|

1.

CENTRAL AND WEST AFRICA

Weakening demand in international markets

Operators across the regional have signalled a significant

weakening of demand in international markets. Some mills

servicing the Chinese market have temporarily ceased

operations due to falling Chinese timber imports, others,

have pivoted production to species in demand in the EU

notably azobe for the Dutch market and timbers such as

padouk for Belgium, agba for Portugal and bahia for Italy.

The overall sentiment is that business remains poor,

exacerbated by the European holiday season.

The correspondent writes “the market for West/Central

African timbers is currently in a precarious state with

many mills struggling to stay operational amid

plummeting demand. The situation is exacerbated by

adverse weather conditions in some regions and regulatory

pressures in others. Operators in the region are hoping for

additional economic stimulus measures in China. At

present it is only the Philippines and Vietnam that are

providing a measure of demand stability”.

Regional round-up

Cameroon

Mills are focusing on redwood species for Europe.

However, it has been reported that arrivals of redwoods

from North Congo and RCA at Douala and Kribi Ports

have dropped. Millers have observed a rise in regulatory

control which has made some mills keeping stocks to a

minimum.

Equatorial Guinea

It has been claimed that some shippers in Equatorial

Guinea are putting KD FAS okoume onto the international

market at around Eur400/cu.m. FOB which a very

competitive price. The correspondent notes “In Gabon and

Congo it is impossible to compete with the Eur400/cu.m.

FOB price due to the high operational costs faced by mills

and the long-distance transport involved.

Gabon

Harvesting remains slow as demand is low for some

species. Okoume continues to be in demand for local

manufacturing but okoume exports to China have stopped.

Electricity disruptions continue to disturb peeling and

plywood operations, particularly in the GSEZ.

No transport issues have been reported but the Bifoun to

Ndjole road, the main route for trucking in and out of

Cameroon, is reportedly in poor condition and repairs will

take several weeks.

Enquiry levels are stable for species such as andoung,

iroko, and padouk in Europe. For the Chinese market

current demand is focused on high-value timbers such as

beli and ovangkol.

Congo

In terms of harvesting and trucking there are no changes

from the mid-July report. Repairs continue on laterite

roads which were damaged during the rain season.

Trucking conditions are expected to improve now that it is

dry. Transport to Pointe Noire is mostly on tarmac roads.

Operators report enquiry levels are satisfactory especially

as importers for the Philippines market are more active.

New EUDR tools

The ATIBT has signalled that, as part of the

implementation of the EU Deforestation Regulation

(EUDR), the European Commission has developed two

additional applications for the Application Programming

Interface (API).

See: https://www.atibt.org/en/news/13527/implementation-of-

the-eudr-new-api-applications-for-due-diligence-declarations

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in the Republic of Congo and Gabon.

See, GGSC

https://www.itto-

ggsc.org/static/upload/file/20240719/1721354559472477.pdf

2.

GHANA

GDP target at 3.1% in mid-year budget

The Government has announced revisions to the country’s

macroeconomic fiscal targets for 2024. The Finance

Minister, Mohamed Amin Adam, said this when he

presented the mid-year Budget to parliament on July 23,

2024.

Dr. Amin Adam said the overall real Gross Domestic

Product (GDP) growth rate has been revised upwards from

2.8% to 3.1%. While he also stated that government has

decided to maintain the end of year inflation target

unchanged at 15%. He further said, non-oil real GDP

growth rate was also revised upwards from 2.% to 2.8%.

The Minister lauded government’s fiscal discipline in the

first half of 2024 stating that government expenditure

amounted to GH¢95.9 billion, below the budget target of

GH¢104.8 billion. He also reported significant progress in

fulfilling the government’s financial obligations to

investors following the completion of the Domestic Debt

Exchange Programme (DDEP) in September 2023.

Fitch Solutions has maintained its 2024 growth rate

forecast for Ghana at 4.3%, higher than the mid-year

budget revision of 3.1% and the International Monetary

Fund projection of 2.9%.

See: https://www.myjoyonline.com/government-revises-

economic-targets-upwards-for-2024/

Main markets account for almost 90% of exports

Three continental markets comprising Asia, Europe and

Africa are Ghana’s key wood export destinations and

together accounted for 89% (77,406 cu.m) of total wood

product export volumes in the first four months of 2024

(86,755 cu.m) as against 91% (89,661 cu.m) registered for

the same period in 2023 according to data from the Timber

Industry Development Division (TIDD).

Asia continued as Ghana’s top market destination earning

the country Eur21.33 million from the export of 54,738

cu.m during the period Jan-Apr 2024. This shows there

were declines of 9% in the value of exports and a 10%

drop in export volumes compared to the Eur23.51million

from exports of 60,971 cu.m in the Jan-Apr period of

2023. Exports of products to Asia included air and kiln-

dried sawnwood, teak logs, plywood, mouldings, billet and

sliced veneer. Key markets included India and Vietnam.

Europe accounted for 13,616 (16%) of the total wood

product export volume in the period under review with a

corresponding export value of Eur8.15 million. The

figures showed a decrease of 21% in value and a decrease

of 16% in volume when compared to the Eur10.37 million

from 16,194 cu.m recorded during Jan-Apr 2023.

The European market maintained its position as the most

attractive in terms of prices for sawnwood, plywood,

boules and briquettes. The main European countries that

traded with Ghana during the period were Germany,

Belgium, United Kingdom and Spain.

African country wood products imports from Ghana

included air and kiln dry sawnwood, plywood (by sea and

land to the regional markets) and rotary and sliced

veneers. These exports earned Ghana Eur3.83million from

the total volume of 9,052 cu.m shipped during the period

Jan.-Apr 2024.

Africa’s share of wood product exports were consumed

largely by ECOWAS countries that included Senegal,

Nigeria, Gambia, Burkina Faso, Sierra Leone and Togo.

The ECOWAS sub-region contributed Eur2.70 million

from 6,980 cu.m of the total African wood product

exports. Egypt, Morocco, Benin, South Africa and

Mozambique were the main Non-ECOWAS markets for

Ghana’s wood products.

The main species exported included teak, wawa,

eucalyptus, ceiba and denya among others.

Exports to the EU surged 8% in 2023

Ghana’s exports to the European Union (EU) increased by

8% in 2023 reaching Eur2.60 billion from Eur2.40 billion

in the previous year while imports from the EU to Ghana

fell from Eur3.70 billion in 2022 to Eur3.30 billion in

2023.

Speaking at the 2nd Ghana-EU Business Forum on the

theme ‘Fostering investment in non-traditional value

chains under the EU Global Gateway Strategy, the Trade

and Industry Minister highlighted the country’s favorable

investment climate.

Ghana’s export trade with the EU is primarily raw

materials and semi-processed goods. These include

sawnwood, plywood, mouldings, sliced and rotary veneers

and boules.

The EU Ambassador to Ghana, Irchad Razaaly, said the

Business Forum provided avenues of dialogue over

boosting trade and investment ties between Ghana and the

EU.

See: https://thebftonline.com/2024/07/05/ghana-eu-trade-dips/

IMF points to financial sector stability

The International Monetary Fund (IMF) has reported that

Ghana’s financial sector stability has been maintained

despite the Domestic Debt Exchange Programme (DDEP).

However, the IMF added credit growth declined amidst an

increase in non-performing loans.

In its Second Review of Ghana’s Extended Credit Facility

Programme the IMF statement said despite facing capital

shortfalls due to the implementation of the domestic debt

exchange (DDE), bank balance sheets improved quickly in

2023 benefiting from high profitability and capital

injections. The government of Ghana has begun the

recapitalisation of state-owned banks.

However, the growth in private sector credit was well

below inflation at 11.0% in 2023. In addition, the

nonperforming loans (NPLs) ratio further increased to

20.6% from 14.8% in December 2022.

See:

https://www.imf.org/en/News/Articles/2024/06/28/pr24241-

ghana-imf-exec-board-completes-2nd-rev-ecf-

arr#:~:text=The%20IMF%20Executive%20Board%20today,prog

ram%20has%20been%20generally%20strong.

and

https://www.myjoyonline.com/financial-sector-stability-

maintained-but-credit-growth-declines-imf/

3. MALAYSIA

Export growth recorded with major trading partners

The Ministry of Investment, Trade and Industry (MITI)

reported that in the first five months of 2024 exports

increased 1.7% year on year to RM126.05 billion while

imports rose 17.8% to RM111.76 billion. May marked the

50th consecutive month of surplus. Export growth was

contributed mainly by higher demand for machinery,

equipment and parts, liquefied natural gas (LNG) as well

as palm oil-based products. Export growth was recorded in

major trading partners; ASEAN, the US and Taiwan

P.o.C.

Sarawak/Japan MOU on forest ecosystem functions

The Sarawak government signed a memorandum of

understanding (MoU) with National University

Corporation Kyushu University (Kyushu-U) in Fukuoka,

Japan to facilitate bilateral collaboration and research on

forest ecosystem functions as part of forest assessments to

be carried out under forest carbon initiatives in Sarawak.

The MoU also aims to facilitate skills sharing through

capacity building, training for forestry officers and a

student exchange programme and other areas of mutually

agreed collaboration.

See: https://www.theborneopost.com/2024/07/24/sarawak-signs-

mou-with-japanese-university-in-connection-with-forest-carbon-

initiatives/

Sabah mangroves action plan

The Sabah State Government will launch a Sabah

Mangrove Action Plan to transform the management and

conservation of mangrove forests in Sabah according to

the Chief Minister, Haji Hajiji Haji Noor, who added 60%

or 378,195 hectares of Malaysia’s mangrove forests are in

Sabah.

Noor commented that this plan is consistent with the ‘Blue

Carbon initiative’, a global programme being coordinated

to focus on the conservation and preservation of the sea

shore ecosystem for climate adaption, biodiversity

protection and wealth generation for people living close to

mangrove forests.

See: https://www.theborneopost.com/2024/07/24/action-plan-to-

conserve-sabahs-mangrove-forests/

Smallholders and communities join planation plan

Sabah Forestry Department has distributed more than

37,000 seedlings to 81 smallholders who are registered

under the 12th Malaysia Plan element ‘Promote Tree

Planting by Smallholders and Local Communities as an

Important Source of Wood for the Timber Industry’.

The initiative primarily focuses on smallholders and local

communities with a land area of below 10 acres. A variety

of species, including Laran, Batai, Binuang, Eucalyptus,

Mahogany, Acacia, and Talisai Paya are being promoted.

Participants have benefited from consultations on forest

plantation practices. Chief conservator of forests Frederick

Kugan said this initiative demonstrates the Sabah Forestry

Department’s commitment and dedication to sustainable

forestry and community engagement.

See: https://www.theborneopost.com/2024/07/23/sabah-forestry-

distributes-over-37000-seedlings-to-81-smallholders/

Attracting investors to plant bamboo

A bamboo planting and smart farming project is set to be

implemented in Baram District according to the Sarawak

Timber Industry Development Corporation (STIDC).

Officials from STIDC and the Malaysian Community Care

Foundation (MCCF) recently visited the district to

encourage local communities to participate in the project.

One of the primary initiatives is to attract investors to

engage in bamboo planting, smart community farming and

ecotourism across the extensive 49,000 ha. Native

Customary Rights (NCR) land in the Baram area.

See:

https://theborneopost.pressreader.com/article/281762749494599

MTCC forest statistics

The Malaysian Timber Certification (MTCC) is an

independent organisation that develops and operates the

Malaysian Timber Certification Scheme (MTCS) which is

endorsed by PEFC.

As of June 2024, there were 6.73 million ha. of MTCS-

PEFC certified forests in 36 certified natural forest units

(FMUs) and nine certified forest plantations (FPMUs).

There were 362 companies holding MTCS-PEFC

certificates for Chain of Custody.

MTCC statistics show that in 2023 Japan maintained its

position as the leading importer of timber products

certified under MTCS, totaling 102,630 cu m. followed by

the Netherlands with United Kingdom, Australia, Belgium

and France among the top importers.

Total exports increased by 7.4 % from 244,946 cu m in

2022 to 264,240 cu m in 2023 with plywood, sawnwood

and mouldings remaining the major exported certified

products.

See: https://mtcc.com.my/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Malaysia.

See, GGSC

https://www.itto-

ggsc.org/static/upload/file/20240719/1721354559472477.pdf

4.

INDONESIA

Furniture imports flooding Indonesian market

The chairman of the Indonesian Furniture and Craft

Industry Association (HIMKI), Abdul Sobur, has pointed

out that the domestic market is being flooded with

imported furniture products. According to HIMKI’s

analysis in the first quarter of 2024 imports of furniture

products increased by 29% year on year to IDR2.07

trillion.

Imported furniture products from China contributed the

most (84%) followed by Vietnam (3%), Malaysia (2%)

and the US 2%.

Other significant shippers of mainly high value items

included Italy, Germany, Singapore, Taiwan P.o.C, South

Korea and Japan.

Sobur said Indonesians are buying simple and cheap smart

furniture and suggested the government should raise the

Domestic Source Component Level (TKDN) for furniture

products.

TKDN represents the value of using goods or services

sourced from within the country. This policy aims to

advance Indonesia's economy by supporting local

industries and reducing the public's dependence on

imported products. TKDN is one of the government’s

instruments to develop domestic industries and promote

the use of local products.

See:https://kumparan.com/kumparanbisnis/mebel-asal-china-

serbu-pasar-indonesia-impor-naik-28-97-di-kuartal-i-2024-

238lvEqmgPe/full

and

https://www.sinarharapan.co/ekonomi/38513145255/mebel-asal-

china-kuasai-pasar-ri-himki-pemerintah-harus-tingkatkan-tkdn

Energy plantation forest development

Agus Justianto, chair of Indonesia's FOLU Net Sink 2030

Working Team at the Ministry of Environment and

Forestry, stated that developing energy plantations (HTE)

is a viable element to increase carbon absorption as

harvested wood can be used as a raw material to generate

electrical power.

During a recent Indonesian Biomass Energy Society

(MEBI) talk show on ‘Energy Plantation Forests in the

Energy Transition Era’ chairman Hadi Siswoyo revealed

that based on KLHK data, there are currently 25 Forest

Utilisation License (PBPH) units that support HTE

development. In addition, State-Owned Enterprises

manage Java's forests (Perum Perhutani) and have

allocated 67,000 hectares for HTE development

See: https://forestinsights.id/hutan-tanaman-energi-berkembang-

positif-bagi-pencapaian-target-folu-net-sink/

Harmonising ASEAN forest management standards

At the 27th Meeting of the ASEAN Working Group on

Forest Product Management the Indonesian government

emphasised the importance of harmonisation of forest

management standards. According to Dida Mighfar

Ridha, Director General of Sustainable Forest

Management at the Ministry of Environment and Forestry,

standardisation is essential for enhancing sustainable

forest management and optimising the utilisation of forest

products.

Indonesia has achieved significant progress in

collaborating with ASEAN member countries including in

the area of the legality and sustainability of forest

products.

One notable achievement is the certification system that

guarantees the legality and sustainability of forest

products. This system is a strategic programme that

ensures wood products and raw materials are obtained

from sources that meet legal and sustainable management

standards.

The same meeting produced several regional policy

recommendations including the implementation of the

ASEAN cooperation action plan for the development of

forest products. The cooperation action plan covers areas

related to trade facilitation, market access and efforts to

increase the competitiveness of ASEAN forest products.

See: https://mediaindonesia.com/humaniora/685055/asean-

perkuat-pengelolaan-hutan-lestari-melalui-asof-27

and

https://www.antaranews.com/berita/4201593/awg-fpd-hasilkan-

sejumlah-rekomendasi-pengelolaan-produk-hutan-asean

Minister - Progress in determining forest areas

The Minister of Environment and Forestry, Siti Nurbaya,

has reported that progress in determining forest areas up to

June 2024 had covered 106,554,227 ha or 84% of the total

forest area. The Minister acknowledged that there are

numerous challenges in determining or confirming forest

areas with one of the main issues being related to forest

boundaries part of the One-Map policy, a valuable in

large-scale spatial planning exercise to address conflicts

related to overlapping land uses and hastening the

implementation of infrastructure and regional development

programmes.

See: https://nasional.kontan.co.id/news/menteri-lhk-progres-

penetapan-kawasan-hutan-capai-106-juta-ha

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Indonesia.

See, GGSC https://www.itto-ggsc.org/static/upload/file/20240719/1721354559472477.pdf

5.

MYANMAR

A rupee-kyat trade settlement mechanism

On 21 July 2024 the Reserve Bank of India (RBI)

authorised eight Myanmar banks to operate a rupee-kyat

trade settlement mechanism aimed at simplifying trade

between the two countries by eliminating the need for

multiple currency conversions. This mechanism allows

importers and exporters from both countries to bypass the

US Dollar for transactions, enabling direct currency

exchanges between Myanmar Kyats and Indian Rupees.

Myanmar aims to reduce its reliance on US dollars for

trade due to increasing difficulties in procuring dollars

hoping that the new rupee-kyat trade settlement

mechanism will boost trade between the two countries

See: https://eng.mizzima.com/2024/07/24/12083

Thailand to monitor financial transaction with Myanmar

Thailand plans to form a task force to enhance financial

institutions' due diligence to prevent transactions that

could lead to arms purchases and human rights abuses in

Myanmar. This follows a UN report highlighting a surge

in money transferred through Thai banks for weapons used

by the Myanmar junta. The Bank of Thailand and the

Anti-Money Laundering Office will lead the initiative.

See:

https://eng.mizzima.com/2024/07/12/11667 and https://www.ban

gkokpost.com/thailand/general/2835537/thailand-to-set-up-task-

force-to-prevent-transactions-for-myanmar-arms

Small scale producers rely on income from mangrove charcoal trade

Mangrove deforestation, driven by charcoal production,

shrimp farming and urbanisation has severely impacted

local ecosystems and communities. Efforts to regulate the

industry, such as the annual production quota, have largely

failed. Small-scale producers in Myanmar have few

alternative livelihoods. In the Thai Port of Ranong migrant

workers are hired to repack and load charcoal sourced

from Tanintharyi mangrove forests despite the trade being

illegal under Myanmar’s 2018 Forest Law.

The amount of Myanmar charcoal imports by Thailand has

decreased, dropping from 104,018 tonnes in 2014 to

69,004 tonnes in 2023 though the overall trade value

remains high due to rising prices. Most charcoal is re-

exported from Thailand to countries like China, Japan,

Australia and Bahrain.

See - https://www.frontiermyanmar.net/en/mangrove-loss-in-

tanintharyi-hits-illegal-charcoal-trade-with-thailand).

Now - President Min Aung Hlaing

General Min Aung Hlaing, holding portfolios as Chief of

Commender, Chairman of State Administration Council

(SAC) and Prime Minister of the government, assumed the

new role of interim president following the Acting

President Myint Swe's medical leave.

ASEAN has excluded Myanmar's political appointees

from its high-level meetings, inviting "non-political

representatives" instead. The junta's efforts to regain

ASEAN's recognition include sending a Foreign Ministry

official to recent meetings. Despite these efforts by

ASEAN the crisis in Myanmar continues to escalate with

an estimated three million people displaced and

widespread poverty affecting half the population.

See: https://www.msn.com/en-us/news/world/myanmar-junta-

leader-assumes-presidential-powers-as-president-takes-sick-

leave-state-media-reports/ar-BB1qr4tQ?ocid=BingNewsVerp

In related news, Myanmar's military is expected to hold a

National Defense and Security Council (NDSC) meeting

to consider extending the state of emergency which is

renewed every six months. According to the constitution,

if the declaration is terminated the NDSC will hold general

elections to form a parliament within six months.

Statement on Myanmar from ASEAN Foreign Minister Meeting

The 57th ASEAN Foreign Ministers’ Meeting (AMM)

was held on 25 July 2024, in Vientiane, Lao PDR. The

Meeting was chaired by Lao PDR under the theme

“ASEAN: Enhancing Connectivity and Resilience.”

On Myanmar the statement from the meeting says “ We

reaffirmed ASEAN’s continued support for Myanmar’s

efforts to bring peace, stability, the rule of law, promote

harmony and reconciliation among the various

communities, as well as ensure sustainable and equitable

development in Rakhine State.

We emphasised the importance of and reiterated our

continued support for Myanmar’s commitment to ensuring

safety and security for all communities in Rakhine State as

effectively as possible and facilitating the voluntary return

of displaced persons in a safe, secure, and dignified

manner. We noted and encouraged the engagement and

cooperation between Myanmar and Bangladesh for the

pilot repatriation project.

We looked forward to ASEAN’s continued facilitation of

the repatriation process through the implementation of

projects as the follow up to the recommendations of the

Preliminary Needs Assessment (PNA). We also looked

forward to the Comprehensive Needs Assessment (CNA)

when conditions allow and encouraged the Secretary-

General of ASEAN to continue identifying possible areas

for ASEAN to effectively facilitate the repatriation

process”

See: https://asean.org/joint-communique-of-the-57-asean-

foreign-ministers-meeting/

and

https://www.scmp.com/news/asia/southeast-

asia/article/3272153/asean-top-diplomats-condemn-myanmar-

violence-urge-peaceful-means-settle-sea-disputes

6.

INDIA

India budget promises spending and job growth

India's Finance Minister, Nirmala Sitharaman, presented

the first full annual budget of Prime Minister Narendra

Modi's new government which took charge in June. Its

focus on the poor, women, youth and farmers was

highlighted. Sitharaman outlined plans to increase

spending, generate jobs and offer middle-class tax relief,

with extensive job creation expected over the next five

years and significant changes in tax brackets and rates.

The budget included massive allocations for infrastructure

and housing which may spur demand in the wood panel

sector.

The budget is themed on improving access to physical,

social and digital infrastructure along with workforce

skills upgradinge. The finance minister announced a flurry

of measures for boosting the infrastructure, housing and

micro and small/medium sized enterprises.

The budget allocates Rp11.1 lakh crore (approx. US$132

billion) for infrastructure with 12 industrial parks

sanctioned under the National Industrial Corridor

Development Programme. Investment-ready industrial

parks are to be developed in or near 100 cities.

See:: https://www.business-standard.com/budget/news/union-

budget-2024-here-are-the-key-highlights-from-fm-sitharaman-s-

speech-124072300664_1.html

and

https://wadeasia.us16.list-

manage.com/track/click?u=7cd7ea804c413675d899051e6&id=b

619d26205&e=dc98727776

India's path to prosperity is via growth

An article in Nikkei.com, quoting Chetan Ahya, the Chief

Asia Economist for Morgan Stanley, suggests that supply-

side reforms and private investment are the key to India's

economic future.

The return of a coalition government in India after two

terms has raised the intensity of the policy debate over

whether the country needs to enact more aggressive

redistributive policies.

Ahya’s view is that one of the key drivers for India's

growth, which Morgan Stanley forecasts to be quite

healthy at 6.5% next year, is improvement in private

investment. Policy continuity, focused on boosting

infrastructure investment and encouraging private

investments with tax incentives, is the best way to achieve

this.

See: https://asia.nikkei.com/Opinion/India-s-path-to-prosperity-

is-through-growth-not-

redistribution?utm_campaign=GL_opinion&utm_medium=email

&utm_source=NA_newsletter&utm_content=article_link&del_ty

pe=6&pub_date=20240720093000&seq_num=17&si=fe0afe7c-

532b-443e-bd57-30a8db100322

IMF raises India’s GDP forecast

The International Monetary Fund (IMF) raised its

projection for India’s gross domestic product (GDP)

growth for 2024-25 by 20 basis points to 7% amid a boost

in private consumption, especially in rural areas.

“The forecast for growth in India has been revised upward

with the change reflecting carryover from upward

revisions to growth in 2023,” the update to the IMF’s

World Economic Outlook (WEO) said. In 2025-26, the

IMF expects growth to slow to 6.5%, as it stated in its

April World Economic Outlook.. The RBI has projected

the Indian economy to grow at 7.2% in FY25.

See: https://www.business-standard.com/

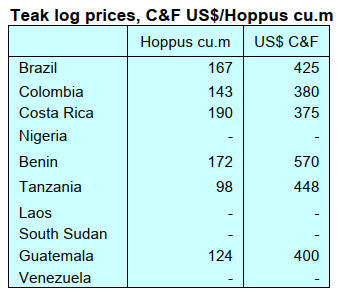

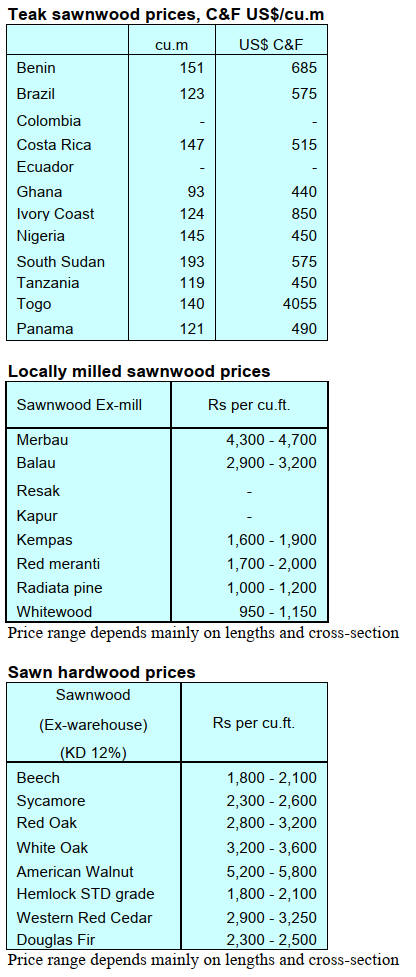

Cost C&F Indian ports in US dollars, Hoppus measure

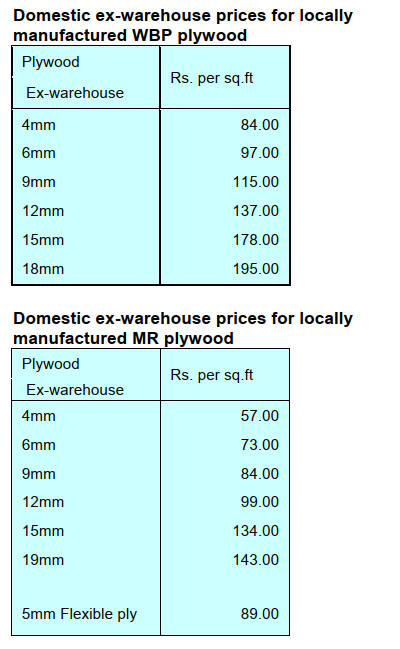

Indian plywood price increases

Plywood manufacturers in India have agreed price

increases. Indian plywood markets are witnessing a

shortfall in imports due to growing container issues and

logistical delays. The price of containers has risen, the

steepest rise since the Covid pandemic. The surge in prices

of imported plywood is also due to higher prices being

demanded for adhesives as well as sea freight.

Rising prices for imported plywood is helping improve the

competitiveness of Indian domestic manufacturers. But

domestic manufacturers have to absorb rising costs of

imported core veneer.

See: https://www.plyreporter.com/plywood/news-of-the-week

7.

VIETNAM

Vietnam wood and wood product trade

highlights

According to Vietnam Customs, wood and wood products

(W&WP) exports to the Chinese market in June 2024

reached US$214 million, up 79.2% compared to June

2023. In the first six months of 2024, W&WP export

turnover from the Chinese market was Vietnam US$1.1

billion, up 54.1% year-on-year.

In June 2024, Vietnamese exports of kitchen furniture

amounted to US$118 million, up 12.4% compared to June

2023. Over the first six months of 2024, export turnover of

kitchen furniture was US$646 million, up 28.9% over the

same period in 2023.

Vietnam's oak imports in June 2024 reached 32,400 cu.m,

worth US$18.6 million, up 1.8% in volume and 1.0% in

value compared to May 2024. Compared to June 2023,

oak imports increased by 9.0% in volume and 17.2% in

value. In the first six months of 2024, oak imports were

167,500 cu.m, worth US$96.1 million, up 23.3% in

volume and 27.1% in value over the same period in 2023.

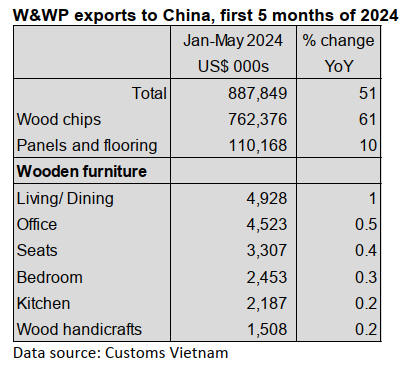

Exports to China soaring

Vietnam’s W&WP exports to China in June 2024 were

US$214 million, up 79.2% compared to June 2023 and for

the first six months reached US$1.1 billion, up 54.1% over

the same period in 2023. Of the W&WP exported to

China, woodchips dominated in the first five months of

2024, being worth US$762.4 million, up 61.3% over the

same period in 2023 and accounting for 85.9% of the total

W&WP exports to the country.

At present, China's paper industry relies heavily on a

combination of imported and locally sourced pulp and

woodchips. The balance between these two fibre sources is

mainly influenced by fluctuating pulp prices in the global

market and costs associated with importing hardwood

chips to feed Chinese pulp and paper mills. In the past 15

years, woodchip imports into China have exceeded pulp

imports.

In 2022, woodchip imports accounted for 64% of China’s

total wood pulp and chip imports. In 2023, as the market

price of pulp fell more significantly than that of wood

chips, China increased pulp imports to 28 million tons, up

24% compared to 2022. As a result, Vietnam's woodchip

exports to the Chinese market decreased.

However, as of the first five months of 2024, Vietnam's

woodchip exports to the Chinese market regained growth

due to soaring demand. Statistics from the China Customs

Administration reveal that China’s woodchip imports in

the first five months of 2024 reached 7.5 million tons,

worth US$1.4 billion, up 35.4% in volume and 12% in

value over the same period in 2023. Of this, woodchip

imports from Vietnam amounted to five million tons,

worth US$833.7 million, up 64.9% in volume and 32.4%

in value over the same period in 2023.

Department of Forestry (DoF) and Suntory PepsiCo

Vietnam co-operation

The DoF under the Ministry of Agriculture and Rural

Development (MARD) and Suntory PepsiCo Vietnam

have signed a memorandum of understanding (MoU) for

sustainable forest development, towards water

replenishment and carbon offset forestry investment and

development. The agreement came as part of a public-

private partnership conference in the multi-use value of

forest ecosystems. The event also marked the launch of the

National Forest Passport Initiative.

See: http://en.stockbiz.vn/News/2024/7/12/1625476/forestry-

department-and-suntory-pepsico-vietnam-co-operate-in-

sustainable-forest-development.aspx

Vietnam has over 14.86 million hectares of forests, rich

and diverse in ecosystem values. Over the years, the

forestry sector has promoted the policy of 'socializing

forestry' through various mechanisms and policies.

Under the MoU, the two sides will work together to plant

native and large timber trees, regenerate water resources,

increase carbon absorption and protect the environment,

while enhancing livelihoods for local people.

Vietnam Carbon Standard and sales of carbon credits

To achieve the goal of net zero emissions by 2050,

Vietnam has issued several policies on reducing

greenhouse gas emissions. Decree No. 06/2022/ND-CP of

the government stipulates regulations on greenhouse gas

inventory, emission reduction and development of the

domestic carbon market. However, these regulations are

not detailed, leading to difficulties in implementation.

Currently, this Decree is being revised.

The forestry sector has been undertaking emission

reduction activities and in readiness for the domestic

carbon market and emission reduction targets. Learning

from emission reduction programs and international

voluntary carbon markets, the development of the national

standard (TCVN) on forest carbon credits has been

officially approved.

The carbon standard will be considered as part of the

Vietnam Forest Certification Scheme (VFCS) to generate

benefits from forest carbon as an additional financing

source for forest owners. The carbon standard is expected

to be issued by the end of 2025.

According to the DoF, in recent years a number of

localities have received proposals from domestic and

international organizations and individuals to provide

technical services in measurement, reporting, appraisal

and verification of carbon credits for selling.

The DoF has warned that the carbon credit trade is

immature and the legal framework is incomplete and in

need of further studies and improvements. To date

Vietnam has collected US$51.5 million from the sale of

forest carbon credits

According to DoF, Vietnam, so far, has been

implementing only one forest carbon credit transfer

program, titled the North Central Region Emission

Reduction Payment Agreement (ERPA), which was signed

on October 22, 2020 between the Ministry of Agriculture

and Rural Development and the International Bank for

Reconstruction and Development of the World Bank.

See: https://vfcs.org.vn/en/news/development-of-a-national-forest-carbon-standard/

8. BRAZIL

Forest Service views concessions as the route to

SFM

and forest conservation

Brazil has announced a plan to expand selective logging

through additional forest concession areas. President Luiz

Inácio Lula da Silva plans to establish these over as much

as 310,000 square kilometres of public undesignated

Amazon rainforest.

The Brazilian Forest Service views concessions as the

route to conservation of these areas. Companies that hold

timber concessions must follow strict rules. They can log

up to six trees per hectare over a 30-year period. Species,

such as Brazil nut and mature seed-producing trees canot

be felled.

The hope is that granting permission to timber companies

to take a limited number of trees gives them a stake in

overseeing the forest. The Forest Service says studies

show that illegal deforestation in concession areas is

significantly lower than outside them.

A working group is assessing which areas should be

designated as conservation areas, Indigenous territories or

as forest concessions.

See: https://apnews.com/article/brazil-amazon-forest-protection-

logging-3afaaaf3789d3d2dc19c2d52584676a7

Measures to reduce forest product export bureaucracy

The Federation of Industries of the State of Mato Grosso

(FIEMT) met with the Ministry of Agriculture and

Livestock (MAPA) in Brasilia, in mid-July 2024. The

main topic of discussion was the request for measures to

streamline export procedures for forest and agro-industrial

products in what is one of the main tropical timber

producing states in the Amazon region. FIEMT requested

changes to federal regulations to reduce bureaucracy in

exporting products via containers that require pest control

fumigation treatment and a phytosanitary certificate.

It also pointed out that a proposed regulatory update could

reduce the time needed to issue certificates and release

containers by up to 15 days resulting in faster, cheaper

shipments. According to FIEMT, MAPA says it

recogniszes the need for change and will soon intervene to

simplify processes helping to boost industry

competitiveness.

See: https://www.sapicua.com.br/fiemt-e-mapa-discutem-

reducao-da-burocracia-na-exportacao-de-produtos-florestais-e-

agroindustriais

Public-private partnerships to support forest conservation

The Brazilian Forest Service (SFB) has signed a Technical

Cooperation Agreement with the Inter-American

Development Bank (IDB) and the National Bank for

Economic and Social Development (BNDES) to structure

public-private partnership (PPP) projects focused on the

sustainable management and restoration of environmental

assets in the Amazon.

With a value of US$1 million, the program is financed by

the Green Climate Fund (GCF) through the IDB's Amazon

Forever program (Programa Amazônia Sempre). The

programme will focus on structuring sub-national PPP

projects for forest conservation and the recovery of

degraded areas, including profiles, pre-feasibility and

feasibility studies, as well as the preparation and

structuring of bidding documents and contracts.

The 2023 legal change in the Brazilian Public Forest

Management law for sustainable production allows

payment for environmental services in forest concessions

which represent a unique opportunity to encourage private

sector participation in forest restoration projects. This

forest concession model has the potential to attract up to

R$60 billion (approximately US$12 billion) in

investments, developing a new production chain for

regeneration of degraded areas while aiming to promote

bio-business and sustainable practices in the Amazon

region.

See: https://www.yumpu.com/pt/document/read/68748303/florestal-264web

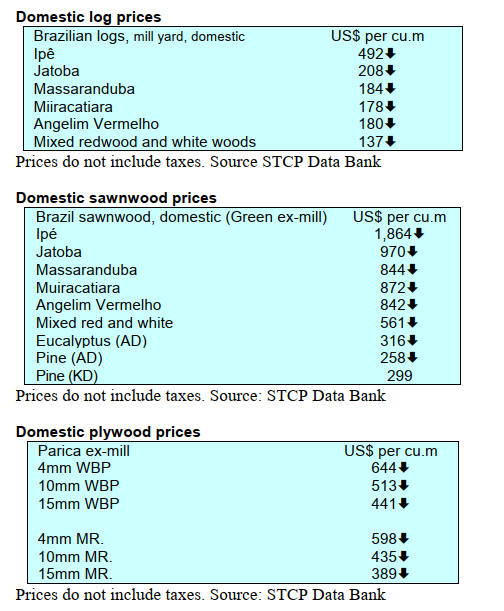

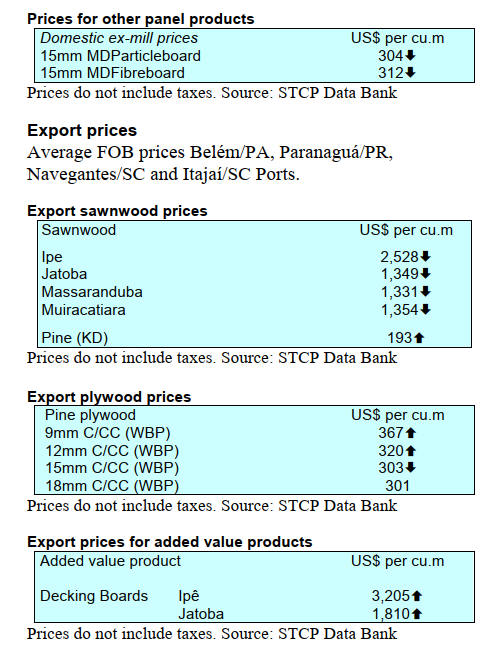

Rise in value of wood product exports

In June 2024, total Brazilian exports of wood-based

products (except pulp and paper) increased 7.4% in value

compared to June 2023, from US$291.5 million to

US$313.1 million.

Pine sawn wood exports increased 1.9% in value between

June 2023 (US$58.6 million) and June 2024 (US$59.7

million). In volume, exports remained the same at 251,000

cu.m.

Tropical sawn wood exports decreased 4.9% in volume,

from 28,700 cu.m. in June 2023 to 27,300 cu.m. in June

2024. In value, exports decreased 22.2% from US$ 14.4

million to US$ 11.2 million, over the same period.

Pine plywood exports increased 61.9% in value in June

2024 (US$79.0 million) compared to June 2023 (US$48.8

million). By volume, exports increased 51.7% over the

same period, from 148,300 cu.m. (June 2023) to 224,900

cu.m. (June 2024).

Tropical plywood exports remained the same in volume

and value in June 2023 and June 2024 at 2,900 cu.m. and

US$1.8 million.

Wood furniture export value decreased 2% from US$45.4

million in June 2023 to US$44.5 million in June 2024.

Wood panel exports higher in the first quarter

The Brazilian forestry sector ended the first quarter of

2024 with a positive balance of US$3.2 billion, an increase

of 1.5% on the same period in 2023. IBÁ (the Brazilian

Tree Industry) highlighted wood panel exports as the key

factor in the rise.

The wood-based panel sector showed a robust

performance in the first quarter of 2024, with exports

growing 57% over the same period in 2023, reaching

369,000 cu.m. On the domestic market, sales rose by

10.4%, totalling 1.8 million cu.m.

China remains the main market for Brazilian forest

products. Exports to Europe, the second largest market,

increased 1.8% to US$ 814.1 million in the first quarter of

2024, while exports to North America increased 6.1%,

reaching US$810.7 million.

An additional highlight was growth in Brazilian exports to

Africa, up 17.1% in the first quarter of 2024, to US$ 59

million.

IBÁ said the Brazilian forest plantation sector is a

significant pillar of Brazil’s economy, describing it as a

crucial supplier to the world's main economies, and

contributing 4.4% of the country's total exports in the first

quarter of 2024.

See: https://www-portaldoagronegocio-com-

br.translate.goog/florestal/mercado-florestal/noticias/setor-

florestal-brasileiro-registra-alta-nas-exportacoes-de-paineis-de-

madeira-no-primeiro-

trimestre?_x_tr_sl=pt&_x_tr_tl=en&_x_tr_hl=en&_x_tr_pto=sc

Concerns over Brazilian nursery capacity

The Brazil Climate, Forest and Agriculture Coalition

points out that the country will need to produce 5.4 billion

native tree seedlings by 2030 to reach the target of

reforesting 12 million hectares and to fulfil its

commitment under the Paris Agreement to reduce carbon

emissions.

However, there are still challenges for the country to

achieve this level of forest regeneration. Without specific

lines of credit and with few targeted public policies, the

market for native tree seedling nurseries is likely to remain

at 300 million seedlings a year, which is insufficient for

the country to meet its global commitment.

See: https://www-madeiratotal-com-

br.translate.goog/dificuldades-dos-viveiros-ameacam-

compromisso-do-brasil-no-acordo-de-

paris/?_x_tr_sl=pt&_x_tr_tl=en&_x_tr_hl=en&_x_tr_pto=sc

Through the eyes of industry

The latest GTI report lists the challenges identified by the private sector

in Brazil.

See, GGSC https://www.itto-ggsc.org/static/upload/file/20240719/1721354559472477.pdf

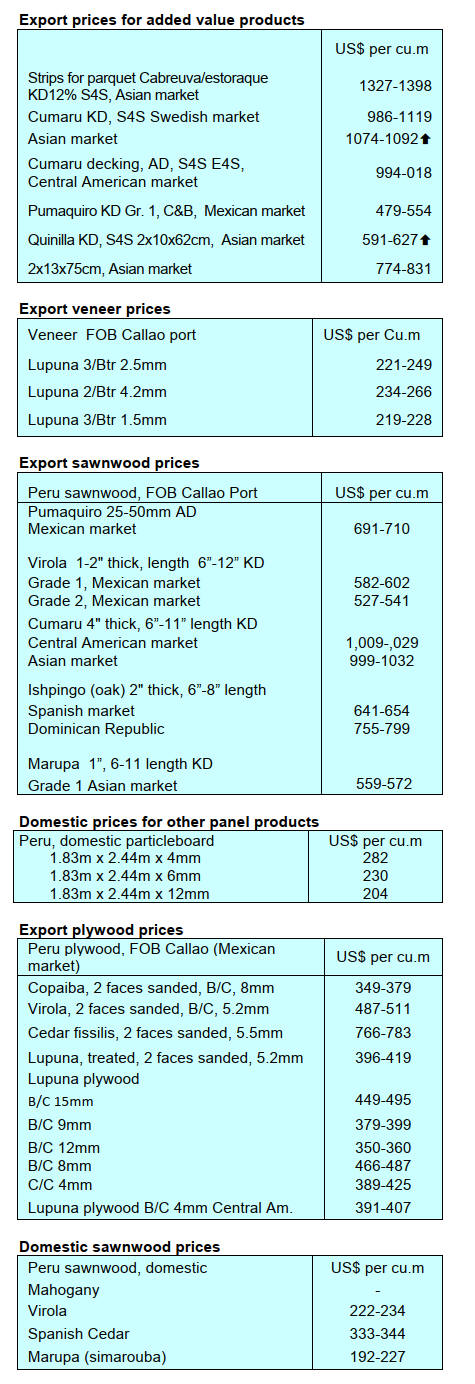

9. PERU

Peruvian furniture exports up in the first four

months of 2024

Exports of furniture and components for the period

January to April 2024 amounted to US$1.58 million, an

increase of 38.6% compared to the same period in 2023,

when they reached US$ 1.14 million.

The main export market for veneer and plywood during

the January to April 2024 period was the United States,

which represented 64.5% of total export value. Chile

followed with 7% of export value and in third place was

Italy with 6%.

Source: https://www-adexperu-org-pe

New FSC Forest Management Standard for Peru

FSC announced the official publication of the new FSC

Forest Management Standard for Peru which covers all

categories of management units in natural forests and

plantations, including small and low-intensity

management forests as well as non-timber forest products

(NTFP).

This new Standard, effective from October 2024, not only

focuses on productive forest management, but also covers

conservation and restoration management of forests.

The English version of the FSC Forest Management

Standard for Peru is available for download in the FSC

Documentation Centre.

See: https://notifix.info/en/news-en/markets/44944-new-fsc-

forest-management-standard-for-peru

Peru applies to host the XVI World Forestry Congress

in 2027

In the framework of the Committee on Forestry (COFO

27), held at the Food and Agriculture Organization of the

United Nations (FAO) headquarters in Rome (Italy), the

Ministry of Agrarian Development and Irrigation

announced that Peru has applied to host the XVI World

Forestry Congress to be held in 2027.

The World Forestry Congress is held approximately once

every six years. The forum allows for the exchange of

opinions and experiences on issues related to forests and

forestry that result in recommendations applicable at

national, regional and global levels. Host countries receive

technical support from FAO.

See: https://www.gob.pe/institucion/serfor/noticias/993981-

peru-postulo-para-ser-sede-del-xvi-congreso-forestal-mundial-

2027

Government to co-finance forest plantations

The Ministry of Agrarian Development and Irrigation,

through the National Forest and Wildlife Service

(SERFOR) and its Sustainable Productive Forests Program

(BPS), will co-finance US$3.93 million in up to 20 forest

plantation projects with communities, associations of

producers and MSMEs within the Departments of Junín,

Áncash, and Huánuco.

The finance should allow the establishment of 2,000

hectares of forest plantations which will contribute to

improving community livelihoods.

The co-financing forms part of the Forest Incentive Plan

(PIF) of the BPS programme, launched in April 2024

seeking to promote forest plantations for commercial

purposes with the objective of reducing pressure on

natural forests, increasing timber forest production in the

country and contributing to the economy and well-being of

the population.

See: https://www.gob.pe/institucion/serfor/noticias/989711-

gobierno-cofinanciara-mas-de-14-millones-de-soles-en-

proyectos-de-plantaciones-forestales-de-productores-durante-

este-ano

|