Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Jul

2023

Japan Yen 140.10

Reports From Japan

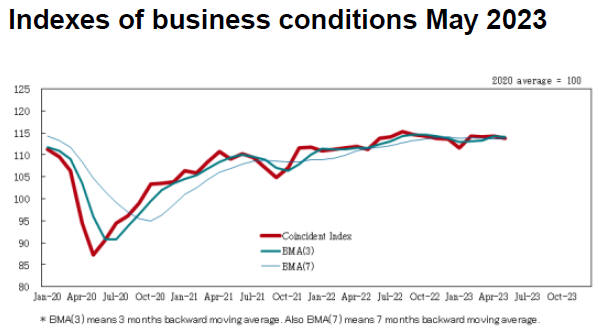

Business sentiment improved for

the first time in seven quarters

Japanese business sentiment improved in the second quarter as raw

material costs stopped rising and increased consumer consumption, as

pandemic curbs were removed, drove up factory output. The Bank of Japan's

latest Tankan survey shows business sentiment among large manufacturers has

improved for the first time in seven quarters.

The survey suggested companies expect to increase capital expenditure and

consider inflation will stay above the Bank of Japan’s (BoJ) 2% target for

the next five years. This could fuel sentiment that conditions for phasing

out the BoJ massive monetary easing policy may be emerging especially if the

momentum of wage increases can be maintained.

See:

https://www.japantimes.co.jp/news/2023/07/03/business/economy-business/tankan-business-sentiment/

And

https://www.boj.or.jp/en/statistics/tk/gaiyo/2021/tka2306.pdf

In related news, a report from Rengo the umbrella trade union group,

confirmed that wage growth was more widespread than many had thought. Wages

observed within Rengo affiliated groups across Japan rose by an average of

3.5% at the beginning of the year. More importantly, signs of broader wage

pressures have been observed in small and medium enterprises (SMEs) which

saw their wage bill rise 3.2%.

See:

https://www.dailyfx.com/news/usd-jpy-price-outlook-rising-japanese-wage-data-lifts-the-yen-20230705.html

Sentiment among large manufacturers improved for the

first time in seven quarters in the second quarter of this year according to

the BoJ. The latest results exceeded the median forecast. Capital spending

by large companies in fiscal 2023 is forecast to grow 13%.

Source: Cabinet Office, Japan

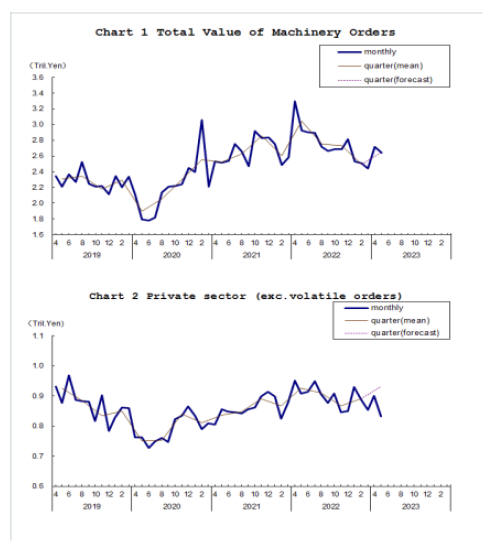

Manufacturing output rising

Industrial production in Japan declined in May but the economic

outlook remains positive, however, cost push inflation and tightening labour

conditions are driving up prices across the board. Manufacturing output

declined 1.6% month-on-month in May but year on year there was an

improvement in the first five months of 2023. The outlook forecast for

manufacturing activity in June anticipates a rise.

See:

https://menafn.com/1106575919/Japan-Remains-On-The-Recovery-Path-Despite-Weaker-Industrial-Production

Corporate bankruptcies rise

Corporate bankruptcies rose in Japan in the first half of this year

as some businesses struggled to repay corona relief loans. The number of

firms failing in the first half of this year exceeded 4,000 for the first

time in five years.

Retail bankruptcies totalled 834, up 46% with restaurants especially hard

hit. Researchers forecast bankruptcies could increase in July as businesses

face the triple threat of loan repayments, rising prices and a labour

shortage.

See:

https://www3.nhk.or.jp/nhkworld/en/news/20230710_37/

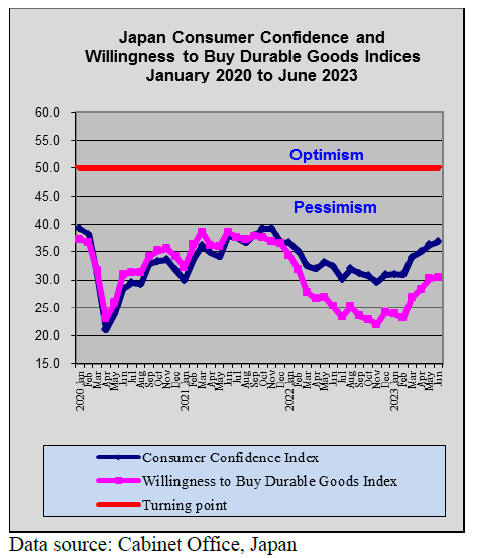

Purchases of durable goods delines

According to the Ministry of Internal Affairs household spending in

Japan fell in May for the third month in a row, dropping 4% year on year.

Purchases of household durable goods such as furniture fell 13%, expenditure

on communications declined 9% and spending on supplementary education such

as cram-school tuition dropped by 15%.

In contrast, consumers spent more on rail tickets, air fares travel and

hotels a reaction to he lifting of coronavirus restrictions.

See:

https://www3.nhk.or.jp/nhkworld/en/news/20230707_25/

Supply-side inflation tough to tackle

Years of stubborn deflation has meant that the Bank of Japan (BoJ)

has defensive policies including ultra-loose monetary policy aimed at

breaking deflation and achieving sustainable and demand-led growth. Now it

is a case of ‘be careful of what you wish for’ as current inflationary

trends in Japan are not home grown but supply-side driven, the result of the

Covid pandemic and energy crisis brought on by Russia’s invasion of Ukraine.

See:

https://www.dailyfx.com/news/usd-jpy-price-outlook-rising-japanese-wage-data-lifts-the-yen-20230705.html

and

https://www.boj.or.jp/en/research/brp/rer/rer230710.htm

Coronavirus cases continue to rise nationwide

Health officials report coronavirus cases continue to rise

nationwide and that the situation in Okinawa is alarming. The latest average

number of Covid patients per medical institution was 7.24 in the first week

of July some 18% higher than in the previous week and the 13th consecutive

week of increase.

The head of Tokyo Center for Infectious Disease Control and Prevention

warned that medical institutions in Tokyo could be overwhelmed if current

infections, mainly seen among young people, spread to the elderly.

See:

https://www3.nhk.or.jp/nhkworld/en/news/20230707_34/

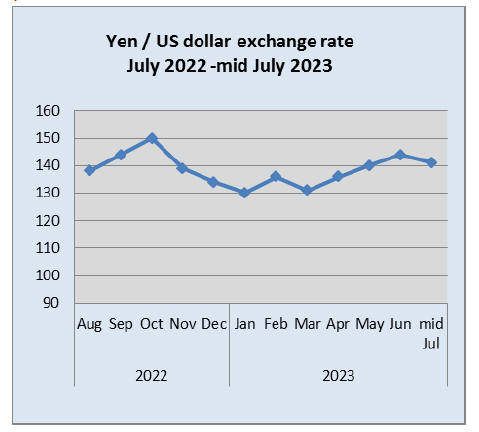

Are we heading towards a currency intervention?

Over the past months the yen has dipped to very low levels against

the US dollar which has prompted Japan’s Finance Minister to communicate

with his US counterparts.

The Japanese government and the BoJ say they will act on exchange rates if

the yen depreciates too far and at a rapid rate. Currency traders were on

high alert when it appearsed the yen was heading to the 150 to the US

dollar, the level at which prompted intervention in the currency market last

year.

See:

https://www.dailyfx.com/news/forex-usd-jpy-eur-jpy-price-forecast-intervention-concerns-provide-optimism-for-yen-bulls-20230704.html

Use of timber mandatory for low-rise

institutional buildings

The Japanese government is promoting the use of timber in the

construction sector. The Building Standards Act was revised in 2000 so that

any building could be built with wood if it fulfills a certain level of

performance. Then came the Act ‘Promotion of the Utilisation of Wood in

Public Building’ which made the use of timber mandatory for low-rise

institutional buildings.

Increased use of timber in buildings represents several challenges including

fire and seismic safety and durability issues but a combination of

technological developments, design and adapted construction systems wooden

buildings have a lot to offer.

See:

https://www.takenaka.co.jp/takenaka_e/mokuzou-mokushitu/

Import update

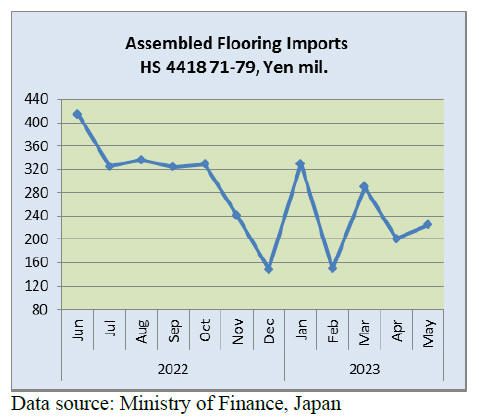

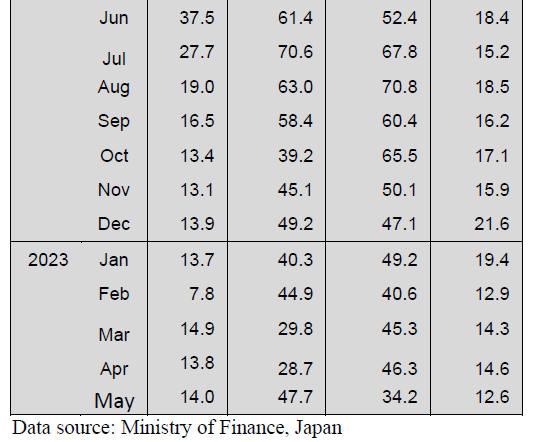

Assembled wooden flooring imports

Despite a slight recovery in the value of Japan’s imports of

assembled wooden flooring (HS441871-79) in May compared to a month earlier,

however, when compared to May 2022 the value of imports was down around 40%.

As in previous months the main shippers of assembled flooring in May were

China, Vietnam, Malaysia and Indonesia. HS441875 comprised the bulk of

Japan’s May imports at around 85% of all categories of assembled flooring of

which most as from China.

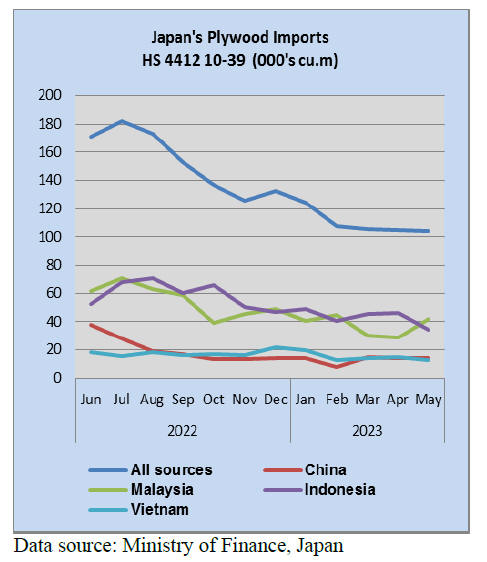

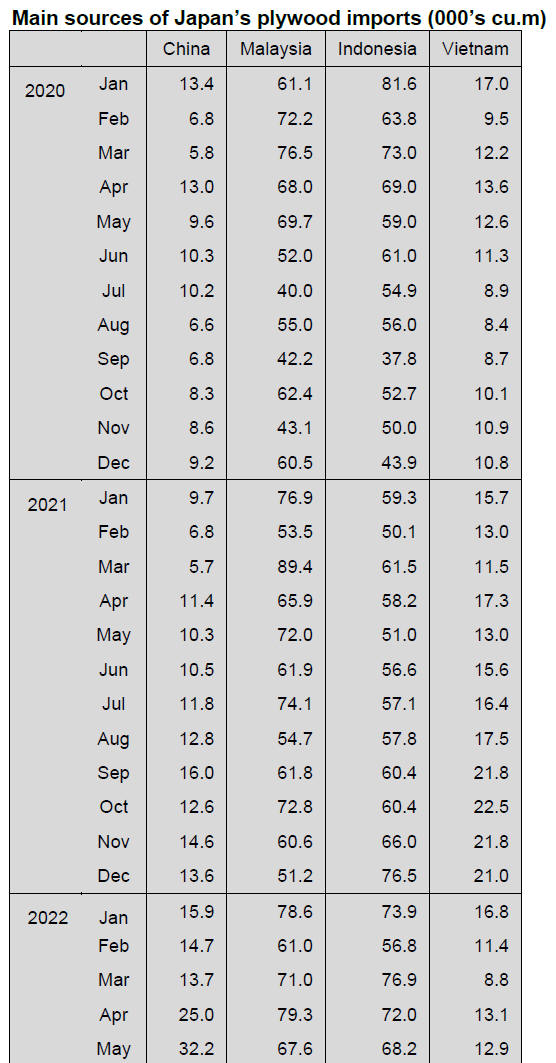

Plywood imports

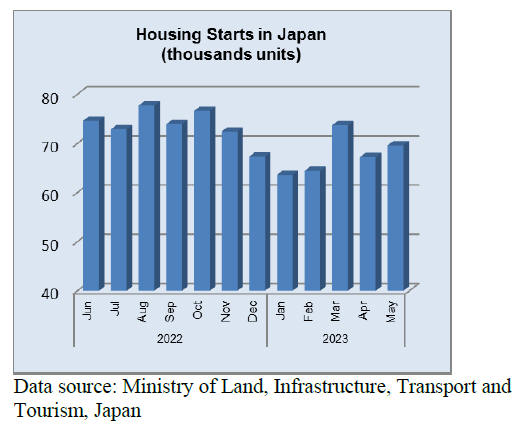

The downward trend in the volume of Japan’s plywood imports which

began in mid-2022 extended into May.

Year on year May 2023 plywood arrivals were over 40% down and the slight

up-tick in import volumes in May compared to a month earlier did little to

reverse the long-term decline in import volumes.

Falling shipments of plywood from the top suppliers, Malaysia and Indonesia,

explain the overall downward trend. Shipments from the other two main

suppliers China and Vietnam remained fairly constant until recently when

there was a sharp drop in plywood imports from China.

Demand for plywood in the domestic market in China has weakened because of

problems in the housing market but this, it appears, has not driven Chinese

plywood manufacturers to begin lowering prices to gain market share in

Japan.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade journal

published every two weeks in English, is generously allowing the ITTO

Tropical Timber Market Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Ta Ann Group to continue harvesting certified forests

Ta Ann Group is a big company, which manages forest and produces

lumber, plywood and oil palm in Sarawak province in Malaysia. Ta Ann Group

has three forests, which are Kapit, Pasin and Raplex, and has certifications

of PEFC (Programme for the Endorsement of Forest Certification) on all three

forests. Total of three forest areas are 346,000 hectares. The Sarawak

Government authorized Ta Ann to grow 320,000 cbms of logs annually in those

three forests for the next 30 years.

The company produces 9,000 cbms plywood in a month. 8,000 cbms of 9,000 cbms

are for painted plywood for concrete form and rest of 9,000 cbms are for

structural plywood and other plywood.

The president of the company says, ‘it is a good and important opportunity

for us to get certifications of PEFC for the next 30 years. We are able to

supply PEFC plywood to Japan stably.

Exporting logs from Kesennuma port

Cedar logs were exported to China from Kesennuma port in Miyagi

Prefecture for the first time on 21st and 22 nd June.

Since there were many cedar logs due to low demand in Japan, Miyagi

Prefecture, Federation of Forest Owners Cooperative Association decided to

export cedar logs because there were concerns about beetles on cedar logs

and deterioration of cedar logs.

A vessel owned by a Chinese company is 5,278 tons. 4 m length and over 18 cm

thickness of cedar logs were exported to China. Volume was about 3,200 cbms.

Cedar logs will be exported China again on 20th, July. Miyagi Prefecture

Federation of Forest Owners Cooperative Association will decide to continue

exporting cedar logs to China or not after this export.

Plywood

The price of domestic softwood plywood almost reached the bottom in

the middle of June. 12mm 3 x 6 structural plywood in June was 1,650 yen,

delivered per sheet and it was 50 yen, delivered per sheet, down from May.

Structural plywood for precutting plants was 1,600 yen, delivered per sheet.

The price of domestic softwood plywood decreased slightly in June from May

and the price stopped decreasing in June. Also, the precutting plants

stopped demanding a reduction in price.

Plywood companies in Eastern Japan have been reducing production since last

autumn and inventory at several companies is now less than before. Then, the

plywood companies announced to stop lowering the price of domestic softwood

plywood as of June. Some reasons are to make the price of domestic softwood

plywood to be stable and the price of electricity, production and personnel

increased.

Volume of South Sea plywood has been low and several kinds of structural

plywood are in short supply. 12mm painted plywood for concrete form costs

1,920 – 1,950 yen, delivered per sheet and this is 50 yen lower than the

previous month. Form plywood costs 1,800 yen, delivered per sheet and this

is 100 yen lower than last month. Structural plywood costs 1,800 yen,

delivered per sheet and this is unchanged price from last month. 2.5 mm

thickness plywood costs 780 yen, delivered per sheet. 4.5 mm thickness

plywood is 950 yen and 5.5 mm thickness plywood are 1,150 yen, delivered per

sheet.

The price of plywood in South Asia reached the bottom price. 2.4 mm 3 x 6 is

US$950, C&F per cbm. 3.7 mm is around US$880, C&F per cbm. 5.2 mm is US$850,

C&F per cbm. 12 mm 3 x 6 painted plywood for concrete form is US$650, C&F

per cbm. Form plywood is US$560, C&F per cbm. Structural plywood is about

US$550, C&F per cbm.

A law of JAS for wood pellet

The Ministry of Agriculture, Forestry and Fisheries established a

law of JAS for wood pellet. Japan Wood Pellet Association’s standards have

been used for approving the wood pellet. However, there is a possibility

that consumers would apply to only JAS certification in the future.

The new law of JAS for wood pellet is about ways of testing wood pellets’

quality to use for houses or business use.

The price of cedar log plunged

Demand and supply of cedar logs are unbalanced in Northern part of

Kanto area. The price of 3m cedar log plunged to around 10,000 yen,

delivered per cbm.

Log companies start to control product but it is

difficult to stop producing logs because there is a budget for the fiscal

year 2023 -2024 and there are employees to pay salary.

There are many cedar logs left at log companies in Northern part of Kanto

because the new starts are decreasing. Then, several laminated lumber plants

and plywood plants have been reducing in a purchase of logs since spring.

The price of cedar log in February, 2023 was around 18,000 yen and the price

started to fall in March, 2023. One of the reasons for the price falling is

that log companies lowered the log price because there were beetles on cedar

logs and logs were damaged in April. This was the beginning of the price

falling.

One of forest associations says that if the cedar log with B quality became

under 10,000 yen, the product cost would be no profits. The forest

association had been tried to keep the price of cedar log but in April, the

price of cedar log with A quality was 11,000 yen, with B quality was around

8,000 yen and with C quality was 6,000 yen. Many log companies started

reducing product.

Only the price of KD cedar log for post plunged widely because the price of

laminated cedar post or laminated whitewood post was also falling. Major

lumber plants started producing cedar post by 3m cedar logs so the price of

3m cedar log plunged. The price of 4m cedar log was 14,000 – 15,000 yen in

May and the price decreased 11,000 – 13,000 yen in June. The price of 4m

cypress log was around 17,000 yen.

|