|

Report from

North America

Sawn tropical hardwood imports continued to rebound

in July

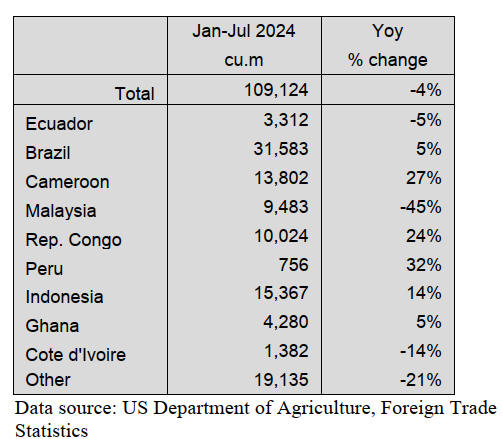

US imports of sawn tropical hardwood improved for the

second straight month in July, rising 12% over June’s

figures. The 17,555 cubic metres of hardwood imported

for the month was 6% less than that imported in July 2023.

Imports from Cameroon and Indonesia both rose more

than 40% in July while imports from Congo (Brazzaville)

were up 36%. Imports from Brazil lagged, falling 23% in

July.

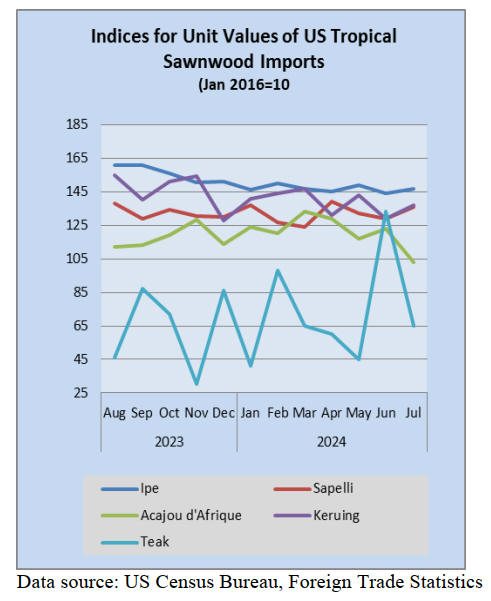

Imports of Sapelli, Mahogany, and Ipe all rose in July to

their highest levels of the year. Total US imports of sawn

tropical hardwood lumber remain down 4% versus 2023

through July.

Canada’s imports of sawn tropical hardwood also rallied

in July, gaining 11% over the previous month to a level

80% higher than a year ago. Imports from Brazil, Ghana,

the US, and Congo (Brazzaville) all rose sharply. Total

Canadian imports are up 44% over last year for the first

seven months of the year.

Hardwood plywood imports down from a year earlier

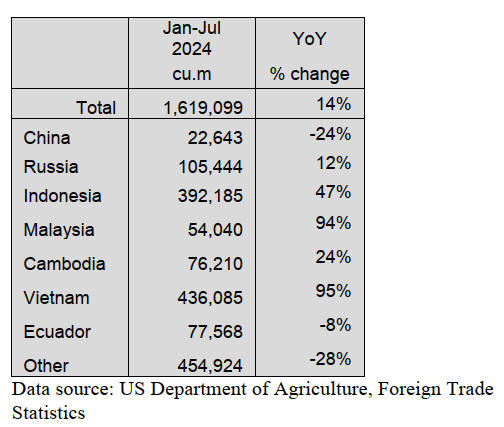

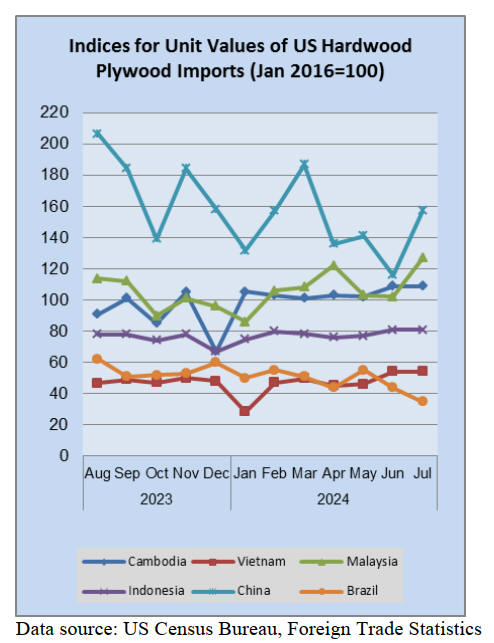

US imports of hardwood plywood rose 9% in July as

imports from its top trading partner surged. Imports from

Vietnam rose by 25% in July and are 95% ahead of last

year for the year so far. Imports from Cambodia and

Russia also gained while imports from Malaysia and

Indonesia saw declines.

While the import volume of 218,817 cubic metres for July

was an improvement over June, it came in 38% below the

volume seen in the previous July. As a result, total US

imports of hardwood plywood, which were outpacing

2023 totals by 32% just a month ago, are now ahead just

14% over last year through July.

Veneer imports from India and China gained more than

60%

US imports of tropical hardwood veneer rebounded in

July, rising 27% over a disappointing June figure. Imports

from India and China both gained more than 60% for the

month while imports from Italy returned to a more

customary level after two months of poor numbers.

Despite the bounce back, imports from Italy are down

76% so far this year versus last year. Imports from

Cameroon fell 15% from the previous month and were

27% lower than that of last July. Year to date, total

imports of tropical hardwood veneer trail 2023 figures by

4% through the end of July.

Fourth straight month rise for assembled flooring

imports

US imports of assembled flooring panels rose for a fourth

consecutive month in July, rising 10% over the previous

month to a level 31% better than last July. Imports from

Thailand rose 61% to climb to their highest level of the

year. That gain was enough to more than offset declines in

imports from China, Indonesia, Vietnam, and Brazil.

Through July, total imports continue to outpace those of

2023 by 32%.

Imports of hardwood flooring dropped for the second

straight month, falling 11% in July. While imports from

Malaysia and China both more than doubled their June

totals, imports from Vietnam fell to zero for the month

while imports from Brazil fell by 20%. Imports from

Indonesia, the leading US trade partner for flooring panels,

held even with the month before. Total imports of

hardwood flooring are behind last year’s pace by 12%

through July.

Moulding imports cool

Imports of hardwood moulding dipped in July after

reaching their highest level in nearly two years in June. At

over US$14.1 million, July imports were down 10% from

the June high but still 22% higher than a year ago.

A 44% decline in imports from Malaysia triggered the

loss, despite healthy gains in imports from Brazil and

China. Total imports for the year remain up 25% over last

year through the end of July.

US wooden furniture imports rise to highest level in

nearly two years

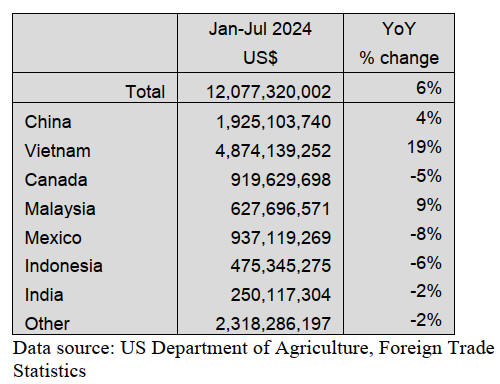

Imports of wooden furniture saw a 7% boost in July, rising

to their highest level in nearly two years. The US$1.84

billion imported in July was the most since October 2022

and was 10% higher than that of July 2023.

Imports from Indonesia rebounded with a 41% increase in

July after falling about the same amount in June, while

imports from Vietnam and China both saw gains of about

10%. Imports from Canada fell by 7%. For the year so far,

total imports of wooden furniture are ahead of last year by

6%.

Residential furniture orders shrank for second

consecutive month in June

New orders for residential furniture in the US were down

6% in June 2024 compared to June 2023, which follows

the 3% year-over-year decline last month, according to the

latest issue of Furniture Insights.

New orders were also down 8% compared to the prior

month of May 2024. However, year to date through June

2024, new orders are still up 3% compared to 2023,

though that spread has narrowed significantly with the last

two months’ declines.

June 2024 shipments were down 8% from June 2023, but

relatively flat with May 2024. Year to date through June

2024, shipments are down 9% compared to 2023.

Inventories and employee levels are again materially in

line with recent months, but down from 2023, indicating

that companies have aligned levels to match current

operations.

According to said Mark Laferriere, assurance partner at

Smith Leonard, which produces the monthly report, June

2024 marked the second straight month in which both new

orders and shipments declined over the comparable prior

year month for the companies in our survey.

See:

https://www.woodworkingnetwork.com/furniture/residential-

furniture-orders-down-june

Nonresidential construction employment rises in

August

The construction industry added 34,000 jobs on net in

August, according to an Associated Builders and

Contractors analysis of data released by the US Bureau of

Labour Statistics. On a year-over-year basis, industry

employment grew by 228,000 jobs, an increase of 2.8%.

Nonresidential construction employment increased by

28,300 positions on net, with growth in all three

subcategories. Nonresidential specialty trade added the

most jobs on net, increasing by 14,000 positions. Heavy

and civil engineering and nonresidential building added

13,500 and 800 jobs, respectively.

The construction unemployment rate fell to 3.2% in

August. Unemployment across all industries declined from

4.3% in July to 4.2% last month.

“August’s employment report is perfectly consistent with

the notion of a soft landing,” said ABC Chief Economist

Anirban Basu. “Unemployment fell both economywide

and in the nation’s construction sector. Job growth in

nonresidential construction was both brisk and broad-

based. Moreover, Federal Reserve officials continue to

indicate that they are ready to reduce interest rates, which

is expected within the next two weeks.

“And yet, the level of concern has been rising among

contractors,” said Basu. “According to both ABC’s

Construction Confidence Index and Construction Backlog

Indicator, the outlook among contractors is dimming

gradually. Many projects have been postponed recently in

the context of still-elevated borrowing costs and tighter

lending conditions.”

See: https://www.bls.gov/news.release/empsit.nr0.htm

and

https://www.woodworkingnetwork.com/news/woodworking-

industry-news/nonresidential-construction-employment-rises-

august

Union disputes threaten disruption of US ports and

Canadian railways

Labour disputes this summer led to halted traffic on two

critical Canada railroads and are threatening a possible

strike by workers at US East Coast and Gulf Coast ports in

October.Lockouts of workers briefly stopped traffic in

Canada on the railroads in August and halted shipments to

and from the United States, cutting off delivery of raw

materials, along with shipping of finished products from

factories and to retail shelves.

They lasted a little over a day at CN and four days at

CPKC. Canada’s Labour Minister Steven MacKinnon

ordered CN and CPKC into arbitration with the Teamsters

Canada Rail Conference to end the lockout.

In the US, critical talks between the labour union

representing workers, the International Longshoremen’s

Association (ILA), and ports management broke down

over the summer with automation being a key sticking

point.

Although talks have not resumed and will not until the

union concludes its internal meeting at least one positive

development has risen in recent weeks. Both the ILA and

the US Maritime Alliance (which represents the

employers) contacted the Federal Mediation &

Conciliation Service (FMCS) in late August with the

intention of getting a mediator involved in the talks.

US East Coast and Gulf Coast ports handle 43% of all US

imports and billions of dollars in trade monthly but

companies have been moving shipping containers to the

West Coast over strike fears.

See: https://www.yahoo.com/news/east-coast-port-workers-

reportedly-160943478.html

Note: the doubling of the unit value for teak may be a statistical

error. Use with caution.

|