US Dollar Exchange Rates of

10th

Oct

2023

China Yuan 7.30

Report from China

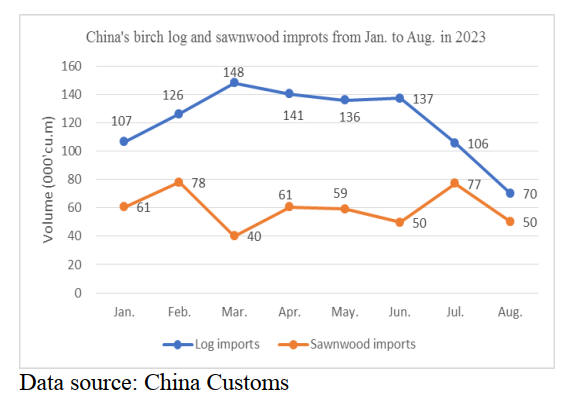

Dramatic

decline in birch log imports

According to China Customs, birch log imports fell

sharply in the first eight months of 2023 and were 971,231

cubic metres valued at US$130.73 million, down 33% in

volume and 36% in value over the same period of 2022.

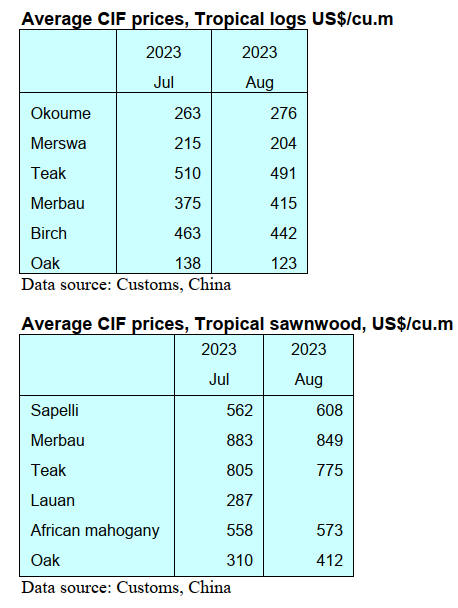

The average CIF price for China’s birch log imports fell

5% to US$135 per cubic metre.

The top suppliers of birch log imports were Russia and

Latvia. 95% of China’s birch logs were imported from

Russia and some was imported from Latvia in the first

eight months of 2023. In addition, China imported small

volumes of birch logs from Estonia, USA, Belgium and

Canada.

China’s birch log imports from Russia were 922,131 cubic

metres valued at US$118.6 million in the first eight

months of 2023, down 27% in volume and 28% in value

compared to the same period of 2022. The CIF price for

China’s birch log imports from Russia fell 1% to US$129

per cubic metre.

China’s birch log imports from Latvia amounted to 48,064

cubic metres valued at US$11.7 million in the first eight

months of 2023, down 73% in volume and 69% in value

compared to the same period of 2022. The CIF price for

China’s birch log imports from Latvia rose 14% to

US$243 per cubic metre.

Russia's increase in the export tax on birch log exports has

put pressure on Chinese enterprises and this is why

imports have declined to a record low.

Rise in birch sawnwood imports

In contrast to log imports, birch sawnwood imports

increased in the first eight months of 2023 and were

475,863 cubic metres valued at US$98.79 million, up 10%

in volume and 3% in value over the same period of 2022.

The average CIF price for China’s birch sawnwood

imports fell 6% to US$208 per cubic metre.

The rise in the export tax rate of Russian birch logs has

prompted enterprises to process birch logs into sawnwood

in Russia and export sawnwood to China. The largest

supplier of China’s birch log imports is Russia. In addition

to imports from Russia, China imported small quantities of

birch sawnwood from Estonia, Belarus, Latvia and

Finland.

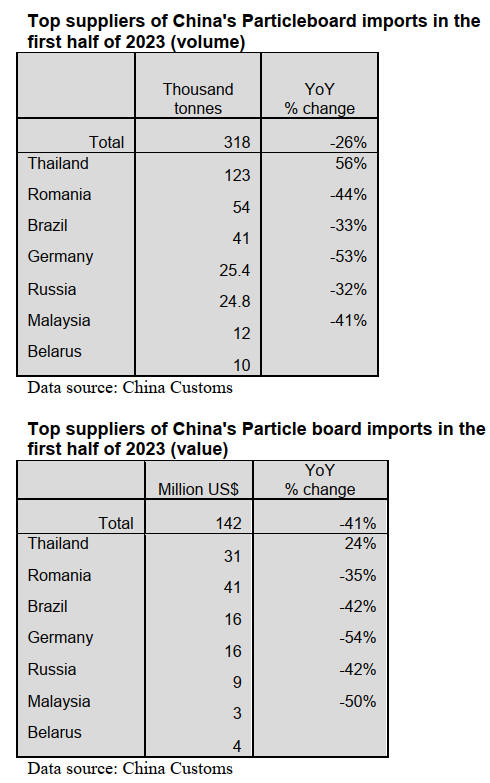

Surge in particleboard imports from Thailand

According to China Customs, in the first half of 2023

China’s particleboard imports fell 26% to 318,000 tonnes

valued at US$142 million, down 41% over the same

period of 2022.

Thailand was the largest supplier for China’s particleboard

imports and they surged 56% to 123,000 tonnes however,

imports from other suppliers fell. The dramatic increase in

China's particleboard imports from Thailand was mainly

due to the fact that Chinese enterprises have set up

factories in Thailand and a large amount of particleboard

produced is exported to China.

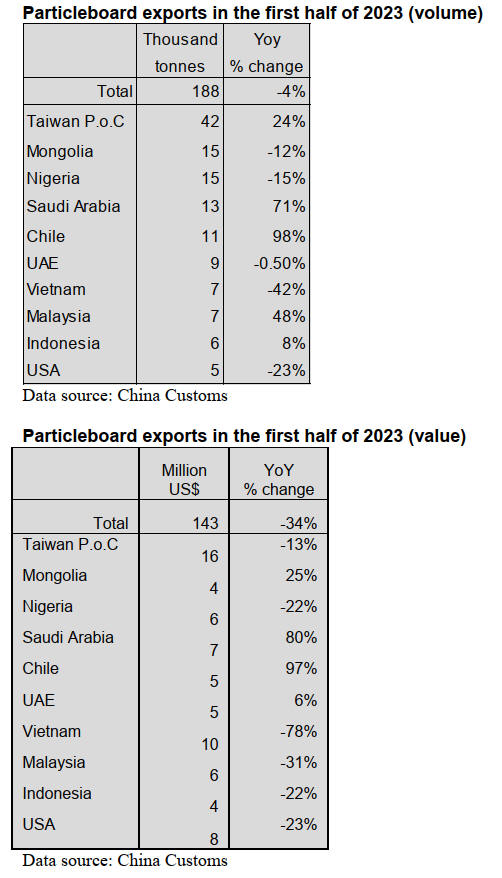

Decline in particleboard exports

China’s Customs data shows that in the first half of 2023

particleboard exports fell 4% to 188,000 tonnes valued at

US$143 million, down 34% over the same period of 2022.

Taiwan P.o.C was the largest destination for China’s

particleboard exports and in the first half of 2023 exports

to Taiwan P.o.C rose 24% to 42,000 tonnes. China’s

particleboard exports to Saudi Arabia, Chile, Malaysia and

Indonesia grew 71%, 98%, 48% and 8% compared to the

same period of 2022.

However, the USA is no longer the largest market for

China’s particleboard exports having dropped 23% in the

first half of 2023. China’s particleboard exports to the

USA fell 51% to 10,352 tonnes in 2022.

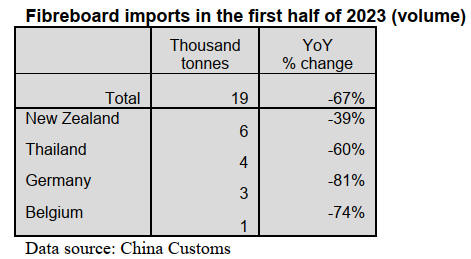

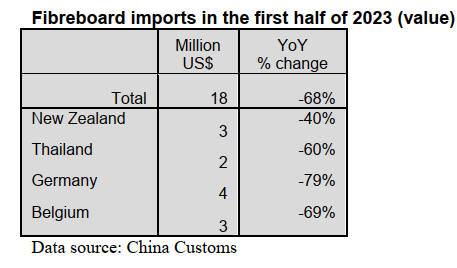

Sharp decline in fiberboard imports

According to China Customs, in the first half of 2023

China’s fiberboard imports fell 67% to 19,000 tonnes

valued at US$18 million, down 68% over the same period

of 2022. Fiberboard imports from all top suppliers; New

Zealand, Thailand, Germany and Belgium fell at even

greater rates in the first half of 2023.

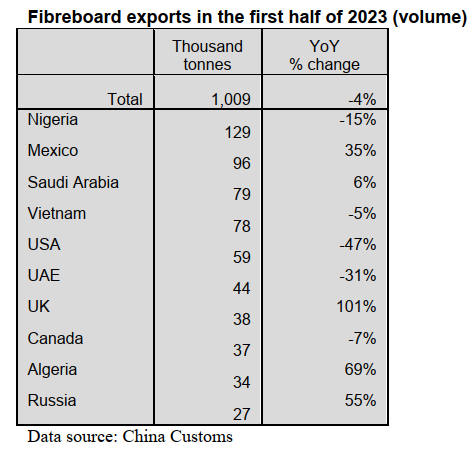

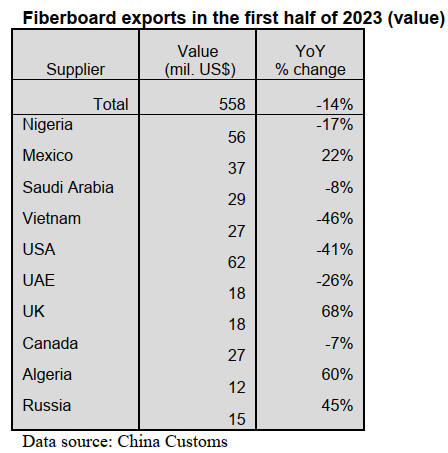

Decline in fibreboard exports

In the first half of 2023 China’s fibreboard exports fell 4%

to 1.009 million tonnes valued at US$558 million, down

14% over the same period of 2022. Nigeria was the largest

export market for China’s fibreboard in the first half of

2023 but exports to Nigeria decreased 15% to 129,000

tonnes.

China’s fibreboard exports to Mexico, Saudi Arabia, UK,

Algeria and Russia grew 35%, 6%, 101%, 69% and 55%

respectively compared to the same period of 2022.

The USA is no longest market for China’s fibreboard

exports having fallen 47% in the first half of 2023. China’s

fibreboard exports to the USA in 2022 rose 19% to

187,392 tonnes due to strong demand.

In the first half of 2023 there was an overall decline in

imports and exports of panel products. There are two main

reasons for this, first China's woodbased panel production

capacity has increased so China no longer needs to import

woodbased panels and second, China has implemented a

rural revitalisation strategy shifting the focus of marketing

to rural consumption not exports.

|