US Dollar Exchange Rates of

10th

May

2024

China Yuan 7.27

Report from China

Production license management for plywood and

blockboard

To ensure the quality and safety of industrial products,

strengthen product management and source control,

prevent major risks from product quality and ensure the

safety of people's lives and property the State Council has

adjusted the coverage of production licenses for some

industrial products.

The new production license management applies to six

products such as cold-rolled ribbed steel bars, bottled

liquefied petroleum gas, steel wire rope, plywood,

blockboard and safety hats. The provincial industrial

product license authority is responsible for implementation

and this authority shall not be delegated.

See:

https://www.gov.cn/zhengce/content/202405/content_6950015.htm?source=wechat

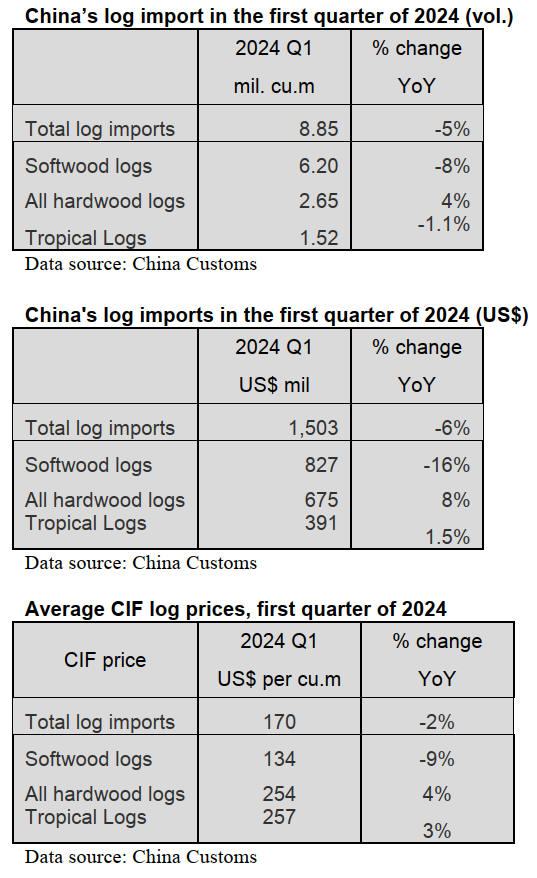

Decline in China’s log imports

According to China Customs, log imports in the first

quarter of 2024 totalled 8.85 million cubic metres valued

at US$1.503 billion, down 5% in volume and 6% in value

compared to the first quarter of 2023. In addition, the

average price for imported logs was US$170 (CIF) per

cubic metre, down 2% from the same period of 2023.

Of total log imports, softwood log imports dropped 8% to

6.20 million cubic metres, accounting for 70% of the

national total. The average price for imported softwood

logs declined 9% to US$134 (CIF) per cubic metre over

the same period of 2023.

Hardwood log imports rose 4% in the first quarter of 2024

compared to the same period in 2023 to 2.65 million cubic

metres, accounting for 30% of the national total. The

average price for imported hardwood logs rose 4% to

US$254 (CIF) per cubic metre over the same period of

2023.

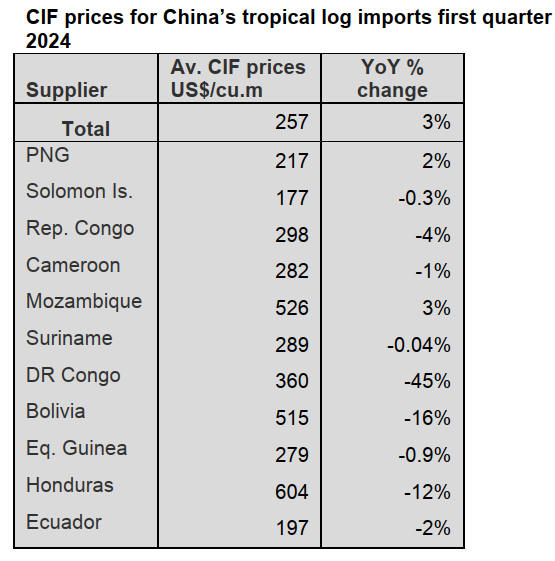

Of total hardwood log imports, tropical log imports were

1.52 million cubic metres valued at US$391 million CIF,

down slightly in volume (1%) but up 1.5% in value from

the same period of 2023. Tropical logs accounted for 17%

of the national total log import volume.

The average price for imported tropical logs was US$257

CIF per cubic metre, up 3% from the same period of 2023.

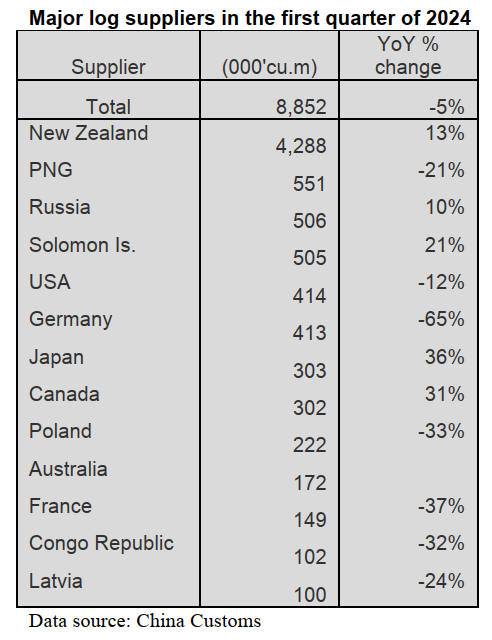

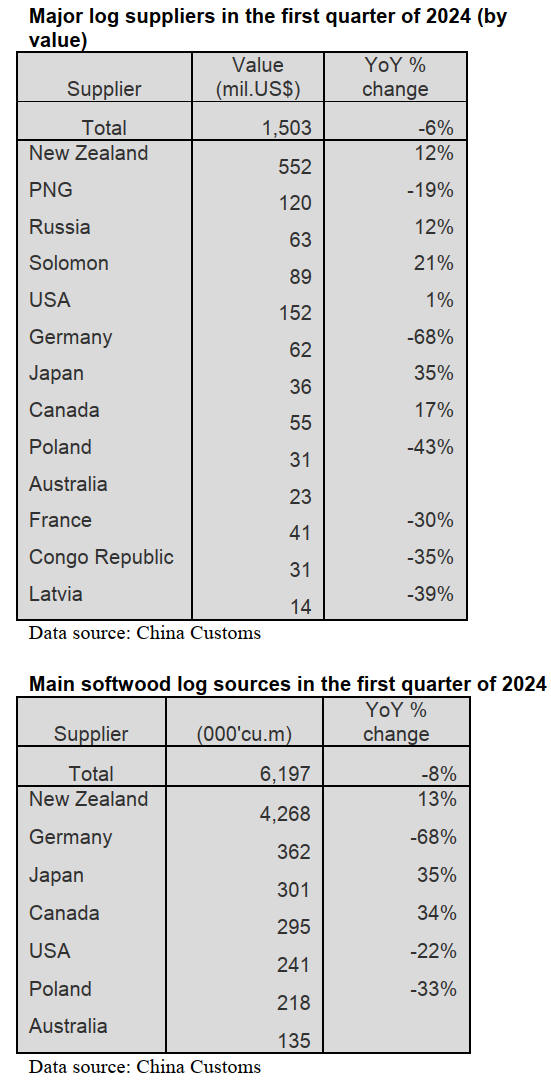

Sharp decline in log imports from Germany

China’s log imports from Germany dropped 65% to

413,000 cubic metres valued at US$62 million, both

declining by 68% in the first quarter of 2024. The average

CIF price for China’s log imports from Germany fell 10%

to US$150 per cubic metre.

The dramatic decline in China’s log imports from

Germany was because the Russia-Ukraine conflict has led

to a general rise in energy prices in Europe and the costs

of major manufacturing and industrial production in

Germany have increased significantly.

Germany has lost its position as the second largest supplier

of log to China, ranking just sixth in the first quarter of

2024.

New Zealand still was the largest supplier of logs to China

in the first quarter of 2024. China’s log imports from New

Zealand rose 13% to 4.29 million cubic metres valued at

US$552 million, both up 12% over the same period of

2023. The average CIF price for log imports from New

Zealand fell 2% to US$129 per cubic metre.

The proportion of China’s log imports from New Zealand

accounted for 48% of the total log imports volume.

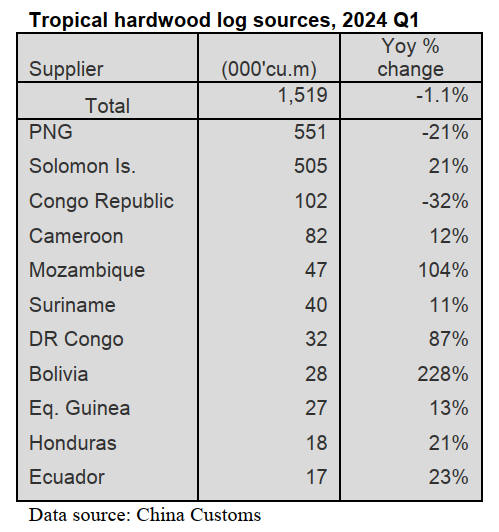

Slight decline in tropical log imports

China’s tropical log imports fell 1% to 1.519 million cubic

metres in the first quarter of 2024. The top three suppliers

of tropical logs to China in the first quarter 2024 were

Papua New Guinea (36%), Solomon Islands (33%) and the

Republic of Congo (7%). 76% of China’s tropical log

imports were from these three countries in the first quarter

of 2024.

China’s tropical log imports from Solomon Is. rose 21%

but from PNG and the Republic of Congo shipped

volumes fell 21% and 32% respectively in the first quarter

of 2024 and this was the main reason for the decrease in

the total tropical log imports. Notably, China's imports of

logs from Mozambique and Bolivia rose sharply in the

first quarter of 2024. After a period of downturn African

logs are experiencing a strong appeal in the Chinese

market once again.

China’s log imports from African countries rose 3% to

387,000 cubic metres in the first quarter of 2024.

Rise in CIF prices for tropical log imports

The average CIF price for China’s tropical log imports

rose 3% to US$257 per cubic metre in the first quarter of

2024. The average CIF prices for China’s tropical log

imports from PNG and Mozambique grew 2% and 3%

respectively.

In contrast, the CIF prices for China’s tropical log imports

from the other top suppliers declined.

It is worth noting that the CIF price for China’s tropical

log imports from the Democratic Republic of Congo fell

45%, in addition, CIF prices for logs from Bolivia and

Honduras declined 16% and 12% respectively.

Global Green Supply Chain (GGSC) report for April

In April the GTI-China index registered 52.3%, a decrease

of 14.5 percentage points from the previous month and has

been above the critical value (50%) for 2 consecutive

months indicating that the business prosperity of the

enterprises represented in the GTI-China index expanded.

However, due to the decline in international demand for

wood products the expansion slowed. Feedback from a

sample of enterprises says some home furnishing

companies in China are actively seeking to strengthen

investment cooperation with developing countries where

market demand is stronger.

As for the 11 sub-indices, three, export orders, existing

orders and inventory of main raw materials were below the

critical value of 50% and the remaining 8 indices were all

above the critical value. Compared to the previous month

the indices for purchase price, inventory of main raw

materials and delivery time increased while the remaining

8 indices declined by 3.5-24.6 percentage points.

Challenges reported by repondents for April

It was difficult to recruit workers, demand from the

downstream markets declined, there was an imbalance

between production and sales, with production exceeding

the sales, it was difficult to procure raw materials such as

European oak veneer, the overall economy of the country

contracted and there was overcapacity in the sector.

For some enterprises the business performance was poor

and cash flow pressures existed, in particular the

woodpanel industry experienced fierce competition and

the market was saturated.

The following suggestions were made:

Increase financing efforts, implement macro-regulations

and controls, relax loan policies for enterprises, increase

the proportion of exports and shift marketing to Southeast

Asia, stabilise the supply of raw materials and the

woodpanel markets.

It was suggested that the government conduct coordination

within and outside the country to improve the business

environment through diversifying foreign markets and

implement promotion at home and abroad. To succeed the

sector needs to improve product quality, develop new

products and explore new enduses.

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in China.

GGSC

https://www.itto-ggsc.org/static/upload/file/20240418/1713424567120852.pdf

|