|

Report from

North America

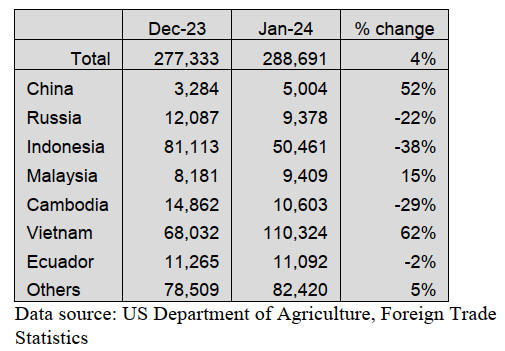

Hardwood plywood imports nearly doubled

US imports of hardwood plywood in January nearly

doubled that of the previous January as the country

imported 288,691 cubic metres. While the total is only a

4% rise from December and is 27% less than the January

2022 haul, the 95% gain over last January is a very

positive sign that imports are continuing to recover from

last year’s slump.

Imports from Vietnam rose 62% in January to their highest

volume since April 2022. Strong gains were made in

imports from China (up 52%) and Malaysia (up 15%)

while imports from Indonesia and Cambodia showed

higher volume than a year ago despite dropping from

December totals.

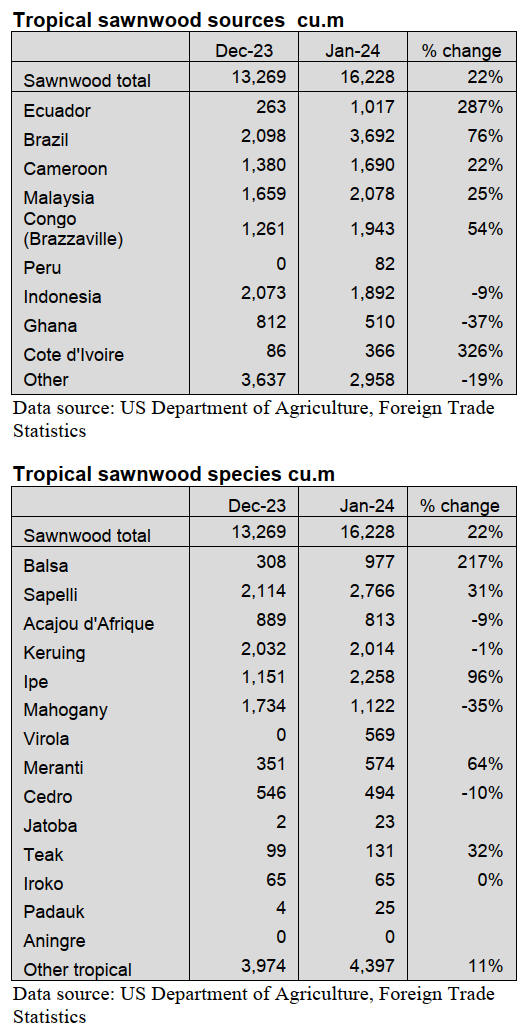

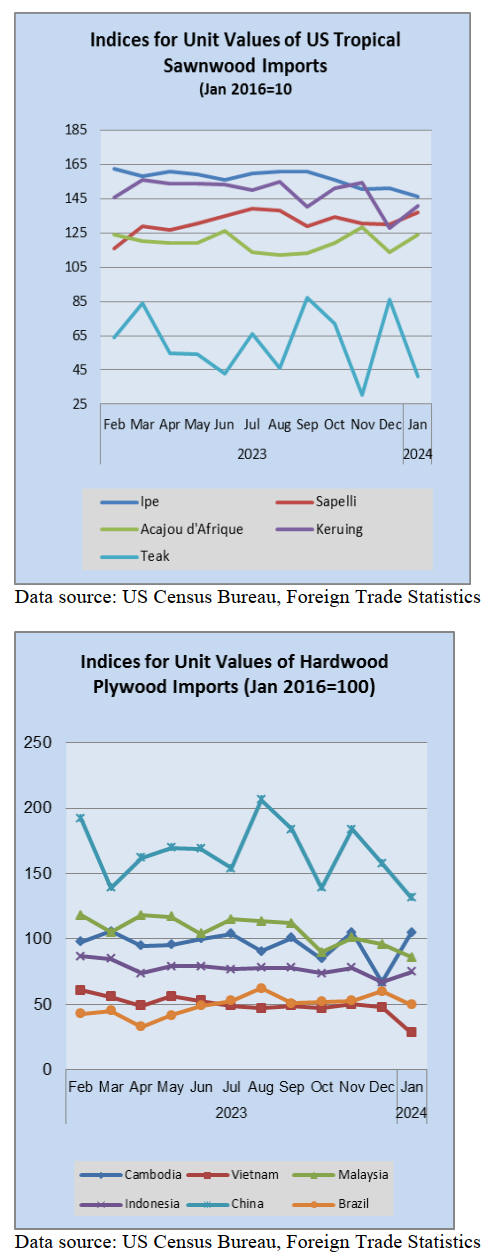

Sawn tropical hardwood imports continue to rebound

US imports of sawn tropical hardwood rose 22% in

January, climbing for the second straight month after

hitting a two-year low in November. Despite the rise the

16,228 cubic metres imported in January was 7% less than

the previous January’s total. Imports from Brazil rose 76%

and imports from Malaysia rose 25%, yet both still fell

short of their January 2023 levels.

Imports of Balsa and Virola started 2024 strong as January

levels of each were more than quadruple that of the

previous January. Imports of paduak, teak, and jatoba in

January were less than half of their January 2023 totals.

Imports of sapelli rose 31% in January but were down 4%

from a year ago.

Canadian imports of sawn tropical hardwood retreated

26% in January after reaching their highest level in nearly

10 years in December. Even with the decline, the January

total of just under US$2 million was 54% higher than

January of 2023. Imports from Cameroon accounted for

more than US$1.1 million, which is the highest level of

any country for one month in at least 10 years.

US veneer imports edge down

US imports of tropical hardwood veneer fell 7% in

January. Despite the drop, at US$2.9 million imports were

3% higher than in January 2023. This occurred despite the

fact that imports from Italy, which continue to be highly

volatile from month to month, fell by 93% from the

previous month and were 94% off last January’s level.

Imports from Cameroon continued to grow in January,

gaining 3% for the month to a level more than four times

that of January 2023. Imports from Cote d’Ivoire were

also strong, gaining 136% over the previous month to

roughly double that of last January. Imports from China

rebounded from an anemic December figure but were still

down 23% from January 2023 levels.

Hardwood flooring imports fell more than 10% in

January

Imports of hardwood flooring by the US fell 11% in

January on sharp declines from the top suppliers. Imports

from Indonesia fell 46% in January while imports from

Brazil dropped by 23%. Compared to January 2023

figures, imports from both countries were down by about

60%.

Imports from Malaysia, which hit a 2-year low in

December, grew 80% in January but were still 43% less

than that of the previous January. Total imports in January

were down 23% from January 2023 figures.

US Imports of assembled flooring panels also fell in

January, declining 14% from the previous month. Imports

from Thailand fell 30% in January while imports from

Vietnam and Brazil each saw a 28% drop.

Despite the decline, imports from all three countries were

well above their January 2023 levels. Imports from

Canada started 2024 strong with January figures up 7%

from the previous month and 41% above their level from a

year ago. Total imports of assembled flooring panels for

January were 29% higher than in January 2023.

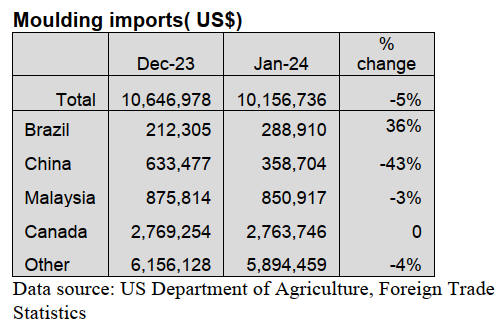

Moulding imports slip

US imports of hardwood mouldings dropped 5% in

January as imports from China declined by nearly half.

Imports from China fell 43% in January to less than half of

what they were in January 2023. Imports from Brazil were

also far behind last January’s levels, trailing 66% from a

year ago despite gaining 36% from the previous month.

Imports from Canada remained level for the month.

Imports of hardwood moulding in January 2024 were

down 7% from the previous January.

US wooden furniture imports held steady in January

US imports of wooden furniture were flat in January,

rising less than 1% from December totals. At US$1.73

billion, imports for the month were 4% below that of

January 2023. However, January 2023 was

uncharacteristically that year’s strongest month for

imports, so any gains in the near future should propel 2024

ahead of last year’s numbers. Imports from China and

Indonesia both rose 10% in January, while imports from

India fell 19% and imports from Vietnam fell 5%.

US cabinet and vanity sales fell in 2023

Sales of kitchen cabinets and bathroom vanities, impacted

by slowdowns in both the new construction and residential

remodeling sectors, declined last year from their 2022

totals the Kitchen Cabinet Manufacturers

Association(KCMA) reported.

The KCMA reported that overall cabinet and vanity sales

for the year were down 2.3% compared to 2022, falling

from a total of US$2.866 billion to US$2.801 billion. The

decline was fueled entirely by a shortfall in sales of stock

cabinets which were down 19.4% from the prior year.

By comparison, sales gains were posted for both custom

(+5.0%) and semi-custom cabinets (0.5%) the KCMA

reported. KCMA also reported that January 2024 sales

continued the downward trend with overall sales down 7%

versus January 2023 as custom sales lagged by more

18.2%.

See:

https://kcma.org/insights/january-trend-business-report-0

Construction firms report mixed outlook for 2024

Construction contractors have a decidedly mixed outlook

for 2024 as firms predict transitions in demand for

projects, the types of challenges they will face and the

technologies (including artificial intelligence) they will

embrace according to survey results by Sage and the

Associated General Contractors of America. Amid these

changes contractors are struggling to cope with significant

labour shortages, the impacts of higher interest rates and

input costs and a supply chain that, while better, is still far

from normal.

“2024 offers a mixed bag for construction contractors; on

one hand, demand for many types of projects should

continue to expand and firms will continue to invest in the

tools they need to be more efficient,” said Stephen E.

Sandherr, the Association’s Chief Executive Officer.

“Meanwhile, they face significant challenges when it

comes to finding workers, coping with rising costs and

weathering the impacts of higher interest rates.”

See:

https://www.agc.org/sites/default/files/users/user21902/2024%20Construction%20Hiring%20and%20Business%20Outlook%20Report_V2.pdf

|