US Dollar Exchange Rates of

25th

Feb

2024

China Yuan 7.19

Report from China

Rise in 2023 sawnwood imports

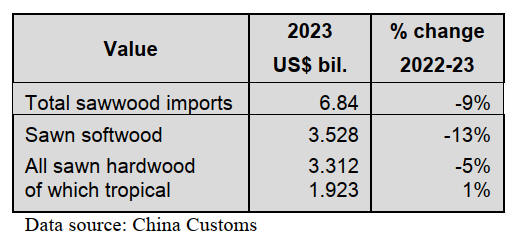

China Customs has reported 2023 sawnwood imports

totalled 27.78 million cubic metres valued at US$6.84

billion, a year on year increase of 5% in volume but a

decrease of 9% in value on 2022. The average price for

imported sawnwood in 2023 was US$246 per cubic metre,

a year on year decline of 13%.

Of total sawnwood imports, sawn softwood imports rose

4% to 17.99 million cubic metres and accounted for 65%

of the national total, almost the same as in 2023. The

average price for imported sawn softwood in 2023 was

US$196 per cubic metre, down 16% year on year.

Sawn hardwood imports totalled 9.79 million cubic metres

valued at US$3.312 billion, a year on year increase 7% in

volume but a decline of 5% in value on 2022. The average

price for imported sawn hardwoods was US$338 per cubic

metre, a year on year decline of 9%.

Of total sawn hardwood imports, tropical sawn hardwood

imports were 6.91 million cubic metres valued at

US$1.923 billion, a year on year increase of 9% in volume

and 1% in value and accounted for about 25% of the

national total, up 1 percentage points on 2022 levels. The

average price for imported tropical sawn hardwood was

US$278 per cubic metre, down 8% year on year.

China’s sawnwood imports in 2023 expanded as there has

been a slight recovery in the consumer markets of building

materials and furniture and there has been a change in

direction in the wood processing industry away from

roundwood to sawnwood.

Drop in sawnwood imports from Russia

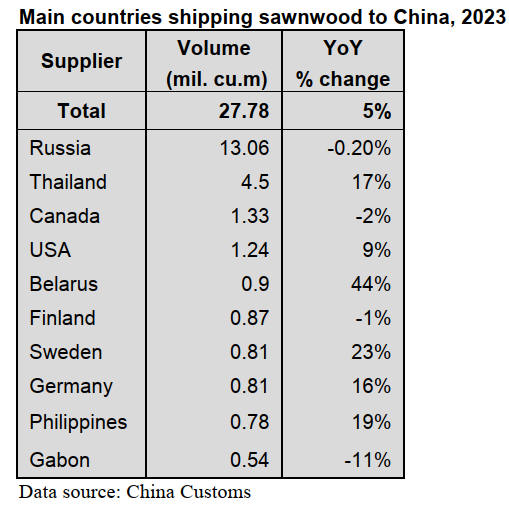

While Russia remained the largest supplier of sawnwood

imports in 2023 the volume imported dropped slightly to

13.06 million cubic metres and accounted for 47% of the

national total. The value of imports was valued at

US$2.647 billion, down 12% on 2022. The average price

for imported sawnwood from Russia in 2023 was US$229

per cubic metre, a year on year decline of 11%.

China’s sawnwood imports from Thailand, now the

second largest supplier, came to 4.5 million cubic metres

valued at US$1.084 billion, up 17% in volume and 10% in

value on 2022. The average price for imported sawnwood

from Thailand in 2023 was US$250 per cubic metre, a

year on year decrease of 3%. The decline in the price of

sawnwood on international market has lifted the rise in

China's import volumes to a certain extent. CIF prices for

all the top suppliers of sawnwood imports fell but at

different rates.

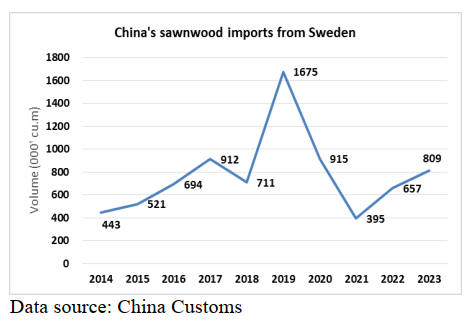

All imports from Sweden are sawn softwood

The Swedish wood industry is facing challenges especially

related to international shipping. It has been estimated that

to avoid Red Sea shipping costs have almost doubled and

the risk of container shortages, delays and disruptions has

risen.

However, even in the face of multiple challenges Sweden's

wood exports to China in 2023 show an upward trend.

China’s sawnwood imports from Sweden rose 23% to

809,456 cubic metres in 2023 and all was sawn softwood.

Chinese importers applaud the quality of the sawnwood

from Sweden.

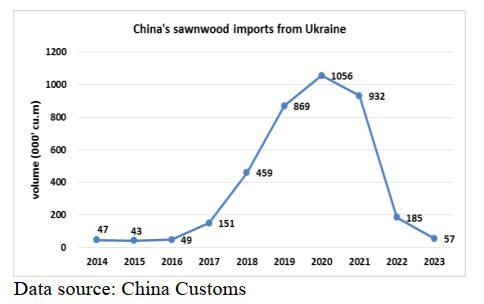

Sawnwood imports from Ukraine continue to decline

China’s sawnwood imports from Ukraine continue to

decline and fell 69% to 57,000 cubic metres in 2023, a

dramatic drop as a result of Russia’s attempted invasion of

Ukraine.

Since 2014 China’s sawnwood imports from Ukraine were

increasing and topped 1 million cubic metres in 2020 but

have been declining since then.

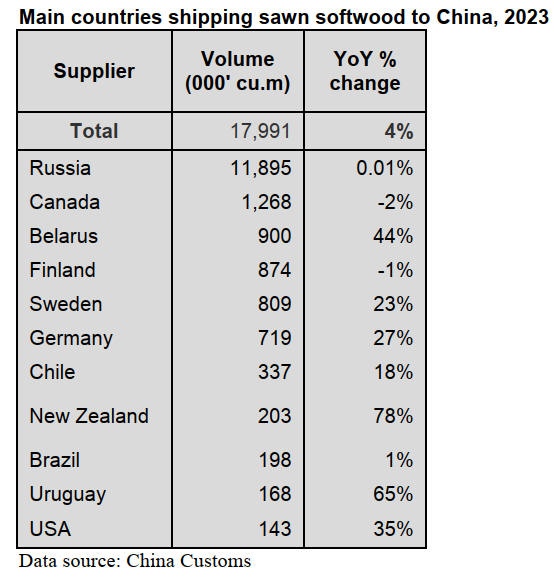

Sawn softwood imports

In 2023 China’s sawn softwood imports rose 4% resulting

driven by increased shipments from most of the top

suppliers. Some of the other shippers posted increased

sawnwood exports to China such as Belarus, New

Zealand, Uruguay and US where imports rose 44%, 78%,

65% and 35% respectively.

In contrast, China’s sawn softwood imports from Canada

and Finland dropped 2% and 1% respectively. The market

share of China’s sawn softwood imports from Canada has

declined significantly since 2014 and amounted to 7% in

2023, around the same level as in 2022.

Surge in sawn hardwood imports from Myanmar and

Vietnam

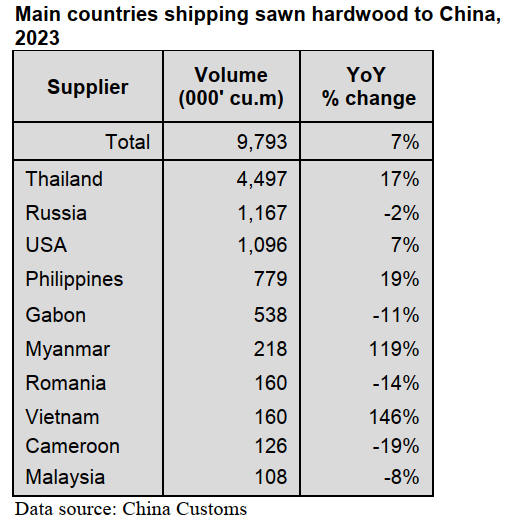

Sawn hardwood imports were 9.793 million cubic metres

valued at US$3.312 billion in 2023, a year on year

increase 7% in volume but decrease 5% in value.

Thailand, Russia and USA still were the main sources for

China’s sawn hardwood log imports in 2023 and

accounted for 46%, 12% and 11% respectively. China’s

sawn hardwood imports from the three countries made up

almost 70% of the national total hardwood imports in

2023.

China’s sawn hardwood imports from Thailand and the

US rose 17% and 7% in 2023 to 4.497 million cubic

metres and 1.096 million cubic metres respectively.

In contrast, China’s sawn hardwood imports from Russia

declined 2% to 1.167 million cubic metres compared to

2022. In 2023 China’s sawn hardwood imports from

Myanmar and Vietnam surged 119% and 146%

respectively.

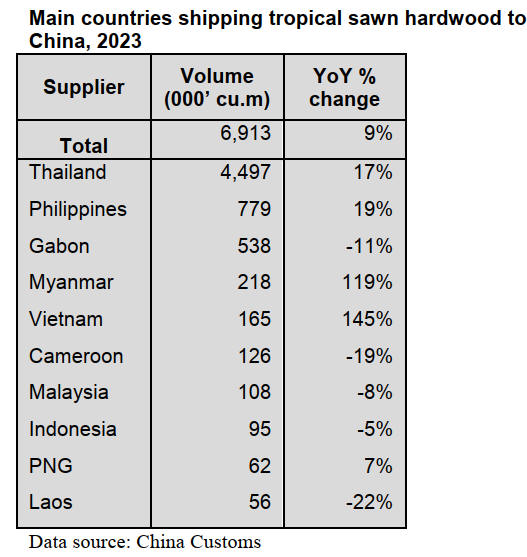

Rise in sawn tropical hardwood imports

China’s sawn tropical hardwood imports in 2023 were

6.913 million cubic metres valued at US$1.923 billion, a

year on year increase of 9% in volume and 0.8% in value

and accounted for about 25% of the national total, up 1

percentage points on 2022.

Thailand was again the largest supplier of China’s sawn

tropical hardwood imports in 2023 sawn tropical

hardwood imports from Thailand totalled 4.497 million

cubic metres valued at US$1.084 billion, a year on year

increase of 17% in volume and 10% in value.

Thailand’s market share for tropical sawn hardwood

exports to China rose to 65% making Thailand the number

one supplier in 2023.

The Philippines and Gabon were the second and third

largest supplier of China’s sawn tropical hardwood

imports in 2023. Sawn tropical hardwood imports from the

Philippines and Gabon amounted to 779,000 cubic metres

and 538,000 cubic metres respectively, a year on year

increase of 19% but decrease 11% respectively.

The top three countries supplied 84% of China’s tropical

sawn hardwood requirements in 2023, namely Thailand

(65%), Philippines (11%) and Gabon (8%) in 2023.

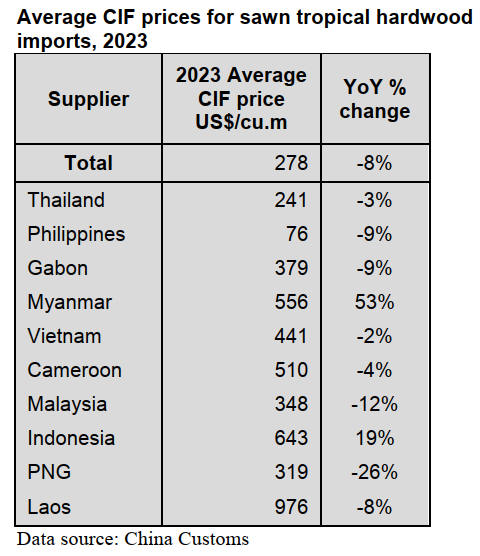

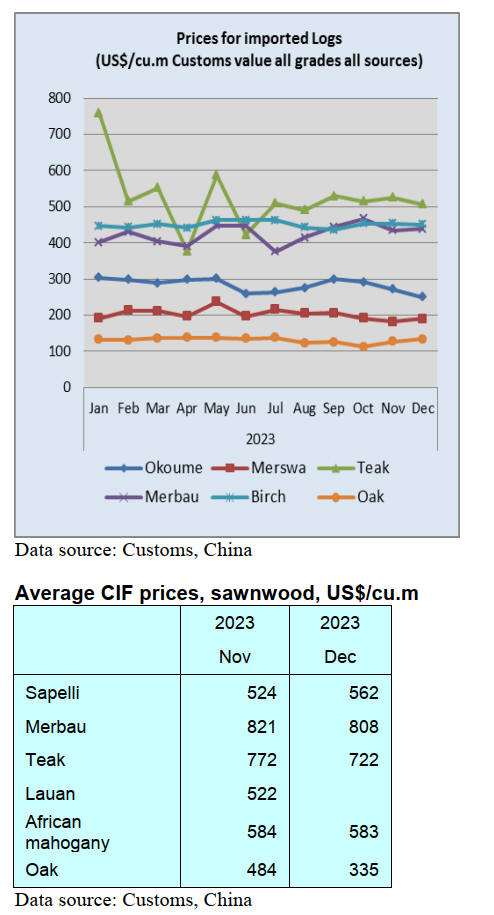

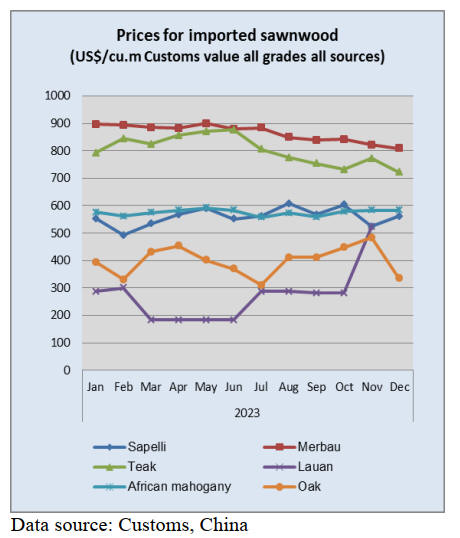

Decline in CIF prices for sawn tropical hardwood

imports

The average price for imported sawn tropical hardwood

was US$278 per cubic metre in 2023, down 8% year on

year. CIF prices for most suppliers of China’s tropical

sawn hardwood imports fell at different rates which

stimulated an increase in sawn tropical hardwood imports

in 2023.

The CIF prices for the top suppliers of sawn tropical

hardwood imports from Thailand, the Philippines and

Gabon declined 3%, 9% and 9% respectively in 2023.

In contrast, CIF prices for China’s sawn tropical hardwood

imports from Myanmar surged 53% and from Indonesia

rose 19% on 2022 level.

GTI-China Index Report, January 2024

According to data released by China's National Bureau of

Statistics, China's GDP grew by 5.2% to more than 126

trillion yuan in 2023. Statistics from the General

Administration of Customs of China showed that China's

total imports and exports reached 41.76 trillion yuan in

2023, up 0.2% year on year.

The statistics for 2023 also showed that the import volume

of logs and sawn timber totaled 65.8 million cubic metres,

a year on year decrease of 6.1%. In 2023, the total output

value of China's forestry sector exceeded 9.2 trillion yuan

and as the output of economic forests reached 226 million

tonnes, forest food become the third largest agricultural

product after grain and vegetables.

On 22 January China launched National Voluntary

Greenhouse Gas Emissions Reduction Trading Market and

China National Offshore Oil Corporation (CNOOC)

completed the country's first transaction on the Beijing

Green Exchange, with a total trading volume registering

250,000 tonnes of national certified voluntary emissions

reductions.

The Beijing Green Exchange predicted that the annual

trading volume is expected to exceed 10 billion tonnes and

the transaction value may exceed 1 trillion yuan, according

to calculations based on its 7 to 8 billion tonnes of quota.

In January this year, as the Chinese Spring Festival was

approaching, some wood processing plants started the

holiday ahead of schedule and many workers had returned

to their hometowns. At the same time, under the influence

of multiple factors such as reduced real estate transactions

and sluggish international demand, the overall trade

performance in the timber sector was weak.

GTI-China enterprises reported that the production volume

decreased compared with previous years, while the costs

of equipment increased due to intermittent operations, and

the shipping fees also rose. In the meantime some

enterprises hoped the government could implement

macroeconomic regulation and control to stimulate an

increase in market demand.

In January, the GTI-China index recorded 34.1%, a

decrease of 13.4 percentage points compared to that of the

previous month, was below the critical value (50%) for 2

consecutive months, indicating that the business prosperity

of the timber enterprises represented by the GTI-China

index shrank from last month and the rate of contraction

expanded.

The production index registered 25.0%, a decrease of 8.3

percentage points from the previous month, was below the

critical value for 2 consecutive months, indicating that the

production volume of the superior timber enterprises

represented by the GTI-China was less than that of last

month.

The new orders index registered 28.1%, a decrease of 27.8

percentage points from the previous month, fell below the

critical value after 3 months, indicating that the number of

new orders of the superior timber enterprises represented

by the GTI-China was less than that of last month.

The export orders index registered 37.5%, a decrease of

17.5 percentage points from the previous month fell below

the critical value after one month, indicating that the

number of export orders of the superior timber enterprises

represented by the GTI-China was less than that of last

month.

See:

https://www.itto-ggsc.org/static/upload/file/20240223/1708653799120615.pdf

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in China.

See:

https://www.itto-ggsc.org/static/upload/file/20240223/1708653799120615.pdf

|