|

1.

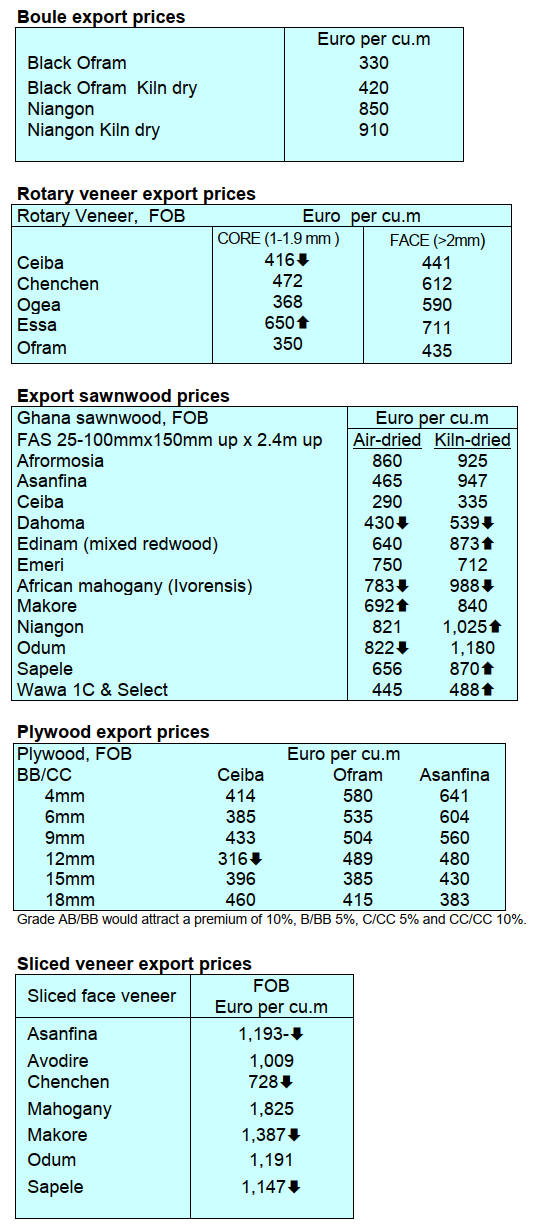

CENTRAL AND WEST AFRICA

Authorised exploitation of kevazingo

The transitional government in Gabon has adopted a draft

decree authorising the exploitation of kevazingo to

"stimulate the development of forest regions," according to

an official statement reported by the media. Harvesting of

kevazingo was suspended in 2018.

The draft decree aims to establish a stricter regulatory

framework for the exploitation of kevazingo. It limits

exploitation to sustainably managed concessions,

strengthens traceability through a geo-referencing system

and requires a CITES permits for finished products.

See:https://www.jeuneafrique.com/1604084/economie-

entreprises/a-la-recherche-de-moteurs-de-croissance-le-gabon-

relance-lexploitation-dun-bois-precieux/

and

https://www.gabonreview.com/retour-conditionne-du-kevazingo-

aubaine-economique-ou-desastre-ecologique-en-devenir/

In other news from Gabon, weather conditions are said to

be unpredictable, particularly in up-country areas. Harvest

levels are below those of last year due to low demand for

some of the redwood species. However, local demand for

okoume remains good but orders for okoume from China

remain low.

Demand from buyes in the Philippines remains steady and

there have been suggestions that demand in Middle East

markets may be recovering with increasing inquiries for

species such as belli, okan, okoume and movingui.

SEEG under provisional administration

The Société d'énergie et d'eau du Gabon (SEEG),

concessionaire for the water and electricity sector in

Gabon, was placed under provisional administration on 27

August according to a decision of the Presidency of the

Gabonese Republic.

Faced with a production shortfall and aging infrastructure

Société d'énergie et d'eau du Gabon (SEEG) is imposing

rotating load shedding to stabilise Libreville's power grid.

The drop in production is mainly due to lower water levels

at the Kinguélé-Tchimbélé dam, an essential infrastructure

for Libreville’s electricity supply.

The dam, which accounts for almost half of the capital’s

energy production, has a deficit of 60 megawatts.

See: https://energynews.pro/en/massive-power-cuts-in-gabon-

seeg-rations-electricity/

The transitional government in Gabon is focusing on road

construction and tackling long-standing issues like the

electricity crisis by building a new hydroelectric dam with

Chinese support. It has been reported in the domestic press

that the Chinese government has pledged investment of

7.2 trillion FCFA for roads, railways and a new port in

Mayumba.

Operators in Cameroon - EU markets remain quiet

Heavy rains have returned slowing harvesting activities

and some mills report a decline in log stocks. The rains are

expected to last until December.

The market in Europe remains dull say operators, while

the Middle East and the Philippines market demand

remains stable. Enquiries from buyers for the Chinese

market are very low but enquiries from Middle East

buyers are said to be improving for species such as iroko,

sapelli and a range of redwoods.

Cameroon President, Paul Biya, recently visited China

where it is reported he secured investment commitments

deals totalling 500 billion FCFA for infrastructure

development among others.

Key projects for the government include Phase 2 of the

Yaoundé-Douala highway, the Edéa-Kribi highway and

the Ngaoundéré-Garoua road.

BRICS countries a significant market

In January this year BRICS expanded to include five new

countries, Egypt, Ethiopia, Iran, Saudi Arabia and the

United Arab Emirates (forming BRICS+). According to a

report by the Cameroonian Institute of Statistics (INS) this

new group is increasingly important to Cameroon’s timber

trade.

The INS reported that over the past five years BRICS+

countries accounted for 29% of Cameroon’s global trade,

with wood products a key component.

See: https://www.businessincameroon.com/public-

management/0609-14120-cameroon-seeks-more-chinese-

funding-for-major-road-projects

Log quota system still in place

Operators in Congo report no harvesting or production

disruptions. Order books are said to be stable for the next

two months. While log exports are officially banned a

quota system is still in place so old log stocks can be

cleared.

Enquiries remain stable with the Philippines continuing to

demand okoume sawnwood. Chinese orders have slowed

and only outstanding contracts are being fulfilled. No

changes in government regulations have been reported and

the focus of government policy is down-stream added

value production.

In the Congo there have been significant investments with

support from China in ministry buildings, up-market

housing projects and road construction. The highly

anticipated Congo River bridge project is another example

of a Chinese contribution.

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in the Republic of Congo and Gabon.

See: https://www.itto-

ggsc.org/static/upload/file/20240822/1724289606498649.pdf

2.

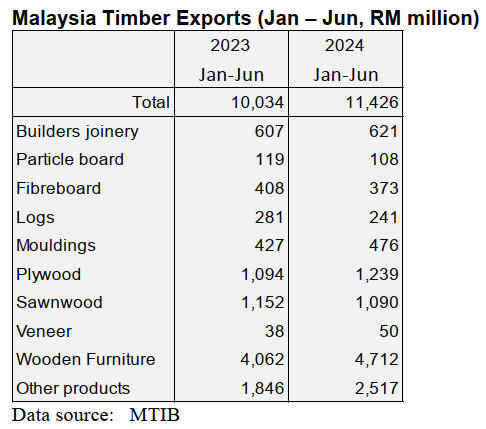

GHANA

Demonstrations planned to stop illegal mining

in forest

reserves

Organised labour and some Civil Society Organisations in

Ghana have threatened a series of demonstrations

throughout the country if government does not act to stop

all illegal small-scale mining (known as ‘galamsey’) in

forest reserves and along water bodies.

The media has reported that galamsey activities have

reached crisis proportions in the country where forests are

degraded and water bodies are polluted.

The activists are seeking urgent government intervention

and calling for a ‘state of emergency’ declaration to halt

all mining operatives from activities near forest reserves

and water bodies.

The call for action is led by organised labour, including

the Trades Union Congress (TUC), the Ghana Medical

Association (GMA), the University Teachers Association

of Ghana (UTAG) and the Ghana Federation of Labour,

Other associations include the Peasant Farmers

Association of Ghana (PFAG) and the Ghana Bar

Association (GBA).

The activist group has called on the government to annul

the regulation LI2462, which allows mining in the

country’s forest and withdraw any licenses for prospecting

and mining in forests, protected areas and near water

bodies. The Minister for Lands and Natural Resources,

Samuel Abu Jinapor, has reportedly described calls for a

state of emergency to combat illegal mining as “draconian

and far-reaching.”

The Ghana President, Nana Akufo-Addo, has set up 5-

member ministerial ad-hoc committee to assess how to

deal with the illegal galamsey.

See: https://gna.org.gh/2024/09/organised-labour-demands-

immediate-declaration-of-galamsey-as-an-emergency/

and

https://www.modernghana.com/news/1340742/galamsey-has-

reached-a-crisis-proportion-forest.html

and

https://citinewsroom.com/2024/09/galamsey-declaring-a-state-

of-emergency-draconian-and-far-reaching-lands-minister/

and

https://www.myjoyonline.com/akufo-addo-sets-up-5-member-

ministerial-ad-hoc-committee-to-assess-galamsey-fight/

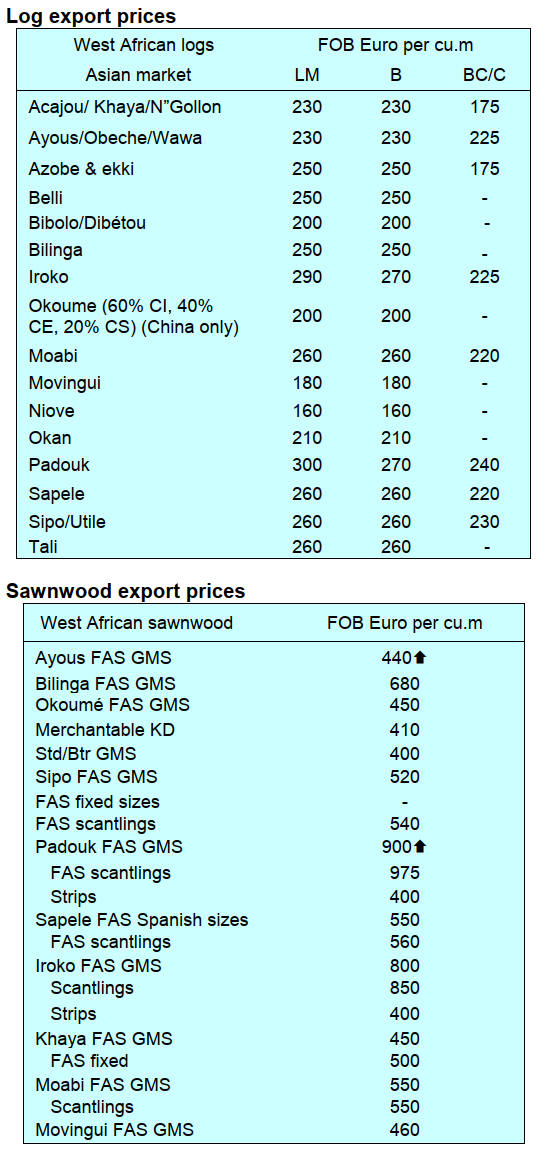

Exports continue a slow year on year decline

Total wood and wood products export in July 2024 earned

the country Eur10.69 million from a volume of 24,392

cu.m which represented a decrease of 2.6% in value but a

1.5% increase in volume as compared to July 2023

according to Timber Industry Development Division

(TIDD) data.

For the first seven months of the year 2024 cumulative

exports continued to show a year-on-year dip of 12% in

volume and 13% in value against the same period in 2023.

Air and kiln-dried sawnwood and plywood for the regional

market accounted for 56%, 13% and 6% respectively and

accounted for 75% of the total export volume for the first

seven months (157,518cu.m) compared to the 179,456

cu.m in the same period in 2023.

Products that made significant export gains were kiln-

dried boules, briquettes, rotary veneer and teak logs. These

products also recorded positive year-on-year growth in

export values except rotary veneer which dipped by 9.5%

to Eur 2.71milion from Eur 2.47million in the first half of

2023.

The United States accounted for 35% (1,920 cu.m) of

rotary veneer shipments from Ghana’s total export volume

of 5,429cu.m and this earned Eur 944,099 in total export

receipts (Eur 2.7 million).

Canada was the second largest market with rotary veneer

import of 1,101cu.m valued at Eur837,788.

Out of seventy-six (76) exporters recorded in July 2024

the top five were Samartex Timber and Plywood Company

Limited, Multimodal Freight Services Limited, 3RDI

Shipping Agency Limited, Golden Logs Exporters

Limited, and John Bitar and Company Limited. These

enterprises shipped twelve (12) different wood products

including air and kiln-dried sawnwood, billets, plywood

for the regional market and rotary veneer to 35 countries.

Forestry sector contribution to Ghana’s economy

A two-day National Policy Dialogue (NPD) has been held

following a study conducted by the Ghana Statistical

Service (GSS) in collaboration with the Forestry

Commission (FC) to assess the contribution of forestry to

Ghana’s economic development.

Participants at the dialogue included stakeholders from the

forestry industry, GSS, Food and Agricultural

Organization (FAO), the Warnell School of Forestry at the

University of Georgia, the Environmental Protection

Agency (EPA) and the National Development Planning

Commission (NDPC) which deliberated on the theme

“Economic Contribution and Sectorial Linkage of the

Forest Sector to the National Economy of Ghana”.

The GSS identified that the forestry sector contribution

has been underestimated as the informal sector

contribution is possibly under reported, weak reporting

and lack of disaggregated data and linkage between the

forest sector and other economic sector’s contribution to

the national economy.

The GSS report revealed that the country’s forestry sector,

particularly forest and logging in 2014 contributed

GH¢10.83 billion to Gross Domestic Product (GDP),

representing 2.0%. The study also revealed that from 2014

to 2023 the economic contribution of the forest sector to

Ghana’s Gross Domestic Product on the average has been

1.5%.

The Chief Executive of the Forestry Commission, John

Allotey, said the forest sector plays a vital role, not only in

preserving our rich biodiversity but also contribute

significantly to the livelihoods of millions of Ghanaians.

He highlighted on numerous benefits derived from the

forest and expressed his optimism that the discussions and

recommendations brought forth from the dialogue will

shed light on the vital role our forests play as key drivers

of economic growth, employment and national

development and lead to a successful outcome that will

drive the advancement of the forest sector.

See: https://fcghana.org/ce-of-fc-calls-for-collective-

commitment-in-advancing-the-forest-sector/

Business confidence index slips

The latest Monetary Policy Report from the Bank of

Ghana (BoG) has recent surveys indicated some softening

of consumer and business sentiment.

According to the Bank, exchange rate volatilities posed the

biggest challenge to businesses. The Business Confidence

Index dipped to 88.8 from 92.6 in last survey as businesses

expressed concern about the cost implications of the rapid

exchange rate depreciation.

Similarly, the report showed that Consumer Confidence

Index declined to 81.2 in June 2024 from 87.7 in April

2024 on account of high food prices and uncertainties on

future economic conditions.

A statement in the report says “these findings were

broadly in line with observed trends in Ghana’s

Purchasing Managers’ Index (PMI) which fell below the

50.0 benchmark to 49.7 in June 2024, from 51.6 in the

previous month”.

Ghana’s inflation rate for August 2024 dropped to 20.4%,

down from 20.9% in July marking the sixth consecutive

month of decline since March 2024 when it was 25.8%.

See: https://www.myjoyonline.com/business-confidence-dipped-

due-to-rapid-exchange-rate-depreciation-in-may-2024-bog-

report/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Ghana.

See: https://www.itto-

ggsc.org/static/upload/file/20240822/1724289606498649.pdf

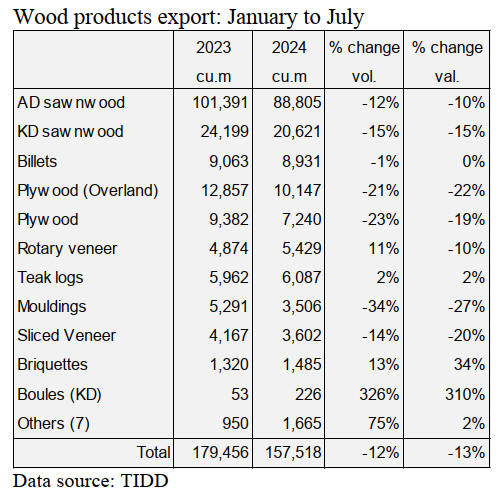

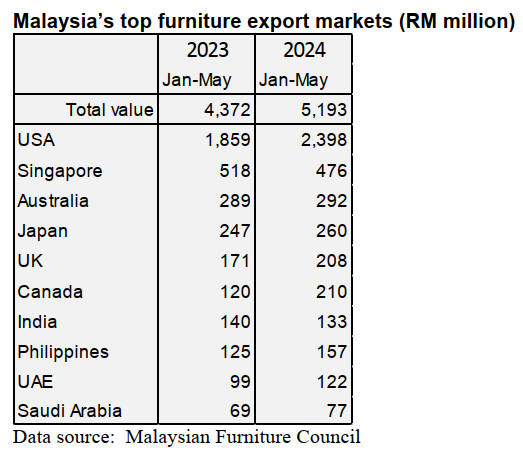

3. MALAYSIA

Positive indicators for the economy

Bank Negara Malaysia (BNM) has maintained the

overnight policy rate at 3% to support the country’s

economic growth. The Bank’s decision to hold the

benchmark interest rate steady was widely anticipated.

BNM said it will ensure that the monetary policy stance

remains conducive to sustainable economic growth amid

price stability.

On the Malaysian economy, BNM said the latest

indicators point towards sustained strength in economic

activity in the second quarter of 2024, driven by resilient

domestic expenditure and better export performance.

Employment and wage growth, as well as policy

measures, will continue to support household spending.

However, analysts at Kenanga Investment Bank have

suggested demand and prices for wood products in the

local market are likely to remain unchanged in the

immediate to medium term due to economic uncertainty

and higher borrowing costs that continue to dampen new

construction and home building activities.

See:

https://www.freemalaysiatoday.com/category/highlight/2024/09/

05/bnm-keeps-opr-at-3-to-support-economic-growth-2/

Kenaf industry in Sabah to be expanded

The Deputy Plantation and Commodities Minister, Chan

Foong Hin, said that, through the National Kenaf and

Tobacco Board (LKTN), his ministry intends to expand

the kenaf industry in Sabah through initiatives in

partnership with cooperatives and the private sector.

He added that for 2024 the LKTN has identified 125 ha. of

land in Sabah in the districts of Beluran, Pitas and Sook

with potential for kenaf cultivation. The ministry is

confident that this industry will create new job.

International Furniture Fair, MIFF 2025

The Malaysian International Furniture Fair 2025 is

scheduled to be held from 1 – 4 March 2025 in Kuala

Lumpur. The venues will be at World Trade Centre Kuala

Lumpur (WTCKL) and the Malaysia International Trade

& Exhibition Centre (MITEC). Free shuttle services

between venues will be available.

The organisers say that around 650 furniture

manufacturers and exporters will be exhibiting from

Australia, Cambodia, China, India, Indonesia, Hong Kong,

Japan, South Korea, Taiwan P.o.C, Thailand, Turkey,

Vietnam, UAE and the USA.

See:

http://theborneopost.pressreader.com/article/281556591192658

Sabah’s untouched forests

A two-week survey is underway in the Imbak Canyon

Conservation Area (ICCA) in central Sabah to strengthen

conservation efforts in this area of biodiversity. Over 150

researchers, government officials and conservation

advocates will visit into the 27,000 ha. fully protected

forest reserve to collect data.

The survey follows the expiration of the ICCA Strategic

Management Plan last year which was developed by

stakeholders under the stewardship of Sabah Foundation

and based on findings from a similar survey conducted in

2012.

Sabah Foundation emphasised the importance of acquiring

up-to-date data on the site's natural resources and wildlife,

crucial for the preservation of the area. Imbak Canyon is

one of five conservation areas under Sabah Foundation's

purview, including the Maliau Basin Conservation Area

and the Danum Valley Conservation Area.

Imbak Canyon is one of Sabah's last substantial unlogged

lowland dipterocarp forests in the heart of Borneo. It

serves as a critical water catchment area for Sungai

Kinabatangan, the longest river in Sabah and functions as

a wildlife corridor connecting Danum Valley (43,800 ha)

and the Maliau Basin (58,800 ha).

This sanctuary is home to endangered species such as the

Bornean pygmy elephant, orangutan and clouded leopard.

It also plays a crucial role in forest restoration, acting as a

gene bank for regenerating degraded areas.

In addition to conservation, the survey will explore the

area's potential for tourism development and identify

research questions for future explorations.

See:

https://www.nst.com.my/news/nation/2024/09/1100939/research

ers-survey-one-sabahs-last-untouched-forests

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Malaysia.

See: https://www.itto-

ggsc.org/static/upload/file/20240822/1724289606498649.pdf

4.

INDONESIA

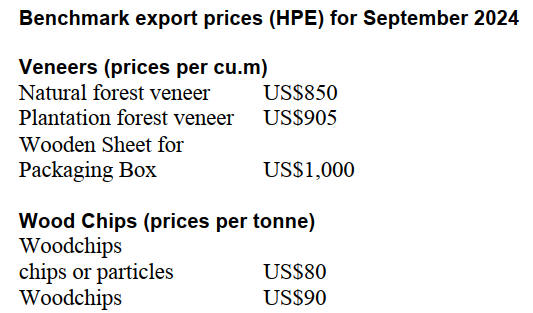

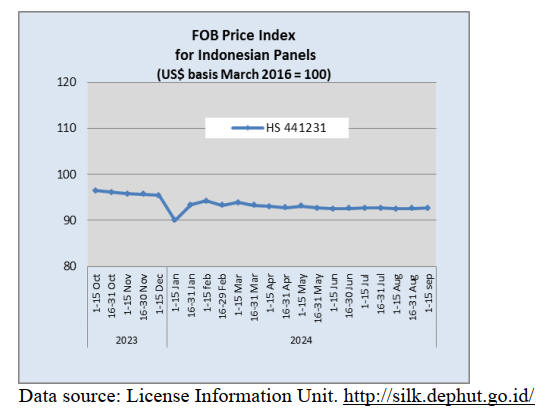

Processed Wood (prices per cu.m)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1,000 sq.mm to

4,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all

four

sides so that the surface becomes even and smooth of

Merbau wood with the provisions of a cross-sectional area

of 4,000 sq.mm to 10,000 sq.mm (ex 4407.11.00 to ex

4407.99.90); US$1,500/cu.m

See:

https://jdih.kemendag.go.id/pdf/Regulasi/2024/1203_Kepmendag

%20dan%20lampiran%20HPE%20dan%20HR%20Produk%20P

ertanian%20dan%20Kehutanan%20Sep%202024.pdf

Upgrading machinery and equipment for downstream

wood product manufacturers - 2nd programme

The Ministry of Industry is preparing for a second

programme of support for upgrading machinery and

equipment for downstream wood product manufacturers.

Putu Juli Ardika, Director General of Agro-Industry at the

Ministry is reported as saying "this programme has three

main objectives: strengthening the value chain in the

processed wood and furniture industry through technology

optimisation, increasing production efficiency in the

sectors and enhancing industrial competitiveness by

improving productivity and production quality”.

He mentioned that the programme implementation is

based on Ministry of Industry Regulation Number 42 of

2022 and Ministry of Industry Regulation Number 31 of

2024. The implementation involves providing discounts or

reimbursement for the purchase of machinery and

equipment. He noted that, as of 27 August 2024, 13

applications had been received through the National

Industrial Information System (SIINas).

The Director of Forestry and Plantation Products Industry,

Setia Diarta, mentioned that as of 2022, a total of 24 wood

processing and furniture companies had taken part in a

programme to upgrade their machinery and equipment.

Based on reports from companies receiving funds this

programme has increased company efficiency by 10-30%,

product quality by 10-30% and company productivity by

20-30%.

See: https://tubasmedia.com/kemenperin-komit-dukung-

pengembangan-industri-kayu-olahan/

and

https://www.tribunnews.com/bisnis/2024/09/02/kemenperin-

siapkan-dana-rp333-miliar-untuk-restrukturisasi-mesin-industri-

kayu

Revitalising the rattan industry

The Ministry of Environment and Forestry facilitated

discussions between raw and semi-finished rattan

producers and advanced processing industries to seek

ways to strengthen Indonesia's rattan industry.

Discussions focused on strategic issues confronting the

rattan processing industry, from raw material sourcing to

finished product production. The meeting also explored

strategies for market creation and efficient management of

the rattan supply chain.

Ristianto Pribadi, Director of Forest Product Processing

and Marketing Management, emphasised that rattan is

abundant in Indonesia and is a sustainable non-timber

forest product. Rattan product exports are a significant for

Indonesia, however, exports declined by over 50%

between 2021 and 2023.

Pribadi noted that the decline in exports negatively

impacted the producers of raw and semi-finished rattan

products.

Indonesia's rattan processing industry faces competition

from other countries, including China, Vietnam, Malaysia,

and the Philippines. Additionally, synthetic rattan products

have posed challenges to Indonesia's rattan marketing.

See: https://en.antaranews.com/news/325155/indonesia-seeks-to-

revitalize-rattan-industry

Vietnam Furniture Association collaboration with

Indonesian businesses

The Vietnam Handicraft and Furniture Association (Ho

Chi Minh City Handicraft and Wood Processing

Association/HAWA) is seeking to collaborate and

cooperate with the Indonesian Furniture and Craft Industry

Association (HIMKI).

The Head of the International Inter-Institutional Relations

Division of HIMKI, Marthunus Fahrizal, welcomed the

suggestion of collaboration from HAWA. He sees this as a

first step in efforts to strengthen the furniture and craft

industry in both countries. He expressed hope for

continued communication efforts so that these aspirations

can be realised. The Indonesian Consul General in Ho Chi

Minh, Agustaviano Sofjan, offered support for the

collaborative efforts between HIMKI and HAWA.

See: https://kumparan.com/kumparanbisnis/asosiasi-furnitur-

vietnam-buka-potensi-kolaborasi-dengan-pelaku-usaha-ri-

23Qz0XAZicx/full

Export of ironwood from East Kalimantan

A Japanese import company has expressed interest in

purchasing finished ironwood products from East

Kalimantan Province. This was conveyed by the company

representatives during their meeting with the Regional

Secretary of East Kalimantan Province, Sri Wahyuni. Sri

Wahyuni noted that the company has been supporting the

planting of ironwood seedlings in Benua Etam for the past

two years.

The Japanese company has shown an interest in buying

ironwood products from local wood entrepreneurs in East

Kalimantan but Sri Wahyuni emphasised that there are

regulations governing its trade.

See: https://kaltim.tribunnews.com/2024/08/22/perusahaan-

jepang-berminat-mengekspor-potongan-kayu-ulin-kaltim.

Egyptians interested in Indonesian agarwood

Two Egyptian companies have shown interest in importing

agarwood products from Indonesia after the Indonesian

Ambassador to Egypt, Lutfi Rauf, hosted a meeting with

several Egyptian buyers.

The buyers explained that the demand for agarwood is for

Grade I which contains oil and Grade II which does not.

When processed the product can meet the requirements of

prayer bead manufacturers and suppliers of perfume raw

materials in Egypt, said the Ambassador.

See: https://harian.fajar.co.id/2024/09/08/buyer-mesir-minati-

kayu-gaharu-indonesia/

Bezos Earth Fund observes social forestry

The Minister of Environment and Forestry Siti Nurbaya

and a delegation from the Bezos Earth Fund recently

visited the Kinipan Village Customary Forest in

Lamandau Regency, Central Kalimantan Province. The

purpose was to observe the efforts of indigenous peoples

in preserving forests and to discuss potential support from

the Bezos Earth Fund for the preservation of customary

forests and the promotion of sustainable management of

natural resources.

Minister Siti expressed her appreciation for the Kinipan

indigenous community's efforts in preserving their

ancestral forests. These forests not only protect

biodiversity but also uphold the community's cultural

traditions.

During the visit, the Bezos Earth Fund delegation

reaffirmed their commitment to supporting conservation

initiatives in Indonesia's ancestral forests through funding

and innovative programmes that prioritise environmental

sustainability.

See: https://ppid.menlhk.go.id/berita/infografis/7855/klhk-ajak-

bezos-earth-fund-lihat-langsung-kemajuan-hutan-sosial

Energy transition key to economic growth

Finance Minister, Sri Mulyani Indrawati, has emphasised

that Indonesia's energy transition efforts are not merely

geared toward environmental protection but are also part

of a long-term strategy to drive economic growth. During

the International Sustainability Forum (ISF) 2024 in

Jakarta she stated that fiscal policy will play a vital role in

supporting the country’s energy transition.

She noted that in recent years Indonesia has issued several

fiscal policy instruments, including green bonds and blue

bonds in both domestic and global markets. These

instruments are designed to secure funding from investors

for environmentally friendly projects, such as renewable

energy development and sustainable forest management.

Indrawati also underscored that Indonesia is one of the

pioneers among developing nations in using fiscal

instruments to fund green projects.

See: https://en.antaranews.com/news/325063/indonesias-energy-

transition-key-to-economic-growth-says-minister

Conclusion of IEU-CEPA negotiations close

Minister of Trade, Zulkifli Hasan, has set a target for

concluding the negotiations for the Indonesia-European

Union Comprehensive Economic Partnership Agreement

(IEU-CEPA). Discussion have beenon going for nine

years.

With the IEU-CEPA in place Indonesian export

commodities entering the European Union would be

exempt from import duties. The agreement is expected to

boost national economic growth. Indonesia has engaged in

similar trade agreements with other countries such as

China and India.

Another advantage of the IEU-CEPA is that it could help

Indonesia avoid the implementation of the European

Union Deforestation Regulation (EUDR). National

industries that will be affected by the implementation of

the EUDR in January 2025 include palm oil, cocoa,

coffee, wood and natural rubber.

See: https://setkab.go.id/en/trade-minister-ieu-cepa-progress-

reaches-90/

5.

MYANMAR

Publication of trade data suspended

Unconfirmed reports say the Ministry of Commerce

(MoC) has reassigned staff in the section publishing trade

data including exports and imports categorised by

commodities. The trade data provided by the MoC is the

most relevant source for researchers and the media.

Currently, there are no other formal sources available

online.

It is unclear why the entire section was reassigned rather

than simply suspending the monthly updates. In a similar

development, the Myanmar Timber Enterprise (MTE) has

stopped uploading the annual harvesting plan and tender

sale results. From 2010 to 2020 MTE worked to improve

transparency and actively participated in the Myanmar

Extractive Industries Transparency Initiative (MEITI)

which suspended its activities in 2021. MEITI withdraw

from Myanmar in 2021.

Although the current government has not conducted any

harvesting for the past three years it is understood that

MTE planned to carry out limited harvesting in this

harvesting season. However, it is learnt that MTE is facing

various challenges, particularly security concerns due to

the weakening security situation. International pressure on

MTE, seen as affecting export revenue, remains a critical

challenge.

Punitive measures against MTE have severely impacted

the timber industry which relies solely on MTE for log

raw materials. Depriving MTE of all sources of income to

deny the authorities access to foreign currency is a

narrative gaining momentum and pushing the timber

industry to the point of collapse.

Thai businesses pulling out

Thai businesses are gradually withdrawing investments

from Myanmar due to its prolonged economic decline,

exacerbated by the COVID-19 pandemic, the 2021

political development and ongoing conflicts.

Siam Cement Group (SCG) has suspended operations and

beverage giant Osotspa has reportedly sold its investments

in two Myanmar subsidiaries. Other Thai companies,

including TPBI Public Company Limited and event

organisers Grand Prix International and Index Creative

Village, have also exited Myanmar.

However, the border trade is still active. Thailand's border

and cross-border trade saw significant growth, with a 22%

year-on-year increase in July 2024 marking four

consecutive months of expansion.

See:

https://www.nationthailand.com/business/investment/40041138 a

nd https://www.nationthailand.com/business/trade/40041207

Internal crisis continues

Since the February 2021 the country has been plagued by

social, political and ethnic turmoil. The conflict has

displaced 3 million people and led to thousands of deaths.

A report by the Special Advisory Council for Myanmar,

an independent advisory group of international experts to

provide an international platform for the democratic

movement in Myanmar, says the government has lost

control over 86% of the country’s townships.

International efforts to resolve the conflict, including

ASEAN's Five-Point Consensus, have largely failed

See: https://specialadvisorycouncil.org/2024/05/briefing-paper-

effective-control-in-myanmar-2024-update/

Overland trade – who in control?

The Institute for Strategy and Policy-Myanmar, a Yangon-

based think-tank, publishes regular reports on the state of

the country with an assessment of the overland trade

between Myanmar and its neighbours.

Among the various statistics in a recent report was the

conclusion that ethnic armed organiszations (EAOs)

opposed to the military are now in control of trade routes

responsible for nearly all of the country’s overland trade

with China.

As the report states, “of the 17 official border trade

stations between Myanmar and its five neighbours India,

China, Thailand, Bangladesh and Laos, resistance groups

now control five: three bordering China (Muse,

Chinshwehaw, and Lwegel), one bordering Thailand

(Mese), and one bordering India (Rihkhawdar).

See: https://thediplomat.com/2024/09/myanmars-border-trade-

with-china-and-thailand-has-collapsed/

and

https://ispmyanmar.com/mp-64/

6.

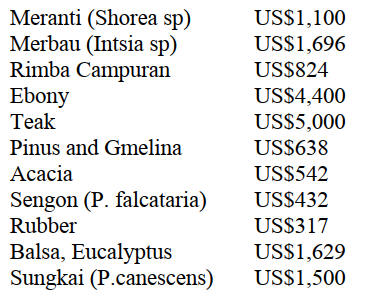

INDIA

Inflation subdued but

price index for veneers tilts up

The annual rate of inflation based on the India Wholesale

Price Index (WPI) was 2.04% for July 2024. The rate of

inflation in July 2024 was primarily due to increases in

prices of food, manufactured food products, mineral oils,

crude petroleum & natural gas and the group ‘other

manufacturing’.

Out of the 22 NIC two-digit groups for manufactured

products, 13 groups saw an increase in prices and 9 groups

a decrease. Some of the important groups that showed

month on month price increases were chemicals and

chemical products, food products, fabricated metal

products (except machinery and equipment) textiles and

‘other manufacturing’.

Some of the groups that witnessed a decrease in prices

compared to June were basic metals, other non-metallic

mineral products, computers, electronic and optical

products, machinery and equipment and furniture.

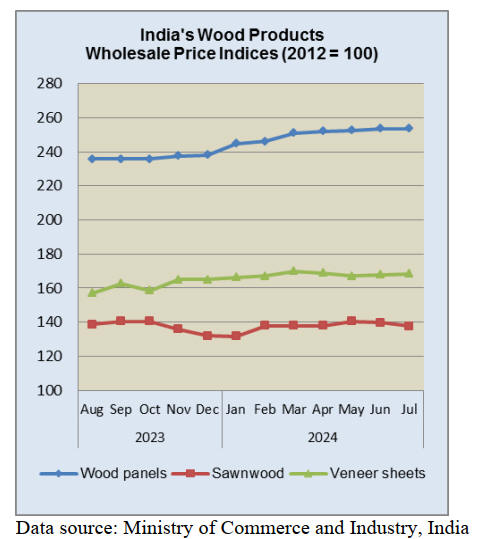

The index for wood panels has risen steadily since the

beginning of the year. In July veneer prices rose but the

sawnwood index showed a decline.

See: https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Indian companies face challenges with EUDR

compliance

The EUDR will have significant implications for India’s

woodworking industry according to local trade media

particularly concerning its export markets. India is a

supplier of wooden furniture to Europe and the new

regulation will necessitate substantial adjustments in how

Indian companies source, process and document their

wood product flows.

One of the primary challenges for Indian exporters

will be

compliance with the stringent traceability requirements of

the EUDR.

This requirement will be particularly demanding for Indian

suppliers who often source wood from domestic small

holders where detailed traceability is difficult to establish.

Compliance with the EUDR will likely result in increased

operational costs for Indian woodworking companies.

The EUDR could also encourage broader adoption of

sustainable forestry practices in India. As demand for

sustainably sources wood increases there will be a greater

incentive for Indian forestry operators to adopt sustainable

methods. This shift could have long-term environmental

benefits and improve the overall sustainability of India’s

forestry and woodworking sectors.

Collaboration between the government, industry

associations and international bodies could be crucial in

helping Indian exporters meet the EUDR requirements.

Indian woodworking companies might also look to

diversify their markets to reduce reliance on Europe. Such

a strategy would require comprehensive market research

and development of new trade relationships.

See:

https://woodnews.in/articledetails.php?cat_id=61&scat_id=2006

&art_id=3236

Acceptance of a wideer range of species for veneer

PlyReporter has highlighted a recent shift in log raw

material sourcing by the plywood sector, particularly for

the production of core veneer. The change on the part of

plywood manufacturers has seen the arrival of logs for

core veneer peeling from Uruguay, Australia, Argentina.

There are also reports that import of core veneer from

Vietnam, Tanzania and Brazil is helping to ease the

extreme difficulty in sourcing logs from domestic

resources.

The Plywood industries in States like Gujarat, Rajasthan,

West Bengal, Maharashtra and Andhra Pradesh have been

using imported core veneers and logs. says PlyReporter.

As imported logs become a viable option for core veneer

production plywood production has become more secure

giving a boost to those secondary manufacturers that

utilise plywood as their raw material.

The acceptance of a wide range of species for veneer cores

is good for log exporters and has revitalized port-based

plywood units in India. Ply Reporter says “There are

approximately 160 plywood presses set up in Kandla

region, and all are becoming more active now with

improving imported timber supply scenario”.

Rise in average house prices

In a press release Credai has reported that positive

sentiment among prospective home buyers has resulted in

lifting average house prices by 10% during the first quarter

of 2024.

Each of the top eight cities reported year on year

appreciation of average house prices. In Bengaluru, Delhi

NCR, Ahmedabad and Pune registered double digit

growth was observed.

Although the market appeared the level of unsold

inventory also rose. Notably, Pune led with a year on year

10% rise in unsold inventory followed by Delhi NCR and

Ahmedabad. As of the end of the first quarter 2024 unsold

inventory in the top eight cities stood close to 10 lakh units

with Mumbai Metropolitan Region alone having almost a

40% share.

See: https://www.credai.org/media/view-details/465

GAIN report - increased reliance on imported timber

A June GAIN report from the US Agricultural service says

“ India’s annual import of logs, lumber and wood products

has increased from US$630 million to US$2.3 billion over

the past two decades, with U.S. market share reaching a

record high US$84 million in 2023. Limited domestic

supplies coupled with booming retail furniture, handicraft

and hospitality sectors are driving demand for newer

species. Exporters are also increasingly sourcing imported

species to meet certification requirements in export

markets”.

The Gain report continues “India’s burgeoning

construction, housing, furniture and handicrafts industries

are increasingly relying on imported forest products to

increase output. Government estimates 51 percent of

India’s population will be living in urban areas by 2047,

leading to a demand surge for furniture products. India’s

furniture market is valued at US$24 billion in 2023,

making it the fifth largest producer and fourth largest

consumer globally, with an expected annualised growth

rate of 11 percent from 2023-28”.

India’s construction, housing, furniture and handicrafts

industries are increasingly relying on imported forest

products. Government estimates 51 percent of India’s

population will be living in urban areas by 2047, leading

to a demand surge for wood products.

See: https://fas.usda.gov/data/india-wood-and-wood-products-

update-2024

7.

VIETNAM

Wood and wood product (W&WP) trade

highlights

According to Vietnam Customs in August 2024

W&WP exports reached US$1.35 billion, down 2.2%

compared to July 2024 but up 4.5% compared to August

2023. Of this, WP exports were US$931 million, down 5%

compared to July 2024 but up 10% compared to August

2023. Over the first 8 months of 2024 W&WP exports

amounted to US$10.2 billion, up 21% over the same

period in 2023 of which WP exports contributed US$7

billion, up 22% over the same period in 2023.

W&WP exports to Canada in August 2024 were valued

at US$19.6 million, up 3.3% compared to August 2023. In

the first 8 months of 2024 W&WP exports to Canada were

valued atr US$153 million, up 22% over the same period

in 2023.

Vietnam’s exports of living and dining room furniture

in August 2024 earned US$243 million, up 15% compared

to August 2023. In the first 8 months of 2024 exports of

living and dining room furniture brought in about US$1.7

billion, up 23% over the same period in 2023.

Vietnam's W&WP imports in August 2024 stood at

US$270 million, up 3% compared to July 2024 and up

46% compared to August 2023. In the first 8 months of

2024 W&WP imports cost US$1.8 billion, up 27% over

the same period in 2023.

In August 2024 NTFP export were estimated at US$70

million, up 2% compared to July 2024 and up 8% over the

same period in 2023. In the first 8 months of 2024 NTFP

exports amounted to US$547 million, up 13% over the

same period in 2023.

W&WP exports expected to grow between 15 – 18% in

2024

According to the Forestry Department (DOF) WP exports

(mostly high-end/value-added indoor/outdoor furniture)

reached US$5.967 billion, up 22% and other products

(woodchip, woodpellet, wood-based panels) earned

US$2.785 billion, up 21%.

W&WPs from Vietnam went to the US, US$5.019 billion,

up 24%; China, US$1.22 billion, up 38%; Japan, US$949

million, down 2.7%; South Korea, US$472 million, down

1% and the EU US$555 million, up 22%.

Woodchip exports surged by 38% and wooden furniture

increased by 20% compared to the same period in 2023.

Associations and processing enterprises have made efforts

and been proactive in production and market promotion,

says the DOF.

Commenting on the export market Nguyen Liem,

Chairman of Binh Duong Furniture Association (BIFA)

said that high interest rates in many countries are

dampening demand.

Current order book positions for many companies are

short

(just 1–2 months) to fill the reduced inventory rather than

that of 6 months or the whole year.

"Small orders, urgent delivery and reduced purchase

prices

are the common picture of export industries, including the

wood industry", said Nguyen Liem.

However, he said that importer inventories are

decreasing

as global demand for wood products turns up. Following a

difficult period of politic, market, interest rate uncertainties

signs of improvement and recovery appear. He anticipated

Vietnam’s W&WP exports will grow by 15-18%, bringing

in US$15.5-16 billion this year.

According to expert judgement there have been good

signs

in the export markets in the first 8 months of 2024

compared to the same period in 2023. However, it is too

early to state that the markets will be well maintained

throughout the year and be sustainable.

Limited economic growth in major markets, high

inflation,

high credit interest rates as well as the high production and

logistics costs, among others, may hamper Vietnam’s

W&WP exports. In addition, the geopolitical instability

with Russia – Ukraine and the tense in the Middle East

may further negatively affect the supply chain.

W&WP imports in the first 8 months of 2024

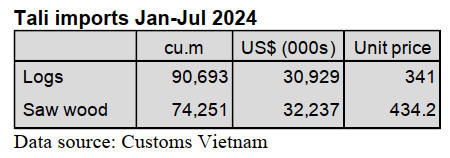

Tali (and substitute) imports

Vietnam's tali imports in August 2024 amounted to 28,800

cu.m, worth US$11.3 million, up 3% in volume and 3% in

value compared to July 2024 and compared to August

2023, imports increased by 45% in volume and 48% in

value.

In the first 8 months of 2024 imports of tali are estimated

at 193,000 cu.m, worth US$74.2 million, down 27% in

volume and 33% in value over the same period in 2023.

Tali (and substitute) log and sawnwood imports

In the first 7 months of 2024 the volume of tali logs

imported into Vietnam was 90,700 cu.m, worth US$30.9

million, down 25% in volume and down 30% in value

over the same period in 2023. Imports of tali sawnwood

stood at 74,300 cu.m, worth US$32.2 million, down 41%

in volume and 45% in value over the same period in 2023.

Tali suppliers

In the first 7 months of 2024, tali imports from major

suppliers decreased against the same period in 2023, while

imports from China, Singapore, Cambodia, UAE rose.

In particular,̉ tali imports from Cameroon fell by

36% in

volume and 41% in value over the same period in 2023,

reaching 109,600 cu.m, worth U$42.7 million and

accounting for 67% of total imports.

Imports of this wood from the Congo amounted to

18,500

cu.m, worth US$7.1 million, down 15% in volume and

down 29% in value over the same period in 2023.

In addition, tali imports from some other markets

decreased year-on-year, such as from Gabon down 33%;

from Nigeria by 29%; from Laos by 47%; Ghana by 31%;

from Equatorial Guinea by 817%; from Hong Kong by

92%.

In contrast imports of tali from China surged by

242%

over the same period in 2023, reaching 8,300 cu.m as well

as from Singapore reaching 1,040 cu.m; and from

Cambodia reaching 884 cu.m.

Wood industry seizes opportunities to achieve

US$15.2 billion export target

Vietnam's W&WP exports are expected to boom in the last

months of this year with a growth rate of over 20% amid

positive signs of recovery in most markets.

“The export market for timber and wood products is

seeing

positive recovery signals, particularly in the main export

products, including wood chips, which have increased by

nearly 38% and timber and wood products, which have

risen by over 20% year-on-year,” according to the Director

of the Forestry.

Vietnam's wood and forestry sector aims to export

$15.2

billion this year, an increase from $14.47 billion last year.

However, experts believe that to achieve this target the

wood industry will face many obstacles.

Since the slowdown in 2023 from the beginning of

this

year wood and forestry processing associations and

enterprises have been proactive in production and seeking

export markets.

A series of market exploration fairs were held,

attracting

customers’ interest in Vietnamese wood products.

Lê Minh Thiện, chairman of the Bình Định Timber and

Forest Products Association, said if wood industry

businesses comply well with the EUDR it will enhance

their competitiveness in the EU and the penetration of

wood products into this market will increase significantly.

However, if companies fail to meet the EUDR

requirements their goods will face difficulty entering the

EU market.

Regarding solutions for the Vietnamese wood

industry, Chairman of the Việt Nam Timber and Forest

Products Association Đỗ Xuân Lập said that businesses

need to focus on improving competitiveness based on five

main pillars. It includes improving production techniques

and using technology, emission reduction, trade promotion

and building internal monitoring standards.

Chairman of the Bình Dương Wood Processing

Association (BIFA) Nguyễn Liêm assessed that the recent

strong growth in wood and wood product exports is a

positive outcome for Vietnam’s wood industry amid many

difficulties.

“However, to grow and develop sustainably wood

industry

enterprises need to proactively adapt to all conditions and

circumstances, thereby making flexible changes in

production, business and export processes. The

development of technology and the supply chain for

products, from raw materials to logistics, is very critical,”

he added.

See: https://vietnamnews.vn/economy/1662453/wood-industry-

seizes-opportunities-to-achieve-15-2-billion-export-target.html

Vietnamese wooden cabinets: US concludes

investigation

The Trade Remedies Authority (Ministry of Industry and

Trade) of Vietnam announced that the US Department of

Commerce (DOC) has finalised its investigation into anti-

dumping and anti-circumvention measures on wooden

cabinets imported from Vietnam.

The DOC upheld its preliminary findings from September

2023, determining that three types of Vietnamese cabinets

with components made in China are subject to existing

duties on Chinese products. However, the broader

investigation into anti-circumvention duties was canceled.

Vietnamese exporters must use a self-certification

mechanism and provide documentation to avoid anti-

dumping and countervailing duties.

This documentation must be maintained for five years for

potential verification by U.S. authorities.

The DOC will notify U.S. Customs and Border Protection

to implement this self-certification regime, which excludes

Vietnamese products not falling under the specified

categories from duties.

The investigations were initiated by the DOC in May and

June 2022, with existing anti-dumping and countervailing

duties on Chinese cabinets ranging from 4.37% to

262.18% and 13.33% to 293.45%, respectively.

See: https://vietnamwood.com.vn/u-s-cancels-investigation-

vietnam-wooden-cabinets/

8. BRAIL

Biome restoration in the Atlantic Forest

The Brazilian Forest Service (SFB) has signed its first

Federal forest concession contract in the Atlantic Forest

biome covering over 3,000 hectares in the Irati National

Forest in the State of Paraná, southern Brazil.

The project wil undertake restoration by replacing exotic

species with native species like araucaria (Araucaria

angustifolia), tree fern and imbuia (Ocotea porosa). The

contract, signed with the company Ibema Participações

S.A., will run for 35 years and includes phases for forest

restoration followed by the potential commercial use of

the planted forests.

In addition, the forest concession allows the use of carbon

credits as supplementary revenue and it is part of the

Investment Partnerships Program (PPI) with support from

the Ministry of the Environment and Climate Change

(MMA), the National Bank for Economic and Social

Development (BNDES) and the Chico Mendes Institute

for Biodiversity Conservation (ICMBio).

See: https://forestnews.com.br/servico-florestal-assina-1o-

contrato-de-concessao-na-mata-atlantica/

Amazon drought disrupts forest regeneration

A study conducted by EMBRAPA (Brazilian Agricultural

Research Corporation) has revealed that continuous

droughts have delayed the replenishment of timber stocks

in managed forests in the Amazon by 20 years, extending

the regeneration cycle from 25 to 45 years.

The research, carried out over a 600-hectare in the

municipality of Lábrea (Amazonas State) from 2000 to

2022 indicated that climatic events such as El Niño

increased tree mortality and negatively affected forest

recovery process. Initially it was expected that the forest

would recover within 25 years, however, recovery has

been slower due to reduced rainfall and extended droughts.

The results of evaluations corroborate findings from

previous studies conducted in the forests of Acre State in

the Amazon Region and other tropical forests which have

shown that tree mortality is associated with climatic

events.

The study highlights the need for further

investigations

into the influence of climate change on forest regeneration

and which commercial timber species are most vulnerable.

The information generated by the study will be compiled

into a database, currently under construction, which will

be made available to research institutions, forestry

professionals and other interested parties through

Embrapa's Research Data Repository (Repositório de

Dados de Pesquisa da EMBRAPA - Redape).

See: https://forestnews.com.br/secas-atrasam-em-20-anos-a-

reposicao-de-estoques-de-madeira-em-floresta-manejada/

Woodtrade Brazil – focus on export opportunities

The 5th Woodtrade Brazil 2024 was held 16 September in

Curitiba and addressed trends and opportunities in the UK

and US markets, underlining Brazil's role as a global

timber and timber products supplier.

The event included two foreign organisations, the UK

Timber Trade Federation and the US National Wooden

Pallet and Container Association (NWPCA). The UK

Timber Trade Federation will provided an analysis of

current trends as well as perspectives and opportunities for

the Brazilian timber industry in the British context.

Meanwhile, NWPCA focused on the American pallet and

packaging market.

Brazil is a significant global supplier of wood exporting a

range of products including plywood, sawnwood,

mouldings, pellets, flooring, doors and pallets. Major

export markets include the United States, the European

Union and the United Kingdom.

Woodtrade Brazil Fair is organised by the Brazilian

Association of Mechanically Processed Wood Industries

(ABIMCI) in partnership with the Federation of Industries

of Paraná (FIEP) and Malinovski and is part of the

International Wood Week (SIM). This also includes the

Lignum Latin America Fair and other related events which

will deliver technical content, innovations, trends and

emerging technologies that are shaping the future of the

timber industry.

See: https://abimci.com.br/mercados-estrategicos-para-a-

exportacao-de-produtos-madeireiros-do-brasil-sao-destaque-no-

woodtrade-brazil-2024/

Sustainable production of timber from natural forests

The forest sector in the State of Mato Grosso, a major

timber producing state in the Amazon Region, stands out

for its sustainable practices in timber production from

natural forests.

Forest News reports exporters who invest in sustainable

forest management and technologies to minimise

ecological impacts are gaining recognition, especially in

demanding international markets such as Europe and

North America, along with Asian markets. These three

main international markets accounted for 54% of Mato

Grosso’s forest product exports in 2024, generating

US$23.5 million in the first seven months of this year

according to the Ministry of Agriculture and Livestock

(MAPA).

Forest News writes “sustainable practices have added

value to wood products and positioned manufacturers in

the State as a benchmark for protecting the Amazon and

responsible economic development. Forest-based

companies have sustained their operations and gained new

markets that demand and prioritise products with

traceability and environmental responsibility, pillars of the

future of the forest sector”.

See: https://forestnews.com.br/exportadores-de-madeira-nativa-

em-mato-grosso-se-destacam-por-producao-sustentavel/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

See: https://www.itto-

ggsc.org/static/upload/file/20240822/1724289606498649.pdf

9. PERU

Ucayali - more than 800

forest fires

The Forest and Wildlife Service (SERFOR) has reported

that in Ucayal,i so far this year, around 840 forest fires

have been reported. During the first and second week of

September, every dawn the city wakes to a haze of smoke

due to nearby forest fires.

The departmental commander of the Ucayali Fire Service

reported that in August alone 46 emergencies were

attended mainly in the districts of Campo Verde and

Nueva Requena, areas prone to fires due to high

temperatures and dry vegetation.

This increase in fires coincides with the alert issued by the

National Meteorological and Hydrological Service of Peru

which warned of an increase in hot spots in the Amazon

region.

The commander of the Ucayali fire Service explained that

the main cause was the uncontrolled burning of fields, a

common practice among local farmers to prepare their

land. "The fire easily gets out of control due to the strong

winds and dry vegetation.

According to the Director of monitoring and evaluation of

natural resources at SERFOR an alarming 98% of forest

fires in Peru are caused by human action. "The country has

recorded more than 2,500 forest fires so far this year,

affecting not only people's lives, but also the essential

ecosystem services that nature provides, he said.

OSINFOR cooperation with Honduras

The Forest and Wildlife Resources Oversight Agency

(OSINFOR) uses a technology that alerts the authorities

when cases are identified that affect the sustainable use of

forest resources. Within the framework of the South-South

and Triangular Cooperation Project OSINFOR is

transferring this technology, called Forest Alerts, to

Honduras to be adopted in the country.

This initiative is an important step in consolidating the

efforts of both countries to conserve their natural resources

and combat illegal activities that threaten their forests and

reaffirms the commitment of Peru and Honduras in the

fight against environmental crimes.

See: https://www.gob.pe/institucion/osinfor/noticias/1017547-el-

osinfor-transfiere-a-honduras-mecanismo-de-alertas-para-

combatir-delitos-forestales-y-fortalecer-la-gestion-de-los-

bosques

In related news, within the framework of the work plan

established with regional governments OSINFOR

transferred a national methodology for the study of the

index and percentage of illegal logging and timber trade to

Loreto with the aim of replicating it in this Amazon

Region. This will allow the regional forestry authority to

make more effective decisions in the fight against illegal

logging.

OSINFOR will provide technical assistance throughout

the process comprising representatives from the eight

Provinces of Loreto with the support of the National

University of the Peruvian Amazon (UNAP), the National

Forest and Wildlife Service (SERFOR) and the technical

and financial support of the USAID FOREST+ program

and the United States Forest Service.

See: https://www.gob.pe/institucion/osinfor/noticias/1021037-el-

osinfor-transfiere-a-loreto-metodologia-para-medir-y-hacer-

frente-a-la-tala-ilegal

|