|

1.

CENTRAL AND WEST AFRICA

Regional round-up

The recent up-tick in some sawnwood prices can be

attributed primarily to a change in Chinese purchasing

patterns with furniture manufacturers opting for more cost-

effective timbers such as okoume and ayous. As a result

there has been decline in demand for more expensive

species like ovangkol, bubinga (Kevazingo) and tali

resulting in weakening prices.

Chinese furniture manufacturers are skilled in the art of

enhancing the appearance of timber through colouring

techniques so consumers may be offered a piece of

furniture made to look like a premium timber.

Vietnam’s Africa imports slump

In the first 11 months of 2023 Vietnamese imports of logs

and sawnwood wood from Africa reached 675,040 cu.m,

down 43% in volume compared to the same period in

2022. In 2023 there was a decline in consumption of

imported timbers because of the downturn in

theVietnamese real estate market.

Imports from Cameroon were down around 30%,

shipments from the DRC were down almost 60% and

shipments from Gabon were down 36%.

Mills in SEZ see expanded demand

Plywood mills operating in Gabon’s SEZs are currently

experiencing high demand, particularly for the Dutch

market. This surge has prompted the reopening of mills

and investment in new lines. The workforce, including

expatriates, can be maintained on condition that they are

registered, even when working under subcontractors.

Slow demand for okoume in Philippines

In Congo enquiry levels are low say operators. Buyers for

the Philippine market have been slowing purchases of

okoume sawnwood. This has led to some mills,

particularly Malaysian operated mills to a reduce

production. Demand in Middle East markets has not

changed with particularly slow demand in Iraq say

shippers. But overall demand remains stable.

Concession fees and export duties rise

ATIBT has reported on changes on concession tax rates

included in Gabon’s 2024 Finance Bill saying this

envisages a consolidation of taxation for certified

operators and an increase in taxation for non-certified

operators. The various rates of area tax rates are reported

asbe:

300 FCFA per hectare for concessions with FSC

or PEFC/PAFC sustainable management

certification

600 FCFA per hectare for legally certified

concessions

1,000 FCFA per hectare for non-certified

concessions.

The budget also envisages a broadening of the export

duties on processed wood products depending of the

extent of processing.

The proposed rates are reported as:

8.5% as opposed the current 7% for primary

processing

5% as opposed to the current 3% for secondary

transformation

3% as opposed to the current 0% for third

transformation

See:

https://www.atibt.org/en/news/13421/gabon-the-latest-news-in-the-timber-sector

In related news, the price of electricity could fall in Gabon

after the exemption granted to Gabon Energy and Water

Company (SEEG) on the price of diesel.

In a press release made public in January the Committee

for the Transition and Restoration of Institutions (CTRI)

announced a reduction in the price of diesel for the SEEG

which will be exempt from paying the price set for

industrial use and will benefit from the ex-depot price

regime.

See:

https://www.lenouveaugabon.com/fr/energies/1101-20245-le-prix-de-l-electricite-pourrait-baisser-au-gabon-apres-l-exoneration-accordee-a-la-seeg-sur-le-prix-du-gazoil

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in the Republic of Congo and Gabon.

See:

https://www.itto-ggsc.org/static/upload/file/20240116/1705365254170310.pdf

2.

GHANA

IMF support to boost growth

The Executive Board of the International Monetary Fund

(IMF) has approved a US$600 million loan facility to

support Ghana’s economic growth.

At a press conference with the IMF the Finance Minister,

Ken Ofori-Atta, described the development as a “pivotal

milestone” in the country’s economic programme

implementation.

The Governor of the Bank of Ghana (BoG), Dr. Ernest

Addison, said the government would continue to

implement sound policies to further ease inflation.

Stephane Roudet, IMF Mission Chief for Ghana said,

despite the difficult economic environment ongoing

reforms had started bearing fruit with signs of economic

stabilisation.

See:

https://mofep.gov.gh/news-and-events/2022-01-22/ghanas-secures-second-tranche-of-imf-us%24600m-for-disbursement

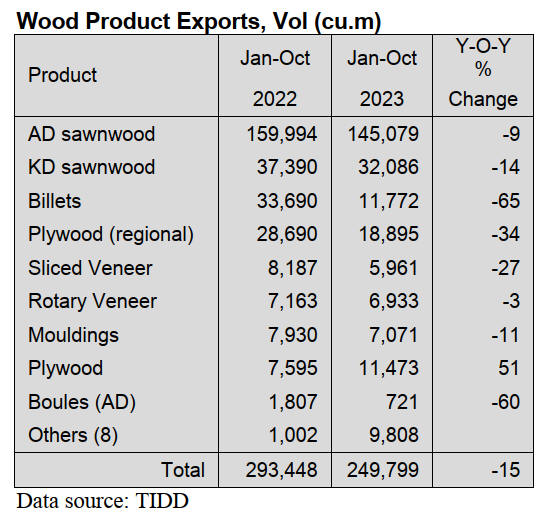

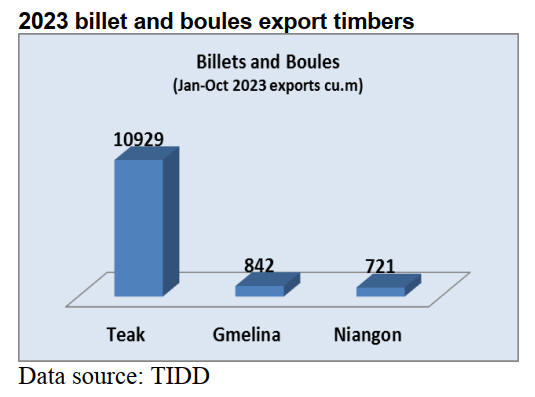

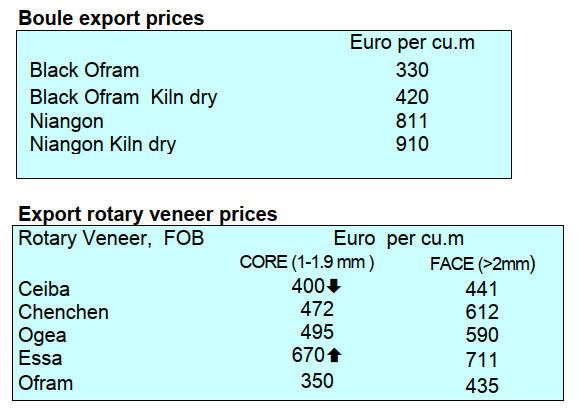

Billet and boule exports plunged in 2023

According the Ghana Forestry Commission Timber

Industry Development Division the volume of Ghana’s

wood product exports for the period January to October

2023 totalled 249,799 cu.m, a 15% shortfall when

compared to the 293,448 cu.m exported in the same period

in 2022.

The January to October 2023 exports earned Eur114.06

million compared to the Eur129.46 million in 2022, a

decrease of 12%. There were seventeen different wood

products exported.

Exports of most wood products fell in the first 10 months

of 2023 with billets and air-dried boules plunging by 65%

and 60% respectively. Billet export volumes dropped to

11,772 cu.m from 2022 year on year a volume of 33,690

cu.m. Air-dried boule exports also dipped from 1,807cu.m

in 2022, to 721cu.m in 2023.

Billets and air-dried boules are primary products and

export volumes, as a percentage of the total export of

primary products, dropped to 7% in 2023, from 18% in

2022. The major species for these products were teak,

gmelina and niangon. The markets for these products

included India, Vietnam, Togo, Germany and the US.

New plant tissue culture laboratory

Ghana has commissioned a plant tissue culture laboratory

established by by Star Agro Forestry Ghana Limited, a

commercial forest plantation developer in the Ashanti

region. The Deputy Minister of Lands and Natural

Resources, Mr. Benito Owusu-Bio, who commissioned the

facility, gave an overview of the Government’s

commitment to partnering with the private sector in forest

restoration activities.

The Chief Executive of Forestry Commission (FC), Mr.

John Allotey, on his part said tree seedlings to be produced

from the tissue culture laboratory will speed up production

of quality planting stock.

The Managing Director of Star Agro Forestry, Mr. Sanjay

Poddar, asked for the Commission’s maximum support for

its smooth operations. He expressed the determination of

his team to embark on a ground-breaking journey in

bringing cutting-edge technology to the heart of Ghana’s

forestry efforts.

D.Invitro Labs Ghana Ltd, in the Volta Region was the

first plant tissue culture laboratory in Ghana. A subsidiary

of SBW BV, a Dutch international group, started its

research in 1976.

See:

https://fcghana.org/plant-tissue-culture-laboratory-commissioned-in-the-ashanti-region/

Investment in forest restoration

The Deputy Minister of Lands and Natural Resources,

Benito Owusu Bio, has stated that a total of 728,609

hectares of degraded lands in Ghana have been restored

since 2017 which has been the greatest investments in

recent times by Government and the private sector in the

forest restoration activities.

In 2013 the land restoration programme covered 132,262

hectares through the Forest Plantation Development

Strategy, 25,342 hectares through enrichment planting and

571,005 hectares through planting within farms.

The Minister said the government’s afforestation

programme is within the framework of the Ghana Forest

Plantation Strategy (2017) and the Green Ghana Project

(2021). According to the Minister, the benefits from the

restoration programme included protection of watersheds,

job creation and support to national and global efforts

aimed at addressing climate change.

See:

https://gna.org.gh/2024/01/ghana-restores-728608-hectare-degraded-lands-within-seven-years-owusu-bio/

3. MALAYSIA

Exports expected to rebound

RHB Investment Bank (RHBIB) has maintained its

projection that Malaysia's GDP will grow by over 4% in

2024 with growth accelerating driven by stronger

international demand. Export growth is projected to

rebound in contrast to the decline of 8% in 2023. Domestic

consumption is forecast to improve.

Despite the challenging global economic situation last year

the trade surplus exceeded RM2 trillion for the third

consecutive year and has sustained a surplus for 26

successive years according to the Ministry of Investment,

Trade and Industry. In related news, Bank Negara

Malaysia maintained it 3% interest rate.

See:

https://www.thestar.com.my/business/business-news/2024/01/20/malaysia039s-gdp-growth-set-to-accelerate-to-46-in-2024---rhb-ib

And

https://theborneopost.pressreader.com/article/282123526371147

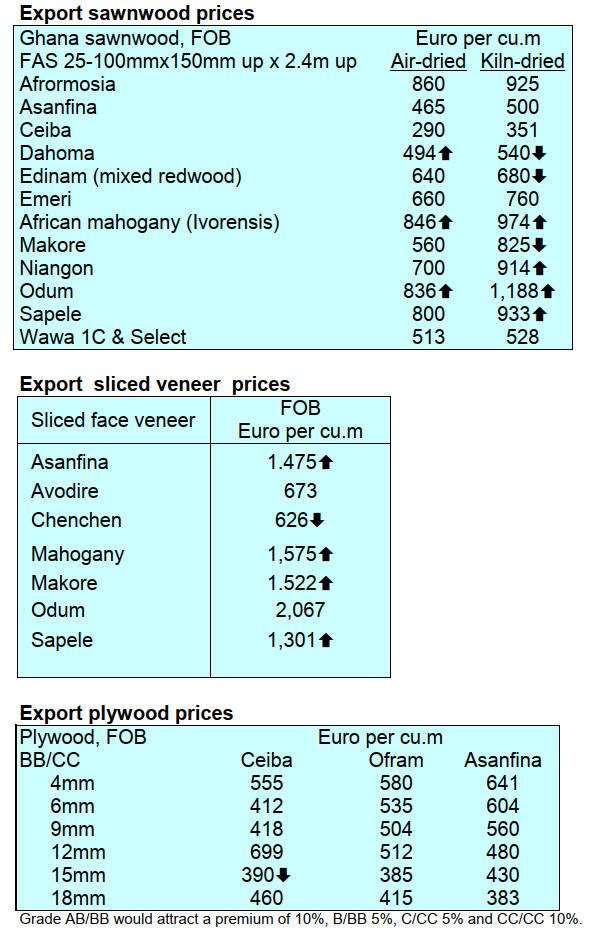

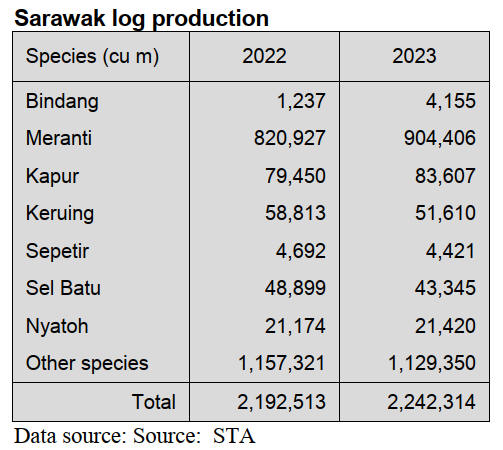

Sarawak timber exports drop

The value of wood product exports from Sarawak dropped

to RM3.1 billion in 2023 from RM3.9 billion in 2022. The

export value of logs stood at RM559 million or 18% of the

overall export value.

Japan remained the primary market for Sarawak’s wood

products accounting for 53% or RM1.7 billion of

Sarawak’s export earnings in 2023. Plywood remained

Sarawak’s main export product making up 48% of total

wood product export earnings.

Calls continue for a transformation of the sector and the

production of high value-added products utilising raw

material from planted forests. To achieve this

transformation the state government is committed to

strengthening the downstream industry, expanding into

biomass, furniture, bamboo and engineered wood.

Biomass products, such as wood pellets, biochar, and

charcoal briquettes have potential in establishing a green

economy in Sarawak. Wood pellets are exported to Japan,

France and Korea and were worth RM36 million in 2023.

In a bid to further diversify the industry Sarawak Timber

Industry Development Corporation STIDC is focusing on

developing the bamboo sector. Despite the global export

value of bamboo products reaching US$66.2 billion in

2022 Sarawak’s export market value was recorded at only

RM 1.2 million.

See:https://theborneopost.pressreader.com/article/281608130303400

Private sector collaboration on tree plantation

operations

The Sarawak Timber Industry Development Corp.

(STIDC) and the Malaysian Panel-Products

Manufacturers’ Association (MPMA) have signed a

memorandum to promote collaboration and knowledge

exchange on sustainable planted forest management

practices within the STIDC’s Licence for Planted Forests

(LPF/0043) project.

Both STIDC and MPMA acknowledge the growing need

for sustainable forest management practices as well as the

importance of research and development in the timber

industry. The chairman of MPMA, Sheikh Othman

Rahman, said the MoU would allow plywood

manufacturers to appreciate the importance of forest

management and industrial tree plantations as source of

raw material.

COVID cases surge

In the face of rising case numbers Malaysia has reactivated

the Covid Heightened Alert System, an early intervention

protocol based on the infection and death levels as well as

the hospitalisation rate to better monitor and appropriately

respond to infections. Singapore, Thailand and Indonesia

have issued advisories asking people to mask up and get

vaccinated.

The number of cases has shot up as much as 75% in these

countries since the start of January pushing case numbers

into the tens of thousands.

See:

https://asia.nikkei.com/Spotlight/Coronavirus/Malaysia-and-Singapore-put-guard-up-as-COVID-cases-surge

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Malaysia.

See:

https://www.itto-ggsc.org/static/upload/file/20240116/1705365254170310.pdf

4.

INDONESIA

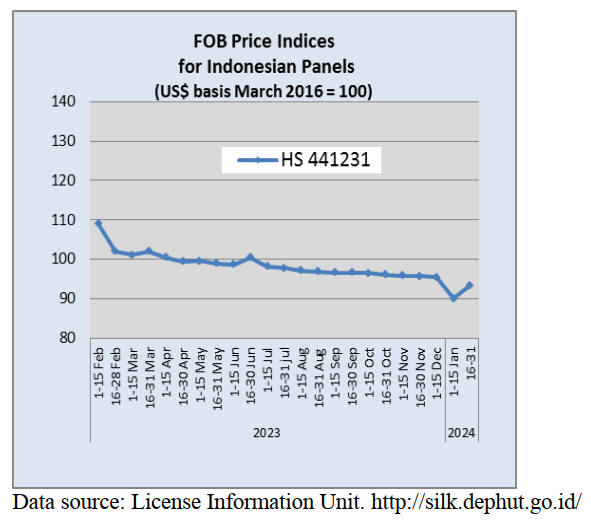

Pursuing 2024 furniture export target

The Indonesian Furniture and Crafts Industry Association

(HIMKI) noted that furniture and crafts exports in 2023

have likely fallen short of the target by almost 30%. A

number of steps have been taken to strengthen the export

performance this year. Abdul Sobur of the HIMKI

explained that there are several steps that must be taken to

achieve the 2024 export target of US$5 billion. According

to Abdul action is needed to ensure the availability of

quality raw materials.

Raw material price stability is a determining factor in the

competitiveness of the furniture and crafts industry. At

present it is estimated that around 30% of raw material

supplies are imported due to the lack of domestic supplies.

Abdul estimates that the equivalent of 12 million cubic

metres of roundwood will be required in 2024.

Apart from that, Abdul said that around 67,000 tonnes of

ready-to-use rattan raw material will be needed to meet the

export target of US$5 billion.

In related news, the Indonesian Furniture Industry and

Handicrafts Association (ASMINDO) has prepared a

roadmap to guide the national furniture and crafts industry

in the face of current challenges. The roadmap aims to

enhance export potential and strengthen domestic market

promotion. ASMINDO’s chairman, Dedy Rochimat,

disclosed that the global furniture market has continued to

grow, reaching a total transaction value of US$729 billion

last year.

“In 2023, the Asian market for furniture reached US$169

billion with the ASEAN region contributing US$13.7

billion” said Dedy.

ASMINDO aims to increase the development of the

national furniture and crafts industry through effective

work programmes that can have a significant impact, he

said, and export markets would be expanded beyond

America and Europe to new markets for example, Saudi

Arabia and Brazil.

See:https://forestinsights.id/rebut-pasar-furnitur-domestik-dan-ekspor-asmindo-siapkan-roadmap/

https://bisnis.solopos.com/ekspor-mebel-turun-pada-2023-ini-langkah-himki-kejar-target-2024-1844544

Plywood ready for export to the Philippines

A small quantity plywood made in South Kalimantan

recently secured a certificate from the South Kalimantan

Animal, Fish and Plant Quarantine office in advance of

shipment to the Philippines. Quarantine official, Aspul

Anwar, explained that the required documents from the

destination country were completed. He noted "for

physical inspection, plywood must be free from pest

organisms or quarantine plant pest organisms in the form

of wood boring insects and other live insects”.

See:https://www.riliskalimantan.com/2024/01/kayu-lapis-asal-kalsel-siap-berlayar-ke.html

Forest management challenges becoming more

complex

The Minister of Environment and Forestry, Siti Nurbaya,

ha said this year environmental and forest management

challenges will become increasingly complex and will

require administrative procedures that are consistent with

the needs of communities.

According to the Minister, governance success can no

longer be solely measured by administrative correctness.

The community must also benefit from the results and that

"bureaucratic work should be more closely related to

society.

In related news, the Minister stated that collaboration

between the government and all stakeholders is crucial in

taking effective measures to tackle climate change. The

government is continuing to encourage community

participation in actions to mitigate and adapt to climate

change starting from energy efficiency to forest and land

fire prevention.

See:

https://forestinsights.id/tantangan-makin-kompleks-menteri-siti-tegaskan-kerja-klhk-harus-terukur-dan-dirasakan-masyarakat/

https://en.antaranews.com/amp/news/302997/govt-invites-commmunity-to-participate-in-climate-action

Forest rangers monitoring capacity

The Deputy Minister of Environment and Forestry, Alue

Dohong, called on members of the Quick Reaction Forest

Ranger Unit, or SPORC, to improve their capacity to

monitor forests in Indonesia.

He remarked that the monitoring of territory by SPORC's

intelligence members aims to prevent potential threats

from turning into incidents, such as illegal logging,

encroachment, fires, hunting and social conflicts which

can have a damaging effect on the function of forests.

According to Dohong, SPORC forest rangers should have

the ability to supervise the condition and dynamics of

forests, identify potential problems and find appropriate

strategies and steps to overcome various forestry and

environmental problems.

See:

https://en.antaranews.com/news/303327/forest-rangers-should-step-up-monitoring-capacity-deputy-minister

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Indonesia.

See:

https://www.itto-ggsc.org/static/upload/file/20240116/1705365254170310.pdf

5.

MYANMAR

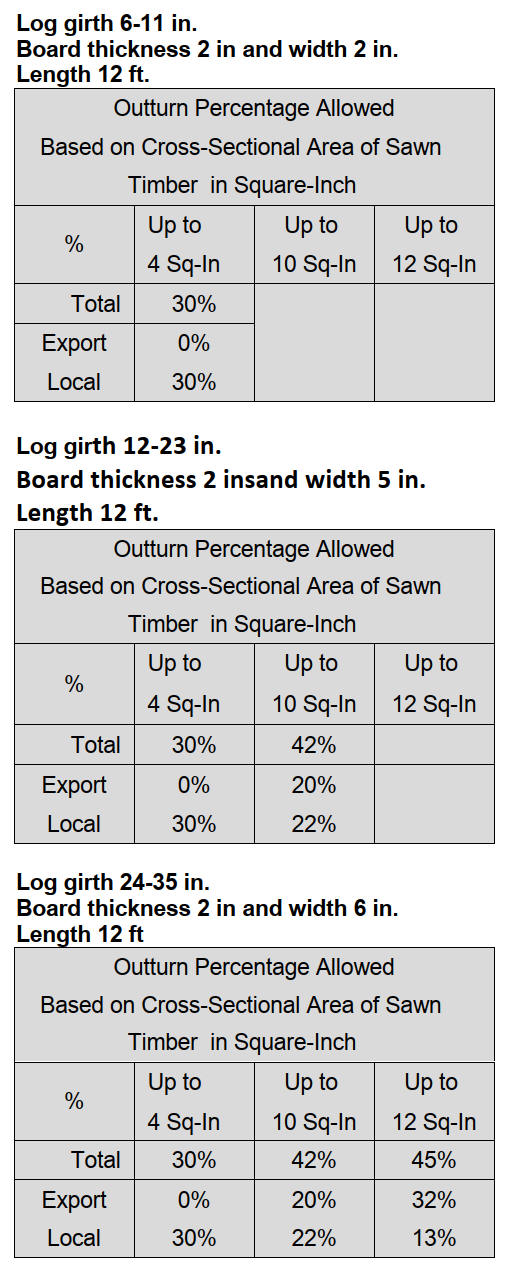

Outturn percentage set for plantation teak milling

According to the Facebook page of Wood Based Furniture

Association the Ministry of Natural Resources and

Environmental Conservation (MONREC) issued a

notification on the specification limit and the maximum

outturn percentage for the sawn timber which are to be

produced from teak thinning poles and posts. Details are

shown in the following tables.

According to the notification the maximum size allowed

for export is 2inch in thickness, 6-inch in width and 12

feet in length. However, depending on the log girth the

maximum width and outturn percentage is variable.

For logs with a girth of 6-11 inches the maximum width is

2 inch and export is not allowed. For logs with a girth of

12-23 inches and 24-35 inches the maximum width is 5

and 6 inches respectively. The outturn percentage for

width 5 inch is 42% and for width 6 inch is 45%.

It is understandable that the setting of outturn limits is

aimed at preventing false outturns percentage which may

create the loophole under which the sawn timber from

natural forest teak can be substituted.

It's important to note that the notification does not cover

wood chips and pellets. In the case of logs from natural

forests there is a similar control on the maximum outturn

percentage. However, millers have the opportunity for an

exception known as Customised Cutting Approval.

Through this method millers can demonstrate the actual

cutting results using sample logs of random qualities

allowing for the approval of a higher outturn percentage.

The notification appears to be primarily targeted at private

plantations as logs from state-owned plantations offered in

MTE Tender sale, are typically over 30 years of age and

the same regulation is applied as to the logs from the

natural forest.

See:

https://myanmarforestcertification.org/wp-content/uploads/2021/01/Plantation-Extraction-Procedure_ENG.pdf.

Central Bank sells foreign currency

Myanmar's central bank has decided to inject over US$200

million worth of foreign currency into the forex market

to control inflation that it says is caused by soaring fuel

prices. This was done after CBM suspended the subsidised

facility to the fuel importer at the official rate of 2100

KYATs. The CBM sold US$19 million in December 2023

and US$53 million in January 2024 primarily directed

toward fuel importers.

Despite this fuel prices have surged by 12 to 15% since

December 2023. The CBM also sold 250 Million Thai

Baht in January and extended a SWAP facility equivalent

to US$4 million in Chinese yuan. Myanmar's heavy

reliance on China and Thailand for most commodities

through border trade underscores the significance of these

financial transactions. Concurrently, the market exchange

rate experienced an increase from 3350 to 3500 Kyats

against US dollar.

The central bank has frequently sold dollars to defend its

currency but this marks the first intervention of over

US$100 million. The kyat has depreciated by nearly 40%

since the beginning of August.

See:

https://asia.nikkei.com/Spotlight/Myanmar-Crisis/Myanmar-plans-200m-currency-intervention-to-fight-inflation

World Bank - worsening economic conditions

The World Bank's latest report on Myanmar acknowledges

the worsening conditions exacerbated by armed conflict

since October 2023, disrupting lives, livelihoods and

major trade routes. The Bank says the economic outlook is

bleak, with those signs of recovery observed in the first

half of 2023 proving fragile and short-lived.

See:

https://www.worldbank.org/en/news/press-release/2023/12/12/economic-recovery-falters-as-conflict-and-inflation-weigh

6.

INDIA

Housing demand set to

rise in urban and rural areas

CREDAI, in collaboration with Liases Foras, has

published a report that suggests housing demand in India

could reach 93 million homes by 2036, driven by growth

in key parameters including population in both urban and

rural areas, healthy macro-economic indicators and

favorable demographics, with several Tier II, III cities

projected to spearhead both demand and supply. With

Government programmes to establish Smart Cities, along

with increasing commercialisation activities in emerging

areas, it is widely expected that the next wave of real

estate growth will stem from Tier II, III regions.

The report was released at the New India Summit

organised by Confederation of Real Estate Developers’

Associations of India, (CREDAI) in Varanasi recently.

India has been the world’s fastest-growing major economy

in the last two years and is forecast to retain the top spot in

2024 as the urbanisation and industrialisation process

reaches the rapid take-off phase.

The Indian economy is projected to grow 6.2% in 2024

slightly lower than the 6.3 % estimate for 2023, amid

robust domestic demand and strong growth in the

manufacturing and services sectors, according to a UN

report. It also forecast that the global growth is set to 2.4%

in 2024 from an estimated 2.7% in 2023.

See:

https://www.constructionweekonline.in/business/indias-housing-demand-expected-to-skyrocket-to-93mn-by-2036-credai-liases-fora

Per capita panel product consumption set to rise

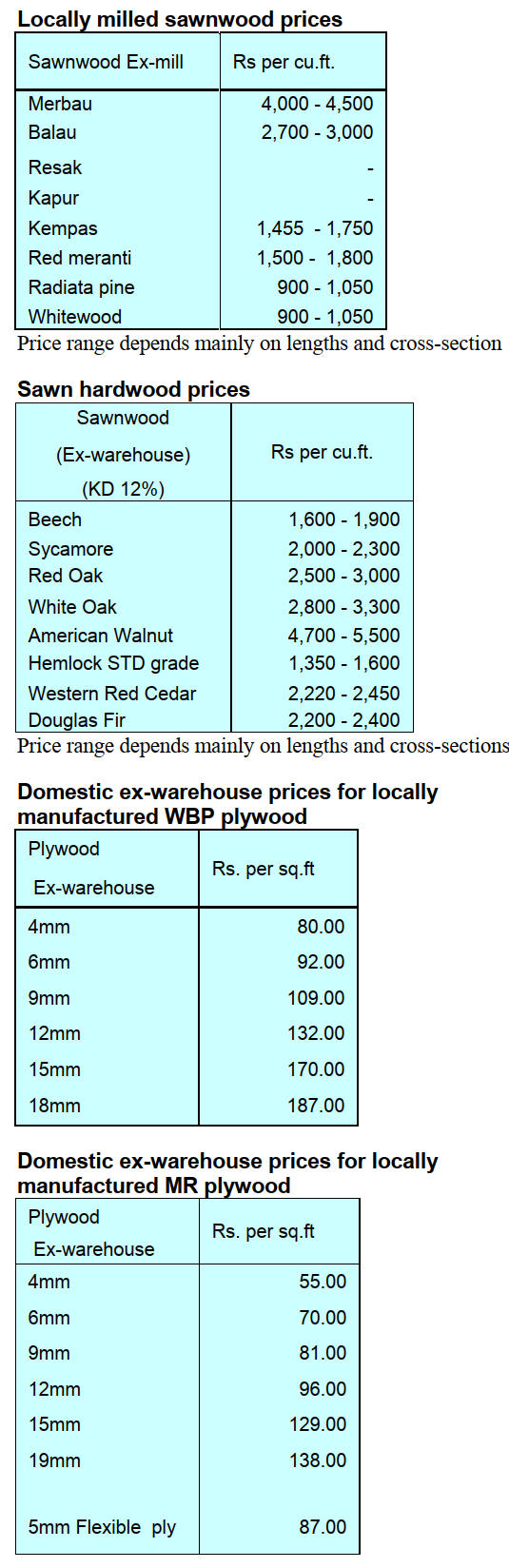

The ITTO correspondent in India writes “markets are

stable as is the exchange rate. India has a huge demand for

furniture and wood-based panel products because of the

growing economy. The per capita consumption of panel

products is much lower than in other countries but it will

grow with improving purchasing power.

Over the past 4 years the plantation timber based industry

has expanded its manufacturing capacity. Plywood, MDF,

OSB and Particleboard industries have increased their

capacity and seen healthy growth”.

Plyreporter says in its latest issu, with rising demand for

properties the demand for quality calibrated plywood and

panel products has also risen significantly but the high

timber cost has become an obstacle for expansion.

The positive sentiment among potential home buyers is

driving home sales and indirectly the demand for

calibrated plywood for use in manufacturing. A recent

survey suggests the consumption of quality plywood will

surge in the coming years due to demand led by architects,

interior designers and builders.

See:

https://www.liasesforas.com/admin/WhitePaper/56/WhitePaper_2023-12-06_63837473649630.pdf

Expanding plantations

Plyreporter has published information from the Ministry of

Environment, Forests and Climate Change. An official

notification in November announces the approval for tree

plantations to be established on areas designated as forest.

The raising of plantations by the Government Department

on the land recorded as forest in the Government records

shall be considered as forestry activity and accordingly,

provisions of the compensatory afforestation and Net

Present Value shall not be applicable for such plantation

activities.

While, the raising of commercial plantations of short

rotation, including plantation of medicinal plants in the

forest land shall be considered as non-forestry activities

and in such cases prior approval of the Central

Government shall be obtained and decision on such

proposals will be undertaken by them on the merits of

such case.

7.

VIETNAM

Wood and wood product (W&WP) trade Highlights

According to the General Department of Customs

Vietnam’s W&WP exports to the UK in December 2023

were recorded at US$20.9 million, down 22% compared to

December 2022. In 2023 the W&WP exports to the UK

were valued at US$195 million, down 19% compared to

2022.

Vietnam's office furniture exports in December 2023

accounted to US$24.4 million, down 13% compared to

December 2022. In 2023 office furniture exports

contributed US$267.9 million, down 28% compared to

2022.

The volume of tali imported in December 2023 stood at

26,700 cu.m, worth US$10.0 million, down 8% in volume

and 8% in value compared to November 2023. Compared

to December 2022, the volume fell by 54% in volume and

57% in value. In 2023 tali imports amounted to 378,200

cu.m, worth US$154.8 million, down 32% in volume and

32% in value compared to 2022.

Imports of logs and sawnwood from Southeast Asia in

December 2023 are estimated at 80,000 cu.m with a value

of US$22.0 million, down 0.4% in volume but up 2.2% in

value compared to November 2023 bringing the total

amount of imports from these suppliers to 838,80 cu.m at

a value of US$231.99 million, down 7% in volume and

23% in value compared to 2022.

In December 2023, W&WP exports amounted to US$1.3

billion, up 10% compared to November 2023 and up 2%

compared to December 2022. In particular, WP exports

reached US$952.6 million, up 10% compared to

November 2023 and up 9% compared to December 2022.

In 2023, W&WP exports totalled at US$13.5 billion, down

16% compared to 2022.

Vietnam's W&WP exports to South Korea in December

2023 reached US$66.4 million, down 33% compared to

December 2022. Generally, in 2023 W&WP exports to

South Korea stood at US$784.3 million, down 23.4%

compared to 2022.

In December 2023 exports of kitchen furniture reached

US$122 million, up 17% compared to December 2022.

Overall, in 2023 exports of kitchen furniture contributed

US$1.19 billion, down 10% compared to 2022.

Vietnam's oak imports in December 2023 were 25,700

cu.m, worth US$14.3 million, down 8% in volume and 8%

in value compared to November 2023. However,

compared to December 2022, import volumes increased

by 33% and 34% in value. In 2023 oak imports amounted

to 280,000 cu.m, worth US$154.7 million, down 2% in

volume and 16% in value compared to 2022.

Imports of logs and sawnwood from China in December

2023 were reported at 65,000 cu.m, at a value of US$25.0

million, down 2% in volume and 1% in value compared to

November 2023 bringing the total volume of wood

imported from China in 2023 to 569,030 cu.m at a value of

US$253 million, down 13% in volume and 28% in value

compared to 2022.

Certification could spur exports

The strict Forest Stewardship Council certification

regulations pose both challenges and opportunities for the

Vietnamese timber industry.

One of the largest retailers in the United States, is seeking

to procure FSC certified wood products from Vietnam.

Vietnam has seen increased demand for FSC-certified

timber materials due to requirements from import markets,

the largest of which are the US and Europe.

However, there are challenges regarding FSC

requirements on verification of the origin wood raw

materials used in manufacturing.

Vietnam primarily purchases FSC wood from South

American and African countries but transport is expensive

and takes a considerable time.

In recent years, the Vietnamese government has

introduced policies such as the Vietnam Forestry

Development Strategy 2021–2030 and a scheme to

develop a sustainable and effective wood processing

industry which promotes the growth of plantations of large

size logs with FSC certification.

As a consequence, an increasing number of companies

operating in the timber processing sector are actively

pursuing prospects for direct involvement in the certified

forest supply chain. A number of companies, including

Woodsland, NAFOCO, and Scancia Pacific have achieved

raw material self-sufficiency it has been reported.

Woodsland Tuyen Quang, an enterprise that manufactures

interior and exterior wood products for IKEA Group, has

collaborated with five forestry companies in the northern

province of Tuyen Quang since 2015 to secure certified

raw material.

According to the company’s president, Do Thi Bach

Tuyet, the company is engaged in collaboration with

forestry firms and domestic organisations to formulate a

forest management strategy spanning a minimum of seven

years with the objective of establishing timber material

areas that satisfy processing requirements.

Vu Thi Que Anh, the FSC representative in Vietnam,

remarked that the ability to access more developed global

markets is one of the greatest benefits for forest owners in

Vietnam through obtaining FSC certification.

According to Que Anh the proportion of forested land in

Vietnam with FSC certification has reportedly increased in

recent years.

The FSC-certified forest area in Vietnam is projected to

extend to around 282,960 ha, representing 64% of the

country’s total planted forest area.

See:

https://vietnamnet.vn/en/vietnam-business-news-january-16-2024-2238964.html

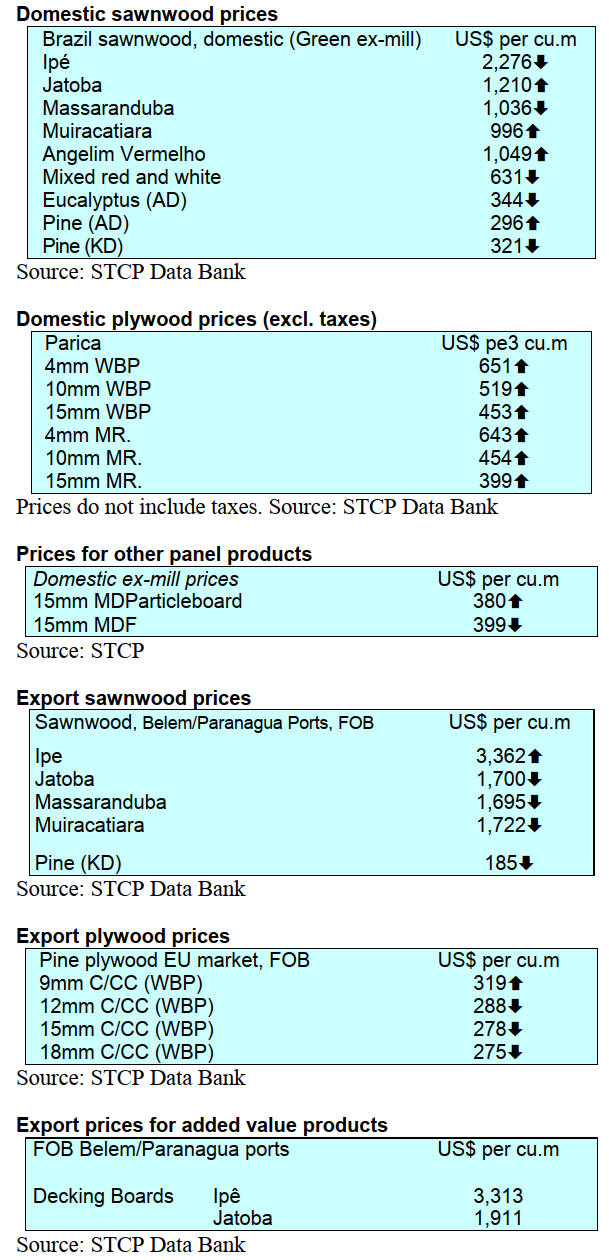

8. BRAZIL

Major investment in

reforestation in Latin America

The Development Bank of Latin America and the

Caribbean (CAF) has announced an investment of US$25

million in Timberland Investment Group's (TIG)

reforestation strategy in Latin America.

TIG, a subsidiary of BTG Pactual, aims to protect and

restore around 150,000 hectares of deforested natural

forests in Brazil, Uruguay and Chile.

The initiative also aims to create sustainable and

independently certified commercial forests to improve

biodiversity and support inclusive community

development.

In line with its mission to boost sustainable development,

CAF aims to become the region's green bank committing

to allocate US$25 billion in green financing by 2026

representing an increase from 24% to 40% of total

approvals.

See:

https://www.remade.com.br/noticias/19710/caf-investe-us$-25-milhoes-em-reflorestamento-na-america-latina

Forest sector goals for 2024 in Mato Grosso State

During a meeting of the forest sector in Alta Floresta,

State of Mato Grosso in the Amazon Region, members of

the forest industry discussed topics such as market

expansion, sectoral policies, associations and health and

safety issues.

The meeting was attended by more than 60 entrepreneurs

from the forest sector who work in the municipalities that

make up Simenorte's union led by representatives of the

Mato Grosso Timber Producing and Exporting Industries

Center (CIPEM). They highlighted the importance of

business association to explore new markets and

achievements such as the inclusion of forest management

plans in credit lines.

In addition, the extension of the validity of logging

permits from 12 to 24 months was highlighted as a

breakthrough.

CIPEM pointed out that the municipalities in the north of

Mato Grosso are important producers of "legal, traceable

and certified" timber from natural forests and emphasised

the importance of business alliances to conduct

negotiations as a bloc and seeking new markets and

improvements for forest-based activities.

FIEMT (Federation of Industries in the State of Mato

Grosso) emphasised the role of associations in

strengthening agroindustry, highlighting the benefits of

sustainable socio-economic development. The State

Environment Secretariat (Sema) stressed the importance of

Sustainable Forest Management Plans in Mato Grosso,

highlighting efforts to integrate State requirements with

the production sector.

The National Forum for Forest-Based Activities (FNBF)

pointed out that timber is the main economic activity in

33% of Mato Grosso's municipalities and FNBF

encourages access to new markets and highlights the

strengthening of alliances as a key to balancing sectoral

policies.

See:

https://cipem.org.br/noticias/metas-para-2024-sao-debatidas-por-empresarios-da-industria-florestal-em-assembleia-no-extremo-norte-de-mt

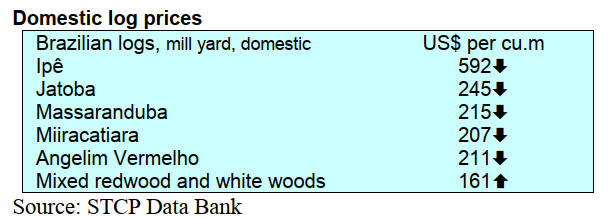

Export update November 2023

In November 2023, Brazilian exports of wood-based

products (except pulp and paper) decreased 6.8% in value

compared to November 2022, from US$276.8 million to

US$258.0 million.

Pine sawnwood exports dropped 18% in value between

November 2022 (US$55.9 million) and November 2023

(US$45.8 million). In volume, exports declined 7% over

the same period, from 214,200 cu.m to 199,700 cu.m.

Tropical sawnwood exports fell 21% in volume, from

23,200 cu.m in November 2022 to 18,400 cu.m in

November 2023. In value, exports decreased 38% from

US$13.3 million to US$8.3 million over the same period.

In contrast, pine plywood exports increased 14% in value

in November 2023 compared to November 2022, from

US$44.2 million to US$50.2 million. In volume, exports

increased 18% over the same period, from 136,300 cu.m

to 160,900 cu.m.

As for tropical plywood, exports also increased in volume

by 33% and in value by 27%, from 1,800 cu.m and

US$1.1 million in November 2022 to 2,400 cu.m and

US$1.4 million in November 2023, respectively.

As for wooden furniture the exported value decreased

from US$52.0 million in November 2022 to US$49.3

million in November 2023, a 5% fall in the total.

Export update December 2023

In December 2023, Brazilian exports of wood-based

products (except pulp and paper) increased 2% in value

compared to December 2022, from US$270.8 million to

US$276.2 million.

Pine sawnwood exports increased 15% in value between

December 2022 (US$45.5 million) and December 2023

(US$52.3 million). In volume, exports increased 30% over

the same period, from 183,700 cu.m to 237,800 cu.m.

Tropical sawnwood exports also increased by 26% in

volume, from 17,500 cu.m in December 2022 to 22,100

cu.m in December 2023. However the value of these

exports decreased 10% from US$10.2 million to US$9.2

million over the same period.

Pine plywood exports rose 16% in value in December

2023 compared to December 2022, from US$43.4 million

to US$50.3 million. In volume, exports increased 22%

over the same period, from 135,600 cu.m to 165,700 cu.m.

Tropical plywood, exports declined in volume 28% and in

value by 8%, from 2,500 cu.m and US$1.2 million in

December 2022 to 1,800 cu.m and US$1.1 million in

December 2023.

As for wooden furniture, the exported value increased

from US$43.9 million in December 2022 to US$45.6

million in December 2023, an increase of around 4%.

Furniture exports - good prospects for 2024

Brazilian exports of furniture and mattresses grew by a

remarkable 10% in November 2023 compared to the

previous month, reaching an amount of US$68.5 million.

ABIMÓVEL (Brazilian Furniture Industry Association)

points out that this positive expansion has led to the view

that there may be better prospects for the furniture industry

in 2024.

An analysis conducted by IEMI reveals that the recent

increase in exports is not only influenced by the dynamics

of the Brazilian and global markets, but is also a direct

reflection of the strategies adopted by the Brazilian

furniture industry which is focused on innovation,

sustainable management and participation in international

events.

Projections for 2024 indicate a relevant cycle for the

Brazilian Furniture Project led by ABIMÓVEL in

partnership with ApexBrasil (Brazilian Trade and

Investment Promotion Agency). With around 150 member

companies exporting to 180 countries, the sector plans to

take part in high-profile events such as the Milan and New

York Design Weeks.

The initiative will focus on actions such as international

fairs and trade missions, highlighting the importance of

keeping up to date with the sector's indicators for effective

planning. The aim is to showcase dozens of Brazilian

brands in exhibitions to promote the best of Brazil.

See:

http://abimovel.com/exportacoes-de-moveis-e-colchoes-ganharam-forca-ao-final-do-ultimo-trimestre-trazendo-melhores-perspectivas-para-o-inicio-de-2024-2/

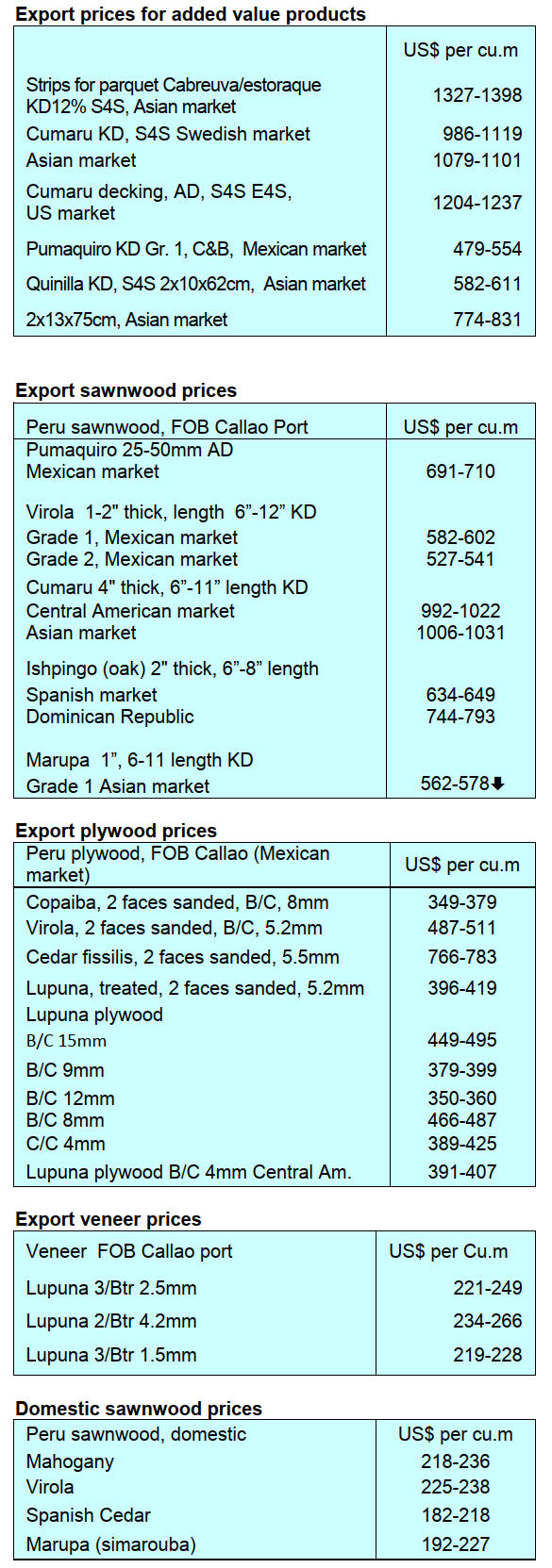

9. PERU

Veneer and plywood

exports disappoint

The Association of Exporters (ADEX) has reported export

shipments of veneer and plywood between January and

November 2023were worth US$2.25 million, a contraction

of 22.5% compared to the same period in 2022 when

exports earned US$2.90 million.

This fall is partly explained by lower demand from

Mexico, the main market in recent years, which went from

US$2.73 million in 2022 to US$1.92 million in 2023, a

drop of almost 30%.

According to data from the ADEX Data Trade

Commercial Intelligence System other export markets

were the Dominican Republic (US$0.19 million), Chile

(US$0.09 million), Ecuador (US$0.02 million) and the

United States (US$0.01 million).

Veneers and plywood represented 2.4% of the total wood

products exported by Peru between January and November

2023.

Action to strengthen forestry development

Representatives of the German Development Bank KfW

and leaders of the Sustainable Productive Forests (BPS)

programme recently met to coordinate a plan to strengthen

forestry development in the region. This initiative seeks to

ensure timely and effective progress of the programme.

The Regional Forestry and Wildlife Management also

participated in the meeting.

The German Development Bank, KfW, which co-finances

the BPS programme which aims to

strengthen the national forest sector with a focus on

sustainability and productivity.

Ucayali is one of the prioritised regions where there is a

focus of the programme because it is has alarge forest area

and a strategic location for the market. The aim is to

consolidate Ucayali as a center of forestry production and

as a timber hub in the Amazon.

At the meeting the BPS coordinator presented the new

heads of the Plantations, Forests and Planning projects.

They will work with regional and local governments. The

heads of the Forests and Planning Projects coordinated to

meet joint goals. In addition, the creation of Forest

Management Units and the acquisition of necessary

technology were discussed.

Training in forest inspection tasks

A group of 30 professionals have were trained to carry out

supervision and control of forest resources through a

specialisation course developed by the Forest and Wildlife

Resources Supervision Agency (OSINFOR) .

OSINFOR plans to train more than 900 professionals in

2024who will be deployed to control action in

approximately 683,592 hectares of forest.

As part of the course the professionals deepened their

knowledge in the supervision and inspection processes and

the use of OSINFOR digital tools and platforms.

See:

https://www.gob.pe/institucion/osinfor/noticias/889618-profesionales-supervisores-fortalecen-knowledges-para-realizar-labores-de-fiscalizacion-forestal-con-el-osinfor

|