|

Report from

North America

Imports of tropical hardwood products weak in

2023

US imports of tropical hardwoods and related products

declined in 2023, particularly sawnwood and plywood.

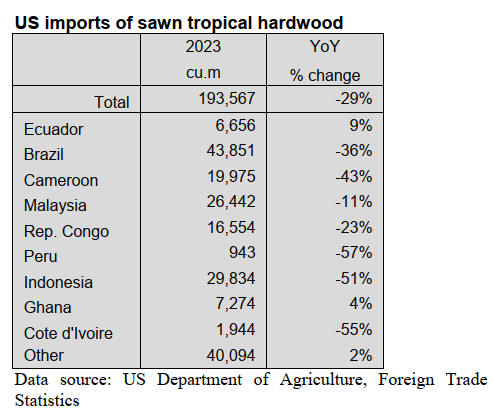

The Department of Agriculture totals for 2023 show sawn

tropical hardwood imports were down 29% from the

previous year and hardwood plywood imports fell 25%.

Imports of wooden furniture fell by 22%, from more than

US$25 billion in 2022 to less than US$20 billion in 2023.

Also falling were imports of wood veneers, down 4% and

hardwood moulding, down 28%.

In contrast imports of wooden flooring rose 11% in 2023

but imports of assembled flooring panels fell by 28%.

December figures, however, were encouraging as most

categories showed imports on the rise.

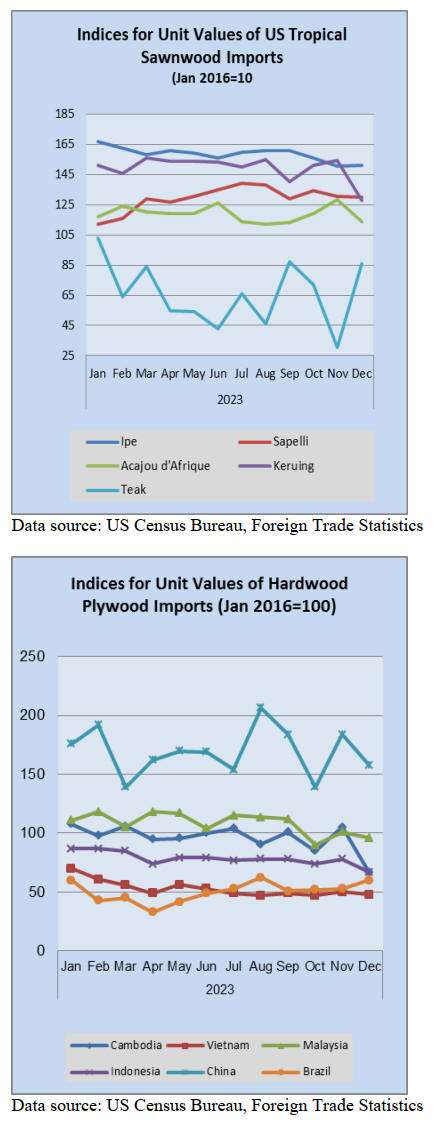

Imports of sawn tropical hardwood rise in December

US imports of sawn tropical hardwood rose 10% in

December, bouncing back in volume from a two-year low

in November. Despite the rise, the 13,269 cubic metres

imported in December was 26% less than in December of

2022. Imports from top suppliers Brazil and Cameroon

both rebounded sharply.

For the year, imports of sawn tropical hardwood fell from

nearly 275,000 cu.m in 2022 to less than 194,000 cu.m in

2023, a decline of 29%. Imports of Sapelli and Ipe, which

were both over 41,000 cu.m in 2022, fell 22% and 47%,

respectively in 2023.

Imports of Acajou d’Afrique, Virola, Meranti, Jatoba,

Teak, Iroko, and Paduak were all down more than 40% in

2023. The top supplying country for tropical hardwoods

remained Brazil, despite imports from the country falling

36% for the year.

Canadian imports jumped 98% in December to reach their

highest level since 2014. The nearly US$2.7 million in

imports recorded in December was the highest since

imports topped US$3 million in August 2014. The strong

month provides some optimism for the New Year after a

2023 which saw imports decline by 12% versus 2022.

US hardwood plywood imports flatten

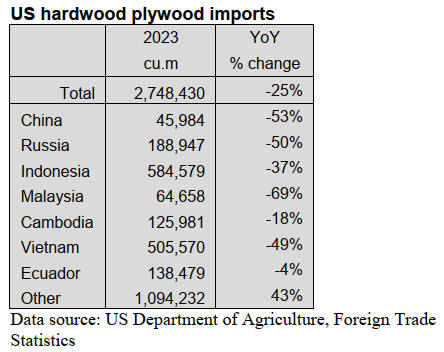

US imports of hardwood plywood rose less than 1% as

imports stabilized at a level well above last winter’s

volume. The 277,333 cu.m of plywood imported in

December was 81% higher than the volume of wood

imported in December 2022. Imports from Indonesia rose

57% to their highest level of the year.

In 2023, Indonesia supplanted Vietnam as the top supplier

of hardwood plywood to the US, despite a 37% drop in

volume. Imports from Vietnam fell 49% for the year.

Total imports were down by 25% in 2023 versus the

previous year with imports from Malaysia, China, and

Russia all falling more than 50%.

Veneer imports surge in December

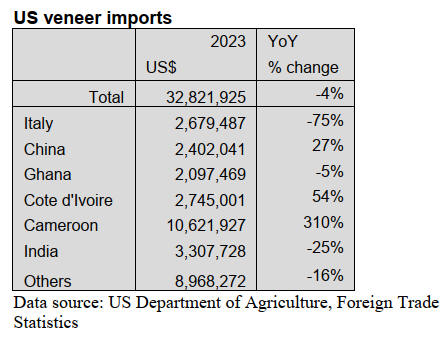

US imports of tropical hardwood veneer rose 24% in

December. The surge placed December imports 2% ahead

of December 2022 levels. Gains in imports from Italy (up

79%) and Cameroon (up 14%) more than made up for

declines in imports from China and India.

For 2023, imports of tropical hardwood veneer fell by 4%

as imports from 2022 top-supplier Italy plunged by 75%.

The US switched to imports from Cameroon, which rose

310% in 2023. Imports from Ghana rose 54% in 2023 as

the US increasingly turned to Africa for veneer. Imports

from India, the #2 supplier in 2022, fell 25% last year.

Hardwood flooring imports rose in 2023

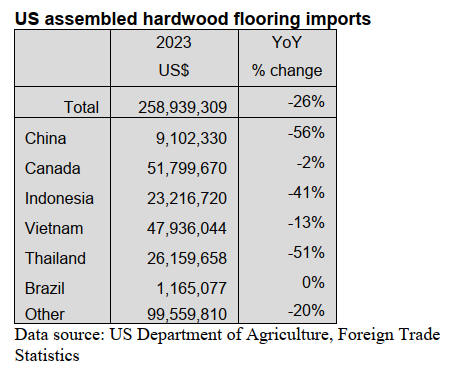

While most hardwood imports declined last year, US

imports of hardwood flooring rose in 2023. Imports ticked

upward 11% over 2022 despite a disappointing December

report. Robust imports from Indonesia fueled the gains as

a 93% rise for the year placed Indonesia as the leading

supplier for the US by a large margin.

Imports from the previous leader, Brazil, fell by 55% in

2023. For December, imports were down 11% from

November’s numbers and 8% below that of December

2022.Imports of assembled flooring panels, however,

showed a marked decline in 2023, falling 26% from 2022

totals.

The result was also fueled by imports from Indonesia,

which in this case fell by 41%, as well as by declining

imports from China (down 56%) and Thailand (down

51%). Yet, the December report pointed in a positive

direction. In December US imports of assembled flooring

panels rose 12% to a level 40% higher than December

2022 numbers.

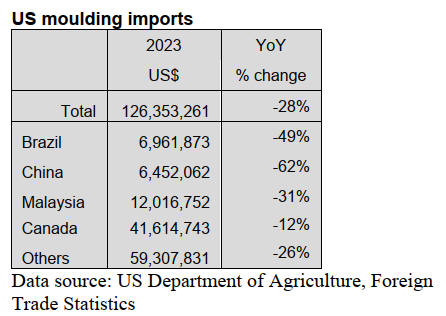

Moulding imports down 28% in 2023

US imports of hardwood moulding fell 28% in 2023.

Imports from Canada, by far the top supplying nation, fell

by 11% for the year as imports fell more steeply from

China (down 62%), Brazil (down 49%), and Malaysia

(down 31%).

Imports for December rose 2% from November but were

still 10% below that of the previous December. Imports

from China more than doubled in December to reach their

highest level since May.

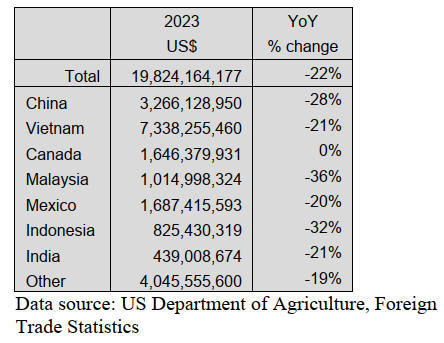

US wooden furniture imports down more than $5

billion in 2023

US imports of wooden furniture declined by more than

US$5 billion in 2023 as imports slowed by more than one

fifth. Imports fell 22% last year from more than US$25.3

billion in 2022 to US$19.8 billion in 2023. Imports from

the top suppliers, Vietnam and China, were down 21% and

28%, respectively.

Imports from most other countries saw similar declines,

although imports from Canada only saw a drop of less

than 1%.

December saw a gain of 1% over the previous month

which was also 1% above the total for December 2022.

Furniture market shows signs of normalising as

residential orders continue to rise

New orders for residential furniture rose 26% in

November compared to 2022 figures, marking seven

straight months of double-digit percentage growth in the

year-over-year comparison, according to the latest issue of

Furniture Insights. Roughly two-thirds of the participants

reported increased orders in November 2023 compared to

a year ago.

"While there is considerable 'noise' behind these numbers

(including the impact of general inflation and container

rate fluctuations to name just two), this does mark the 7th

straight month orders have grown double-digit percentages

over the prior year, so there does appear to be some

traction," said Mark Laferriere, assurance partner at Smith

Leonard, which produces the monthly report.

Year to date, new orders were up 4% over the same period

of 2022, although 2022-to-date orders were down 34%

over the same period of 2021, Laferriere noted. "As we’ve

stated previously, comparisons to prior years have been

difficult due to the unprecedented circumstances

impacting the industry since mid-2020, but that does seem

to be normalizing, even if still not at the levels we’d

prefer."

See:

https://www.woodworkingnetwork.com/furniture/residential-furniture-orders-continue-double-digit-rise-year-over-year

and

https://hfbusiness.com/CurrentIssue/CurrentIssueModule/ArticleId/24881/statistically-speaking-us-furniture-manufacturers-feeling-the-slowdown

|