|

Report from

North America

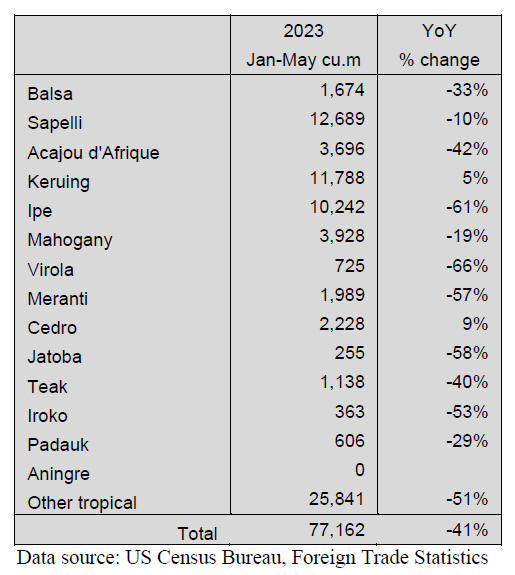

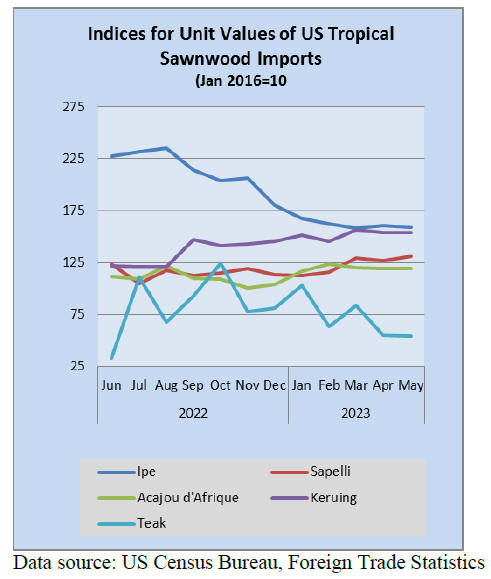

Sawn tropical hardwood imports edged down in May

US imports of sawn tropical hardwood fell 4% in May after two

consecutive months of growth. The 15,681 cubic metres imported in May

was 43% below the volume from May 2022. Imports from Brazil, the leading

trade partner, rose 8%, but that gain was more than offset by declines

in imports from Malaysia (down 7%), Indonesia (down 20%), and Cameroon

(down 36%).

Imports from nearly all trading nations remain down sharply through the

first five months of the year. Imports of Ipe rose 70% in May to reach

their highest level of the year; however, they still came short of last

May’s volume by over 37%. Imports of Sapelli and Keruing both declined

13% in May.

Keruing and Cedro are the only woods being imported at a greater rate in

2023 so far than last year, while imports total less than half of last

year’s amount of Ipe, Virola, Meranti, Jatoba, Iroko, and Annigre

through May. Overall imports remain down 41% versus last year so far

this year.

Canada’s imports of sawn tropical hardwood fell by more than a quarter

for the second straight month in May, declining 30% to their lowest

level in 20 months. Imports of Mahogany fell sharply while imports of

Sapelli fell more modestly but were at less than a quarter of their May

2022 level. Overall imports, which had led those of 2022 for the first

four months of the year, are now behind by 14%.

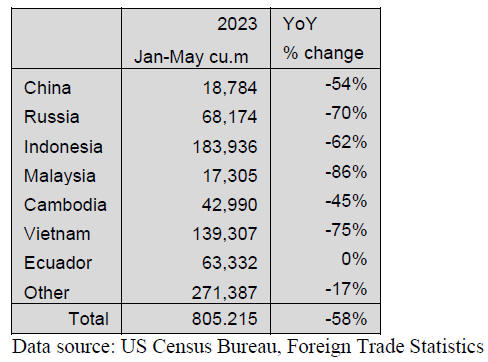

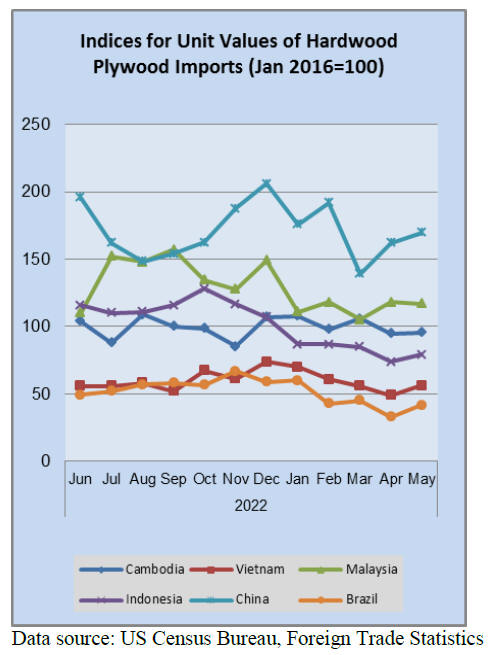

Hardwood plywood imports gain on increases from Russia, China

US imports of hardwood plywood rose 36% in May, rising for a

third consecutive month. The 218,862 cubic metres of plywood imported

last month is the highest volume month so far this year, but still was

only about two-thirds that of the previous May.

Imports from Russia bounced back, rising more than eight-fold in May while

imports from China rose by 70%. Despite the upward trend, total imports

for the year so far trail 2022 by 58% with volume from nearly every

trade partner (besides Ecuador) down by more than half.

US veneer imports up 9% in April

US imports of tropical hardwood veneer also rose for a third

straight month, growing 6% by value as imports from Cameroon remained

strong. Imports from Cameroon, which had surpassed US$1 million in April

for only the second time in the last eight years, rose an additional 9%

in May. Imports from India also made a strong gain in May, returning to

January levels after several slow months. While imports from Ghana and

Cote d’Ivoire both fell in May, year-to-year imports from both counties

are up sharply through May. Total imports lead last year by 21%

US hardwood flooring imports off 3%

US imports of hardwood flooring fell slightly in May, declining

3% by value from the previous month. May imports were 10% below that of

last May as imports from Brazil dropped 50%. Imports from Indonesia and

Malaysia were also down, falling 33% and 23%, respectively, imports from

China rose 40%. Imports from Brazil so far this year are now less than

half the total of this time last year. Overall imports of hardwood

flooring are up 8% over 2022 year to date.

Imports of assembled flooring panels rose 8% in May with imports from

Brazil, Thailand, China and Vietnam all showing strong gains. Imports

from Brazil are up 40% over last year through May while imports from

other major supplying countries are down sharply. Total imports of

assembled flooring panels are down 41% versus last year through May.

Moulding imports gain 30%

US imports of hardwood moulding had their strongest month of

2023 so far in May, rising 30% by value from the previous month. Imports

from Brazil rose 92% in May while imports from Malaysia rose 60%.

After several weak months to start the year, imports have now risen for

two consecutive months.

May imports were less than those of the previous May by 21% while

year-to-year imports are down 30% through the first five months of the

year.

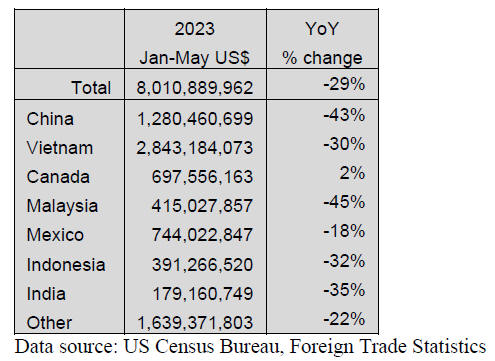

US wooden furniture imports gain in May

US imports of wooden furniture had their strongest month since

January, rising 8% in May for a second consecutive monthly gain. Despite

the gain, the US$1.74 billion in May imports was 30% lower than May 2022

totals.

Imports from China and Vietnam continued to rebound with imports rising

around 15% from both countries. Imports from Canada rose 1% for the

month and have remained steady all year as year-to-date imports from

Canada are up 2% over last year through May.

Total imports are down 29% from last year through the first five months

of the year.

US cabinet sales down 7.8% in May

According to the Kitchen Cabinet Manufacturer's Association's

(KCMA) monthly Trend of Business Survey, participating cabinet

manufacturers reported a decrease in sales of 7.8% in May. Sales were up

by 6.1% for May 2023 compared to the same month in 2022.

The survey reported that compared with the previous month custom sales

were up 2.3%, semi-custom sales were down 15.3% and stock sales were up

7.1%. Compared with May 2022 custom sales were up 16.6%, semi-custom

sales were up 11.3% and stock sales were down 20.1%

See:

https://kcma.org/insights/may-trend-business-report

US cabinet demand forecast to rise to US$20.9 billion in 2026

Demand for kitchen cabinets in the US is forecast to rise 2.9%

annually to $20.9 billion in 2026, according to the "US Kitchen Cabinets

Market 2023-2026" report from ResearchAndMarkets.com.

This represents a deceleration from the 2016-2021 period as new housing

construction and home remodeling normalises following exceedingly high

levels in 2021, and prices for materials used in the construction of

cabinets (such as wood) recede from inflation- and supply chain-related

highs in 2021 and 2022.

The gain will be supported primarily by homeowners investing more money

into kitchen renovation projects and opting for more high-end materials,

in conjunction with interest among homeowners in using cabinets as both

aesthetic and functional elements of their kitchens.

See:https://www.woodworkingnetwork.com/cabinets/us-cabinet-demand-forecast-rise-209-billion-2026

Trending: Celebrities on social media bragging about the wood in

their homes

When it comes to wood, celebrities are obsessed, at least

that’s what viewers have gleaned from tours of their homes.

Since 2012, Architectural Digest has taken the masses inside celebrity

homes through its “Open Door” series. In doing so the series

inadvertently amassed, what Los Angeles comedy writer and director

Karolyn McKenzie calls “celebrity wood brags,” distinct origial stories

owners tell about the reclaimed wood in their homes.

The fascination with celebrity ‘wood brags’ has gained traction on

social media platforms like TikTok, where users like McKenzie have

compiled videos highlighting the numerous instances of famous

individuals expressing their admiration for wood during house tours.

With millions of views, these videos have struck a chord with viewers

who find humor in the specific and often extravagant origins of the wood

featured in celebrity homes.

The popular videos feature celebrities such as tennis legend Serena

Williams as well as actors and entertainers like Maggie Gyllenhaal,

Kirsten Dunst, Peter Sarsgaard, Michael Imperioli and RuPaul.

See:https://www.architecturaldigest.com/story/why-are-celebs-bragging-about-their-wood-furniture

and

https://www.washingtonpost.com/lifestyle/2023/07/04/celebrity-wood-brags-tiktok/

|