US Dollar Exchange Rates of

25th

Jun

2024

China Yuan 7.26

Report from China

Equipment upgrades and trade-ins

The Chinese government recently took action to facilitate

economic transformation and improve people's

livelihoods.

The campaign is market-oriented and government-guided

and includes four major areas: equipment renewals, trade-

ins of consumer goods, recycling of used goods and the

harmonisation of standards.

The priority is equipment upgrades in promising industries

in order to accelerate the elimination of out dated or

inefficient equipment with high energy consumption, high

emissions or hidden safety risks. A focus will be on

accelerating the development of recycling systems and

development of enterprises engaged in the processing and

utilisation of renewable resources.

The scheme for trade-ins of household consumer goods is

aimed at supporting residents to carry out interior

renovations for kitchens and bathrooms through various

ways with government support and enterprise discounts.

The aim is to promote old home transformation and

actively cultivate consumption of items such as smart

home technologies, promote home improvement and

encourage enterprises to create online model rooms,

provide affordable products and services and meet

diversified consumer needs.

It has been reported that the effect of the ‘old for new’

policy started in May 2024 came to coincide with the May

Day holiday and traditional peak purchasing season. It was

found that consumption of building materials and home

furnishing was stimulated.

See:

https://www.gov.cn/gongbao/2024/issue_11246/202403/content_

6941843.html

Analysis of the wood flooring industry

The output, consumption and export volume of China's

wood flooring are ranked first globally. Wood flooring is

an important end product and value-added product.

However, China's wood flooring production has been in

decline in recent years. After the peak in 2019 most

enterprises have suffered a profits decline and the

industrial prospects are grim.

Tough times for laminate and solid wood flooring manufacturers

The development of China’s wood flooring industry is

basically stable. According to statistics from China

National Forest Product Industry Association (CNFPIA)

the total sales of wood flooring by enterprises with an

annual income of RMB20 million or more in 2023 was

about 322 million square metres, down about 9% year-on-

year.

Of total sales, laminate wood flooring sales were 142

million square metres, accounting for 44% of the national

total. Sales of solid wood composite flooring amounted to

120 million square metres, accounting for 37%, sales of

solid wood flooring was 30 million square metres,

accounting for 9%, the sales of bamboo flooring came to

25 million square metres, accounting for 8% and sales of

other flooring amounted to 5 million square metres,

accounting for 2% of the national total.

China's wood flooring industry showed a steady

development trend from 2010 to 2023 and the volume

sales of wood floors climbed to the highest of 425 million

square metres in 2019 and fell to the lowest of 322 million

square metres in 2023.

The volume of laminate wood flooring and solid wood

flooring sales experienced a steep declining trend but sales

of solid wood composite flooring increased steadily and

the sales of bamboo flooring remained stable. At present

there are more than 93 national standards and industry

standards closely related to wood flooring covering

product testing methods, safety and environmental

protection, services and supporting facilities, equipment

and raw materials, grade and evaluation.

Currently, mechanisation, automation and digitalisation by

enterprises coexist but their development is unbalanced in

different regions and different enterprises. The wood

flooring industry is shifting from product driven to

innovation and data-driven.

Many wood flooring companies have set up technology

centres, R & D centres or research institutes, conducting

research and development mainly around innovative floor

connection methods, innovative substrates or surface

decoration materials, optimising product structure,

upgrading product performance and enriching product

functions.

The number of authorised invention patents in wood

flooring industry reached 514 in 2023. New products such

as solid wood floors for floor heating, impregnated paper

veneer solid wood composite floors, stone-wood plastic

floors, reconstituted bamboo floors, moisture-proof

laminate floors are popular in domestic and foreign

markets.

Existing difficulties in the wood flooring industry

--- With the rise of labour costs and product

homogenisation it is hard to get out of the middle

and low-end market for wood floors.

--- With the rise of foreign trade protectionism and

the evolution of domestic market demand China’s

wood flooring is facing the situation of declining

competitive advantage and brand advantage.

--- Due to the vicious competition and lack of

innovation of the wood flooring industry itself the

overall share of the floor paving materials market

at home and abroad is facing a crisis of decline.

--- Sales of wood flooring are becoming more and

more difficult as products and services do not

effectively meet market demand. The urgent need

is to change from product oriented to user

experience oriented, the implementation of

demand driven, "can let consumers in the use of

products or services to be met" as the standard for

enterprise transformation and upgrading.

Thriving timber industry in Heze City

As of June 2024 there were 7,716 wood processing

enterprises in Heze City of Shandong Province, the annual

processing volume of wood reaches 31 million cubic

metres, the output value of wood processing is more than

RMB110 billion in 2023.

There are more than 1 million employees and its wood

products are exported to more than 100 countries and

regions. Exported products cover medium and high-

density fiberboard, furniture and wood floors and wooden

crafts.

Statistics shows that in the first quarter of 2024 there were

789 wood processing enterprises with output value of

RMB20 million or more in Heze City, an increase of 170

enterprises compared with August 2023, accounting for

28% of the city's industrial enterprises; The revenue was

RMB17.89 billion and the profit was RMB1.42 billion, up

15% and 31% year-on-year.

Production centre for sport flooring

Driven by the development of sports and the rise of a

national fitness craze demand for sports flooring has

expanded away from only competitive sports arenas into

individual’s exercise areas. Sales of sport flooring have

been increasing and a new market with potential for the

flooring industry has emerged.

At present, there are 120 wood sports flooring production

enterprises in Fushun City accounting for 60% of the

number of domestic enterprises engaged in this sector. The

production and sales of sports floor reached 6 million

square metres accounting for about 60% of the domestic

market. Fushun City won the title of "China Sports Floor

Industry Base" in 2023 becoming the only city in China to

win this honor.

Sports flooring is mainly solid wood flooring and solid

composite wood flooring. The species used for sports

flooring are mainly pine, oak, maple and birch.

Global Timber IndexReport – China, May 2024

Data released by China’s General Administration of

Customs on 9 May showed that China’s exports of

furniture and furniture parts between January and April

2024 reached US$23.725 billion representing a year-on-

year increase of 16.5%.

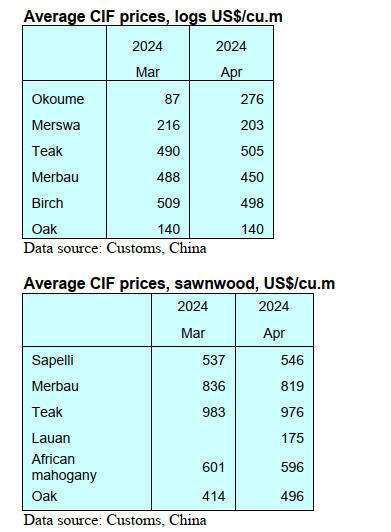

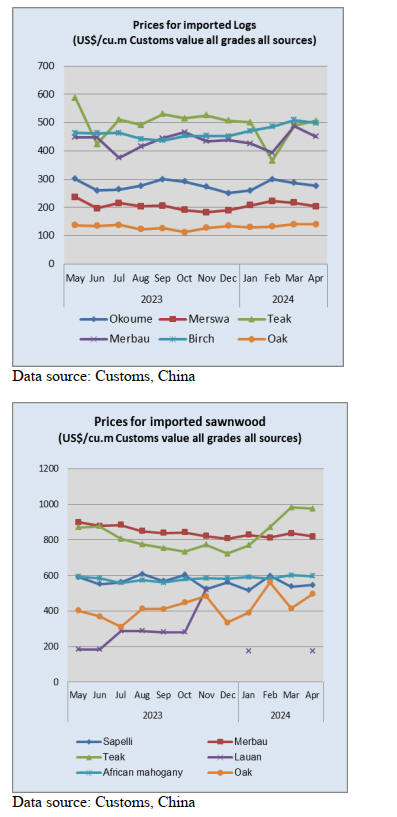

During the same period China’s total imports of logs and

sawnwood were 21.864 million cubic metres, marking a

year-on-year increase of 0.3%. Among them, rubberwood

imported from Thailand reached over 1.69 million cubic

metres indicating a notable year-on-year increase of 32%.

The volume of timber imported from Gabon also increased

significantly (+85%), reaching 0.27 million cubic metres.

On 17 May the People’s Bank of China and the National

Financial Regulatory Administration issued a notice once

again lowering the interest rate for personal housing loans

and reducing the down payment ratio.

Stimulated by a series of new policies for the property

market introduced in the first half of this year the

operating rate in the construction sector rose and demand

for construction wood was gradually recovering. Due to

factors such as geopolitical conflicts and freight charges

enterprises input costs keep on rising.

Maersk, Hapag-Lloyd, CMA CGM, COSCO Shipping and

other shipping companies announced increases in freight

rates which will push up the prices of raw material import

costs.

In May the GTI-China index registered 42.2%, a decrease

of 10.1 percentage points from the previous month and fell

below the critical value (50%) after 2 months indicating

that the business prosperity of the timber enterprises

represented by the GTI-China index shrank from the

previous month.

Due to factors such as a decrease in domestic and foreign

timber demand and the Labour Day holiday, China’s

timber sector saw a decline in both orders and production

volume and some GTI enterprises reported an

overstocking problem.

As for the 11 sub-indices, two indices (inventory index of

finished products and inventory of main raw materials)

were above the critical value of 50% and the remaining 9

indices were all below the critical value.

Compared to the previous month the inventory index for

finished products and the inventory index for main raw

materials increased by 1.8-8.3 percentage points while the

remaining 9 indices declined by 5.0-19.1 percentage

points.

See:

https://www.itto-ggsc.org/static/upload/file/20240620/1718839024156844.pdf

|