|

Report from

Europe

European wooden furniture consumption fell 11% in

2023

The last four years, marked from the start of 2020 by the

Covid-19 pandemic and from February 2022 by war in

Ukraine, have seen unprecedented changes in Europe’s

wood furniture sector.

During this relatively short period, there have been major

alterations in patterns of supply and demand, trade flows,

consumer preferences and working conditions, distribution

channels, design, and fashion trends. Companies

throughout the sector are having to evolve new strategies

in response to a transformed world.

Europe’s wood furniture sector has passed through a

period characterised by an initial but very short-lived fall

in demand in the second quarter of 2020 during the first

Covid lockdown, followed by very rapid demand

escalation in 2021 with the onset of the home

improvement boom. This occurred at a time when material

shortages and other logistical challenges greatly reduced

availability.

The war in Ukraine and other geopolitical challenges then

drove a rapid escalation in energy prices, adding greatly to

the existing inflationary pressures. Rising interest rates

and declining consumer spending, after demand had been

satiated by high spending in the previous two years, then

led to a sharp decline in demand starting in the second half

of 2022 and continuing throughout 2023.

These trends are all evident in the changing value of

production, trade, and consumption of wood furniture in

the EU27+UK in recent years (Chart 1).

After the sharp upturn in the European market for wood

furniture in 2021, when large investments were made in

home improvement during the COVID pandemic,

production and consumption fell back respectively by 11%

and 12% in 2022.

Production and consumption then fell by another 8% and

11% respectively in 2023. In 2023, wood furniture

production in the EU27+UK was valued at €39.7 billion

while consumption was €39.4 billion. Other than in 2020,

when the market fell sharply at the height of the COVID

pandemic, such low levels had not been since 2014 when

Europe was emerging from the 2010-2012 Sovereign Debt

crises.

These figures underline the extent of the downturn in the

European economy. In 2023, Europe faced increased

uncertainty, sluggish economic performance, and a

marked slowdown in the construction industry.

As a result, European consumer demand for furniture was

under strain, particularly in the lower and mid-price

segments. Demand was hit by the higher cost of living

caused by inflation, particularly for energy, and rising

interest rates. Renewed interest in other discretionary

spending categories, such as travel, added to the

challenges in the furniture market last year.

The costs of producing furniture in the EU also continued

to rise in 2023. High energy prices, costs of capital and

rising labour costs could not be passed onto customers,

greatly reducing profitability. Extra-EU export prospects,

particularly in the US and China, were also cooling and

were not buoyant enough to support EU production.

Various bankruptcies, layoffs and downsizing plans were

reported in the industry last year. European furniture

manufacturers were forced to revise their list prices

upwards during the year.

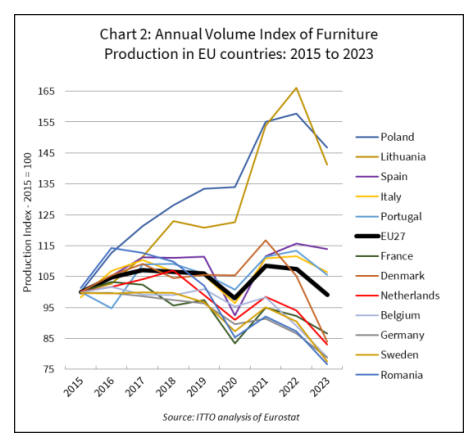

Furniture sector performance has varied widely between

European countries in recent times. Eurostat data shows

that while overall EU27 furniture production in 2023 was

close to the level prevailing in 2015, some countries

including Romania, Belgium, Sweden, Germany,

Netherlands, Denmark, and France, had fallen well below

that level.

Most of these countries recorded only a modest rebound in

furniture production in 2021 followed by a dramatic

downturn from the second half of 2022 onwards.

In contrast, furniture production in Poland and Lithuania

continued strong even during the first year of the

pandemic in 2020 and increased very rapidly during 2021

and 2022. Although there was a sharp downturn in 2023,

production in Poland and Lithuania remained well above

the pre-pandemic level. Furniture production in Spain,

Italy, and Portugal was less volatile than in other European

countries during the 2019 to 2023 period and remained

well above the pre-pandemic level despite sliding last year

(Chart 2).

The European furniture industry is highly integrated from

both a market and an industrial perspective with most

furniture components (such as wood and wood-based

panels) being sourced from European countries. Almost

80% of furniture consumption is met by European

production. However, imports from Asian countries,

particularly China, were increasing rapidly in the years to

2021.

The long-term trend in the quantity of European wood

furniture trade as revealed by Eurostat data is shown in

Chart 3. The rise in European internal trade and in imports

from outside the region which began in 2013 as the

European economy gradually recovered from the

Sovereign Debt crisis, continued throughout the pandemic

in 2020 and accelerated in 2021.

European exports of wood furniture to countries outside

the region, which were flat in the period between 2013 and

2020, also increased in 2021. However, all these trends

reversed starting in the second half of 2022. European

imports, exports and internal trade in wood furniture

declined by 18%, 9% and 4% respectively in 2022. In

2023, imports fell a further 5%, exports were down 17%,

and internal EU trade declined 12%.

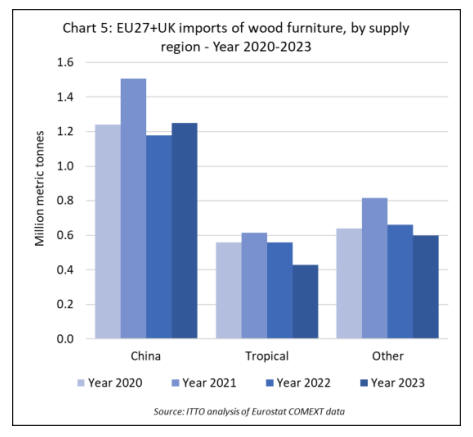

The total quantity of EU27+UK imports of wood furniture

from outside the region fell 5% to 2.28 million tonnes in

2023. This followed an 18% fall the previous year (Chart

4). The decline in imports in 2023 was less dramatic than

forecast by ITTO in October (see ITTO-MIS Volume 27

Number 19, 1-15 October 2023), primarily due to a revival

in imports from China after the COVID lockdowns in that

country ended and as freight rates fell quickly last year.

This meant that Chinese goods could again be shipped into

the European market at competitive prices, just at a time

when prices for goods manufactured in Europe were

rising.

In 2023, wood furniture imports into the EU27+UK from

China increased by 6% to 1.25 million tonnes, still well

down on the peak level of 1.51 million tonnes in 2021, but

above the pre-pandemic level.

European wood furniture imports from non-tropical

countries other than China fell 9% last year to 600,000

tonnes, following a 19% decline the previous year.

Imports from Turkey, Ukraine, and Serbia all recovered

some ground last year but not enough to offset the decline

in imports from Belarus - now subject to European

sanctions – and falling imports from Bosnia, Switzerland,

and USA.

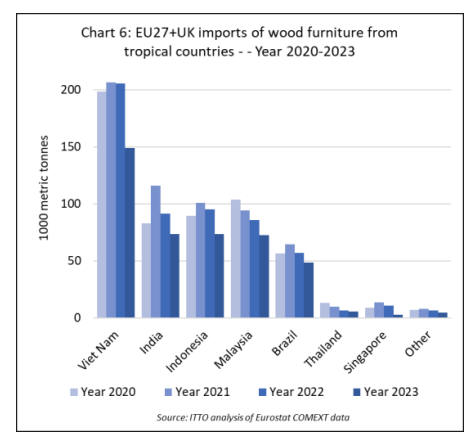

EU27+UK imports of wood furniture from tropical

countries fell 23% last year to 430,000 tonnes, following a

9% decline in 2022 from the peak levels of 2021.

European wood furniture imports from tropical countries

were hit by a big decline in demand for outdoor furniture

last year, a sector where tropical furniture still dominates.

The reemergence of China as a major force in European

wood furniture supply in 2023 also contributed to the

sharp decline in tropical countries share of European

imports (Chart 5).

Imports from all tropical countries supplying wood

furniture to the EU27+UK declined very sharply last year

including Vietnam (-28% to 148,900 tonnes), India (-20%

to 73,400 tonnes), Indonesia (-23% to 73,400 tonnes),

Malaysia (-15% to 72,800 tonnes), Brazil (-15% to 48,300

tonnes), Thailand (-19% to 5,400 tonnes) and Singapore (-

74% to 2,900 tonnes) (Chart 6).

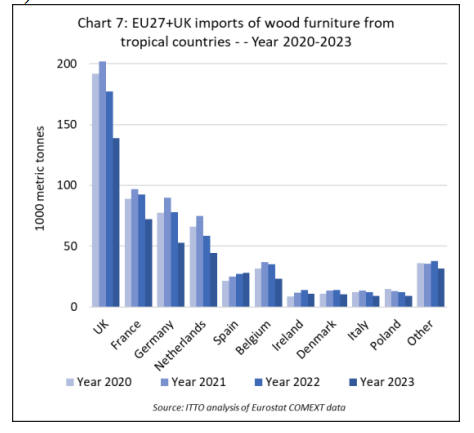

There was a big fall in tropical wood furniture imports into

the UK, the largest European market, in 2023, down 22%

to 138,700 tonnes. Large declines were also recorded by

France (-22% to 72,000 tonnes), Germany (-33% to

52,600 tonnes), Netherlands (-24% to 44,300 tonnes),

Belgium (-34% to 23,200 tonnes), Ireland (-23% to 10,700

tonnes), Denmark (-26% to 10,500 tonnes), Italy (-26% to

9,100 tonnes), and Poland (-27% to 8,900 tonnes).

Of all large European markets, only in Spain did imports

hold up well in 2023, rising 3% to 28,100 tonnes (Chart

7).

CSIL forecast gradual recovery in European furniture

market demand

According to CSIL, the Italy-based furniture industry

research organisation in their latest quarterly issue of

World Furniture Online (www.worldfurnitureonline.com),

this year prospects are slowly improving for the European

wood furniture sector. The major challenges that have

recently weighed heavily on the European furniture

industry, such as price increases and supply chain

disruptions, appear to be easing. Furniture demand is

expected to gradually improve in the second quarter of

2024 and to recover in 2025.

Based on interviews with European furniture companies,

CSIL also identify key recent changes in the structure and

strategies of the sector. Most furniture manufacturers

surveyed by CSIL in 2023 said they were increasingly

shortening supply chains by becoming more local (at

country or regional level). Within Europe, Portugal, Italy,

and Spain were identified as the main beneficiaries of this

perspective.

The relocation is driven by various reasons, including

shortening time to market. However, business

sustainability, liquidity and security of supply have

emerged as key issues that are intensified by international

events.

The implementation of the EU Deforestation Regulation

(EUDR), due from 31st December this year, which

imposes strict wood traceability requirements, is another

factor that might intensify the trend towards shortening

supply chains in the future.

CSIL’s analysis of the structure of the European furniture

industry highlights that the sector is still predominantly

made up of small and medium-sized enterprises (SMEs).

The sector employs a significant number of people, with

more than 1 million workers in over 135,000

manufacturing companies. While the industry remains

SME-based, both manufacturing and retailing are

becoming increasingly concentrated.

According to CSIL, the top 100 European companies

generate more than 30% of the total value of furniture

produced in Europe, an increasing share compared to 10

years ago. On the distribution side, the top 15 EU furniture

retailers also account for almost 30% of the market.

CSIL comment that over the past few years, from 2019 to

2023, there have been many strategic mergers and

acquisitions (M&A) in the European furniture

manufacturing sector. According to CSIL “this has

highlighted the dynamic and evolving nature of the

industry, with companies strategically positioning

themselves to strengthen their market position and

leverage synergies.

Furthermore, the M&A landscape within the European

furniture industry shows a predominant focus on local

transactions with the vast majority of total deals being

acquired by companies within the region”.

EU and Côte d’Ivoire sign FLEGT VPA agreement

On 19 February 2024, the European Commission and Côte

d’Ivoire signed their Forest Law Enforcement,

Governance and Trade (FLEGT) Voluntary Partnership

Agreement (VPA), a major step on the way to sustainable,

legal forestry.

According to FERN, an EU based NGO, the VPA “marks

more than 10 years of multistakeholder negotiation and

technical preparation to promote the trade of legal timber

between Côte d’Ivoire and the EU, a long and arduous

process that has been saluted as a model of

multistakeholder participation”.

FERN note that “civil society organisations, private sector

representatives and traditional chiefs have consistently

been included in VPA discussions, a practice that has

proved a great advantage in the implementation of many

forestry reforms over past years”.

As for existing EU VPAs with other tropical timber

producing countries, the VPA with Côte d’Ivoire is a

legally binding trade agreement designed to ensure that all

timber and timber products destined for the EU market

from Côte d’Ivoire comply with Ivorian laws and also that

the forestry sector contributes to the social, environmental

and economic development of the country.

FERN comments in relation to the VPA with Côte d’Ivoire

that “more challenges remain, naturally, as the

transformation that FLEGT VPAs drive is vast, going

beyond trade to include transparency, land rights reform

and civil society participation, among other things”. With

signing of the VPA, efforts around practical

implementation will now intensify in the country.

FERN also note that many questions arise concerning the

VPAs’ interface with the fast-approaching entry into force

of the EUDR with FERN noting that “the incoming,

stricter EUDR has led many to doubt the relevance of the

FLEGT VPA”.

Countering this perception, FERN quote Bakary Traoré,

Director of the Ivorian NGO Initiative pour le

développement communautaire et la conservation de la

forêt (IDEF) and long-time participant in the VPA

process:

“No, the EUDR does not render FLEGT totally obsolete.

Admittedly, it is diminished because it is mentioned only

as an element that ‘complements’ the EUDR in ‘specific

cases’.

In practice, however, I remain convinced that, for the

moment, no technical tools on a par with FLEGT are

available to the competent European authorities to prove

the legality of timber in the context of due diligence. And

it is a relevant tool that would do the trick. Provided we

maintain the negotiation phase’s momentum.”

|