|

Report from

Europe

Rethinking trategy for Europe’s furniture sector

Europe continues to perform a key role in the global

furniture trade and industry, but that role is shifting as

European operators seek to reduce risk by shortening

supply chains and with introduction of new environmental

regulations. For wooden furniture, the EU Deforestation

Regulation (EUDR) is likely to play a particularly

significant role in future procurement practices.

In global terms Europe has lost ground to emerging

markets in furniture production and consumption in recent

years. However, it remains the world’s third-largest

market after Asia Pacific and North America. With more

than 230 million households, a relatively high level of per

capita consumption, and annual retail furniture sales of

EUR 165 billion, Europe accounts for over a quarter of the

global world furniture market.

This is according to the latest edition of the World

Furniture Magazine published by CSIL, the Italian

furniture industry research organisation.

See: https://www.worldfurnitureonline.com/magazine/)

A key feature of the European furniture sector, according

to CSIL, is that it is characterised by an exceptionally high

level of business-to-business trade concentration and

integration: as much as three quarters of cross-border

furniture trade worldwide occurs between European

countries where there is a robust intra-regional trade

network. And unlike in the U.S. where a large share of

furniture production has been relocated to China,

Southeast Asia and Mexico, 80% of current demand in

Europe continues to be met by European manufacturers.

As elsewhere in the world, Europe’s furniture market

exhibited robust growth during the pandemic in 2021 as

consumers spent heavily to improve their home

environment, establish home offices, and improve outside

space. Economic support measures in the immediate

aftermath of the pandemic continued to fuel the boom into

2022, but the market decelerated rapidly in 2023.

According to the latest figures from CSIL, the overall

value of furniture consumption in Europe contracted by

3.5% last year.

CSIL note that the European furniture sector has faced a

multitude of challenges since the pandemic outbreak with

disruptions along the entire value chain. Since 2023, the

rising cost of living has intensified pressure on consumer

spending, particularly for big-ticket items such as

furniture. At the same time, major logistical challenges,

volatility in transport costs, and other supply problems

forced furniture manufacturers and retailers to rethink their

business strategies.

Most furniture companies surveyed by CSIL in 2023 said

they are actively working to shorten supply chains and

increase dependence on local production to reduce risk

and shorten time to market. Within Europe, Portugal, Italy,

and Spain have particularly benefited from this trend.

Chinese wooden furniture recovers ground in Europe

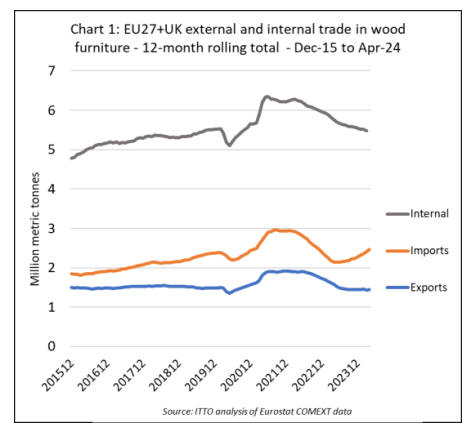

However, the latest Eurostat and UK trade data appears, at

first sight, to partially contradict this analysis. The data

shows that internal European trade in wooden furniture

has been slowing continuously since the start of 2023,

very much in line with the wider decline in consumption.

It also shows that European exports of wooden furniture to

countries outside the region, after falling rapidly in 2022,

have remained flat since the second quarter of 2023. But it

also shows that European imports from other parts of the

world have been increasing since the middle of last year

(Chart 1).

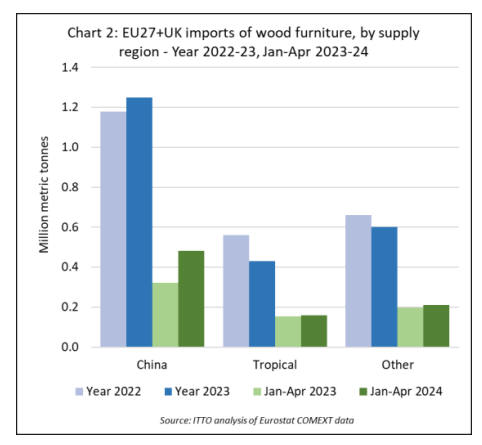

Closer analysis of the data reveals that the recent growth

in wooden furniture imports into the EU27+UK has been

driven by China. Imports into Europe from China

increased by 6% to 1.25 million tonnes in 2023 and were

up by more than 50% at 480,000 tonnes in the first four

months of this year.

In contrast imports from tropical countries fell by 23% to

430,000 tonnes in 2023 and were up only 4% in the first

four months of this year. Imports from all other countries

(mainly non-EU European countries and Turkey)

decreased 9% to 600,000 tonnes in 2023 and increased by

7% to 210,000 tonnes in the January to April period this

year (Chart 2).

Wooden furniture imports from China have increased both

into the UK, the largest single wooden furniture importing

country in Europe, and into the EU. UK imports from

China increased 13% to 417,000 tonnes in 2023 and were

up another 34% to 152,000 tonnes in the first four months

of this year.

EU imports from China were up only 3% in 2023 to

833,000 tonnes but increased 59% to 331,000 tonnes in the

first four months this year. Imports of wooden furniture

from China have increased very sharply into all the main

EU markets this year including France, Germany, and the

Netherlands.

EUDR to significantly impact Europe’s wooden

furniture market

The sharp rise in wooden furniture imports from China by

European countries since the start of 2023 is partly

explained by the fact that it follows a big decline in 2022

when Chinese exports were seriously impacted by rigorous

lockdowns during the pandemic. The accelerating rise in

imports from China this year may be partly related to

EUDR as European importers build stock before

enforcement of that law is due to begin on 30 December.

Recent news reports suggest that China’s government has

told the EU that it is not prepared to allow geolocation

coordinates of harvest sites of regulated products (which

include all wooden furniture), as required by the EUDR, to

be supplied with products exported from China, citing

security concerns (see https://woodcentral.com.au/china-

rejects-key-eudr-rules-impasse-leaves-eu-in-crisis).

The EU has responded that imports without geolocation

coordinates will not be possible once EUDR is enforced

and that there will be no exceptions for any country,

including China.

How this standoff plays out, and the wider challenges of

providing geolocation coordinates of harvest sites for a

composite product like wooden furniture, particularly

when the wood is derived from smallholders or imported

from third countries, is expected to have a very significant

impact on European market access for wooden furniture

starting next year.

The impact will be greatest for exports to EU countries,

less so for exports to the UK where legal obligations

remain tied to the UK Timber Regulation (mirroring the

EU Timber Regulation). However, large UK retailers are

calling for the UK to align more closely with EUDR and -

under a newly-elected Labour government ambitious to

lead on environmental issues and to be closer to the EU - it

may be that exports to the UK will, in time, be subject to

an equivalent standard.

European imports of tropical wooden furniture remain

low

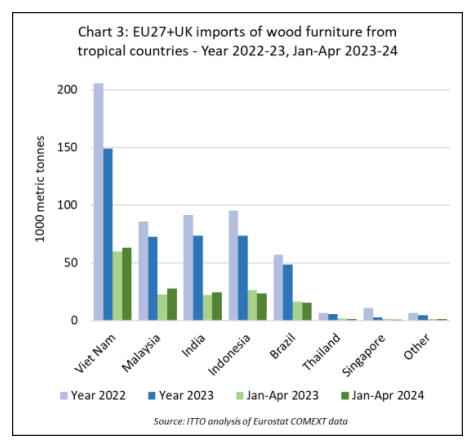

For now, European imports of wooden furniture from

tropical countries remain low and show little sign of

recovery. In the first four months of this year, imports

from Vietnam were 280,000 tonnes, unchanged from the

same period last year.

Imports were down 20% from Indonesia at 122,000

tonnes, down 8% from Brazil at 37,000 tonnes, and down

30% from Thailand at 8,000 tonnes, during the same

period. However, imports from India increased 10% to

95,000 tonnes and 22% from Malaysia to 65,000 tonnes

(Chart 3).

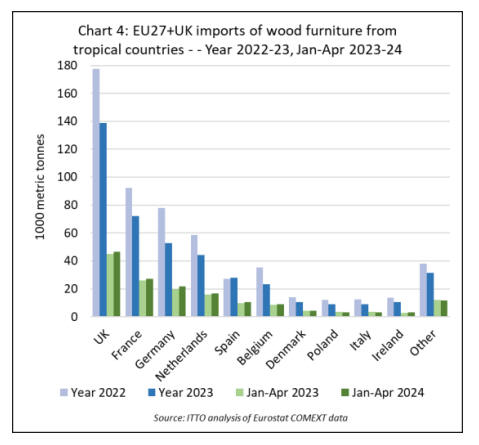

Considering European destinations for tropical wooden

furniture, after most recorded a large downturn last year,

there was slow recovery in all the main markets in the first

four months of this year including UK (+3% to 46,400

tonnes), France (+6% to 27,400 tonnes), Germany (+11%

to 21,900 tonnes), Netherlands (+5% to 16,900 tonnes),

Spain (+8% to 10,500 tonnes), Belgium (+6% to 9,100

tonnes), and Denmark (+1% to 4,500 tonnes) (Chart 4).

Transformation of Europe’s outdoor furniture sector

The outdoor furniture sector has gone through one of the

most dynamic transformations among the sub-segments of

the European furniture industry and its evolution was

highly conditioned by the COVID-19 pandemic. This is

according to the latest report on the European outdoor

furniture sector by CSIL, the Italian furniture industry

market research organization.

The market for outdoor furniture in Europe was valued by

CSIL at around EUR 3.5 billion in 2023. In 2021 and 2022

the outdoor furniture sector performed even better than the

wider European furniture market, but in 2023 performance

fell back to the industry average. The largest markets for

outdoor furniture in Europe are Germany, the United

Kingdom, Italy, and France, which together account for

60% of the total market.

Production of outdoor furniture in Europe was valued by

CSIL at around EUR 2.5 billion in 2023, 5% less than in

2022. Despite the recent downturn, average growth in

European outdoor furniture output was 5% per year

between 2018 and 2023. The major manufacturing

countries are Italy, Germany, France, and the United

Kingdom, which together provide around 60% of total

European production.

According to CSIL, “in 2023, Europe grappled with

elevated uncertainty, sluggish economic performance, and

a pronounced deceleration in the construction industry.

This strained the demand for outdoor furniture among

European consumers, especially in the lower and middle-

price segments. This stems from a higher cost of living

due to inflation, rising interest rates, and increased prices

for commodities and energy”.

While European production of outdoor furniture has

increased, imports still satisfy a relatively larger share of

consumption compared to other sections of the furniture

market. This reflects the internationalization strategy

operated by European manufacturers locating plants where

raw materials are sourced (teak wood, rattan, etc.) and the

cost of labor is lower. Leading European outdoor furniture

brands continue to rely heavily on imports from Asian

countries despite recent supply chain challenges.

However, some European companies have increased

imports from neighboring countries (Baltics, Poland,

Romania) to minimize transport costs and reduce delivery

times.

A notable feature of the outdoor furniture sector in Europe

is the role of the contract segment. In the first year of the

pandemic, a sharp decline in the contract segment of the

outdoor furniture market was offset by good performance

in the retail channel, particularly by e-commerce.

However, starting in 2021, most manufacturers

experienced a rebound also in contract projects. In the last

two years, the contract segment has buffered many

companies from decreasing revenues in the retail sector.

Specific sub-segments such as hospitality, restaurants,

education, and the boat segment have helped sustain

demand. Although the retail sector remains dominant, in

the past 2 years the share of contract project sales has

increased for many suppliers.

Product trends in Europe’s outdoor furniture sector

A key trend in Europe’s outdoor furniture sector is that

consumers increasingly see outdoor space as an extension

of their home’s indoor environment. They expect to use

outdoor areas such as gardens and balconies all year

round, even in winter. The pandemic reinforced this trend.

Upholstered furniture and seating now tend to take center

stage and many new collections have profiles and

coverings that are suitable for both indoor and outdoor

use. One rapidly expanding niche is for outdoor kitchens.

Although this segment is still quite small overall, demand

is still more than supply and there are opportunities for

new players with new ideas.

CSIL closely monitors the performance of the outdoor

furniture market in Europe through the comprehensive

Reports: ‘The Outdoor Furniture Market in Europe’ and

‘The Contract Furniture and Furnishings Market in

Europe’. These studies delve into statistics and indicators,

demand drivers, country analysis, competitive landscapes,

and product categories. More details are available at

www.worldfurnitureonline.com.

UK conference sets timber building sights high

With its rising population and shifting demographics, the

UK urgently needs more homes. The Centre for Cities

(www.centreforcities) estimates that the current housing

backlog is around 4.3 million individual dwellings. At the

same time UK construction and buildings in use account

for 30% of the country’s carbon emissions. So new home

building, and renovation need to use more bio-based

materials, notably wood, if the country is to meet its 2050

net zero targets.

This was the clear message of the first ever UK Timber

Design Conference (UKTDC). Held in London in June,

the event was hosted by the Timber Development UK

(TDUK) trade body, Swedish Wood and not-for-profit

sustainable construction facilitator Built by Nature.

The conference looked at latest developments in timber-

based building in the country and how growth of the sector

can be driven faster and further. The audience of over 200

comprised timber suppliers, architects, engineers,

contractors, developers, designers and other specifiers.

They included leaders in their fields, and many were

members of TDUK.

The latter was formed three years ago from the merger of

the Timber Trade Federation (TTF) and the Timber

Research and Development Association (TRADA). This

gives it a membership across the timber and wood

products supply chain (including tropical timber importers

and traders) and also the specifier and end-use sectors,

notably construction. Its mission is to grow and develop

timber consumption and widen its application, with a core

emphasis on how this can reduce emissions and support

development of a low carbon, circular economy. TDUK

maintains the tie-up of the two bodies in one organisation

gives the industry a stronger, more united voice to

decision and policy makers. A particular focus is on

highlighting the environmental and technical potential of

timber in construction, hence the launch of the UKTDC,

which TDUK Chief Executive David Hopkins said will

now be an annual event.

Putting sustainability at construction’s heart

First on the UKTDC stage was keynote speaker Richard

Walker, Chairman of Bywater Properties, a developer

which places sustainability and low environmental impact

high on its agenda. The result is a strong focus on use of

wood, and notably engineered or mass timber in its

building developments. “Clearly, we’re not a charity”,

said Mr Walker, “We need to make a profit to keep on

doing what we’re doing.

But building in timber also has a commercial aspect in

terms of demonstrating our USP. Our approach also

builds customer respect, which further adds to our

commercial edge.”

Underlining Bywater’s focus on low carbon timber

building, in 2023 it concluded a joint venture agreement

with Sumitomo Forestry, the Japanese forestry and timber

giant. Bywater SFC is described as an ‘end-to-end’ timber

construction specialist with a goal of achieving over £1

billion of assets, focusing on decarbonised construction in

the form of mass timber real estate developments across

the UK and Europe.

One of the first outcomes of the partnership is Paradise,

mass timber-based six-storey office block in London

boasting a wood content that locks away 60-years’of the

building’s operational emissions.

Bywater sees opportunities for mass timber not just in

whole new build projects, but also in refurbishment and

renovation. This includes extending buildings vertically to

use their so-called ‘air space’.

With building energy efficiency and use of renewables

now at an increasingly advanced stage, the key to further

reducing construction’s environmental footprint is to

tackle embodied carbon. That is the sum total of the

emissions resulting from the production, transport and

erection of the particular building materials. Bywater

sees mass timber as a prime solution; with wood not only

sequestering carbon while growing and storing it for its

lifespan, but also being low energy to produce and process

compared to energy intensive materials such as steel and

concrete.

“The embodied carbon in build is where the big emissions

are and where they can be saved,” said fellow Bywater

founding partner Theo Michell. “Mass timber is not the

golden bullet to tackle embodied carbon, but it is an

important part of the tool kit.”

Mr Walker also stressed that government support was

needed to drive more timber building. ‘Sclerotic’ planning

rules needed reform and restrictions on the height of

building in wood needed a rethink.

Building in harmony with nature

Chairing a panel discussion on the investment and

bureaucratic hurdles faced by the timber building sector,

Joe Giddings of Built by Nature highlighted its grant-

making activities targeted at achieving its objective of a

‘built environment in harmony with nature’.

In terms of carbon performance, he said, timber’s

attraction is centred on the ‘three S’s’; its sequestration of

carbon from the atmosphere, it’s carbon storage and its

capacity to substitute higher environmental impact

construction materials.

Built by Nature is currently supporting around £1.3 billion

of building developments. With leading developers, it has

also supported production of the Commercial Timber

Buildings Guidebook, a good practice and risk mitigation

handbook for mass timber office building in the UK.

A further challenge to UK timber building has been

securing insurance. Consequently, Built by Nature has also

backed production of the Mass Timber Insurance

Playbook, a guide on how to secure cover published by the

Alliance of Sustainable Building Products and written by

insurance professionals.

In the session on ‘Drivers of Timber Construction’ at the

conference, Russell Tame of UK property developer

Human Nature said part of his company’s role is to help

drive investment in timber building by “increasing the

understanding of less informed groups” about its merits.

“Some investors and clients are enlightened, others still

ask ‘doesn’t it catch fire and can we get insurance’.”

The company’s Head of Sustainable Construction Andy

Tugby added that “This is no time for business as usual in

construction, we have to develop climate friendly

solutions and commit to exponential sustainability. This

isn’t just a case of using more timber, but using it better

and most efficiently, to get the maximum benefit from the

resource”.

Exploring timber hybrid options

In the same session, Sam Tame of developer Related

Argent highlighted timber’s capacity to work with other

building products.

“Of three of our recent projects, one is a 148,000 sq ft full

timber-frame office, but the other two are concrete frame

with cross laminated timber (CLT deck),” he said. “It’s

important to look at other materials to get the right

solution for the project, particularly as their producers are

now looking to catch up with timber in terms of

environmental impact. In a fourth project we’re also

evaluating the option of eco-concrete and steel.”

The consensus was that commercial timber developments

were 3-5% more costly than the equivalent in concrete and

steel. However, developers said this was increasingly

offset by speed of build and tenants’ positive view of

timber building, which led to faster occupancy rates and a

quicker return on investment.

In the conference session on ‘Building Confidence in

Timber Construction’, Judith Schulz of engineers Arup

highlighted the still greater need to demonstrate the fire

performance of timber building since the fatal Grenfell

Tower fire in London in 2017. Although the latter was a

conventional concrete and steel building, timber was

caught up in the subsequent review of UK building

regulations, with a ban on use of combustible materials in

walls of residential and other categories of buildings over

18m.

The route to fire safety

As part of the proof of performance effort, Arup has

produced the guidebook ‘Fire Safe Design of Mass Timber

Buildings’.

“This looks at the layers of building safety taking a risk-

based methodology, ranging from evacuation strategy, to

the extent of exposed timber and types of adhesives used

in mass timber,” said Ms Schulz. “We hope to support

greater uptake of mass timber building, which has been

held back by a lack of [technical guidance]. We should

also use leverage of the approaches taken by authorities in

other jurisdictions to develop market confidence.”

Architect Andrew Waugh of UK mass timber building

pioneers Waugh Thistleton Architects said the objective of

the practice’s New Model Building guidebook was also to

plug the knowledge gap and increase confidence in timber

building in the post Grenfell context. This effectively

provides a template for constructing regulatory compliant

mass timber buildings under 18m.

“It provides 30 generic details for any residential building

under this height, each with three choices of product. It’s

effectively a check list for contractors, covering

everything from fire safety to moisture management,” said

Mr Waugh. “If these are adhered to, developers can be

sure of receiving approval from the UK [provider of

warranty and insurance] National House Building

Council.”

Mr Hopkins highlighted one of TDUK’s contributions to

the understanding of and trust in timber-based

construction, the publication Timber Typologies. Written

with Waugh Thistleton, this addresses the performance of

various types of timber building, from lightweight timber

frame, to mass timber, and the projects to which they’re

best suited.

Extending upwards with wood

Increasing capacity of existing buildings with roof top

extensions, as mentioned by Mr Walker of Bywater, was

the focus of another conference session. Speakers said it

was particularly appropriate for urban development,

helping towns and cities grow without extending their

boundaries – and timber was the ideal material for such

projects. Its strength to weight meant that the height of the

building could be increased without having to reinforce

the existing structure.

It's becoming such an area of interest that the Dutch have a

word for it, ‘optoppen’, or top up building. UK timber

building specialist engineer Whitby Wood, with a

consortium of European partners led by Built by Nature,

has now launched the optoppen website on the topic.

Director Kelly Harrison said the objective of the open-

source, interactive site was to ‘enable city planners and

asset owners to quickly understand the vertical extension

potential of their buildings’ using timber and other bio-

material construction solutions.

Newly elected Labour Party pledge to build 1.5 million

homes

The UKTDC conference took place two weeks ahead of

the UK election and, in the final panel discussion,

construction professionals were asked what they’d like to

see from the new government in terms of building

regulation and support. The Labour party, which in the

event won by a landslide as widely predicted, has pledged

to build 1.5 million new dwellings in five years.

Speakers said they would like to see fiscal measures to

encourage retrofit construction, and greater investment in

building materials and products research and development.

Perhaps the strongest support came for regulation to drive

down embodied carbon in construction, with increased

timber building seen as one of the prime routes to achieve

this.

|