Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Jun

2024

Japan Yen 156.65

Reports From Japan

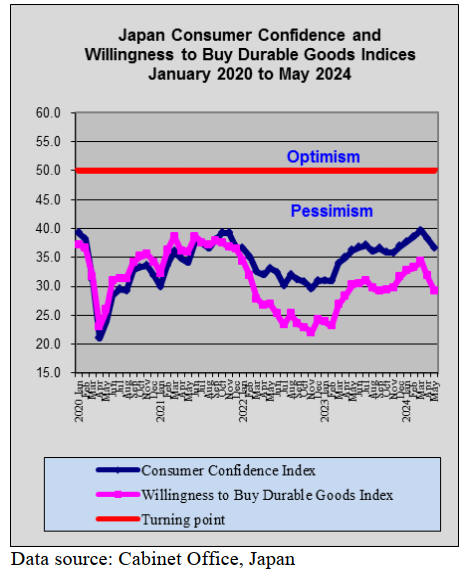

Economy yet to show clear

signs of recovery

The Cabinet Office has reported GDP shrank at an

annualised pace of 1.8% in the first three months of this

year through. Data shows consumers and companies cut

back on spending with companies reporting rising stock

levels as the highest inflation in decades continues to eat

away at household spending power. This is seen as a

warning sign to the Bank of Japan as it considers the

timing of its next interest rate increase.

New, six-year growth programme under preparation

In early June the Prime Minister chaired a meeting of the

Council on Economic and Fiscal Policy. Participants

discussed the preparation of a policy document ‘Basic

Policy on Economic and Fiscal Management and Reform’.

The Prime Minister said the government will adopt a new

six-year programme aimed at pursuing both economic

growth and fiscal reform which will focus on economic

growth while aiming to achieve fiscal soundness by

increasing tax revenue.

It is reported that private-sector members of the Council

urged the government to stick to its goal of bringing the

combined primary budget balance of the central and local

governments to a surplus in fiscal 2025 when the new

programme begins. The private sector panel members also

urged the government to remain committed to lowering

the country’s outstanding debts.

In addition, private-sector panel members asked the

government to return its expenditure structure to normal

after its spending ballooned due to measures to fight the

COVID-19 pandemic.

See:

https://www.arabnews.jp/en/business/article_123423/

Inflation and labour shortages drive wages higher

A recent Nikkei survey suggests a majority of Japanese

companies raised their base pay this year in response to

persistent labour shortages, good news for households

facing increasing inflation.

See:

https://asia.nikkei.com/Spotlight/Work/Over-90-of-Japan-companies-agree-to-base-pay-hikes-in-2024-survey?utm_campaign=GL_JP_update&utm_medium=email&utm_source=NA_newsletter&utm_content=article_link

The survey showed around 70% of respondents received

demands for a higher base pay from unions of which over

90% increased base pay. In monetary terms the increase

averaged out to 13,594 yen (US$86) a month, up from

2023. With inflation increasing a higher base pay is

considered crucial to raising wages in real terms.

The respondents (68%) stated their decision was

because

of increases in consumer prices most other respondents

said they increased wages to support government requests

for higher wages.

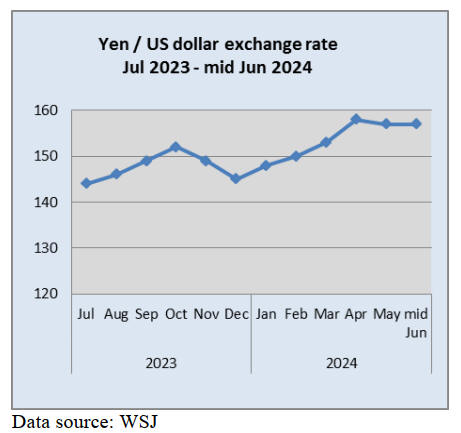

Yen exchange rate buffeted after GDP data

released

The Japanese yen edged lower in early June as the US

dollar strengthened and the yen exchange rate was further

buffeted when the first quarter GDP figures were released.

After the Bank of Japan (BoJ) announced a slowdown

in

its massive Government bond purchases, the prelude to a

move away from quantitative easing, the yen was down

slightly at 157 against the US dollar. The BoJ decision was

largely anticipated and had little impact on the yen

exchange rate which lingers at historic lows.

See:

https://www.asahi.com/ajw/articles/15305387

In other currency news, Japan will issue new banknotes in

July this year in the first redesign for 20 years. The

banknotes feature as an anti-counterfeiting measure the

world’s first three-dimensional holograms that make the

portraits on bills appear to rotate when tilted. Tactile

marks allow the visually impaired to identify the

denominations.

From the time that they are issued, the new banknotes will

be available from financial institutions and ATMs.

Currently issued banknotes will continue to be legal

tender.

See:

https://www.nippon.com/en/news/p01958/

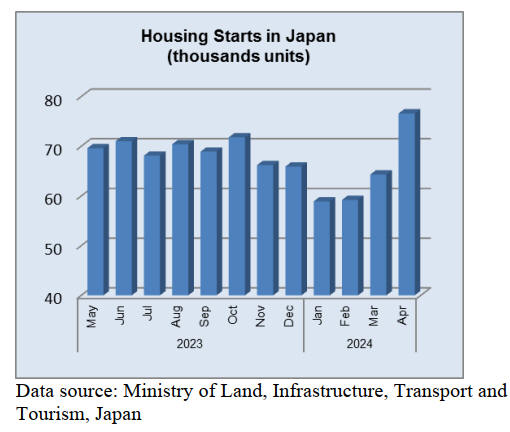

Vast divide between urban and rural housing

trends

Real estate prospects in Tokyo for 2024 are looking bright

according to a survey by Mitsubishi UFJ Trust and

Banking. Prices for newly built condominiums in Tokyo's

23 wards are continuing to rise by about 7% annually.

Properties priced over 60 million yen are expected to

experience a substantial 8% surge in value. Conversely,

properties priced under 60 million yen are forecast to see a

slightly lower but still significant increase.

See:

https://www.e-housing.jp/post/2024-property-investment-forecast-in-japan-according-to-experts

In contrast to the upbeat Tokyo market there is a surplus of

vacant home in rural areas driven by demographic

changes. As the population ages and younger generations

move to urban centres for better job prospects and modern

lifestyles rural areas are left with a declining population

and empty homes.

The Japanese government has recognised the need to

address this issue and many regional governments have

introduced initiatives to promote the utilisation of vacant

houses. Local governments often provide grants, tax

breaks and low-interest loans to buyers willing to renovate

and live in or rent out these properties.

See:

https://goconnect.jp/2024/06/02/the-investment-opportunity-in-japans-abandoned-rural-houses/

Addressing the root cause of cedar pollen

allergy

Japan is forging ahead with efforts to tackle cedar pollen

allergy which is said to affect 40% of the population. In

May 2023, Prime Minister Kishida held the second

Ministerial Meeting on Pollen Allergy and the participants

engaged in discussions and agreed on the aim to reduce

cedar pollen by 50% by 2053. This will be achieved by

accelerating the felling plantation cedar forests and

replanting with species that produce less pollen.

The report to the meeting noted that artificial forests

created after the end of World War II to conserve land and

meet growing demand for timber are reaching a stage

where the trees can be felled and used. It was pointed out

that it is necessary for the entire society, including

consumers, to work to reinvigorate timber demand.

See:

https://english.kyodonews.net/news/2024/06/f6f593deb21a-japan-to-replace-cedars-with-low-pollen-trees-to-tackle-hay-fever.html?phrase=Costa%20Atlantica%20&words=

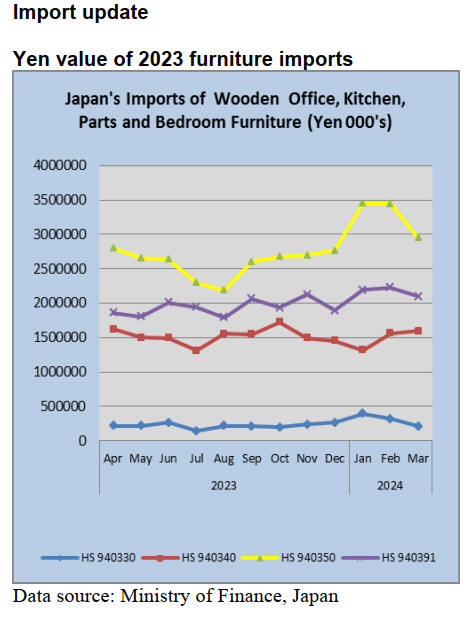

The prolonged weakness of the Yen against the US dollar

continues to drive up the cost of imports and drive down

discretionary purchases by Japanese households and these

factors have negatively affected imports and consumption

of wooden furniture.

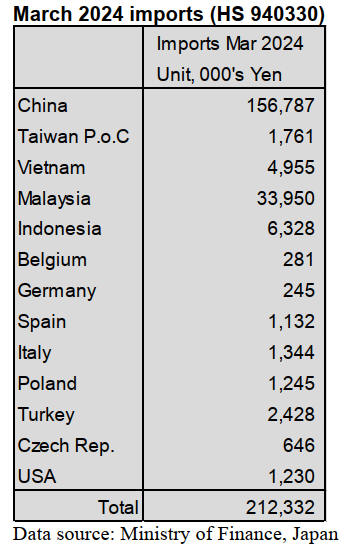

March wooden office furniture imports (HS 940330)

In March China and Malaysia were the top two shippers of

wooden office furniture (HS940330) to Japan, accounting

for almost 90% of total March arrivals.

The value of exports of HS940330 from China to Japan in

March dropped sharply (-40%) from a month earlier. On

the other hand the value of shipments from Malaysia

surged three fold to account for a record high of 116% of

Japan’s March wooden office furniture import values.

The other significant shippes of HS940330 in March were

Indonesia and Vietnam.

Year on year the value of Japan’s imports of wooden

office furniture in March 2024 were some 20% below that

of March 2023.

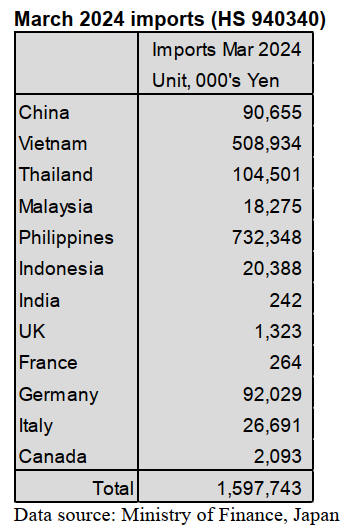

March 2024 kitchen furniture imports (HS 940340)

Year on year, the value of imports of wooden kitchen

furniture items (HS940340) in March fell around 10% but

rose slightly compared to the value of February imports.

The top shippers were the Philippines, accounting

for

about 46% of the value of March imports followed by

Vietnam at 32% and Thailand 6.5%. The value of

shipments from the Philippines rose in March compared to

a month earlier while shipments from Vietnam were little

changed from the value of February shipments.

The top three shippers accounted for around 85% of the

value of March imports, other significant shippers were

Germany and Italy which together accounted for 7% of the

value of imports.

February marked a rebound in the value of arrivals

of

wooden kitchen furniture to Japan and the slight upswind

in the value of March arrivals built on the February figure.

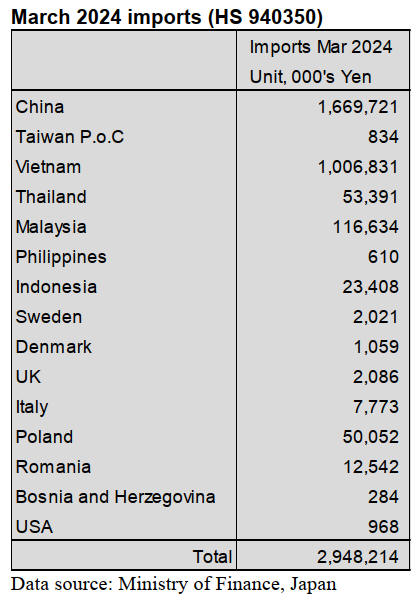

March 2024 wooden bedroom furniture imports (HS

940350)

After five consecutive monthly increases in the value of

wooden bedroom furniture (HS930350) the value of

February imports steadied but there was a major

downward correction in March. Year on year, the value of

March imports were down 19% and there was a 14%

month on month drop in the value of imports. China

accounted for almost 60% of the value of March imports

toJapan followed by Vietnam at 34% and Malaysia at 4%.

The big losers in March were Vietnam, where the value of

arrivals dropped over 30% and Malaysia, where the value

of imports was down around 40% compared to February.

China remained the top supplier in March and the value of

imports was around the same level as in February.

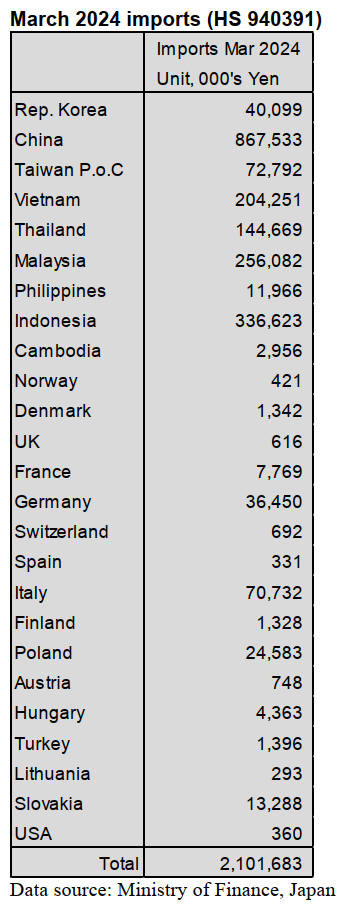

March 2024 wooden furniture parts imports (HS

940391)

Shippers in just four countries, China, Indonesia Malaysia

and Vietnam accounted for 80% of the value of March

imports of wooden furniture parts. Suppliers in China

accounted for around 40% of March arrivals followed by

Indonesia at 16%, Malaysia 12% and Vietnam 10%.

Compared to the value of February imports the value of

March imports from China were down around 14% and

there was a 25% decline in the value of imports from

Vietnam while the value of March arrivals from Indonesia

and Malaysia were at around the same level as in

February.

In March there were 15 member states of the EU and

the

UK that shipped wooden furniture parts to Japan,

however, the combined value of these shipments

represented just 8% of Japan’s March imports of furniture

parts.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Plywood

Plywood manufacturers in Japan announced to raise the

price of structural softwood plywood in April and May,

2024 and the plywood price stopped decreasing. On the

other hand, the orders to precutting plants in May are low

and demand for houses is not recovered yet.

12 mm 3 x 6 domestic structural softwood plywood from

major plywood manufacturers costs 1,300 yen, delivered

per sheet.

However, the price of structural softwood plywood in

the

Metropolitan area is around 1,280 yen, delivered per sheet.

Some plywood manufacturers will raise the plywood price

again because the price of glue has been increasing.

For South Sea plywood, the price of 12 mm plywood has

increased after May, 2024. Since the inventory of South

Sea plywood in Japan has been decreasing, major plywood

manufacturers in Malaysia raised the 12 mm plywood

price by US$20, C&F per cbm in May, 2024.

The price of 12 mm 3 x 6 painted plywood for concrete

form in May was around US$650, C&F per cbm.

Structural plywood was US$560 – 570, C&F per cbm.

Form plywood was US$560 – 580, C&F per cbm. If the

price of painted plywood for concrete form rose by

US$20, C&F per cbm, the import cost would be 2,200

yen, FOB per sheet, calculated by 156 yen against the

dollar.

There are not enough logs in Indonesia and some

Indonesian plywood manufacturers expect to raise the

plywood price but the plywood price at this time was

leveled off from the previous time. 2.4 mm 3 x 6 is around

US$950, C&F per cbm. 3.7 mm 3 x 6 plywood is around

US$880, C&F per cbm. 5.2 mm 3 x 6 plywood is around

US$850, C&F per cbm.

The price of 2.5 mm plywood in Japan is 780 yen,

delivered per sheet. 4 mm plywood is 1,000 yen, delivered

per sheet. 5.5 mm plywood is 1,170 – 1,200 yen, delivered

per sheet.

The price of structural plywood / form plywood is 1,750

yen, delivered per sheet. 12 mm 3 x 6 painted plywood for

concrete form is 1,950 yen, delivered per sheet.

How do we face the weak yen?

The interest rate differentials between Japan and the U.S.

have been influencing the yen. The yen was 150 yen

against the dollar at the beginning of 2024 and the yen was

once 160 yen against the dollar.

Since the new starts have not stopped decreasing, wood

industry and building materials industry have been

struggling with this situation. It is hard to find a solution to

recover in the new starts. The yen depreciated to 150 yen

against the dollar last autumn.

Some building materials companies had already raised the

selling price of building materials at that time. Many

Japanese buyers were concerned about the price hike of

imported lumber and imported plywood due to the weak

yen but the actual demand for lumber or plywood was not

enough so the lumber market was weak.

KD domestic studs or ceiling joists became price

competitive. However, the movement of cedar posts,

cypress posts and cypress foundations were sluggish so the

lumber price kept decreasing. On the other hand, the log

price incrased.Exporting domestic logs and domestic

lumber would be good due to the weak yen.

However, people wonder whether exporting domestic logs

and domestic lumber would be a good opportunity to

promote the use of domestic lumber in Japan in the future.

If the volume of imported lumber continued to fall, there

would be no diversity of lumber in Japan. It seems that it

is the end of a period for low-priced imported lumber.

|