US Dollar Exchange Rates of

10th

Aug

2024

China Yuan 7.17

Report from China

Decline in log imports

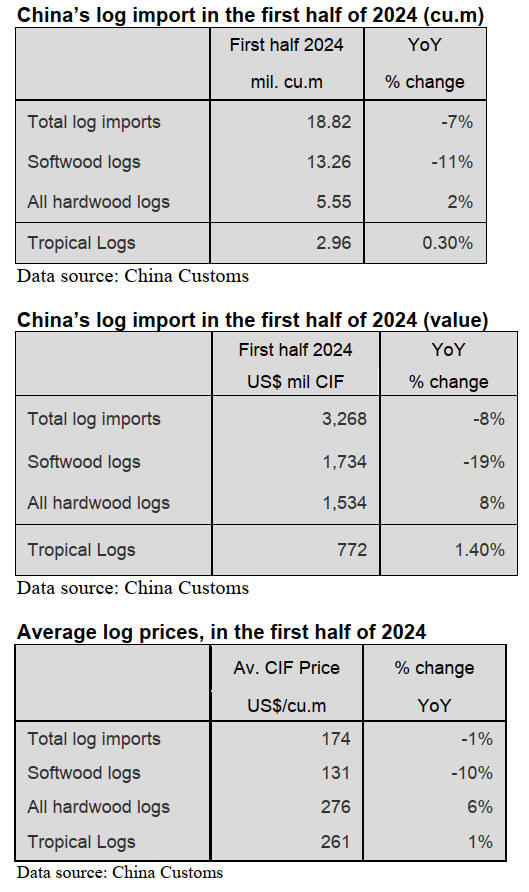

According to China Customs log imports totalled 18.82

million cubic metres valued at US$3.268 billion in the first

half of 2024, down 7% in volume and 8% in value over

the same period of 2023. The average price for imported

logs was US$174 (CIF) per cubic metre, down 1% from

the same period of 2023.

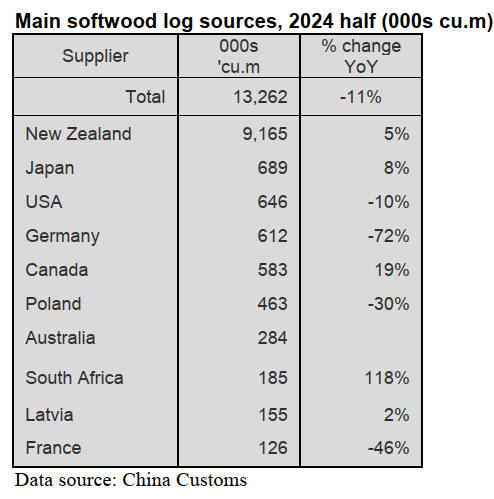

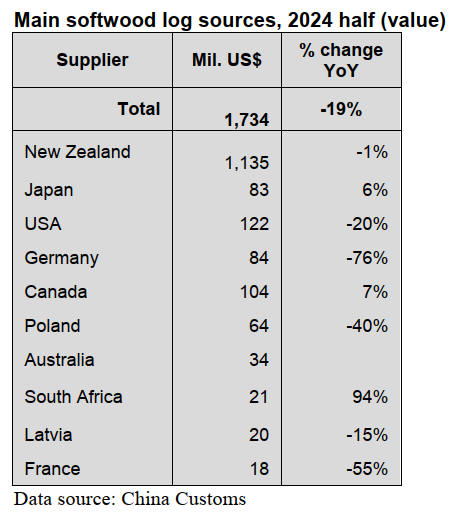

Of total log imports, softwood log imports fell 11% to

13.26 million cubic metres and accounted for 70% of the

national total, down 3 percentage points from the same

period of 2023. The average price for imported softwood

logs declined 10% to US$131 (CIF) per cubic metre over

the same period of 2023. Hardwood log imports rose 2%

to 5.55 million cubic metres, accounting for 30% of the

national total. The average price for imported hardwood

logs rose 6% to US$276 (CIF) per cubic metre over the

same period of 2023.

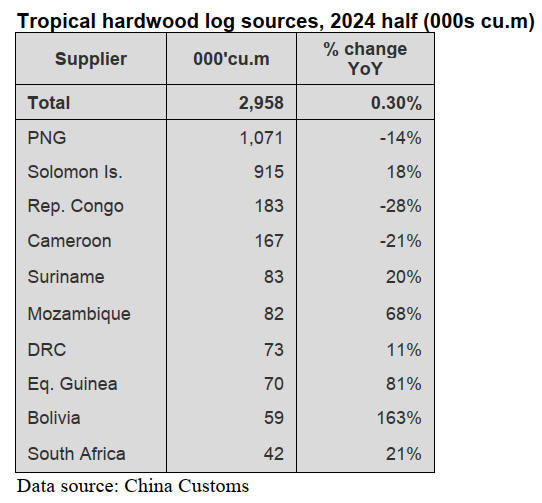

Of total hardwood log imports, tropical log imports were

2.96 million cubic metres valued at US$772 million CIF,

up 0.3% in volume and 1.4% in value from the same

period of 2023 and accounted for 16% of the national total

log import volume, up 1 percentage points over the same

period of 2023.

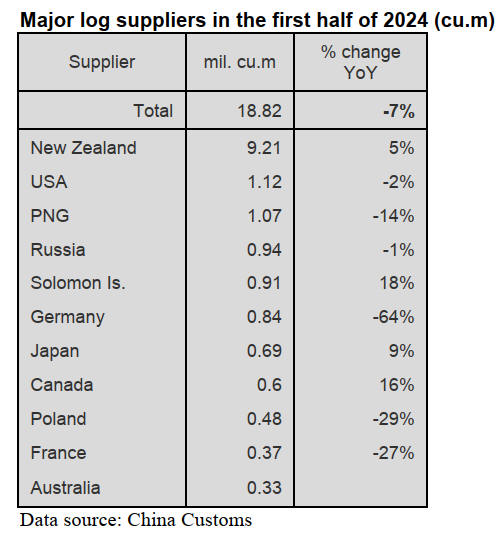

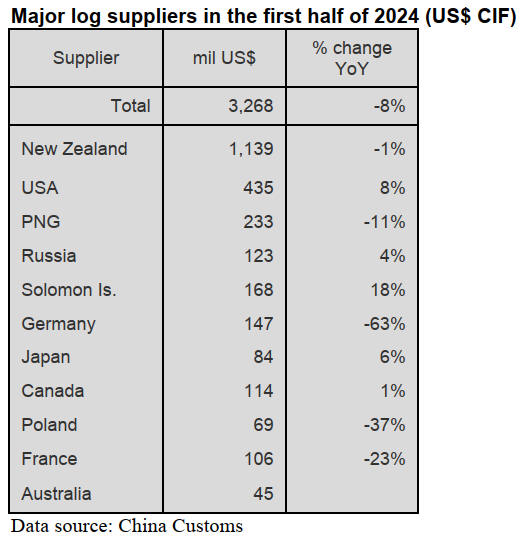

Sharp decline in log imports from EU

In the first half of 2024 China's log imports from European

Union came to 2.418 million cubic metres valued at

US$481 million, down 47% in volume and 44% in value

from the same period of 2023 and it was this trend that

impacted the decline in the total log imports.

China’s log imports from Germany, Poland and France as

the top three suppliers among the European Union, fell

64%, 29% and 27% to 842,000 cubic metres, 477,000

cubic metres and 369,000 cubic metres respectively in the

first half of 2024.

In terms of species the largest decline was large diameter

fir and spruce logs (minimum section size 15 cm and

above), which fell by 63% to 1.28 million cubic metres in

the first half of 2024. Fir and spruce imports from

Germany, Poland and France fell 73%, 46% and 40%

respectively over the same period of 2023.

Germany out of top three suppliers for imported logs

China’s log imports from Germany fell 64% to 840,000

cubic metres in the first half of 2024. Germany has

dropped out of the top three suppliers of logs to China and

was ranked sixth in the first half of 2024.

China’s spruce and fir (44032300), Korean pine and Scots

pine (44032110), Douglas fir (44032520) log imports from

Germany reduced 73%, 61% and 26% respectively.

Furthermore, the average CIF prices for spruce and fir,

Korean pine, Scots pine and Douglas fir logs fell 16%,

15% and 1% to US$137, US$132 and US$177 per cubic

metre respectively.

It has been reported that German log prices declined in the

first half of 2024 and this with the recent increases in

freight rates and local transport costs it has become

unprofitable to export.

Rise in log imports from Australia

China’s log imports from Australia fell to zero in 2022

because of a ban on imports as the quarantine service in

China detected pests in log shipments. However, in the

first half of 2023 China has resumed importing Australian

timber .

China’s log imports from Australia in the first half of 2024

surged more than 400% to 330,000 cubic metres over the

same period of 2021 ranking 11th among the top suppliers.

Slight rise in tropical log imports

China’s tropical log imports rose 0.3% to 2.958 million

cubic metres in the first half of 2024. China imported

tropical logs mainly from Papua New Guinea (36%),

Solomon Islands (31%), the Republic of Congo (6%) and

Cameroon (6%). Just 4 countries supplied nearly 80% of

China’s tropical log requirements in the first half of 2024.

China’s tropical log imports from PNG, the Republic of

Congo and Cameroon fell 14%, 28% and 21% respectively

in the first half of 2024. In contrast, China’s log imports

from the other top suppliers grew at different rates.

China’s tropical log imports from Bolivia surged in the

first half of 2024.

|