|

1.

CENTRAL AND WEST AFRICA

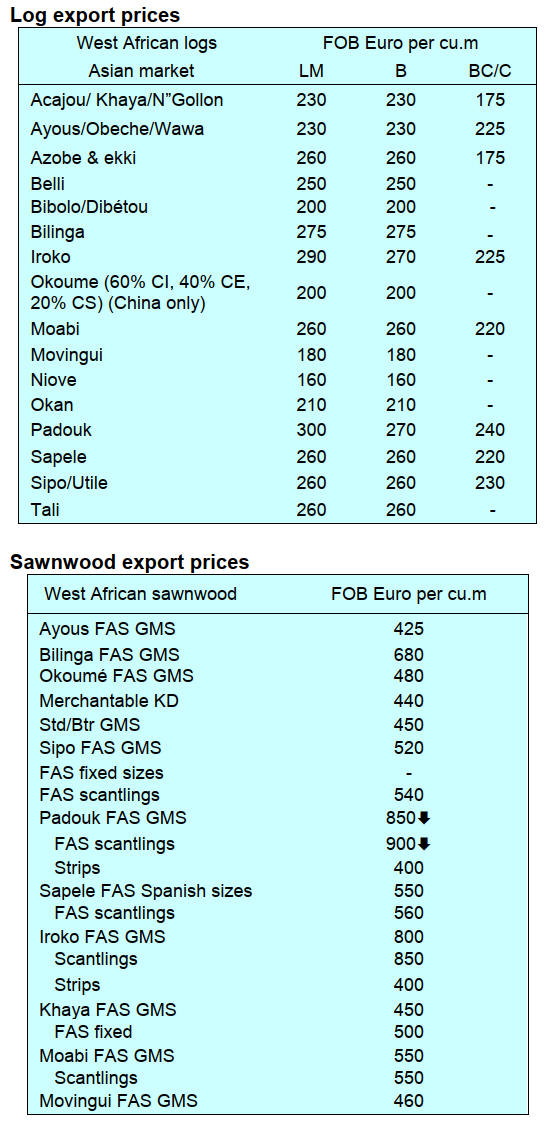

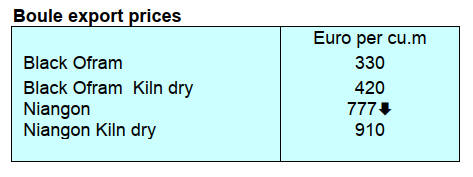

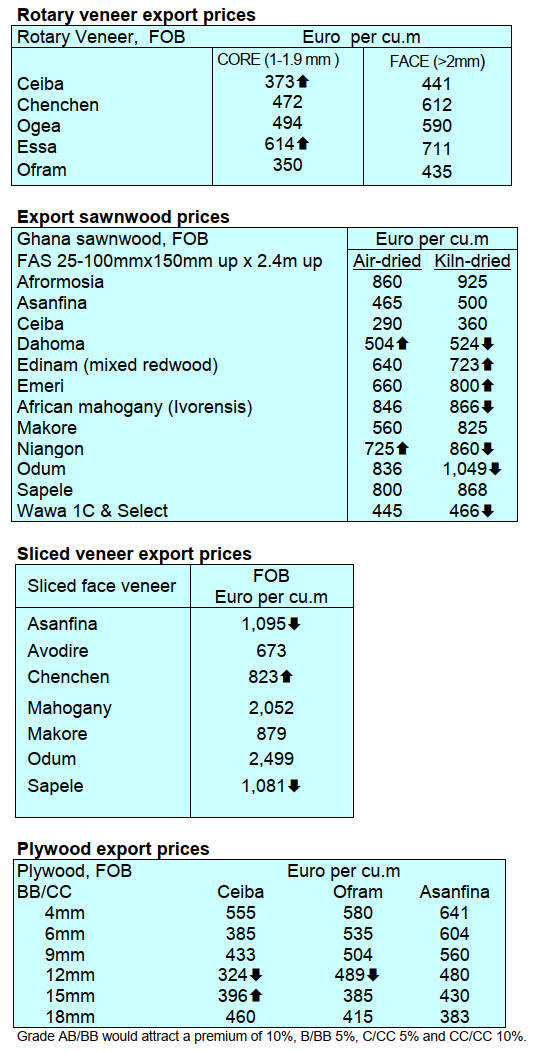

Rising demand for sawnwood

Reports suggest demand for azobe and bilinga logs has

weakened as there are fewer mills processing tropical logs,

especially in Europe. However, there has been a notable

rise in exports of sawnwood. Prices for sawn azobe and

bilinga remain stable following price declines over the

past few months. However, doussie sawnwood prices have

been rising which, say millers, is a paradox of low demand

paired with an even scarcer supply,.

It has been reported that in Belgium prices for adouk

sawnwood have slipped as there has been a surge in

shipments from Gabon and Cameroon, with Cameroon

adouk priced lower thanthe same species and

specifications from Gabon.

Reconstruction in Dubai - anticipated rise in demand

Prices in Asian markets are reported as generally stable.

However, demand for ovangkol is low as landed stocks are

higher than usual.

The pace of demand in Middle East markets is said to be

slow, as it has been for several months. Exporters in West

and Central Africa anticipate a rise in demand as

reconstruction begins after the recent disaster in Dubai.

Importers in India are showing interest in the azobe,

especially targeting low-quality timber. Producers say this

market is not attractive as they prefer to utilise falling

grade sawnwood internally for added value processing.

Extreme heat affecting working conditions

Cameroon is experiencing an unusually hot dry season

which is expected to last until June. Operators say supply

chains remain stable despite the harsh weather conditions.

In Gabon and Congo it is the rain season with

temperatures significantly higher than usual reaching

levels that impact the work environment. Millers in Gabon

face the additional problem of frequent electricity power

cuts which are severely impacting production, especially

kilning processes and plywood milling. The disruptions

are attributed to outdated infrastructure with promises

from the power company to resolve the problem by the

end of June.

Gabon National Convention reported in domestic

media

Media coverage in Gabon is predominantly focused on the

actions of the new government, especially following the

conclusion of the National Convention. This event has led

to the formation of special teams aimed at reorganising

government functions and this could influence future

policy directions impacting various sectors, including

forestry.

See:

https://www.lenouveaugabon.com/fr/gestion-publique/0205-20327-le-dialogue-national-inclusif-du-gabon-debouche-sur-1000-resolutions-visant-a-enforcer-la-democratie

Cheik Fantamady Kanté, World Bank Director of

Operations for Gabon commented that the National

Dialogue provided an opportunity to learn of the

government priorities and to see that these priorities are

well aligned with what the World Bank can support in

Gabon particularly with regard to providing basic social

services an the environment for job creation for young

people.

See:

https://www.gabonreview.com/projets-prioritaires-du-ctri-la-banque-mondiale-promet-son-appui/#respond

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in the Republic of Congo and Gabon.

GGSC

https://www.itto-ggsc.org/static/upload/file/20240515/1715738178173723.pdf

2.

GHANA

Forestry Commission issues deadline to its

debtors

The Ghana Forestry Commission (FC) has published a list

of debtors which include the names of individuals and

timber firms which owe the Commission money. The FC

website asked the debtors to settle their account by 31st

May 2024.

The statement says; “The Forestry Commission wishes to

bring to the attention of the following companies and

individuals whose names appear below to kindly settle

their indebtedness with the Forestry Commission by 31st

May, 2024. The Forestry Commission will resort to other

means within the law to recover all outstanding debts after

the deadline”. The list shows a total 530 individuals and

timber firms which own the FC money.

The statement adds “anyone who needs further

information or clarification could contact the

Commission’s Headquarters in Accra”.

See:

https://fcghana.org/forestry-commission-timber-firms-contractors-indebtedness/

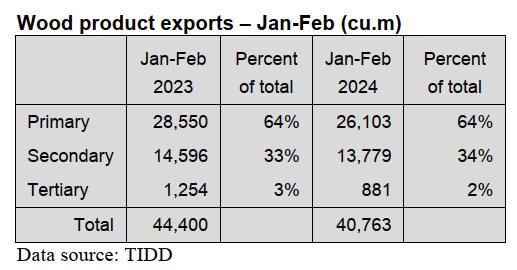

Primary products 64% of wood product exports

Ghana’s primary product exports in the first 2-months of

2024 accounted for 64% of the country’s total wood

export volume (40,763cu.m), an 8% decline. In the same

period in 2023 exports amounted to 44,400cu.m.

Exports of secondary wood products accounted for 34% in

2024 against 33% in 2023.

The exported primary products were air-dried sawnwood,

billets, teak logs, air-dried boules and kindling which

totalled 26,103cu.m in 2024 compared to 28,550cu.m in

2023.

According to the data from the Timber Industry

Development Division (TIDD) the average unit prices for

the secondary and tertiary products recorded increases in

early 2024 compared to the same period in 2023. Average

prices for primary products fell from Eur393/cu.m in 2023

to Eur384/cu.m in 2024.

The TIDD identifies some of the leading exporters for the

period as Samartex Timber and Plywood Company

Limited (9%), Miro Forestry Ghana Limited (7%),

Multimodal Freight Services Limited (6%), Logs and

Awnwood Limited (6%) and John Bitar and Company

Limited (6%).

The main species in demand were teak (49%), ceiba (8%),

wawa (8%), eucalyptus (8%) and denya (5%).

For the period under consideration India topped the list of

export destinations importing around 50% of the total

volume of wood products. While Germany (6%), Vietnam

(5%), Saudi Arabia (4%), US (4%) and others (31%).

Investors seek tax relief

Netherlands investors in Ghana, through the

Ghana/Netherlands Business and Culture Council

(GNBCC), have asked for the tax burden on businesses to

be reduced and asked for a streamlining of the

government’s regulatory processes to improve efficiency.

They also urged for ‘deepened digitalisation’ in public

service to address their exposure to corrupt practices in the

sector.

The statement on the GNBCC website says; “High

regulatory and compliance cost is identified as one of the

key cost components for the firms, and the synchronisation

of regulatory and permit processes leads to firms paying

extra costs through unofficial channels.

Thus, the government must deepen the existing e-

government services to ensure that the services are

delivered efficiently and reduce the cost of compliance.

This will help to reduce the bureaucratic interference of

public agencies in the activities of investors,” they

recommended during research sponsored by the GNBCC”.

A report on the findings of research conducted by the

IMANI Centre for Policy Education (CPE) was

disseminated to members of the GNBCC at the

stakeholder dialogue. The report is titled, “Reviewing

current economic and investment challenges and

opportunities for shared benefits and growth- a focus on

the members of the Ghana Netherlands Business and

Culture Council (GNBCC).”

According to a Senior Research Associate at IMANI/CPE,

Dennis Asare, a review of the existing tax regime was also

recommended by the respondents.

The GNBCC urged ‘deepened digitalisation’ in the public

service which would go some way to address exposure to

corrupt practices facing enterprises. The Council lamented

on the high regulatory and compliance cost in public

agencies as one of the key cost components for companies.

According to the GNBCC, the current macroeconomic

challenges have already increased the cost of doing

business for firms.

In a related development, the President of the Association

of Ghana Industries (AGI), Dr. Humphrey Ayim-Darke,

proposed that government should establish local

companies to compensate for the departure of

multinational corporations due to the high cost of doing

business.

In a reaction to these calls from businesses the Minister of

Finance, Dr. Mohammed Amin Adam indicated

government’s efforts to improve the business climate

outlining a series of initiatives aimed at making the

economy a preferred investment destination.

Businesses in Ghana are struggling with the high cost of

their operations, which range from port charges,

demurrage, taxes, high policy rate and depreciation of the

local currency among others.

See:

https://www.gnbcc.net/News/Item/7684

and

https://citinewsroom.com/2024/05/deliberately-establish-local-enterprises-to-replace-relocated-companies-agi-to-govt/

Importers suffer high port and handling charges

The Ghana Shippers’ Authority (GSA) organised a

workshop for importers following numerous complaints

from shippers concerning demurrage fees levied by

shipping lines and other handling charges from some

terminal operators.

Importers have long grappled with the burden of cargo

detention, demurrage and other charges stemming from

delays at the ports as this results in an unnecessary

financial burden.

To try and address these issues the GSA initiated steps to

establish Service Level Agreements (SLAs) with Shipping

Service Providers on behalf of shippers to promote

accountability within the shipping and logistics sector.

These agreements are expected to outline the obligations

of shipping service providers to shippers, streamline port

clearance processes, clarify time-related shipping costs,

offer guidance on cost avoidance strategies and delineate

the role of the GSA in this context.

The Chief Executive Officer (CEO) of GSA, Mr. Kwesi

Baffour Sarpong, announced these developments in a

speech read on his behalf during a workshop on “Avoiding

Demurrage and Rent” for Ministries, Departments and

Agencies (MDAs) held at the Shippers’ House in Accra.

See:

https://thebftonline.com/2024/05/06/shippers-authority-push-for-demurrage-free-port-through-strategic-engagement-with-mdas/

3. MALAYSIA

Inflation moderates

The Statistics Department’s latest consumer price index

(CPI) reveal that inflation remained at 1.8% in March

buoyed by higher prices for housing, water, electricity,

gas, services as well as transport.

Tightening forest degazetting and replacement

processes

Under the Malaysian Constitution, forestry is under State

jurisdiction. The National Forestry Act coordinates

forestry matters nationally and recently amendments to the

Act were passed.

Among the key changes were the tightening of the

degazetting and replacement process for permanent forest

reserves, the introduction of a public investigation process

before the degazetting of any forest reserve and the

simultaneous replacement of the degazetted forest.

The Natural Resources and Environmental Sustainability

Minister, Nik Nazmi Nik Ahmad, urged State

governments to adopt the amendments as, so far, only

Perlis and Selangor States have fully adopted the

amendments.

See:

https://www.thestar.com.my/news/nation/2024/04/30/more-state-governments-should-adopt-national-forestry-act-amendments-says-nik-nazmi

Efforts to bring deforestation levels down recognised

Free Malaysia, a news portal with a focus on Malaysian

current affairs, published a story in which it reports the

EU’s Commissioner for Environment and Fisheries,

Virginijus Sinkevičius, commended Malaysia’s efforts to

bring deforestation levels down.

It is reported that this comment was made during a virtual

conference with the Malaysian Minister of Plantations and

Commodities, Johari Ghani. Sinkevičius also reportedly

acknowledged Malaysia’s commitment to certified

sustainable commodity production.

“The EU and Malaysia will continue to work closely

together on the implementation of the forthcoming EUDR

and how the MSPO certification provides readiness and

assurances for supply chain partners and regulators in the

EU,” said a statement.

Johari emphasised the role of the Malaysian Sustainable

Palm Oil (MSPO) Certification Scheme in strengthening

efforts to meet EUDR requirements on traceability, being

deforestation-free and with legitimate land titles and good

labour practices.

Sinkevičius is reported as saying the EU is ready to

continue working with Malaysia to enhance deforestation-

free supply chains.

See:

https://www.freemalaysiatoday.com/category/nation/2024/04/25/eu-hails-malaysias-efforts-to-reduce-deforestation/

In related news, with the December 2024 implementation

of the European Union Deforestation Free Products

Regulation (EUDR) in mind the Malaysian Timber

Council (MTC) organised a webinar to provide updates to

stakeholders and equip them with the knowledge they

need to navigate through this regulation as well as

facilitate strategic and sustainable business approaches.

Efforts by the Government and MTC have been ongoing

to aid Malaysian timber exporters in satisfying the EUDR.

See:

https://mtc.com.my/images/publication/260/Timber_Malaysia_Jan-Mar_2024.pdf

Sabah forest revenue

The Sabah Forestry Department collected RM155.3

million in revenue in 2023. Of this RM93.3 was from

timber royalties and the proceeds from the collection of

inspection fees for exported wood products provided much

of the balance.

The revenue from permit fees, licence renewal fees,

royalties from agroforestry products, vehicle registration

fees and others was RM58.2 million.

See:

https://www.thestar.com.my/news/nation/2024/05/05/seeing-to-the-trees-for-proper-forest-management

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Malaysia.

GGSC

https://www.itto-ggsc.org/static/upload/file/20240515/1715738178173723.pdf

4.

INDONESIA

Processed Wood

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1000 mm2 to

4000 mm2 (ex 4407.11.00 to ex 4407.99.90).

Processed wood products which are leveled on all

four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 4,000 mm2 to

10,000 mm2 (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all

four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 10,000 mm2 to

15,000 mm2 (ex 4407.11.00 to ex 4407.99.90)

See:

https://jdih.kemendag.go.id/pdf/Regulasi/2024/575_Kepmendag%20HPE%20dan%20HR%20Produk%20Pertanian%20Lampiran.pdf

and

https://forestinsights.id/harga-patokan-ekspor-produk-kayu-mei-2024-ada-kenaikan-untuk-kayu-olahan/

Mission to discuss EU Forest Map data

The government will embark on a mission to discuss the

global forest map (GFM) on the European Union Forest

Observatory (GFM EUFO) platform which serves as a

reference for the European Union’s Deforestation-free

Regulation (EUDR) implementation.

Scrutiny by Indonesia has revealed accuracy issues with

the GFM EUFO. Acting Director General of Sustainable

Forest Management at the Ministry of Environment and

Forestry, Agus Justianto, explained that Indonesia’s

mission will be carried out through the Indonesian

Embassy in Brussels.

A comparison of the GFM EUFO map with the

SIMONTANA (National Forest Monitoring System)

reveals differences.

To strengthen Indonesia’s position in facing the challenges

from EUDR the Ministry of Environment and Forestry has

requested all holders of Forest Management Units (PBPH)

to overlay the EU’s GFM map with their PBPH maps and

PBPH Operational maps and check for variations. The

results of this analysis and ground check will be used for

negotiations with the European Union.

See:

https://forestinsights.id/indonesia-embarks-on-diplomatic-mission-to-rectify-eu-forest-map-reference/

and

https://www.antaranews.com/berita/4079901/ri-siap-jalankan-misi-diplomasi-koreksi-peta-hutan-acuan-eudr?utm_source=antaranews&utm_medium=desktop&utm_campaign=editor_picks

Countries seek changes to EUDR

The regulatory initiative developed by the European Union

the EU Deforestation-Free Regulation (EUDR) represents

a significant challenge for exporters to the EU.

While the modalities for implentation are not yet released

Indonesia, along with Malaysia and the EU, agreed to

establish an Ad Hoc Joint Task Force on the EUDR to

address various issues related to the implementation of the

EUDR. This task force will identify the best solutions and

resolutions regarding the implementation of the EUDR.

A bipartisan group representing the Republican and

Democratic parties in the United States has also

highlighted challenges and there has been consideration of

requesting a delay in implementation or changes to the

regulation.

See:

https://www.thejakartapost.com/business/2024/04/25/countries-including-us-seek-changes-to-eu-deforestation-regulation.html

and

https://finance.detik.com/berita-ekonomi-bisnis/d-7309525/ri-dapat-dukungan-dari-as-soal-protes-uu-anti-deforestasi-uni-eropa

Indonesia seeks 1% of global furniture market

Indonesian furniture exporters aim to capture 1% percent

of the global furniture market following a significant

decline in exports last year. In 2023, Indonesia's furniture

exports totaled US$2.1 billion, marking a 23 percent

decline from the previous year.

Global furniture sales are estimated to have reached

US$730 billion last year, with a projected increase to

US$766 billion this year according to the Indonesian

Furniture and Handicraft Industry Association, Asmindo.

The United States remains the largest export destination

for Indonesia's furniture, accounting for 55% of exports

with almost 70% being of wooden furniture.

In related news, the Chairman of the Indonesian Furniture

and Handicraft Industry Association (Himki), Abdul

Sobur, said that exporters are welcoming the strengthening

of the US dollar Indonesia uses 80-90% domestic raw

materials thus avoiding high priced imports.

Sobur said he is optimistic that export earnings from the

furniture, furnishings and crafts industries can grow by at

least 10% compared to the 2023 performance.

According to Sobur the industry is determined to explore

non-traditional markets outside of the European market

such as South Korea, China, Japan and ASEAN countries

while at the same time building capacity in order to meet

the EUDR requirements for exporting to Europe.

See:

https://www.liputan6.com/bisnis/read/5584534/ukm-mebel-indonesia-target-kuasai-1-pasar-perabotan-dunia?page=2

and

https://www.kompas.id/baca/english/2024/05/08/en-industri-mebel-optimis-ekspor-tumbuh-10-persen-tahun-ini?loc=hard_paywall

Singaporean firm invests in Batang Industrial Park

The Batang Industrial Park recently revealed that it had

attracted a US$25 million investment from Singapore.

Kawasan Industri Terpadu (KIT) Batang, also known as

Grand Batang City, announced that this investment came

from Singapore-based wood pellet producer Sampoerna

Kayoe. This also marked the first investment deal that the

industrial zone had secured this year. Sampoerna Kayoe is

planning to build a wood pellet plant in the Industrial Park.

See:

https://jakartaglobe.id/business/singaporean-firm-invests-25m-in-batang-industrial-park

Indonesia’s forest-based economy explained

Indonesia presented its forest management

accomplishments at the 19th United Nations Forum on

Forest (UNFF) and emphasised its commitment to

developing a forest-based economy. Alue Dohong, Deputy

Minister of Environment and Forestry reported that

Indonesia has successfully surpassed its national target of

reducing deforestation rates to below 0.45 million

hectares. Additionally, Indonesia has also committed to

achieving the target of social forestry allocation, which is

set at 12.7 million hectares.

Deputy Minister Alue also mentioned Indonesia's efforts

to develop a forest-based economy through community

empowerment in the public economic sector. During the

meeting the Indonesian Delegation participated in several

strategic discussions related to forest policy developments.

See:

https://ppid.menlhk.go.id/berita/siaran-pers/7709/indonesia-tunjukkan-komitmen-hijau-di-forum-hutan-pbb

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Indonesia.

GGSC

https://www.itto-ggsc.org/static/upload/file/20240515/1715738178173723.pdf

5.

MYANMAR

Soaring living costs – construction activity grounded

Persistent inflation is making life increasingly challenging

for people, especially for those with very low incomes.

The cost of essential goods continues to rise, primarily

driven by escalating fuel prices. Myanmar heavily relies

on fuel imports. According to the World Bank, fuel

imports accounted for almost 30% of merchandise imports

in 2022.

The surge in prices extends beyond fuel, affecting staple

items such as rice, meat, edible oils and vegetables which

have seen prices double or triple over the past year.

The implementation of the national military service law

earlier this year has prompted many young individuals,

predominantly males, to seek employment opportunities in

neighboring countries and this has led to a labour shortage

across various sectors. The construction sector has been

severely impacted by rising building material costs and a

labour shortage.

Construction materials are in short supply in Myanmar and

prices are rising. Many construction materials have to be

imported and companies are facing difficulties obtaining

the relevant import permits and foreign currency to

purchase materials.

The labour shortage is also the result of the conscription

law (National Military Service). On 1 May the government

suspended passport applications for those between the

ages of 23 and 31.

See -

https://myanmar-now.org/en/news/junta-lifts-suspension-of-overseas-work-permits-for-men-but-imposes-age-restrictions/

Informal diplomacy at work

The Japanese media (Nikkei Asia) has reported that

representatives of five ethnic groups, from Myanmar,

including the Karen National Union, the Chin National

Front and the Karenni National Progressive Party, were

granted permission to visit Japan. Nikkei Asia points out

that the Japanese government has avoided any official

endorsement of this visit.

It is reported the group may have met with representatives

of the Nippon Foundation, a philanthropic group headed

by Japan's special envoy for Myanmar, Yohei Sasakawa.

See:

https://asia.nikkei.com/Spotlight/Myanmar-Crisis/Thailand-Japan-signal-policy-shifts-on-engaging-Myanmar-s-resistance

Union Taxation Law for 2024-25

On 29 March 2024, Myanmar’s State Administration

Council enacted the Union Tax Law for the financial year

starting 1 April 2024 and ending 31 March 2025 (“2024

UTL”). The Union Tax Law has been issued annually

2014.

See:https://www.allenandgledhill.com/perspectives/articles/27910/mmkh-issues-union-tax-law-for-financial-year-2024-2025

New York Times reports on Myanmar

The New York Times issued a cover article “ What’s

Happening In Myanmar’s Civil War?” with comments on

the political, social and military situation in the country.

See:

https://www.nytimes.com/interactive/2024/04/20/world/asia/myanmar-civil-war.html

and

https://www.pbs.org/newshour/world/more-civilians-die-in-myanmars-civil-war-as-military-uses-brutal-tactics-against-resistance-gains

6.

INDIA

Election process imopacts

businesses

India's Parliamentary elections have been going on since

mid-April. The correspondent reports “production and

output in the timber and building sectors have slowed as

mill workers, carpenters and builders have taken leave and

returned home to cast their vote.

Once again, temperatures have soared across the country

and this is also affecting productivity. Because of the

extreme heat the risk of forest fires has increased.

Ocean freight charges and shipping opportunites have

become an issue for importers so they have reduced

imports.”

Domestic raw material costs rising

In its latest issue, Plyreporter discusses the increase in

poplar log prices. Plywood manufacturers in Northern

India, the main plywood manufacturing hub, have reported

soaring poplar prices. The industry reported an all-time

high in March when poplar timber prices rose to Rs1700

per quintal (100kg) that driven up production costs.

The main reason for the jump in raw material costs, says

Plyreporter, is the Red Sea shipping crisis that has pushed

up landed prices for imported wood pulp and paper mills

have turned to domestic poplar.

See:

https://www.plyreporter.com/article/153833/poplar-timber-prices-touches-new-all-time-high-mark

Wooden furniture gaining in popularity

India’s furniture industry is growing rapidly and almost

65% of Indian furniture is made of wood. The demand for

wood raw material in India’s furniture manufacturing

industry has increased. The interest in wood products in

the home has grown over the past few years as home

owners, especially young people stared to use wood for

interior decoration along with increased interest in wooden

furniture.

It has been estimated that the domestic Indian furniture

market will grow at a compound annual growth rate

(CAGR) of 13% between 2020 and 2024. Because of the

growing salaried class, the number of metropolitan

families and the rise in disposable income demand for

furniture is expected to continue to grow.

See:

https://www.indiatoday.in/information/story/what-are-the-future-prospects-in-the-furniture-industry-2508135-2024-02-28

Companies rebalancing their supply chains

The results of a poll of global business leaders undertaken

by Price Waterhouse Cooper says many are looking at

India and Southeast Asia as alternative supply chain

destinations as trade relations between China and the US

remain unsettled.

The poll, commissioned by Eastspring Investments, found

that over the next decade in the rank of supply chain

importance India will become the third most important

link, up from the current fourth and Southeast Asia will

also move up one place in the supply chain ranking. In

contrast, the poll determined Germany will move down

one place and Japan will drop to sixth.

According to the survey, boosting supply chain resilience

is a key business priority with most stating that

rebalancing their supply chain would cost less than the

potential risk by not rebalancing.

See:

https://www.pwc.com/gx/en/about/pwc-asia-pacific/global-supply-chains-the-race-to-rebalance.html

and

https://www.eastspring.com/assets/awp-23/docs/awp-download-report.pdf

7.

VIETNAM

Wood and wood product trade highlights

Customs data shows that in April 2024 W&WP exports

reached US$1.3 billion, up 0.2% compared to March 2024

and up 19% compared to April 2023. WP exports

accounted for US$893 million, up 0.7% compared to

March 2024 and up 141% compared to April 2023.

In the first 4 months of 2024 W&WP exports earned

US$4.8 billion, up 24% over the same period in 2023. WP

exports alone, contributed US$3.3 billion, up 26% over the

same period in 2023.

Vietnam's W&WP imports in April 2024 amounted to

US$265 million, up 37% compared to March 2024 and up

57% compared to April 2023. In the first 4 months of 2024

W&WP imports were valued at US$801 million, up 26%

over the same period in 2023.

Vietnam's imports of logs and sawnwood in April 2024

reached at 498,200 cu.m worth US$166.9 million, up 38%

in volume and 37% in value compared to March 2024.

Compared to April 2023 imports of logs and sawnwood

rose 50% in volume and 39% in value. The increased log

and sawnwood imports in April 2024 resulted from the

increased demand from export manufacturers.

In the first 4 months of 2024 imports of logs and

sawnwood stood at 1,421 million cu.m worth US$472.5

million, up 12% in volume and 3% in value over the same

period in 2023.

In the first 4 months of 2024, the W&WP exports to

Canada totalled US$74.4 million, up 27% over the same

period in 2023.

In April 2024 exports of kitchen furniture brought in about

US$107 million, up 31% compared to April 2023. In the

first 4 months of 2024 exports of kitchen furniture totalled

US$397 million, up 34% over the same period in 2023.

Vietnam's poplar imports in April 2024 were at 44,000

cu.m worth US$14.4 million, up 38% in volume and 37%

in value compared to March 2024. Compared to April

2023 imports were up 46% in volume and 14% in value.

In the first 4 months of 2024, imports of poplar wood were

estimated at 108,800 cu.m, worth US$39 million, up 35%

in volume and 17% in value over the same period in 2023.

Imports of logs and sawnwood from the EU in April 2024

reached 50,000 cu.m at a value of US$16 million, up 13%

in volume and 3% in value compared to March 2024. The

total volume of wood materials imported from the EU in

the first 4 months of 2024 reached 184,020 cu.m, at a

value of US$59.40 million, down 3.5% in volume but up

2% in value over the same period in 2023.

Vietnam's wood export surged in the first four months

D.P.Tran, writing for vneconomy.vn, offers a valuable

insight into the current situation in the Vietnamese wood

processing sector. He writes “the success of Vietnam's

wood industry can be attributed to several key factors:

the country's strategic positioning as a global

exporter of wood and wood products which has

enabled it to expand its market reach

Vietnam's forestry development policies, business

support initiatives and an extensive network of

free trade agreements have provided a conducive

environment for the wood industry's growth

the abundant forest resources coupled with its

competitive labour force and access to raw

materials has bolstered export competitiveness

the wood industry has embraced technological

advances, digital transformation, investment in

product development, process optimisation and

productivity enhancements

Despite its recent recovery the industry faces considerable

hurdles as Vietnam's primary export markets tighten

regulations regarding the origin and legality of wood

products”.

He emphasises that enterprises need to comply with

environmental regulations and traceability standards and

advocates increased investment in design, creativity and

product innovation which will create opportunities for

diversifying export markets.

See:

https://vneconomy.vn/vietnams-wood-export-surges-23-7-in-first-four-months-of-2024.htm

Imported raw material sources

In the first quarter of 2024 the area of newly planted

forests nationwide amounted to 37,300 hectares, down

1.4% over the same period last year due to heavy rains

badly affecting the progress of afforestation in selected

localities.

In the first 3 months of 2024 imports of logs and

sawnwood from major suppliers such as China, the US,

Thailand, Laos, Chile and Brazil increased against the

same period in 2023. In contrast, imports from some other

suppliers such as the EU, Cameroon, Malaysia and Congo

decreased.

In particular, log and sawnwood imports from China

accounted for 16% of total imports in the first 3 months of

2024, reaching 165,200 cu.m, worth US$63.4 million, up

56% in volume and 23% in value over the same period in

2023.

The imports from the US increased by 37% in volume and

35% in value year-on-year reaching 142,800 cu.m, worth

US$61.4 million equivalent to 13.5% of the total imports.

Imports from Thailand soared by 36% in volume and 45%

in value over the same period in 2023 reaching 129,300

cu.m, worth US$27.0 million, accounting for 12% of total

imports.

In addition, imports of logs and sawnwood from some

other markets increased compared to the same period in

2023 such as from Laos, up by 12%, from Chile up by

55%, from Brazil up by 103%, from Papua New Guinea

up by 141% and from New Zealand up by 8%.

In contrast, log and sawnwood imports from some other

sources in the first 3 months of 2024 declined over the

same period in 2023 such as from the EU down by 0.2%,

Cameroon by 53%, Malaysia by 34%, Congo by 47% and

Suriname by 40%.

Imported species

In the first 3 months of 2024 imports of pine, poplar, oak,

eucalyptus and walnut increased against the same period

in 2023 while some of the other species, including ash,

tali, pachy (white afzelia) padouk, rubberwood and teak

declined.

Imports of pine, the main timber imported, accounted for

15% of total log and sawnwood imports in the first three

months of 2024 reaching 161,800 cu.m and worth

US$34.4 million, up 60% in volume and 51% in value

over the same period in 2023.

Poplar imports surged in the first three months of 2024 by

53% in volume and 38% in value over the same period in

2023 reaching 76,700 cu.m, worth US$28.5% million

equivalent to 7% of total imports.

Oak imports increased by 43% in volume and 48% in

value over the same period in 2023, reaching 74,100 cu.m,

valued at US$42.8 million.

In addition, imports of some other species increased

against the same period in 2023 such as eucalyptus, up by

207%, sapelli, up by 19%, walnut, up by 50%, beech up

by 27% and fir up by 72% etc.

In contrast, imports of ash in the first 3 months of 2024

decreased to 86,200 cu.m, worth Ú$22.5 million and ,

accounted for 8% of total wood raw material imports.

In the first 3 months of 2024, the average import price of

logs and sawnwood stood at US$331.5/cu.m, down 9%

over the same period in 2023.

In particular, the price of logs and sawnwood from China

fell 22% over the same period in 2023 to US$383.6/cu.m,

from the US prices fell by 1.5% to US$430.0/cu.m, from

Laos prices fell by 7% to US$459.2/cu.m, from Chile

prices fell by 6% to US$233.8 per cu.m. and from Papua

New Guinea prices fell 4%.

Outlook of Vietnam’s timber imports

Exports of wood and wood products in the first 4 months

of 2024 have shown positive signals thanks to the increase

in imports by key markets.

The recovery in the first months of this year has

enabled wood enterprises to increase production and given

positive expectations for Vietnam's wood industry for

2024. In particular, demand recovery in major markets

such as the US, China, Canada, the UK and the EU has

brought cheer to Vietnam's wood product

manufacturers.

Wood processors have accelerated linkage with farmers

along the supply chain, focusing on investment in and

development of large timber plantations to secure raw

materials. Due to the lack of many species required by

customers Vietnam’s wood industry still depends on

imported wood raw material.

See:

https://english.haiquanonline.com.vn/wood-exports-started-well-29702.html

Woodchip exports and impact on the pulp sector

Vietnam’s exports of eucalyptus and hybrid acacia

chips have increased more than 10 times in the last

decade. In 2001, the country exported only 400,000

tonnes of wood chips but by 2011 it had increased this

to about 5 million tonnes.

The expansion of pulp capacity in China has led to a

sharp increase in the number of hardwood plantations

and chip making facilities in Vietnam. Chips are mainly

exported through the Hai Phong Port area and via ports

in Central Vietnam. At many ports in Central of

Vietnam such as Ky Ha (Quang Nam), Dung Quat

(Quang Ngai), Chan May (Thua Thien Hue), there are

regular bulk carriers. The export markets are S. Korea,

Japan and China. With limited domestic supply China

will continue to rely on neighboring countries to

provide chips for pulp production.

A representatives of Dak Lak agroforestry farmers

group said that, due to the lack of capital, they had to

exploit trees early to cut sawn timber for export instead

of planting several years for higher value sawn timber.

One ton of wood in the market costs 500,000 VND,

while one ton of sawn timber costs four times as much.

The massive export of wood chips does not only affect

the demand for wood materials and pulp materials in

the future but also affects the wood processing and

paper industries.

According to Vu Ngoc Bao, General Secretary of the

Vietnam Pulp and Paper Association, paper mills in the

country have to import raw materials at high prices

while the export price of wood chips in Vietnam to

China and Japan is much lower.

Despite the huge amount of wood chips exported the

value of exports is only about US$300 million but the

amount spent to import pulp amounts to US$700

million per year.

Recently, An Hoa Paper Joint Stock Company (An Hoa

Paper) proposed to increase the export tax on chips to

create conditions for production of pulp from domestic

raw material. Bao, leader of Paper & Pulp Association

supported the idea from An Hoa Paper.

In response forestry companies and forest planters are

opposed to the paper industry suggestion and the Binh

Dinh FPA Company has written a petition to the

Ministry of Industry and Trade, Ministry of Agriculture

and Rural Development, General Department of

Forestry and the Wood asking that no changes be made

to export duties or chip exports.

See:

https://www.paper-vietnam.com/en/news/vietnam-the-worlds-largest-exporter-of-wood-chips-and-its-impact-on-the-pulp-market-2-99.html

8. BRAZIL

Debate on railway

logistics for exports

Representatives from industry and organisations that use

the railway to transport goods for export, along with

experts in the field, system operators and regulatory

agencies recently participated in a meeting organised by

the Brazilian Association of Mechanically Processed

Timber Industry (ABIMC) to discuss solutions for export

logistics focusing on the railway network.

The main objective was to address the need for

harmonisation among the various channels involved in

export logistics and to seek optimal product flows, taking

into account industrial growth and challenges facing the

logistic infrastructure.

During the meeting the condition of logistic infrastructure

was analysed, especially regarding the railway system, in

order to plan effective short, medium and long-term

actions to mitigate current bottlenecks.

The meeting featured presentations of studies addressing

the volume and movement of cargo in different modalities

emphasising the importance of an integrated perspective

(loading, arrival at the port and shipment) to understand

logistic challenges.

Additionally, the National Railway Transportation

Department of the National Land Transportation Agency

highlighted the need to bring railways into a more

competitive national context by seeking investments from

both the public and private sectors to improve railway

infrastructure.

See:

https://abimci.com.br/abimci-participa-de-reuniao-para-debater-panorama-do-modal-ferroviario/

Discussions on forest policies between Brazil and

Bolivia

Representatives from the State government of Acre and

Bolivian Governors met in April to discuss forest policies

for the Amazon Region, including conservation and

sustainable development strategies.

The Governors' Climate and Forests Task Force (GCF

Task Force) led the meeting which involved local leaders,

subnational government communities and project

financiers linked to sustainability in order to exchange

experiences and explore effective policies.

The government of Acre highlighted successful cases such

as environmental regularisation and projects such as the

Biotechnology Park, aimed at boosting the local economy

based on biodiversity and sustainable production, aligning

with the Amazon 2030 agenda and strengthening

cooperativism to promote development.

During the meeting innovative approaches on forest

management, climate mitigation, combating deforestation

and biodiversity preservation were discussed, including

the incorporation of indigenous knowledge.

The government of Acre also emphasised its leadership in

creating specific programmes, setting goals and incentives

to mobilise local and regional resources for climate

initiatives. These actions have attracted private

investments and strategic partnerships such as the Amazon

Fund worth almost R$100 million and strengthening the

regional commitment to sustainability and socio-economic

development.

See:

https://forestnews.com.br/acre-bolivia-discutem-politica-florestal/

International Coalition seeks transition period for

EUDR implementation

The international coalition "On Sustainable Timber," made

up of various timber-producing countries, including Brazil

represented by ABIMCI, sent documents to the European

Commission requesting clarification on some legal issues

and an acceptable transition period to ensure greater

effectiveness in the implementation of the EUDR which

will come into effect in December this year.

Additionally, ABIMCI is mobilising representatives from

the forest industry and the Ministry of Agriculture,

Livestock and Supply (Mapa) to determine how the

federal government can address the issue of EUDR

implementation.

ABIMCI is also discussing technical issues, conformity

assessment, risk assessment and classification in Brazil,

system operation and data security, certification of origin,

geolocation, inspection and sanctions among others.

The EUDR establishes rigorous due diligence

requirements for the importation of products by the

European Union. The document sent to the European

Commission seeks to clarify key terms in the regulation,

such as forest, forest plantation, planted forest,

deforestation and forest degradation, which are not yet

fully defined.

In addition, coalition members held a meeting to discuss

challenges faced by timber-producing countries. The

group is considering a possible in-person agenda with the

European Commission to present the position of

participating countries regarding the EUDR.

The International Coalition has also developed a Timber

Coalition website where the documents addressed to the

EU are available.

See:

https://www.timbercoalition.org/_files/ugd/b764c2_028f19e7c2a9452a9c294b1b40cd42e9.pdf

and

https://bioenergyeurope.org/wp-content/uploads/2024/03/Joint-cross-sector-coalition-letter-on-EUDR-implementation.pdf

France a target market for Brazilian furniture

The French furniture market stands out as one of the main

destinations for Brazilian exports according to the "Study

of Opportunities for the Brazilian Furniture and Mattress

Exporter - Target Country: France."

With a sophisticated logistics infrastructure and a strategic

position in Europe France offers significant opportunities

for the Brazilian industry. The study suggests the steady

growth of apparent furniture consumption in the country,

reaching US$14.2 billion in 2022 (a 3.4% increase since

2018) highlights the growing dependence on imported

products.

French demand for quality furniture, innovative designs

and sustainability provides a window of opportunity for

the Brazilian furniture industry which has shown signs of

recovery and growth in the French market.

With a 42% increase in furniture export to France in 2022

compared to the previous year, Brazil is well-positioned to

meet the demands of the French market, especially

considering the recent strengthening of diplomatic

relations between the two countries.

However, to capture the opportunity in the French market

and achieve a projected growth of +33% (US$37.6

million) in the short-term continuous investment in

quality, innovation and sustainability will be crucial.

See:

http://abimovel.com/relacoes-bilaterais-fortalecidas-e-alta-demanda-por-importados-fazem-da-franca-mercado-alvo-para-a-industria-brasileira-de-moveis/

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Brazil.

GGSC

https://www.itto-ggsc.org/static/upload/file/20240515/1715738178173723.pdf

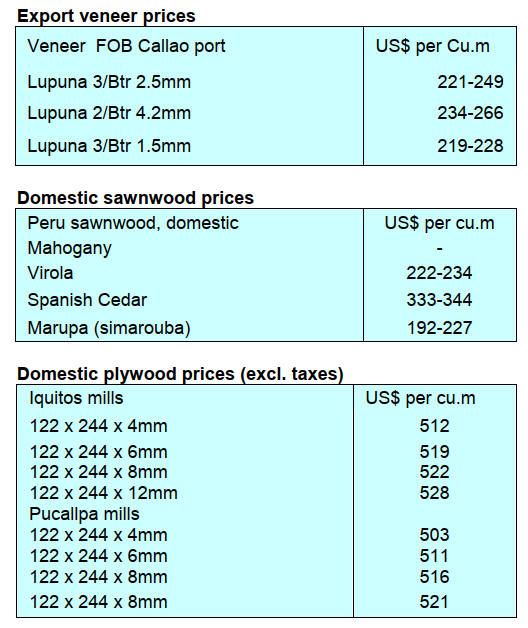

9. PERU

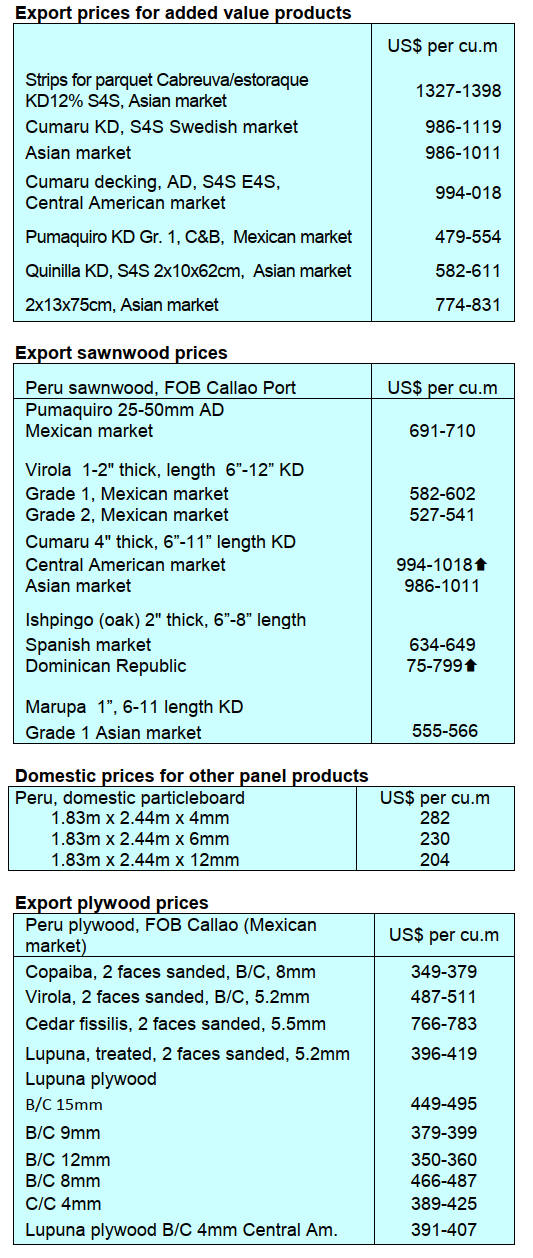

Veneer and plywood

exports suffer a decline

The Management of Services and Extractive Industries of

the Association of Exporters (ADEX) reported that export

shipments of veneers and plywood in the first two months

of this year earned US$107,000, a decline of 10% year on

year.

This drop is partly explained by the decline in orders from

Mexico, the main buyer. According to figures from the

ADEX Data Trade Commercial Intelligence System no

other country placed orders for these products in the first

two months of this year.

Promoting compliance with regulations among forest

users

With the aim of promoting compliance with forestry

regulations and strengthening the sustainable use of forest

resources, the Forest and Wildlife Resources Supervision

Agency (OSINFOR) held three workshops in April to

explain forestry regulations to Brazil nut (locally termed

chestnut) concessionaires in the Provinces of Tambopata

and Tahuamanu, in Madre de Dios.

The workshops brought together those involved in

sustainable forest management, from Brazil nut concession

holders, forest agents, public authorities and

representatives of environmental organistaions.

With the support of institutions such as the Specialised

Prosecutor's Office for Environmental Matters (FEMA),

the Association of Forest Regents of Madre de Dios

(AREFOMAD) and the Regional Forestry and Wildlife

Authority of Madre de Dios, participants had the

opportunity to update their knowledge on rights, duties

and responsibilities in forestry matters.

See:

https://www.gob.pe/institucion/osinfor/noticias/946858-osinfor-promueve-el-cumplimiento-de-la-normativa-forestal-entre-usuarios-del-bosque-en-madre-de-dios

Meeting of international and national experts at

forestry forum

The Sustainable Productive Forests (BPS) programme of

the National Forestry and Wildlife Service (SERFOR) and

the Regional Government of San Martín recently hosted

an International Forestry Forum themed “Favorable

environments for innovative and sustainable forestry

businesses in Peru”. The aim was to exchange experiences

on forest plantations for commercial purposes, forest

management and forest planning.

The forum brought together national and

international

experts from Colombia, Ecuador, Brazil, Chile, the

Caribbean and the United States who explained the

challenges, successes and good practices in forest

plantations implemented in their countries. As part of the

forum the first invitation for Peru’s innovative co-

financing mechanism, the Forest Incentives Program (PIF)

was opened.

See:

https://www.gob.pe/institucion/serfor/noticias/944414-san-martin-serfor-reune-a-expertos-internacionales-y-nacionales-en-foro-forestal

|