sep

2024

Japan Yen 142.10

Reports From Japan

Business federation

welcomes new Prime Minister

Business leaders in Japan called on Shigeru Ishiba, the

newly elected president of the ruling Liberal Democratic

Party (and now Prime Minister) to accelerate economic

growth amid signs of recovery, including rising wages and

prices.

The newly appointed Prime Minister is expected to come

up with a stimulus package immediately. Masakazu

Tokura, chairman of the Japan Business Federation, the

country's biggest business lobby, described the new PM as

"a leader who is ready to propel innovations adding, our

country is facing a turning point to see if we can move out

of deflation completely" stressing that political and

economic stability is to realize growth”.

Speaking after being elected Ishiba said that he will follow

the same basic approach as former Prime Minister Fumio

Kishida's government in trying to pull Japan out of years

of deflation. "The economy won't improve if consumer

spending doesn't increase," he said.

Ishiba is also emphasising distribution of wealth to

workers and calling for the national average minimum

wage to rise to 1,500 yen per hour within this decade.

Corporate leaders upbeat on prospects

Corporate leaders in Japan are increasingly bullish about

the domestic economy as wage increases have started to

overtake the rise in inflation. The upbeat mood comes

from the expectation the consumer spending will rise.

According to a recent Nikkei survey more than 70% of top

business leaders in Japan say the economy is expanding

with most pointing to a recovery in consumer spending as

wages rise.

See: https://www.nippon.com/en/news/yjj2024092501042/japan-

2023-private-sector-pay-up-marginally-to-4-6-m-yen.html

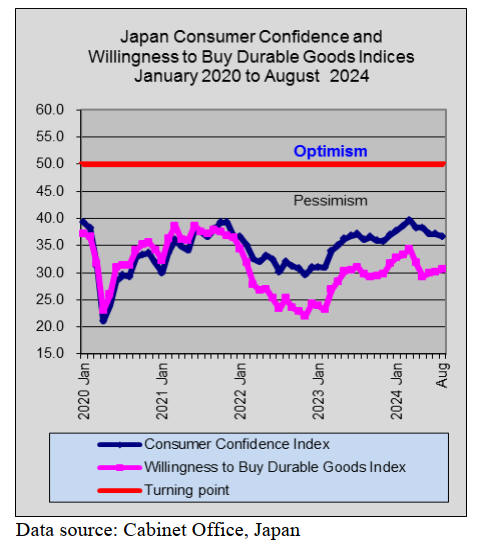

Falling household spending holding back growth

After an economic rebound in the first half of 2023

Japan’s economy has since struggled. Real gross domestic

product fell 0.5% in the first quarter of 2024 from the

previous quarter and was down 1.3% from its peak in the

second quarter of 2023.

Most of the downturn was due to falling domestic

household spending which fell in three of the last four

quarters.

Analysis by the Deloitte Global Economics Research

Center published in its Japan Economic Outlook suggests

that stronger wage growth and more moderate inflation are

expected to boost consumer spending. In early 2024 the

weak currency drove export growth.

The report identifies that as the Bank of Japan tightens

monetary policy consumer spending and consequent

growth may be relatively modest.

In related news, the Ministry of Finance has reported a

trade deficit for a second straight month in August despite

signs of sluggish consumer spending that slowed imports.

Exports totaled 8.4 trillion yen (US$59 billion), up 5.6%

from the same month last year. Shipments to Asia rose

while exports to the US fell. Imports totaled 9.1 trillion

yen (US$64 billion), up 2.3% from a year earlier. By

region, imports from Europe showed the strongest growth.

Both numbers fell short of forecasts for 10% growth in

exports and an even higher increases for imports.

See: https://www2.deloitte.com/us/en/insights/economy/asia-

pacific/japan-economic-outlook.html

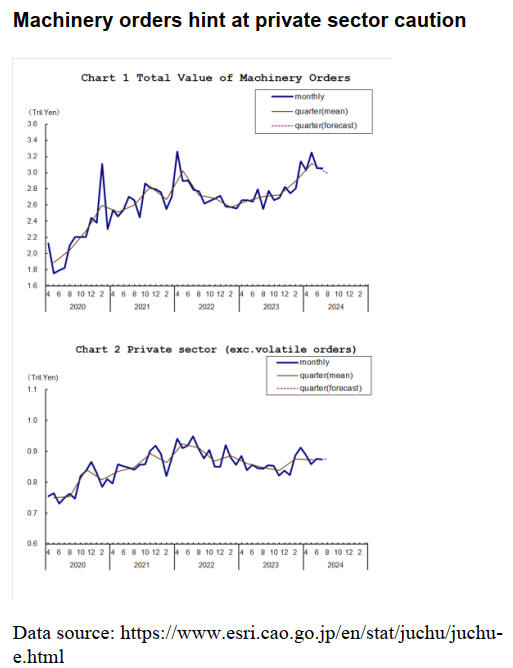

Seasonally adjusted July core machinery orders, an

indicator of business prospects, declined slightly from the

previous month according to a release from the Cabinet

Office. Private-sector orders, excluding those for ships and

power equipment, a closely watch leading indicator of

corporate capital spending, was little changed from June

when orders rose 2% month on month in June.

BoJ - inflation expectations have risen

At the Monetary Policy Meeting held 20 September the

Policy Board of the Bank of Japan assessed the economy

has recovered moderately, although some weakness has

been seen and overseas economies have grown moderately

on the whole. However exports and industrial production

have been more or less flat but with improved corporate

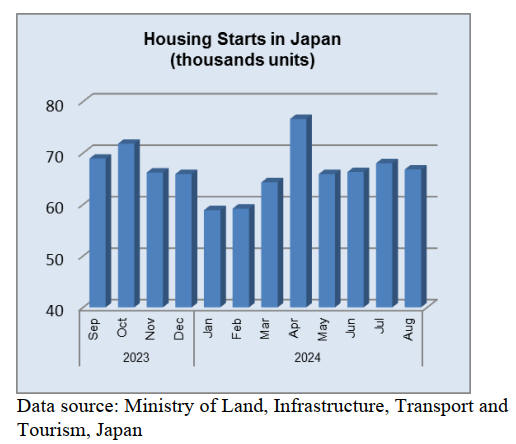

profits fixed investment has been rising.

The employment and income situation have improved and

there has been an uptick in private consumption despite

the impact of price rises but investment in housing

investment has been subdued.

The Bank says inflation expectations have risen

moderately and the economy is likely to keep growing at a

pace above its potential growth rate, with overseas

economies continuing to grow moderately and as a

virtuous cycle from income to spending gradually

intensifies against the background of factors such as

accommodative financial conditions.

Underlying CPI inflation is expected to increase gradually

since it is projected that the output gap will improve and

that medium to long-term inflation expectations will rise

in tandem with wages.

See: https://www.boj.or.jp/en/mopo/mpmdeci/mpr_2024/k240920a.pdf

Aging population has implications for house builders

Japanese aged 65 or older now account for nearly 30% of

the population. Data from the Ministry of Internal Affairs

and Communications shows Japan’s elderly population hit

36.25 million in 2023, a record high, with those aged 65 or

older now accounting for almost one-third, a higher

proportion than most other countries in the region. The

data also showed that a record 9.14 million elderly people

were employed last year, accounting for one in seven

employees.

Japan is grappling with a worsening demographic crisis as

a dwindling number of working-age people face being

saddled with mounting healthcare and welfare costs and

this will dampen the prospects for spending on

discretionary goods and has serious implications for the

housing market leading several Japanese house builders to

explore foreign market opportunities.

See: https://www.aljazeera.com/economy/2024/9/16/japans-

elderly-population-rises-to-record-36-25-million

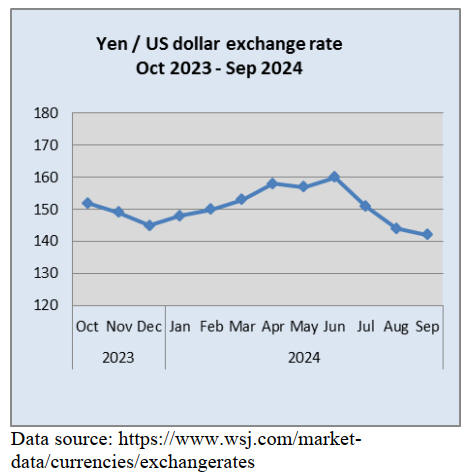

Japanese Yen exchange rate remains steady

The day before the Bank of Japan (BoJ) Policy Board

meeting Governor Kazuo Ueda said that the Bank has time

to evaluate market and economic conditions before

making any significant policy adjustments, which has been

interpreted as signaling no interest rate increases are

imminent.

He noted that Japan's real interest rate remains negative

which is helping to stimulate the economy and drive up

prices.

Weak yen attracted investment in real estate

Japan is enjoying an unexpectedly active property market

but some see risks ahead. The weak yen has attracted

investment in real estate which is beginning to drive up

prices.

The data from the Land Institute of Japan data shows

prices have been rising since the end of the pandemic with

prices in some areas close to a 20-year high. Inevitably,

there are worries this could trigger a housing market

crash.

Recent Cabinet Office data shows house prices in July

rose by 2.8% year-on-year. While that’s a fraction of the

increases seen in the UK, the US and the EU it represents

the fastest price rise in Japan since 2014.

See: https://capital.com/en-au/analysis/japan-house-price-crash-

foreign-investment-weak-yen

Import update

Japan has plans to broaden antidumping duties to cover

products shipped through third countries.

At present duties apply only to products from spesified

countries of origin but do not cover goods that have been

modified slightly or reprocessed in third countries. New

regulations will be put in place to make it easier to

investigate suspected circumvention of trade restrictions

and duty avoidance.

See: https://asia.nikkei.com/Economy/Trade/Japan-to-expand-

antidumping-duties-to-fight-

evasion?utm_campaign=GL_JP_update&utm_medium=email&u

tm_source=NA_newsletter&utm_content=article_link

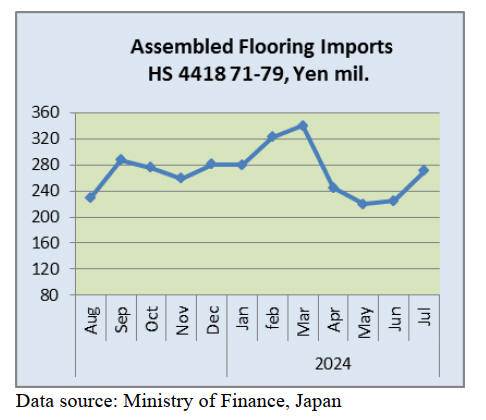

Assembled wooden flooring imports

June marked a reversal of the decline in the value of

assembled flooring imports (HS441871-79) which was

observed since April. The July data from the Ministry of

Finance shows the up-swing continued in July. Month on

month there was a 20% increase in the value of imports,

however, compared to July 2023, there was an 8% decline

in July this year.

The yen/US dollar exchange rate at the beginning of the

second half of the year was around yen 145 to the US

dollar, a marked strengthening from the level of 150-160

in the second quarter of this year and this strengthening

has given a boost to importers.

As in previous months the main category of assembled

flooring imports was HS441875, accounting for 70% of

the total value of assembled flooring imports, slightly

down from the previous month. The second largest

category in terms of value was HS441879 followed by

HS441874.

Shippers in China accounted for almost 70% of

Japan’s

imports of assembled wooden flooring in June with

shippers in Vietnam accounting for another 15%. Three

other countries shipped assembled flooring (HS441875) to

Japan in July, Germany, Denmark and Italy.

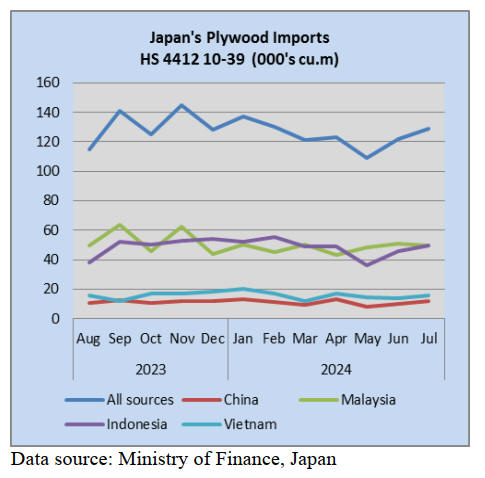

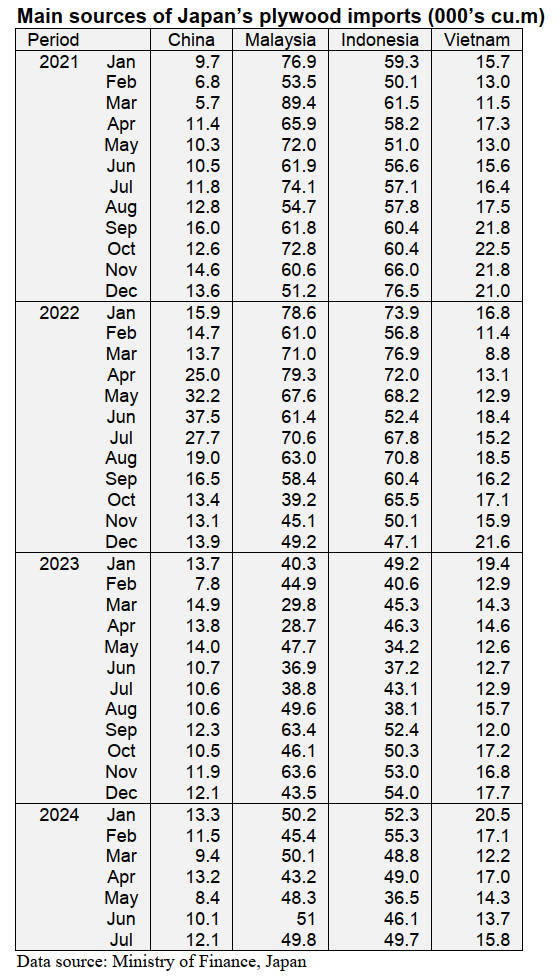

Plywood imports

Of the various categories of plywood imported in July

most was HS441231. Of total shipments from Malaysia

and Indonesia, over 90% was HS441239. Shipments from

China were more varied with HS441234 and 39

accounting for around 40% each of July shipments with

HS441231 accounting for most of the balance.

Shippers in Vietnam supplied mainly HS441231 (70%)

with HS441234 making up most of the balance. Other

shippers appearing in Japan’s plywood import statistics in

July included Finland, Latvia and Russia.

The volume of July plywood imports (441210-39) was

128,706 cu.m, up by over 20% from the same month in

2023 however, month on month the volume of July

shipments was little changed.

Year on year the volume of July arrivals from China,

Malaysia and Vietnam increased with July arrivals from

Indonesia being at around the same level as in June.

Import data shows that for the two main plywood suppliers

to Japan, Malaysia and Indonesia, July volumes were little

changed from the previous month.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Imports of European lumber

Volume of European softwood lumber in January to June

2024 is 981,000 cu.m, 24.5 % more than January to June,

2023. It seems that the volume of European softwood

lumber has increased from last year but the inventories,

which were overstocking last year, are less than last year

and the volume of European softwood lumber did not

reach 1,000,000 cu.m at the first half of this year.

Additionally, a shortage of European softwood lumber did

not occur. It could say that demand for European softwood

lumber has been declining.

Since there was a strike in Finland, a certain amount of

European softwood lumber arrived in Japan in July, 2024.

After August 2024, the arrival volume of European

softwood lumber will be the same volume as the first half

of this year or less than the volume at the first half of this

year.

Planed or polished stud are 362,124 cu.m, 24.2 % more

than the same period last year. Non - planed or polished

lamina is 615,242 cbms, 24.9 % more and non-planed or

polished tongue and groove joint is 3,656 cu.m, 6.3 % less

than the same period last year. Non-planed or polished

lumber made of pine is 409,577 cbms, 24.6 % more and

non-planed or polished lumber made of fir or spruce is

205,665 cu.m, 25.6 % more than the same period last year.

Several countries, which supply studs to Japan, have

exceeded the results in January to June 2023. Sweden,

which supplies studs to Japan the most, had a 3.7 %

decrease in supply volume from the same period last year.

Studs from Latvia increases 3.1 % up from the same

period last year. Austria is 6.2 % higher than the same

period last year.

For lamina, Austria is 33 % down and Estonia is 37.9 %

down from January to June 2023. Also, Latvia is 2.0 %

decreased. Finland is 4.2 % up.

Imports of wood fuel for 1st half of 2024

Volume of imported wood fuel at the first half of 2024 is

3,970,000 tonnes, 7.0 % less than the same period last

year. The volume of PKS decreased 30 % from the same

period last year but the volume of wood pellet is nearly

2,800,000 cbms at the first half of this year.

Imported wood fuel is used at large wood biomass power

plants and coal-fired power plants. However, some wood

biomass power plants have stopped operations due to the

fire and other accidents and it takes time to repair the

wood biomass power plants.

Since it is easier to get the certification of PKS than before

and supply of PKS started to increase. PKS does not burn

a lot of calories compared to wooden pellets. However, the

price of PKS was $130, FOB per ton before March 2024

and this is the reason for the decrease at the first half of

this year. Volume of PKS during January to June 2024 is

1,193,160 tonnes, 28.3 % down. Indonesian PKS is

884,303 tonnes, 29.6 % down. Malaysian PKS is 297,770

tonnes, 25.0 % down and Thai PKS is 11,087 tonnes, 6.3

% up.

Volume of wooden pellets at the first half of 2024 is

2,778,140 tonnes, 6.6 % increased from the same period

last year. Vietnamese wooden pellet is 1,398,322 tonnes,

19.9 % up.

Canadian wooden pellet is 523,389 tonnes, 28.2 % down.

American wooden pellet is 508,835 tonnes, 6.5 % down.

Indonesian wooden pellet is 149,976 tonnes, 348.0 % up.

Malaysian wooden pellet is 148,402 tonnes, 50.2 % up.

Wooden house business in Indonesia

Iida Group Holdings Co., Ltd. in Tokyo Prefecture, the

university of Bandung Institute of Technology in

Indonesia, Bogor Agricultural University in Indonesia and

The University of Tokyo agreed on a joint research about

spreading wooden houses in Indonesia. The joint research

had started for a new enterprise in 2027. They will develop

technical research and will also build a model home in the

universities in Indonesia.

There are a lot of forest resources in Indonesia and to

consume the local forest resources is one of their goals.

Usually, most houses in Indonesia are made of blocks or

bricks but the Indonesian government gropes for spreading

wooden houses. However, there is a problem which is

wood decay by termites.

Iida Group has been supplying houses in Okinawa, where

it is very hot and humid, and will provide its know-how

for the joint research. On the joint research, they will also

develop durability, quake resistance, maintenance system

and housing loan system.

South Sea logs and products

Movement of lumber for truck bodies is firm. However,

demand for other materials is low and the inquiries are a

few. Since the logs in South Asia are in short, South Asian

sellers do not sell the logs proactively. Japanese

distributors reduce the inventories. Then, some kinds of

lumber are in short. There were orders for large laminated-

boards before the holiday in the middle of August, 2024

due to the strong yen.

Some buyers were cautious to purchase products due to

the unclear movement in the future but some of buyers

purchased the products until October 2024. It is hard to

lower the price because the current products are purchased

in high price at the weak yen. Demand and supply for

South Sea log are balanced. South Sea logs are not in short

because a certain amount of South Sea logs had arrived in

Japan in July and August 2024.

Volume of composite wood flooring in 1st half of 2024

Production and sales volume of composite wood flooring

in January to June 2024 are below the results of January to

June 2023. The results of this year exceed the pace of

decline in new starts, which is 4.5 %, in the first half of

2024.

The ratio of specially processed sheet exceeds 70 % from

the same period last year. Since the prices of building

materials and of a house have skyrocketed, small houses

and single-story buildings are built. Therefore, floor areas

have been declining.

Production of composite wood flooring is 6.8 % less and

the sales volume is 7.7 % less than the same period last

year. The floor areas of new starts decrease 7.2 % down

from the first half of last year.

The production and the shipment of composite wood

flooring in every month in January to June 2024 did not

exceed the results in last year.

On the other hand, demand for sound proofing floors

are

firm. The production of LL45 is 945,000 tsubo, 4.2 %

more and the sales volume of LL45 is 950,000 tsubo, 2.8

% more than the same period last year. The reason for the

increase is that there were many apartment buildings were

built and the other reason is that people are more

interested in soundproofing floors than before COVID-19.

MDF and domestic plywood occupies 39 %, 2 points

down, of the sales volume. MDF and imported plywood

occupies 27 %, 2 points up. The imported plywood is 14

% and this is unchanged from the same period last year.

The sales volume of fancy boards is 23 %, 1 point down

and of specially processed sheet is 77 %, 1 point up from

the same period last year.

|