|

1.

CENTRAL AND WEST AFRICA

Generally dull international demand

The overall producer sentiment is that markets are dull

some experiencing low levels of activity. The Middle East

market in particular is currently characterised by low

demand which is linked to higher than usual stocks in Iraqi

and Dubai ports. In addition, shippers in West Africa face

competitive pricing from Indonesia and Malaysia in the

South African market.

Inquiries for some timber species such as okoume,

andoung, iroko, and padouk have fallen in the Asian and

Middle East countries. In Holland the high level of sawn

azobe stocks has impacted the flow of orders and led to a

slight decrease in demand for logs.

The market outlook is not very bright and hopes are

pinned on a rebound in demand in China after the Chinese

New Year. Demand in the Philippines is currently quiet.

Challenges in South Africa and changes in US import duty

advantages signal a dynamic period for producers.

Producers are of the understanding that the US

government has suspended Uganda, Gabon, Niger and the

Central African Republic (CAR) from its special US-

Africa trade programme set out in the African Growth and

Opportunity Act (Agoa) which provides eligible sub-

Saharan African countries with duty-free access to the US

for more than 1,800 products.

Regional challenges

Several African countries face challenges due to heavy

rainfall. In the Central African Republic transport

difficulties arise from heavy rain and this is impacting the

arrival of trucks at Douala Port. Producers in Cameroon

are also grappling with heavy rain which is causing delays

in log deliveries to mills. In Gabon, heavy up-country rain

and a recent train derailment have led to a 50% drop in log

supplies to mills in NKOK.

Peeling factories in the special economic zone (NKOK)

are under government pressure to reduce the number of

expatriate workers. The shortage of technicians for

peeling mills and mechanics for heavy machinery is

evident prompting companies to consider reducing

production. The government plans a comprehensive check

of the special zone managed by OLAM, including NKOK,

the port and the airport.

Revitalisation of associations in the Republic of Congo

With the support of ATIBT Congo through the Private

Sector Support Project financed by the European Union

the general meeting of the Union patronale des entreprises

privées de la filière bois (UNIBOIS) held in Pointe-Noire

ended with the appointment of the union's executive.

See:

https://www.atibt.org/en/news/13406/support-for-the-revitalisation-of-professional-associations-in-the-forestry-and-timber-sector-in-the-republic-of-congo

2.

GHANA

2024 budget – manufacturers disappointed

Ghana's Finance Minister, Ken Ofori-Atta, recently

presented the country's 2024 budget, signalling a positive

economic outlook with projections of accelerated growth

and declining inflation. The government expects the

economy to expand from a 2.3% growth rate in 2023 to at

least 2.8% in 2024.

The budget reflects Ghana's commitment to stabilise the

economy following a challenging period marked by high

inflation which peaked at 35% in October. With the

implementation of central bank policies inflation is

anticipated to fall to 15% by the end of 2024.

Ahead of the reading of the budget the Chief Executive

Officer (CEO) of the Association of Ghana Industries

(AGI), Seth Twum Akwaboah, stated that the

manufacturing sector faces numerous challenges which

stifles growth of local industries.

According to the AGI the tax system in Ghana is not

favourable for the manufacturing of goods for local

consumption or export. He expressed concern on the

numerous taxes that are not favouring manufacturing

mentioning a few such as the Growth and Sustainability

Levy and the Value Added Tax (VAT) which all add to

the cost of doing business.

The CEO also expressed concern about the country’s

porous borders which make it difficult for local

manufacturers to compete with imported products that get

into the country through unapproved routes and importers

escape taxes. In its 2024 pre-budget survey report KPMG

(Klynveld Peat Marwick Goerdeler) stated that businesses

in the country are urgently calling for a comprehensive

review of tax policies, improved power supply and a focus

on nurturing skilled labour.

After the budget was published the Chief Executive of the

Ghana Chamber of Commerce and Industry, Mark Badu-

Aboagye, expressed dissatisfaction as, according to him,

businesses and manufacturers were disappointed not to see

some tax relief and that this leaves them with little

optimism for the coming year.

See:

https://www.myjoyonline.com/current-tax-system-doesnt-favour-manufacturing-sector-agi/

and

https://mofep.gov.gh/sites/default/files/budget-statements/2024-Budget-Highlights.pdf

First eight months wood export slump

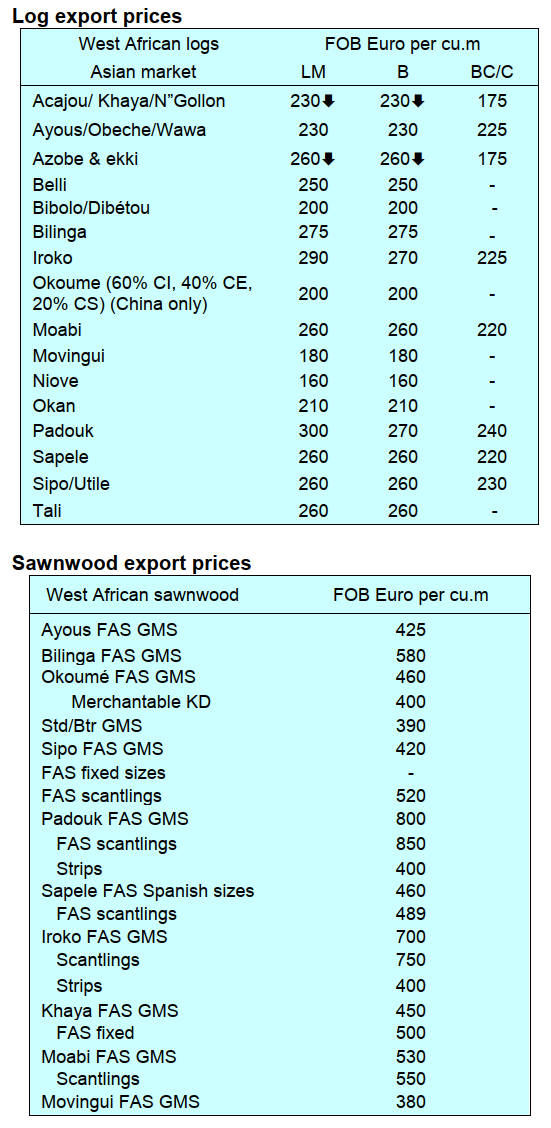

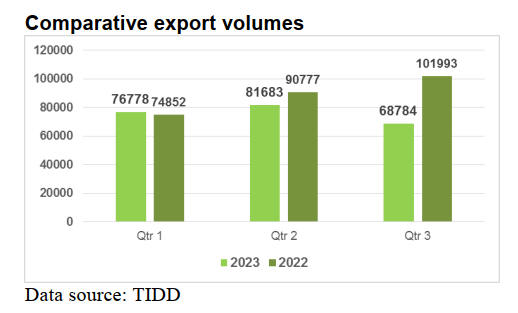

A total of 68,785cu.m. of wood products were exported in

the third quarter of 2023 compared to 81,683cu.m during

the second quarter a decline of around 16% in volume.

According to data from the Timber Industry Development

Division (TIDD) of the Forestry Commission total wood

export for the first nine months of 2023 dropped by 15%

to 227,245cu.m from the 267,622cu.m recorded in the

same period in 2022.

While in 2022 the volume of wood product exports

gradually increased that was not the case in 2023.

Exports in third quarter of 2023, 68,784 cu.m, earning

Eur30.64 million were below that in the same period in

2022 (101,993 cu.m and Eur45.56 million) representing

declines of 33% in volume and 33% in value. Products

that recorded significant volumes during the current year

included lumbers, veneers, plywood and billets.

Of the wood products only plywood exported to the

regional West African markets and Briquettes to the

United Kingdom and Ireland recorded volume increases of

22% and 26% respectively in Q3 in 2023 compared to Q2

of the same year. Other wood products exported during the

period were dowels, sliced veneer to regional markets

kindling, KD boules and offcuts.

Ghana targets 24m tonnes of carbon credits by 2030

The Deputy Minister of Finance, Dr. John Kumah, has

hinted that Ghana is targeting 24 million tonnes of carbon

credits by the year 2030 as part of the country’s

commitment to reducing carbon emissions and mitigating

the impact of climate change.

Dr. Kumah made this known when members of the

Intergovernmental Committee of Senior Officials and

Experts for North and West Africa met in Accra on the

theme ‘Investing in Energy Transition, Food Security and

Regional Value Chains for Sustainable Development in

North and West Africa Sub-Regions’.

Ghana is among 15 other countries that have signed the

Emissions Reductions Payments Agreements (ERPA) with

the World Bank and could earn millions of dollars under

this project if successfully implemented.

See:

https://www.ghanaweb.com/GhanaHomePage/business/Government-targeting-24m-tonnes-of-carbon-credits-by-2030-John-Kumah-1875674

In a related development, the Ghana Forestry Commission

is, for the first in its history, supporting farmers in the

Northern Region of Ghana with the first 1,000 grafted

shea seedlings, to be planted on Ghana Shea Landscape

Emissions Reduction Project (GSLERP) sites. This falls

under the Reducing Emissions from Deforestation and

Degradation programme (REDD+), which has the

GSLERP, as one of its pillars.

See: https://fcghana.org/?p=4185

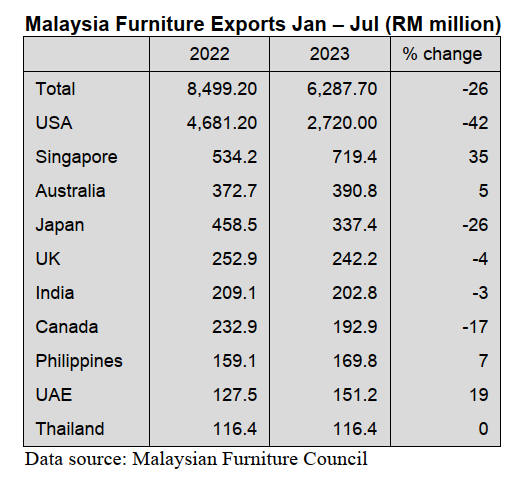

3. MALAYSIA

Wood product exports decline

The value of Malaysia’s exports of wood products

dropped 19% year-on-year to RM14 bil. between January

and August this year compared to RM17.3 bil. in the same

period last year. The Malaysian Timber Industry Board

(MTIB) chairman said this was not a surprise as there has

been a weakening in global demand.

Despite the slow sales this year he said he is confident that

the timber industry can reach the export target of RM28

bil. and domestic sales of RM20 bil. by 2025 in line with

the National Agri-commodity Policy 2021-2030 supported

by the National Timber Industry Strategic Plan 2021-2025.

According to him, the domestic market accounts for as

much as 60% of the country’s timber sector’s sales adding

that this year Malaysia ranks 14th globally among wooden

furniture-producing countries.

See:

https://www.thestar.com.my/business/business-news/2023/11/06/malaysias-wood-export-value-declines-191-in-january-to-august-2023

Interest rates unchanged

In an effort to remain supportive of the economy Bank

Negara has decided to keep its overnight policy rate (OPR)

unchanged at 3%. The move was in tandem with the US

Federal Reserve’s maintenance of its funds target rate at

5.25% to 5.5%. A Bank Negara spokesperson commented

that the current OPR level is conducive in holding up the

economy, consistent with the current assessment of

inflation and growth prospects.

Over the last few weeks there have been calls for the Bank

to consider raising the OPR to support the ringgit, which

remains one of the 10 worst-performing Asian currencies

this year. However, economists have warned this would

only lead to higher household and business costs, hence

dampening domestic demand.

Aiming for a sustainable bamboo supply

Sarawak Timber Industry Development Corporation

(STIDC), the Bintulu Development Authority (BDA) and

Pertama Ferroalloys have signed a Memorandum of

Understanding on a Samalaju greening project and the

supply of sustainable raw materials through bamboo

cultivation.

STIDC and BDA will supply quality bamboo seedlings to

the project, communities and commercial entities, offer

technical expertise, oversee bamboo planting and

management and identify potential bamboo consumers.

See:

https://dayakdaily.com/stidc-bda-and-pertama-ferroalloys-sign-mou-on-samalaju-greening-project-sustainable-supply-of-bamboo/

Oil palm sector could benefit from embracing

agroforestry

Oil palms are planted in monoculture plantations but

monocultures have been criticised. One specialist

recommended that oil palm plantation companies should

adopt agroforestry as this approach will increase

biodiversity and sustainability.

Professor Alain Rival from the French Agricultural

Research Centre for International Development (Cirad)

said agroforestry is the use of land that combines trees

with crops or livestock or both. He said that through this

approach oil palm plantation owners could select any

forest tree species to be planted in between oil palms.

As an example, Rival cited Cirad’s trial projects where the

agroforestry approach was applied on 37 hectares of land

in the Kinabatangan District in Sabah to combine oil palm

with 15 different forest species.

Rival said that land owners could grow durians,

mangosteen, pepper and vanilla, among others, as cash

crops. He said smallholders, especially, can benefit from

these cash crops.

See:

http://theborneopost.pressreader.com/article/282192245702320

Heart of Borneo framework to be reviewed

Sarawak is revising the framework for the Heart of Borneo

(HoB) initiative to ensure that it would align with the

state’s existing policies and development

agenda, particularly the Post COVID-19 Development

Strategy 2030 (PCDS 2030). The state’s Forest

Department, as the secretariat for HoB Sarawak, is

currently working on the final draft of the revised project

implementation framework.

This document will guide the prioritisation and

implementation of programmes and activities within the

Heart of Borneo region up to the year 2030. It is not

intended to replace the earlier 2009 framework but rather

serves as an updated and supplementary document to it.

See:

https://sarawaktok.bernama.com/news.php?c=02&id=2234213

Workplace furniture, a focus for MIFF 2024

The Malaysian International Furniture Fair 2024 will take

place 1 – 4 March 2024 in Kuala Lumpur. One aspect of

the Fair is to promote diverse office furniture. Office

furniture design is undergoing a transformation driven by

the changing needs and priorities of businesses. As

companies continue to create a more comfortable, inviting

and productive working environment this reshaping office

interior designs.

See:

https://www.miff.com.my/media/news-and-featured-articles/146/the-evolution-of-modern-workplaces/

4.

INDONESIA

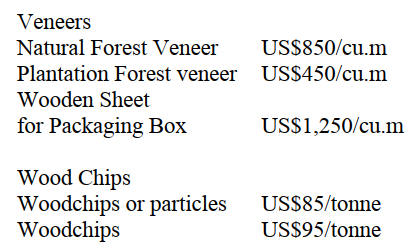

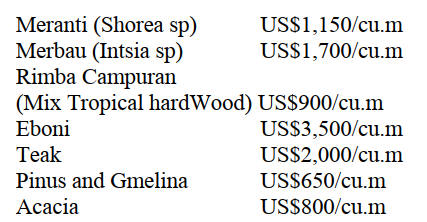

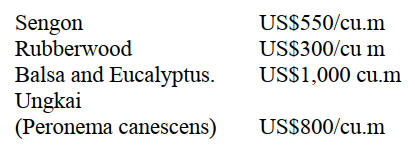

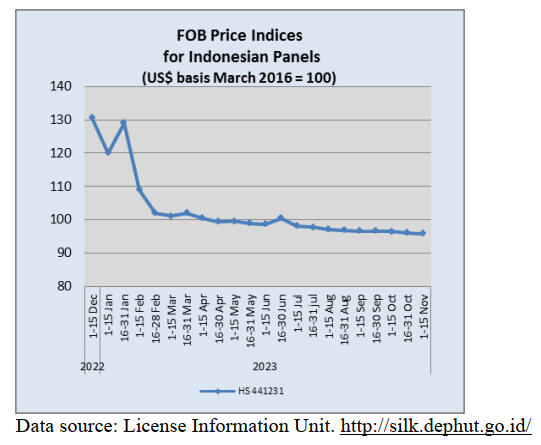

Export benchmark prices

for November

The November Export Benchmark Price (HPE) for wood

products has been released by the Ministry of Trade. The

HPE increased for several products.

Prices increased for veneer from natural forest species and

plantation wood, wooden sheets for packing boxes and

woodchip/particles. The increase in HPE also applies to

sawnwood with a cross-sectional area of 1,000–4,000

sq.mm in meranti, merbau, teak, acacia and balsa.

For some products the price was lowered, namely sawn

sengon with a cross-sectional area of 1,000 sq.mm–4,000

sq.mm.

The following is a list of Wood HPE for November 2023.

Processed Wood

Processed wood products which are level on all four sides

so that the surface becomes even and smooth with the

provisions of a cross-sectional area of 1000 sq.mm to 4000

sq.mm(ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 4000 sq.mm to

10000 sq.mm(ex 4407.11.00 to ex 4407.99.90)

See:

https://forestinsights.id/harga-patokan-ekspor-hpe-kayu-november-2023-ada-kenaikan-untuk-kayu-gergajian-meranti-merbau/

Independent audits key to SVLK transparency

A transparent and accountable audit process by

Conformity Assessment Bodies (CAB) is one of the

advantages of the Indonesian Legality and Sustainability

Verification System (SVLK) in support of forest

governance said Karina Restu Panggalih, Sustainable

Forest Management Auditor at PT Mutuagung Lestari, one

of the CABs She added that based on the regulations from

the Ministry of Environment and Forestry an institution

can become a CAB after receiving accreditation from the

National Accreditation Committee (KAN).

“Accreditation is based on the international standard

ISO17065 in 2012 regarding the criteria for financial

institutions implementing product, process and service

certification systems,” said Karina during a discussion

between the CAB Forum and a delegation of forestry

experts from Laos.

Karina explained that the SVLK audit refers to the

regulations set by the Ministry. Such as Regulation No.

P.08/2021 concerning Forest Management and Preparation

of Forest Management Plans and Decree No. 9895/2022

concerning Standards and Guidelines for Implementing

the Legality and Sustainability Verification System

(SVLK). “SVLK is implemented through two activities,

assessment for sustainable forest management and legality

verification for forest products,” said Karina.

See:

https://forestinsights.id/independent-auditors-and-monitors-key-to-svlk-transparency-and-accountability/

and

https://agroindonesia.co.id/auditor-dan-pemantau-independen-kunci-transparansi-dan-akuntabilitas-svlk/

Indonesia shares experience in developing SVLK with

Laos

The Ministry of Environment and Forestry (KLHK)

recently shared its experience in developing the Legality

and Sustainability Verification System (SVLK) with a

delegation from Laos.

Agus Justianto, Director General of Sustainable Forest

Management told the delegation from Laos that the SVLK

has been key in encouraging better governance in the

forestry sector taking into account requirements in

international markets.

The latest SVLK developments include improving

traceability with geo-location. In addition some indicators

have been strengthened such as welfare and gender issues.

The Director General of the Forest Inspection Department

of the Laotian Ministry of Agriculture and Forestry,

Khamphone Mounlamai, said that Laos has also developed

a timber legality assurance system and hopes to reach a

FLEGT-VPA agreement in the near future.

The Laotian delegation comprised officials from the

Ministry of Agriculture and Forestry, Ministry of Trade,

provincial government, civil society organizations (CSOs)

and business representatives. The delegation's visit to

Indonesia was supported by the German Agency for

International Cooperation (GIZ), the German

Development Bank (KfW) and the European Forest

Institute (EFI).

The Loa delegation visited Malang and Surabaya in East

Java Province to observe how the Indonesian SVLK is

implemented. One aspect that attracted the attention of the

Lao delegation was the use of Supplier’s Declaration of

Conformity (SDOC) so low risk planted timber produced

by farmers or other micro-scale forestry business units

could be included in Indonesia’s SVLK and have full

market access.

See:

https://en.antaranews.com/news/297015/indonesia-shares-experience-on-developing-svlk-with-laos

and

https://agroindonesia.co.id/kunjungi-jawa-timur-delegasi-laos-pelajari-implementasi-svlk-indonesia/

Industry ready to intensify presence in Asian markets

Wiradadi Soeprayogo, Chairman of the Indonesian

Sawmill and Woodworking Association (ISWA), said the

timber industries are ready to intensify marketing in Asian

countries as they anticipate a further decline in demand in

Europe and America which is already having a negative

impact on ISWA members business.

He said in 2022 the export value of wood products and

sawnwood reached US$2.4 billion but in 2023 (as of

November) a decline of 13% was observed. He added that

to penetrate new markets exporters must be prepared to

meet the specific requirements in the various markets and

prepared to address their concerns on environmental

issues.

He said that these various challenges cannot be overcome

by ISWA alone but require inclusive collaboration with

related parties, namely the government, universities and

professional organisations.

See:

https://www.antaranews.com/berita/3794706/industri-kayu-gergajian-dan-olahan-siap-intensifkan-pasar-asia

Carbon trading still a challenge

Chairman of the Indonesian Forest Concessionaires

Association (APHI), Indroyono Soesilo, explained that

Carbon Economic Value (NEK) is one source of funding

to achieve Indonesia’s GHG emission reduction target. To

implement carbon economic value the Indonesian

government has issued a number of regulations.

“However, implementation is still full of challenges,” he

said when speaking an International Webinar “Lesson

Learned on the Utilisation of the Carbon Economic Value

on Mitigation Action in Forest Management.

APHI Secretary General, Purwadi Soeprihanto, explained

that one of the challenges faced by forest concession

companies (PBPH) in implementing carbon economic

value is the methodology for measuring GHG emission

reduction performance. This is because the methodology

applied still does not fully cover the 2030 FOLU Net Sink

mitigation action.

He said “It is necessary to accelerate the ratification of the

methodology that can be applied to PBPH in accordance

with the 2023 FOLU Net Sink mitigation action,”

See:

https://lestari.kompas.com/read/2023/11/08/200000686/pengusaha-hutan-sebut-perdagangan-karbon-indonesia-hadapi-tantangan-?page=all

In related news, the Ministry of Environment and Forestry

(KLHK) has introduced the concept of carbon trading in

the forestry sector to improve the economy in Southwest

Papua Province. The Secretary of the Directorate General

of Sustainable Forest Management (PHL) of the KLHK,

Drasospolino, explained the benefits through carbon

trading in the forestry sector.

The approach of the KLHK through socialisation is

considered important so stakeholders and businesses can

understand the procedures, requirements and calculations

when viewing carbon trading results. He said that, in

general, there are two mechanisms for carbon trading in

the forestry sector: emissions trading and greenhouse gas

emissions offset. Because of this, he said, the Southwest

Papua Province has a great opportunity to contribute to

efforts to reduce greenhouse gas emissions through direct

and offset emission reductions.

See:

https://en.antaranews.com/news/297960/klhk-introduces-benefits-of-carbon-for-economic-improvement-in-papua

Converting palm plantations back to forest

Some 200,000 hectares of oil palm plantations found in

areas designated as forests in Indonesia are expected to be

returned to the state to be converted back into forests.

Indonesia, the world's biggest palm oil producer and

exporter, issued rules in 2020 to determine the legality of

plantations operating in areas that are supposed to be

forests in order to adjust governance in the sector.

It has been estimated that 3.3 million hectares of the

country's nearly 17 million hectares of palm plantation are

found in areas classified as forest.

The government is still cataloguing plantations found in

designated production forests so these areas can be

returned to the State for rehabiliation, meaning owners

will have to pay fines but they can continue to grow palm

trees and which are in protected areas and must be

returned to the state, he said.

See:

https://english.kontan.co.id/news/indonesia-says-200000-hectares-of-palm-plantations-to-be-made-forests

21% of the world's mangrove forests are in Indonesia

The Ministry of Environment and Forestry (KLHK) said

that Indonesia has 3.39 million hectares of mangroves or

21% of the total mangrove forests in the world.

Director of Land Water and Mangrove Rehabilitation at

the Ministry of Environment and Forestry, Inge Retnowati,

said that based on the 2022 National Mangrove Map the

area of mangroves in Indonesia increased to 3.39 million

hectares up from the 3.36 millin ha. is 2021.

The province with the largest mangrove forest is Papua

which has more than 1 million ha. followed by West

Papua Province with 480,000 ha. and Riau with 227,000.

See:

https://katadata.co.id/tiakomalasari/ekonomi-hijau/6538708fc6c13/21-hutan-mangrove-dunia-ada-di-indonesia-ini-3-provinsi-terbesar

5.

MYANMAR

Myanmar furniture makers eye the domestic market

The Myanmar Wood-Based Furniture Association

(MWBFA) sponsored the Myanmar Furniture Exhibition

2023 at a popular shopping mall to promote sales in the

domestic market in the face of falling international

demand and trade restrictions. This event was timed to be

during the so-called ‘marriage season’ when demand for

furniture rises.

Furniture manufacturers face a major challenge from

imported furniture which is often cheaper than locally

made items.

In addition to the classic designs with solid wood,

manufacturers have started to use the finger-jointed

plantation teak.

Myanmar teak was in demand in international markets for

garden furniture but this market has closed due to

international measures against Myanmar wood products

and the strict domestic regulation of export procedures for

wood products some of which have been eased recently.

Reducing the dependency on US dollar

The Industrial and Commercial Bank of China (ICBC)

Yangon Branch joined China’s Cross-Border Interbank

Payment System (CIPS). The Central Bank of Myanmar

(CBM) Governor, Than Than Swe, said membership will

enable Myanmar to greatly reduce its dependence on US

dollars for international transactions.

Myanmar Prime Minister, General Min Aung Hlaing, has

often commented that some countries are using US dollars

“to bully smaller nations.” He has since been seeking ways

to replace the use of the dollar and promoting the use of

the Chinese yuan (RMB) and Russian ruble.

ICBC Yangon Branch is among the first commercial

banks that have been authorised to provide RMB financial

services for border trade between China and Myanmar.

These services include RMB account opening, deposits,

settlements, financing and foreign exchange for both

Chinese and Myanmar clients.

Than Than Swe said the CIPS system offered an

alternative to the Society for Worldwide Interbank

Financial Telecommunication (SWIFT). The authorities in

Myanmar have been encouraging exporters and importers

to use yuan, baht and rupees in the border trade with

China, Thailand and India.

See:

https://www.irrawaddy.com/business/myanmar-branch-of-icbc-joins-chinas-global-trade-payment-system.html

Border trade disrupted

It has been reported that Myanmar traders are suffering

huge losses after fighting in Shan State has almost shut

down the country’s main China border trade. It is reported

that the ethnic Brotherhood Alliance has taken control of

all major routes to the border trading towns of Muse, Chin

Shwe Haw, Laukkai and Hseni since launching an

offensive in October.

The Muse border zone accounts for about 70% percent of

Myanmar’s cross-border trade with China. Exporters

handling perishable goods are also facing huge losses. In

addition the authorities in Myanmar are losing an

estimated US$400,00 per day in tax revenue from lost

border trade.

See:

https://www.irrawaddy.com/business/myanmar-china-trade-corridor-closed-as-battle-rages-in-northern-shan.html

US Treasury prohibits financial services by US

entities

with Myanmar energy company

The U.S. Department of the Treasury’s Office of Foreign

Assets Control (OFAC) published a new directive that

prohibits certain financial services by U.S. persons to or

for the benefit of Myanma Oil and Gas Enterprise

(MOGE).

The Directive says:

“Pursuant to sections 1(a)(iv), 1(b), and 8 of Executive

Order 14014, “Blocking Property With Respect to the

Situation in Burma” (the “Order”), the Director of the

Office of Foreign Assets Control (OFAC) has determined,

in consultation with the Department of State that the

Myanma Oil and Gas Enterprise (MOGE) is a political

subdivision, agency, or instrumentality of the Government

of Burma, and that the following activities by a U.S.

person are prohibited on or after December 15, 2023

except to the extent provided by law or unless licensed or

otherwise authorised by OFAC: the provision, exportation

or re-exportation, directly or indirectly, of financial

services to or for the benefit of MOGE or its property or

interests in property.

All other activities with MOGE or involving MOGE’s

property or interests in property are permitted, provided

such activities are not otherwise prohibited by law, the

Order, or any other sanctions program implemented by

OFAC. Except to the extent otherwise provided by law or

unless licensed or otherwise authorized by OFAC, the

following are also prohibited: (a) any transaction that

evades or avoids, has the purpose of evading or avoiding,

causes a violation of, or attempts to violate any of the

prohibitions contained in this Directive; and (b) any

conspiracy formed to violate any of the prohibitions in this

Directive.”

Additionally, OFAC designated three entities and five

individuals connected to Burma’s military regime pursuant

to Executive Order (E.O.) 14014. These actions are

occurring in alignment with designations by both the

United Kingdom and Canada.

See:

https://ofac.treasury.gov/recent-actions/20231031

and

https://www.upstreamonline.com/energy-security/-a-basic-necessity-pttep-ploughs-on-with-myanmar-gas-production-after-us-sanctions-partner/2-1-1549748

6.

INDIA

Economy recovered but

growth slowed recently

During the COVID pandemic India’s Gross Domestic

Product (GDP) growth slowed to 6.6% but the economy

has made a rapid recovery in the two consecutive years

following COVID as the economy has grown at rates of

9.1% and 7.2%. However, in recent months, there has

been a slight slowdown. Despite weaker results reported

by Indian IT companies the services sector has remained

strong and exports are robust.

The strengthening of the digital infrastructure in

India has

led to increased accessibility to affordable transactions

across the entire country and the government’s expanded

direct benefit transfer programmes have become easily

accessible to the people.

In addition, increased capital expenditure has significantly

improved the physical infrastructure especially in the

transportation sector.

The Reserve Bank of India (RBI) has been working to

keep the Consumer Price Index (CPI) below 6%. Over the

past few years there has been significant improvement in

company balance sheets and this has encouraged lending.

Peeler logs now more readily available

PlyReporter, the Indian trade journal, writes there are

signs of an easing of log supplies to plywood makers in

the northern States of Yamunanagar, Ludhiana,

Hoshiarpur and Rudrapur as poplar logs are more readily

available but that these are mostly of small girth.

Since 2017 every state in the Northern Region has been

actively planting poplar and now the extent of poplar

plantations exceeds that of eucalyptus in Punjab and

Haryana. A boost to the sector in Haryana came when the

Chief Minister of the State halved the market fee from 2%

to 1%. He is reported by PlyReporter as saying “this will

help the Yamunanagar plywood industry and

Yamunanagar district (Northern India) based units as they

will save approximately Rs.60 million annually and this

will be a big support for industries.“

The supply of plywood to the market has been supported

by increasing imports of core veneer from Vietnam,

Tanzania, Brazil and logs for core veneer peeling from

Uruguay, Australia and Argentina.

The plywood industries based in Gujarat, West Bengal,

Maharashtra, Andhra Pradesh were buying core veneer

from Northern India but, due to high price of domestic raw

material, many shifted to imported core veneers and logs.

The shift to imported core veneer is helping North India

based plywood manufacturers as domestic raw material is

more readily available.

See:

https://www.plyreporter.com/article/93397/north-to-get-relief-by-2nd-half-of-2023-timber-supply-to-ease-up-for-punjab-haryana-ply-reporter-prediction-2023

Tamil Nadu potential as furniture hub

Government and industry sources are upbeat about

prospects for the furniture manufacturing sector in Tamil

Nadu given its skilled manpower and access to ports. It is

hoped that Tamil Nadu can transform into a hub for

furniture production and exports as companies pursue the

‘China plus policy’ and explore alternatives to the Chinese

market. The potential for exports is huge since India has

only 5% share of the world market.

Moreover, the India/Australia Economic Cooperation and

Trade Agreement (ECTA) and India/UAE Comprehensive

Economic Partnership Agreement (CEPA) signed last year

offer zero-duty market access for made-in-India furniture

to these markets. In addition to expanding into new

international markets there are opportunities in the

domestic market. The value of the Indian furniture market

thought to be around US$32 billion with an annual growth

of 20%-25%.

See:

http://timesofindia.indiatimes.com/articleshow/104999876.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Press release from organisers of WOFX

WOFX, World Furniture Expo 2023 will be held 28-30

November 2023 at the Bombay Exhibition Center,

Mumbai. This event is dicated to business to busness

interactions for the furniture sector in India. As a

dedicated furniture and interior décor show WOFX aims

to connect leading builders, architects, dealers,

distributors, importers, retailers, etailers and other buyer

groups .

The event will bring to India the latest designs,

innovations and technological developments in the

furniture industry by showcasing suppliers from India,

Bangladesh, Singapore, Thailand, Malaysia, Indonesia,

Vietnam, China, Turkey and more.

See:

https://wofxworldexpo.com/press-release-4

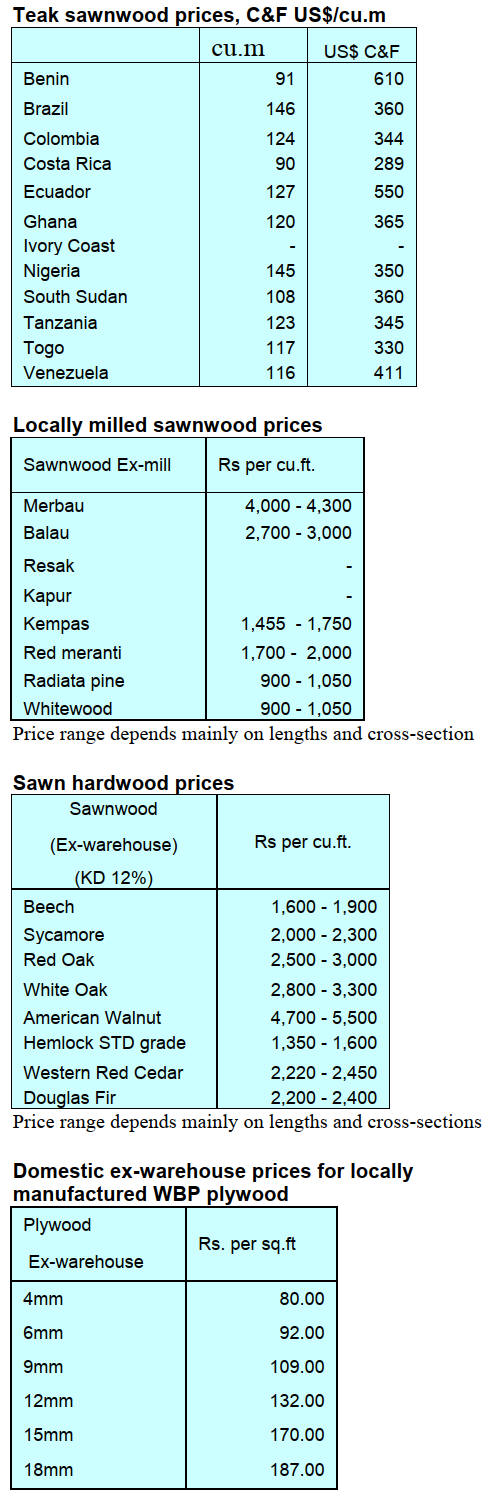

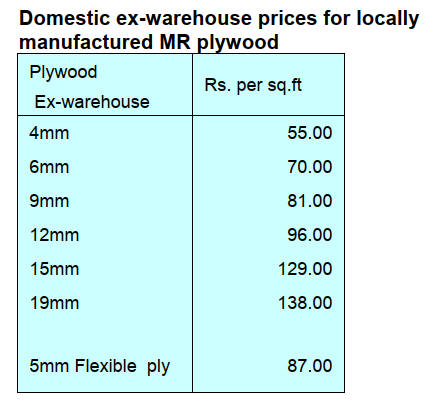

The import data has not been updated for November as

Diwali celebrations made it difficult to gather the

information. The October information is reproduced

below.

7.

VIETNAM

Wood and Wood Product (W&WP) trade highlights

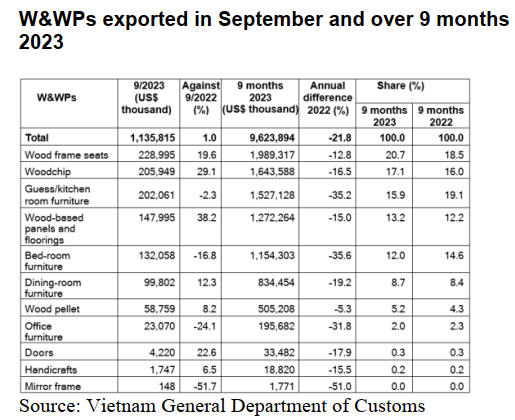

Vietnam’s W&WP exports in October were around

US$1.2 billion, up 5.7% compared to September 2023 but

down 0.9% compared to October 2022. In particular, WP

exports are forecast to have earned US$790 million, up

4% compared to September 2023 and up 0.3% compared

to October 2022. WP exports alone should be valued at

US$7.3 billion, down 22% over the same period in 2022.

Vietnam's W&WP imports in October 2023 are estimated

at US$180.0 million, down 5% compared to September

2023 and down 19% over the same period in 2022. Up to

the end of October 2023 W&WP imports were valued at

US$1.786 billion, down 31% over the same period in

2022.

Vietnam's imports of raw wood (logs and sawnwood) in

October 2023 are estimated at 424,500 cu.m, worth

US$135.0 million, up 8% in volume and 8% in value

compared to September 2023. However, as compared to

October 2022 it decreased by 14% in volume and 24% in

value.

In the first 10 months of 2023 imports of raw wood

reached 3,704 million cu.m, worth US$1,262 billion, down

27% in volume and 35% in value over the same period in

2022.

Vietnam’s exports of non-timber forest products (NTFPs)

in October 2023 are estimated at US$60 million, up 14%

compared to September 2023 bringing total NTFP exports

in the first 10 months of 2023 to US$598.69 million, down

14% over the same period in 2022.

W&WP exports gradually recovering

WP exports alone contributed US$7.3 billion, down 22%

over the same period in 2022. However, in October, with a

monthly earning of US$1.2 billion, W&WP export values

have increased by 6% compared to September 2023 and

shown a certain level of recovery.

Despite recovery signals, the wood processing industries

still face many difficulties and the growth of the sector is

still hindered by the gloomy global economy and

weakened W&WP demand. As a result, Vietnam’s export

target of US$17 billion in 2023 cannot be achieved.

It is expected that in the last 3 months of 2023

W&WP

exports will add about US$4 billion bringing exports in

2023 to between US$13.6 – US$14 billion.

Export markets

W&WP exports to the top market, the US, showed signs

of recovery in September 2023 with the growth rate of

7.5% compared to September 2022, narrowing the decline

in the first 9 months of this year. W&WP exports to the

US over the first 9 months of 2023 were valued US$5.2

down 24% year on year.

The recovery of exports to the US is an optimistic signal

for the industry as the US often consumes 50 - 55% of

total W&WPs exports from Vietnam. In the last 3 months

of 2023, W&WP exports to the US are expected to recover

thanks to a better US economic outlook as well as the

reduction of inventories and inflationary pressures.

In addition to the US market, W&WP exports to other

markets in the first 9 months of 2023 all declined. In

particular, exports to Japan reached US$1.3 billion, down

9%; China US$1.2 billion, down 25%; South Korea

US$583 million, down 21%; EU US$303.5 million, down

37%.

Forecast

Vietnam's W&WP exports in the first 10 months of this

year are estimated at US$10.8 billion, down 20% over the

same period in 2022. The main reason behind this

downturn is the lack of orders from major markets. This

trend has been prevailing since the end of 2022 and lasting

through the first months of 2023.

However, demand for furniture in international markets

and Vietnam's supply capacity are both positive. From

August 2023, buyers have started to return.

The recently signed free trade agreements are

expected to

facilitate made-in-Vietnam furniture shipments to potential

markets such as the EU, Asian countries and the Middle

East.

The outlook for W&WP exports is expected to be more

positive in the last months of 2023 with the

revitalisation of property markets and increasing

demand for home furniture replacement before the New

Year holidays.

W&WP imports in the first 10 months of 2023

According to preliminary statistics, Vietnam's log and

sawnwood imports in October 2023 amounted to 424,500

cu.m, worth US$135.0 million, up 8% in volume and 8%

in value compared to September 2023. However,

compared to October 2022, it decreased by 14.0% in

volume and 24.4% in value.

In the first 10 months of 2023, log and sawnwood

imports

totalled 3.704 million cu.m, worth US$1,262 billion, down

279% in volume and 35% in value over the same period in

2022.

Suppliers

In the first 9 months of 2023 import volumes of raw wood

from major markets such as the EU, USA, China,

Cambodia, Chile and Laos dropped against the same

period in 2022, while the imports from smaller suppliers

such as Thailand, Malaysia, Indonesia and Sierra Leone

increased slightly.

Log and sawnwood imported from the EU accounted for

18% of total imports, reaching 575,800 cu.m, worth

US$174.7 million, down 11% in volume and 20% in value

over the same period in 2022.

Imports of raw wood from the US decreased by 26% in

volume and 34% in value over the same period in 2022

with the volume of 391,900 cu.m, worth US$167.3 million

a 12% share of total imports.

Imports of raw wood from Chinat decreased by 26% in

volume and 39% in value over the same period in 2022,

amounting to 388,000 cu.m, worth US$181.4 million and

accounted for 12% of total imports.

In addition, the import volume of raw wood from some

other suppliers decreased over the same period in 2022

such as; from Cameroon decreased 22%; Chile fell 10%;

Laos minus by 25%; Brazil dropped by 44%; New Zealand

down by 16%; Russia by 27%.

Imported species

Statistics from the General Department of Customs reveal

that in the first 9 months of 2023 the import volume of

major species such as pine, tali, poplar, oak, pachi/doussi,

padauk and eucalyptus dropped year-on-year while the

imports of other species increased (rubber, teak, fir,

pecans).

Pine, as the top imported wood, accounted for

15% of total

raw wood imports in the first nine months of 2023

reaching 508,000 cu.m, worth US$111.6 million, down

37% in volume and 50% in value over the same period in

2022.

Tali imports decreased by 25% in volume and 23% in

value over the same period in 2022, reaching 297,200

cu.m, valued at US$124.2 million, accounting for 9% of

the total imported raw wood.

Poplar imports decreased by 19% in volume and 33% in

value compared to the same period in 2022, reaching

235,100 cu.m, valued at US$97.6 million.

In addition, the import volume of some species

decreased

as compared to the same period in 2022 such as oak

decreased by 7.5%, pachi/doussi by 63%, padauk by 30%,

eucalyptus by 62%, mukulungu by 14%; sapele by 45%.

In contrast, imports of ash in the first 9 months of

2023

increased by 12% in volume and 10% in value over the

same period in 2022, reaching 404,200 cu.m, worth

US$103.8 million and accounted for 12% of total imported

raw wood.

In addition, import volumes of some woody species

increased over the same period in 2022 such as

rubberwood increased by 12%, teak by 50%, spruce by

110%, pecan by 46%, menghundor by 38%, mersawa by

9%.

Prices

In the first 9 months of 2023 the average price of raw

wood imported into Vietnam stood at US$343.8/cu.m,

down 11% over the same period in 2022.

In particular, the price of raw wood from the EU

decreased

by 10% to US$303.3/cu.m, from the US by 10%, to

US$426.8/cu.m, China down by 17%, to US$467.6/cu.m,

Laos dropped by 8%, to US$469.0/cu.m.

Non-timber forest product exports decreasing

According to the General Department of Customs, NTFP

exports in September 2023 amounted to US$52.83 million,

down 17.9% compared to August 2023 but up 6.5%

compared to September 2022. Over the first 9 months of

2023, Vietnam’s NTFP exports were valued at US$538.69

million, down 16% over the same period in 2022.

In October 2023 the US$60 million from NTFP exports is

expected to bring total exports in the first 10 months of

2023 to US$598.69 million, down 14% year-on-year.

Vietnam, a model in forest protection and sustainable

development

Vietnam intends to implement international commitments

and also create new values for agricultural development.

The European Commission (EC) has recognised

Vietnam’s quick action in adapting to the European Union

Deforestation-free Regulation (EUDR), saying Vietnam's

message of turning challenges into opportunities has

inspired the EC in working with partners.

The information was revealed at a working session

between a delegation from the Ministry of Agriculture and

Rural Development (MARD) led by Minister Le Minh

Hoan and the EC’s officials.

During working sessions with the EC Commissioner for

Environment, Oceans and Fisheries, Virginijus

Sinkevičius, Hoan stated that the Vietnamese

Government's policy is to guide agriculture towards an

ecological, green and sustainable direction.

Vietnam not only wants to implement international

commitments but to create new values for agricultural

development accompanied by environmental protection,

preserving resources for future generations, and

contributing to global sustainable development, he said.

The Minister also highlighted the Vietnamese

Government's commitment to developing a transparent,

responsible, and sustainable agricultural sector as Vietnam

has become a major food supplier in the world.

Regarding the EUDR, Hoan said that Vietnam's message

of compliance with the regulations meets the requirements

for exporting coffee, rubber, wood and wood products to

the EU market. It is also an opportunity to develop

Vietnam's agriculture sector in line with the sector's

strategic orientation of transparency, responsibility,

sustainability and green growth.

As soon as EC approved the EUDR, MARD participated

in many in-depth discussions at both EC’s technical and

leadership levels as well as quickly directed specialised

agencies to prepare an adaptation action plan framework

for the EUDR.

See:

https://en.vietnamplus.vn/vietnam-becomes-global-model-in-forest-protection-sustainable-development-ec/270014.vnp

8. BRAZIL

Forest biomass potential

as a source of energy

Law No. 233/2005 addresses forest policy and also deals

with forest replacement and after the introduction of

regulation No. 06/2022, forest residues (stumps, roots,

branches) that used to be burned began to be used for

bioenergy production.

A study by the Secretaria do Meio Ambiente e

Infraestrutura (SEMA) on the Coefficient of Volumetric

Yield (CRV) proved to be fundamental to making

sustainable forest management projects more viable

through the utilisation of stumps, roots and branches.

Demand for the forest biomass continues to grow in the

state of Mato Grosso.

According to a survey carried out by the Center of Timber

Producing and Exporting Industries of Mato Grosso State

(CIPEM) based on indicators gathered by the Federation

of Industries of Mato Grosso (FIEMT), the value produced

in 2022 from biomass exceeded all previous years.

Last year, R$310.1 million was earned from the annual

production of 3.5 million cubic metres, representing an

doubling of production.

CIPEM said, in view of the high demand for biomass

it is

essential that the environmental licensing agency

establishes procedures that are consistent with the reality

of enterprises that produce biomass for energy generationt.

See:

https://cipem.org.br/noticias/potencial-da-biomassa-florestal-como-fonte-de-energia

Illegal logging in non-designated public forests

Around 38,000 hectares of forest in Pará State in the

Amazon Region, were logged of which 46% (17,800

hectares) occurred illegally between August 2021 and July

2022, according to the Logging Monitoring System -

SIMEX (Sistema de Monitoramento da Exploração

Madeireira).

Much of this logging was in public forests that have not

yet been designated for a defined use by the State. In these

non-designated public land areas, 1,711 hectares were

illegally harvested representing an increase of 86%

compared to the previous period (August 2020 to July

2021) when 919 hectares of unauthorised logging was

identified.

SIMEX data shows that of the total illegally logged area of

13,300 hectares occurred within registered properties.

Illegal logging in non-designated areas accounted for 9.5%

of the total. Protected areas accounted for 5.8%, 5.3% in

indigenous lands and 0.5% in conservation units.

The municipalities with the largest areas of illegal activity

were: Paragominas, with 4,167 hectares (23%); Dom

Eliseu, with 2,741 hectares (15%); and Goianésia do Pará,

with 1,696 hectares (9%).

The monitoring system showed that there was a reduction

in logging in protected areas during the period analysed. In

indigenous lands, illegal logging fell to just 951 hectares.

In conservation units the area logged without authorisation

went from 126 hectares in the previous period to 96

hectares. The most affected protected areas in the latest

monitoring work were the Amanayé indigenous land, the

Jamanxim National Parkand the Sarauá indigenous land.

See:

https://www.remade.com.br/noticias/19546/extracao-ilegal-de-madeira-cresce-em-areas-ainda-nao-destinadas-do-para

Mato Grosso expands its timber exports

The state of Mato Grosso in the Amazon Region is Brazil's

fourth largest timber exporter and generated around

US$71 million in exports of forest products between

January and September 2023. Almost half of all

municipalities in the state have forest-based industries

with Colniza and Aripuanã leading the state's log

production according to the Brazilian Institute of

Geography and Statistics (IBGE).China and India stand

out as important consumers of wood products from Mato

Grosso harvested from areas with sustainable forest

management plans. According to the Ministry of

Agriculture and Livestock (MAPA), up to September

India imported 38,101 tonnes (US$20.5 million) and

China imported 8,964 tonnes (US$6.8 million).

It should be noted that Mato Grosso's wood product

exports to India are mainly teak from forest plantation and

the state hopes to expand exports of native timber species

from sustainable forest management.

Ahead of Mato Grosso, the largest exporting states up to

September 2023 were Santa Catarina (US$1 billion), Rio

Grande do Sul (R$436.7 million) and Pará (US$177.1

million).

In order to increase exports to China and India CIPEM

plan lead a delegation of entrepreneurs from the forest

sector to participate in the Global Wood Forum in Macau,

November 21-22.

See:

https://forestnews.com.br/mato-grosso-exportacoes-madeira-mercados-globais/

Export monitoring provides indicators of furniture

trade

The "Monitoring of Furniture Exports" report developed

by Market Intelligence (IEMI) was produced exclusively

for companies associated with the Brazilian Furniture

Sector Project, an initiative of ABIMÓVEL (Brazilian

Furniture Industry Association) and Apex Brasil (Brazilian

Trade and Investment Promotion Agency) with the aim of

boosting exports and the internationalisation of Brazil's

furniture industry.

The study tracks exports in four main product categories

(upholstered furniture, wooden furniture, metal furniture

and mattresses), observing the monthly variation in

exports of 17 key products which are representative for the

categories and markets of strategic interest. In September

2023 Brazil exported approximately US$57.9 million

(FOB) in furniture, representing a drop of 11% compared

to the same month in the previous year.

Furthermore, exports to different countries showed

significant variations. There was a sharp drop in exports to

Germany (61%), Colombia (51%), the United States

(28%) and Peru (22%). On the other hand a significant

increase in the monthly variation of exports was recorded

in the United Arab Emirates (158%), followed by Chile

(19%), Mexico (62%), Panama (74%) and the United

Kingdom (12%).

The ABIMÓVEL report is an important tool for

companies associated with the project providing essential

data for understanding and adjusting export strategies.

This report was prepared on the basis of estimates built on

data from IEMI's research with companies in the sector

(producers and retailers) as well as on data and short-term

performance indicators produced by official sources of

information (IBGE (Brazilian Institute of Geography and

Statistics), SECEX (Secretariat of Foreign Trade),

CAGED (General Register of Employed and Unemployed,

among others.

See:

http://abimovel.com/brazilian-furniture-monitoramento-das-exportacoes-traz-indicadores-do-comercio-exterior-de-moveis-e-colchoes-em-setembro/

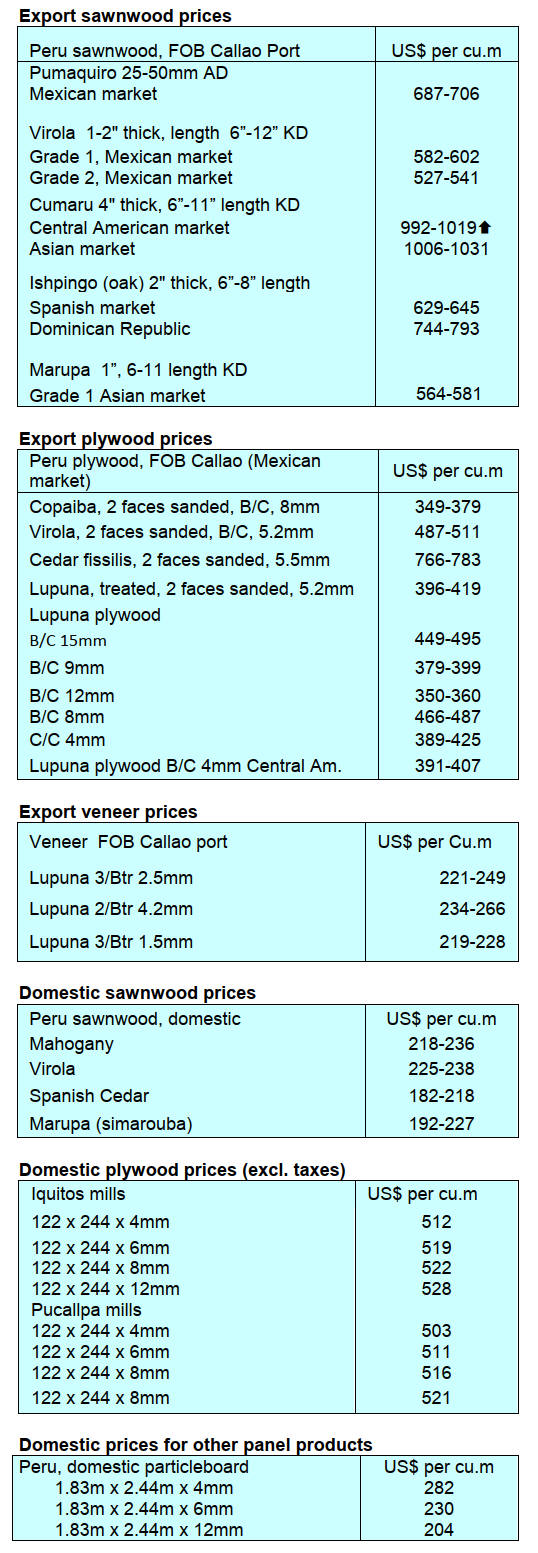

9. PERU

Bosques Amazonicos

issues sustainable financial

instruments

The company Bosques Amazonicos S.A.C. (BAM) issued

its Third Sustainable Short-Term Instrument Program –

Series A in the Peruvian capital market successfully

placing US$3.404 million at a rate of 8% for a term of 360

days.

The funds will be used to finance conservation,

reforestation, restoration and innovative projects in the

Amazon. The initiative will benefit more than 1,000

member families.

The third programme of sustainable short-term

instruments certified by Pacific Corporate Sustainability

(PCS) will be used to cover and scale up projects with

high social and/or environmental impacts.

BAM's strategy is framed in the development of three

pillars: conserve, restore and finance which generate value

for forests and their investors, promotes the sustainable

development of local economies and contributes to

reducing the effects of climate change.

See:

https://gestion.pe/economia/empresas/bosques-amazonicos-emite-instrumentos-financieros-sostenibles-por-us-3404-millones-noticia/

Incentives for companies obtaining voluntary forest

certification

The Ministry of Agrarian Development and Irrigation

(Midagri) will provide incentives and benefits to

individuals or companies that obtain voluntary forestry

certification and deliver additional ‘good practices’ for

forestry and wildlife competitiveness. This was possible

after approving guidelines in the Executive Directorate

Resolution No. D000244-2023-MIDAGRI-SERFOR-DE.

Midagri, through the National Forestry and Wildlife

Service (Serfor), ordered the pre-publication of the

proposal for “Guidelines for the granting of incentives

and/or benefits for voluntary forest certification and other

good practices for forest competitiveness and of wildlife”

at the end of August of this year in order to receive

comments or contributions from interested people.

The incentives range from discounts on various procedures

such as payment for harvesting rights to the granting of

additional points in processes for granting timber forestry

concessions.

See:

https://agraria.pe/noticias/midagri-otorgara-incentivos-a-quienes-obtengan-certificacion-33735

Proof of good forestry practices in Ucayali

Region

The delivery of 22 titles to forestry concession holders in

Ucayali will allow the beneficiaries to market wood

products nationally and internationally.

In October the Forestry and Wildlife Resources

Supervision Agency (Osinfor) handed out what is called

‘Certificates of Compliance’ to 22 holders of enabling

titles in the Ucayali region. The head of Osinfor, Lucetty

Ullilen, expressed her satisfaction on the work well done

during Forest Week.mThe holders who received their

‘Certificates of Compliance in’ Pucallpa enthusiastically

welcomed the announced incentives.

Carlos Henderson, a representative of a logging

concession, stated that these certificates, along with the

incentives, will be a showcase for clients who value

sustainability and legality.

Bosques Amazonicos announces merger plans

Bosques Amazónicos S.A.C. (BAM) reported its intention

to merge with three companies operating in the same

sector in a statement issued to the Superintendence of

Markets and Securities (SMV).

BAM has operated in Peru since 2007 and is dedicated to

the development and marketing of environmental services

including afforestation and reforestation of forests and

aims to join Bosques Amazónico SFM S.A., Asterix SFM

S.A. and Desarrollos Amazónico S.A.C.

Desarrollos Amazónico S.A.C is oriented towards

afforestation and reforestation activities, agricultural,

industrial or manufacturing explotation, administration of

timber forests, planting, harvesting and marketing of

tropical fruits.

Asterix SFM S.A. carries out multiple activities related to

the generation of rights or benefits derived from the

sustainable exploitation of the environment as well as the

generation of verified carbon emissions, carbon credits.

See:

https://gestion.pe/economia/empresas/bosques-amazonicos-anuncia-planes-de-fusion-con-tres-empresas-noticia/?ref=gesr

|