Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Jul

2023

Japan Yen 144.10

Reports From Japan

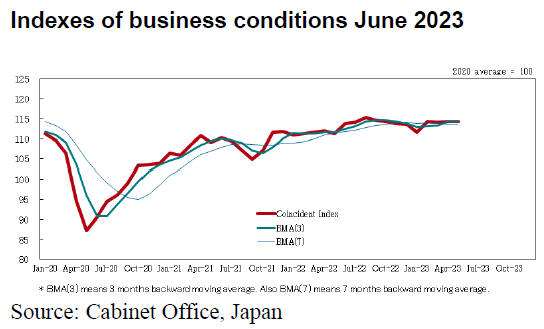

Covid downgrade

boosted business optimism

An Asahi Shimbun survey of business sentiment among 100 major companies

found that 76 viewed the domestic economy as “expanding” or “gradually

expanding” an increase of 30 companies from the previous survey in November

2022.

Many corporate leaders expressed optimism that economic activity and

personal consumption is rising now that COVID-19 has been downgraded to the

equivalent of seasonal flu. However, concerns remain about labour shortages

and a slowdown in global demand.

The Asahi Shimbun reports:

75 companies said the domestic economy is “gradually expanding.”

22 companies viewed the economy as “at a standstill”, half that of the

previous survey.

When asked to choose two reasons for their assessment most companies said

their optimism was due to the recovery of personal consumption.”

See:

https://www.asahi.com/ajw/articles/14965289

BoJ needs to see robust domestic demand and higher wage growth before

change of direction

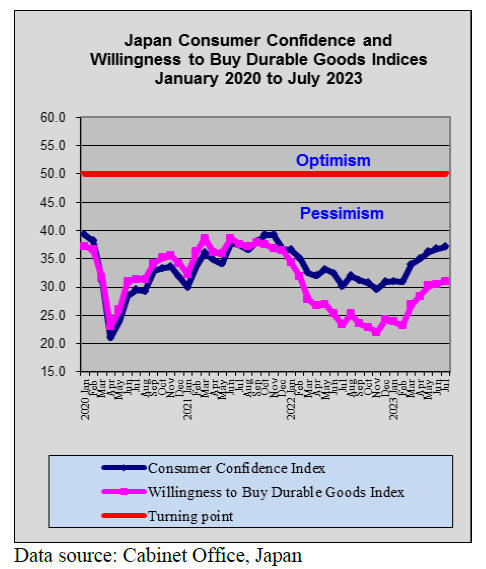

Because inflation continues to exceed the Bank of Japan (BoJ) 2% target the

government cut the growth forecast but acknowledged growing signs of change

in the country's deflationary mindset.

According to the Prime Minister Japan's economy is recovering moderately

with positive signs emerging such as wage increases and encouraging

corporate investment.

In the mid-year review of its forecasts the government expects the economy

to expand in the fiscal year ending in March 2024 despite declining exports

as global demand slows. The government expects robust domestic consumption

and capital expenditure to support growth in fiscal 2024.

The BoJ governor has dismissed suggestions of an early exit from the Bank’s

ultra-loose policy saying the recent cost-driven rise in inflation must be

replaced by price gains driven more by robust domestic demand and higher

wage growth.

A recent survey of households by the BoJ found inflation expectations rose

in the second quarter 2023 which, if sustained, could signal that conditions

for phasing out massive monetary stimulus may be falling into place. The

ratio of Japanese households expecting prices to rise a year from now stood

at 86% in June, up from March to the highest level since June 2022.

See:

https://asia.nikkei.com/Economy/Japan-cuts-growth-forecast-sees-inflation-exceeding-BOJ-target

and

https://www.japantimes.co.jp/news/2023/07/12/business/japan-households-inflation-survey/

Major retailer to build stores with domestic wood

Muji, the Japanese retailer which sells a wide variety of household and

consumer goods and which places emphasis on recycling, reducing production

and packaging waste, plans to construct 20 stores made of domestic timber.

The idea to utilise domestic timber is part of the company’s sustainable

business model. The company has concluded an agreement with the Ministry

Agriculture, Forestry and Fisheries which is promoting the use of domestic

timber.

See:

https://japannews.yomiuri.co.jp/business/companies/20230601-113282/

Changing demographics to impact timber consumption

There was a drop in the number of citizens in Japan in 2022 with all 47

prefectures seeing declines for the first time. However, the number of

non-Japanese residents surged to a record high balancing out some of the

population loss.

Data from the Ministry of Internal Affairs revealed that the population of

Japanese nationals stood at around 122.42 million as of 1 January 2022 a

decrease of over 800,000 year on year and the 14th year-on-year decline.

This change in demographics will impact demand for new homes and consumption

patterns as many of the foreign workers are short-term workersand many are

in low paying jobs.

See:

https://www.japantimes.co.jp/news/2023/07/26/japan/society/number-of-japanese-drops-in-all-47-prefectures-for-first-time-as-foreign-population-surges/

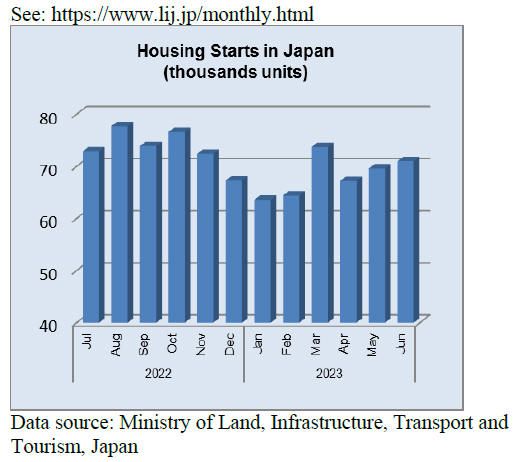

Home prices rising

Residential property prices continue to rise in Japan despite weakening

demand and the economic slowdown. During 2022 the nationwide residential

property price index rose by 7.5% an acceleration from y-o-y rises of 6.3%

in 2021, 3.1% in 2020 and 0.6% in 2019, according to Land Institute of Japan

data.

The house price growth continued early this year but there are wide price

variations in terms of location and property type. In the first quarter 2023

existing detached house prices were up by 4.7% y-o-y after an annual growth

of 8.3% in the first quarter 2022.

The outlook for Japan’s housing market is tough to forecast because of cost

push inflation and heightened economic uncertainty. Demand remained weak in

early 2023.

In Tokyo, sales of both existing condo units and detached houses fell by

1.1% and 5.5%, respectively, in the first quarter of this year compared to

the same period in 2022.

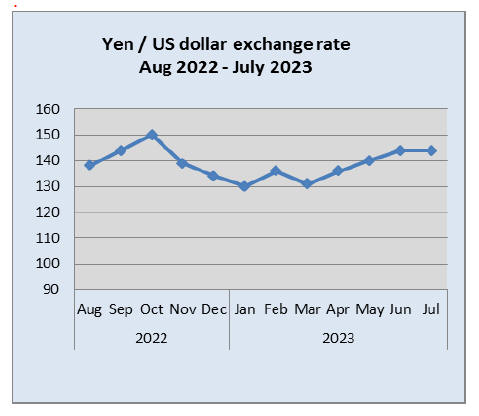

Weak yen of concern, BoJ holds the key

The yen dropped to 144 against to the dollar in late July, held down by

clear indications the BoJ will not be changing its policy in the short-term.

The BoJ has indicated it will need to see a sustainable link between wages

and inflation before changing its policy. The question is, when will a

policy change come? as this will be a market moving event.

Recent data showed Japan's core inflation rose to 3.3%, well above the BoJ

target. At its policy board meeting at the end of July expressions used in

the report and in the press conference have been interpreted as possibly

signaling a change in policy direction. This sent the yen firmer against the

US dollar but whether this will be sustained is the question.

See:

https://www.reuters.com/markets/currencies/dollar-firms-yen-steady-after-japan-inflation-holds-above-boj-target-2023-07-21/

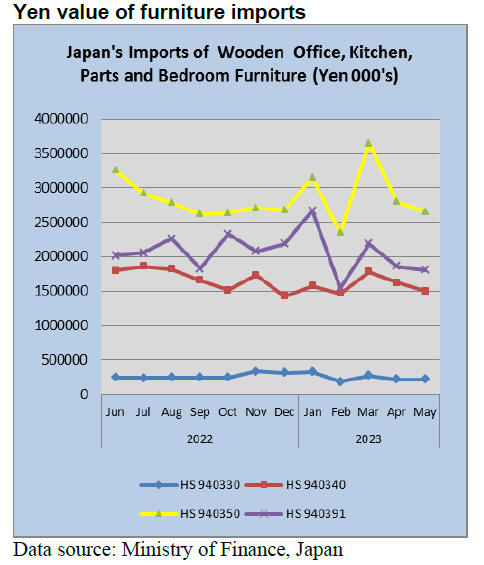

Import update

May marked the second consecutive decline in the value

of imports of office, kitchen and bedroom furniture and

wooden furniture parts. This comes at a time when

consumers are reeling from across-the-board price

increases and when inflation has eaten away the wages

increases agreed earlier in the year.

Since the third quarter of 2022 the monthly value of

furniture imports has become less predictable. For each of

the three of the furniture categories tracked, wooden

office, kitchen and bedroom furniture, monthly import

values have swung widely, a feature not seen before in

Japanese furniture imports.

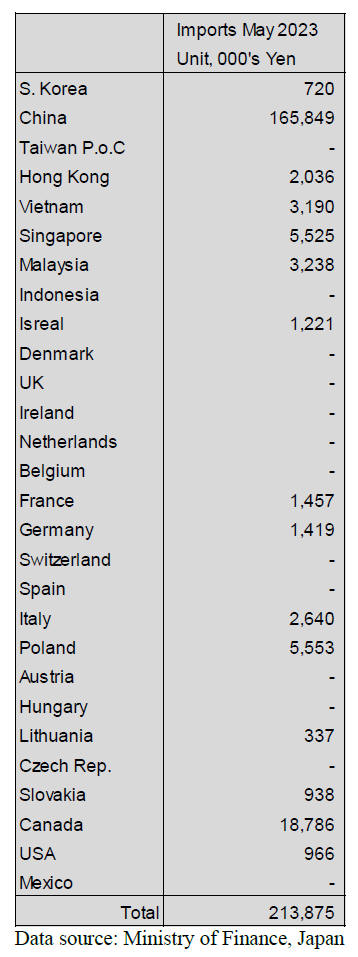

May wooden office furniture imports (HS 940330)

The value of wooden office furniture imports in May this

year were around 13% higher than in May 2022 but the

value of May imports were little changed from the level

seen in April.

May shipments of wooden office furniture from China to

Japan accounted for over 77% of all wooden office

furniture imports, a slight rise on the 75% in April. In May

there was a shuffling amongst the other main shippers with

shipments from Vietnam dropping to less than a quarter of

April shipments and two new suppliers, Canada and

Singapore surging to become the second and third largest

shippers. Exporters in Poland have a steady business with

Japan but in May the value of shipments dropped by over

50%.

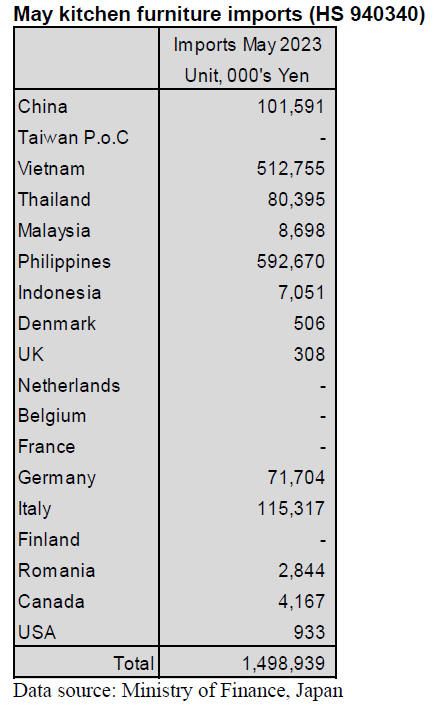

May kitchen furniture imports (HS 940340)

The value of May 2023 imports of wooden kitchen

furniture was some 11% below that recorded in April and

also 11% below that recorded in May 2022. All the top

suppliers saw shipment values drop.

The Philippines was the top supplier in May but shipments

were down 5%, shipments from Vietnam were down 14%,

shipments from Italy were down around 15%, however,

shippers in China gained a greater share of the value of

wooden kitchen furniture imports.

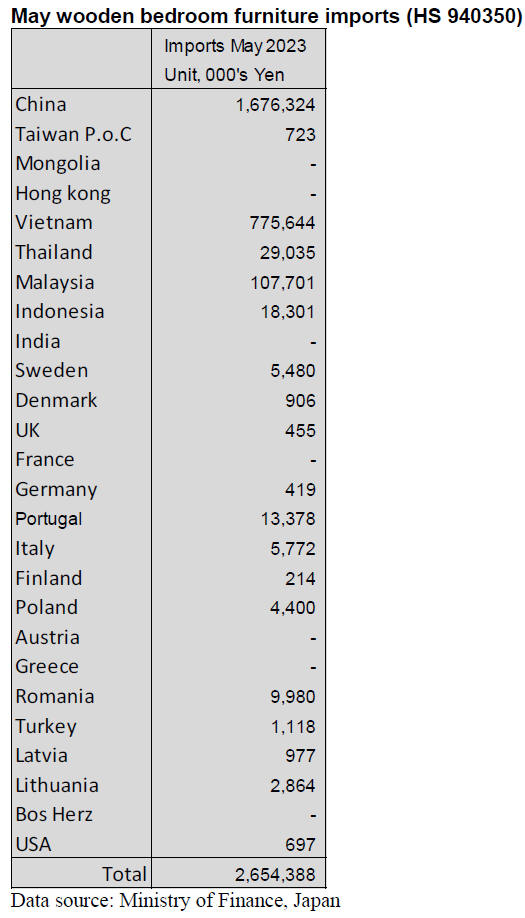

May wooden bedroom furniture imports (HS 940350)

After the sharp rise in the value of shipments of wooden

bedroom furniture in March, there was a decline in April

and the down-trend continued into May. Year on year, the

value of May wooden bedroom furniture arrivals was

down 18% and compared to the value of April imports

there was a further 5% decline.

The top supplier, China, accounted for just over 60% of all

wooden bedroom furniture imports in May and the value

of imports was around the same level as in April. The

second largest supplier, Vietnam saw the value of imports

drop 12% compared to a month earlier. For the third

largest supplier, Malaysia, the value of May shipments

was down over 20%. These top three suppliers accounted

for 97% of the value of all May wooden bedroom furniture

imports.

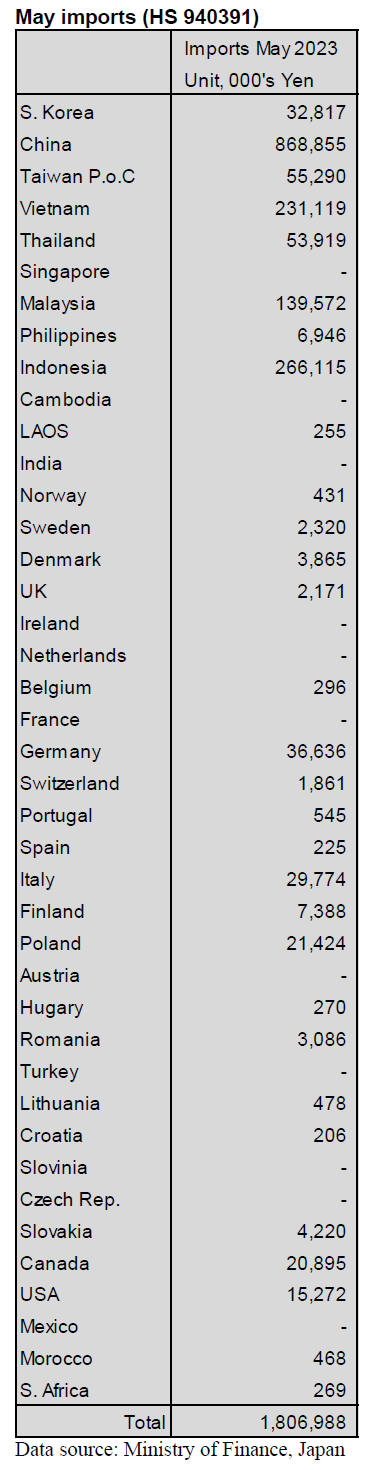

May wooden furniture parts imports (HS 940391)

Japan’s imports of wooden furniture parts (HS940391) are

substantial. Most imports of wooden furniture parts

originate in China and in May shipments from China

accounted for close to 50% of the value of all May

arrivals. Arrivals from Indonesia in May accounted for

15% followed by Vietnam 13% and Malaysia 8%.

Unlike the other categories of furniture, wooden furniture

parts imports into Japan come from a wide range of

sources but the top four suppliers in May accounted for

over 80% of all wooden furniture parts imports.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Business suspension orders

The MAFF (Ministry of Agriculture, Forestry and

Fisheries) demands Pt Mutuagung Lestari in Indonesia and

Greenpanel Corporation in China to stop certifying JAS

(Japanese Agricultural Standards) on lumber and to

improve a way of certifying JAS on lumber.

Pt Mutuagung Lestari knew that structural plywood of

Benbenmao New Material Co., Ltd. in China was not good

enough to satisfy the conditions of JAS but Pt Mutuagung

Lestari did not take measures for that. Benbenmao New

Material is a plywood company which is not able to get

the JAS certification on lumber now.

Greenpanel Corporation authorized several companies as

certification authorities of JAS even though there were

errors on examinations. A term of a stop for operations of

Pt Mutuagung Lestari is 90 days, which is 19th July, 2023

to 16th October, 2023. Greenpanel Corporation stops an

operation during 19th July, 2023 to 16th September, 2023

for 60 days.

The MAFF demands on both companies to report about an

improvement of certificating JAS, a revision of the

organization, a cause of this case and measures to prevent

a relapse. A deadline of the report will be 17th September,

2023 for Pt Mutuagung Lestari and will be 18th August,

2023 for Greenpanel Corporation.

According to The FAMI (The Food and Agricultural

Materials Inspection Center), low formaldehyde structural

plywood was produced maximum 1,230,000 sheets, about

31,000 cbms and about 87,000 sheets, about 21,000 cbms,

were imported to Japan. Japanese importers sold at least

620,000 sheets, about 15,000 cbms, to the clients. The low

formaldehyde structural plywood was produced during

22nd February, 2022 to 17th September, 2022. The sizes

were 9 mm, 12 mm, 15 mm, 24 mm and 28 mm thickness,

190 mm width and 1,890 mm length.

Product of LVL was maximum 30,000 LVL, 300 cbms.

About 15,000 LVL, about 200 cbms, was imported to

Japan. Japanese importers sold 13,000 LVL, 110 cbms.

LVL was produced during 15th June, 2022 to 16 th

September, 2022. The sizes were 22 – 50 mm thickness,

40 – 910 mm width and 1,000 – 3,000 mm of length.

The FAMI found out that glue and quality of some

structural plywood used for houses were not satisfied the

conditions of JAS. However, the strength and the

emanated quantity of formaldehyde of structural plywood

satisfied the conditions of JAS.

The price of cedar log keeps falling

The price of cedar log has been plunging in Fukushima Prefecture since

March, 2023. The price of 3 m cedar log for posts and 4 m cedar log

decreased under 10,000 yen, delivered per cbm, in late June. This is for the

first time in three years to be under 10,000 yen. In some area, the price of

cedar log is about 8,000 yen, delivered per cbm.

Once the price of cedar log skyrocketed in April, 2021 due to the wood shock

and the average price of cedar log during April, 2021 to March, 2023 had

been around 14,000 – 15,000 yen, delivered per cbm. Some reasons are that

demand of log for producing lumber increased a lot in 2021 and there were

many inquiries about logs to manufacture plywood in 2022. Since the price

and demand were stabilized, it was able to cut down the trees and able to

supply logs stably. Also, there was movement of employment expansion.

However, demand of log started decreasing at the beginning of this year and

the log price also started decreasing.

3 m cedar log for producing posts costs 9,500 yen, delivered per cbm. 4 m

cedar log of medium diameter is 9,000 yen, delivered per cbm. There are many

logs left at the log markets. Cedar logs for manufacturing plywood are 9,000

– 10,000 yen, delivered per cbm. However, there are not many orders for

cedar logs.

Cedar logs for producing wooden chips are very popular now. The wooden chips

will be used for manufacturing paper and for manufacturing wooden biomass

fuels. The cedar logs for wooden chips are sold by 6,500 – 7,000 yen,

delivered per cbm.

Domestic logs in Northeast Japan

There are less logs in Northeast Japan because the price of softwood

logs had declined. Volume of log at the log markets is 20 % less than the

same period last year. Demand of log has not recovered yet and the price of

cedar log is still weak. The price of larch log has not changed because of

less larch logs at the log markets. Manufacturers still have a lot of cedar

logs. There is a concern that beetles would be on logs.

In Akita Prefecture, 3.65 m cedar log of medium diameter is 11,000 yen,

delivered per cbm. 3.65 m cedar log for post is 10,000 yen, delivered per

cbm. In Iwate, Miyagi and Aomori Prefecture, 4 m cedar log with medium

diameter is 10,000 yen, delivered per cbm and 3 m cedar log for post is

11,000 yen, delivered per cbm.

4 m larch log of medium diameter is 20,000 yen, delivered per cbm. For

piles, the price of larch log is 12,000 yen, delivered per cbm. For biomass

fuels, the price is 7,000 yen, delivered per ton.

Since there are many logs in Northeast Japan, the logs were exported China

but it would be difficult to export the logs anymore because the economy in

China is not good.

In this year, hardwood logs are popular and high-priced. Oak log of large

diameter is over 60,000 yen, delivered per cbm and of medium diameter is

over 40,000 yen, delivered per cbm. Japanese walnut log is with good quality

is 50,000 yen, delivered per cbm.

10 Japanese companies participate Eastwood Climate Smart Forestry Fund I

Sumitomo Forestry Co., Ltd. in Tokyo Prefecture announced that East

Forests LLC in the U.S.A. established Eastwood Climate Smart Forestry Fund I

(hereinafter, the Fund) and started an operation. 10 Japanese companies

participate this Fund and the operation will be fifteen years. It is about

six billion yen in assets.

Eastwood Forests was jointly established in October, 2022 by Sumitomo

Forestry’s wholly owned subsidiary Sumitomo Forestry America, Inc. and the

CEO of Eastwood Forests experts in establishing and managing forestry funds

in the U.S.A. Eastwood Forests will serve as the asset management company of

the Fund, providing advice on the management of forest assets. Sumitomo

Forestry’s wholly owned subsidiary SFC Asset Management Co., Ltd. handles

the Fund’s private placement and has been entrusted by the general partner

to manage operation in Japan.

10 Japanese companies, which participate this Fund, are ENEOS Corporation,

Osaka Gas Co., Ltd., Tokyo Century Corporation, Japan Post Holdings Co.,

Ltd., NYK Line, Fuyo General Lease Co., Ltd., Sumitomo Mitsui Banking

Corporation, Sumitomo Mitsu Trust Bank Limited, Unicharm Corporation and

Sumitomo Forestry.

The companies participate this Fund because some of them are to achieve a

goal of decarbonization and add value on their products or services.

South Sea logs and lumber

The weak yen has been influencing the price of South Sea lumber and

Chinese lumber. Once the yen depreciated over 135 yen against the dollar in

March, 2023. Chinese and Indonesian manufacturers accepted Japanese

importers’ request, which was a reduction in the price of lumber. However,

an amount of order was not a lot. In the beginning of July, the yen

depreciated to 145 yen against the dollar but it is difficult for Chinese

and Indonesian manufactures to lower the price. Japanese importers are

cautious to purchase South Sea or Chinese lumber even though the inventory

in Japan is not enough.

The price of Merkus pine lumber in Indonesia is US$820 – 850, C&F per cbm.

The price of red pine lumber in China is US$870 – 890, C&F per cbm. In

Japan, the price of Indonesian Merkus pine lumber is around 122,000 yen,

delivered per cbm. The price of Chinese red pine lumber is around 127,000

yen, delivered per cbm. Also, there is an influence of the weak yen for

South Sea lumber. Additionally, Indonesian manufacturers reduce producing

South Sea lumber and will be difficult to get South Sea logs. Therefore, it

is important to keep getting new orders even though the amount of order is

not a lot.

The price hike of painted (coated) plywood for concrete form

The price of painted plywood for concrete form in South Asia started to

rise. A major South Asian shipper will raise the price by US$10 – 20. It had

been hard for manufacturers in South Asia to get enough profits. Japanese

importers will definitely purchase plywood because their inventory is less.

The price will be depended on the negotiation and Japanese importers must

raise the price of plywood in Japan quickly.

The latest price of 12 mm thickness 3 x 6 is around US$650, C&F per cbm. The

import cost is around 1,890 yen, FOB per sheet, calculated by 139 yen

against the dollar. In Kanto region, the price is 1,850 – 1,900 yen,

delivered per sheet.

Some South Asian shippers raised the price after April, 2023. If the price

in South Asia were US$670, the import cost would be 2,020 yen FOB per sheet

calculated by 144 yen against the dollar. This would be 130 yen higher than

the previous time. If the import cost were 1,960 yen, FOB per sheet, the

plywood would be sold by 2,000 yen, delivered per sheet, in Japan.

At domestic markets, the price of plywood had been decreasing as the futures

price in South Asia decreased so Japanese buyers hesitated to purchase due

to anticipation of lowering prices. Arrival volume of plywood from Malaysia

during January to May, 2023 is 186,153 cbms, 48.3 % down from the same

period last year. Since product of plywood decreased, a major Indonesian

shipper struggles to get profits so the Indonesian shipper closed one of its

two plants and will raise the price.

In Japan, the inventory of plywood has been declining so Japanese importers

must order plywood. The inventory is now 40 – 50 % less than the highest

volume in October, 2022. The plywood will arrive in September, 2023 if the

Japanese importers order now.

Volume of imported plywood during January to May, 2023 is 784,712 cbms,

31.9% down from the same period last year. The prices of plywood and

structural plywood in South Asia has not reached the bottom price and if the

price of painted plywood for concrete from reached the bottom price, then

the price of imported South Sea plywood would get rid of all the negative

factors and would be ready to bounce back.

|