US Dollar Exchange Rates of

25th

Aug

2023

China Yuan 7.28

Report from China

Rise in

sawnwood imports

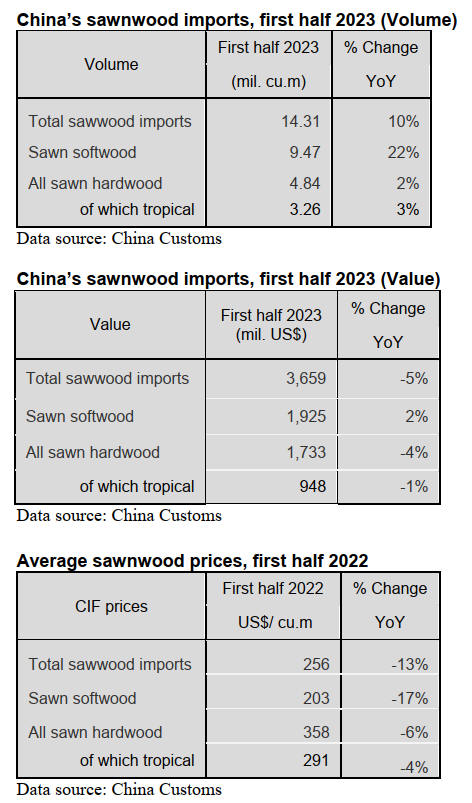

According to data from China Customs, in the first half of

2023 sawnwood imports totalled 14.31 million cubic

metres valued at US$3.659 billion, up 10% year on year in

volume but down 5% in value. The average CIF price for

imported sawnwood declined 13% to US$256 per cubic

metre over the same period of 2022.

Of total sawnwood imports sawn softwood imports rose

22% to 9.47 million cubic metres, accounting for 66% of

the national total and up 3% over the same period of 2022.

The average CIF price for sawn softwood imports fell 17%

to US$203 per cubic metre over the same period of 2022.

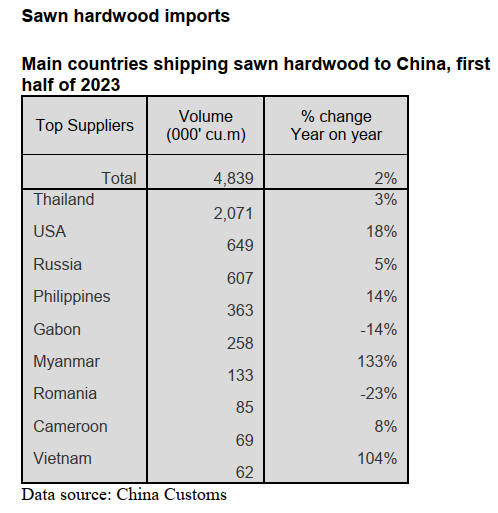

Sawn hardwood imports grew 2% to 4.84 million cubic

metres. The average CIF price for sawn hardwood imports

fell 6% to US$358 per cubic metre over the same period of

2022.

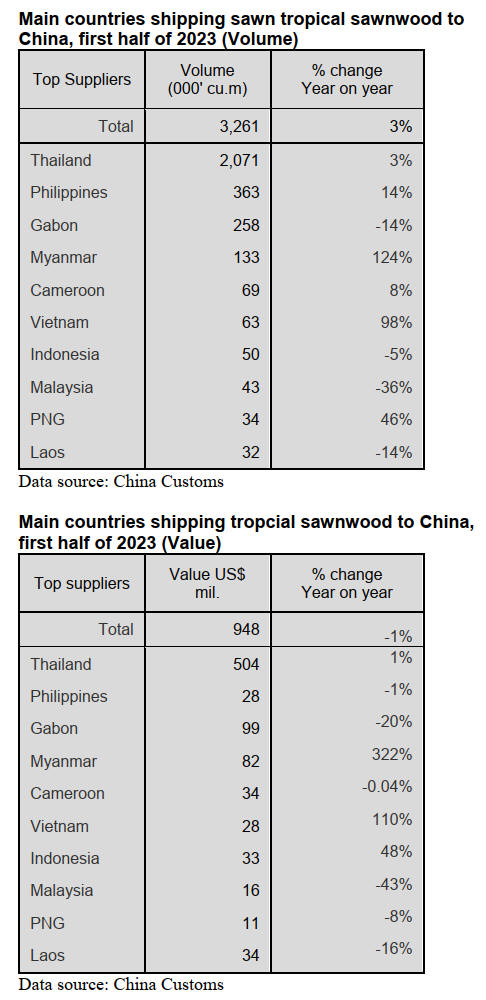

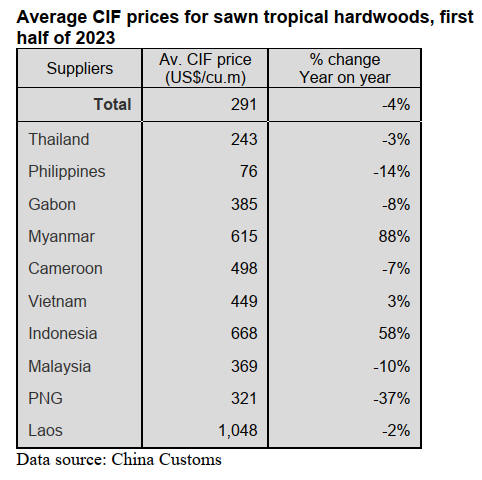

Of total sawn hardwood imports tropical sawn hardwood

imports were 3.26 million cubic metres valued at US$948

million, up 3% in volume but down 1% in value and

accounted for about 23% of the national total. The average

CIF price for tropical sawn hardwood declined 4% to

US$291 per cubic metre over the same period of 2022.

Rise in sawnwood imports for

almost all top suppliers

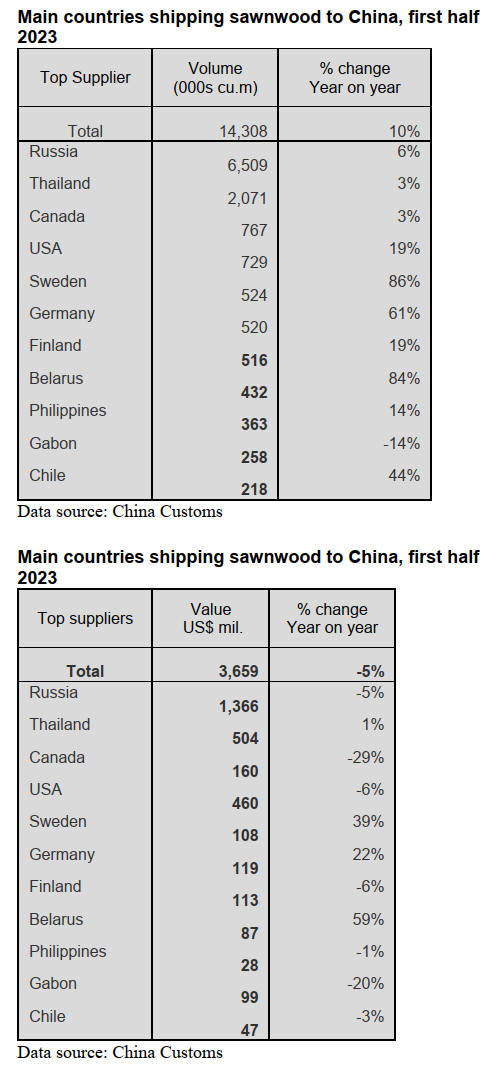

The total volume of China’s sawnwood imports rose 10%

because the volumes of imports from Russia and Thailand,

the largest and the second largest suppliers, grew 6% and

3% respectively. These two suppliers accounted for nearly

60% of the total sawnwood imports in the first half of

2023.

Notably, China’s sawnwood imports

from Sweden,

Germany and Belarus surged 86%, 61% and 84%

respectively in the first half of 2023. However, the volume

of sawnwood imports from Gabon fell 14% in the first half

of 2023.

The following are three main

reasons for the increase in

China’s sawnwood imports in the first half of 2023.

government policy to revitalize and accelerate the

real estate market

government polices to promote domestic

consumption

increased production supply countries, smooth

international shipping and competitive prices

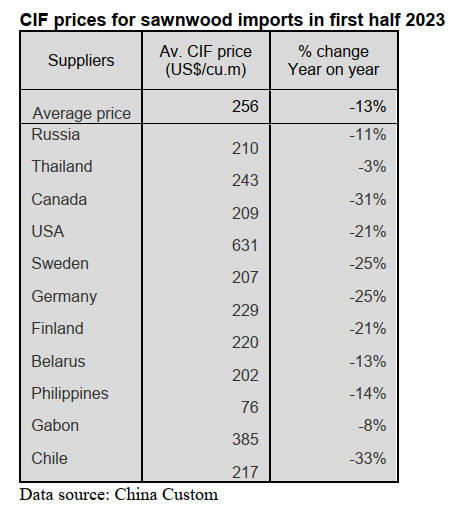

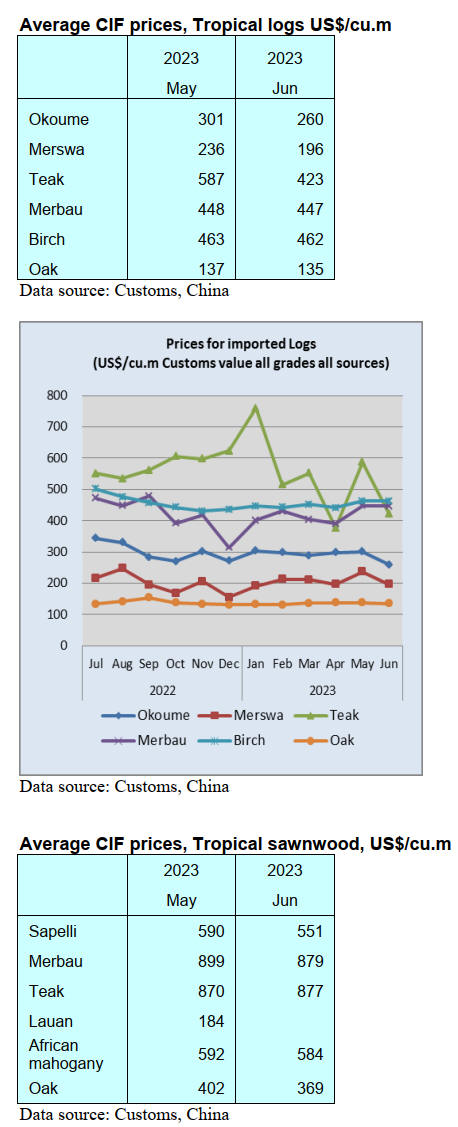

Decline in sawnwood CIF prices

CIF prices for sawnwood imports from Russia and

Thailand, the largest and second largest suppliers, fell 11%

and 3% respectively in the first half of this year. Other

countries where price declines were observed are shown in

the table below.

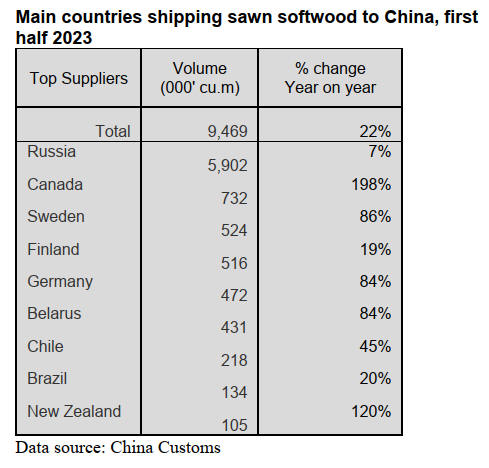

Surge in sawn softwood imports

from Canada

In the first half of 2023 China’s sawn softwood imports

totalled 9.47 million cubic metres and the reason for the

rise in sawnwood imports was increased imports from the

top suppliers. Russia was the top sawn softwood supplier

to China in the first half of 2023 and 62% of China’s sawn

softwood was imported from Russia. Year on year sawn

softwood imports from Russia rose 7% to 5.9 million

cubic metres.

Canada was the second largest sawn softwood supplier to

China and the volme of imports in the first half of 2023

surged nearly 200%.

China’s sawn softwood imports from Sweden, Germany

and Belarus all increased in the first half of 2023.

Rise in tropical sawn

hardwood imports

Of total sawn hardwood imports tropical sawn hardwood

imports were 3.26 million cubic metres valued at US$948

million, up 3% in volume but down 1% in value and

accounted for about 23% of the national total in the first

half of 2023.

Thailand has been the largest supplier of tropical sawn

hardwood (predominantly rubberwood) to China for many

years.

China’s sawnwood imports from Thailand in the first half

of 2023 rose 3% to 2.07 million cubic metres valued at

US$504 million, up 1% in volume over the same period of

2022 and accounted for 64% of the national total sawn

tropical hardwood imports. The average CIF price for

tropical sawnwood from Thailand fell 3% to US$243 per

cubic metre over the same period of 2022.

The Philippines and Gabon were the second and third

largest suppliers of tropical sawnwood imports accounting

for 11% and 8% of the total tropical sawnwood imports

respectively in the first half of 2023.

China’s tropical sawn hardwood imports from the

Philippines and Gabon in the first half 2023 totalled

363,000 cubic metres (up 14%) and 258,000 cubic metres,

(down 14%) over the same period of 2022.

The top 10 countries supplied 96% of China’s tropical

sawnwood requirements in the first half of 2023, namely

Thailand, the Philippines, Gabon, Myanmar, Cameroon,

Vietnam, Indonesia, Malaysia, PNG and Laos.

CIF prices for tropical sawn hardwood imports have been

but prices for sawn tropical hardwood imports from

Myanmar and Indonesia surged 88% and 58% respectively

in the first half of 2023.

Signs of recovery in wood products markets

The GTI report says in July this year the timber and wood

products market in China saw some recovery however, the

Global Timber Index GTI- China remained at a low level.

The number of new orders to Chinese enterprises

represented in the GTI increased compared to the previous

month but the export order index fell slightly.

In July the GTI-China index recorded 53%, an increase

compared to that of the previous month and rose above the

critical value after 2 months indicating that there was some

business expansion.

Chinese enterprises reported difficulty in procuring high-

grade oak, increased raw material prices and higher

company costs and unpredictable delivery and shipping

schedules.

The existing orders index in July registered 42.9%, a

decrease from the previous month and was below the

critical value for 50 consecutive months indicating that the

number of existing orders held by enterprises represented

by the GTI-China Index were less than that of the previous

month.

The new orders index registered 57.1%, an increase from

the previous month and was above the critical value of 50.

On the other hand, the export orders index for July

registered 36.4%, the same as the previous month and was

below the critical value for 4 consecutive months.

See:

https://www.itto-ggsc.org/static/upload/file/20230816/1692147989860563.pdf

|