Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Apr

2024

Japan Yen 157.9

Reports From Japan

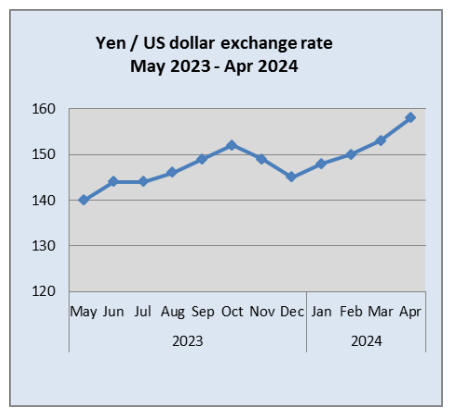

34-year low for the yen

The yen fell to 160 to the dollar on the 29 April as a bout

of frantic yen selling took place after the Bank of Japan

left interest rates unchanged even as the outlook for an

early US rate cut faded.

The 160 level was a 34-year low for the yen which had

been in the mid-155 yen range before the BoJ decision.

Finance Minister, Shunichi Suzuki, recently met with his

US and South Korean counterparts where he claimed the

groundwork was laid for the Japanese authorities to act

against excessive yen weakness.

Although the yen's slide prompted speculation that

Japanese authorities were poised to intervene with support,

the US interest rate outlook suggests there is little Tokyo

can do to change the overall direction of exchange rates.

Despite this it appears there was an intervention by Japan

as the yen exchange rate suddenly strengthened. Japanese

officials have remained silent on whether there was action

taken.

Analysts have suggested even if there was an

intervention

the yen would probably gain for a short time but the

interest rate differential between the US and Japan would

likely cause the yen to eventually return to the pre-

intervention level.

While the government and Bank of Japan have tried to

play down the impact this decline will have on living costs

consumers are not convinced. The almost 10% decline in

the value of the yen against the US dollar is having a

marked impact on import costs.

See:

https://www.japantimes.co.jp/business/2024/04/17/markets/yen-intervention/

Some municipalities face almost total depopulation

A recent report from a panel consisting primarily of

private-sector experts forecasts that approximately 40% of

Japan's municipalities face almost total

depopulation, underscoring the severity of urban migration

and the aging population.

Since 2014 the government has implemented various

initiatives aimed at addressing the low birthrate and the

over-concentration of people in Tokyo with little success.

Nationwide the number of births continues to drop while,

at the same time, young people from the Prefectures flock

to the main cities.

See:

https://www.japantimes.co.jp/commentary/2024/04/26/japan/japans-shrinking-population/

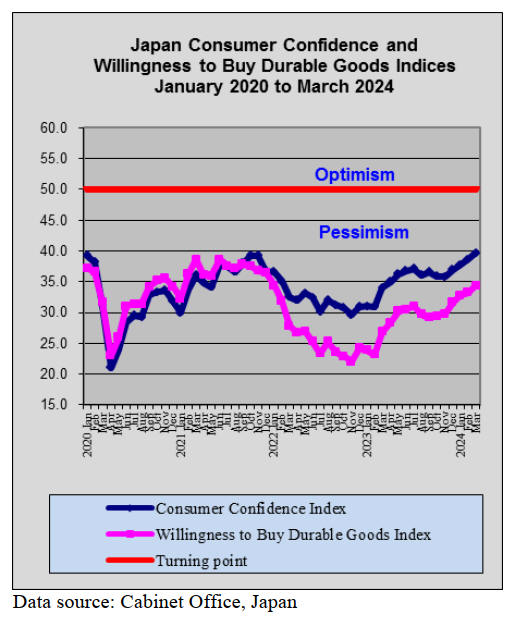

Persistent price increases dampen spending

Households in Japan continue to cut back on spending as

prices for everyday goods continue to climb. Spending

dropped 0.5% in February year on year, sliding for a 12th

consecutive month.

The decline narrowed from a 6% drop in the previous

month and compared with economists’ forecast of a 2.9%

retreat. Persistent price increases and the steady decline in

real wages are having an impact on spending patterns with

discretionary purchase of, for example household goods

including furniture, dropping.

See:

https://www.japantimes.co.jp/business/2024/04/05/economy/households-continue-to-cut-outlays/

Boom year for tourist arrivals

With all indications pointing to a boom year for tourist

arrivals in Japan hospitality, especially hotels are

attracting foreign investors to the Japanese property

market. Domestic investors are also eager to get into the

hotel real estate sector and find funding is low cost despite

the county's first interest rate hike in 17 years in March.

Observers suggest hotels and apartment buildings, rather

than warehouses, are expected to be the focus in 2024.

Foreign investors typically account for 20% to 25% of

property investment in Japan according to a major real

estate research and investment company (JLL) data.

According to the Japan National Tourism Organization

Japan recorded 3.08 million travelers in March, up 12%

from the same month in 2019 before the COVID-19

pandemic. The number of monthly visitors for the first

time in March exceeded 3 million and tourism spending

broke a quarterly record.

But while the rebound is bringing the government's goal of

15 trillion yen (US$97 billion) in annual tourism spending

by 2030 within reach it is also driving up prices and

creating problems for local residents especially in popular

areas. The rebound in tourism has driven up hotel room

rates and this will likely encourage an expansion in the

hospitality sector.

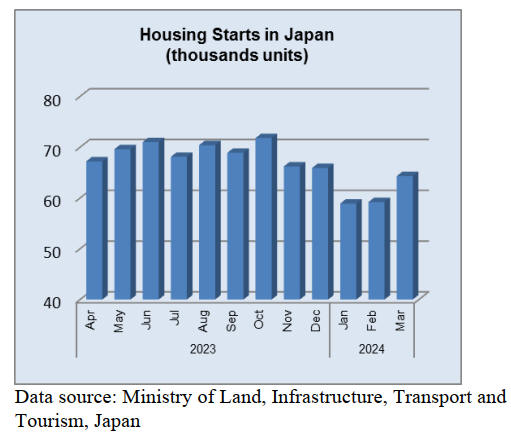

March housing starts were up sharply compared to February but

down 13% year on year.

See: See:

https://nrm.nikkei.co.jp/articles/-/21574

and

https://asia.nikkei.com/Business/Travel-Leisure/Japan-foreign-tourists-top-3m-in-March-fueling-record-spending-boom

Tax implemented for forest maintenance

In order to secure funds for forest maintenance for local

governments Japan has implemented its plan for a tax of

1,000 yen per person per year in fiscal 2024. The new tax

will be added to the residential tax from June.

From the forecast revenue from the new tax of billion yen

per year part will be paid to local governments to support

their activities to manage forests, increase forestry workers

and replace cedar trees which cause pollen allergies in

many people. The government will take account of the

size of forest areas rather than the population when

distributing tax revenues for forest management.

See:

https://www.arabnews.jp/en/business/article_118706/

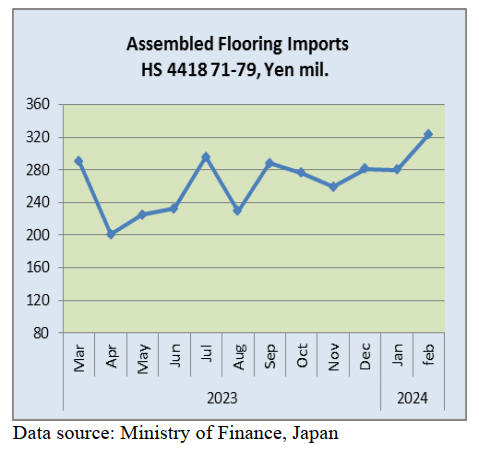

Import update

Assembled wooden flooring imports

In February the main category of assembled flooring

imports was (HS441875), accounting for over 70% of the

total value of assembled flooring imports. The second

largest category in terms of value was HS441873

exceeding that of HS 441879.

The value of imports of assembled wooden flooring

(HS441871-79) in February 2024 were sharply up from

the same month in 2023, a 50% increase and compared to

the value of January imports there was a 13% increase in

the value of February imports.

The yen exchange rate against the US dollar has driven up

the cost of flooring imports but the steady rise in imports

cannot be explained as only due to the weak yen as the yen

exchange rate has been in the range of 140-150 yen per

dollar for most of 2023 rising to about yen 150 in the early

part of 2024.

The main shippers of assembled flooring in February were

China 56%, down slightly from a month earlier, Vietnam

13%, Malaysia 8%, Thailand 8% and Indonesia 6%. In

January there was a significant shipment of flooring from

the US, however, none was reported for February.

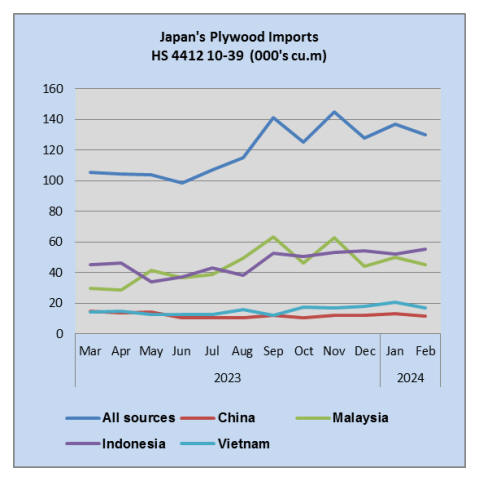

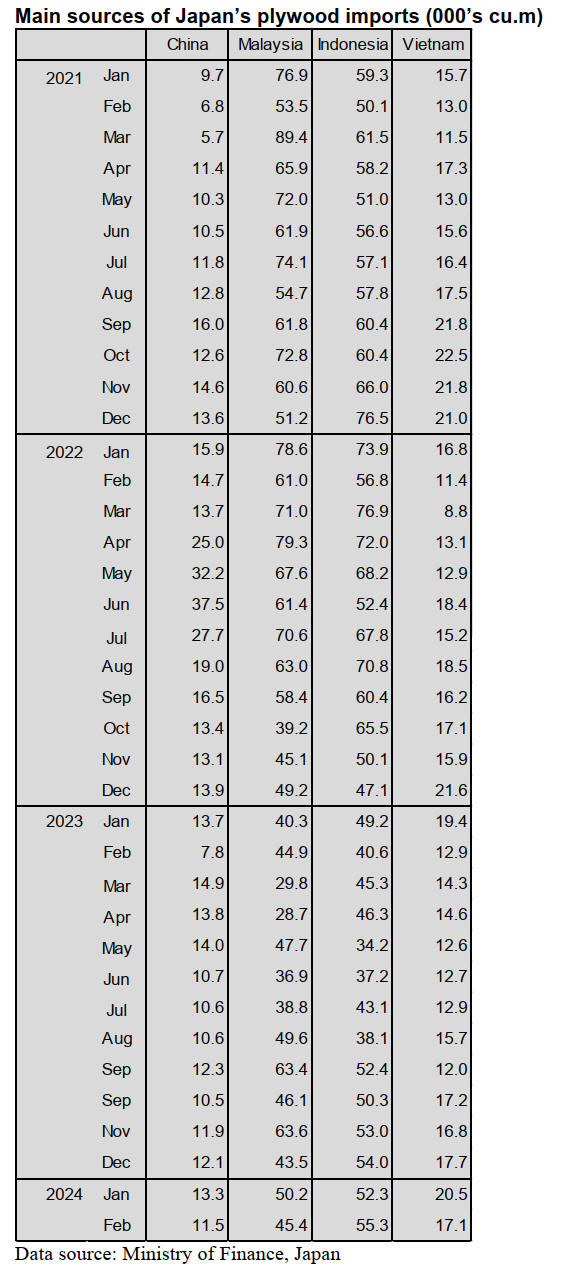

Plywood imports

Of the four main suppliers of plywood (HS441210-39) to

Japan; Indonesia, Malaysia, Vietnam and China all except

for Indonesia saw February shipments drop below those of

the previous month. However, the total volume of

February plywood imports was around 20% higher year on

year. The volume of plywood imports in February from all

of the four main shippers was higher than in February

2023.

Of the various categories of plywood imported, 87% was

HS441231 in February with HS441233 and HS441234

accounting for 6.5% and 4.5% respectively. The four main

shippers of plywood to Japan, Indonesia, Malaysia,

Vietnam and China consistently account for over 90% of

plywood imports. Other shippers of small quantities

include Finland, Chile and New Zealand.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Influence of strike in Finland

The strike at the coast of a bay in Finland started on 11th

March, 2024 and it keeps going on strike in April. The

strike has been influencing the wood industry widely.

A lot of strikes by labour unions occur in Finland and the

strikes occur almost every year in recent years. However,

this strike is different from usual strikes. This is the protest

activity against the Government of Finland, which

announced the labor market reforms and social security

cuts, and it is not about the raise in workers’ wages to the

companies.

Therefore, it would take a long time to end the protest

activity. The strike supposed to end on 25th March, 2024

but Habor loading and unloading department of Transport

Workers’ Union in Finland decided to extend the strike in

April.

Some lumber plants and laminated lumber plants in

Finland keep producing lumber because they are able to

send lumber to some areas.

However, it is for sure that the shipment schedule is

confused at the plants. If the strike took a long time, the

plants have to control production.

Due to this strike, Metsa Group in Finland has already

announced to stop operations at its five plants such as

lumber plants, pulp plants, and paperboards plants in

Finland. It is difficult for the company to procure raw

materials and ship lumber.

There is a possibility that the arrival of European lumber

in June or July, 2024 would be very low due to the strike.

Also, there is another reason that the vessels avoid passing

through the Red Sea due to the conflict near to the Red

Sea.

Due to the strike, the arrival volume of laminated

structural lumber in April, 2024 is a level of 30,000 cbms

for the first time in thirteen years.

In Japan, a sense of caution for a tight supply of European

lumber is not strong so far because demand for European

lumber is low in Japan. However, some Japanese buyers

are concerned about the tight supply of European lumber

in the future so they would increase their inventories.

Demand and supply of lumber at Tokyo port

According to Tokyo Lumber Terminal Co., Ltd., the

inventories of lumber in March increase for the first time

in seven months.

The ratio of inventories is 2.4 months. Total inventories of

North American lumber and European lumber are 7,800

cbms increased. Russian lumber has been increasing.

Shipment of lumber rises slightly from the previous month

but receipt of lumber is 2,400 cbms up so the volume of

inventories increased.

The receipt of European lumber is 16,000 cbms in March

and this is 3,700 cbms more than last month. The receipt

of North American lumber is 15,000 cbms and this is

4,000 cbms higher than the previous month. Russian

lumber in March is 8,500 cbms and this is 1,400 cbms less

than the previous month.

The stock percentage of North American lumber is 3.0

months and it is 0.2 month higher than the previous

month. The stock percentage of European lumber is 2.1

months and it is 0.1 month increased from last month. The

stock percentage of Russian lumber is 1.8 month and it is

0.2 month less than last month.

Family Board to raise the price of particleboard

Family Board in Tokyo Prefecture raises the price of

particleboards of Seihoku Corporation in Tokyo Prefecture

and Shinakimoku Kogyo Co., Ltd. in Tokyo Prefecture by

8 % up as of June. The reasons are the increased

transportation cost and the increased purchasing cost for

chips.

The transportation cost for delivering the particleboards

from Family Board’s plants soared last autumn because

the petrol cost skyrocketed but the company did not raise

the price of particleboards. Then, the new law for

distribution business started in April, 2024 and the new

law influenced the company’s transportation cost to rise.

The transportation cost is 20 – 30 % higher than last

summer.

Also, the price of raw materials such as wooden chips has

increased. The purchasing cost of wooden chips is 20 – 25

% higher than before.

There is a possibility that the company would raise the

price of particleboards again in the future. This is because

the price of glue increased. Some chemical companies,

which produce glue for lumber, have already announced

about price hike of glue to Family Board.

South Sea logs and lumber

It was a 147 – 148 yen appreciation against the dollar at

the half of Mach, 2024 and some Japanese distributors

purchased South Sea and Chinese lumber. Japanese

distributors do not have a lot of jobs and have less

inventories of South Sea and Chinese lumber. Last year,

the yen had been 150 yen against the dollar and

distributors did not purchase a lot of lumber. Laminated

board plants in China and Indonesia lowered the price

because the sales were not good after the Chinese New

Year holiday.

However, laminated boards plants in China and Indonesia

did not lower the price widely. Since the unseasonable

weather in Papua New Guinea, South Sea logs have

arrived to Japan three or four months behind the schedule.

Manufacturers, which produce blocks for steel companies

or shipbuilding companies, did not have enough South Sea

logs temporally. However, demand and supply for South

Sea logs are balanced now.

Log price remains high in Miyazaki Prefecture

The new starts are decreasing in Miyazaki Prefecture. The

log price keeps high because there are not enough logs but

the price of lumber starts to decline.

The price of cedar log is 15,500 yen, delivered per cbm in

Miyakonojo city, Miyazaki Prefecture. This is 500 yen

higher than the previous month. Demand for structures is

low and movement of posts and beams is sluggish.

KD Cedar small timber is 70,000 yen, delivered per cbm.

Price hike of KD cedar lumber

Several lumber manufacturers in Miyakonojo city, Miyagi

Prefecture raised the price of KD cedar structural lumber

and KD cedar small sized lumber by 2,000 yen, per cbm as

of April, 2024. The reason is the new rule for drivers in

distribution business. The transport companies must

reduce extra work, solve a shortage of truck drivers, and

solve overloading.

If it were a long-distance transport, the truck driver must

take a ferry on the way. Therefore, the transport

companies raised the price to their clients. Also, the log

price has been increasing recently so the companies had no

choice to change the price.

Now, the price of KD cedar post is 60,000 yen, delivered

within Kyushu region per cbm. The price of KD cedar

purlin is 55,000 - 56,000 yen. KD cedar beam is 65,000

yen. KD cedar stud is 60,000 yen. KD cedar small size is

63,000 - 64,000 yen.

|