Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Aug

2024

Japan Yen 144.37

Reports From Japan

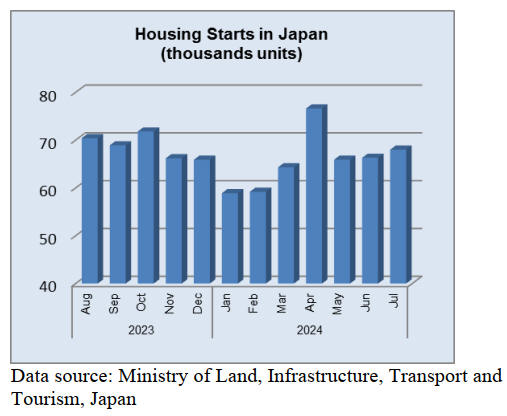

Rise in personal consumption lifts growth

Japan's economy expanded at a much faster-than-expected

annualised 3.1% in the second quarter, rebounding from a

slump at the start of the year. Capital investment increased

by 0.9 percent, and housing investment was up by 1.6%.

The improvement was attributed to a rise in personal

consumption and the suggestion that another interest rate

increase is likely.

The Bank of Japan had forecast that a solid economic

recovery will help address inflation and justify raising

interest rates further.

See: https://www3.nhk.or.jp/nhkworld/en/news/20240815_07/

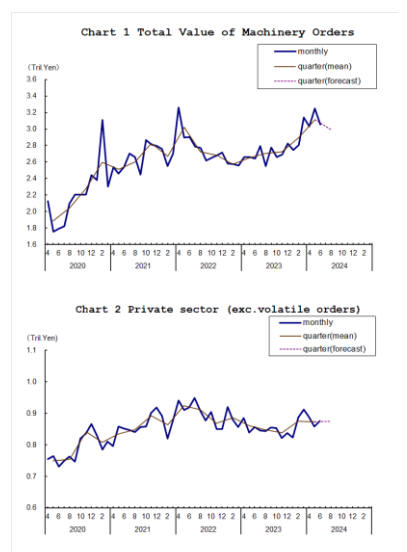

Second quarter machinery orders disappoint

The total value of machinery orders received by 280

manufacturers operating in Japan decreased by 6% in June

from the previous month however, in the April-June

period there was a 7.4% quarter on quarter rise.

Private-sector machinery orders, excluding volatile ones

for ships and those from electric power companies,

increased by 21% in June but showed decreased by 0.1%

in April-June period.

The Cabinet Office maintained its assessment that there

has not been a significant rise in machinery orders as core

machinery orders from manufacturers shrank reflecting a

decrease in orders for semiconductor production

equipment. In the July-September period machinery orders

were forecast to decrease by 4% and private-sector orders,

excluding volatile ones, are forecast to increase slightly

from the previous quarter.

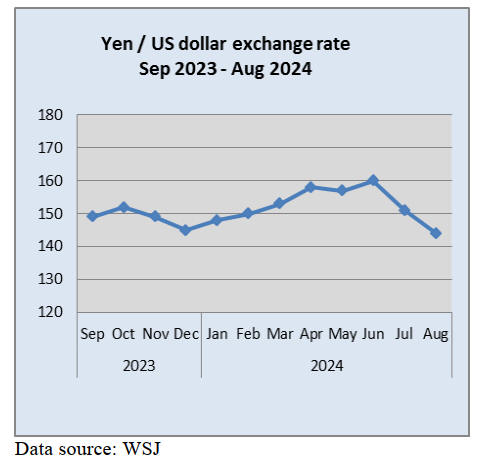

Companies report record profit – outlook uncertain

Japanese companies have just posted record quarterly

profits but the yen’s rebound is fueling worries about just

how sustainable their earnings growth will be amid weak

demand in China and the risk of a slowing US economy.

The outlook is uncertain, however, as the strengthening

yen will dent export growth.

Analysts estimate that each 1 yen appreciation in the

Japanese currency against the dollar could reduce profits

by up to 0.6%.

See:

https://www.japantimes.co.jp/business/2024/08/22/companies/ye

n-rise-hampers-japan-firm-growth/

Typhoon No.10 inflicts serious damage

Torrential rain in late August caused serious flooding in

many areas. The Meteorological Agency issued warnings

for Tokyo and surrounding areas as unstable atmospheric

conditions hit the region. Known colloquially in Japan as

‘guerrilla rainstorms’ these are localised heavy downpours

occurring suddenly and are difficult to predict.

At the end of August Japan was bracing for what is likely

to be the strongest typhoon to make landfall. Winds of up

to 250 km/hour were forecast and serious damage to

property has been reported.

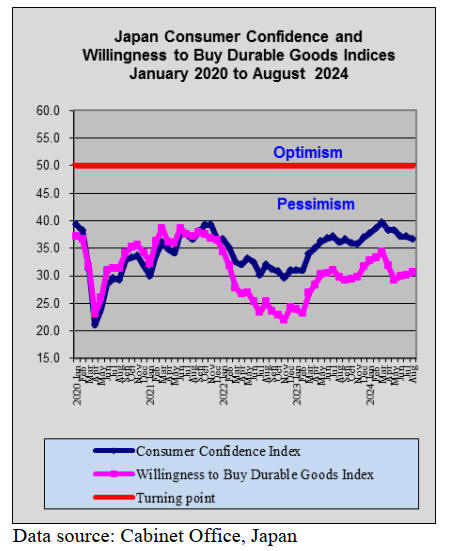

Little change in consumer confidence index

The Cabinet Office has reported the seasonally adjusted

consumer confidence index was 36.7 in August, almost

unchanged from the previous month.

The income growth indicator was down to 39.7 while the

overall livelihood index moved up to 34.7. In contrast the

employment index weakened but the willingness to buy

durable goods rose slightly.

Yen appreciation continues

The yen appreciated in the last half of August driven by

hawkish sentiments by a variety of officials, some from

the Bank of Japan (BoJ). An additional factor could have

been the ‘safe-haven’ flows amid rising geopolitical

tensions.

See: https://www.fxstreet.com/news/japanese-yen-rises-due-to-

increasing-odds-of-a-further-boj-rate-hike-202408190401

Suggestion of two more interest rate increases

In an interview the Head of Mizuho Financial Group Bank

suggested the Bank of Japan (BoJ) could hike interest rates

twice by the end of March 2025 to reach 0.5%, reflecting a

sustained growth in the Japanese economy. This would

have an impact on commercial bank lending rates and will

affect mortgage holders.

However, the Chief Executive Officer of Mizuho Bank is

repoted as saying “rate hikes won't be a tool to arrest the

weakening yen, which has plunged to a 38-year low

against the dollar,”

The BoJ ended negative interest rates after eight years in

March this year but there is no concensus amongst

analysts when another interest rate will be announced.

See: https://asia.nikkei.com/Business/Finance/Japanese-banks-

lending-rates-rise-for-7th-straight-month

International Conference on African Development

Ministers from African nations and Japan meet in Tokyo

and pledged to collaborate on finding solutions to climate

change and other global challenges. Ministers and other

representatives from Japan and 47 of African’s 54

countries attended the meeting in Tokyo.

The Tokyo International Conference on African

Development concluded with the adoption of TICAD’s

first joint communique which also includes the need to

create a supportive environment for startups to promote

investment in Africa. The meeting served as a preparatory

step for the 9th TICAD summit scheduled to be held in

Yokohama next August.

See: https://www.mofa.go.jp/files/100715925.pdf

Import update

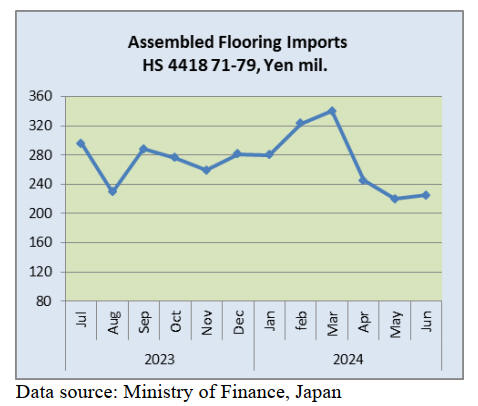

Assembled wooden flooring imports

After two consecutive monthly declines the value of

Japan’s wooden flooring (HS441871-79) imports rose

slightly in June but with the yen at around 115 to the US

dollar in June the uptick in imports was of little

significance. In the first quarter of this year the month on

month value of imports was rising faster than the pace of

yen depreciation signaling the import volumes were rising.

That changed in the second quarter.

Despite the erratic trend in the value of imports during the

first half of this year compared to June 2023 imports, the

performance in June 2024 was average and month on

month June 2024 imports were around 12% higher.

As in previous months the main category of assembled

flooring imports was HS441875, accounting for 76% of

the total value of assembled flooring imports, up from the

68% in May. The second largest category in terms of value

was HS441879 followed by HS 441874.

Shippers in China accounted for almost 70% of Japan’s

imports of assembled wooden flooring in June with

shippers in Vietnam accounting for another 15%. Of the

balance shippers in Thailand and Austria did well in June

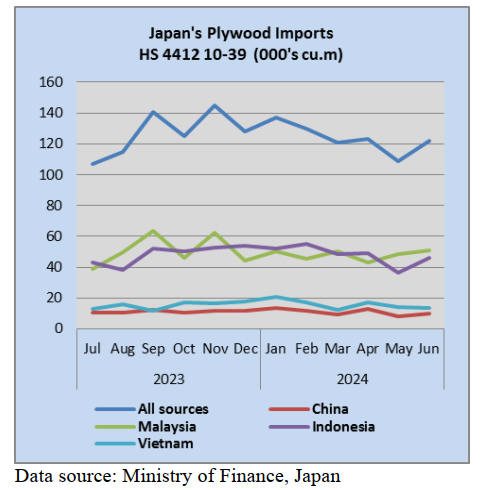

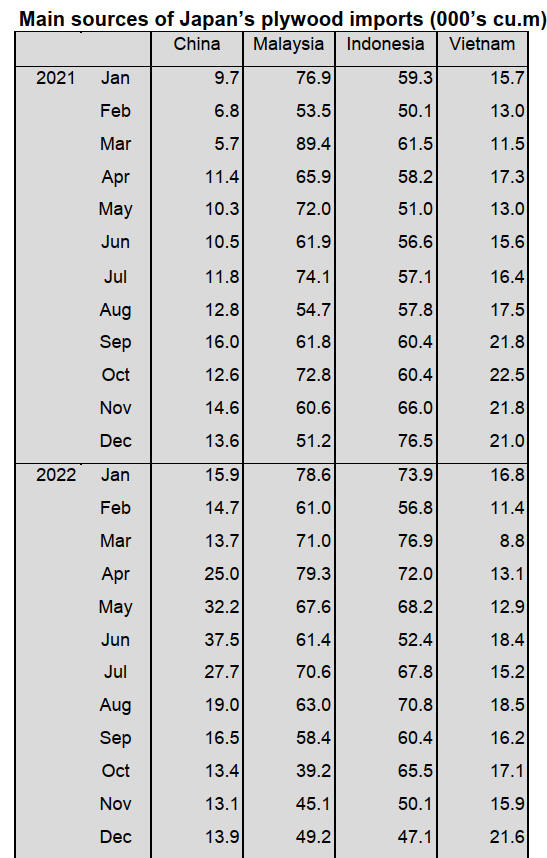

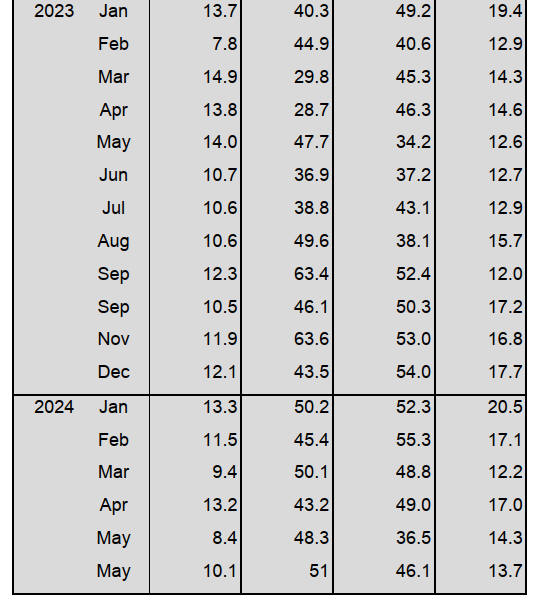

Plywood imports

Year on year, the volume of June plywood imports

(441210-39) was 121,846 cu.m up over 25% from the

volume recorded for June 2023 and month on month there

was an 12% increase in the volume of imports. Shippers in

Indonesia and China recorded a month on month increase

in volumes dispatched, June arrivals from Malaysia were

at around the same level as in May while shipments from

Vietnam dropped in June from a month earlier.

Of the various categories of plywood imported, 87%

was

HS441231 in June with HS441233 and HS441234 each

accounting for around 5% of the balance. The four main

shippers of plywood to Japan; Indonesia, Malaysia,

Vietnam and China consistently account for over 90% of

plywood imports. Other shippers appearing in Japan’s

plywood import statistics in June were Finland, Latvia,

Taiwan P.o.C and New Zealand.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Decline in price of PKS

The price of PKS (palm kernel shells) continues falling in

Indonesia. The spot price of authenticated Indonesian PKS

was US$136, FOB per tonne, in January, 2024. However,

the price declined to US$133, FOB per tonne, in February

2024 and declined to US$130, FOB per tonne, in March,

2024. In May, 2024, the price was USUS$119, FOB per

tonne. Then, the authenticated Indonesian PKS was

USUS$110 – 115, FOB per tonne, in June, 2024. Now, the

price is USUS$90 – 95, FOB per tonne.

A reason for a decline in the price of PKS is that huge

wooden biomass power plants, which consume imported

PKS or wooden pellets in Japan, postpone their operations

due to adjusting equipment. Moreover, there was a fire at

one of huge wooden biomass power plants and the

operation has been stopped. As a result, demand for PKS

has been stagnant.

There are not a lot of new orders for PKS because some

wooden biomass power plants get PKS from the inventory

in Japan or PKS from a demurrage vessel on the sea. In

Indonesia, it is the season to harvest palm oil and there are

a lot of PKS. There had been a concern about the third

party certification but auditing organizations have been

increased for the third party certification so the concern is

solved. Therefore, supply of authenticated PKS will

increase.

The spot price of wooden pellets in Vietnam is

USUS$120, FOB per tonne. This price has been

unchanged and this is the reason that the price of PKS has

not rose because calorie consumption of PKS is low.

North American logs

North American log and lumber markets are not good.

Douglas fir lumber manufacturers in Japan do not

purchase a lot of Douglas fir logs due to low demand.

The arrival volume of Douglas fir logs at the first half of

this year is 14.2 % less than the same period last year.

However, lumber manufacturers in Japan reduce

production so there is a certain amount of Doulgas fir logs

at distributors’ inventory. It is hard to predict that demand

for Douglas fir logs would recover or not. If the yen kept

appreciating against the US dollar in August, 2024, there

would be a possibility that Japanese buyers buy Doulgas

fir logs.

There are often fires occurring at mountains in North

America and there are concerns about a shortage of

Douglas fir logs. However, Japanese buyers still do not

order because Douglas fir logs due to low demand.

The orders to precutting companies in Japan have been

increasing in July and August, 2024. It seems that demand

for houses recovers slightly but it is not for sure because

there is no schedule to produce lumber after September,

2024. As a result, the precutting companies also do not

purchase a lot of North American logs. Consumers

stopped buying domestic small sized lumber instead of

Douglas fir small sized lumber. However, it is still

difficult to sell Douglas fir small sized lumber due to low

demand.

Some Japanese wholesalers expect that the purchasing cost

would decline because the yen appreciated against the US

dollar. However, the influence of strong yen would not be

big because the yen had depreciated widely. A recovery of

demand after September, 2024 would be the focus for

sales.

Radiata pine logs and lumber

Major Japanese wholesalers raised the price of Chilean

radiata pine lumber by 3,000 yen, FOB per cbm as of

August, 2024 because the yen was nearly 160 yen against

the US dollar.

The price of Chilean radiata pine thin board used to cost

around 57,000 yen, FOB per cbm and now it costs 60,000

yen in Kanto region. The price of Chilean radiata pine thin

board in Chubu region and Kinki region will be raised in

the future.

The import cost for NZ radiata pine logs shipped from NZ

to Japan in June, 2024 is high because the yen was nearly

160 yen against the US dollar and also the price of NZ

radiata pine logs in NZ was US$8, C&F per cbm

increased. The import cost is almost same as Chilean

lumber. However, the price of NZ radiata pine logs is

unchanged so far.

Demand for crating, which is made of radiata pine, is

lower than May, 2024 in July and August, 2024.

There was a long holiday in May, 2024.It is popular to use

recycled pallets as eco-friendly so consumption of lumber

is decreasing.

Plywood

Movement of domestic structural softwood plywood is not

good because the starts are decreasing. Some plywood

manufacturers and distributors offer to raise the price in

August, 2024 and there were last-minute requests for

plywood before the holiday in the middle of August.

The price of 12 mm 3 x 6 domestic structural softwood

plywood was around 1,180 yen at the end of July in Tokyo

metropolitan area.

Movement of imported South Sea plywood, especially

painted plywood for concrete form, is dull. The yen was

160 yen against the US dollar until the beginning of July

and the yen appreciated to around 146 yen at the end of

August. At the end of July, the price of 2.4 mm 3 x 6

plywood was raised by about US$10, C&F per cbm.

In South Asia, 12 mm 3 x 6 painted plywood for concrete

form is around US$600, C&F per cbm. Plywood form is

around US$510, C&F per cbm. Structural plywood is

around US$520, C&F per cbm. 2.4 mm 3 x 6 plywood is

around US$950, C&F per cbm. 3. 7is around US$880,

C&F per cbm. 5.2 mm is around US$850, C&F per cbm.

On the other hand, the price of South Sea plywood in

Japan is deadlocked now. In Tokyo metropolitan area, 2.5

mm plywood is 780 yen, delivered per sheet. 4 mm

plywood is 1,000 yen, delivered per sheet. 5.5 mm

plywood is 1,170 – 1,200 yen, delivered per sheet.

Structural plywood is 1,650 yen, delivered per sheet. 12

mm 3 x 6 painted plywood for concrete form is around

1,950 yen, delivered per sheet. Plywood form is 1,750 yen,

delivered per sheet.

South Sea log and products

A number of inquiries for South Sea lumber and Chinese

lumber has been increasing slightly. Demand is not a lot

but distributors have to purchase South Sea lumber or

Chinese lumber because they do not have enough

inventories. Some distributors purchased a certain amount

of South Sea lumber or Chinese lumber as the yen

appreciated to 140 yen against the US dollar.

There is a lot of inquiries for South Sea lumber to produce

truck bodies. Large laminated boards made of Chinese red

pine and of Indonesian Merkus pine are leveled off from

the previous month. The prices of South Sea and Chinese

lumber are unchanged from last month in Japan. Demand

and supply for South Sea logs are balanced. Demand for

blocks for steel and shipbuilding is stable and for truck

bodies is firm.

In Malaysia, plywood manufacturers have been reducing

production and there are not enough logs. The weather in

Papua New Guinea is bad so it is difficult to predict when

the logs will be collected enough.

Period for carrying out of logs extended

The Ministry of Agriculture, Forestry and Fisheries will

extend a period for carrying out standing trees which are

contracted to be carried out this yea, and this is to control

the supply of National Forest’s lumber. One year will be

extended for free. This is a precautionary measure for

eased demand and supply. Also, The Ministry of

Agriculture, Forestry and Fisheries launches the sales

system to control supplying logs in wide areas.

National Forest lumber occupies about 15 % of domestic

lumber supply. The Ministry of Agriculture, Forestry and

Fisheries supplies logs and standing trees and focuses on

controlling the supplying of standing trees this time.

Normally, the period for carrying out the standing trees is

three years and there will be a fine when it is overdue.

Buyers are able to decide about the fine.

To find a new way of supplying logs, The Ministry of

Agriculture, Forestry and Fisheries will launch a new

system at Regional Forest Office in Hokkaido Prefecture

and Tohoku region. A reason for launching a new system

is to help other areas’ Regional Forest Office, when its

demand and supply for logs were eased extremely.

An estimate of supply for logs in 2023 is 3,160,000 cbms,

13.3 % more than 2022 and for standing trees in 2023 is

1,840,000 cbms, 5.7 % more than 2022. Total supply for

logs and standing trees in 2023 were 5,000,000 cbms, 10.4

% up from the previous year.

Supply for logs in 2024 will be 3,430,000 cbms, 5.5 %

more than last year and for standing in this year will be

9,160,000 cbms, 2.1 % more than the previous year.

|