Japan

Wood Products Prices

Dollar Exchange Rates of 25th

May

2024

Japan Yen 170.09

Reports From Japan

Majority of Japanese firms

say weak yen hurts profits

According to a recent survey of over 1,000 companies by

Teikoku Databank and reported in the Japan Times, many

consider the weak yen is not good for business.

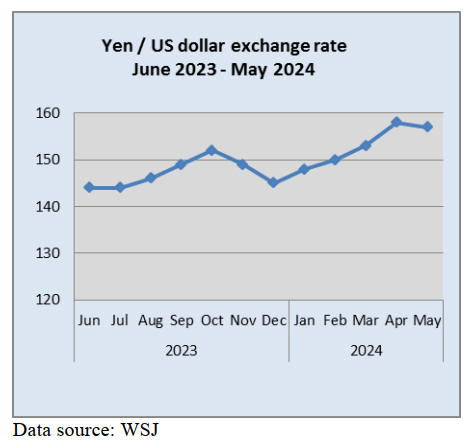

About 64% of firms surveyed said the weak yen has

eroded their profits, while just 78 firms saw a positive

impact. Companies citing a negative impact said they were

unable to pass on rising raw materials costs to customers.

Most companies suggested a yen trading around yen 110-

120 to the dollar would be appropriate. At the end of May

the yen was 157 to the US dollar.

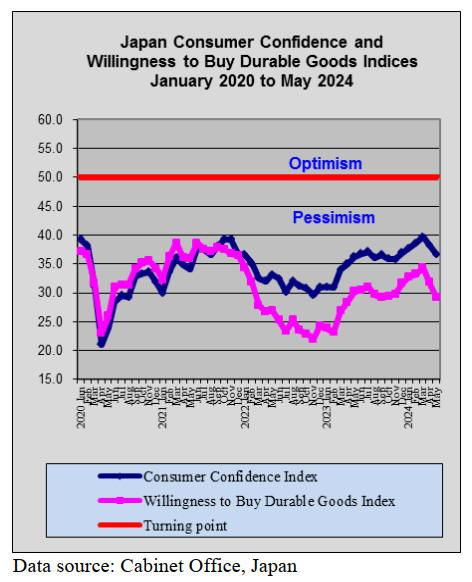

While the weak yen has bolstered earnings by exporters it

continues suppress domestic spending. Household

spending has fallen every month for more than a year.

See:

https://www.businesstimes.com.sg/international/majority-japanese-firms-says-weak-yen-hurts-profits-survey

Calls for stepping up structural reforms

Masato Kanda, speaking before a meeting of Group of 7

finance ministers and central bankers, pointed out that

Japan needs to make its economy more internationally

competitive and at the same time he urged economic

reform to tackle structural issues seen as pulling down the

yen exchange rate.

Kanda emphasised the need to push ahead with wage

increases, create conditions for increased capital spending

and strengthen job market mobility.

See:

https://asia.nikkei.com/Editor-s-Picks/Interview/Japan-top-currency-diplomat-calls-for-stepping-up-structural-reforms2

IMF - upturn in consumption forecast for later this year

In early May the International Monetary Fund (IMF)

concluded the Article IV consultation with Japan this

included discussion of the findings of the Financial Sector

Assessment Program (FSAP) for Japan.

The IMF noted the Japanese economy has continued to

recover since the pandemic with broad-based price

increases following three decades of low inflation.

Growth is expected to continue with an upturn in

consumption forecast for later this year. For 2024 growth

is projected to decelerate to 0.9% but consumption is

expected to pick-up in the latter half of 2024 and in 2025

due to the combination of rising nominal wages and lower

inflation which will lift disposable incomes.

See:

https://www.imf.org/en/News/Articles/2024/05/13/pr24156-japan-imf-executive-board-concludes-2024-article-iv-consultation?utm_medium=email&utm_source=govdelivery

and

https://www.imf.org/en/News/Articles/2024/02/08/mcs020824-japan-staff-concluding-statement-of-the-2024-article-iv-mission

Higher exports but trade deficit

The value of Japan's exports grew for the fifth consecutive

month in April, according to the Ministry of Finance.

Exports of automobiles increased by 18%, semiconductor

manufacturing equipment rose 28% and exports of

electronic components including semiconductors were up

20%.

However, Japan recorded a trade deficit of around US$3

billion in April as higher crude oil prices and a sharp drop

in the yen exchange rate drove up the value of imports

offsetting robust export growth.

See:

https://asia.nikkei.com/Economy/Japan-exports-grew-for-5th-month-in-row-in-April-led-by-cars-chips

First quarter dip in GDP

The Japanese economy shrank year on year at an annual

rate of 2% in the first quarter of this year. Although

unemployment remains low wage growth has been slow

and prices have risen due to weakness of the yen against

the US dollar.

Quarter-on-quarter, the preliminary seasonally adjusted

GDP, a measure of the value of a nation’s products and

services, slipped 0.5% in the January-March period

according to the Cabinet Office.

See:

https://apnews.com/article/japan-economy-inflation-gdp-yen-bb372c3c9d79c31b8a5accb0a650b822

Interest rate hike may come earlier than

anticipated

When the Bank of Japan (BoJ) began unwinding its

negative interest policy in March this year it emphasised

that financial conditions would be kept easy and interest

rates would only slowly increase.

But that was before the yen/dollar exchange rate crashed

and remains weak despite two suspected currency

interventions and the BoJ reduced its purchases of

Japanese government bonds.

The BoJ policy statement also came as the US Federal

Reserve stated there will only be three interest rate cuts

this year, down from the six that were anticipated. These

changes have increased the possibility that interest rates in

Japan may be raised earlier than expected, especially as

the weak yen is at the heart of the higher prices faced by

consumers.

See:

https://asia.nikkei.com/Spotlight/Market-Spotlight/Potential-for-earlier-BOJ-rate-hike-rises-amid-hawkish-signals-weak-yen

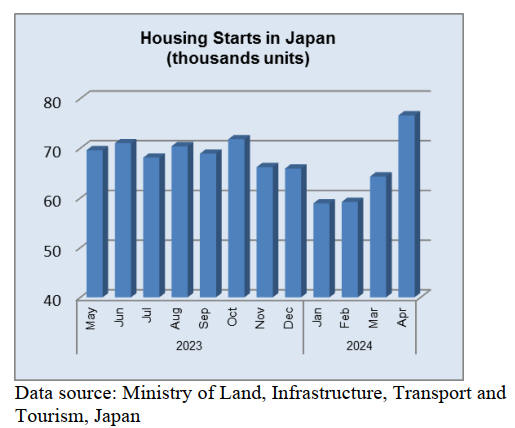

Carbon footprint in constructing wooden house

Researchers at Kyushu University have published a

comprehensive analysis on the carbon footprint of

constructing a wooden house in Japan. The study covered

the total amount of emissions produced along the entire

supply chain including the processing and transport of the

raw materials that go into building a house.

According to the team's findings, “the estimated carbon

footprint of building a single wooden house in Japan is 38

tonnes of CO2. Making up the largest share of that,

accounting for 32% of total emissions, was the electric

power sector. Other sectors included iron production at

12%, with cement, road freight transport and private

power generation each producing around 7% of total

emissions”.

See:

https://phys.org/news/2024-05-carbon-footprint-wooden-house-japan.html#google_vignette

Import update

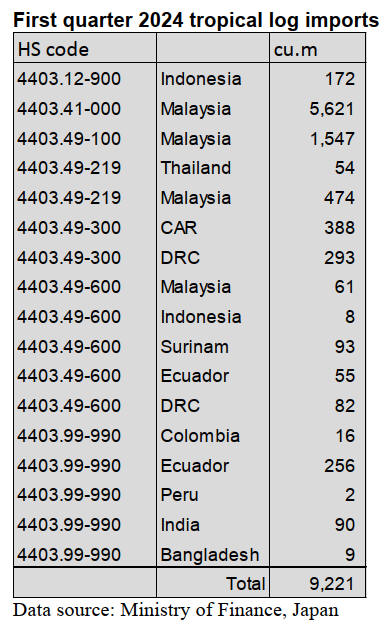

Log and sawnwood imports

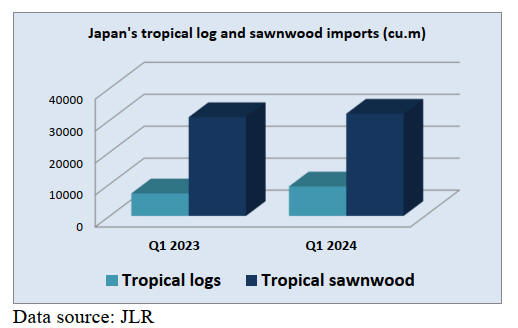

Japan has a long history of tropical timber imports. It was

from the Philippines that Japan first imported tropical

timber, starting in the 1950's and peaking in the second

half of the 1960's.

Japan used to be the world's biggest consumer of tropical

logs but in 2023 imports had dropped to 30,759 cu.m from

a peak of 26.79 million cu.m in 1973. More than half of

2023 log imports came from Malaysia with the balance

from 12 other countries.

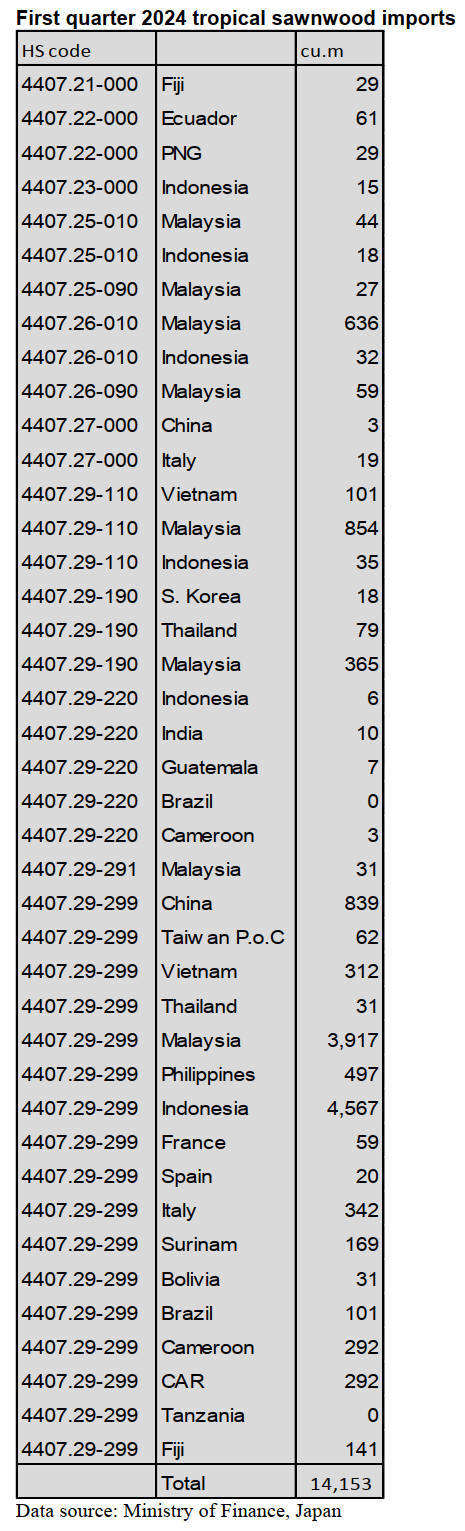

First quarter 2024 tropical sawnwood

imports

Imports of tropical sawnwood have followed the same

downward trend as seen for tropical logs. In 2013 tropical

sawnwood imports were around 280,000 cu.m but dropped

to 136,000 in 2023.

Import update

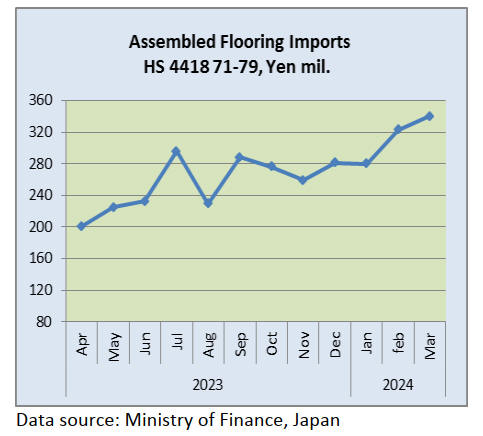

Assembled wooden flooring imports

In March the main category of assembled flooring imports

was (HS441875), accounting for over 70% of the total

value of assembled flooring imports. The second largest

category in terms of value was HS441873 exceeding that

of HS 441879.

The value of imports of assembled wooden flooring

(HS441871-79) in March 2024 were up from the same

month in 2023 and compared to the value of February

imports there was a 15% increase in the value of Marchy

imports.

The yen exchange rate against the US dollar has driven up

the cost of flooring imports but the steady rise in imports

cannot be explained as only due to the weak yen as the yen

exchange rate has been in the range of 140-150 yen per

dollar for most of 2023 rising to over 150 in the early part

of 2024.

The main shippers of assembled flooring in February were

China 58%, down slightly from a month earlier, Vietnam,

Malaysia, Thailand and Indonesia.

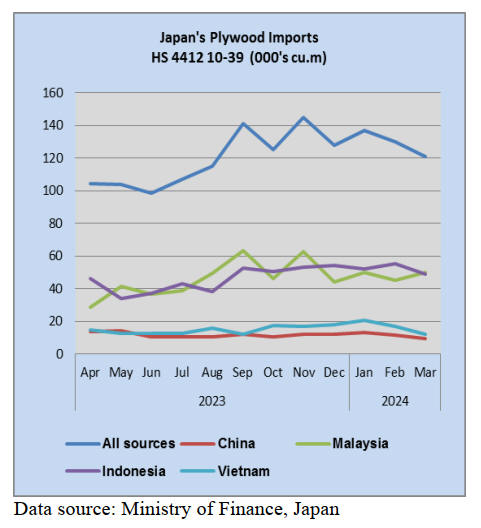

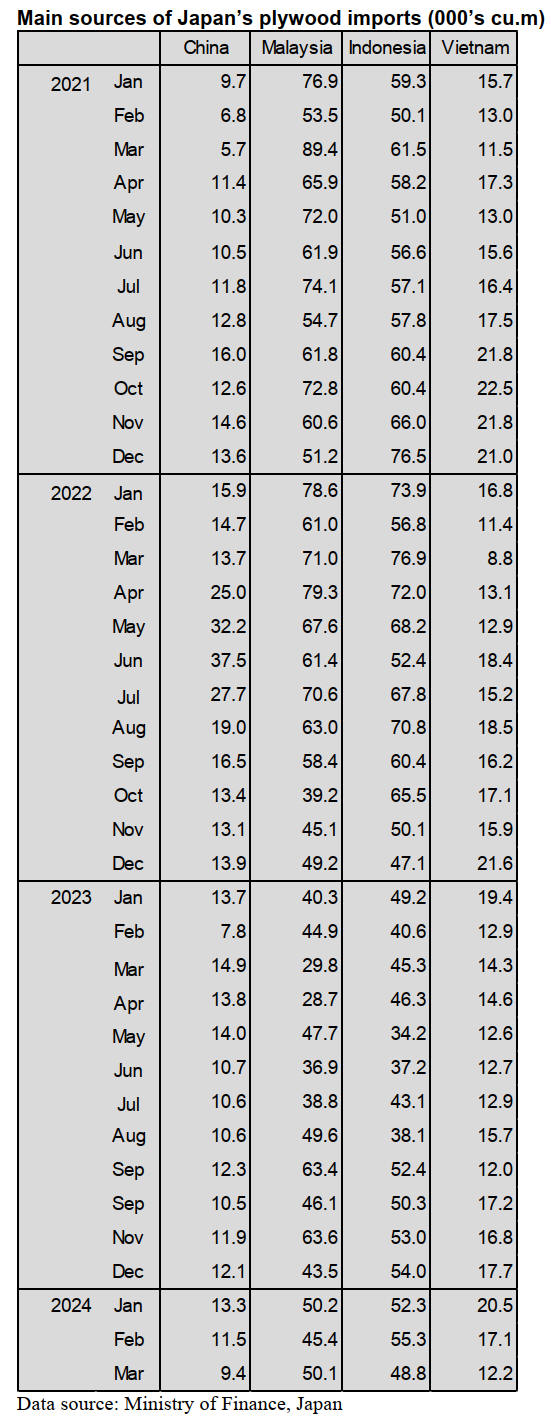

Plywood imports

Of the four main suppliers of plywood (HS441210-39) to

Japan; Indonesia, Malaysia, Vietnam and China all except

for Indonesia saw March shipments drop below those of

the previous month. However, the total volume of March

imports fell from the previous month but were up year on

year.

Of the various categories of plywood imported, 83% was

HS441231 in March with HS441233 and HS441234

accounting for the balance. The four main shippers of

plywood to Japan, Indonesia, Malaysia, Vietnam and

China consistently account for over 90% of plywood

imports.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR. For the JLR report

please see:

https://jfpj.jp/japan_lumber_reports/

Japan Novopan Industrial to raise price of products

Japan Novopan Industrial Co., Ltd. in Osaka Prefecture

will raise the prices of all kinds of particleboards gradually

starting June, 2024. The prices of all kinds of

particleboards will be 10 % higher than the current prices.

The reasons are that the prices of materials, such as glue or

wooden chips, glue, production cost and transportation fee

are rising.

The company will change the price of 2 x 6 floor at first.

Then, the prices of products for woodworking, structural

materials for prefabricated houses, and structural

particleboards will be raised. The company expects clients

to understand this price hike.

According to the company, the price of wooden chips has

increased 14 % since the beginning of this year. The price

of glue has increased 4 %. The prices of a curing

accelerator, mold release agent, sales, general and

administrative expenses, and labor costs have increased 2

%. The price of distribution costs has increased 5 %.

After the invasion in Ukraine by Russia, the price of

petroleum and LNG rose and the price of petrochemical

products also rose. Additionally, the yen started to

depreciate against the dollar in this year. Also, prices for

everything keep increasing. Then, the company raised

wages for its employees.

The annual production of particleboards is 150,000 –

160,000 tons at Sakai plant, which is a head plant, in

Osaka Prefecture and the annual production of

particleboards is 120,000 tons at Tsukuba plant in Ibaraki

Prefecture. Japan Novopan Industrial is one of the greatest

particleboard manufacturers in Japan.

Akimoku Board stopped producing hardboards and

insulation boards

Since the hardboard and insulation board markets have

been shrinking, Akimoku Board Co., Ltd. in Akita

Prefecture has decided to voluntarily close its business and

has stopped producing hardboards and insulation boards at

the end of April, 2024.

The company was established in 1999. The company

manufactured boards by a wet process. The hardboards

were used for crating and curing boards for floors and the

insulation boards were used for tatami boards.

Monthly production of hardboards was 400 – 450 tons and

monthly production of insulation boards was 200 – 250

tons.

The reasons for stopping manufacturing insulation boards

were that Japanese – style rooms were not popular and the

COVID-19 or the woodshcok influenced the new starts

after 2020. The sales of insulation boards went down

badly.

South Sea logs and lumber

Since demand for blocks for steel ship building is high

shipbuilding is high, demand for south Sea log is very

strong. South Sea log is very strong blocks for steel is

popular and South Sea log is the best material to produce

the blocks.

The arrival volume of South Sea logs during January to

February 2024 is 7,985 cbms, 13,4% higher than the same

period last year. Next South Sea logs will arrive to Japan

in June or July 2024.

The price of log in South East Asia increases due to the

weak yen. Is difficult to sell South Sea log with good

quality to Japanese buyers. Malaysia plywood

manufacturers have reduced production so loggers hesitate

to cut down trees. Also, loggers in PNG lost their

motivation to cut down trees because demand logs in

China is sluggish.

Once the yen depreciated to 155 yen against the dollar

many distributors started to purchase South Sea lumber

and Chinese lumber because they assumed the yen would

appreciate against the dollar easily.

March supply of plywood

Total plywood supply in March, 2024 is 361,000 cbms.

This is 4.4 % less than February, 2024 and this is straight

four months decreasing. Domestic plywood is 2.0 % down

from the previous month and imported plywood is 7.1 %

down from the previous month.

On the other hand, shipment of domestic plywood is 8.5 %

higher than last month and this is for the first time in three

months to be a level of 200,000 cbms. The inventory at the

end of April, 2024 decreases.

Production of structural softwood plywood is 174,000

cbms, 2.6 % less than last month. Production of under 6

mm plywood, under 6 – 12 mm plywood, under 12 – 24

mm plywood, and over 24 mm plywood has decreased

from the previous month.

However, shipment of plywood is 20,000 cbms, 12.4 % up

from last month. The shipment exceeds production by

9,000 cbms. Production of domestic painted plywood for

concrete form is 2,300 cbms higher than the previous

month.

This was the largest volume of domestic painted plywood

for concrete form for the first time since June, 2023.

The market of structural softwood plywood had been very

sluggish until the middle of March, 2024. However,

several major plywood manufacturers announced to raise

the structural plywood price as of April, 2024.

Then, consumers started to purchase the structural

plywood so the movement of structural plywood began to

move. The imported plywood supply decreases for two

months continuously. Indonesian plywood is 11.2 % down

from last month but Malaysian plywood is 10.5 % up from

last month.

The average Indonesian plywood supply during January,

2024 to March, 2024 is 60,000 cbms. The average

Malaysian plywood supply during January, 2024 to

March, 2024 is 48,000 cbms.

Since the inventory of domestic plywood soared in 2023,

the average Indonesian plywood supply during January,

2023 to March, 2023 was 52,000 cbms. The average

Malaysian plywood supply during January, 2023 to

March, 2023 was 38,000 cbms.

FSC structural cypress plywood

Japan Kenzai Co., Ltd. in Tokyo Prefecture starts selling

12 3 x 6 domestic structural cypress plywood, which has

the JAS (Japanese Agricultural Standards) certification

and has the FSC (Forest Stewardship Council)

certification. The new plywood is an eco-friendly product.

Noda Corporation in Tokyo Prefecture manufactures

plywood. This new plywood is sold in Kanto region

mainly and in Chubu region.

The new plywood consists of five layers. Cypress is used

on front face and back side. Cedar is used for the second

and the fourth layers. Cedar or cypress is used in the

center of the new plywood. Cypress is not infected with

insects easily and it is easy to manufacture products.

In Japan, supply volume of domestic plywood exceeded

supply volume of imported plywood in 2016. The

company expects to expand selling the new plywood.

|