US Dollar Exchange Rates of

25th

Nov

2023

China Yuan 7.15

Report from China

Signs of

recovery are mixed

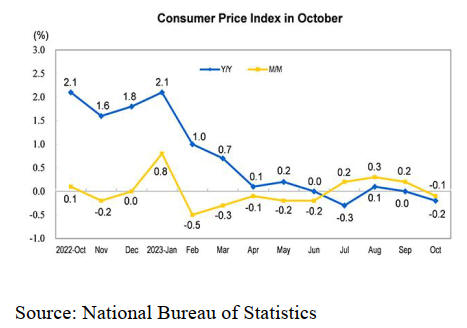

Consumer prices fell in October after briefly leveling out,

a sign that consumers remain cautious despite the

government stimulus measures. Also, producer prices fell

for a 13th consecutive month, dropping 2.6% year on year,

against a 2.7% decline forecast by economists and

following a 2.5% contraction in September.

China’s economy has shown mixed signs of recovery in

recent months leading economists to debate whether it will

hit the government’s GDP growth target this year of 5%,

the lowest in decades. Prices fell into negative territory in

July before edging back into growth in the months that

followed.

The IMF has upgraded its forecast for China’s GDP

growth to 5.4% citing stronger support from policymakers

who have been easing monetary policy and easing

restrictions on property purchases and mortgages to try to

stabilise the real estate market.

Consumer Price Index for October 2023

The National Bureau of Statistics released the October

consumer price indices which show the national consumer

price index (CPI) decreased by 0.2% year on year. Prices

in urban areas decreased by 0.1% and prices in rural areas

decreased by 0.5%. The price of food decreased by 4%

and prices for consumer goods dropped by 1.1%.

Group standard on carbon footprint accounting

Eleven departments, including the Standardisation

Administration of China, the National Development and

Reform Commission and the Ministry of Industry and

Information Technology jointly issued the Guidelines for

the Construction of a Carbon Peak and Carbon Neutral

Standard. The Carbon Peak and Carbon Neutral Standard

system was structured around basic universal standards as

well as the development needs for carbon reduction,

carbon removal and carbon market development.

A Technological Specification for Carbon Footprint

Accounting for Timber Products was recently published

with aim of responding to national policies and promote

systematic construction of carbon peak and carbon neutral

standard system. The Standard number is T/TSNR002-

2023. This Standard is China's first carbon footprint

accounting standard for timber product.

The release of this standard makes up for the gap in the

field of carbon footprint accounting for wood products and

improves the transparency and consistency of the

evaluation and notification of carbon footprint accounting

for wood products to help enterprises better understand the

carbon footprint of their wood products to achieve targeted

carbon reductions.

Promoting bamboo as a substitute for plastic

It has been reported that a three-year Action Plan to

accelerate the development of "Bamboo as a Substitute for

Plastic" has been released by the National Development

and Reform Commission (NDRC) to provide direction,

specific measures and support policies for the

development of "replacing plastic with bamboo" in various

industries and is a guide for achieving green and

sustainable development of the industry.

The Action Plan proposes that players in the upper, middle

and downstream industrial chain for "raw materials,

processing and marketing are encouraged to expand in

major bamboo producing areas and commercial and trade

enterprises are encouraged to cooperate with bamboo

product enterprises in production and marketing and

supply and demand matchmaking.

The furniture sector should speed up the formulation and

improvement of bamboo furniture standards and open up

the boundaries of the industry, cooperate with household

appliance makers and building materials and decoration

industries to build an ecological standard system for

bamboo products.

It is necessary to strengthen the two-way cultivation of

production and consumption and encourage enterprises to

develop more practical and environmentally friendly

furniture products such as bamboo desks and chairs,

bamboo shoe racks, bamboo lamps and lanterns and guide

consumers to choose more high-quality and low-carbon

bamboo furniture and household goods.

It is necessary to explore the construction of furniture "old

for new" and recycling systems with relevant national and

local departments, reduce the cost of furniture product

renewal and increase the proportion of bamboo furniture

products.

The furniture industry is encouraged to focus on leading

enterprises and areas with rich bamboo resources and

build world-class bamboo furniture production enterprises

and bamboo furniture industry bases.

See:

https://www.ndrc.gov.cn/xxgk/zcfb/tz/202311/t20231102_1361715_ext.html

Surge in sawnwood and log imports from Sweden

According to data from China Customs, wood product

imports from Sweden totalled over 905,000 tonnes in the

first half of 2023. China’s imports from Sweden were

wood pulp (41%), timber products (35%) and paperboard

and paper products (23%).

China’s wood pulp, timber products, paperboard and paper

products imports were about 375,000 tonnes, 320,000

tonnes and 210,000 tonnes valued at US$333 million,

US$123 million and US$219 million respectively.

Most of the solid wood products imported from Sweden

were sawnwood (83%) and logs (16%) valued at US$108

million and US$10 million, surging 86% and 240% year

on year in volume in the first half of 2023.

Decline in China’s plywood exports to Sweden

According to China Customs, China’s wood product

exports to Sweden totalled over 23,000 tonnes in the first

half of 2023. About 92% of China’s exports to Sweden are

wood products (50%), paperboard and paper products

(34%) and furniture seats (9%). China’s paperboard and

paper products, furniture and seats exports to Sweden were

about 12,000 tonnes, 8,000 tonnes and 2,000 tonnes

valued at US$25 million, US$27 million and US$45

million respectively.

China’s furniture and seats exports to Sweden rose 5% but

China’s wood products, paperboard and paper products

exports to Sweden fell 26% and 27% respectively in the

first half of 2023.

China’s plywood exports to Sweden fell 26% to 12,000

cubic metres valued at US$6.93 million, down 27% in the

first half of 2023.

Other wood product exported to Sweden include clothes

hangers, disposable wood sticks (HS code 4421, 20%),

wooden tableware, kitchen utensils (HS code 4419, 9%),

wooden frames for drawing, picture or mirror (HS code

4414, 7%), down 21%, 37% and 17% respectively.

Inner Mongolia's "made in Ulanqab" furniture exported

to Russia

Finished furniture made in Ulanqab City, Inner Mongolia

Autonomous Region are being exported to Russia on the

China-Europe train for the first time, the destination is

Russia’s Yekaterinburg. 24 categories of furniture were

shipped such as sofas, beds, dining tables and chairs which

were customised according to the needs of Russian

customers.

Chinese enterprises imported timber from Russia to

Ulanqab through the China-Europe freight train for

processing into furniture products and then re-exported

these items to Russia and other countries. Chinese

enterprises have a large number of customers in Russia.

Chinese enterprises will rely on the China-Europe freight

train and Ulanqab's geographical and resource advantages,

strengthened industrial advantages and extended industrial

chain to provide impetus for cross-border, cross-regional

and cross-field industrial cooperation in the future.

More local products from Ulanqab will be exported to

create new patterns of foreign trade in Ulanqab City.

Since the first China-Europe freight train was launched in

Ulanqab city in 2016 the development of the train service

has been continuously improved. Since the beginning of

2023 the total number of China-Europe freight trains from

Ulanqab City was 114 trains with 4,690 carriages, up

200% year-on-year with a total cargo value of US$203

million and a total cargo weight of 63,200 tonnes. This has

provided a solid foundation for Ulanqab City to actively

participate in the construction of the China-Mongolian-

Russia Economic Corridor.

Global Legal and Sustainable Timber Forum

As part of the implementation of the Legal and Sustainable

Timber Forum (LSSC) Programme and in response to

demands from the global timber industry, ITTO

and the Macao Trade and Investment Promotion Institute

(IPIM) entered a Collaborative Framework Agreement to

co-host the Global Legal and Sustainable Timber Forum to

accelerate building Legal and Sustainable Forest Products

Supply Chains to promote legal and sustainable (“green”)

forest products supply chains and increase the trade in

legally and sustainably produced forest products.

The Forum was held 21-22 November 2023. After two

days of extremely interesting presentations and

discussions, consensus emerged among participants on key

strategies to promote the legal and sustainable

development of the global timber industry and accelerate

its recovery. These included nine key actions.

Forum statement

Timber is a crucial material for a sustainable future

according to 700 participants from governments,

enterprises, international organizations and research

institutions at the inaugural Global Legal and Sustainable

Timber Forum (GLSTF) which issued a set of nine actions

to ensure the stability of the timber sector’s future based

on legal and sustainable forest management and supply

chains.

The aim of the Forum, which was convened jointly by

ITTO and the Global Green Supply Chain Initiative and

the Macao Trade and Investment Promotion Institute was

held in Macao SAR, China, 21–22 November 2023 and

brought together key players in the global timber sector

and mapped a course for the sector’s future sustainable

development.

“Timber is an environmentally-friendly, renewable,

carbon-storing, recyclable material and thus a pillar of

sustainability when produced, processed, traded and used

legally and sustainably,” said ITTO Executive Director

Sheam Satkuru during the Forum. “We believe in the

benefit of bringing all stakeholders in the sector together

because forests and timber are vital for the planet’s

future.”

The world is facing many challenges, such as economic

volatility stemming from the aftermath of the COVID-19

pandemic, global conflicts, trade wars, rising energy

prices, climate change, biodiversity loss and resource

pressure. But Forum participants agreed that such

challenges present opportunities for timber to become a

cornerstone of circular bio-economies.

A sustainable and resilient timber industry, it was asserted,

would not only contribute to wealth creation but also

support healthy lifestyles and reduce the risk of climate

change. The sustainable use of timber can also help

safeguard other forest services, such as conserving

biodiversity, soil and water, storing carbon, preventing

land degradation, and reducing the risk of disasters.

After two days of extremely interesting presentations and

discussions consensus emerged among participants about

key strategies to promote the legal and sustainable

development of the global timber industry and accelerate

its recovery. These include the following nine key actions:

1) Strong networks and partnerships: there is an urgent

need for strong networks and partnerships built on mutual

respect and trust to support legal and sustainable forest

management and timber supply chains.

2) Nature-based solutions: building and improving legal

and sustainable timber supply chains should be recognized

as key nature-based solutions from local-to-global

challenges.

3) Trade promotion: the trade of legal and sustainable

timber products should be promoted to facilitate a stable,

fair, transparent and predictable environment for the

recovery and growth of the global timber industry.

4) Global Legal and Sustainable Timber Forum: the

Forum is a necessary platform for scaling up cooperation

and information exchange between the public and private

sectors and should be held annually.

5) The Global Timber Index: this initiative, which has

been piloted for about a year and was officially launched

at the forum, improves the quality and regularity of timber

market information, encouraging greater information

exchange in the private sector, and enhancing the

efficiency of policy formulation. It should be continued

and scaled up.

6) Advanced technology and traceability: the use of new

technologies, tools and methodologies should be

encouraged to help ensure the legitimacy and

sustainability of timber resources, including the

implementation of sustainable forest management and

digital timber traceability.

7) Financial mechanisms: innovative financial

mechanisms, such as payments for ecosystem services,

should be further developed and used to increase

investment in support of sustainable forest management

and sustainable supply chains.

8) Timber industrial parks: legal and sustainable timber

industrial parks should be established to incubate

enterprises as models for the wider industry, thereby

accelerating the adoption of best practices and advanced

technologies.

9) Support: the global timber industry requires more

support for adopting advanced technologies as a means for

accelerating its sustainable development.

At its conclusion the Forum urged participants to continue

working together by connecting, cooperating and sharing

knowledge. The inaugural GLSTF, planned as an annual

event, has emerged as a cornerstone for building this

global network.

See:

https://www.itto.int/news/2023/11/24/global_forum_calls_for_action_to_sustainably_develop_timber_sector/

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in China.

See:

https://www.itto-ggsc.org/static/upload/file/20231121/1700552181514582.pdf

|