|

1.

CENTRAL AND WEST AFRICA

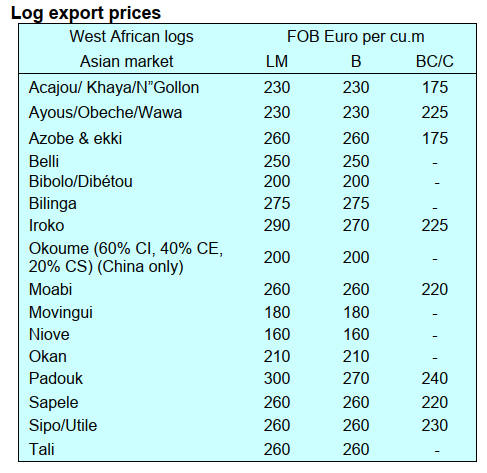

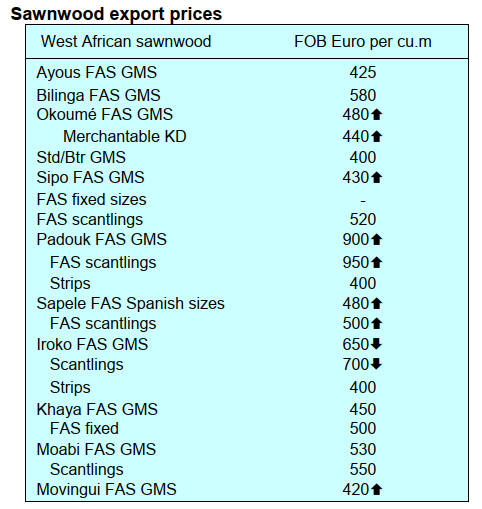

Slow demand in Asian and Middle East markets

Operators in the region report market conditions are not

favourable and that this has led to the closure of some

mills in Gabon and Congo, particularly those operated by

Chinese and Indian companies. Asian and Middle East

markets are experiencing reduced demand particularly for

some prime species such as okoume. The trade hopes for a

revival of business with China and Vietnam after the 10

February New Year celebrations.

Weather conditions improved

Gabon is currently experiencing the dry season which

allows maintenance of the roads but trucking remains

problematic due to damaged bush roads. As Gabon's

timber industry embraces the dry season challenges persist

as log stocks need to be rebuilt.

Similarly, in Cameroon harvesting remains challenging

due to the lingering effects of heavy rain. With the arrival

of the dry season, expected to last until June, forest

operations and trucking will return to normal.

In Congo the dry season has commenced facilitating a

return to harvesting activities. The North experiences a dry

season for six months, mirroring conditions in Gabon, but

parts of the country anticipate rain to return at the end of

February.

Regional round-up

In Cameroon it is the time for businesses to renegotiate

concession agreements, a regular occurrence. While major

timber companies have harvesting concessions some also

acquire a portion of their logs from small scale operators

through the so-called ‘vente de coupe’ system.

See: (https://www.linguee.com/french-english/translation/vente+de+coupe.html).

One observer has said “obtaining a legitimate EUTR

document for such operations will prove challenging due

to the numerous ‘vente de coupe’, many of which lack

clear legal ownership”.

The new government in Gabon is emphasising total

control over institutions, ministries, management, finances

and workforce aiming to eliminate corrupt practices.

The government's initial mandate of 20% expatriates for

operators is impacting production and has been met with

concern. The government, in collaboration with operators,

has adopted a more flexible plan, allowing for a range of

20% to 25% expatriates to address operational needs and

industry concerns.

In related news, the domestic press in Gabon has

reportedAfrica Global Logistic (ex Bolloré) intends to

invest around CFA 20 billion in redevelopment and

modernisation of Owendo Port and Port Gentil.

The announcement was made by AGL's Director General

of Ports and Terminals, Olivier de Noray, during a

meeting with the Prime Minister of the transition

government.

See:

https://www.lenouveaugabon.com/fr/transports-logistique/2212-20232-agl-prevoit-d-investir-20-milliards-fcfa-d-ici-avril-2024-pour-le-reamenagement-des-ports-d-owendo-et-de-port-gentil

Mill production down in third quarter in Gabon

According to data from the Ministry of the Economy

activity in the timber industries in Gabon at the end of the

third quarter of 2023 fell by 17% quarter-on-quarter. The

decline was attributed mainly to the decline in orders from

buyers for the Asian markets. The slowdown was made

worse by difficulties operators had in transporting goods

as the highways were in bad condition.

At the end of the third quarter of 2023 sawmill production

was down 13%, veneer output fell 22% and plywood

producers saw an 8% drop in business compared to the

second quarter of 2023.

See:

https://www.lenouveaugabon.com/fr/agro-bois/1212-20223-industrie-du-bois-la-baisse-des-commandes-asiatiques-fait-chuter-l-activite-au-gabon

Production in Congo is expected to be stable for the next

two months and with a suspension of the log export ban

the export quota system will be reintroduced. However,

the market situation is concerning with low demand,

notably from the Philippines, which is slowing down

purchases of okoume sawnwood. This downturn has

prompted operators to reduce their workforce.

EUDR webinar

ATIBT has announced an open invitation for a webinar on

the EUDR with two objectives: to present the EUDR and

to provide answers to questions and concerns of timber

industry players operating in Central and West Africa. The

webinar will be held online on Thursday 25 January from

8.30am GMT (9.30am Paris time).

Register at:

https://us06web.zoom.us/meeting/register/tZ0oduCprzMoG9YCLYc8Zs4YXIXYfcpaf9YI#/registration

2.

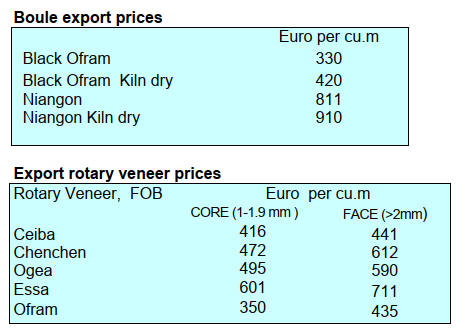

GHANA

Industrialisation through sustainable and

efficient

supply chains

The Association of Ghana Industries (AGI) held its 63rd

Annual General Meeting on the theme ‘Industrialisation

Through Sustainable and Efficient Supply Chains’. The

event gathered over 250 industrialists drawn from all 16

regions who are focused on promoting industrialisation

through sustainable and efficient supply chains.

The AGI president, Dr. Kwesi Humphrey Ayim Darke,

said there is no doubt that we have gone through turbulent

times as an association and as a nation. Despite the

headwinds the resilience to strive on and move forward is

apparent as is our total commitment to an improved

business environment for Industry.

He added “to strengthen our advocacy in that direction,

AGI has been at the forefront of multi-stakeholder

engagements with government; and I am glad our efforts

are yielding results”. Dr. Darke lamented that the

multiplicity of taxes has been a major bane to businesses’

competitiveness.

A guest speaker for the occasion, Silver Ojakol, Chief of

Staff-African Continental Free Trade Area (AfCFTA)

Secretariat, said “the agreement (AfCFTA) was created

for the private sector, not for the technocrats, non-

government officials. Government officials use it as a

policy tool to increase intra-African trade but beyond

intra-African trade there are the areas of investment,

intellectual property, propelling innovation and novel

thinking in our young people and industries”.

Source:

https://thebftonline.com/2023/12/08/agi-bemoans-multiplicity-of-taxes/

Forestry Commission to seek authorisation to export

rosewood

Nyadia Sulemana Nelson, Deputy CEO, of the Forestry

Commission has indicated the Commission will seek

authority from the CITES Secretariat to resume exports of

rosewood in 2024.

In June 2022 CITES members agreed to suspend all

international trade in rosewood from Westand Central

Africa. Before the ban was imposed, there was a rise in

illegal felling and export of this highly sought after

species.

See:

https://www.ghanabusinessnews.com/2024/01/01/ghana-forestry-commission-to-seek-permission-from-cites-secretariat-to-export-rosewood-in-2024/

Legislation allowing mining in forest reserves

challenged

A coalition of Civil Society Organisations (CSOs) has

petitioned the speaker of Parliament, Alban Sumana

Kingsford Bagbin, to annul the Environmental Protection

(Mining in Forest Reserves) regulation, Legislative

Instrument 2462 (L.I.).

The L.I., they argued, allows institutionalised mining in

forest reserves without restrictions, casting a shadow on

the ecological integrity of the country’s forest resources

and commitment to environmental sustainability and

conservation. According to the CSOs, the said legislative

instrument (L.I. 2462) violates the constitution and other

laws that safeguard forests.

Source:

https://thebftonline.com/2023/12/20/csos-petition-speaker-of-parliament-over-l-i-2462-2/

3. MALAYSIA

2023 GDP growth target

attainable

The indications are that Malaysia is set to achieve its 2023

GDP growth target of 4% to 5% given the positive growth

momentum according to the Statistics Department. The

Chief Statistician said consumer spending tends to be

above average in the fourth quarter which gives a final

boost to growth.

In other news, it was reported that the trade surplus

reached RM12.87 bil. in October marking the 42nd

consecutive month of trade surplus since May 2020.

Certification Council briefing on EUDR

The Malaysian Timber Certification Council (MTCC) has

reported on a briefing session for PEFC Chain of Custody

(CoC) certificate holders under the Malaysian Timber

Certification Scheme (MTCS).

The event served to update attendees on the current status

of MTCS implementation, explore the revised PEFC CoC

Standard and address concerns regarding the European

Union Deforestation Regulation (EUDR).

The briefing provided an overview of progress made in

implementing the MTCS, highlighting key achievements

and ongoing initiatives.

This included updates on the latest PEFC Chain of

Custody standard, PEFC Trademarks standard and MTCS

documents. MTCC highlighted the transition to the PEFC

ST 2020 by 31 December 2023. Any certificates that have

not fully transitioned by 1 January 2024 will automatically

be updated to “expired” on the PEFC database.

The most anticipated topic of the day was the update on

the EUDR. The regulation places strict reporting

obligations on companies placing wood products on the

EU market. MTCC reassured attendees that they are

working closely with PEFC to ensure MTCS-PEFC

certified timber products originating in Malaysia comply

with EUDR requirements. MTCC has committed to

disseminate the latest EUDR update to all stakeholders

through various communication channels and to

participate and contribute to the Task Forces related to

EUDR.

See:

https://mtcc.com.my/mtcc-updates-pefc-coc-holders-on-implementation-progress-and-eudr/

Environmental Compliance Audit

The November issue of the Sarawak Timber Association

(STA) Review reports on participation of STA members in

two pilot projects on an environmental compliance audit

(ECA). The Natural Resources and Environment Board

(NREB) and STA jointly organised a workshop to revisit

and refine findings from the pilot projects with the

objective of enhancing the Guidelines for the Natural

Resources and Environment (Audit) Rules, 2008 (NRE

(Audit) Rules, 2008) and ultimately facilitating the full

implementation of the Rules.

STA and NREB have been working for some time now,

through many training sessions, to get STA members

ready for full implementation of the NRE (audit) Rules.

Over the years of training, 112 internal environmental

auditors and 95 personnel in environmental quality

monitoring were trained.

The NRE (Audit) Rules, 2008 was formulated to compel

project proponents to undertake internal ECAs, thus

enhancing accountability in adhering to Environmental

Impact Assessment (EIA) Terms and Approval

Conditions.

The pilot projects reported that the majority of

stakeholders acknowledged that ECA had improved

environmental stewardship among project proponents,

contributing to improved compliance with EIA terms and

approval conditions. Notwithstanding that, issues such as

frequency of internal and external ECA and professional

audit fees were common throughout the pilot projects.

The group of participating companies urged the NREB to

develop a transparent fee structure matrix to effectively

streamline and clarify the charges involved in ECA,

ensuring that the companies’ transition towards self-

regulated compliance is not hindered by high costs.

Additionally, workshop participants also evaluated the

suitability and applicability of terms and conditions

outlined in the EIA approvals for both natural forests and

planted forests, with the aim of ensuring clarity and a

consistent understanding among different auditors.

See:

https://sta.org.my/images/STAReviewNov23.pdf

Sawn rubberwood export quota

The Ministry of Plantation and Commodities has approved

the sawn rubberwood export quota for 2024 at 50,000

cu.m. In connection with this all registered exporters are

encouraged to apply for a sawn rubberwood export quota.

The approval of the export quota is subject to MTIB's

management mechanism.

See:

https://www.mtib.gov.my/pengumuman/kuota-eksport-kayu-getah-bergergaji-2024

Malaysian International Furniture Fair

The Malaysian International Furniture Fair (MIFF) is

preparing for its 30th anniversary event scheduled for

March 1-4, 2024. The Fair, known for its significant

presence in the global furniture trade, has opened visitor

registration for the upcoming event.

This year's Fair is set to take place at the Malaysia

International Trade and Exhibition Centre (MITEC) and

World Trade Centre Kuala Lumpur (WTCKL). Over 650

exhibitors, both local and international, are expected to

participate, showcasing a wide array of trends, designs and

products.

See:

https://www.furninfo.com/furniture-industry-news/23175

4.

INDONESIA

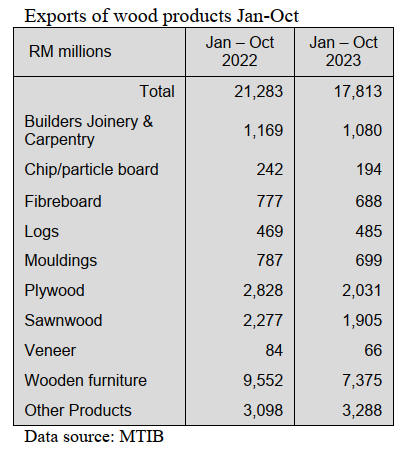

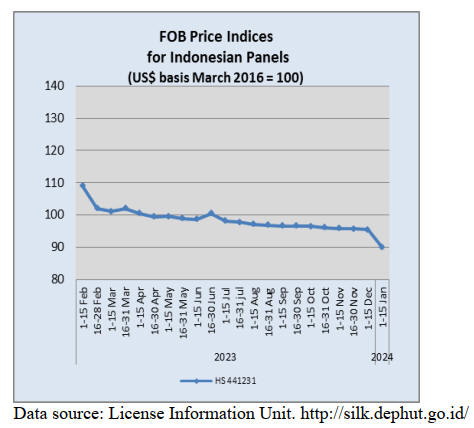

Export benchmark prices

for January 2024

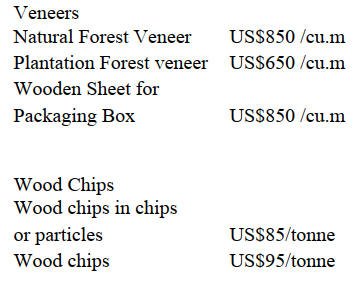

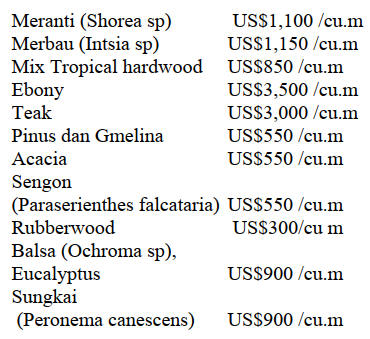

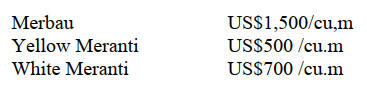

The following prices apply for the period from 1 January

to 31 January 2024.

Processed Wood

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1000 sq.mm to

4000sq. mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all

four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 4000 sq.mm to

10000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

See:

https://jdih.kemendag.go.id/pdf

Sustainable forest management yields positive results

Acting Director General for Sustainable Forest

Management at the Ministry of Environment and Forestry,

Agus Justianto, said in a statement the sustainable

management of forests throughout 2023 achieved several

positive results including maintaining the productivity of

forest to ensure the sustainability of forestry businesses.

Besides productivity, the accelerated implementation of

the multi-forestry business model also helped make forest

management increasingly inclusive by involving the

community.

Agus reported in 2023 planting and enrichment were

carried out on 667,780 hectares of the forest areas. The

figure was far above the target of 428,000 hectares. He

further disclosed that log production reached 58.13 million

cubic metres or 102% of the target.

He said "most log production comes from plantation

forests (89%) while from natural forests 7% comes from

BUMN Perhutani. In addition to timber the production of

non-wood forest products such as rattan, agarwood, latex

and bamboo also increased.

See:https://en.antaranews.com/news/

Investment in forestry rose in 2023

The Ministry of Environment and Forestry (KLHK)

recorded a growth of US$331 million in investment in the

forestry sector in 2023. Agus Justianto said that the

investment in the forestry sector exceeded the upstream

sector investment target which was US$107 million.

Agus explained that an investment of US$196 million for

the upstream sector namely Forest Utilization Business

Licensing (PBPH)/ Forest Concession Holder. Meanwhile,

downstream investment under the Forest Product

Processing Business Licensing (PBPHH) scheme reached

US$202.47 million.

The Ministry claimed that the growth in forestry sector

investment is aligned with good forestry governance. One

of the ways this was achieved was through information

systems which promote transparency in bureaucratic

processes. This helps to prevent high costs and ensures

accountability.

The information systems include the Forest Product

Administration Information System (SIPUHH), Timber

Legality Information System (SILK), Forest Product Raw

Material Fulfillment Plan Information System (SI

RPBBHH) and Online Single Submission (OSS).

See:https://emitennews.com/news/

and

https://www.msn.com/id-id/berita/

Association calls for SVLK promotion in international

markets

The Association of Indonesian Forest Concession Holders

(APHI) is hoping for more promotion of the Legality and

Sustainability Verification System (SVLK) in international

markets. Indroyono Soesilo, the chairperson of APHI, said

the SVLK system has gained worldwide recognition as a

reliable means of ensuring that the wood products

purchased are derived from sustainably managed forests.

The implementation of SVLK indirectly supports

Indonesia's Forestry and Other Land Uses (FoLU) Net

Sink 2030 by reducing the occurrence of deforestation and

illegal logging while simultaneously expanding the legal

timber market, he added.

Krisdianto, the Director of Forest Product Processing and

Marketing Development at the Ministry of Environment

and Forestry, stated that rebranding and strengthening the

SVLK is a strategic step in ensuring the legality and

sustainability of wood products. This is particularly

important as many countries are now implementing

regulations to ensure that imported wood products come

from sustainably managed forests and not from areas

deforested or degraded.

See:https://investor.id/business/350095/pengusaha-hutan-dukung-promosi-svlk-di-pasar-global

and

https://forestinsights.id/

Special economic zone for wood industry planned

The government plans to build a special economic zone

(SEZ) for the wood industry to improve the

competitiveness of Indonesian timber and furniture

products.

The chairman of the Sedulur Wood and Furniture

(Sekabel) Association, Setyo Wisnu Broto, said a special

economic zone for the wood industry is necessary as

Indonesia is losing international market share to Vietnam.

At a meeting with President Joko Widodo, Broto raised

several issues such as the challenges faced by the industry

as well as the challenge in meeting the requirements of the

EUDR. No details are available on which area will be

chosen for the wood industry SEZ as 30 potential locations

had been proposed.

See:

https://en.antaranews.com/news/302025/

and

https://economy.okezone.com/read/2023/

Furniture exports declining

The Indonesian Furniture and Crafts Industry Association

(HIMKI) reported a 28% year on year decline in furniture

exports in 2023 due to geopolitical tensions and high

inflation in export markets. Abdul Sobur, chairman of

HIMKI, stated that another contributing factor to the

decline in exports was the high price of domestic raw

materials.

Despite the decline in exports, Sobur is optimistic about

growth in the furniture and crafts industry but suggested

that the government's export target of US$5 billion in 2024

may need to be adjusted. “We are optimistic about the

future of Indonesia's furniture and craft industry.

Indonesia has the potential to become the world's

largest

producer,” he added.

See:

https://ekonomi.bisnis.com/read/

https://tubasmedia.com/nilai-ekspor-industri-mebel-indonesia-periode-2023-anjlok/

Forest entrepreneurs target Middle East market

Indonesian forestry businesses are looking to expand

markets in the Middle East by establishing a hub in Dubai.

According to Indroyono Soesilo, Chair of the Indonesian

Forestry Community Communication Forum (FKMPI) and

General Chair of the Association of Indonesia Forest

Concession Holders (APHI), export opportunities for

Indonesian forest products in in the region are immense

and that Dubai is perfect as a hub for the Middle East and

global markets.

In early December Indroyono, along with administrators

from FKMPI and APHI, held a meeting with the Fakih

Group of Companies, one of the largest in Dubai. The

meeting was made possible with the help of the Indonesian

Consul General for Dubai, Candra Negara and the

Indonesia Trade Promotion Center (ITPC) in Dubai. The

Fakih Group is constructing 50 hotels in the UAE and 40

hotels/apartments in Jeddah and they require a steady

supply of plywood, mouldings wood and furniture.

See:

https://forestinsights.id/pengusaha-hutan-indonesia-incar-pasar-timur-tengah-lewat-dubai/

Information system to boost performance

The Ministry of Industry hopes that the interconnection of

the foresy product information system with the Ministry of

Environment and Forestry (KLHK) will spur the

performance of the processed wood industry and national

furniture industry.

The Ministry of Industry agreed to exchange data between

the Ministry of Environment's Sustainable Forest

Management Information System (SIPHL) and the

Ministry of Industry's National Industrial Information

System (SIINas) with the facilitation of the Coordinating

Ministry for Maritime Affairs and Investment (Kemenko

Marves).

The Director General of Agro Industries at the Ministry of

Industry, Putu Juli Ardika, stated that the interconnection

between SIPHL KLHK and SIINas Ministry of Industry

will provide benefits to the government as policy makers

and also to wood industry players both in the upstream and

downstream sectors.

See:https://voi.id/en/economy/339642

Norway continues contribution to FOLU Netsink

for

Indonesia

Indonesia and Norway have agreed to continue

cooperation in reducing deforestation. Norway will

continue its US$100 million contribution to deforestation

reduction performance.

The signing of the commitment to continue the

contribution arranged by the Director of the Indonesian

Environmental Fund Management Agency, Joko Tri

Haryanto together with the Norwegian Ambassador to

Indonesia Rut Kruger Giverin and witnessed by the

Minister of Environment and Forestry, SitiNurbaya.

Minister Siti said that this addendum to the earlier

agreement is a huge achievement and was based on

verification of emission reductions from 2017–2018 to

2018–2019. Indonesia’s FOLU Net Sink 2030 Operational

Plan is also a reference and orientation for Norway in

providing support to Indonesia because 60% of emissions

come from the FOLU sector.

See:https://asiatoday.id/read/norway-

and

https://ppid.menlhk.go.id/berita/siaran-pers/7548/

5.

MYANMAR

More challenges than opportunities

Significant challenges lie ahead in 2024 for both the

timber trade and forest conservation, primarily arising

from political developments since February 2021. The

military's refusal to convene parliament and allegations of

election fraud triggered months of widespread protests.

Many sought refuge in remote forest areas engaging in

armed conflict against the military-led State

Administration Council (SAC).

Although the ‘Prime Minister’ occasionally outlined

plans

for future elections to restore civilian governance, analysts

cast doubt on the likely holding of elections in the near

future.

The forestry sector is not immune to challenges. Even

before 2021, exporters of timber faced legality issues with

the many countries and agencies asserting that Myanmar

failed to meet international legality verification

requirements even at the first step of the harvesting.

Despite recognised reform efforts by major stakeholders

such as Forest Department and the Myanma Timber

Enterprise this has not proven sufficient for access to be

granted to major markets.

Forest conservation was prioritised from 2011 to 2020

under two civilian governments and the SAC continued

this by extending the logging ban until 2023. However,

due to expanding conflict areas, some forests have become

inaccessible posing challenges to forest governance and

log harvesting.

Harvesting from the northern natural forests is no longer

possible and this has led to a decline in teak log

availability. Millers with log stocks from earlier harvests

have attempted to meet the limited market demand.

Simultaneously, there's a lack of new orders for teak

products from the EU and USA, primarily due to sanctions

against the Myanma Timber Enterprise, the sole supplier

of logs to millers.

Despite timber from both government and private

plantations being allowed for export, there are no signs of

log exports from private plantations. It is assumed that this

is due to the private plantations being too young for

harvest as most were planted around 2006. Harvestable

timber from government plantations is traded only by the

Myanmar Timber Enterprise which is subject to

international sanctions.

To tackle concerns related to legality and sustainability the

Myanmar Forest Certification Committee (MFCC) has

prioritised forest certification for private plantations. As

indicated on their website the MFCC is actively

addressing the accreditation issue for Certification Bodies

under both the Myanmar Forest Certification Scheme

(MFCS) and Myanmar Timber Legality Assurance System

(MTLAS).

Despite the 2021 suspension of the PEFC-Endorsement

process MFCC is making efforts to certify private

plantations under the MFCS. However, promoting

products from private timber plantations poses an

additional challenge, particularly in competing with other

producing countries in Asia, Latin America and Africa.

Taking all current aspects into account the future of forest

conservation and the timber trade presents more severe

challenges than favorable opportunities for 2024.

Steep decline in border trade

The value of Myanmar’s border trade, which accounts for

the majority of the country’s foreign trade, dropped by

over US$100 million in the first nine months of the current

fiscal year compared to the same period of the previous

fiscal year, according to data from the Ministry of

Commerce. Myanmar’s border trade fell with all five of its

neighbours China, Thailand, Bangladesh, India and Laos.

With the exception of China, Myanmar’s imports from

those countries have also steadily declined.

See:

https://www.irrawaddy.com/news/burma/myanmar-border-trade-falls-100-million-in-april-december-amid-clashes.html

New Time Frame for depositing export earnings

The Central Bank of Myanmar (CBM) has ordered

exporters shipping goods outside Asia to deposit foreign

earnings in local banks within 90 days, up from a previous

requirement to do so within 60 days. Companies exporting

within Asia must deposit their earnings within 45 days

instead of 30 days.

Widespread international sanctions are affecting trade and

the private sector faces a significant challenge in accessing

foreign currency given the increasing pressure on foreign

reserves.

See:

https://www.thestar.com.my/aseanplus/aseanplus-news/2023/12/26/myanmar-central-bank-sets-new-timeframe-for-exporters-to-deposit-earnings

New ASEAN envoy appointed

Laos, the current chair of the Association of Southeast

Asian Nations (ASEAN), has appointed a veteran

diplomat as its special envoy to Myanmar ahead of the

bloc’s foreign ministerial retreat in Luang Prabang later

this month.

It has been reported that Lao Foreign Minister,

Saleumxay

Kommasith, appointed Alounkeo Kittikhoun, a former

Vice Minister for Foreign Affairs, as special envoy.

Alounkeo is charged with pushing forward ASEAN’s

Five-Point Consensus Peace Plan which calls for the

immediate cessation of violence and inclusive political as

well as the provision of humanitarian aid to populations in

need.

See:

https://www.irrawaddy.com/news/myanmars-crisis-the-world/asean-envoy-from-laos-visits-myanmar-junta-chief.html

and

https://thediplomat.com/2024/01/asean-chair-laos-appoints-special-envoy-on-myanmar/

6.

INDIA

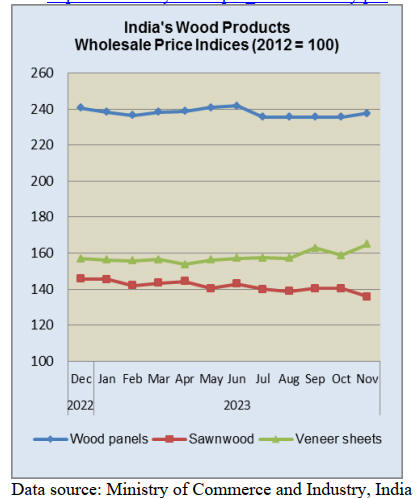

Veneer and plywood price

indices move higher

The annual rate of inflation based on all India Wholesale

Price Index (WPI) in November was 0.26 compared to

minus 0.52% recorded in October 2023. The positive rate

of inflation in November 2023 was primarily due to

increases in prices of food, minerals, machinery and

equipment, computers, electronics and optical products,

motor vehicles, other transport equipment and other

manufactured products.

The index for manufacturing increased to 140.4 in

November 2023 from 140.3 in October. Out of the 22 NIC

two-digit groups for manufactured products prices in 8

groups increased, 10 groups decreased ands 4 groups

remained unchanged. Some of the groups for which prices

increased were other manufacturing, manufacture of food

products, trailers and semi-trailers, fabricated metal

products except machinery and equipment, wood and of

products of wood and cork.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Consumers looking for quality and reliability

The Indian economy is expanding fast and consumers with

greater disposable incomes are now looking for quality

products. Wood products such as particleboard, MDF,

plywood and many other items are being imported from

China, Vietnam, Thailand, Indonesia and Europe.

At present these products do not carry the Indian

Standards Institute (ISI) mark but this will soon be

mandatory. The implementation of the new Bureau of

Indian Standards (BIS) is coming and is likely to create

challenges for exporters. If overseas shippers cannot

secure the ISI mark it is anticipated there will be an

increase in demand for domestic products.

For the past two and a half months extensive discussion

across various timber sectors in India involving

associations, manufacturers and importers have been

conducted and overseas manufacturers, Indian and foreign

have started applying for ISI recognition.

According to the BIS, the new Standard requirements will

come into force on 24 February 2024. Of the roughly

3,800 wood processing mills in the formal sector only a

third have, as of 15 January 2024, concluded the process

to secure BIS certification.

Many are asking what will be the situation with the large

number of domestic industries which do not have an ISI

mark for their products? Will they be able to sell their

products? What will happen to overseas shippers of

products if they don’t get certification before the time

limit?

Plyreporter has said BIS officials are visiting various

manufacturing clusters to assist with the process of

obtaining ISI marks. Plyreporter suggests foreign

companies will typically require at least 6 months to

complete the certification process. Analysts anticipate a

shortage of imported products in the market and it remains

to be seen whether the certification period for international

suppliers will be adjusted.

The Federation of Indian Plywood and Panel Industry

(New Delhi), the largest plywood federation, has written a

letter to the Joint Secretary in the Ministry of Commerce

and Industry.

The letter includes a request for extension of

implementation of the new requirements for woodbased

panels, plywood and wooden flush doors, shutters and

resin treated compressed wood Laminate products. The

Federation says the Indian plywood manufacturing sector

has many SMEs and MSMEs with very few large players.

The small manufacturers cater to the lower segment of the

market and the product is mainly a ‚use and throw‘

product and that this segment is largely unregulated in

terms of Standards.

The Federation recommends developing Indian standards

for utility grade products for manufactures who are unable

to meet the criteria set in the new Standards. The

Government is yet to respond to the Federation.

Approximately 1,500 containers of panel products and

decorative materials come to India from different

countries. So an up-tick is expected in the demand for

domestic products, if the domestic players are ready there

is a big opportunity for them to seize.

See:

https://www.plyreporter.com/article/153778/imported-panel-products-supply-may-affect-post-bis-qco

Nature-based products for government projects

To advance ‘Green Building‘ attributes and the ‘Green

Rating for Integrated Habitant Assessment‘ ratings the

Indian Council of Forestry Research and Education

(ICFRE) has suggested the promotion of woodbased and

bamboo-based components in building projects undertaken

by the Government.

In a letter to the Chief Engineer, Civil Construction Unit

of MoEFCC, the Director-General of ICFRE suggested

that it would be desirable for the Government of India to

lead by example when it comes to building projects and

adopt best practice with regards to nature-based products

and solutions.

7.

VIETNAM

Wood and wood product (W&WP) trade highlights

W&WP exports in December 2023 are estimated at

US$1.25 billion, up 2.4% compared to November 2023

but down 4.7% compared to December 2022. In particular,

WP exports are estimated at US$872 million, up 0.5%

compared to November 2023 but down 0.2% compared to

December 2022.

In 2023 total W&WP exports were valued at

US$13.4 billion, down 16.5% compared to 2022.

Of this, WP exports are estimated at US$9.1

billion, down 17.5% compared to 2022.

W&WP exports to the EU market in December

2023 amounted to US$52 million, down 26.8%

compared to December 2022.

In 2023 W&WP exports to the EU market

totalled at US$447.2 million, down 31.8%

compared to 2022.

In December 2023 woodchip exports earned

US$170 million, down 24.5% compared to

December 2022.

Overall in 2023, wood chip exports contributed

US$2.2 billion, down 18.5% compared to 2022.

In December 2023 Vietnam spent US$200

million for W&WP imports, down 1.2%

compared to November 2023 and down 3.2%

compared to December 2022.

Overall in 2023, W&WP imports stood at

US$2.186 billion, down 27.8% compared to

2022.

Vietnam's imports of poplar wood in December

2023 were 30,600 cu.m worth US$11.6 million,

up 1.5% in volume and 1.2% in value compared

to November 2023. Compared to December

2022, it increased by 42% in volume and 45.5%

in value. Overall, in 2023, poplar imports

amounted to 324,400 cu.m, worth US$ 131.9

million, down 11.9% in volume and 26.2% in

value compared to 2022.

Vietnam’s imports of raw wood (Logs and

sawnwood) from Africa in November 2023

reached 64,690 cu.m with the value of US$25.10

million, up 23.4% in volume and 30.3% in value

compared to October 2023 but down 51.9% in

volume and 51.3% in value compared to

November 2022.

Overall, in the first 11 months of 2023, imports of raw

wood from Africa reached 675,045 cu.m, at a value of

US$264.35 million, down 43.4% in volume and 40.5% in

value over the same period in 2022.

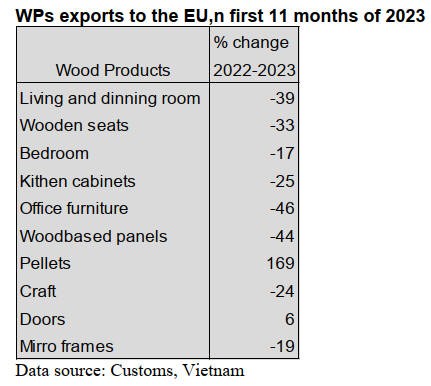

2023 W&WP exports to the EU decreased sharply

December 2023 W&WP exports to the EU fell 26.8%

compared to December 2022. In 2023 W&WP exports to

the EU totalled US$447.2 million, down 31.8% compared

2022. With the EU economic stagnation in 2023

demand for non-essential commodities including W&WPs

dropped significantly.

In 2023 wooden furniture accounted for 77% of total

W&WP exports to EU contributing US$306.7 million,

down 34.6% compared to 2022. Wooden living and dining

room furniture sub-groups earned,US$137.4 million, down

1%; wooden-frame seats US$112.1 million, down 33%,

bedroom furniture US$35.3 million, down 17.3%.

According to Eurostat the value of EU wooden furniture

imports in the first nine months of 2023 reached 5 million

tonnes, worth EUR16.6 billion (US$18.4 billion), down

8.5% in volume and 10.6% in value against the same

period in the previous year.

Despite facing many difficulties in demand and new

regulations in the market the EU is still an important

export markets for Vietnamese wood and wood products

and has a more room for development.

In the first 11 months of 2023 W&WPs exports from

Vietnam to France accounted for US$90 million of EU

imports, down 23.8% over the same period in 2022

followed by the Germany, down 47.9%, Netherlands,

down 18.8%, Belgium, down 41.1% and Spain down 9.8%

Wood chip exports declined in 2023

In December 2023 woodchip exports were valued at

US$170 million, down 24.5% compared to December

2022. In 2023 woodchip exports reached US$2.2 billion,

down 18.5% compared to 2022.

In the first 11 months of 2023 China was the top market

for chips consuming US$1.3 billion of woodchips from

Vietnam, down 23.8% over the same period in 2022 and

accounting for 64% of Vietnam’s total woodchip exports.

Next to China, Japan purchased chips worth US$562

million, down 11.4% over the same period in 2022, S.

Korea US$80.6 million, down 6.5%, Indonesia US$59.7

million, up 648%, Taiwan P.o.C US$10 million, down

41.5%.

With newly established paper mills in Guangxi and Fujian

China’s woodchip demand for pulp and paper production

is expected to grow further. Vietnam, with the advantage

of short transportation distance aims to take advantage of

this demand.

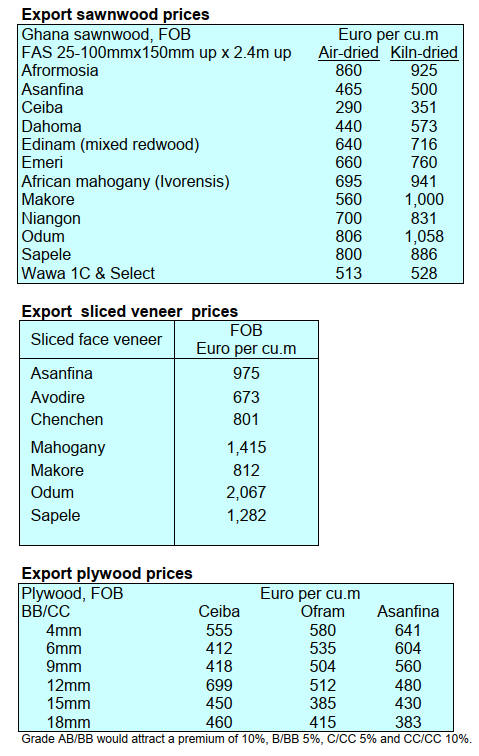

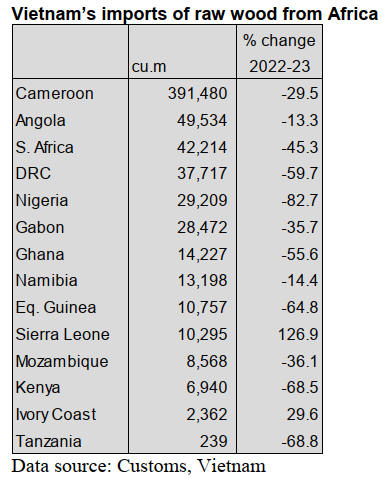

Sawnwood imports from Africa

In November 2023 Vietnam imported 64,490 cu.m of raw

wood (logs and sawnwood) from Africa with a value of

US$25.10 million, up 23.4% in volume and 30.3% in

value compared to October 2023 but down 52% in volume

and 51% in value compared to November 2022.

In the first 11 months of 2023 imports of raw wood from

Africa reached 675,040 cu.m with a value of US$264.35

million, down 43.4% in volume and 40.5% in value

compared to the same period in 2022.

In 2023 there was a decline in domestic wood

consumption. The downturn in the real estate market is

said to be the major reason behind the dropped in raw

wood imports. In 2024, the real estate market is forecast to

recover. However, as Vietnam is reinforcing its control

over tropical hardwood imports to assure timber legality,

imports of raw wood from Africa will remain low.

African timber suppliers

Cameroon was the top supplier of tropical hardwood to

Vietnam in November 2023 reaching 36,470 cu.m at a

value of US$16.60 million, up 18.3% in volume and

31.1% in value compared to October 2023 but down

54.1% in volume and 50.7% in value compared to

November 2022.

Overall, in the first 11 months of 2023, imports of raw

wood from Cameroon reached 391,480 cu.m at a value of

US$171.28 million, down 29.5% in volume and 27.1% in

value over the same period in 2022.

In November 2023 wood imports from Angola, as second

top supplier, decreased by 12.7% in volume and 15.8% in

value compared to October 2023, reaching 2,800 cu.m

with a value of US$729,000.

Over the first 11 months of 2023 imports from Angola

reached 49,530 cu.m with a value of US$13.19 million,

down 13.3% in volume and 10.8% in value over the same

period in 2022.

Categories of imported wood

In November 2023 imports of raw wood from Africa

increased due to an increase in sawnwood imports

compared to October 2023. In contrast, imports of logs

fell.

Over the first 11 months of 2023, sawnwood imports from

Africa reached 322,720 cu.m, with a value of US$125.69

million, down 32.0% in volume and 31.3% in value

compared to the same period in 2022.

The average price of imported sawnwood in November

2023 stood at US$382 per cu.m, up 8.7% from October

2023 but down 4.3% from the same period in 2022.

Overall, for the first 11 months of 2023, the average

import price of sawnwood from Africa stood at US$389

per cu.m, up 1.1% from the same period in 2022.

Imports of padouk sawnwood in November 2023

increased by 45.2% in volume and 43.0% in value

compared to October 2023, while that of pachy was up by

230.6% in volume and 435.6% in value.

Over 11 months of 2023 imports of sawn padouk wood

decreased 16.2% in volume. Pachy sawnwood imports

decreased by 55.3% in volume and 55.6% in value.

In November 2023, tali imports soared by 81.0% in

volume and 67.4% in value compared to October 2023,

but were down by 27.9% in volume and 35.1% in value

compared to November 2022.

Over the first 11 months of 2023, tali remained the top

imported sawnwood from Africa reaching 154,040 cu.m at

a value of US$69.40 million, down by 12.1% in volume

and 9.3% in value year on year.

Log mports of logs from Africa to Vietnam in November

2023 reached 26,710 cu.m, at a value of US$10.61

million, down by 14.1% in volume and 10.0% in value

compared to October 2023 and down by 65.2% in volume

and 62.8% in value compared to November 2022.

The average import price of logs from Africa in November

2023 stood at US$397 per cu.m, up 4.8% against October

2023 and up 7.0% compared to November 2022.

In the first 11 months of 2023, the average import price of

logs stands at $393 per cu.m, up 8.2% from the same

period in 2022.

In November 2023, imports of tali, pachy and sapele wood

dropped against previous the month. In contrast, imports

of mukulungu, teak and eucalyptus soared.

Over the 11 months of 2023 imports of most logs from

Africa fell against the same period in 2022.

2024 will be challenging for Vietnam's wood sector

2024 is forecast to remain challenging for the wood

industry given several issues affecting the sustainability of

production and export. Statistics from the Ministry of

Agriculture and Rural Development show that the sector’s

exports reached US$14.39 billion last year, down 15.8 per

cent year-on-year.

Major export markets have increasingly strict regulations

on product legality and sustainability. Specifically, the EU

Deforestation Regulation (EUDR) requires products

imported into this market to prove legality,origin and that

they have not added to deforestation or forest degradation.

Along with the EU, many other markets have also set new

and strict policies causing many difficulties for wood

exports. The US market requires an increase in the

frequency of investigations applying trade remedies to the

industry and also compliance with labour and employment

regulations. Japan also requires wood products to have

sustainability certificates.

German importers require Vietnamese exporters to

provide additional certificates related to product origin,

employment status, wages, waste treatment and other

related certificates. Meanwhile, Canada currently tends to

put forward more environmental regulations in its product

design, manufacturing and marketing strategies.

Recently, the Canadian Government published a

regulatory framework to establish mandatory requirements

for recycled content and labelling for plastic products

which will impact most of Vietnam’s export commodity

groups, from consumer goods packaging to other key

export sectors.

See:

https://vietnamnet.vn/en/2024-remains-challenging-for-wood-sector-experts-2234673.html

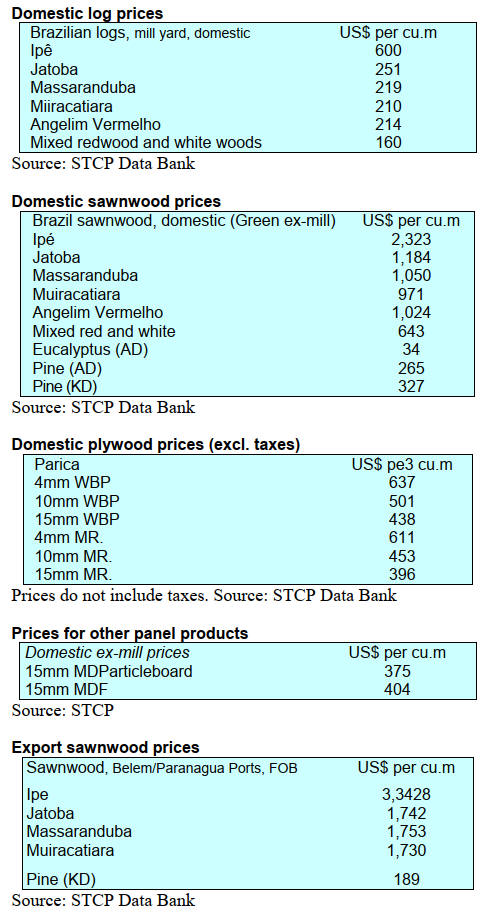

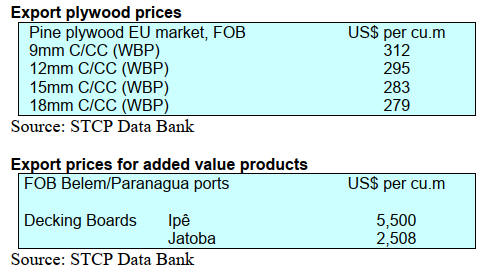

8. BRAZIL

Businesses in Mato Grosso

prepare for 2024

During the Ordinary General Meeting (OGM) of industrial

entrepreneurs from the forest sector hosted by

SINDUSMAD (Union of Timber Industries in the North

of the State of Mato Grosso) goals for 2024 were

discussed and the performance in 2023 were evaluated.

CIPEM (Center for Timber Producing and Exporting

Industries of Mato Grosso State) presented the programme

and events planned to promote the production potential of

the forest sector in Mato Grosso to expand national and

international trade in forest products.

Initiatives such as the 5th edition of Forest Day scheduled

for the first half of 2024 were highlighted. This event will

demonstrate activities in a Sustainable Forest Management

area including the process of conserving native vegetation,

harvesting, wood transportation, sawmilling and

production of finished forest products. In addition,

participation in international fairs in France and Brazil are

planned to showcase the potential of timber produced in

the State.

It was reported that the forest sector has made significant

progress such as the inclusion of a credit line for

sustainable forest management in the Federal

government's Safra Plan 2023/2024, launched in June

2023. Financing for forest resource management is

provided for in the RenovAgro Programme for a period of

up to two years at interest rates of around 7% per year.

Work on the’ Safe Base’ project focused on worker health

and safety was also reported.

See:

https://cipem.org.br/noticias/expansao-de-mercado-para-produtos-florestais-de-mato-grosso-sera-fortalecida-em-2024

Environmental challenges addressed during COP 28

Discussions at COP 28 in 2023 highlighted the need for a

collaborative approach to conserve biodiversity and

mitigate the environmental impacts of human activities on

the environment. Representatives from the forest sector in

Mato Grosso State stressed the importance of

differentiating between legal and illegal deforestation and

pointed out the National Institute for Space Research

(INPE) identifies areas destined for production activities.

The forest sector supports the crucial role of sustainable

forest management SFM in preservation, generating goods

and services and promoting local socio-economic

development.

INPE reported that in just one year the state of Mato

Grosso lost approximately 2,086 km² of forest and

emphasised that SFM is emerging as a powerful solution.

With a total area of 4.7 million hectares of managed

forests in private areas a SFM strategy not only preserves

the designated areas but also generates goods and services.

The forest sector of Mato Grosso state reiterated its

commitment to sustainable practices, investment in

monitoring technologies and engagement in initiatives to

expand areas under SFM offering a balanced approach

between conservation and sustainable development.

See:

https://simenorte.com.br/noticias/cop-28-desafios-ambientais-em-mato-grosso/

Promoting furniture exports to Peru

Peru, with its diversified economy and GDP growth of

8.7% in 2022, is a promising market for the Brazilian

furniture industry. The sectoral project ‘Brazilian

Furniture’, an initiative of ABIMÓVEL (Brazilian

Furniture Industry Association) in partnership with

ApexBrasil (Brazilian Trade and Investment Promotion

Agency), aims to reverse the decline in wood product

exports to Peru by bringing together buyers and partners in

the region.

Although Peru has a diversified economy and is the fifth

largest in Latin America, the Study of Opportunities for

the Brazilian Furniture and Mattress Exporter - Target

Country: Peru, highlights challenges in Peru's economic,

cultural, consumer and logistical infrastructure requiring

assertive strategies for the expansion of Brazilian

companies.

The Peruvian market, with furniture consumption at

US$511 million in 2022, is mainly fueled by imports

(37.9% of the market) representing an opportunity for the

Brazilian industry. Although Brazil is the second largest

supplier the 25% drop in exports between 2018 and 2022

indicates the need for action and innovation.

ABIMÓVEL highlighted the importance of a diversified

product mix and quality given the growing demand for

stylish and comfortable furniture. Marketing and sales

strategies adapted to the local market, the influence of e-

commerce and a preference for cost-effectiveness and

recognised brands are crucial for the successful presence

and expansion of Brazilian companies in Peru.

See:

http://abimovel.com/exportacoes-brasileiras-de-moveis-e-colchoes-para-o-peru-podem-crescer-ate-67-nos-proximos-anos/

ABIMCI/PEFC discuss certification and EUDR

In early December 2023 ABIMCI (Brazilian Association

of the Mechanically Processed Timber Industry) hosted a

meeting with representatives of PEFC International along

with representatives of FIEP (Federation of Industries of

Paraná State) to discuss optimising forest certification for

small forest owners.

ABIMCI stressed the importance of collaboration and

exchange of information to better understand the new

market regulations especially the EUDR. Representatives

from PEFC International said the PEFC Standards address

aspects of protecting forests and halting deforestation,

addressing climate change and protecting sustainable

livelihoods which is at the core of the EU Timber

Regulation and that PEFC is committed to achieving

alignment with the EUDR through Standard adjustments.

PEFC shared data on its global presence in 56 countries

reporting that as of September 2023 more than 288 million

hectares of forest was PEFC certified (80% of global

forests, of which Brazil accounts for 35%) excluding

Russia and Belarus.

Source: ABIMCI News December 2023

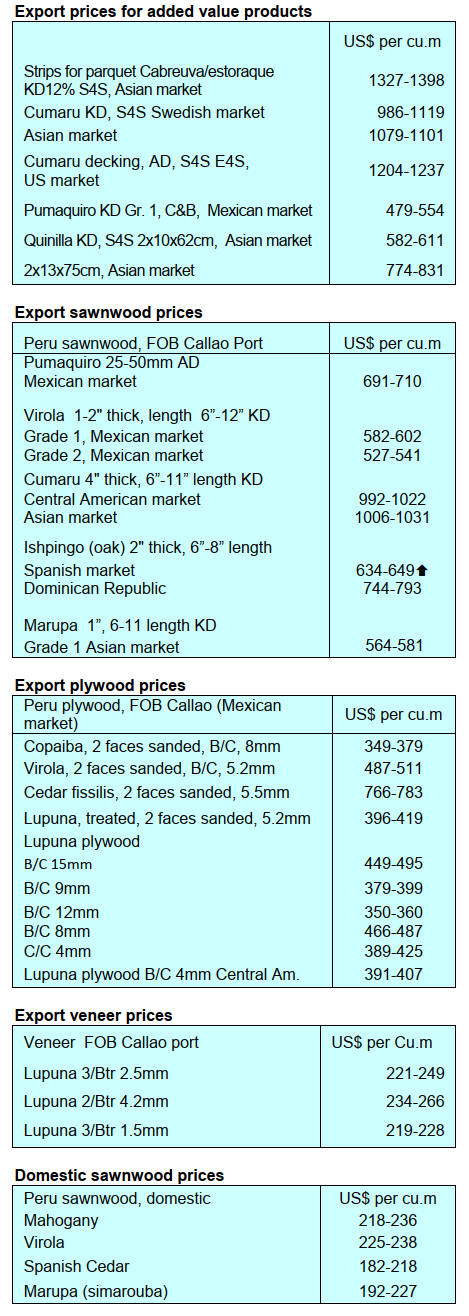

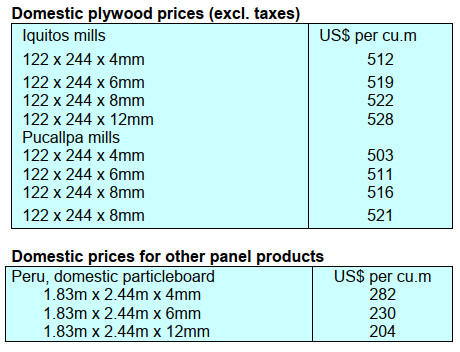

9. PERU

Shipments of

construction products

Shipments of wood products for construction between

January and October 2023 totalled US$4.4 million

representing a growth of 29% compared to the same

period of the previous year (US$ 3.4 million) as reported

by the Association of Exporters (ADEX).

This increase is partly explained by greater demand from

Mexico which increased from US$0.15 million in 2022 to

US$0.2 million in 2023 (January-October). The main

destination was, however, the US (US$1.8 million)

representing a slight increase of 3%.

According to figures from the ADEX Data Trade

Commercial Intelligence System there were exports to

Chile (US$0.87 million +179%), Dominican Republic

(US$0.16 million, +168%) and France (US$0.12 million -

73%). The most notable item in these ten months of the

year was carpentry products and items for construction

(US$1.8 million), which maintained a similar level to

2022 (variation of 0.3%) and a share of 41%.

Likewise, doors and their frames (US$0.69 million), other

structural engineered wood products (US$ 0.67 million),

others for mosaic floors (US$0.31 million), other doors

and their frames (US$0.31 million) were shipped along

with tropical wooden frames (US$0.17 million). These

other products accounted for around 5% of the total

shipped.

The value of shipments of the products above was

surpassed by sawnwood (US$35.6 million) and semi-

manufactured products (US$9.4 million).

In addition, firewood and charcoal were exported (US$4.1

million), manufactured products (US$3.9 million),

furniture and its parts (US$3.45 million), veneers and

plywood (US$2.2 million) and veneersheets (US$ 1.4

million).

Peru and Brazil to address CITES listing of

Shihuahuaco and Tahuarí

In the last week of December the National Forestry and

Wildlife Service (SERFOR) and the Brazilian Institute of

the Environment and Renewable Natural Resources

(IBAMA) presented their proposals on the implementation

of Shihuahuaco (genus Dipteryx) and Tahuarí (genus

Handroanthus) in Appendix II of CITES.

At the meeting they proposed developing collaboration

mechanisms between trading countries to optimise their

action in order to guarantee the sustainable use of these

important forest species.

IBAMA expressed its interest and willingness to share

information with SERFOR and proposed establishing

periodic meetings starting in January 2024. During its

presentation IBAMA highlighted the strategies it has

developed for identifying forest species.

The meeting was held at the headquarters of the Peruvian

Foreign Ministry in Lima and had the participation of

representatives of SERFOR, as CITES Administrative

Authority; of the Ministry of the Environment of Peru, as

CITES Scientific Authority; the Forestry and Wildlife

Resources Supervision Agency-OSINFOR, as CITES

Enforcement Entity and from Brazilian officials through

virtual connection.

See: https://www.gob.pe/institucion/serfor/noticias/886345-intercambio-internacional-de-experiencias-sobre-la-inclusion-del-shihuahuaco-y-tahuari-en-el-apendice-ii-de-

la-cites

Measuring carbon in agroforestry systems

At the end of December the National Forestry and Wildlife

Service (SERFOR) of the Ministry of Agrarian

Development and Irrigation and the Agrofor Project

(CIFOR – ICRAF) held a course ‘Quantification of carbon

stored in small-scale agroforestry and forestry practices in

the scope of CUSAF’ aimed at strengthening the

capacities of specialists from the Regional Governments of

Amazonas, Loreto, San Martín and the staff of the

SERFOR headquarters on concepts and criteria to

determine the amount of carbon stored in agroforestry and

small-scale forestry practices scale.

Fifty-two people were trained to understand of the subject

and be prepared to effectively apply carbon measurement

techniques in real situations and evaluate agroforestry

systems such as the case of Transfer in Use contracts for

Systems.

See:

https://www.gob.pe/institucion/serfor/noticias/888710-serfor-y-el-proyecto-agrofor-fortalecen-capacidades-de-funcionarios-en-la-medicion-de-carbono-en-sistemas-agroforestales

|