|

1.

CENTRAL AND WEST AFRICA

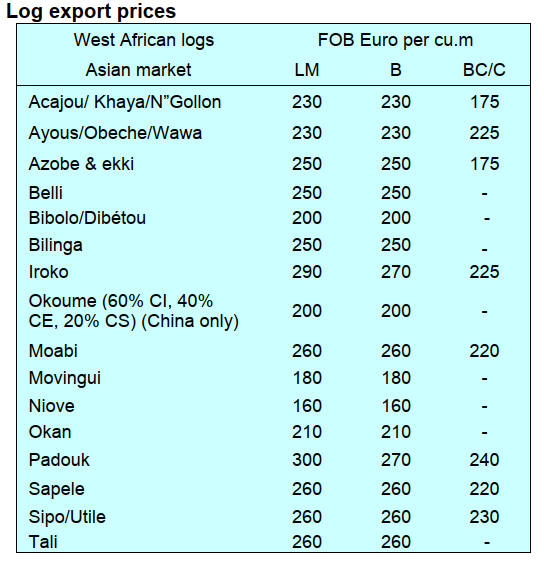

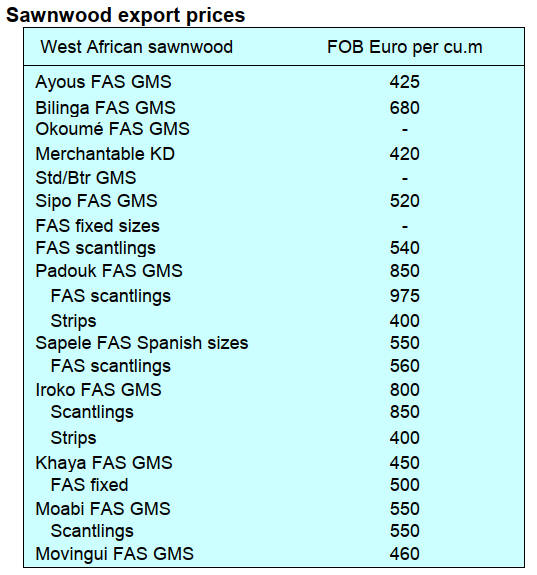

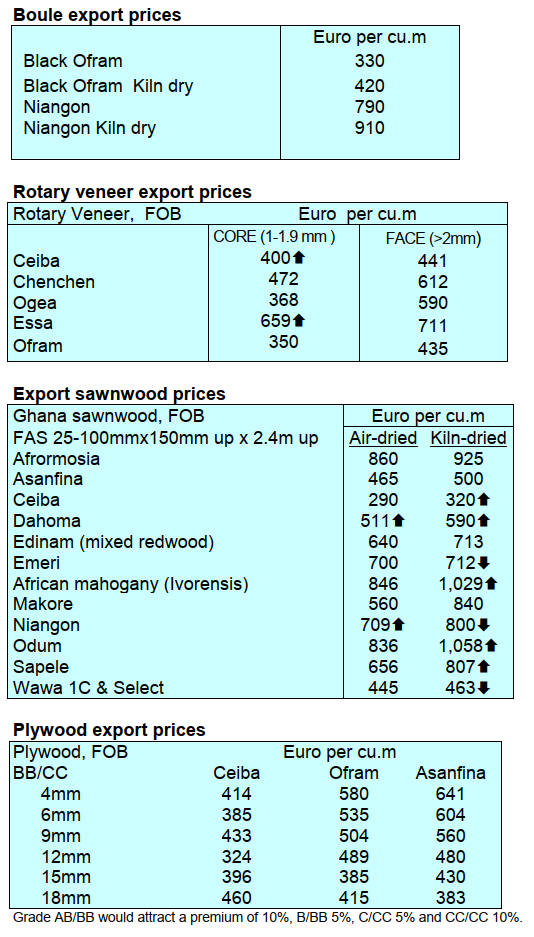

Downturn in demand from China contniues

Producers comment that markets remain challenging

especially as there has been a significant downturn in

demand from China.

Demand in China continues to decline, even with prices

for sawn okoume KD dropping to Eur400 per cubic metre

from Equatorial Guinea. As reported earlier exporters

outside of Equatorial Guinea say this cannot be matched as

production and transaction costs continue to climb.

In contrast to the China, demand from Philippine

importers remains strong driven in part due to

reconstruction following severe storms in recent months.

The pace of incoming orders from Vietnam is reported as

stable with no significant price movement reported.

The issue of high stocks in some Middle East countries is

no longer being raised and producers say the market is

starting to recover as stocks decline. Buyers in Europe are

still in holiday mood so there is currently only a trickle of

orders.

Regional update

Cameroon

Heavy rain is affecting operations in the Douala region

while around Yaoundé the weather is more favourable and

not disrupting log deliveries.

Gabon

It has been reported that five mills servicing the Chinese

market have closed due to a lack of orders. These mills do

not have logging concessions so rely on buying in logs so

cash flow is always an issue and some rely heavily on

advance payments, a problem as orders fade.

The wood based panel sector in Gabon remains stable with

strong (but currently quiet) demand in European markets

notably the Netherlands.

It has been reported that to address a vehicle shortage

forestry officers have been allocated addition vehicles to

conduct monitoring operators.

The World Bank and IMF are said to be exerting pressure

on the government to rein in expenditure which has

reportedly led to changes in government priorities. It has

been reported that the government plans to consolidate

ministries into one or two buildings to reduce high

building rental charges.

In related news, the Gabon Review has published an

article by Adrien Nkoghe Essingone, a former Member of

Parliament in Gabon, in which he calls for the lifting of

the log export ban.

The article says “since the ban on log exports the

processing rate has certainly increased but it has not

generated the expected added value in terms of budgetary

resources. Contrary to popular belief, local processing

does not always create more added value than the export

of raw products”.

See:https://www.gabonreview.com/tribune-pour-un-gabon-

forestier-le-pari-de-la-souverainete-economique/

Congo

Some Malaysian mills operating in the Congo have

reportedly cut output due to market pressures, especially

the downturn in demand from China and are shifting to

other markets to sustain operations. However, plywood

exports to Europe and Morocco remain stable.

Central African Republic

The rain season has returned to the CAR but there are no

reports of disruptions. Mills produce primarily for

European markets shipping ayous, iroko, some assamela

and sipo. The main concerns of producers are the poor

road conditions, perceived political instability and the long

distance transport to ports.

2.

GHANA

40% increase in stumpage fees agreed

The Forestry Commission met on August 11 with chiefs

and timber industry players to deliberate and review

Timber Stumpage fees. The review became necessary due

to the depreciation of the local currency and high inflation

rates. The old stumpage fees had not been reviewed in the

last six years.

Many present stated that “the review of the stumpage fees

is long overdue and has become necessary to be evaluated

as things have changed since the last review.”

The Chief Executive of the Forestry Commission, Mr.

John Allotey, stated that the revenue expected from the

stumpage would be given to the appropriate parties so they

get what is due to them according to the laws governing

the state.

The Executive Director of the Forest Services Division,

Mr. Hugh Brown, presented a Review of Timber

Stumpage Fees 2024”. According to him, stumpages are in

two parts. 50% is retained by the FC and the other half is

paid as royalties to chiefs. He went on to explain how the

stumpage fee is calculated.

According to Mr. Brown, one of the key things that has

affected the stumpage is the depreciation of the local

currency and some of the difficulties the Timber Industry

Association has faced in their businesses. This includes the

impact of external inflation on the cost of machinery and

high and rising operational costs, for example fuel, labour,

electricity and forest protection measures.

The Commission proposed a 50% increase in the current

stumpage fees to be implemented effective 1st September

this year.

The Commission also proposed a thorough stumpage fee

review process, which should be undertaken through a

multi-stakeholder consultative process in the first or

second quarter of 2025. He added that the Commission

recommended regular annual reviews to be undertaken to

progressively bring stumpage fees charged by the FC in

line with the legal provisions under the law.

The CEO of the Ghana Timber Association (GTA), Nana

Dwomoh Sarpong, appealed for a reduction of the

stumpage fee increment from 50% to 30%. He noted that

COVID-19 is still affecting the industry as they are still

paying COVID-19 tax.

From the deliberations, thoughts, and considerations, all

parties agreed to reduce the proposed 50% increment to

40%, effective 15th September, 2024.

See: https://fcghana.org/timber-stumpage-fees-reviewed/

Certificate course in Natural Resource Management

The Forestry Commission Training Centre (FCTC), which

is affiliated to the University of Energy and Natural

Resources (UENR) in Sunyani, has introduced an 18-

months Certificate in Natural Resource Management

(CNRM) Programme.

At its opening ceremony at Ejisu in the Ashanti Region

sixty-seven freshmen and women entered the programme.

The course is expected to produce mid-level technicians

for forestry and wildlife operations.

In his welcoming address, Dr. Andy Osei Okrah, Director

of FCTC, indicated that the event was to celebrate the

matriculation and unique inauguration ceremony for the

Certificate programme.

Mr. John Allotey, Chief Executive of the Forestry

Commission, said he was excited to witness the first

matriculation of the CNRM programme as the

Commission needs a well-trained and prepared workforce

for the technical task in the sector.

As part of measures to maintain standards and improve its

human resources to address the challenge of limited

technical expertise the Wood Industry Training Centre was

restructured into FCTC with the new focus to provide

training for Forestry Commission (FC) staff and allied

institutions in the forestry sector. That initiative was to

bring back the training of technical-level professionals for

the Commission and the industry.

See: https://fcghana.org/fctc-holds-maiden-cnrm-matriculation-

ceremony/

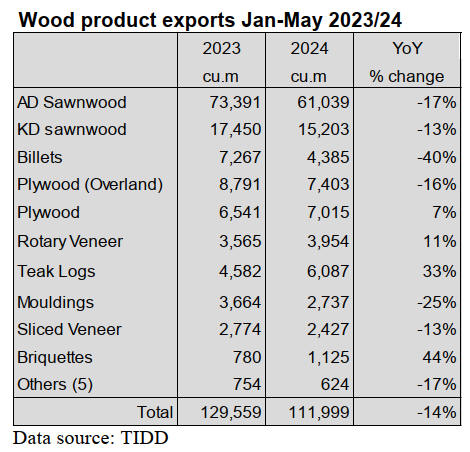

Ghana’s billet export volume dips 40%

According to data published by the Timber Industry

Development Division (TIDD) of the Forestry

Commission, Ghana’s billet export volume dropped to

4,385cu.m in the first five months of 2024, from 7,267

cu.m registered in 2024 representing a 40% decline year-

on-year.

This also resulted in a corresponding 42% drop in the total

receipts for the product for the period under consideration.

Cumulative wood export totals for the first five months of

January to May 2024 compared to same period in 2023 are

tabulated below;

The low billet export volume contributed to the poor

performance of total exports for the period, which declined

by 14% and 12% respectively. For the period reviewed

only one company exported just 16.5 cu.m in May 2024

compared to the total volume of 330 cu.m valued at Eur

106,340 in April.

Billets are a major component of the country’s primary

product exports which together with boules, kindling,

sawnwood), rollboard and teak logs earned Eur 28.54

million from 71,963 cu.m of the total export of wood

products between January and May 2024. These figures

indicated decreases of 16% and 14% in volume and value

respectively compared to the timber export figures

between January and May 2023. The major species for

billets are gmelina and teak.

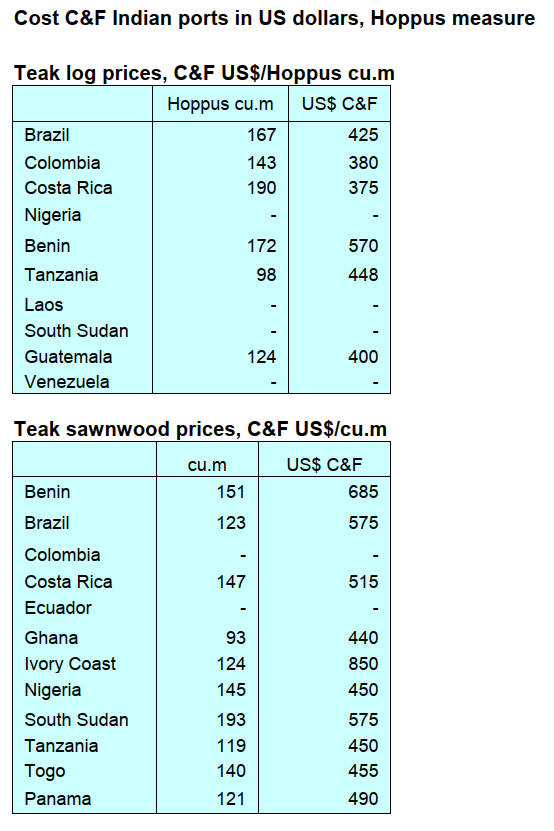

India is the main destination for Ghana’s billets, which

along with sawnwood, sliced veneer and teak logs was the

leading Asian importer of Ghana’s wood products.

Targeted support for SMEs to boost value addition

According to the Institute of Statistical, Social and

Economic Research (ISSER) at the University of Ghana,

Small and Medium-sized Enterprises (SMEs) in key

sectors of the country could promote higher value addition

to their products and services if they could secure

financing.

ISSER recommended targeted financial support for these

SMEs in their 2024 Mid-Year Budget Review titled ‘A

Critical Assessment of the 2024 Mid-Year Budget by

ISSER’. By implementing targeted measures, ISSER

believes Ghana can significantly enhance the capacity of

SMEs to add value, stimulate economic growth and attract

investment into vital sectors.

In a bid to support the country’s SMEs the government is

investing 8.2 billion Ghana cedis through the newly

launched SME Growth and Opportunity Programme.

During the launch President Nana Akufo-Addo

highlighted the modalities of the programme and indicated

it will be coordinated by the Ministry of Finance and the

Ministry of Trade and Industry.

There are around 850,000 SMEs in Ghana and they

contribute significantly to the economy accounting for an

estimated constituting around 70% GDP and providing

80% of private sector employment. Despite their

significant contribution to the country’s economy the

sector battles several challenges, especially access to

credit.

See: https://www.myjoyonline.com/isser-urges-targeted-support-

for-smes-to-boost-value-addition-in-key-sectors/

3. MALAYSIA

Ringgit strenghthens against the US dollar

On 5 August the Malaysian ringgit climbed to its strongest

against the dollar since April 2023, supported by a solid

economy as weak US economic data spurred selling of the

dollar. The ringgit had slumped since early this year,

dropping in late February to its weakest level since 1971.

The rebound came after US jobs data released

Friday showed a rise in the unemployment rate.

Sawn rubberwood shortage

For many years, according to Muar Furniture Association

president Steve Ong, furniture makers have been facing a

shortage of rubberwood. Speaking to the Star newspaper

Ong said the impact was more noticeable recently because

of changes in plantation practices and the high level of

rubberood veneer exports.

Ong said about 80% of wooden furniture in Malaysia is

produced using rubberwood. He urged the government to

intervene by limiting the export of rubberwood and to

prioritise local manufacturing.

The Furniture Association was pushing for replanting

programmes to salvage the situation hoping that such

efforts could be undertaken through a systematic

replanting plan to produce logs suitable for sawnwood

production. Ong said rubber trees planted for timber can

be harvested in seven to eight years as compared to

harvesting rubberwood from trees that produce latex

which take a period of 20 to 25 years.

See:

https://www.thestar.com.my/news/nation/2024/07/28/rubber-

wood-shortage-hits-furniture-makers

Conservation of mangrove ecosystems

A total of 20,000 mangrove trees were planted through a

strategic collaboration between Yayasan Hijau Malaysia,

Sabah Forestry Department and Wiwynn Technology

Service Malaysia in Hutan Simpan Tawau, Sungai

Mangkalitan.

Natural Resources and Environmental Sustainability

(NRES) Minister, Nik Nazmi Nik Ahmad, said the

initiative held in conjunction with the International Day

for the Conservation of Mangrove Ecosystem 2024, marks

another significant milestone for mangrove conservation

in Malaysia.

Nik Nazmi added that since 2005, the government took

significant steps to conserve and rehabilitate mangrove

areas through the Tree Planting Programme with

Mangroves and Suitable Species along National

Coastlines, an initiative following the devastating tsunami

in December 2004.

See: https://www.dailyexpress.com.my/news/239013/undefined/

Cooperation to improve upstream and downstream

sectors

The Malaysian Timber Council (MTC) aims to strengthen

its partnership with the Sarawak Timber Industry

Development Corporation (STIDC) and the private sector

towards supporting the growth of the nation’s woodbased

industry. MTC Chief Executive Officer, Noraihan Abdul

Rahman, acknowledged that the STIDC has clear plans to

improve both the upstream and downstream sectors of

Sarawak’s wood-based industry. Noraihan also said there

are opportunities for collaborative efforts in boosting

Malaysia’s wood-based and bamboo industries.

STIDC General Manager, Zainal Abidin Abdullah,

indicated that the STIDC aims to transform and modernise

the timber industry with the goal of increasing export

earnings to RM8 billion by 2030. Zainal Abidin pointed

out that a Sarawak Bamboo Community Project involved

146 participants and covered more than 63 hectares, while

the commercial bamboo plantations had expanded to 3,597

hectares across Sarawak.

See:

http://theborneopost.pressreader.com/article/281599540773234

New Permanent Forest for Sarawak

A total of 31 areas in Sarawak have been proposed as new

Permanent Forest Estates (PFE) covering an estimated

814,437 hectares according to Deputy Premier, Awang

Tengah Ali Hasan. Currently, Sarawak has 67 Totally

Protected Areas (TPA) with a total area of more than 2.1

million hectares which includes over 847,000 hectares of

land and 1.2 million hectares of water bodies as well as

118 PFEs with a total area of 3,960,381 hectares.

“I hope that the federal government would provide more

funding through the Ecological Fiscal Transfer (EFT) for

conservation activities” said the Deputy Premier.

Regarding mangrove forests, Awang Tengah disclosed

that Sarawak has so far gazetted 12,950 hectares or 19% of

the total mangrove forest area in Sarawak as TPAs.

Additionally, 11,084 hectares or 16% of the total

mangrove forest area have been designated as PFE.

See: https://www.theborneopost.com/2024/07/26/31-areas-in-

sarawak-proposed-as-new-permanent-forest-estates-says-awg-

tengah/

First carbon credits auction

Bursa Malaysia announced that its subsidiary Bursa

Carbon Exchange (BCX) conducted the first Malaysian

Carbon Credit Auction with carbon credits from the

Kuamut Rainforest Conservation Project in Sabah. This

represented a crucial step in Malaysian nature-based

carbon project showcasing Malaysia’s capacity to develop

its own carbon projects to international standards.

The auction attracted participation from businesses and

organisations committed to reduce their environmental

impact through several credible pathways, one of them by

offsetting hard to abate GHG emissions through carbon

credits. The auction of the domestic forest protection and

regeneration project was cleared at RM50 (roughly

US$11.30) per contract.

A key factor for this conservation project is that it delivers

tangible climate, community and biodiversity co-benefits

earning itself a Gold Level for Climate status under the

Climate, Community and Biodiversity (CCB) Standard.

See:

https://theborneopost.pressreader.com/article/282175066372199

4.

INDONESIA

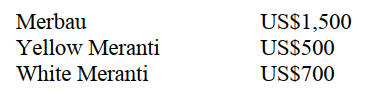

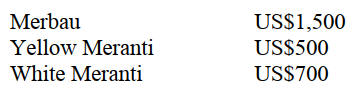

Export Benchmark Price (HPE) of Wood for

August

The following lists benchmark prices 1-31 August.

Processed Wood (prices per cu.m)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1,000 sq.mm to

4,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all

four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 4,000 sq.mm to

10,000 sq. mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 10,000 sq.mm to

15,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

See:https://jdih.kemendag.go.id/pdf/Regulasi/2024/964_Kepmen

dag%20HPE%20dan%20HR%20Produk%20Pertanian%20dan%

20Kehutanan%20Agustus%202024%20dan%20Lampiran.pdf

31 million cubic metres of Acacia logs in 2023

Statistics Indonesia (BPS) data shows that Indonesia

produced 68.22 million cubic metrs of roundwood in

2023. Acacia was the largest contributor to roundwood

production, accounting for 31.11 million cubic metres or

45.61% of the total, followed by the mixed tropical

hardwood group with 30.93 million cubic metres (45.3%)

In 2023, Sumatra was the largest roundwood producing

region of the country, with a volume reaching 46.10

million cubic metres or 67.57% of total national

production. Next came Kalimantan with 12.09 million

cubic metre (17.73%) and followed by Java with 8.67

million cubic metres (12.7%).

See: https://databoks.katadata.co.id/datapublish/2024/07/29/ini-

jenis-kayu-yang-banyak-diproduksi-indonesia-pada-2023

Indonesia is largest rattan products exporter, says

ministry

Indonesia is the world’s largest exporter of rattan products,

according to the Indonesian Ministry of Industry. The

value of Indonesia's rattan exports hit USD158.5 million,

accounting for 42.2% of the global rattan product trade of

US$375.6 million.

The ministry's Agro-Industry Director General, Putu Juli

Ardika, said Indonesia accounts for 80% of rattan on the

global market, noting that a total of 306 rattan species are

found in the country. However, only 28 species have been

utilised commercially.

According to data released by the ministry last year, the

average monthly production volume of the national rattan

furniture industry was 284,800 tonnes while that of the

national rattan processing industry stood at 17,600 tonnes.

The ministry is actively promoting improvements in the

rattan and wood supply chain for the furniture and craft

industry.

It is hoped this will have a positive impact on enhancing

the overall performance and competitiveness of these

sectors.

See:https://industri.kontan.co.id/news/kemenperin-pacu-

optimalisasi-rantai-pasok-industri-rotan

and

https://forestinsights.id/kemenperin-dorong-efisiensi-rantai-

pasok-rotan-pacu-daya-saing-industri-furnitur/

Indonesia launches SOIFO 2024 report

The Indonesian Minister of Environment and Forestry, Siti

Nurbaya, has unveiled the 2024 edition of the ‘State of

Indonesia’s Forests’ (SOIFO) report. The publication

provides updated data and insights into the condition of

Indonesia’s forests, addressing current challenges and

future opportunities in forest management. The launch

event took place during the 27th session of the FAO

Committee on Forestry (COFO) at FAO headquarters in

Rome.

During the event, Minister Siti introduced the National

Forest Monitoring System (SIMONTANA), a platform

designed to support sustainable forest management and

climate resilience as well as to enhance international

collaboration. “SIMONTANA is an integrated monitoring

platform featuring remote sensing and terrestrial

technologies.

See:

https://nasional.sindonews.com/read/1423391/15/peluncuran-

soifo-2024-platform-simontana-pantau-hutan-indonesia-secara-

akurat-1721984862

and

https://news.detik.com/berita/d-7450511/klhk-bakal-luncurkan-

buku-the-state-of-indonesias-forests-2024-di-roma

Field inspections to improve forestry data accuracy

Given the crucial role of the information in policy making,

Indonesia’s Ministry of Environment and Forestry

(KLHK) ensures the country’s geospatial forestry-related

data is accurate by conducting field checks. During a

recent podcast, Hanif Faisol Nurofiq, Director General of

Forestry Planning and Environmental Management

(PKTL), at the ministry explained that the geospatial

technology used in the One Map Indonesia Policy has

good accuracy because field inspections ensure conformity

between satellite images and facts on the ground.

See: https://www.antaranews.com/berita/4223839/klhk-perkuat-

akurasi-data-kehutanan-dengan-pemeriksaan-lapangan

Carbon trading in Indonesia

Indonesia's carbon trading market is still relatively small

but the government sees it as key to the country’s aim of

cutting carbon emissions by 43.2% by 2030. Elen Setiadi,

Deputy for Business Development and State-Owned

Enterprises Innovation at the Coordinating Ministry for

Economic Affairs, reported that Indonesia's carbon trading

market has reached a transaction value of Rp 36.7 billion

(US$2.26 million) since its launch in September 2023, to

June 2024. The trading volume amounted to 608,000 tons

of carbon dioxide (CO2) equivalent.

The global market for CO2 permits reached a record 881

billion euros (US$948.75 billion) in 2023, marking a 2%

increase from the previous year, according to analysts at

the London Stock Exchange Group (LSEG) in February.

The EU's emissions trading system (ETS) was worth

around €770 billion (US$829 billion), representing 87% of

the global total. The North American markets were valued

at a combined €71.4 billion (US$76.9 billion), and the

Chinese market at €2.3 billion (US$2.5 billion).

"Carbon trading is expected to be a vital instrument in

reducing greenhouse gas emissions and achieving

decarbonization targets," said Elen during Carbon Trading

and Market in Indonesia 2024 webinar in Jakarta recently.

In the first half of 2024, Indonesia recorded a carbon

transaction value of Rp 5.9 billion (US$0.37 million) with

a trading volume of 114,500 tons of CO2 equivalent.

See:https://jakartaglobe.id/business/carbon-trading-in-indonesia-

reaches-226-million-far-behind-global-leaders

and

https://www.antaranews.com/berita/4210875/per-juni-2024-

pemerintah-catat-transaksi-bursa-karbon-rp367-miliar

Carbon tax rules prepared

Coordinating Minister for Economic Affairs, Airlangga

Hartarto, revealed that rules for a carbon tax have been

prepared. However, Airlangga has not been able to

confirm when the tax will be implemented.

Previously, Deputy for BUMN Business Development,

Research and Innovation of the Coordinating Ministry for

the Economy, Elen Setiadi, said that the discussion of the

Draft Government Regulation (RPP) on the Carbon Tax

Roadmap was still ongoing. Elen said that, based on the

RPP, the Carbon Tax Roadmap is proposed initially to

only regulate application of the tax for power generation

sub-sectors or in this case, steam power plants (PLTU). In

the second stage it will extend to fossil fuels used in the

transportation sector.

See: https://voi.id/en/economy/401506

Over 1 million ha. social forestry concessions for

communities

The Indonesian government has set a target of 12.7 million

hectares of land being allocated for community forest

management access. To date, 1.07 million hectares has

been allocated for this purpose under the Social Forestry

Decree (SK), and a further 43,000 hectares as Agrarian

Reform Objective Land (TORA). Additional lands are

being allocated under the decree for people's oil palm land,

and through environmental fund service certificates for the

community.

During the LIKE 2 Festival in Jakarta, Minister of

Environment and Forestry, Siti Nurbaya, announced an

additional Social Forestry Decree for customary forests

covering 15,879 hectares and a decree for rejuvenation of

people’s oil palm land covering 37,000 hectares.

"With the submission of the Social Forestry Decree, the

realisation of social forestry has now reached 8.018

million hectares for 1.4 million Heads of Families (KK),”

stated Siti Nurbaya. She said the indicative area of

customary forests has been set at 1.11 million hectares and

265,000 hectares have been determined through a decree.

In total, 1.37 million hectares of customary forests have

been designated for 138 indigenous community groups.

She stated that the Indonesian government will continue

this process.

See: https://www.rri.co.id/nasional/890138/pemerintah-serahkan-

sk-hutan-sosial-seluas-jutaan-hektare

5.

MYANMAR

Economic instability

The crisis in Myanmar reached a new level of severity

after the State Administration Council (SAC) extended its

rule for the sixth time in July 2024. This extension came

alongside the appointment of General Min Aung Hlaing as

the new Acting President.

The economy is in a serious situation. The exchange rate

has deteriorated sharply with the kyat plummeting from

1,300 kyats per US dollar in January 2021 to a staggering

6,000+ kyats per dollar in August 2024. This dramatic

depreciation has had devastating effects on the economy.

The government’s inability to stabilise the economy is

evident and the economic crisis is exacerbating the overall

humanitarian situation in the country according to the

regioal media.

The SAC has stated that it plans to hold elections in 2025.

The dissolution of the National League for Democracy

(NLD) under a new military-drafted electoral law has

further undermined the credibility of any future elections.

See:https://www.frontiermyanmar.net/en/myanmar-junta-

extends-state-of-emergency-by-six-months/

and

https://www.frontiermyanmar.net/en/united-wa-state-army-

moves-into-strategic-town-in-northern-shan-state/

Efforts to restore peace

The Japanese media has reported Chinese Foreign

Minister Wang Yi was to visit Myanmar mid-August

saying there are growing suggestions from China for the

SAC to restore peace.

Wang's visit to Myanmar comes after his special envoy for

Asian affairs, Deng Xijun, held talks with Myanmar leader

Min Aung Hlaing in early August

See: https://asia.nikkei.com/Politics/International-

relations/China-s-top-envoy-to-meet-military-regime-officials-in-

Myanmar

Floods – an additional burden to farmers

The recent decrease in the reference price for rice has

added to the burden on farmers which have recently seen

floods damage much of the rice crop. In addition, price

controls have disrupted supply chains for essential such as

fertilisers and fuel. Flooding in the Irrawaddy Region is

anticipated to reduce rice yields by up to two-thirds.

Price control on imported items

The media has reported the government is set to introduce

reference prices for imported goods. The Ministry of

Economy and Commerce has required that import licenses

and declarations comply with these reference prices.

It is reported that an Import Value Verification Team has

reviewed 373 HS Code lines and confirmed reference

prices for 3,279 product types. To combat the surge in

commodity prices reference prices have been set for

essential items such as rice, oil, fuel, and agricultural

inputs. However, economic observers argue that these

measures and the imposition of fixed prices are not

sustainable long-term solutions.

See: https://burmese.dvb.no/post/663829

and

https://burmese.dvb.no/post/663626

Power supply shut down due to civil unrest

Regional and international media outlets have reported

Sembcorp Industries has suspended operations at its

Myingyan Independent Power Plant in Mandalay. The

decision came in response to escalating civil unrest in the

region, including in the Myingyan township, where its 225

megawatt (MW) gas-fired power plant Sembcorp

Myingyan is located.

The Singapore-based company said in a statement that it

will resume operations at the plant as soon as reasonably

practicable once conditions are safe.

See: https://www.bangkokpost.com/world/2845821/myanmar-

power-plant-shut-down-amid-escalating-unrest

6.

INDIA

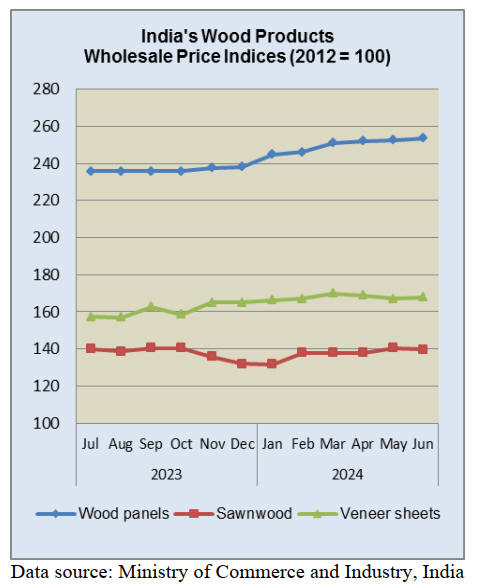

Wood panel price index

climbs

The annual rate of inflation based on the India Wholesale

Price Index (WPI) was 3.36% in June 2024. The positive

rate of inflation was primarily due to increase in prices of

food, manufactured food products, crude petroleum and

natural gas, mineral oils and other manufacturing. The

index increased to 141.9 in June 2024 up from 141.7 for

May, 2024.

Out of the 22 NIC two-digit groups for manufactured

products, 8 groups witnessed an increase in prices, 10

groups witnessed a decrease in prices and 4 groups

witnessed no change in prices.

The price index for wood panels continued to climb in

June on the back of firm demand. The price index for

wood veneers moved a little higher while the index for

sawnwood fell slightly.

Some of the groups that recorded decreases in prices were

basic metals, other non-metallic mineral products,

fabricated metal products, pharmaceuticals, medicinal

chemical and botanical products, machinery and

equipment.

See: https://eaindustry.nic.in/pdf_files/cmonthly.pdf

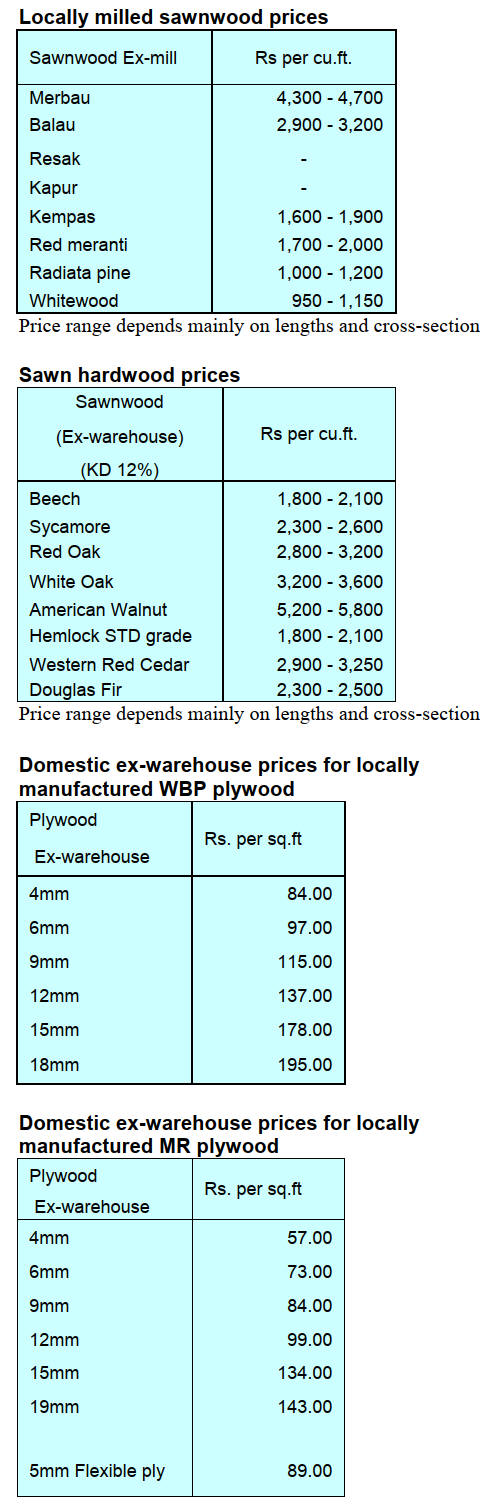

Imported panel prices rising –

difficulties with

shipments

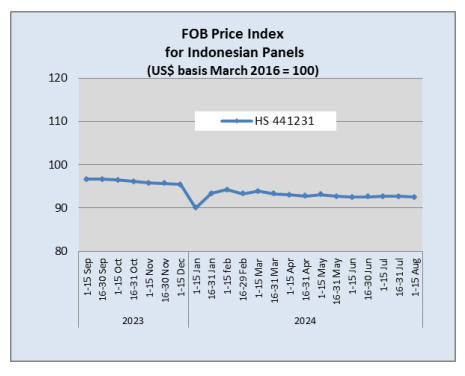

Ply reporter has an article discussing how disrupted sea

freight and logistic issues are seriously impacting the

panel markets with shipments from Vietnam especially

being affected as container freight rates surge again. In

addition, rising adhesive costs are another factor pushing

up FOB prices for imported panels

Rising prices for imported panels has brought some relief

for domestic manufacturers who have recently increased

panel prices.

See: Plyreporter.com June issue

and

https://www.plyreporter.com/article/153952/sudden-container-

crunch-may-take-its-toll-on-core-veneer-imports-from-vietnam-

and-tanzania

Economy highly dependent on nature

A recent statement from the World Economic Forum

Centre for Nature and Climate highlights how India’s

economy is highly dependent on nature and extremely

vulnerable to climate risks. The starement says “third of its

GDP comes from sectors greatly reliant on nature.

Research has found that the climate crisis could cost the

country from 6.4% to more than 10% of its national

income by 2100, taking 50 million more people back into

poverty.

Against this background, a new survey of India’s largest

companies by the World Economic Forum shows that they

have made strong commitments to sustainability and

natural climate solutions (NCS), which aim to protect,

conserve, restore and sustainably manage terrestrial,

freshwater, coastal and marine ecosystems“.

See: https://www.weforum.org/agenda/2024/08/india-economy-

natural-climate-solutions/

7.

VIETNAM

Wood and Wood Product (W&WP) trade

highlights

According to Vietnam Customs W&WP exports in July

2024 reached US$1.3 billion, up 4% compared to June

2024 and up 16% compared to July 2023.

Of this WP exports, alone contributed US$915 million, up

7% compared to June 2024 and up 21.6% compared to

July 2023.

In the first 7 months of 2024 W&WP exports were

estimated at US$8.8 billion, up 22% over the same period

in 2023. Of this, WP exports are estimated at US$5.98

billion, up 22% over the same period in 2023.

W&WP exports to the US in July 2024 earned US$743

million, up 4% compared to June 2024 and up 22%

compared to July 2023. In the first 7 months of 2024 WP

exports totalled US$4.8 billion, up 21% over the same

period in 2023.

Exports of living-room and dining-room furniture in July

2024 reached US$215 million, up 15% compared to July

2023. In the first 7 months of 2024 exports of living and

dining-room furniture brought in about US$1.25 billion,

up 23% over the same period in 2023.

Vietnam's W&WP imports in July 2024 were valued at

US$260 million, up 12% compared to June 2024 and up

37% compared to July 2023. In the first 7 months of 2024

W&WP imports cost US$1.5 billion, up 23% over the

same period in 2023.

According to statistics from the General Department of

Customs imports of raw wood (log and sawnwood in June

2024 reached 461,600 cu.m, worth US$151.8 million,

down 8% in volume and 9% in value compared to May

2024. Compared to June 2023, imports increased by 12%

in volume and 12% in value. In the first 6 months of 2024

imports of raw wood totalled 2.48 million cu.m worth

US$821.8 million, up 16% in volume and 9%. in value

over the same period in 2023.

NTFP exports in June 2024 reached US$70.18 million, up

6% compared to May 2024 and up 1% over the same

period in 2023. In the first half of 2024 NTFP exports

earned US$408.26 million, up 14% over the same period

in 2023.

According to preliminary statistics exports of wood and

wood products to the EU market in July 2024 contributed

US$36.6 million, up 39% compared to July 2023. In the

first 7 months of 2024 W&WP exports to the EU came to

US$313.6 million, up 33% over the same period in 2023.

Vietnam's office furniture exports in July 2024 reached

US$29 million, up 23% compared to July 2023. Generally,

in the first 7 months of 2024, office furniture exports

earned US$172 million, up 12% over the same period in

2023.

Vietnam's poplar imports in July 2024 amounted to 39,200

cu.m, worth US$15.3 million, up 12% in volume and 12%

in value compared to June 2024.

However, compared to July 2023 poplar imports increased

by 40% in volume and 30% in value. In the first 7 months

of 2024, imports of raw wood accounted for 211.9 million

cu.m, worth US$80.8 million, up 21% in volume and 8%

in value over the same period in 2023.

Vietnam’s imports of raw wood from Africa in July 2024

decreased slightly, amounting to 70,000 cu.m, with a value

of US$17 million, down 5% in volume and value

compared to June 2024. This brought the total amount of

raw wood imported from Africa in the first 7 months of

2024 to 533,460 cu.m

Imports had a value of US$142.76 million, up 111% in

volume but down 3% in value over the same period in

2023.

Most earnings from carbon credits distributed to

localities

Vietnam has received a US$51.5 million payment from the

World Bank for verified emissions reductions (carbon

credits) said Tran Quang Bao, Director of the Department

of Forestry.

Around 80% of this sum has been distributed to six north

central provinces and the remaining 20% will be

distributed to the localities.

Regarding benefit sharing, which refers to how the value

created from the sale of carbon credits is distributed, Bảo

said that the Government issued a decree on piloting the

transfer of emission reduction results and financial

management of greenhouse gas emission reduction

payment agreements in the North Central Region.

Accordingly, only 0.5% will be used to coordinate the

general agreements and 3% to perform measurement,

control, supervision, training and technical guidance. The

balance is to be allocated to targeted localities.

Based on the contracted forest area the localities will

allocate funds to people and communities that signed

contracts to protect and manage the forests.

Presently, the Ministry of Agriculture has issued a benefit-

sharing plan and is organising training on how to distribute

benefits to localities. The main beneficiaries are

communities, ethnic minorities and forest keepers.

According to the Forestry Department, the Emission

Reductions Payment Agreement (ERPA) in the North

Central Region was signed on October 22, 2020, between

the agriculture ministry and the International Bank for

Reconstruction and Development (IBRD) under the World

Bank Group as the Trustee of the Forest Carbon

Partnership Facility (FCPF).

The ERPA aims at transferring reduced emissions of 10.3

million tonnes of CO2 in the northern part of the central

region in 2018-2024 to the FCPF via the World Bank, with

the unit price of US$5 per tonne of CO2, worth US$51.5

million in total.

About 95% of the transferred results will be returned to

Việt Nam to contribute to the national commitment to

greenhouse gas emissions to obtain the goals of the Paris

Agreement on climate change approved at COP21.

According to the Forestry Department, Việt Nam has not

had a mandatory market for carbon credits. The transfer of

emission reduction results is carried out through bilateral

agreements between relevant parties.

Regarding the forest carbon credit market, the Prime

Minister has assigned the agriculture ministry to

implement two agreements to transfer emissions reduction

results including the ERPA in the north central region and

another ERPA in the south central and Central Highlands

regions.

In the ERPA in the south central and Central Highlands

regions, Việt Nam transfers to LEAF/Emergent 5.15

million tonnes of CO2 to reduce emissions from forests in

the regions in the 2022-2026 period.

LEAF/Emergent will pay for this service at a minimum

price of US$10 per ton of CO2 with a total value of

US$51.5 million. The area of commercial and service

forests registered to reduce emissions is 4.26 million ha,

including 3.24 million ha of natural forests and 1.02

million ha of planted forests.

See: https://vietnamnews.vn/environment/1653145/most-

revenues-from-carbon-credits-distributed-to-localities-

official.html

Dual benefits for the Vietnamese wood industry from

creating carbon credits

During the period 2010-2020 the average annual net

emissions in Vietnam’s forestry is about negative 40

million tonnes of CO2 equivalent.

If converted into monetary value, reducing 40 million

tonness of CO2 is equivalent to about VND3,500 billion

with the assumption that the cost of reducing emissions of

1 tonne of CO2 is equivalent to US$5.

From an investor's perspective, according to Mr. Nguyen

Ngoc Tung, Director of VinaCarbon Climate Impact Fund,

the wood industry has great potential in creating carbon

credits to compensate for other industries and help

Vietnam reach net zero emissions by 2050. Vietnam has

more than 14 million hectares of forests, of which nearly

half are production forests.

According to Mr. Tung, if wood industry enterprises are

aware that investing in sustainable development and

reducing emissions is an inevitable and necessary trend

that must be implemented, their revenue will not only

come from wood processing activities and forest products

but also from carbon credits.

At the same time, investing in reducing emissions for the

wood industry also means that businesses comply with

international regulations on sustainable forest management

and exploitation, thus, it will increase competitiveness and

the ability to penetrate markets like the EU, bringing

higher value to businesses' exports.

Vu Tan Phuong, Director of the Vietnam Forest

Certification Office (VFCO), also said that the results of

the national greenhouse gas inventory and calculation of

gas emissions in forestry show that the forestry sector is

the only sector with negative net emissions, i.e. the

amount of carbon absorbed by forests is greater than the

amount of carbon emitted.

During the period 2010-2020 the average annual net

emissions in forestry was about negative 40 million tonnes

of CO2 equivalent.

In addition to the benefits that forests are bringing to

production activities, the implementation of measures to

reduce greenhouse gas emissions in forestry will make an

important contribution to implementing Vietnam's

emission reduction goals and creating additional financial

resources from carbon credit purchasing, exchange and

trading activities in domestic and international carbon

markets.

Currently, the Government is building a domestic carbon

market and when it comes into operation, it will open up

opportunities to buy, sell, exchange and trade carbon

credits between businesses, promoting investment to

reduce greenhouse gas emissions and increase carbon

absorption in forestry activities.

Need to proactively and actively "go green"

Vietnam has policies which will eventually create a

sustainable forestry sector that meets market requirements.

The major policy directions for forestry development by

2030 are to achieve the goal of 1 million hectares of forest

certified for sustainable forest management, 100% of

wood and wood products for export and domestic

consumption will be harvested from legal and sustainable

sources.

To achieve the stated goals the National Forest

Certification System (VFCS) was established under the

Decision No. 1288/QD-TTg dated 1 October 2018 and

recognised by the PEFC and managed and operated by the

Office of Sustainable Forest Management Certification.

Since officially operating in 2020 the Vietnam Forest

Certification system has made an important contributions

in implementing sustainable forestry development goals,

meeting market requirements, enhancing the Vietnamese

wood brand, and promoting trade in forest products and

improve the capacity of relevant parties.

From the perspective of a consulting unit, Mr. Tran Duc

Tri Quang, Data Director of FPT IS shared the view that

the process of creating carbon credits has three main steps,

including baseline emissions assessment of three years

before project implementation; emission reduction

assessment and credit estimation from the second year;

assess feasibility, complete registration, independent

assessment. In particular, the required starting point is the

baseline emission value of three years before project

implementation.

When businesses consider setting up emission reduction

projects, it is necessary to conduct a greenhouse gas

inventory and accumulate data for three years as a basis

for calculating the ability to reduce emissions.

In order to attract investment and take advantage of capital

from investment funds, Mr. Quang said that wood industry

enterprises need to be proactive in the "greening" process,

since the leadership must recognise aware of the

importance of sustainable development, establishing

specialised departments and being ready to change

approach and management to suit a carbon credit

generating project.

In addition, businesses also need to improve their

competitiveness, apply scientific and technological

advances to improve labour productivity and digitally

transform to reduce production costs, strengthen brand

promotion and product quality and build large-scale

industrial parks for processing.

See: https://wtocenter.vn/su-kien/24267-dual-benefits-for-the-

wood-industry-from-creating-carbon-credits

8. BRAZIL

IBAMA strike over -

timber sector counting the cost

The strike by the employees at the Brazilian Institute for

the Environment and Renewable Natural Resources

(IBAMA) which began early this year caused disruption

and losses to the timber and other sectors that depend on

the functioning of the agency.

The Union of Timber Industries of Northern Mato Grosso

has confirmed the strike prevented the processing of

documentation essential for the continuity of operations,

export contract dealines could not be met and credibility in

international markets suffered.

See:https://www.cnnbrasil.com.br/blogs/caio-

junqueira/politica/governo-e-ibama-assinam-acordo-para-

encerrar-greve/

It has been reported by the Brazilian Ministry of

Planning,

Budget and Management that the government and IBAMA

employees signed an agreement on 12 August that puts an

end to this strike.

Authorised harvesting for those with sustainable

management plans

The government of the State of Amapá in the Amazon

Region recently approved 32 requests for Forest

Harvesting Authorisations (Autex) from producers who

will engage in sustainable forest management. These

licenses have revitalised 16 timber companies in the

region adding around 800 direct jobs in just six months

with the potential to create up to 4,000 indirect jobs over

the next eight months.

This approval will strengthen the timber sector and the

economy of the State of Amapá with the issuance of over

60 authorisations in just a year and a half.

The State Government of Amapá ensures transparency

of

the process by requiring a forest management plan that

identifies each tree, and requires low impact logging.

These approvals allow land owners in the region to

legalise their activities and expand agricultural production

providing sustainable economic development and job

creation.

See: https://www.remade.com.br/noticias/20114/governo-do-

amapa-concede-autorizacoes-para-manejo-florestal-sustentavel

Lacey Act Declarations required for wood products

from Brazil

Beginning December 2024 Brazilian exporters of wood

products will need to provide detailed information on their

production chain to meet the new requirements of Phase 7

of the Lacey Act. This phase mandates that US importers

submit a "Lacey Act declaration" for an additional series

of products, including furniture.

This will require Brazilian companies to be prepared to

provide complete information on the production chain of

the products such as the scientific name of the species,

country of origin, product value and quantity, Harmonized

Tariff Schedule (HTSUS) code, Manufacturer

Identification Code (MID) among other information.

The US market is the main destination for Brazilian

furniture and companies will have to adapt to these new

requirements to ensure the continuity of imports.

See: https://www.remade.com.br/noticias/20115/eua-passarao-a-

exigir-declaracao-lacey-act-para-produtos-de-madeira-e-de-

origem-vegetal:-moveis-estao-na-lista

Sustainable use of natural forests crucial for Brazilian

forest sector

The sustainable use of natural forests is crucial for the

Brazilian forest sector especially in the Amazon. The

practice of sustainable forest management (SFM) allows

for the preservation of forests while promoting economic

growth.

The international tropical wood market is worth around

US$25 billion per year in which Brazil participates with

around US$1 million with the potential to increase its

share through sustainable practices.

Brazil already has efficient tools for tracking and

controlling the logging in natural forest. However, it still

needs to advance in promoting more SFM initiatives to

gain a larger share of the market.

With 50% of Brazil´s land still covered by natural forest,

the country has a unique opportunity to expand in this

market through policies that encourage SFM. Encouraging

the consumption of wood from these practices can not

only strengthen the economy but also curb deforestation

and promote forest conservation.

See: https://gazetarural.com/uso-sustentavel-da-floresta-nativa-

contribui-para-sua-preservacao/

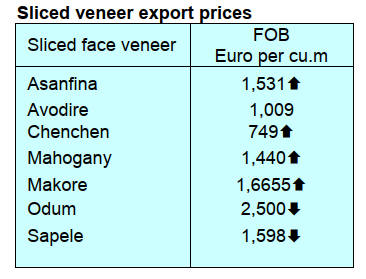

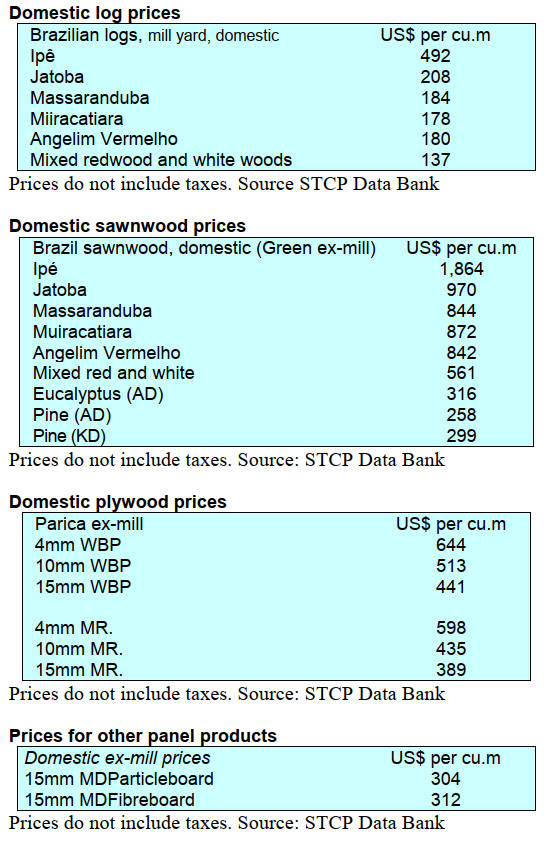

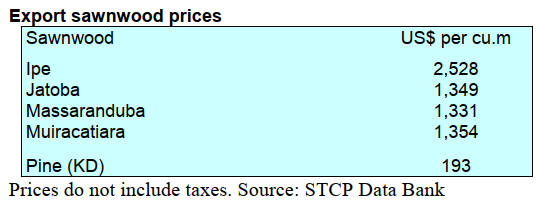

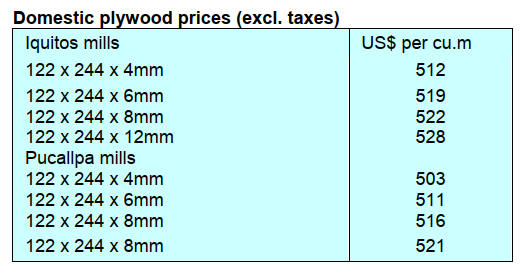

Export prices

Average FOB prices Belém/PA, Paranaguá/PR,

Navegantes/SC and Itajaí/SC Ports.

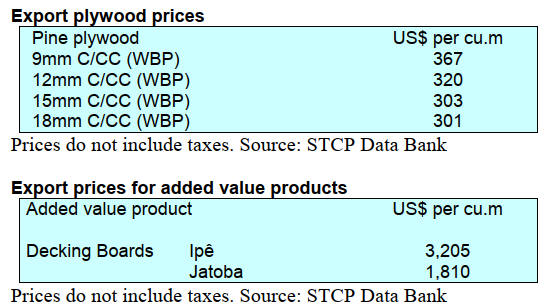

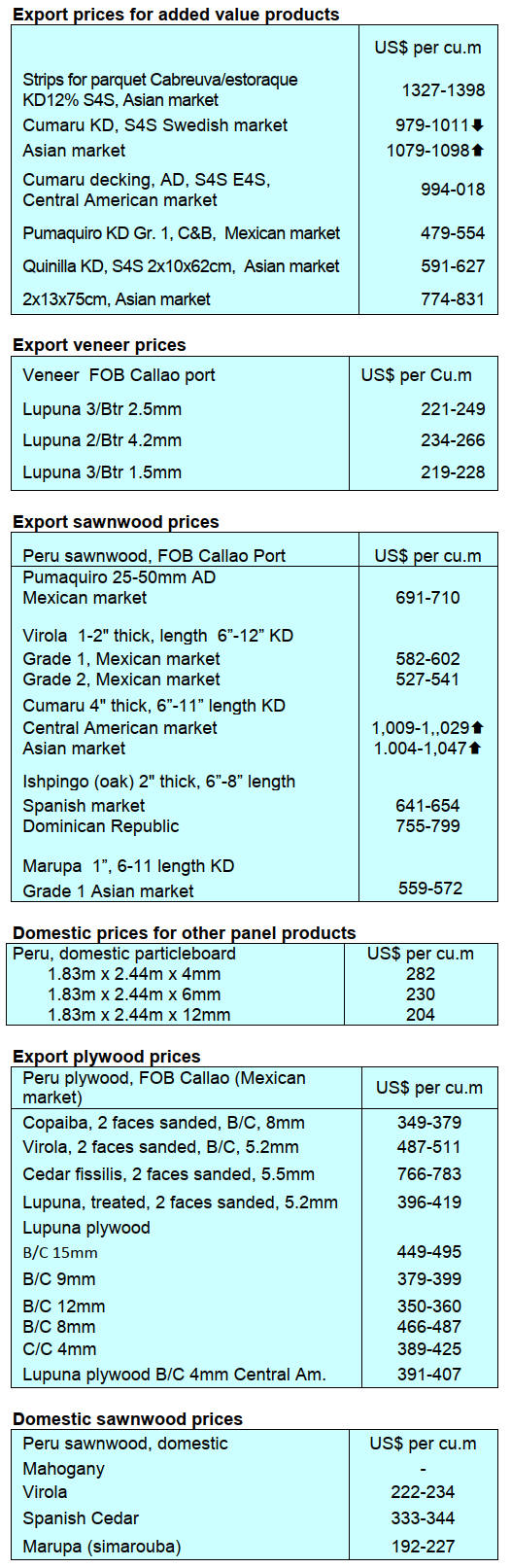

9. PERU

Wooden furniture

shipments recover

Between January and May 2024 wooden furniture exports

were valued at US$0.95 million, an increase of 32%

compared to the same period of the previous year

(US$0.73 million) according to the Services and

Extractive Industries Management unit of the Exporters

Association (ADEX). This amount was the second highest

over the past five years (January-May) since in 2022 when

the figure was just over US$1.1 million.

During the first five months of 2024 furniture exports were

shipped to 15 destinations with 65% to the US followed by

Guatemala which replaced Bermuda for second place.

Other markets were Spain (US$62,741), Italy

(US$47,691), Bermuda (US$41,308), Chile (US$40,801),

France (US$27,324), Puerto Rico (US$15,400),

Dominican Republic (US$3,943) and Panama (US$3,761).

Of the countries mentioned, Bermuda and Panama

experienced the highest growth rates. In contrast exports to

Italy and Chile fell.

Forestry Convention in Pucallpa

The Association of Forestry Producers of Ucayali

(APROFU), the Chamber of Commerce of Ucayali and the

company Tropical Forest will host the first National

Convention of Timber Industrialists to be held in the city

of Pucallpa 21-22 August this year.

This event will bring together public, private, political,

union, academic and professional actors linked to the

forestry sector and the wood forestry products industry in

order to reach agreements and commitments on unifying

proposals to be presented to the government.

During the convention the Forestry Agreement will be

signed between state institutions, private companies and

other stakeholders.

Particleboard imports decreased during the first half of

2024

In the first half of 2024 there was a notable decrease in

particleboard/MDP imports with total import values

falling 17% compared to the same period in 2023. The

import value fell from US$79.5 million in the first half of

2023 to US$66.1 million in 2024.

Ecuador was the main supplier country but experienced a

13% decline with export values falling to US$32.9 million

in the first half of 2024 from the US$38.0 million in the

same period in 2023. Imports from Spain also declined,

dropping 25%.

Brazil was one of the few countries that experienced an

increase in its exports to Peru with an increase of 151%,

reaching a total of US$11.1 million in the first half.

Imports from Chile faced a significant drop of 38%.

Justice operators trained in OSINFOR technological

tools to combat timber trafficking

In a joint effort to strengthen the fight against illegal

timber trafficking the Forest and Wildlife Resources

Monitoring Agency (OSINFOR) and the Environmental

Team of the United Nations Office on Drugs and Crime

(UNODC) organised a workshop to strengthen the

technical capacities of justice operators in Ucayali for the

interpretation and use of information derived from

supervisions with technological and remote sensing tools.

The objective was to strengthen the coordination of justice

system operators regarding the legal framework applicable

to the sustainable use of forest resources and the use of

information tools that contribute to the investigation of

environmental crimes.

Case studies and practical field simulations were presented

allowing participants to apply knowledge in real

situations, including the use of drones and operations

against the trafficking of forest resources.

See: https://www.gob.pe/institucion/osinfor/noticias/963166-

operadores-de-justicia-en-ucayali-se-capacitan-en-el-uso-de-

herramientas-tecnologicas-del-osinfor-para-enfrentar-el-trafico-

de-madera

SERFOR requires declaration of shihuahuaco and

tahuarí stocks

With the entry into force of the inclusion of the

shihuahuaco (Genus Dipteryx) and tahuarí (Genus

Handroanthus) in Appendix II of the Convention on

International Trade in Endangered Species of Wild Fauna

and Flora (CITES) the National Forest and Wildlife

Service (SERFOR) requires companies to declare before

24 November the stocks held of these species.

The provision of CITES allows the export of these after 25

November provided stocks have been declared. SERFOR

will carry out the verifications to confirm the authenticity

of the stock information.

The Director of Sustainable Management of Forest

Heritage in SERFOR reported that there are around 113

processing centres that have stocks of these timbers in the

Departments of Ucayali, Madre de Dios, Loreto, Pasco,

Junín, Huánuco and Cusco.

See: https://www.gob.pe/institucion/serfor/noticias/999750-

serfor-solicita-declarar-stocks-de-shihuahuaco-y-tahuari-hasta-el-

24-de-noviembre

|