Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Sep

2023

Japan Yen 146.90

Reports From Japan

GDP revised down

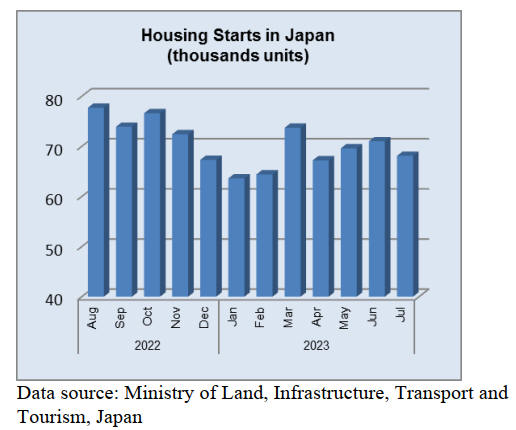

In the April-June quarter the Japanese economy expanded

at a slower pace than initially estimated as businesses and

consumers spent less and this disappointing news is why

the government intends to introduce an economic stimulus

package by the end of September.

Revised figures from the Cabinet Office show GDP grew

at an annualised 4.8% from the previous three months with

the expansion almost entirely reliant on export growth.

That was a smaller gain than the preliminary reading of

6% and came in well below economists’ forecast of 5.6%

growth.

Business spending figures were also revised to show

investment dropped 1%. Previously the government

estimated that capital investment was flat compared to the

first quarter. Consumer spending also fell more than first

forecast.

See:

https://www.japantimes.co.jp/business/2023/09/08/economy/japan-gdp-revised/

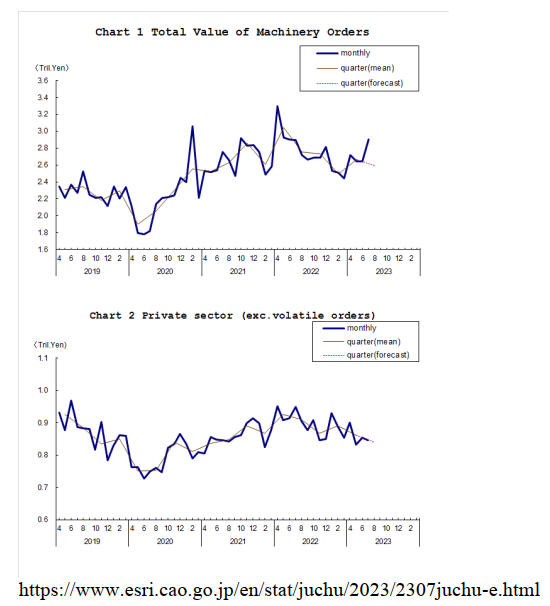

Despite the disappointing second quarter data on

investment the total value of machinery orders received by

280 manufacturers operating in Japan increased by 9.8%

in July from the previous month.

Private-sector machinery orders, excluding volatile ones

for ships and those from electric power companies,

decreased a seasonally adjusted by 1.1% in July.

End of ulta-easing policy not far away

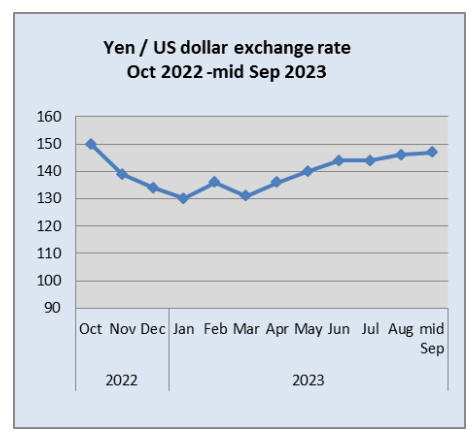

Early September comments from Bank of Japan Governor

(BoJ), Kazuo Ueda, to the effect that the end of the Bank’s

negative interest rate policy (NIRP) is not so far away,

resulted in the yen exchange rate becoming more volatile.

The yen had begun moving closer to the 150 mark but on

the comments from the BoJ the yen strengthened.

The local media have reported that the BoJ is waiting to

see if wages and prices rise before making a decision on

interest rates.

The finances of a wide range of industries including

automobiles and distribution have been improving due to

the depreciation of the yen and this was reflected in the

summer bonuses at major companies. Although an

increase in interest rates will be an extra burden on

households the thinking is that if the economy improves

companies will have the strength to absorb the increased

burden and keep price increases to a minimum .

The government is concerned that China's worsening

economy could undermine Japan's recovery, especially if

the government in China fails to implement extensive

stimulus measures to boost domestic demand. Under these

circumstances the Bank of Japan will be cautious about

shifting to a more ‘normal’ monetary policy. China's

economic downturn is undermining Japan's export

dependent economy.

See:https://www.dailyfx.com/news/japanese-yen-rallies-on-bank-of-japan-s-ueda-comments-will-usd-jpy-reverse-20230911.html

and

https://japannews.yomiuri.co.jp/business/economy/20230909-135602/

In early September, when announcing changes to the

Cabinet, the Japanese Prime Minister said he will soon

compile a package of "drastic" economic measures to

boost the country's fragile recovery. The aim, he said, is to

“protect the people's lives from burdensome price rises

and to reinforce the trend of wage increases and

investment expansion”.

In a move aimed to help struggling household finances the

Ministry of Agriculture said that it will lower domestic

sale prices of imported wheat by 11% on 1 October.

The weighted average price for five imported wheat

products for sale to domestic milling companies will drop

to 68,240 yen per tonne, on the back of plentiful harvests

in major production areas in the United States and falls in

ocean freight fees. This will be the first drop in three

years.

See:

https://www.nippon.com/en/news/yjj2023091200872/japan-to-lower-imported-wheat-prices-by-11-pct.html

Real wages decline foro a 16th consecutive month

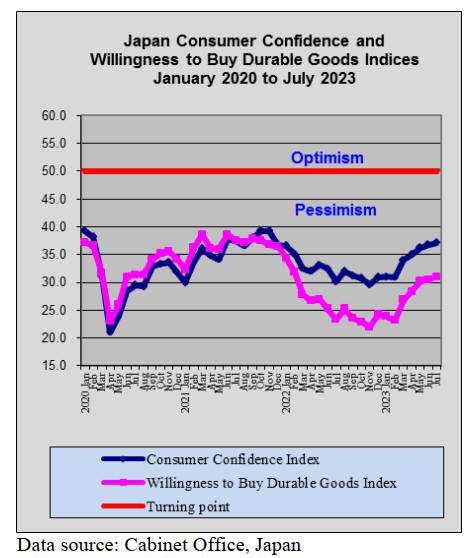

Data from the Cabinet Office in Japan shows real wages

extended their decline for a 16th consecutive month in

July as salaries failed to keep up with rising prices.

Global financial markets closely follow wage trends in

Japan as the Bank of Japan emphasises sustainable wage

rises as a prerequisite for deciding whether and how to

reverse its ultra-loose monetary stimulus.

Inflation-adjusted real wages, a barometer of consumers'

purchasing power, slid 2.5% in July from a year earlier

following a 1.6% slump in the month before.

Hottest ever summer in 2023

According to the Japan Meteorological Agency the

country experienced its hottest ever summer in 2023. The

average temperature for the June to August summer

months was the highest on record.

Based on measurements at 15 observation stations across

the country temperatures were almost 2 degrees higher

than seen over the last three decades (1991–2020) and the

highest since statistics began in 1898.

Wood carbonisation technology rooted in tradition

Japanese technology has spread globally and some have

their roots in tradition. One such technology is the

production of cabonised wood (yakisugi) which involves

burning the surface of the timber to be used for exterior

construction.

The carbonisation process begins with the flaming of the

wood surface, brushing to remove excess charcoal, the

application of a waterproofing coating and finally a

coating of sealant. All of these conditions

make yakisugi treated wood extremely durable. Satoshi

Kimura, Operations Director at Japanese-based company

says wood treated in this way can last for 80-90

years when properly maintained.

See:

https://www.archdaily.com/880330/carbonized-wood-a-traditional-japanese-technique-that-has-conquered-the-world

Yen moves on to Bank of Japan Governor comments

In early September the Japanese currency strengthened on

comments from the BoJ and at the same time the US dollar

gained as investors awaited inflation. At one point the US

dollar strengthened to 147.15 against the yen.

Analysts anticipate yen exchange rate volatility after

comments from Bank of Japan (BOJ) Governor Kazuo

Ueda heightened expectations the Bank could shift away

from its negative interest rate policy.

Import update

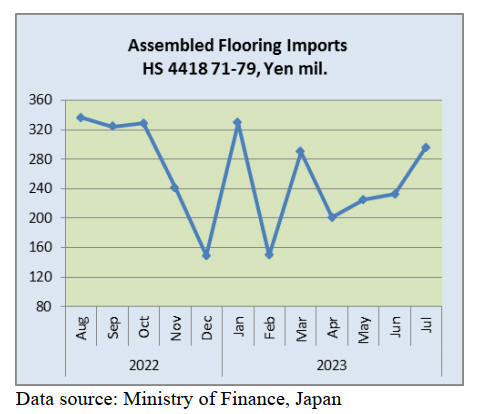

Assembled wooden flooring imports

July marked the third consecutive month when there was

an increase in the value of imports of assembled wooden

flooring (HS441871-79). This has brought the average

value of monthly imports almost back to levels seen in the

first half of the year.

Year on year, July imports of assembled wooden flooring

were down 9% but compared to June the value of imports

jumped 27%. Of the various categories of assembled

flooring imports in June, HS441875 was the largest

accounting for 66% of the total value of assembled

flooring imports followed by HS441879. The main

shippers of HS441875 in July were China 56% Malaysia

12% and Thailand and Indonesia around 6% each.

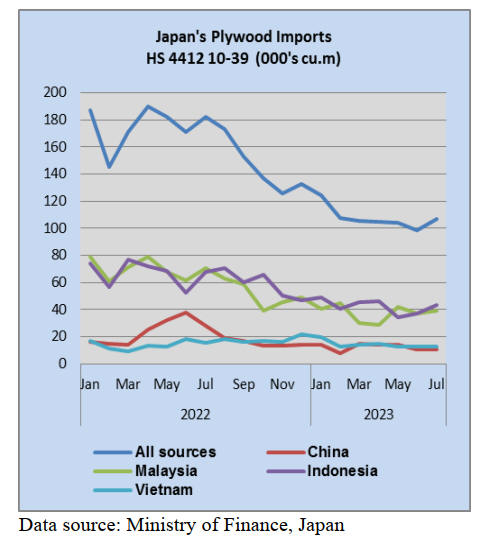

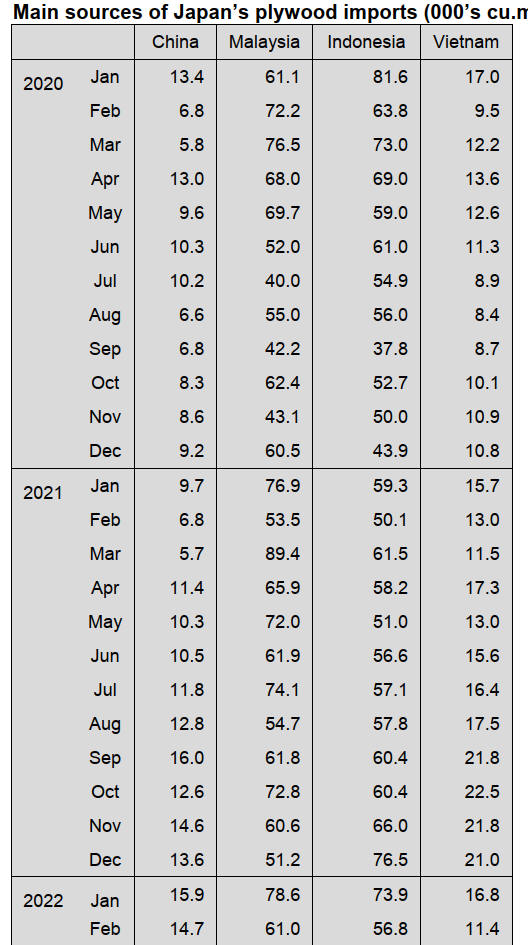

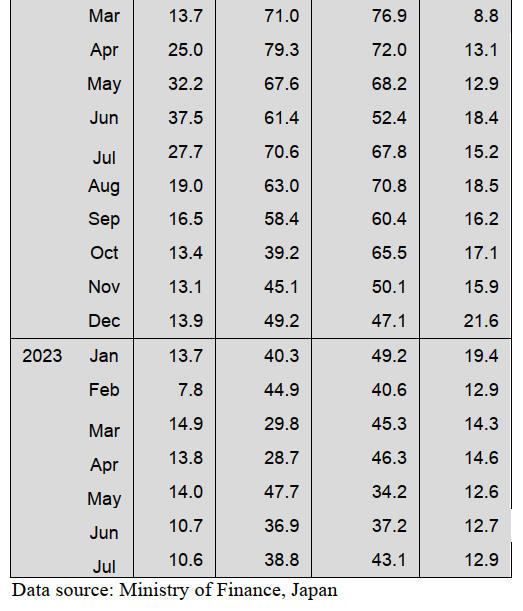

Plywood imports

July marked yet another month of declines in the volume

of imported plywood, a trend which began in mid-2022.

Year on year July 2023 plywood arrivals were 42% down

with all shippers seeing year on year declines in the value

of shipments. The volume of shipments from Malaysia and

Indonesia were down sharply. Compared to arrivals in

June import volumes were flat in July for each of the four

top suppliers.

A major Sarawak-based plywood exporter has forecast

that plywood export prices are likely to improve in the

second half of 2023 as Japan adjusts up its low plywood

inventory (see page 4).

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Damage from torrential rain

Tohoku Regional Forest Office announces about damages

in national forests by the torrential rain in July. There are

23 places of devastation of forest land in Akita Prefecture

and the total damage is 1.1 billion yen. There is one place

damaged in Iwate Prefecture and the total damage is 30

million yen.

There are 562 forestry roads destroyed in Akita Prefecture

and the total damage is 1.7 billion yen. There are 27

forestry roads destroyed in Iwate Prefecture and the total

damage is 100 million yen. In Aomori Prefecture, 23

forestry roads are destroyed and the total damage is 31

million yen. There is one forestry road damaged in

Yamagata Prefecture and the total damage is 20 million

yen.

In Akita Prefecture, the total damage of devastation of

forest land of forest under private ownership is 13 billion

yen and of damaged forestry roads is 12 billion yen.

According to The Ministry of Agriculture, Forestry and

Fisheries, there are several kinds of support for

manufacturers which related to forestry business and

lumber business.

Forests owned by foreign capital

According to The Ministry of Agriculture, Forestry and

Fisheries, there are 14 cases of acquirement forest in Japan

by foreign capital in 2022. This is 5 cases less than 2021.

The forest area is 41 hectares, 190 hectares less than the

previous year. 90 % of 41 hectares is Hokkaido Prefecture.

The purpose of use is asset holding. There are other forests

acquired in Kanagawa, Niigata, Shizuoka, Kyoto and Nara

prefectures.

There are 4 acquisitors from China including Hong Kong,

3 acquisitors from Singapore, 2 acquisitors from Macao

and 2 acquisitors from the Virgin Islands. Total forest area

acquired during 2006 to 2022 is 2,732 hectares by 320

cases.

Wood product imports for the first half of 2023 for

China

Volume of logs during January to June, 2023 is 9.3 % less

than January to June, 2022. One of reasons is that Russia

banned exporting logs to overseas. On the other hand,

volume of lumber is 10.5 % more than the same period

last year. 1,000 cbms of all Russian logs are red pine logs

and the rest of all Russian logs is hardwood logs. There

are no more softwood logs imported China from Russia.

German logs are 10 % less than the first half of 2022.

Polish and Japanese logs increased from the same period

last year. NZ logs are 8.3 % increase from the same period

last year because storm and flood damages, which were

cause by a cyclone, have been influencing the log export.

However, the log export would rise after the situation in

NZ gets back to normal. Volume of lumber of many

countries exceed the results of January to June, 2022.

Especially, volume of lumber of Sweden and Belarus are

two times more than the same period last year.

Import of laminated structural lumber

Imported laminated structural lumber in January to June,

2023 is 281,012 cbms, 42.8 % less than January to June,

2022. This if for the first time in thirteen years to be under

300,000 cbms. The reason is that orders for laminated

structural lumber have been a small volume since last year

due to an excessive supply. Volume of laminated small

lumber such as laminated post decreases a lot from the

first half of 2022.

Laminated structural lumber from Finland is 130,713

cbms, 32.1 % down from the same period last year.

Laminated structural lumber from Romania is 38,156

cbms, 58.8 % down from the same period last year. Ther

reason for decline would be a reduction of product at

Radauti mill of HS Timber Group in Romania.

Austria declines by 49.4 %. Russia declines by 47.3 %.

China declines by 64.1 %.

Volume of Germany during January to June, 2022 was

23,815 cbms but volume of Germany during January to

June.

Domestic lumber and logs

Dull movement of domestic lumber in August influences

demand and supply of logs. The price of cedar post

reaches the bottom in northern part of Kanto region at the

end of July but the movement of domestic lumber changed

in August. The market price of KD cedar post in Kanto

region is around 55,000 – 60,000 yen, delivered per cbm.

Demand and supply of lumber, laminated lumber and

plywood are sluggish through the nation so a market tone

is low. The price of log with A sort for lumber and log

with B sort are not easy to be lowered.

The price of raw timber in northern part of Kanto region

declined to 10,000 yen, delivered per cbm during May and

June. In Ibaraki Prefecture and Fukushima Prefecture, the

log price was 8,000 yen. Then, there was a reduction of

raw timber and the log price started to rise in July and

August.

In Tochigi Prefecture, 3m cedar log was around 11,000 –

13,000 yen at the end of July. There is less raw timber in

Kyushu area due to the torrential rain at the beginning of

July. Some manufacturers from northern part of Kyushu

area, Kumamoto Prefecture and Miyazaki Prefecture

collected logs and once the market price of log became

strong. However, demand and supply are weak in places,

where had no damages of the torrential rain.

In Akita Prefecture, there was also a heavy rain and there

were damages on mountains and forests. However, there

are enough inventory of plywood and laminated lumber

and there is no effect for raw timer now.

Plywood

Movement of domestic softwood plywood in August was

not good. Since the price of domestic softwood plywood

reached the bottom in July, there had been orders to

trading companies and wholesalers. However, demand of

house is unclear in the future so movement of domestic

softwood plywood became slow after the summer holiday

in August.

Consumers purchase only a small amount to fill current

needs. 12 mm 3 x 6 structural softwood plywood is 1,600

yen, delivered per sheet and this is no change from last

month.

Plywood companies in Western and Easter Japan left

prices unchanged in August. Thus, several plywood

companies would raise the price in September because of

increasing fuel expenses, electricity bills and salaries.

Volume of imported plywood has been decreasing and

demand of imported plywood is not active after the

summer holiday ended in August.

2.4 mm 3 x 6 plywood in South Asia costs around $950,

C&F per cbm. 3.7plywood is $880, C&F per cbm. 5.2 mm

plywood is $850, C&F per cbm. Form plywood is $560,

C&F per cbm. Structural plywood is $560, C&F per cbm.

The market price of form plywood and structural plywood

is 1,800 yen, C&F per cbm. 2.5 mm plywood is 780 yen,

C&F per cbm. 4 mm plywood is 1,000 yen, C&F per cbm.

5.5 mm plywood is 1,200 yen, C&F per cbm.

The price of painted plywood for concrete form reaches

the bottom in South Asia. In July, shippers in South Asia

raised the price by $20 – 50, C&F per cbm, up from

previous time because there is a shortage of painted

plywood for concrete form in Japan. The price in South

Asia is $670, C&F per cbm. The price of 12 mm 3 x 6

form plywood in Japan is 1,950 yen, delivered per sheet.

Wood products import for the first half of 2023

According to The Japan Lumber Importers’ Association,

volume of imported lumber during January to June, 2023

is 4,438,000 cbms, 34 % less than the result of January to

June, 2023. This volume would not exceed the result of

1962. It was 9,310,000 cbms in 1962.

Imported log is 1,058,000 cbms, 26.7 % less than the same

period last year. This is because of a decrease in North

American log. Imported lumber is 1,692,000 cbms, 40.5 %

less than the same period last year. European lumber

decreases 43.5% from the first half of 2022. The

woodshock, which occurred in spring, 2021 started to

calm down in autumn, 2021.

However, volume of imported lumber at the first half of

2022 was massive volume because the lumber arrived to

Japan very late. Then, trading companies decreased a

number of orders for lumber at the second half of 2022.

Therefore, the volume of lumber at the first half of 2023

plunged. North American log and lumber are 29.8 %

down. European log and lumber are 43.4 % down.

There has been no record for Russian log because of

banned import and export between Russia and Japan.

There had been a small demand for South Sea log for

producing plywood. Since demand of domestic log for

crating increased, volume of NZ log decreased.

Laminated structural lumber is 281,000 cbms, 42.8 % less

than the first half of 2022. This decrease in laminated

structural lumber is linked to the decrease in North

American and European lumber. Plywood is 33 % less

than the same period last year.

|