|

Report from

North America

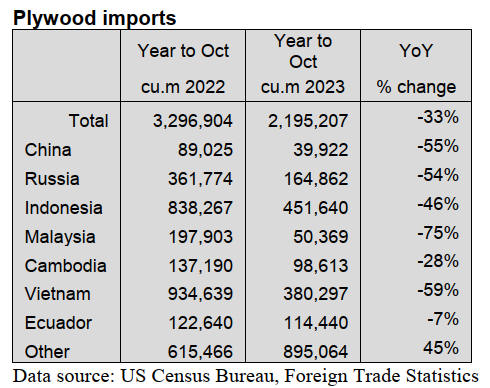

Hardwood plywood imports rally

US imports of hardwood plywood rose 78% in October,

rallying back after two months of disappointing declines.

The 320,269 cubic metres of plywood imported in October

was 14% higher than October 2022 imports. Imports from

Russia rose to their highest level of the year, more than

doubling the previous month’s totals, while imports from

China rose 59%.

Imports from Malaysia and Cambodia both rose by around

75% while imports from Indonesia and Vietnam both rose

by about 30%. Despite the surge, hardwood plywood

imports for 2023 remain far behind last year with total

imports from Malaysia, Vietnam, China, and Russia all

less than half of what they were at this point last year.

Total imports are down 33% through October.

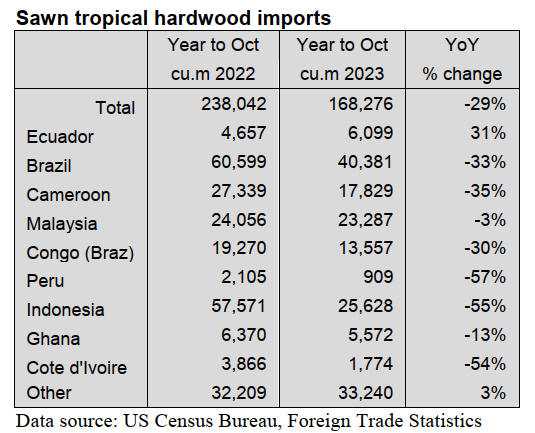

Imports of sawn tropical hardwood lag

US imports of sawn tropical hardwood fell slightly in

October, declining 4% from the previous month. The

17,256 cubic metres imported in October was 17% below

the volume imported in October 2022. Imports from the

largest trading partners stayed relatively flat as imports

from Brazil fell 2% and imports from Indonesia gained

2%.

Imports of Keruing rose 85% in October and are up 6%

over last year through the first 10 months of the year.

Balsa imports rose 4% and are up 15% for the year so far.

Imports of all other woods are down for the year with

imports of Ipe, Virola, Jatoba, Teak, and Anigre all

lagging by more than 50% versus last year. Canadian

imports of sawn tropical hardwood rose 10% in October

due to chiefly to imports from Congo/Zaire, which rose to

their highest monthly total in at least 10 years.

Imports from the US and Bolivia also rose sharply while

imports from Brazil fell by 83%. Imports of Iroko were

especially strong this October, propelling year-to-date

numbers for 2024 ahead of last year for the wood.

Imports of Iroko are up 35% over last year while imports

of all other woods remain behind last year’s pace. Total

imports remain down 16% versus last year through

October.

Veneer imports’ rebound, but not as sharply as in most

years

US imports of tropical hardwood veneer nearly doubled in

October, rebounding from their annual September dip with

a 96% gain over the previous month. Imports from China

more than doubled, imports from Cameroon increased

eight-fold and imports from Ghana rose more than ten-

fold.

However, the upward swing was not as robust as in

previous years and import totals actually lost ground

versus last year. Imports went from outpacing last year to

trailing as October 2023 imports trailed October 2022

numbers by 15%. Imports for the year are down less than

1% through October.

Imports of flooring show solid gains

US imports of hardwood flooring rose 15% in October,

fueled by a strong gain in imports from China. Imports

from China were up 66% in October, rising to their highest

level in 20 months. Imports from Indonesia were also

strong, gaining 35% over the previous month. Imports

from Indonesia are ahead of last year by 151% through

October while imports from all countries are up 3% so far

this year.

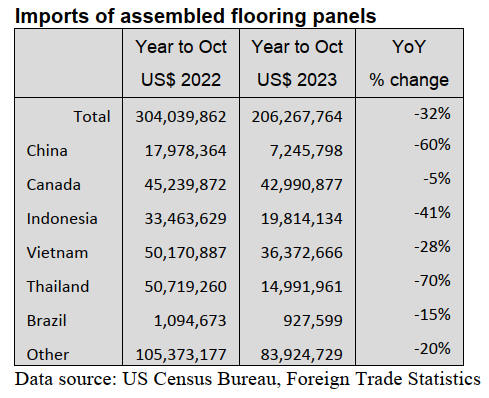

Imports of assembled flooring panels also moved upward,

rising 16% in October. Here again imports from China

were a factor. Imports from China rose 85% to the highest

level since January. Imports from Thailand were up 78%,

surging to their best month in more than a year. Despite

the gain, imports for the month were down 6% from the

previous October. Total imports of assembled flooring

panels continue to trail 2022 numbers and are off by 32%

versus last year.

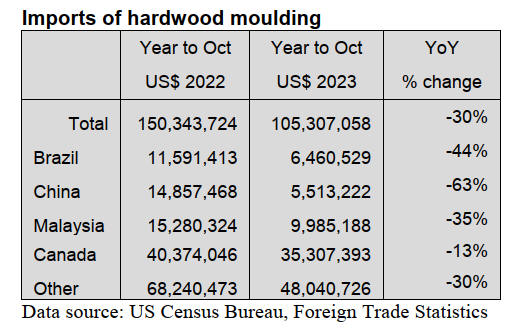

Moulding imports slip

US imports of hardwood moulding fell by 8% in October

and was 24% less than that of the previous October.

Imports from chief supplying nations were mostly on the

upswing with imports from Brazil gaining 44%, imports

from Canada up 10%, and imports from Malaysia up 7%.

Imports from China fell 7% and imports from other parts

of the world were down by a combined 24% for the

month.

Imports from Brazil continue to greatly underperform—

even with this month’s percentage gain the US$490k

imported was only one-third that of October 2022. Total

imports for the year so far are down 30% versus las year

with imports from China down 63% through October.

US wooden furniture imports rise to highest level since

January

US imports of wooden furniture rose 12% in October,

rising to their highest level since January. The US$1.75

billion in imports was 13% less than the previous

October’s total. Imports from China advanced 22% in

October while imports from Vietnam, Canada, and

Malaysia all improved by 10% or more.

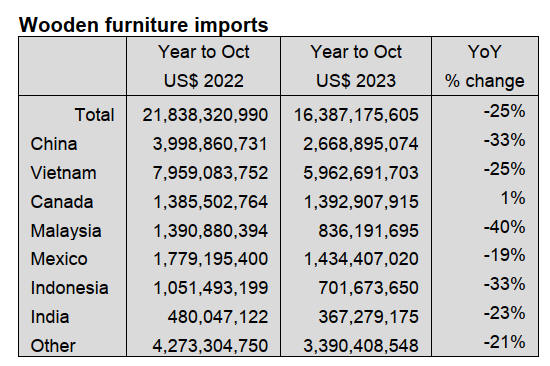

Despite the gains, year-to-date totals from nearly all

trading partners are far behind their 2022 pace. Total

wooden furniture imports are down 25% versus 2022

through October.

Jobs report shows strong but moderating hiring

Hiring picked up in November as striking auto workers

and actors returned to work and businesses continued to

largely shrug off high inflation and interest rates.

Employers added 199,000 jobs and the unemployment rate

fell from 3.9% to 3.7%, the Labor Department reported.

The report bolsters economists' belief that the Fed will

hold rates steady for the third straight meeting and is likely

done with its sharp rate hikes intended to bring down

inflation. Price increases have been moderating and the job

market has been gradually cooling.

"What we wanted was a strong but moderating labor

market, and that’s what we saw in the November report,"

says economist Robert Frick of Navy Federal Credit

Union.Yet the drop in the unemployment rate gives Fed

Chair Jerome Powell more evidence to not rule out further

rate increases and "push back on the idea that the Fed will

be (cutting rates) soon," says Ian Shepherdson, chief

economist of Pantheon Macroeconomics.

Employment in manufacturing rose by 28,000 in

November, reflecting an increase of 30,000 in motor

vehicles and parts as workers returned from a strike.

Employment in manufacturing has shown little net change

over the year.

Third quarter GDP revise upward

US real gross domestic product (GDP) increased at an

annual rate of 5.2% in the third quarter of 2023, according

to the "second" estimate released by the Bureau of

Economic Analysis. The GDP estimate is based on more

complete source data than were available for the

"advance" estimate issued last month.

In the advance estimate, the increase in real GDP was

4.9%. The update primarily reflected upward revisions to

nonresidential fixed investment and state and local

government spending that were partly offset by a

downward revision to consumer spending. Imports, which

are a subtraction in the calculation of GDP, were revised

down.

|