US Dollar Exchange Rates of

25th

May

2024

China Yuan 7.24

Report from China

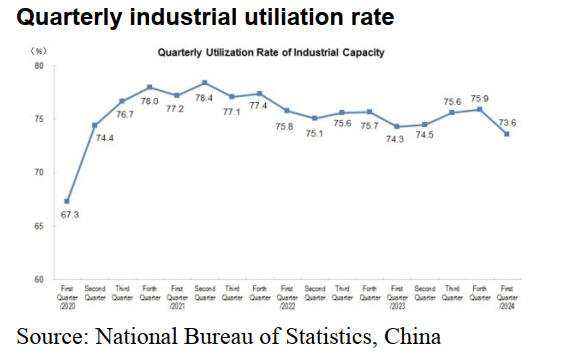

Industrial capacity utilisation

A press release from the National Bureau of Statistics

provides data on industrial capacity utilisation. In the first

quarter of 2024 the industrial capacity utilisation rate for

surveyed industrial enterprises was 73.6%, down by 0.7

percentage points from the same period in 2023 and 2.3

percentage points down from the previous quarter.

See:

https://www.stats.gov.cn/english/PressRelease/202404/t20240424_1955021.html

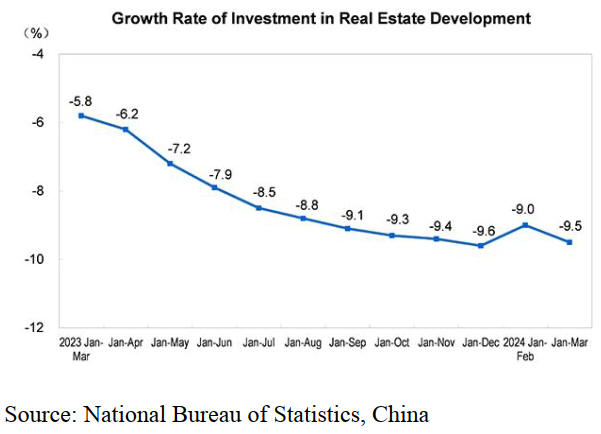

First quarter investment in real estate

Between January and March investment in real estate

development was 2,208.2 billion yuan, a year-on-year

decrease of 9.5%, of which the investment in residential

buildings was 1,658.5 billion yuan, down by 10.5%.

See:

https://www.stats.gov.cn/english/PressRelease/202404/t20240424_1955015.html

Plans to stabilise real estate market

China’s housing market slumped after a change in

government policy on borrowing by property developers

and the decline in the sector sunk other businesses such as

home furnishing, appliances and construction.

Real estate has long been important for China’s economy

driving its rapid growth however, this came with risks.

Home prices rose sharply relative to household incomes in

the years before the pandemic, in part because consumers

preferred to invest their savings tangible assets, but that

has changed. Home sales have fallen as potential buyers

see prices falling and some developers unable to secure

financing to complete projects.

With the property downturn now in its third year, there has

been a hollowing out of the real estate sector. Housing

starts have fallen by more than 60% relative to pre-

pandemic levels and construction timber imports have

fallen.

In May the authorities in China unveiled their most

significant steps yet to address the crisis that has been a

drag on the property sector and the economy. At a press

briefing a Deputy Governor the People's Bank of China

(PBOC) said it would set up a 300 bil. yuan (US$41.5bil.)

fund to support affordable housing.

This money is intended to support local state-owned

enterprises to buy unsold homes. It has been estimated

China has nearly four million empty apartments along

with an estimated 10 million homes already sold but not

ready to occupy.

Other measures include cutting the amount home buyers

need for a deposit and encouraging local authorities to

purchase unsold properties. There is some doubt that local

governments, already saddled with huge debts, would be

able to absorb the unsold properties, the value of which is

said to nearly US$4 trillion.

How the Chinese government initiative to address the

crisis in the real estate sector will evolve is yet to be seen

but the amount of investment the authorities are reportedly

making available to boost sales and complete partially

built homes is certain to lead to a boost in timber imports.

See:https://www.imf.org/en/News/Articles/2024/02/02/cf-chinas-real-estate-sector-managing-the-medium-term-slowdown

and

https://www.bbc.com/news/articles/c51nyglznm6o

and

https://www.nytimes.com/2024/05/24/business/china-property-crisis.html

and

https://www.scmp.com/business/china-business/article/3263202/china-property-beijings-stimulus-plan-needs-more-time-money-and-policy-support-resolve-long-standing

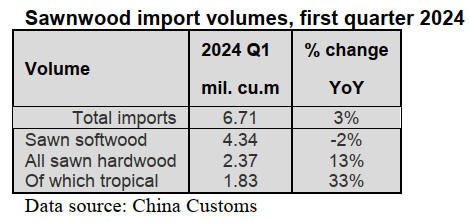

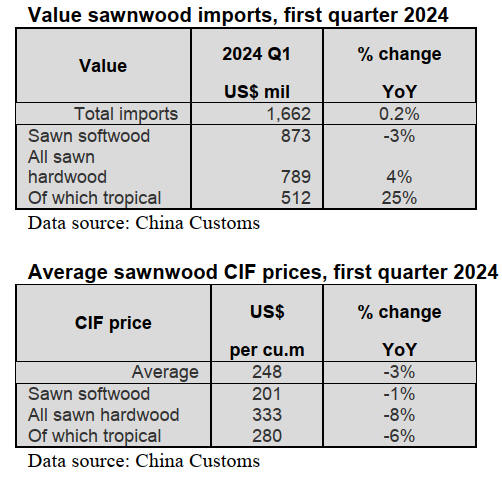

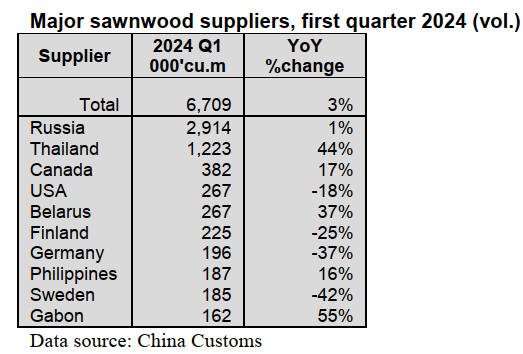

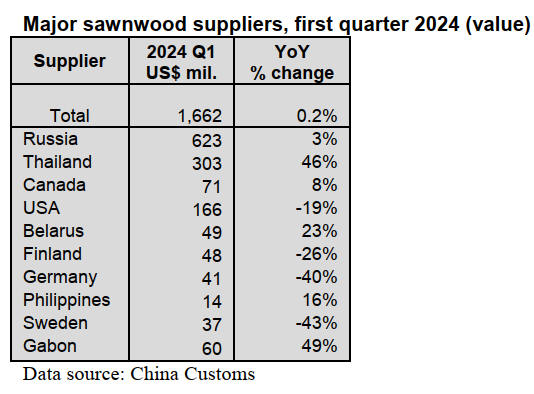

Sawnwood imports higher in first quarter

According to China Customs, sawnwood imports in the

first quarter of 2024 totalled 6.71 million cubic metres

valued at US$1.662 billion, up 3% in volume and 0.2% in

value compared to the first quarter of 2023. However, the

average price for imported sawnwood was US$248 (CIF)

per cubic metre, down 3% over the same period of 2023.

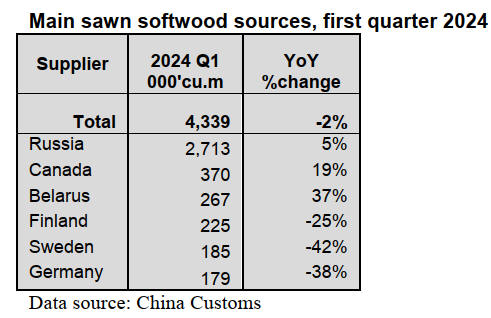

Of total sawnwood imports, sawn softwood imports

dropped 2% to 4.34 million cubic metres and accounted

for 65% of the national total. The average price for

imported sawn softwood fell 1% to US$201 (CIF) per

cubic metre over the same period of 2023.

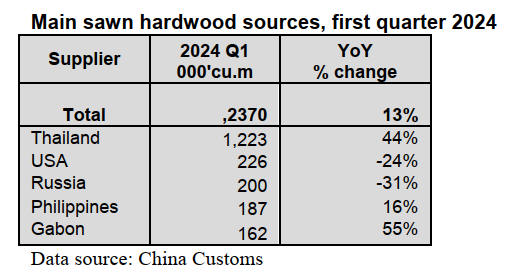

Sawn hardwood imports rose in the first quarter by 13% to

2.37 million cubic metres and accounted for 35% of the

national total. The average price for imported sawn

hardwood fell 8% to US$333 (CIF) per cubic metre over

the same period of 2023.

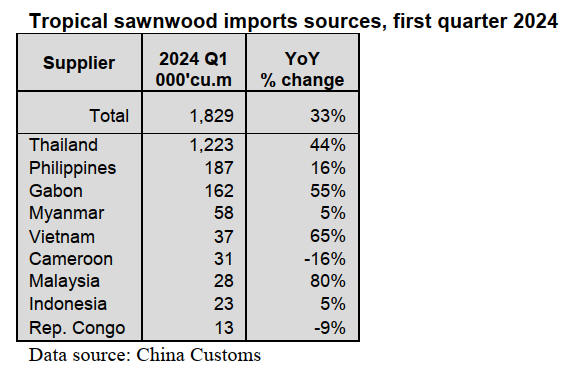

Of total sawn hardwood imports, tropical sawnwood

imports were 1.83 million cubic metres valued at US$512

million CIF, up 33% in volume and 25% in value from the

same period of 2023 and they accounted for 27% of the

national total import volume.

However, the average price for imported tropical

sawnwood was US$280 CIF per cubic metre, down 6%

from the same period of 2023.

Surge in sawnwood imports from Thailand

Russia was, as in previous quarters, the largest supplier of

China’s sawnwood imports in the first quarter of 2024.

The proportion of China’s sawnwood imports from Russia

accounted for 43% of the total sawnwood import volume.

China’s sawnwood imports from Russia rose 1% slightly

to 2.914 million cubic metres over the same period of

2023.

Thailand was the second largest supplier of sawnwood

imports in the first quarter of 2024. The proportion of

China’s sawnwood imports from Thailand accounted for

18% of the total sawnwood import volume.

China’s sawnwood imports from Thailand surged 44% to

1.223 million cubic metres over the same period of 2023.

China's sawnwood imports from Thailand have soared

mainly because of falling prices which, in part, are the

result of adjustments in Thailand's timber tariff policy in

2022.

China's sawnwood imports from USA decline

considerably in the first quarter of 2024 dropping 18% to

267,000 cubic metres over the same period of 2023.

In contrast, China’s sawnwood imports from Canada in the

first quarter of 2024 grew 17% to 382,000 cubic metres

over the same period of 2023.

Main sawn softwood sources, first quarter of 2024

Russia was the largest supplier for China’s sawn softwood

imports in the first quarter 2024. 63% of China’s sawn

softwood imports are from Russia and imports from

Russia rose 5% to 2.713 million cubic metres in the first

quarter of 2024.

Imports from Canada and Belarus, the second and third

largest suppliers, rose 19% and 37% to 370,000 cubic

metres and 267,000 cubic metres respectively in the first

quarter of 2024.

In contrast, China’s sawn softwood imports from Finland,

Sweden and Germany fell 25%, 42% and 38%

respectively in the first quarter of 2024.

Main sawn hardwood sources, first quarter 2024

Thailand was the largest supplier for China’s sawn

hardwood imports in the first quarter of 2024. 52% of

China’s sawn hardwood imports are from Thailand and

imports from Thailand soared 44% to 1.223 million cubic

metres in the first quarter of 2024.

However, USA and Russia, the second and third largest

suppliers of China’s sawn hardwood imports fell 24% and

31% to 226,000 cubic metres and 200,000 cubic metres

respectively in the first quarter of 2024.

China’s sawn hardwood imports from the Philippines and

Gabon grew 16% and 55% respectively in the first quarter

of 2024. 84% of China’s sawn hardwood imports were

from five countries in the first quarter of 2024.

Significant rise in tropical sawnwood imports

China’s tropical sawnwood imports rose 33% to 1.829

million cubic metres in the first quarter of 2024. The top

three suppliers of China’s tropical sawnwood imports were

Thailand (67%), Philippines (10%) and Gabon (9%). 86%

of China’s tropical sawnwood imports were from these

three countries in the first quarter of 2024.

Meanwhile, China’s tropical sawnwood imports from

Thailand, Philippines and Gabon grew by 44%, 16% and

55% to 1.223 million cubic metres, 187,000 cubic metres

and 162,000 cubic metres respectively in the first quarter

of 2024.

China’s tropical sawnwood imports from Vietnam and

Malaysia also surged 65% and 80% respectively in the

first quarter of 2024. The significant rise in total tropical

sawnwood imports resulted from the rise in imports from

most of the top source countries.

In contrast, China’s tropical sawnwood imports from

Cameroon and the Republic of Congo dropped 16% and

9% respectively in the first quarter of 2024.

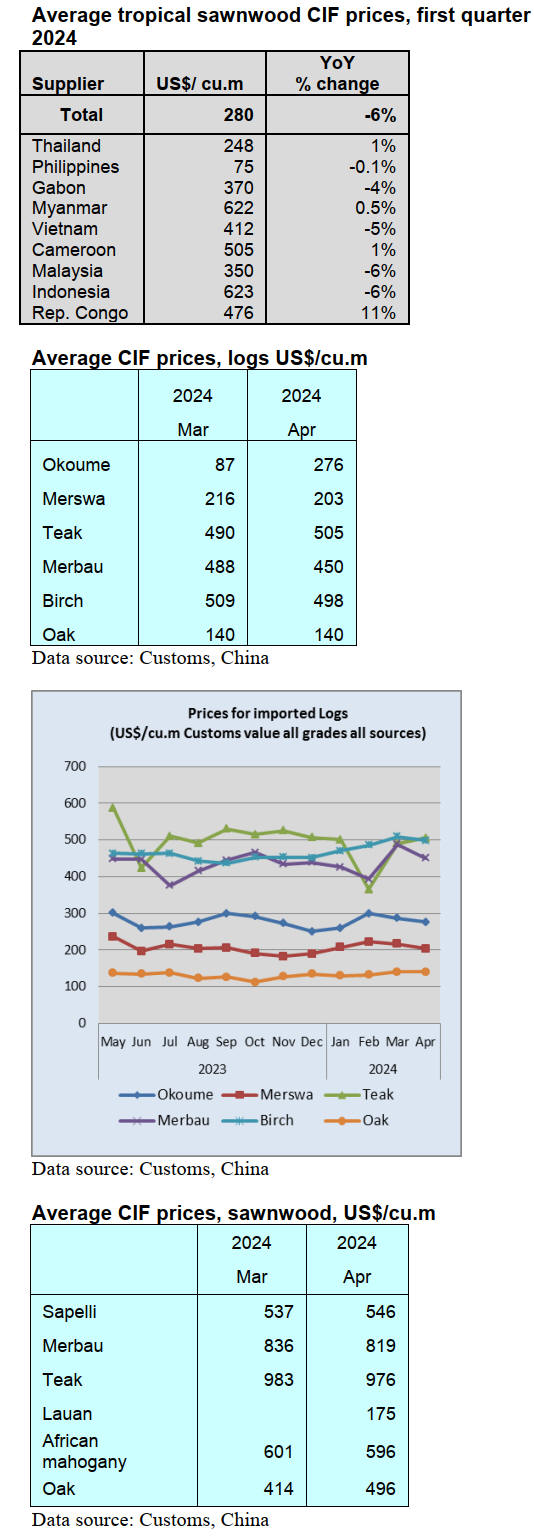

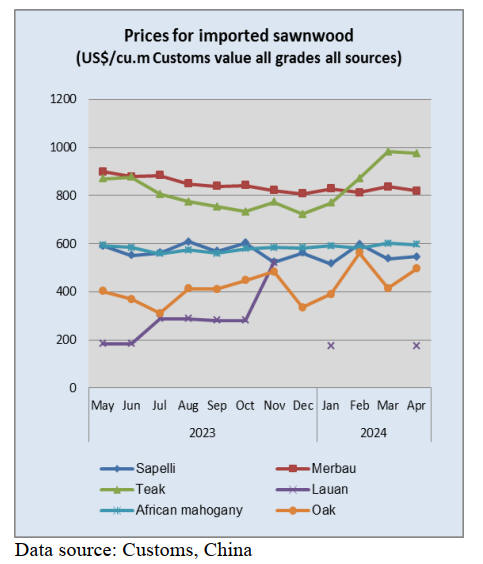

Decline in average CIF price for tropical sawnwood

imports

The average CIF price for China’s tropical sawnwood

imports in the first quarter of 2024 declined by 6% to

US$280 per cubic metres over the same period of 2023.

The CIF prices for sawnwood from the top suppliers did

not change significantly.

For example, the avarge CIF price for China's tropical

sawnwood imports from Thailand in the first quarter of

2024 just rose 1% and from the Philippines prices dropped

0.1%.

The CIF price for China’s tropical sawnwood imports

from the Republic of Congo in the first quarter of 2024

rose the biggest and by 11% over the same period of 2023.

|