|

1.

CENTRAL AND WEST AFRICA

Forestry Minister appointed in Gabon

The military coup in Gabon is dominating both the

regional and domestic news. Africanews.com has reported

Gabon's military leader, General Brice Oligui Nguema has

unveiled his transitional government consisting of

representatives from diverse political backgrounds.

The domestic press in Gabon has reported Colonel

Maurice TOSUET has been appointed Minister of Water

and Forests.

Rumours were circulating in trade circles that the previous

Forestry Minister, Lee White, was under house arrest but

in a communication with UK based Declassified UK

Professor White dismissed fears he was missing and

confirmed via WhatsApp saying “I am fine at home in

Libreville where the situation is calm.”

See:

https://declassifieduk.org/british-minister-in-gabon-did-not-see-coup-coming/

Three ministers from Ali Bongo's previous government

have retained their positions. Camélia Ntoutoume-

Leclercq remains the Minister of National Education,

Hermann Immongault, formerly Minister of Foreign

Affairs, now serves as the Minister Delegate for the

Interior and Raphaël Ngazouzé, who previously oversaw

vocational training, has assumed responsibility for the

Civil Service portfolio.

See:

https://www.africanews.com/2023/09/10/gabon-pm-unveils-transitional-government-officials//

and

https://www.lenouveaugabon.com/fr/gestion-publique/0909-20102-transition-voici-les-26-membres-du-gouvernement-de-raymond-ndong-sima

In other news, it has been reported that in Gabon there is a

significant level of unrest within the forestry sector. A

strike has been initiated by all special zone workers at

Nkok. This is said to be because subcontractors have

failed to provide social security coverage for workers.

Also, it is understood that all operators have been

instructed to suspend operations until further notice.

Trucking operations running smoothly

Mid-September usually marks the end of the dry period in

Gabon. Operators report trucking operations were running

smoothly there were no significant disruptions in milling

operations and log stocks are adequate. Producers in

Gabon report demand remains stable in Europe but the

slowdown in demand for some species for the Far East and

the Middle East markets continues.

Weather conditions in Cameroon are markedly different

from Gabon. At present the timber industry is

experiencing disrupted harvesting activities due to heavy

rains. It is reported that milling operations have slowed but

this is not because of a log shortage as stocks are built up

during the dry season.

While export order levels are stable the slower milling

operations have pushed up delivery times. The absence of

Chinese buyers in the market has led to reduced enquiries

from this important market segment.

The timber industry in Congo is currently grappling with

weather-related challenges. Heavy rains have begun in the

southern regions causing delays in timber production. In

the northern regions bordering Cameroon extremely heavy

rains have been reported further disrupting harvesting

activities.

Despite challenges posed by poor road conditions,

transportation on tarmac roads and the Trans Congo rail is

reported as functioning well. The riverside storage area in

Brazzaville continues to be a transship point for logs by

rail to Pointe Noire Port.

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in the Republic of Congo and Gabon.

See:

https://www.itto-ggsc.org/static/upload/file/20230915/1694740138375092.pdf

2.

GHANA

FLEGT licenses for timber exports to EU

Ghana is set to become the first African country and

second in the world to begin issuing licenses for timber

exports under the Forest Law Enforcement, Governance

and Trade (FLEGT) scheme. This follows the successful

assessment of timber marking and tracking processes in

the Bobiri Forest Reserve in the Ashanti region by a

European Union and Ghana Forestry Commission team.

The FLEGT scheme forms part of measures the Forestry

Commission has instituted in compliance with tree

harvesting regulations, including traceability at origin in

line with the European Union’s Voluntary Partnership

Agreement signed between both countries in November

2019.

In February last year the Minister for Lands and Natural

Resources (MLNR), Samuel A. Jinapor, hosted the

European Union Ambassador to Ghana, HE Ichard

Razaaly. The MLNR Minster discussed key actions

undertaken by government in preparation for the issuance

of FLEGT licenses. He also acknowledged the importance

of Ghana government collaborating with EU to realize the

full benefits of the timber industry.

See:

https://myjoyonline.com/ghana-to-begin-issuance-of-flegt-licenses-for-timber-exports-to-eu

In related news, as part of the Joint Implementation

Committee for the FLEGT VPA the European

Commission is hosting a delegation from Ghana in

Brussels during the week of 18-22 September.

ATIBT, in a news flash, has indicated that the European

private sector is invited to this meeting to exchange views

with the delegation.

The delegation from Ghana has expressed an interest to

meet with private-sector players in the responsible tropical

timber sector to discuss opportunities for developing trade

in Ghanaian timber and the situation on the European

market.

For more see:

https://www.atibt.org/en/news/13372/ghanaian-delegation-to-meet-private-sector-players-in-brussels-on-tuesday-september-19

Billet exports dropped

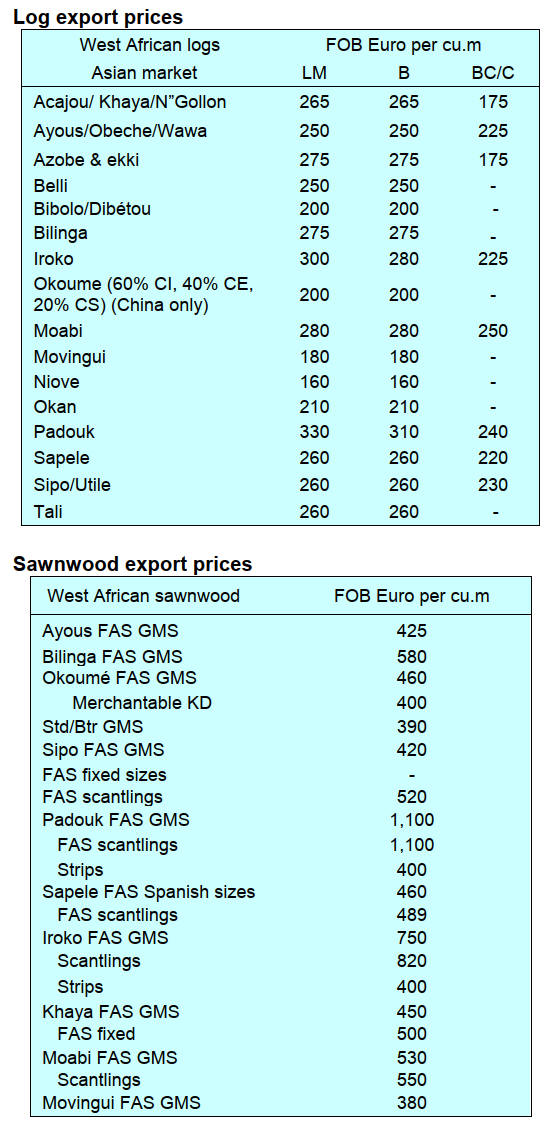

Ghana’s wood exports to Asian markets accounted for

60% (60,805 cu.m) of the total export volume for the

period January to April 2023 according to data from the

Timber Industry Development Division (TIDD).

This represented a 1,427cu.m volume increase when

compared to that recorded for the same period last year.

The export of wood products to Asian markets included air

and kiln dry sawnwood, billets, sliced veneer and

mouldings. The major species shipped as billets in the

period January to April 2023 were teak and gmelina which

contributed 5,717 cu.m and 33 cu.m respectively.

The total billet export volume in the first four months of

2023 dropped by 53% from 12,346 cu.m in 2022 to 5,750

cu.m. The corresponding revenue from these exports were

Eur3.78 million in 2022 compared to Eur1.83 million,

registering 52% decline.

According to the TIDD data the country’s primary product

exports in the first four months were teak billets (8,899

cu.m) earning Eur2.86 million and representing 6% of the

total export value Eur45.47 million for the period.

These figures indicated decreases of 28% and 24% in

volume and value respectively as compared to the timber

export contribution of 12,346 cu.m and Eur3.77 million

recorded during the period of January to April 2022.

The top market destinations for Ghana’s wood products

included India (55%), Senegal (7%), Togo (4%), United

States of America (3%) and United Arab Emirates (3%).

India’s imports for the period were mainly kiln-dried

sawnwood and billets which accounted for 8% and 12%

respectively of the total shipments.

India was the primary destination (in terms of value) for

Ghana’s wood products. India’s import volumes of air-

dried sawnwood (46,802cu.m), billets (5,552cu.m) and

sawn teak (3,017cu.m) for the period represented 85%,

97% and 96% of total shipments respectively.

3. MALAYSIA

Industrial Master Plan 2030

The Malaysian government has released some details of

the ‘New Industrial Master Plan 2030’ (NIMP 2030)

which will involve an investment of around RM95 billion

over seven years. The plan aims to generate employment

for around 3 million people through the creation of high-

skilled jobs in the higher value-added sectors which will

adopt automation and high tech manufacturing processes.

The NIMP 2030 has four missions which are to advance

economic complexity, tech-up for a digitally vibrant

nation, to strive for net-zero future and to safeguard

economic security and inclusivity. The NIMP 2030 will

focus on improving the lives of the people through wealth-

sharing for a more equitable society. The median salary in

the manufacturing sector is expected to grow by almost

10% to reach RM4,510/month from the current RM1,976

which is below the national average.

See: https://www.nimp2030.gov.my/

and

https://www.nst.com.my/news/nation/2023/09/949822/govt-rolls-out-seven-year-new-industrial-master-plan-nimp-2030-create-33

Japanese plywood buyers expected to increase

imports

A major Sarawak-based company that produces plywood

expects plywood export prices to improve in the second

half of 2023 as Japan adjusts up the low inventory levels.

The company commented that Japan’s plywood importers

have been restrained by the weak yen in their buying over

the past few months. The yen has depreciated this year

from 128 yen to the dollar in January to about 146 yen to

the dollar currently.

Trading of plywood between Japan and Malaysia is

conducted in US dollars so the weak yen has made

importing more expensive for the Japanese. Japan sources

hardwood plywood mainly from suppliers in Malaysia and

Indonesia as well as smaller quantities from China and

Vietnam.

See:

https://www.thestar.com.my/business/business-news/2023/09/04/ta-ann-expects-plywood-export-prices-to-rise-in-2h23

Sabah 25 Year Forest Master Plan

The Sabah Forestry Department is formulating a 25 year

Forest Master Plan setting the direction for the State’s

long-term forest resources management. The plan, in line

with the Sabah Forest Policy 2018, will focus not only on

forest reserves but also forest areas within state land and

alienated lands.

Around 27% of the State land in Sabah, or about

two million hectares, has been gazetted as Totally

Protected Areas (TPA) and 75% of this is in the area

known as Sabah’s Heart of Borneo project area.

In related news, Sarawak will have soon the largest

protected area including National Parks, Nature Reserves

and Wildlife Sanctuaries through its conservation efforts.

It is reported that the Sarawak government intends to have

over one million hectares in terrestrial protected areas and

over 1.6 million hectares in marine landscapes. With this,

Sarawak will have the largest system of protected areas in

Malaysia under the categories of National Parks, Nature

Reserves and Wildlife Sanctuaries.

See:

https://www.dailyexpress.com.my/news.cfm?NewsID=218723

Furniture Council members mission to Japan

The July/August Malaysian Furniture Council Newsletter

reports a group of 12 entrepreneurs visited Japan in early

July to conduct a marketing mission in Tokyo and

Fukuoka. This offerd an opportunity for the delegation to

witness the latest furniture trends. At the same time the

delegation also visited the Japan Furniture Industry

Development Association (JFIA).

A number of Japanese furniture retailers and wholesalers

such as Tokyo Interior, Otsuka Kagu, Room’s Taishodo,

and Murauchi Furniture Access were also visited by the

delegation.

Through the help of JETRO Fukuoka a B2B session with

Seki Furniture Inc, a major wholesaler in Fukuoka was

conducted. Currently, Japan is the 3rd largest furniture

export destination for Malaysia.

See:https://www.mfc.my/_files/ugd/fd8b5c_9dcdc9b6cbfe4fc0a64d7fa78513de3e.pdf

2024 MIFF announced

MIFF2024 will take place 1-4 March 2024 at the Malaysia

International Trade and Exhibition Centre (MITEC) and

World Trade Centre Kuala Lumpur (WTCKL).

See:

https://www.miff.com.my/visitors/register-now/?cid=edm0609823visregopen

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Malaysia.

See

https://www.itto-ggsc.org/static/upload/file/20230915/1694740138375092.pdf

4.

INDONESIA

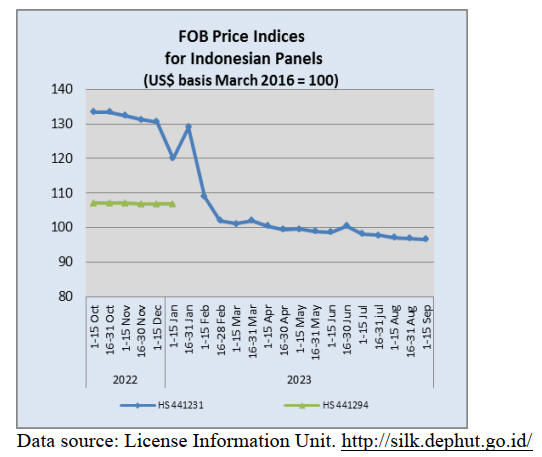

Export benchmark price

of Merbau increased

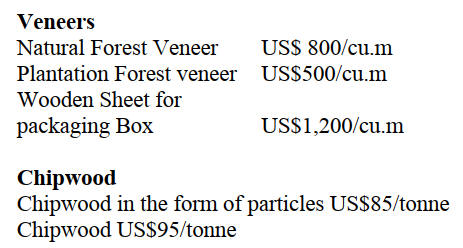

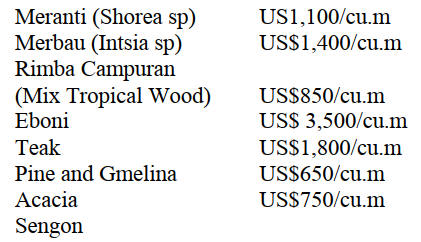

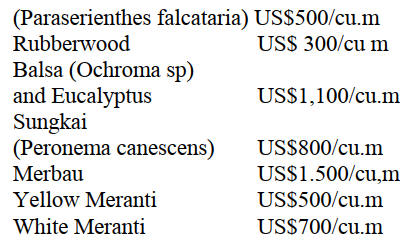

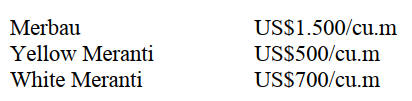

A press release from the Ministry of Trade provides

Export Benchmark Prices (HPE) for wood products. For

September 2023 were increased for sawn merbau, teak and

sungkai with a cross-sectional area of 1,000-4,000 sq.mm.

For some products the benchmark price was lowered for

example wood chips or particles, sawn wood with a cross-

sectional area of 1,000-4,000 sq.mm of acasia, sengon,

balsa and eucalyptus.

The following is a list of Wood HPE for September

2023:

Processed Wood

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1000 sq.mm to

4000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood that has been dried and leveled on

all four

sides so that the surface is even and smooth with a cross-

sectional area of more than 10,000 sq.mm to 15,000

sq.mm, of the type :

See:

https://forestinsights.id/harga-patokan-ekspor-hpe-kayu-september-2023-kayu-gergajian-merbau-naik/

Encouraging forestry sector down-streaming

Putu Juli Ardika, Director General of Agro Industry in the

Ministry of Industry, said that increasing the added value

to forest products through down-streaming would open up

more jobs, increase export earnongs, generate foreign

exchange, increase state revenues and boost economic

growth.

Currently, the processing industry that is developing

fastest is the wood pellet industry. The wood pellet

industry supports the transformation from fossil-based

energy to New Renewable Energy. This industry has also

been approved for tax benefits.

In 2022 the performance of forest based downstream

industries reach US$15 billion, with imports worth

US$4.68 billion. On the employment side there were 2.83

million workers involved in forest product-based

industries.

Putu explained, in the future, the development of

downstream forest product-based industries will be

directed at commodities whose production takes into

account environmental sustainability principles, including

sources from sustainable raw materials, implementing a

circular economy and playing a role in reducing

greenhouse gas emissions.

See:

https://kemenperin.go.id/artikel/24289/Hilirisasi-Industri-Pengolahan-Berbasis-Hasil-Hutan-Tumbuh-Berkelanjutan

Furniture sector contribution to GDP declined

The Minister of Industry, Agus Gumiwang Kartasasmita,

has reported the furniture sector contribution to National

GDP has dropped. In 2022 the furniture industry

contributed 1.3% to non-oil and gas GDP with an export

performance value of US$2.5 billion. Up to June 2023

exports of furniture and crafts reached US$1.1 billion.

Against this backdrop the Minister explained

several

issues which affect the current and future furniture market

namely the increasing trend to online shopping, the use of

industry-based technology, the increasing demand for

environmentally friendly furniture and the increasing need

for functional, ergonomic designed and customised

furniture especially for the millennial generation.

In responding to these new conditions the Ministry of

Industry has developed a strategy that focuses on three

things, strengthening product promotion media, increasing

production of environmentally friendly furniture and

strengthening reference research on the furniture market.

Apart from continuing to expand the export market it is

also hoped that furniture industry players will also further

develop the domestic market with innovations that are in

line with domestic characteristics and demand.

See:

https://www.tubasmedia.com/industri-furniture-diharapkan-hingga-2029-dapat-memberikan-kontribusi-lebih-besar-terhadap-sektor-manufaktur/

Strengthening forestry business with Finland

A number of Indonesian businesspeople, members of the

Association of Indonesian Forest Concession Holders

(APHI) and representatives of the Indonesian Chamber of

Commerce and Industry (Kadin) visited Finland. A

memorandum of understanding was signed between the

Medco Group and the Finnish technology company,

Valmet Technologies Oy for the development of biomass

energy development.

Medco Group's Papua Project President Director, Budi

Basuki, explained the mission of the Papua Project with

the support of Valmet is "Brightening the Eastern Part of

Indonesia with a Biomass Power Plant".

After successfully building and operating a 3.5 MW

Biomass Power Plant (PLTBm), Medco Group will

develop another plant with a total capacity of 55 MW. The

biomass used is sourced from wood chips.

See:

https://forestinsights.id/pengusaha-indonesia-kunjungi-finlandia-untuk-perkuat-bisnis-kehutanan-mou-pemanfaatan-biomassa-ditandatangani/

and

https://www.suara.com/pressrelease/2023/09/06/150500/indonesia-finlandia-tandatangani-kesepakatan-kerja-sama-biomassa-hutan-dalam-forum-ireis-2023

Technology can increase competitiveness of

timber

sector

Indonesian wood and furniture products, which are known

for their uniqueness and beauty, can improve their

competitiveness through the adoption of advanced

technology.

This was the theme of a seminar "Unlocking

Opportunities: Integrating IFMAC & WOODMAC

Technology in Indonesia's Growing Furniture Industry"

held in Semarang in late August.

The seminar was part of the preparations for the IFMAC

& WOODMAC 2023 exhibition.

Wiradadi Soeprayogo, Chairman of the Presidium of the

Indonesian Sawmill and Wood working Association

(ISWA), said that the growth potential for the Indonesian

wood processing and furniture industry in the global

market is enormous but will need the adoption of

technology if the opportunities are to be captured.

He explained that with the introduction of advanced

technology and innovative solutions from global

companies Indonesia can increase the competitiveness of

local furniture businesses while creating new opportunities

for investment, employment and economic growth.

See:

https://surabaya.tribunnews.com/2023/08/25/bangkitkan-pasar-industri-kayu-indonesia-himki-iswa-dan-wakeni-gelar-pameran-ifmac-woodmac-2023

ASMINDO participates in South Korean exhibition

The Indonesian Embassy in Seoul, the Ministry of Trade,

and ASMINDO (Indonesian Furniture and Handicraft

Industry Association) participated in the KOFURN 2023

exhibition in South Korea. At the event, ASMINDO

Chairman Dedy Rochimat signed a memorandum of

understanding with KFFIC (Korea Federation of Furniture

Industry Cooperatives) Chairman Lee Sung Jong

regarding the development of the furniture industry in

Indonesia and the Republic of Korea.

KOFURN 2023 is Korea's largest global furniture and

interior exhibition with more than 4,000 entries and a sales

value of US$1.6 million. This year, 13 manufacturers from

Indonesia promoted natural materials, handcrafted and

unique artisanal products packaged through a variety of

products to decorate the home or hospitality projects.

See:

https://www.msn.com/id-id/ekonomi/other/kenalkan-furnitur-indonesia-asmindo-ikuti-pameran-di-korea-selatan/ar-AA1fPAPy

EU Counselor - SVLK cannot satisfy due diligence

required by the EUDR

At a recent event the First Counsellor for Environment,

Climate Action and Digital cooperation at the European

Union Delegation to Indonesia and Brunei Darussalam,

Henriette Faergemann was reported by Kompas, an

Indonesian national newspaper,as saying “We (the EC) are

of the view that all of the sustainability certificates

including the ISPO, RSPO, MSPO and SVLK can support

forest and environmental sustainability but cannot replace

the due diligence required by the EUDR”.

“We believe that all sustainable certificates, including

ISPO, RSPO, MSPO, and SVLK, can support forest and

environmental sustainability, but they cannot replace the

thorough testing required by EUDR” said Faergemann.

Faergemann is also reported as saying the EU Commission

and Parliament does not have the mandate to verify

sustainable certificates.

In addition, the EU does not have sufficient resources to

check all sustainable certificates from hundreds of

countries.

The EUDR mandates that seven commodities entering the

EU market must not originate from land deforested or

degraded forest land after December 31, 2020. The seven

commodities are coffee, palm oil, cattle, soybeans, cocoa,

wood, charcoal, and rubber, as well as derived or

processed products such as meat, furniture, paper, leather,

and chocolate.

The regulation requires products to be certified through

due diligence based on geolocation or based on satellite

imagery and global positioning system (GPS) coordinates.

Large companies have 18 months and small companies 24

months to comply with various requirements in the

regulations that took effect on June 29, 2023.

See:

https://www.kompas.id/baca/english/2023/08/24/en-uni-eropa-syarat-uji-tuntas-eudr-tak-tergantikan

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Indonesia.

See:

https://www.itto-ggsc.org/static/upload/file/20230915/1694740138375092.pdf

5.

MYANMAR

Conserve forests and green urban areas – Prime

Minister

Myanmar Prime Minister, Senior General Min Aung

Hlaing, stressed the importance of conserving forests close

to rural communities and also encouraged urban dwellers

to green their environs as a national duty. This was

announced at the fourth monsoon tree-growing ceremony

2023 in Nay Pyi Taw. The PM also said the extraction of a

sustainable volume of timber is necessary for the

development of the nation and that replanting trees will

improve the socio-economic lives of the people.

Analysts interpreted his statement as a suggesting the

probability of a resumption of log harvesting which was

halted when the military-led government took the power

on 1 February 2021.

It is understood that the Myanma Timber Enterprise

(MTE) intended to harvest about 6,000 tons of teak in

2023-24 but there is no statement of the MTE Annual

Harvest Plan. According to the website of the MTE the

last announced Annual Harvesting Plan was for 2020-21.

The Prime Minister pointed out the current average

temperature of the capital is 28.50°C although it was

26.97°C in 2006. While reporting the current forest cover

at 42% he cited the unlimited extraction of timber by the

colonialists and the continued extraction to bolster finance

of the State in successive eras as a cause of forest loss.

Myanmar has been blamed for excessive harvesting but

the rate of harvesting was drastically reduced in 2014

when the log export ban was enacted. The trend of

reduction of harvesting was enhanced by enacting a

logging ban during the previous NLD (National League

for Democracy). The logging ban was for ten years in

Bago Yoma and for one year over the entire country in

2016-17.

See:

https://www.gnlm.com.mm/everybody-needs-to-conserve-forests-in-rural-areas-and-green-urban-areas-as-national-duty/

Investment in manufacturing sector

Myanmar’s manufacturing sector attracted more than

US$63.5 million from 26 enterprises in the five months to

August of the current financial year 2023-2024 including

capital expansion by the existing enterprises. This was

reported by the Directorate of Investment and Company

Administration (DICA). Chinese companies primarily

made investments in the manufacturing sector.

The Myanmar Investment Commission approved a total of

31 foreign projects from seven countries in the past five

months with an FDI of US$484 million

including expansion of capital by the existing enterprises

and the power sector topped the FDI line-ups with

US$317.178 million from two enterprises.

The manufacturing enterprises that need a large labour

force are prioritised to create job opportunities for the

local community. Myanmar’s manufacturing sector is

largely concentrated in garments and textiles produced on

a cutting, making and packing (CMP) basis and it

contributes to the country’s GDP to a certain extent.

See:

https://www.gnlm.com.mm/myanmars-manufacturing-sector-attracts-fdi-surpassing-us63-5-mln-in-april-august/

Expatriate workers must remit minimum 25% of foreign

currency income back to Myanmar

The Myanmar Government is now demanding that

expatriate workers remit at least 25 percent of their foreign

currency income back home through the country’s banking

system.

CB Bank, one of the country’s largest private banks,

recently told migrant workers they must remit a quarter of

their salaries either monthly or every three months through

official channels.

Migrant workers who do not comply will be barred from

working overseas for three years after their current work

permit expires, the announcement warns.

See:

https://www.irrawaddy.com/news/burma/cash-starved-junta-milks-myanmar-migrant-workers-with-new-remittance-rule.html

6.

INDIA

Farm forest expansion held

back by regulations

Plyinsight has reported that Sajjan Bhajanka, President of

Federation of Indian Plywood and Panel Industry, has said

because wood grown on farmland is considered as a forest

product it is subject to all the regulations that apply to

forest products and this discourages farmers from growing

trees.

The Federation proposes shifting farm-forest from the

forest sector to the agriculture sector which would provide

more economic benefits to the farmers so they would be

encouraged to plant more trees.

The Federation also proposed the removal of licensing

requirement for wood-based units that primarily use ‘farm

forest wood’ as raw material. This, it is claimed, will

support the establishment of sustainable businesses at the

plantation sites and generate employment and livelihood

opportunities for farmers.

See: https://plyinsight.com/economic-benefits-of-agriculture-sector-should-be-extended-to-agroforestry/

US$5.8 trillion real estate sector possible by 2047

A recent report by Knight Frank India prepared in

collaboration with the National Real Estate Development

Council (NAREDCO), forecast India's real estate sector

could expand to a staggering US$5.8 trillion sector by

2047. This would represent a significant increase from the

current estimated value of US$477 billion. If this is

achieved the real estate sector will contribute 15.5% to

total economic output in 2047 from an existing share of

7.3%.

However, some analysts point to a housing crisis for the

poor in the capital saying the slow speed of building

affordable housing, reduced land and space entitlements,

accelerated housing production for the privileged and

large-scale demolitions and evictions have contributed to

what some consider an urban housing crisis.

See:

https://www.thehindu.com/business/realty-sector-set-to-expand-to-58-tn-in-2047-knight-frank/article67235781.ece

and

https://www.aljazeera.com/gallery/2023/8/30/photos-the-housing-crisis-for-the-poor-in-indias-capital

G20 to support new trade corridor

India hosted this year's Group of 20 summit and on the

sidelines world leaders unveiled a project to create a rail

and shipping corridor linking India, the Middle East and

Europe. This project is considered historic as it would

improve trade logistics.

See:

https://www3.nhk.or.jp/nhkworld/en/news/20230910_13/

Weak currency a problem for importers

The rupee exchange rate against the US dollar is very

close to its historic low in six months despite the Reserve

Bank of India (RBI) action in the currency market to lower

volatility. Having traded in its narrowest range in two

decades this year the rupee fell to a 10 month low of 83.18

in early September close to the 83.29/US$ record low in

October 2022. A weakening currency is always a problem

for importers but currency volatility creates a risky trading

environment.

Inflation in India is expected to remain above the RBI's

2% to 6% target range until October. Rather than policy

action the RBI has focused efforts on market intervention

spending around US$14 billion in August.

See:

https://www.reuters.com/markets/currencies/indian-rupee-stay-weak-third-analysts-expect-new-low-within-year-2023-09-07/

Domestic investment lifts GDP

The International Monetary Fund forecast a decline in

India's GDP growth over the next two years saying GDP

growth could fall from 7.2% in FY23 to 6.1% in the

current financial year and then rise slightly to 6.3% in

FY25.

The latest World Economic Outlook data projected a 0.2%

point upward revision from its April estimates reflecting

momentum from stronger-than-expected growth in the

fourth quarter of 2022 as a result of stronger domestic

investment.

See:

https://www.livemint.com/news/india/indias-gdp-growth-to-drop-in-coming-months-imf-projects-6-1-growth-in-fy24-11690290502927.html

7.

VIETNAM

Vietnam - Highlights of wood and wood product

(W&WP) trade

According to the General Department of Customs,

Vietnam's W&WP exports to South Korea in August 2023

amounted to US$66 million, down 10% compared to

August 2022. In the first 8 months of 2023 W&WP

exports to S. Korea were estimated at US$528 million,

down 22% year on year.

In August 2023 bedroom furniture exports were valued

at

US$136 million, down 29% compared to August 2022. In

the first 8 months of 2023 exports of bedroom furniture

earned US$998 million, down 39% over the same period

in 2022.

Vietnam's imports of padouk wood in August 2023

amounted to 12,000 cu.m, worth US$4.2 million, up 3% in

volume and 2% in value compared to July 2023.

Compared to August 2022 imports decreased by 48% in

volume and 56% in value. In the first 8 months of 2023

imports of padouk were 90,400 cu.m, worth US$33.6

million, down 18% in volume and 29% in value over the

same period in 2022.

Vietnam firms anticipate robust export

opportunities in

the US

The US President visited Vietnam in September at the

invitation of Party Secretary General Nguyen Phu Trong

as the two countries celebrated the 10th anniversary of

their comprehensive partnership.

More export opportunities

According to the General Department of Customs in the

first seven months of this year shipments of wood and

wood products to the US reached US$3.9 billion,

accounting for 54% of the entire industry's exports. The

US has been the largest market for wood products from

Vietnam for years.

Nguyen Chanh Phuong, Vice Chairman of the Handicraft

and Wood Industry Association of HCMC (HAWA), said

when the bilateral relationship is in good shape businesses

will benefit.

Phuong noted that Vietnam believes in the stability and

development of the US market. He anticipates inflation in

the US will fall and purchasing power will increase again.

Tran Lam Son, Deputy General Director of Thien Minh

Import-Export Co., Ltd., expected many large US furniture

enterprises to come to Vietnam and visit furniture

manufacturing hubs after Biden's visit. Thien Minh

specialises in outdoor furniture products made from

plantation wood.

See:

https://theinvestor.vn/vietnam-firms-anticipate-robust-export-opportunities-from-president-bidens-visit-d6511.html

Amazon, Alibaba demand more Vietnam-made home

décor

As purchases of home decorations and compact furniture

on e-commerce platforms such as Amazon and Alibaba

increase opportunities are opening up for Vietnamese

businesses to sell made-in Vietnam products.

According to Amazon statistics home decoration and

furniture items have experienced outstanding growth in the

2020-2022 period. Even after returning to the office,

people still spend a lot of time enjoying their life at home

and online shopping for such products continues.

Over the past three years home and kitchen decor

have

been some of the best-selling item categories for

Vietnamese sellers on Amazon. In the last three months,

potential buyers for Vietnamese products in this category

have increased 64% year-on-year.

The most sought-after items have been dining sets,

kitchenware, home textiles and affordable, practical

storage, according to Alibaba.

See:

https://e.vnexpress.net/news/business/industries/amazon-alibaba-demand-more-vietnam-made-home-decor-4648742.html

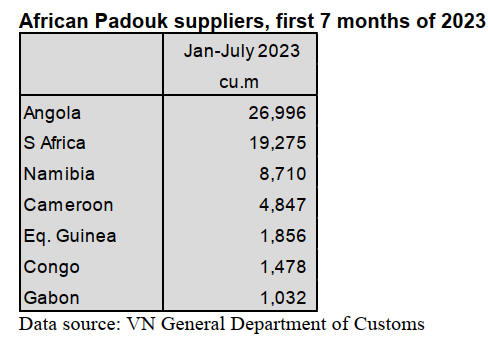

Vietnam’s imports of padouk wood from Africa

decreased slightly

Vietnam's padouk imports from Africa, the largest

supplier, accounted for 83% of total padouk imports in the

first 7 months of 2023, down 4% in volume and 7% in

value over the same period in 2022, to 65,500 cu.m, worth

US$19.5 million.

According to statistics from Vietnam General Department

of Customs, Vietnam's padouk imports in July 2023 were

1,600 cu.m, worth US$4.1 million, down 5% in volume

and 4% in value compared to June 2023. Compared to July

2022, imports dropped 29% in volume and 31% in value.

The average import price of padouk in the first 7 months

of 2023 was around US$373.5 per cu.m, down 14% over

the same period in 2022. In particular, the price of padouk

wood from Africa decreased by 4% to US$297.0 per cu.m.

Padouk wood suppliers

In the first 7 months of 2023 volume of padouk from

Africa, Laos and China decreased compared to the same

period in 2022 while, imports from Thailand, Hong Kong,

Tanzania, Denmark and the UAE increased.

Padouk from all African suppliers accounted for 83% of

total imports in the first seven months of this year reaching

65,500 cu.m, worth US$19.5 million, down 4% in volume

and 7% in value over the same period in 2022.

Imports from Laos decreased by 42% in volume and 46%

in value over the same period in 2022, amounting to 7,200

cu.m, worth US$7.8 million and accounting for 9% of

total imports in the first 7 months of this year.

. .

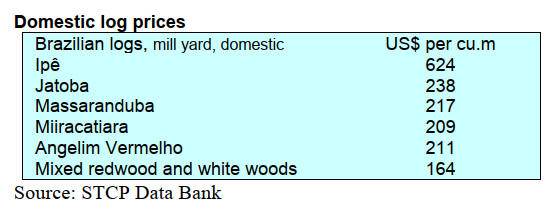

8. BRAZIL

Wood frame construction

takes off

Wood frame construction is gaining acceptance in Brazil.

Plantation pine is the main input for wood frame building

structures. This system has been seen to offer benefits

such as faster construction, waste reduction and energy

savings.

The recent standardisation of timber frame construction

published by the Brazilian Association of Technical

Standards (ABNT) is generating interest in the sector as an

important step for industrialised and sustainable

construction across the country. The advantages in wood

frame construction are said to be thermal and acoustic

comfort, shorter construction times and competitive prices.

Wood frame construction can help to tackle the housing

shortage in Brazil.

The southern region of Brazil, especially the states of

Paraná and Santa Catarina, where a large part of the

country's pine plantations are available can benefit from

this construction method. Pine sawnwood and panels are

readily available in the country. Wood frame construction

represents a viable and technologically advanced

alternative to civil construction in Brazil without

necessarily replacing traditional methods but

complementing and contributing to technological

diversification in the sector.

According to ABIMCI (Brazilian Association of the

Mechanically Processed Timber Industry) the publication

of the technical standard for wood frame construction was

an important achievement for the timber industry and the

civil construction sector.

See:

http://www.remade.com.br/noticias/19405/construcao-mais-rapida--preco-competitivo-e-tecnologia:-a-aposta-de-crescimento-do-setor-de-madeira

Acre and Mato Grosso discuss joint action in the

timber sector

Representatives and entrepreneurs of the timber sector in

the states of Acre and Mato Grosso recently discussed

strengthening the sector in the Amazon Region. The

stakeholders who took part in the discussion included

entrepreneurs from timber-producing municipalities,

managers of the Center of Timber Producing and

Exporting Industries of the Mato Grosso State (CIPEM)

and Task Force of Governors for the Forest and Climate

(GCF Task Force), the Acre Timber Industries Union

(SINDUSMAD/AC), the Secretariat for the Environment

and Indigenous Policies (SEMAPI), the Acre Environment

Institute (IMAC) and the Acre Planning Secretariat

(SEPLAN).

The main objective of the meeting was to explore options

for boosting the forest sector in the region with a focus on

the bio-economy as an essential pillar for balancing

economic and social development and environmental

conservation. The hope is to present a sustainable

development model appropriate for the region at COP30

(30th Conference of the Parties to the United Nations

Framework Convention on Climate Change) in 2025.

During the discussions the similarities and differences

between the two states were analysed especially in relation

to licensing systems and challenges in finding a public

policy on forest management that works for both states.

The Acre State government has the strengthening of the

timber sector as a priority and the dialogue with Mato

Grosso enabled an exchange of experience and

development of options for the sector.

See:

https://forestnews.com.br/acre-mato-grosso-acoes-setor-madeireiro/

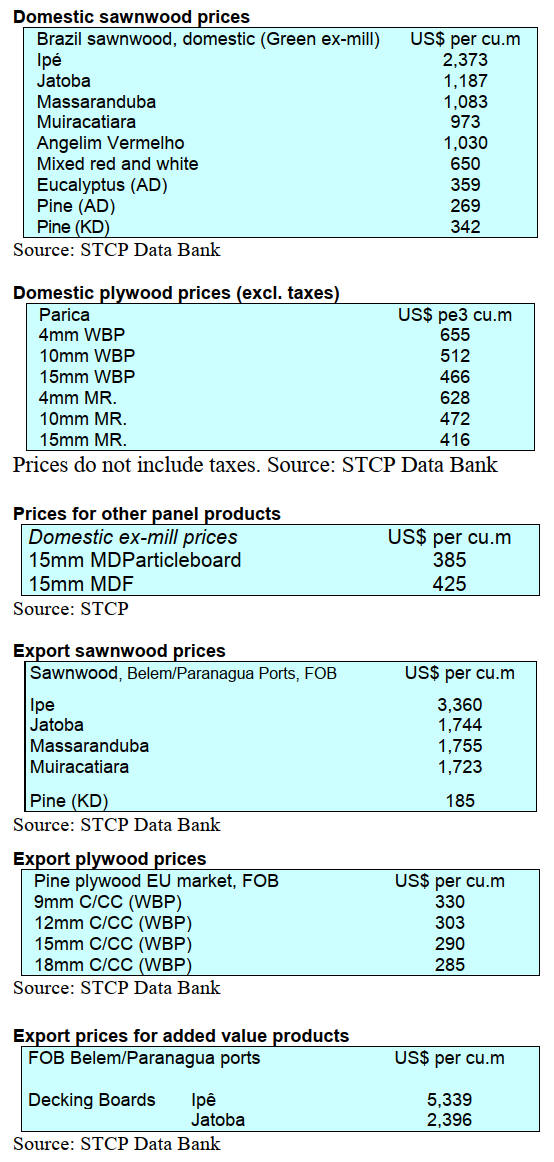

Performance of the furniture sector in the first

half of

the year

Exports of furniture and mattresses declined significantly

in June 2023 totalling US$59.0 million, a 12% drop

compared to the previous month. This negative

performance impacted the first half year performance

which dropped 16% compared to the same period in 2022

with exports totalling US$349.2 million compared to

almost US$417.0 million in the first half of last year.

There has been a continuous downward trend in export

earnings over the last 12 months with an 18% decline in

the value of exports. Several factors, including currency

fluctuations, logistical challenges and international

competition contributed to this negative trend.

The United States remains the main export market for

Brazilian furniture accounting for around 32% of the total

exported by the sector in the first half of 2023. Other

destinations that have shown significant trade include

Uruguay, Chile, the United Kingdom, France and the

Netherlands.

The Brazilian Furniture Industry Association

(ABIMÓVEL) and the Brazilian Trade and Investment

Promotion Agency (ApexBrasil), in partnership with

public agencies and companies in the sector, are

developing strategies to reverse this negative trend and

increase exports of Brazilian furniture.

The sector is looking for innovation, quality and global

competitiveness in order to face the current challenges and

guarantee its relevant role in the Brazilian economy.

Cooperation between the industry, the government and

other stakeholders is considered crucial to stimulate

exports to ensure the sector's future growth.

See:

https://forestnews.com.br/exportacoes-moveis-e-colchoes-flutuacoes/

Woodflow export system for wood products

A fully online software service ‘WoodFlow Exporter

System’ has been introduced to facilitate timber exports.

The system allows companies to manage their foreign

trade operations in an analytical and secure way.

Companies that export wood products are able to use the

programme without having to register on the WoodFlow

platform making it an accessible and secure tool for

sharing information with foreign buyers.

Each company is responsible for inputting data and the

platform, among other features, will allow exporters to

have a strategic overview of all their shipments,

profitability and even the documentation for each process.

The entire system is highly secure, following the General

Data Protection Act (Lei Geral de Proteçăo de Dados -

LGPD).

This system also assures improved reliability of export

document storage, simplified online monitoring of the

process and provides customised dashboards to check

results and costs.

See:

https://www.madeiratotal.com.br/woodflow-aposta-em-sistema-saas-para-exportacao-de-madeira/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

See:

https://www.itto-ggsc.org/static/upload/file/20230915/1694740138375092.pdf

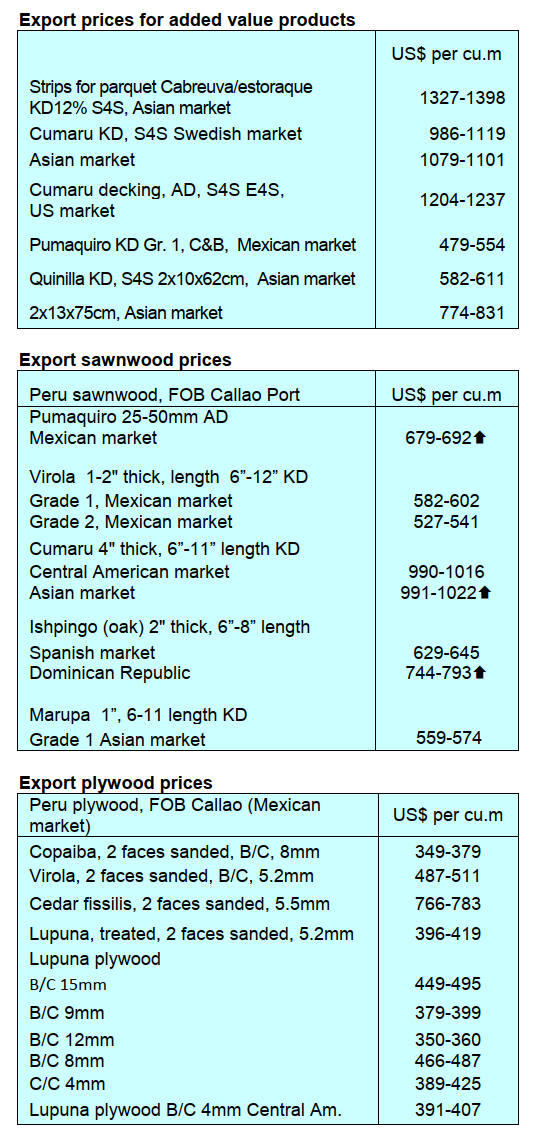

9. PERU

Wood product exports

fell in the first half of the year

Shipments of wood products between January and June

totalled US$54.3 million which was a decline of 28%

compared to the same period in 2022 (US$75.8 million)

according the Association of Exporters (ADEX).

This contraction is partly explained by lower orders from

Peru’s two main buyers, France (US$10.8 million) and

China (US$10.7 million) which decreased their demand by

22% and 30% respectively.

In the case of France the increase in the price of Peruvian

wood products made Peru less competitive compared to

suppliers from other countries such as Brazil and Russia.

Regarding China, the real estate sector is going through a

deepening crisis with a growing risk of default among

some developers seeking to sell apartments and demand

for wood products in this sector has dropped sharply.

Other export destinations were Mexico (US$8.2 million),

a year on year increase of 50%, the Dominican Republic

(US$5.7 million) a reduction of 40% and the US (US$3.9

million) with a contraction of 33%. Completing the top ten

export markets were Belgium (US$2.9 million), Ecuador

(US$2.4 million), Vietnam (US$1.9 million), Denmark

(US$1.5 million) and Chile (US$0.9 million).

According to figures from the ADEX Data Trade

Commercial Intelligence System, semi-manufactured

products were the most traded, accounting for US$22.4

million of the total but with a decrease of 42%. Second in

the ranking was sawnwood, at US$21.9 million despite

falling 17%.

Others were construction products (US$2.6 million);

fuelwood and charcoal (US$2.2 million); furniture and

parts thereof (US$1.8 million); manufactured products

(US$1.5 million); plywood (US$1.2 million), veneers and

sheets (US$0.65 million). In the first six months of the

year the most important exporting companies were

Maderera Bozovich, IMK Maderas, Grupo Maderero

Amaz, Consorcio Maderero and Industria Forestal

Huayruro.

Regional authorities promote agroforestry systems to

increase forest cover

With the aim of promoting agroforestry systems to reduce

deforestation in the Amazon forests, the National Forestry

and Wildlife Service (SERFOR) and the Regional

Government of Ucayal recently conducted an event

“Exchange of experiences in the implementation of

Agroforestry Systems (SAF)”.

This event, which took place in the city of Pucallpa,

brought together governors of Ucayali, Loreto and

Huánuco, regional authorities of San Martín, Madre de

Dios, Midagri, SERFOR, producers, international

cooperation agencies and businesspeople.

The SAF combine agricultural and forestry activities and

their function is to maintain and restore forest ecosystems,

to make them sustainable and increase productivity both

on state lands and on private properties. The Regional

Governor of Huánuco and president of the Amazon

Regional Commonwealth, Antonio Pulgar Lucas,

inaugurated the event and reported that in his region more

than 400 hectares have been delivered to the associations

under the Transfer in Use Contracts for Agroforestry

Systems (Ccusaf).

For his part, the Executive Director of SERFOR, Alberto

Gonzales-Zúńiga, presented the ‘Strategic Framework for

Reducing Deforestation through Agroforestry Systems’ in

which regional and local governments, producer

organisations and the private sector have a role.

Alliance promotes digital tools in forest management

The Forest and Wildlife Resources Supervision Agency

(OSINFOR) and the Regional Forestry and Wildlife

Management (GERFFS) of Ucayali have joined to

promote the use of technological tools for forest

management among the holders of new enabling titles in

the region.

The main objective of this initiative is to improve the

monitoring and compliance with forestry and wildlife

obligations by the holders of enabling titles in order to

guarantee sustainable use of these resources.

The collaboration between OSINFOR and GERFFS

reinforces the commitment of both institutions in

promoting responsible practices in forest management and

contributing to the conservation of forests and biodiversity

in the region.

|