Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Aug

2023

Japan Yen 144.80

Reports From Japan

New economic

stimulus measures being drafted

By September the government intends to have drafted new

economic stimulus measures aimed at counteracting the

downside risks of inflation. It is anticipated the package

will include measures to encourage businesses to invest in

advanced technologies and boost worker pay to offset the

decline in inflation-adjusted wages. The government will

also consider ways to plan for supply chain disruptions

and expand investment in Japan by foreign companies.

The package will also include more inflation

countermeasures following a plan for subsidies to deal

with soaring gasoline, electricity and gas prices.

The Cabinet Office has used stimulus measures every year

since 2019. Previous measures were to deal with weak

consumption because of COVID-related restrictions.

See:

https://asia.nikkei.com/Politics/Japan-to-draw-up-stimulus-package-as-soon-as-September

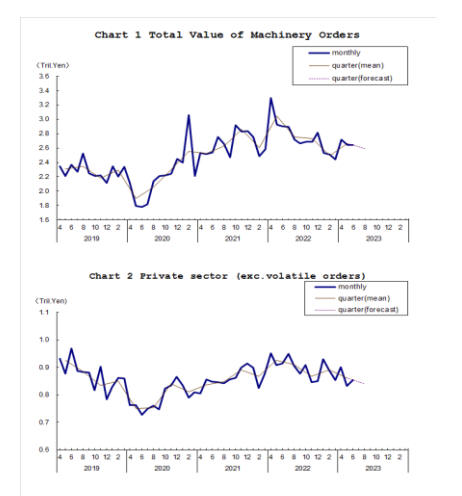

Falling machinery orders

The total value of machinery orders received by major

manufacturers operating in Japan increased by 0.2% in

June from the previous month. In the April-June period it

increased by 7.1% compared with the previous quarter.

In the July-September period the value of machinery

orders has been forecast to decline by almost 3% and

private-sector orders, excluding volatile ones, are forecast

to also fall by around 3% from the previous quarter.

Source: Cabinet Office, Japan

Effort to drive growth through wage increases may not

deliver as expected

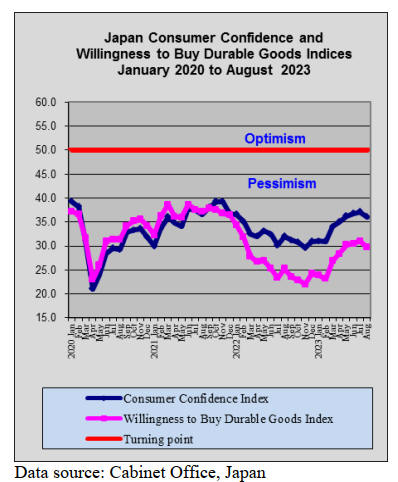

Private consumption contributes to about 50% of Japan's

nominal gross domestic product and around 15% of

Japan's GDP is thus attributable to consumption by

households headed by pensioners.

31 August 2023

The elderly account for a growing share of personal

consumption in Japan and according to Takuya Hoshino,

an economist at Dai-ichi Life Research Institute, a third of

Japan's total consumption last year was driven by

pensioners. Against this background the effort to drive

growth through wage increases may not deliver as pay

increases do not benefit pensioners who have seen the

value of their pensions eroded by inflation. Given Japan's

high proportion of retirees encouraging older people to

spend will be crucial to lifting GDP.

See:

https://asia.nikkei.com/Spotlight/Datawatch/Pensioners-share-of-spending-hits-nearly-40-of-total-in-Japan

Tokyo to eliminate areas congested with old

wooden

houses

In 2020 Tokyo authorities estimated the area of congested

old wooden houses at around 8,600 hectares, many of

which much would suffer severe damage in the event of a

major quake. In the quake that hit Tokyo100 years ago

thousands were killed largely because of the fires that

broke out. The authorities in Tokyo aim to reduce the

areas where old wooden houses are concentrated to zero

by 2040 in preparation for a major earthquake thais

forecast to strike the capital.

See:

https://www.japantimes.co.jp/news/2023/08/20/japan/society/tokyo-aiming-to-eliminate-areas-congested-with-wooden-houses/

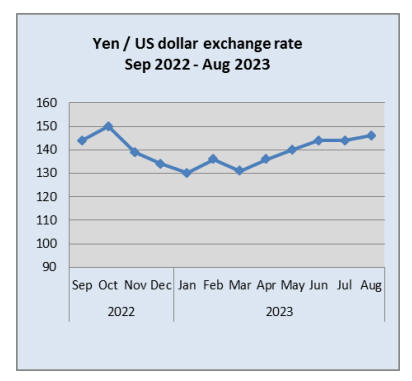

Negative economic side effects of weak yen

starting to

show

Hiromi Yamaji, CEO of the Japan Exchange Group, has

been quoted as saying the yen is too weak and its benefits

for Japanese stocks are diminishing while negative

economic side effects are starting to show. The widening

interest rate gap between Japan and the rest of the world

and the weak yen are making imports much more

expensive.

Recently the yen dropped below145 to the dollar but

this

did not trigger a response from Japanese policymakers

which has been read a signaling the Bank of Japan will

carefully consider market intervention as there are still

some benefits from a weaker currency.

https://www.japantimes.co.jp/business/2023/08/24/economy/forex-weak-yen/

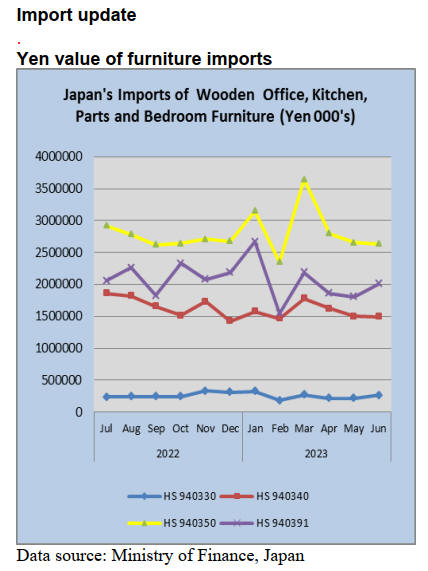

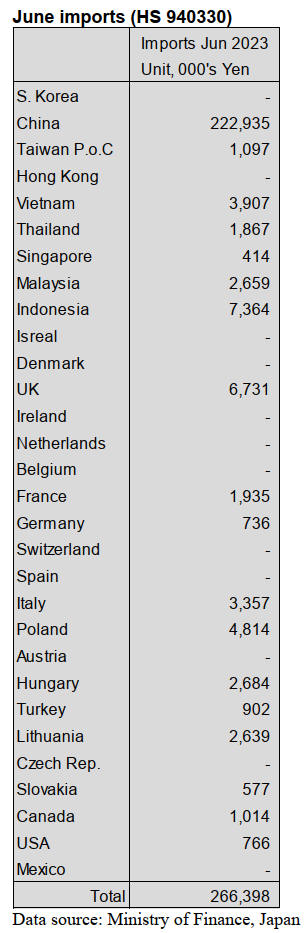

June wooden office furniture imports (HS 940330)

June shipments of wooden office furniture from China to

Japan accounted for 84% of all wooden office furniture

imports, a significant rise over May shipments. The value

of Japan’s wooden office furniture imports in June this

year were around 8% higher than in May and sharply up

(24%) on the value of May 2022 imports.

With such a high proportion of wooden office furniture

imports coming from China there was little market share

left for other suppliers.

Of the other 18 June shippers only Indonesia and the

UK

stand out at around 3% each of June shipments.

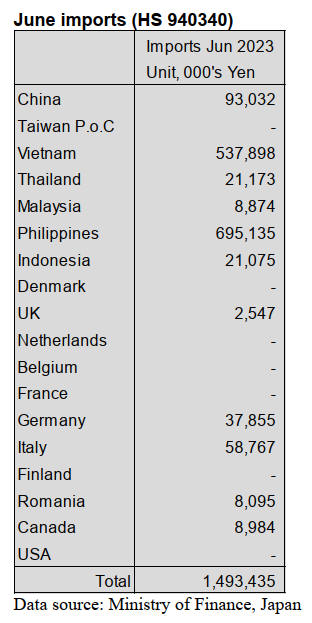

June kitchen furniture imports (HS 940340)

After the surge in imports of wooden kitchen furniture at

the end of the first quarter of this year there has been a

steady decline and the value of June imports were down

17% year on year and compared to a month earlier June

arrivals were flat.

For the year to date, just two shippers, the Philippines and

Vietnam, dominated Japan’s imports of wooden kitchen

furniture. In June shipments from the Philippines

accounted for 46% of the value of imports of HS940340

with a further 39% coming from Vietnam. The other

shippers of note in June were Italy and Germany but the

value of shipments was small.

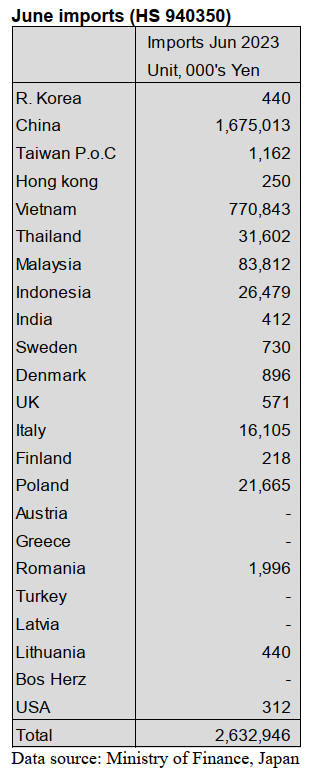

June wooden bedroom furniture imports (HS 940350)

The wide variation in the values of wooden bedroom

furniture observed in the first quarter of this year have

subsided and the value of monthly imports over the past

three months has returned to the average level seen at the

end of last year.

However, there is a clear downward trend in the value of

imports and the value of June imports was 35% below that

in June last year. Compared to a month earlier the value of

June imports were little changed but the value of wooden

bedroom furniture imports exceeds by far the value of

other furniture categories tracked in this report.

The top supplier in June was, once again China,

accounting for 64% of June import values followed by

Vietnam at 29%. Malaysia and Indonesian shippers are in

the top 20 ranking of shippers of wooden bedroom

furniture but shipments are small.

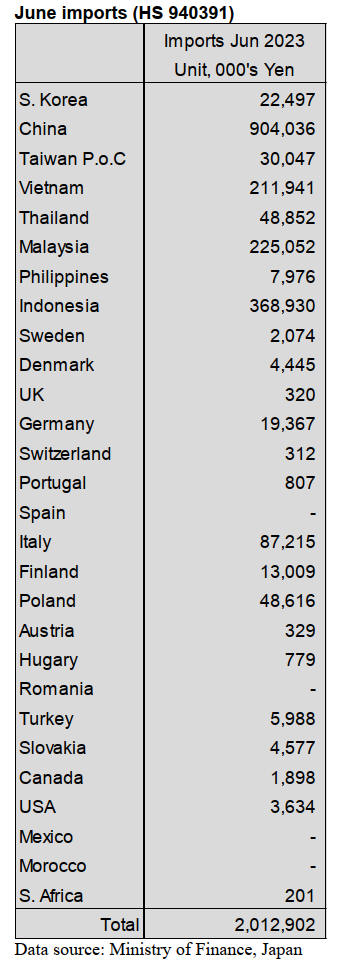

June wooden furniture parts imports (HS 940391)

As is the case with bedroom furniture, the wide variations

monthly imports of wooden furniture parts (HS940391)

seen earlier in the year have levelled off and settled back

to the trend seen at the end of 2022.

Around 85% of June imports of wooden furniture part

were supplied by shippers in just four countries, China

(45%), Indonesia (18%), Malaysia (11%) and Vietnam

(10%). Other significant shippers in the top twenty

suppliers for June were Italy and Poland.

Month on month there was an 11% rise in the value of

wooden furniture parts imports in June but compared to

the value of June 2022 imports there was little change.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

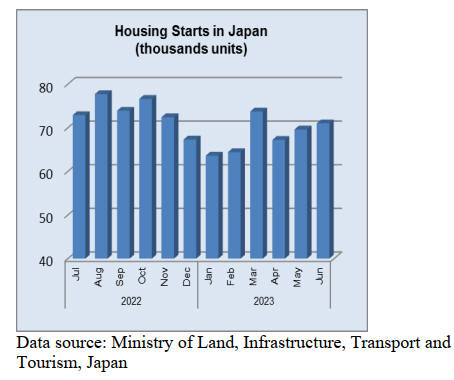

Total housing starts in first half of 2023

Total starts during January to June of 2023 are 409,549

units, 2.2% less than January to June, 2022. The starts of

owner’s and unit built for sale kept decreasing. There is no

recovery for the starts of owner’s. Total starts in June,

2023 are 71,015 units, 4.8% less than June, 2022 and this

is for the first time in two months to not exceed the starts

in June, 2022.

Owner’s unit is 110,254 units, 10.5% down from the

same

month last year. Unit built for sale is 68,944 units, 4.4%

less than the same month last year. Rental units in June,

2023 does not exceed June, 2022’s result but the total

starts of rental unit during January to June, 2023 are

168,810 units, 2.5% more than the same period last year.

The starts of conventional wooden houses are 170,509

units, 6.0% down from the same month last year. The

starts of 2 x 4 houses are 42,103 units, 2.0% less than the

same month last year. Prefabricated house is 5,026 units,

11.3% up from the same month last year.

Condo is 58,473 units, 5.3% up from the same month last

year. Total starts of condo in June, 2022 were 55,525

units, 4.4% more than June, 2021.

A forecast for the starts of owner’s at the second half of

2023 is very difficult. The total starts of owner’s in June,

2023 are 20,325 units, 12.4% less than June, 2022. This is

straight 19 months decreasing.

Rental unit in June, 2023 is 30,112 units, 0.6% down from

the same month last year. This is for the first time

decreasing since April, 2023. Rental unit in the Greater

Tokyo Metropolitan area is 11,241 units, 5.2% up from the

same month last year. This is straight four months

increasing.

European lumber

Movement of European lumber in Japan rose slightly in

July to August, 2023. One of the reasons is that many

constructions of a house framework completed before the

Japanese summer holiday in August. A number of

constructions is less than last year but this situation is

better than the situation in April to June, 2023. Demand of

European lumber after the Japanese summer holiday will

not increase but not decrease.

The price of laminated lumber keeps falling. However, the

price of whitewood stud has been stabilized since May,

2023. It is 69,000- 71,000 yen, delivered per cbm. The

price used to be 50,000 – 55,000 yen, delivered per cbm,

before the woodshock so it is able to say that the price of

whitewood is still high.

However, demand is lower than before. The price of finger

jointed cedar stud and KD cedar solid stud are 50,000 –

60,000 yen, delivered per cbm. There is not a shortage of

whitewood stud yet even though arrival volume of

whitewood stud has been low since last November and

also inventory at the ports has been declining.

A number of contracts in August is less than the same

month last year. Whitewood stud in Europe was €410-420,

C&F per cbm in July and August. It is €30 down from

May and June. However, the yen continued to depreciate

against the euro so the import cost is 67,000 – 70,000 yen,

FOB per cbm. This import cost is unchanged from last

time.

Plywood

The price of domestic softwood plywood is about to reach

the bottom because the inventory of domestic softwood

plywood has been decreasing and plywood companies did

not change the price at the end of July, 2023.

12mm 3 x 6 of structural softwood plywood is 1,600 yen,

delivered per sheet. In some area, the price is under 1,600

yen, delivered per sheet , but it does not influence the

market price so far. Anticipation of falling prices has been

solved and consumers started purchasing structural

softwood plywood. Inventory at plywood companies in

June, 2023 was 0.7 moth of shipment and this is an

appropriate level. There is a shortage of several kinds of

plywood but it is able to find and purchase lumber at other

companies.

Imported plywood in June, 2023 was 142,632 cbms,

38.2% less than June, 2022. Especially, demand and

supply of South Sea plywood is very tight. The price of 12

mm 3 x 6 of painted plywood for concrete form is 1,900

yen, delivered to form plywood firms per sheet and this is

about 50 yen up, delivered to form plywood firms per

sheet, from June. It is 1,950 yen, delivered at wholesalers

per sheet. Form plywood and structural plywood are 1,800

yen, delivered to wholesalers per sheet. This is leveled off

from last month.

2.5 mm plywood is 780 yen, delivered per sheet. 4 mm

plywood is 1,000 yen, delivered per sheet. This is

unchanged price from previous month. 5.5 mm plywood is

1,200 yen, delivered per cbm and this is 50 yen higher

than the previous month.

2.4 mm 3 x 6 plywood in South Asia is around $950, C&F

per cbm. 3.7plywood is $880, C&F per cbm. 5.2 mm

plywood is $850, C&F per cbm. 12 mm 3 x 6 painted

plywood for concrete form is $650, C&F per cbm. Form

plywood is $560, C&F per cbm.

Structural plywood is $560, C&F per cbm. Inventory of

painted plywood for concrete form is decreasing. Some

shippers in South Asia raised the selling price by $10 – 20,

C&F per cbm, up from the previous time. Consumers in

Japan had been cautious about purchasing plywood due to

the exchange rate fluctuation but some consumers

purchased plywood when the yen appreciated against the

dollar in the middle of July.

South Sea logs and products

An exchange rate fluctuation influences South Sea lumber

and Chinese lumber. Japanese buyers purchased lumber

when the dollar became 130 yen from 145 yen but they

stopped purchasing lumber as the yen depreciate against

the dollar. Logistics companies wait and see the right

timing to purchase lumber.

Indonesian Merkus pine lumber is $820 – 850, C&F per

cbm. Chinese red pine lumber is $870 – 890, C&F per

cbm. These prices are steadiness.

It is the season of fresh Merkus pine logs in Indonesia and

it is not easy to change the prices. Chinese companies

narrow down the orders of raw materials and they are not

active to produce lumber. They decided to not lower the

lumber price for Japan because they know that demand of

lumber in Japan is very sluggish.

In Japan, Merkus pine lumber is around 122,000 yen, FOB

per cbm. Chinese red pine lumber is around 127,000 yen,

FOB per cbm. These prices stabilize from the previous

time. There are a few new orders so fluctuation of

domestic price is small. Inquiries for South Sea lumber are

sluggish due to low demand of deck.

Demand and supply of South Sea log is balanced. Arrival

volume during January to June, 2023 is 14,343 cbms,

21.4% less than the same period last year. The arrival

volume decreased by over 20% from last year but there are

enough South Sea logs for steel manufacturers and

shipbuilding companies. South Sea log companies in

South Adia will not lower the price because they do not

have enough logs.

Demand and supply of lumber at the 1st half of 2023

According to The Ministry of Agriculture, Forestry and

Fisheries, shipment of lumber during January to June,

2023 does not exceed the result of January to June, 2022.

It is 6% less than last year. Inventory is 12% more than the

same period last year. Shipment of log during January to

June, 2023 is nearly 5% down from the same period last

year. Also, shipment of lumber during January to June,

2023 is almost 7% down.

Arrival volume of domestic log at the first half of 2023 is

6,494,000 cbms, 3% down from the first half of 2022. A

ratio of domestic log of all logs is about 81.1% and it is

3.6 points increased from last year. Since the starts of

wooden house during January to June, 2023 decrease by

4.9% and this result has influenced demand and supply of

lumber.

Damage by torrential rain in Akita Prefecture

There was a torrential rain on 14th July, 2023 in Akita

Prefecture. There have been serious damages at domestic

lumber plants. Roads to mountains are closed because of

collapse. There are high-performance machines for

forestry left at the mountains. It will be able to go to the

mountains after the local government finishes checking the

safety in August.

The price of logs or lumber will remain low and there will

be less logs. Also, there is a possibility of delays for

establishing new machines of large diameter logs, which

were planned to start an operation in autumn. The total

damage by this torrential rain is about 7.7 billion yen for

agriculture, forestry and fishery industries.

|