|

Report from

Europe

UK tropical wood and wood furniture imports at all

time low in 2023

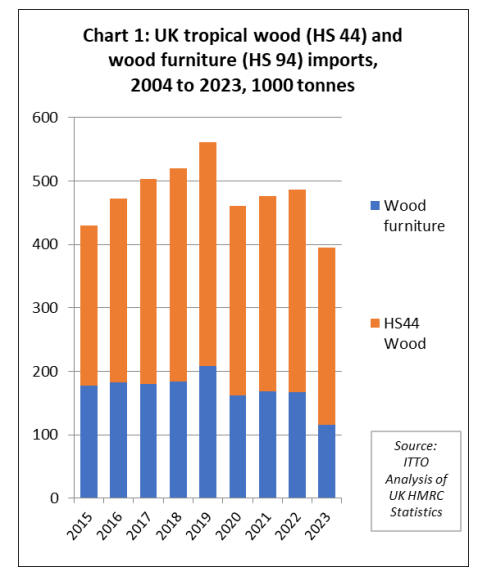

In 2023, the UK imported 395,500 tonnes of tropical wood

and wood furniture products with a total value of $940

million, respectively 13% and 33% less than the previous

year.

In tonnage terms this was the lowest on record, 8% less

than the previous low of 430,000 tonnes in 2015 (Chart 1

above). This is around half the level of tropical wood

imports into the UK typical two decades ago before the

2007-2008 recession.

UK imports of tropical wood and wood furniture in the

fourth quarter of 2023 were 87,834 tonnes, lower even

than the 89,111 tonnes imported in the second quarter of

2020 when the country was at a standstill during the first

COVID lockdown. The fourth quarter figures were 16%

down on the previous quarter, and 2% less than same

period the previous year.

Underlying the historically low levels of import is the

weakness of the UK economy. According to the Office of

National Statistics, the UK economy was in recession in

the second half of 2023, shrinking by 0.1% in the third

quarter and by 0.3% in the fourth quarter.

Due to stronger growth in the first two quarters of 2023,

GDP in the UK is estimated to have increased by just

0.1% over the full year. The Bank of England predicts the

UK economy will grow by just 0.25% in 2024.

The UK Construction Products Association Winter

Forecast predicts growth in the UK building sector in

2024, but by only 0.6%. This follows a contraction of

4.7% in 2023. “Both private housing and private housing

repair, maintenance and improvement are forecast to be

the worst affected by the prevailing economic conditions

of flatlining growth, stubborn inflation and interest rates

remaining [relatively high] throughout 2024,” said the

CPA.

UK import value of tropical wood furniture down 43%

year-on-year

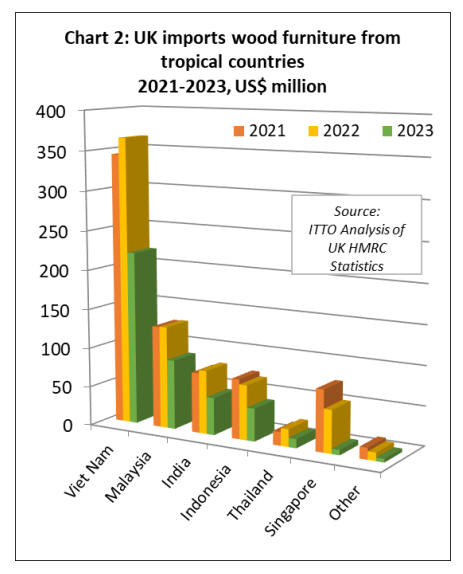

Of all wood products imported into the UK from the

tropics, furniture declined the most last year. The UK

imported USD420 million of tropical wood furniture

products in 2023, 43% less than the previous year. In

quantity terms, wood furniture imports were 115,700

tonnes in 2023, 24% less than in 2022.

Tropical wood furniture imports in 2023 decreased for all

leading supply countries to the UK including Vietnam (-

40% to USD220 million), Malaysia (-32% to USD88

million), India (-41% to USD47 million), Indonesia (-40%

to USD42 million), Thailand (-48% to USD12 million),

and Singapore (-88% to USD6.6 million) (Chart 2).

UK joinery imports decline from all leading tropical

supply countries

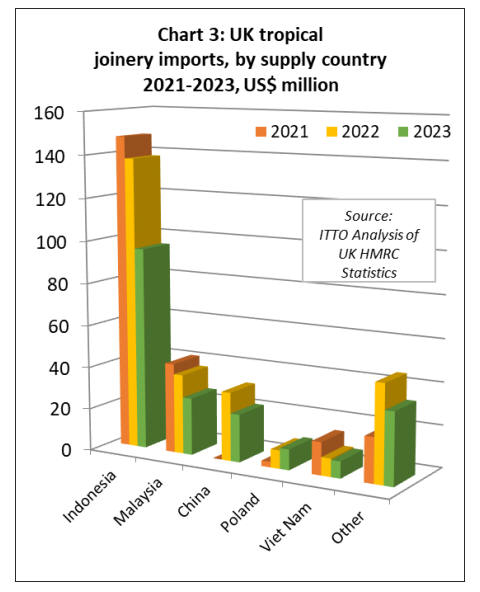

Total UK import value of tropical joinery products fell

27% to USD196 million in 2023 and import quantity was

down 14% to 69,800 tonnes. UK import value of joinery

products from Indonesia (mainly doors) was USD96

million in 2023, down 30% year-on-year.

Imports from Malaysia (mainly laminated products for

kitchen and window applications) fell 28% to USD27

million in 2023. UK import value of Chinese tropical

joinery products, nearly all doors, was USD22 million in

2023, 30% less than the previous year. UK import value

on joinery products from Vietnam declined 7% to USD8

million during the year (Chart 3).

UK direct imports of tropical hardwood plywood offset

by rise from China

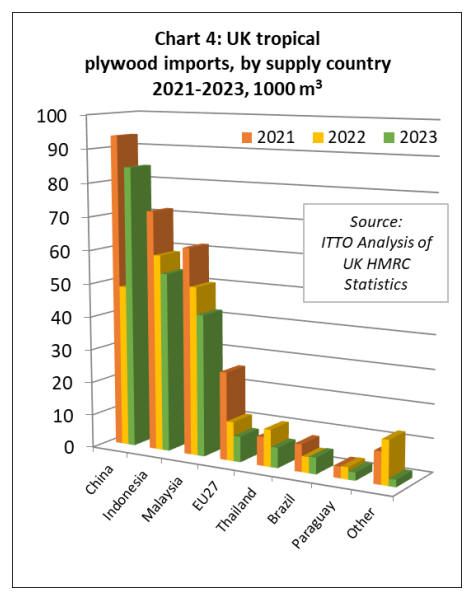

In 2023, the UK imported 203,600 cu.m of tropical

hardwood plywood, 1% less than the previous year.

Import value fell more sharply, by 29% to USD188

million. A large decline in direct imports of higher-value

tropical hardwood plywood from tropical countries was

offset by a rise in imports of lower-value plywood with an

outer layer of tropical hardwood from China (Chart 4).

The UK imported 84,400 cu.m of plywood with an outer

layer of tropical hardwood from China in 2023, 74% more

than the previous year. This followed a sharp fall in UK

imports of Chinese products faced with tropical hardwood

in 2022 in favour of products faced with temperate

hardwoods.

The rebound in UK imports of tropical wood plywood

from China in 2023 may partly reflect UK buyers concern

to avoid importing Chinese plywood containing Russian

birch in contravention of UK sanctions on Russian wood

products imposed following the invasion of Ukraine in

February 2023.

UK imports of tropical hardwood plywood direct from

tropical countries fell 22% to 111,600 cu.m in 2023.

Imports were down 9% to 53,600 cu.m from Indonesia,

down 16% to 42,400 cu.m from Malaysia, down 45% to

6,100 cu.m from Thailand, down 4% to 4,900 cu.m from

Brazil and down 32% to 2,400 cu.m from Paraguay.

Meanwhile, the combined effects of supply shortages and

rising energy and other material costs on the European

continent continue to impact on UK imports of tropical

hardwood plywood from EU countries which were just

7,600 cu.m in 2023, 35% less than the previous year.

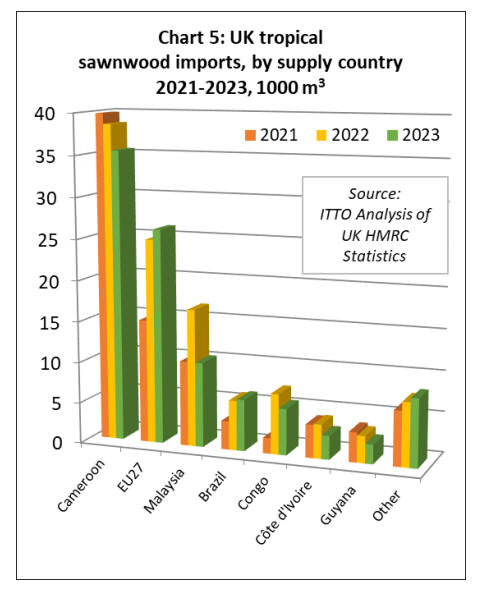

UK switches to indirect imports of tropical sawnwood

from the EU

UK imports of tropical sawnwood were 97,500 cu.m in

2023, 11% less than the previous year. Import value fell

10% to USD112 million during the year. Although UK

imports of tropical sawnwood held up reasonably well

compared to other tropical products in 2023, a larger share

was sourced indirectly, in this case from the EU, rather

than direct from the tropics (Chart 5).

Indirect UK imports of tropical sawnwood via the EU

were up last year despite the economic slowdown and

Brexit disruption, increasing 5% to 26,200 cu.m. To some

extent, UK’s continuing dependence on indirect imports of

tropical sawnwood from the EU is due to a shortage of

kiln drying space in African supply countries combined

with lack of any hardwood kiln drying capacity in the UK.

A large share (36% in 2023) of sawnwood sourced directly

from the tropics by UK importers now comes from

Cameroon. UK imports of tropical sawnwood from

Cameroon were 35,500 cu.m in 2023, 8% less than the

relatively high level in 2022. UK tropical sawnwood

imports from Malaysia, which revived to some extent in

2022 after many years of decline, fell by 38% in 2023 to

just 10,400 cu.m.

UK imports of tropical sawnwood from Brazil were 6,200

cu.m in 2023, a gain of 3% compared to the previous year.

Imports from all other leading tropical supply countries

declined including Republic of Congo (-23% to 5,600

cu.m), Cote d’Ivoire (-30% to 2,900 cu.m) and Guyana (-

28% to 2,350 cu.m).

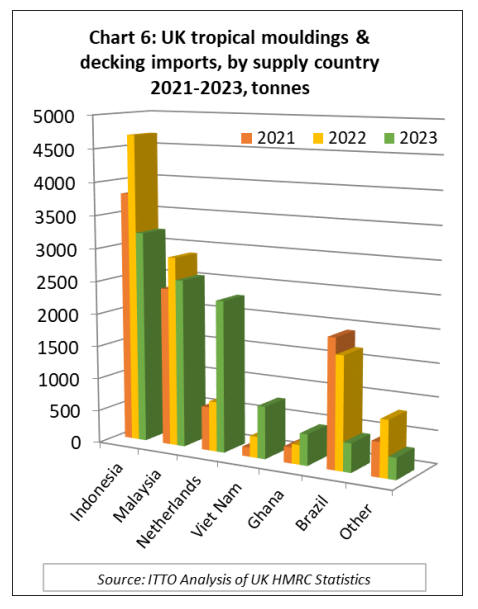

UK imports of tropical hardwood mouldings/decking fell

12% to 10,100 tonnes in 2023. Import value was down

20% to USD28 million. UK imports of mouldings/decking

declined sharply last year from Indonesia (-31% to 3,200

tonnes), Malaysia (-12% to 2,550 tonnes), and Brazil (-

74% to 440 tonnes).

In contrast, UK imports of this commodity group

increased three-fold from the Netherlands to 2,300 tonnes,

were up 147% from Vietnam to 790 tonnes, and increased

61% to 470 tonnes from Ghana (Chart 6).

Mounting calls for delay to EU Deforestation

Regulation

In recent weeks a growing number of trade associations

and some politicians, many representing interests inside

the EU, have been raising concerns around the timetable

for implementation of the EU Deforestation Regulation.

The first real indication that the timetable may be slipping

came on 7 March 2024 when the Financial Times (FT)

published an article under the heading “EU delays stricter

rules on imports from deforested areas”

See:

https://www.ft.com/content/8dab4dc6-197b-4a2f-86f0-d5e83ce00b09

The story in this article is not as dramatic as implied by

the headline. It does not suggest any delay to the legal

requirements due to be imposed on EU operators from 31

December 2024 – prohibiting their trade in regulated

products from deforested areas. Only that “Brussels will

put off classification of countries into low, standard or

high risk, which was due to be implemented by December

[2024], instead designating every country as standard

risk”.

Drawing on information from “three EU officials”, the FT

claims that the “the EU intends to delay strict policing of

imports from areas prone to deforestation after several

governments in Asia, Africa and Latin America

complained that the rules would be burdensome, unfair

and scare off investors”.

The FT goes on to quote one “EC official” directly: “We

will simply not classify which means everywhere will be

medium risk — we need more time to get the system in

place. We have had a lot of complaints from partners. [The

delay] means no country will have an advantage over

another.”

While the FT article does not itself imply that other

aspects of the law’s implementation will be delayed, it

prompted an immediate response from EU trade and

industry associations who suggested that any delay to the

risk classification of countries required that the obligations

to be placed on EU operators must also be delayed.

The case for this wider delay in EUDR implementation

was made in a joint declaration issued on 12 March by six

European organisations, namely: the European

Confederation of Woodworking Industries (CEI-Bois), the

European Furniture Industries Confederation (EFIC), the

European Organisation of the Sawmill Industry (EOS), the

European Panel Federation (EPF), the European Timber

Trade Federation (ETTF), and the European Federation of

the Parquet industry (FEP).

The industry statement, which is available at

https://www.efic.eu/joint-statement-on-eudr, suggests that

“the benchmarking of countries is a central part of the

EUDR and its implementation, and any delays related to

this classification will only result in additional costs and

administrative burden for market actors, without any real

advantages either for the producing countries or for the

CAs [EU Member State Competent Authorities]”.

The statement goes on to suggest that under EUDR

“whether market actors source their commodities from

standard risk countries or from high-risk countries, they

are facing the same due diligence obligations. Simply put,

the benefit implied by the seemingly planned delay of the

country risk benchmarking does not exist because no

simplified procedure for export or imports is actually

foreseen for standard risk countries, compared to high risk

countries”.

The six European organisations signing the statement

expressed their regret that “the EUDR has become a huge

administrative and regulatory monster” and urged “the EU

institutions to delay the entry into application of the

EUDR for the operators and traders to amend the EUDR

in order to eliminate unnecessary bureaucratic hurdles and

to provide actors with sufficient time to adapt for full and

adequate compliance”. They also called on the European

Commission to “swiftly proceed with the classification of

the low-risk countries, with this action being its main

priority”.

Concerns about the implementation timetable for EUDR

were also raised by 19 wood trade organisations in France

in a joint letter to the French Environment Minister on 13

March. This states that, “all the trade organisations that

have signed this letter support the introduction of a legal

instrument to guarantee that wood and wood-derived

products have no impact on deforestation. However, the

principle of ‘strict traceability’ and the processes

envisaged by the EUDR are fraught with implementation

difficulties and still raise questions of interpretation”.

The letter goes on to make specific reference to the results

of the pilot test of the “information system” where due

diligence statements, including geolocation data of all

plots of land from which regulated products are harvested

must be entered for every consignment imported into, or

exported from, the EU market. The pilot test was

undertaken between December 2023 and January 2024.

The letter notes that “among the 112 European companies

taking part in this test were several French companies in

the forestry, wood and paper industry”.

After summarising six specific areas of weakness in the

information system based on the experience of the French

companies, the letter concludes that in view of “the

extraordinary complexity of this [legal] text, its legal

weaknesses and its many uncertainties….this European

Regulation is inoperable for both operators and traders”.

The signatories of the joint letter therefore call for a

revision of the EUDR after the European elections and ask

the French Environment Minister to raise the issue at a

meeting they say is scheduled on April 3rd about the

EUDR with the Belgian Presidency.

A sign of the mounting momentum behind the calls for a

delay to the EUDR came in a Reuters news report which

stated that at a closed-door meeting of the European

Agriculture and Fisheries Council on 26 March

“Agriculture ministers from 20 of the EU's 27 member

countries supported a call by Austria to revise the law”.

The report quotes a statement by Austria's agriculture

minister Norbert Totschnig that "We now urge the

Commission for a temporary suspension of the regulation

allowing for a feasible implementation accompanied by a

revision of the regulation". Reuters report that Ministers

from France, Italy, Poland, and Sweden were among the

supporters of this position.

Judging by comments of the German Federal Minister of

Food and Agriculture on the doorstep to the meeting on 26

March 2024, the call for delay is also supported by

Germany. The Minister welcomed the EUDR “as a

milestone […] for protecting the global forests […] and

human rights […]” but also emphasised that “during the

implementation the aim must be clear…the way must be

flexible”.

The Minister went on to note that “Germany is a low-risk

country, our forests are growing – an aspect that should

also be taken into account by other EU Member States”.

He called on the European Commission to “urgently

extend the actual transition phase” suggesting that “if it

does not quickly succeed in doing so, the law cannot be

implemented for Germany as it would result in an

unbearable workload for our economy, but especially for

our [Competent Authority] and SMEs” (the above is an

unofficial transcript of comments made by the Minister in

German (at 7:57 minutes) in the doorstep interview at:

https://newsroom.consilium.europa.eu/permalink/253320)

Legal and political obstacles to EUDR delay

While these calls are being made for a delay to EUDR

implementation, there appear to be very significant legal

and political obstacles to these being acted upon. As a

representative of the European Forest Owners Federation

(CEPF) has suggested (in the latest newsletter of the

German GD Holz wood trade association) “a

postponement is unrealistic, as this would require a new

legislative procedure involving the Parliament,

Commission and Council (the EUDR having already come

into force in mid-2023)”.

In public statements, European Commission officials are

not countenancing any talk of delay or flexible

interpretation of the law. According to the Reuters report

on 26 March, the EU Environment Commissioner

Virginijus Sinkevicius “questioned why countries had

raised concerns about the policy a few months before EU

Parliament elections in June, when they had spent years

negotiating the deforestation law and approved it last

year.” The Commissioner is reported to have told a news

conference that "of course, we will listen to the arguments,

but I honestly don't see any issues.”

Similarly, according to a MercoPress article, on 8 March

EC Environment envoy Emanuele Pitto told Paraguayan

exporters in Asunción that there “would be no turning

back from Rule 1115 [EUDR] banning raw materials and

products associated with deforestation and forest

degradation”.

The EC envoy emphasised to his Paraguayan audience that

“all those involved get acquainted with the regulation and

understand that the requirements are adapted to the needs

of consumers”. He said that “if Paraguay wants to

continue exporting to the countries of the bloc, if it is

interested, it will do so by adapting to the [EUDR]

requirements, but not of the European Union, but of the

consumers”.

This implied, said the envoy, that exporters wanting to

supply the EU must “demonstrate the origin of their

products and that they are free of deforested land, for

which the country needs a traceability tool or system that

can geolocate whether or not the product comes from

deforested land”. Furthermore in “case of non-compliance,

sanctions and confiscations would ensue”

See:

https://en.mercopress.com/2024/03/08/no-backtracking-on-rule-1115-eu-envoy-tells-paraguayan-producers).

The Financial Times returned to the subject of EUDR in

an opinion piece headed “The global downside of

European consumers’ green principles” published on 21

March. This comments that “Europe might be struggling

for long-term economic growth, but its regulatory

productivity is unsurpassed”

See:https://www.ft.com/content/9ace290e-e51d-4a5e-b853-decfc55ffeb2

The central observation of the FT article is that the EU’s

regulatory drive is not at all due to the ‘protectionist’

instincts of domestic producers in the EU. Instead,

“European public and consumer sentiment, or at least

campaigners’ influence, is now one of the most powerful

forces determining swaths of EU trade policy and hence

global regulation”. This observation seems borne out by

the fact that there seem to be at least as many objections to

EUDR implementation now coming from the wood-

working industry inside the EU, as from external suppliers

of the regulated commodities.

Environmental campaigning organisations were also quick

to criticise the calls for a delay to EUDR. In an “open

letter to EU governments” signed by 46 NGOs issued on

28 March the EU is urged to “uphold its commitment to

combat global deforestation and forest degradation both at

home and abroad”. “Any delay in implementation would

hamper its credibility," the NGOs wrote, adding: “We urge

all Member States to be at the forefront of a fast and

effective implementation of EUDR, instead of falling for

industries’ lobbying efforts.”

The NGOs open letter is at:

https://www.fern.org/fileadmin/uploads/fern/Documents/2024/The_EUDR_will_only_work_if_MS_start_implementation_now.pd

f

No expansion of regulations on imports

The UK Government has told members of parliament that

it does not intend to extend its forthcoming ban on the sale

of imported products linked to illegal deforestation to

cover commodities linked to deforestation that is

technically legal in the country of origin.

The possible implications for the tropical timber sector

will be addressed in the next issue of this report.

The UK government statement can be found at:

https://committees.parliament.uk/committee/62/environmental-audit-committee/news/200626/government-rejects-committees-call-to-prohibit-products-from-legal-deforestation/

|