4.

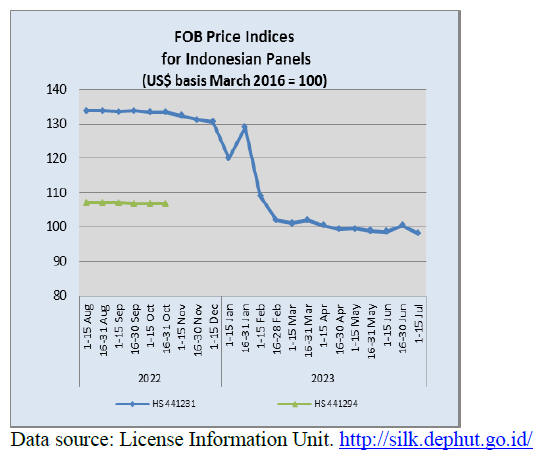

INDONESIA

EU and domestic regulations could

weaken furniture exports

The combined impact of the EUDR and the Indonesian government's

legality verification system (SVLK) could potentially hurt the domestic

furniture industry and erode Indonesia's furniture export competitiveness

according to Abdul Sobur, chairman of the Indonesian Furniture and

Handicraft Industry Association (Himki).

When the EUDR is implemented this will add to production and delivery costs

and if prices do not rise then eventually the regulations will weaken

Indonesia's competitiveness, Abdul said. He added, unnecessary costs must be

eliminated as restrictive regulations could hamper the target to achieve

US$5 billion in furniture exports.

See:

https://jakartaglobe.id/business/overlapping-deforestation-laws-in-eu-indonesia-hurt-furniture-exports

and

https://investor.id/business/331929/tumpang-tindih-regulasi-tekan-ekspor-furnitur-nasional

In related news, the Director General of Agro-Industry at the Ministry of

Industry (Kemenperin), Putu Juli Ardika, denied that the EUDR will

negatively impact exports of products from Indonesia as, according to him,

“the majority of exporters already have certificates meeting EU standards

ensuring the manufacturing process for exported products does not damage the

forest.

See:

https://www.msn.com/id-id/ekonomi/bisnis/uu-anti-deforestasi-disebut-hambat-ekspor-%20%20komoditas-indonesia-kemenperin-dampaknya-tidak-signifikan/ar-AA1chUTK

Coordinating Minister of Economic Affairs, Airlangga Hartarto, has said that

Indonesia has 18 months remaining to act before the implementation of the

EUDR adding that the regulation would label products as originating from

high-risk, standard or low-risk countries.

He said Indonesian commodities potentially impacted by the EUDR include palm

oil and derivatives, coffee, soya, cocoa, beef and wood products.

Deforestation rate in 2022, a steady decline

The Minister of Environment and Forestry, Siti Nurbaya, reported

Indonesia's deforestation rate in recent years to the House of

Representatives. According to the Minister, Indonesia's deforestation rate

continues to decline year by year. She revealed that in 2015 Indonesia's

deforestation rate was recorded at 1.09 million hectares but it had fallen

to 460,000 hectares in 2019.

The rate of deforestation fell again in 2021 to 110,000 hectares. The

Minister revealed that in 2022 deforestation extended over 107,000 hectares.

She explained that, to monitor deforestation, the Directorate General of

Forestry Planning and Environmental Management has developed a National

Forestry Monitoring System (Simontana) that records the condition of

Indonesia's forests.

See:

https://forestinsights.id/laju-deforestasi-indonesia-tahun-2022-menteri-lhk-angkanya-terus-menurun/

Social forestry creating economic growth in villages

The Minister of Environment and Forestry has said that the concept

of social forestry, which gives communities the right to manage forests in a

sustainable manner, can create economic growth in villages. Communities can

secure social forestry management rights through five schemes: village

forest management schemes, community forestry, community plantation

forestry, customary forest and partnership schemes.

The Minister said that social forestry has also expanded to the downstream

sector so that communities can now develop into productive communities.

See:

https://en.antaranews.com/news/285111/social-forestry-creating-new-economic-growth-in-villages-minister

Seek export opportunities from US-China trade dispute

Indonesia must optimise opportunities arising from the ongoing

trade dispute between the United States and China according to the

Coordinating Minister for Economic Affairs, Airlangga Hartarto. He said that

Indonesia has become a member of the first regional cooperation group to

focus on supply chain issues namely the Indo-Pacific Economic Framework

(IPEF).

The other IPEF members include Brunei, Fiji, Singapore, Thailand, Malaysia,

Vietnam, Australia, India, Japan, New Zealand, South Korea, the Philippines

and the United States.

IPEF member countries have committed to realising economic cooperation

involving the private sector as well as implementing technical assistance

and capacity-building programmes.

See:

https://en.antaranews.com/news/285141/indonesia-must-take-advantage-of-us-china-trade-war-minister

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Indonesia.

See:

https://www.itto-ggsc.org/static/upload/file/20230714/1689299252208888.pdf

5.

MYANMAR

Indications of decline in timber

exports

For the first quarter of 2023-24 timber export earnings have been

reported at US$17.3 million which is about half of the value in the same

period of 2022-23 (US$34.5 million) according to to lcal media, Eleven News.

In the last financial year timber exports were in fifth position in export

rank at US$140 million after manufactured products (including garments) and

agricultural, mineral and maritime products. Wood product exporters say

order levels have fallen as many previous buyers of Myanmar wood products

have withdrawn their business.

Foreign investment declines sharply

Foreign investment in Myanmar fell 60% in the first quarter of this

year compared to the same quarter in 2022 according to figures from the

Directorate of Investment and Company Administration (DICA).

In the first quarter the Myanmar Investment Commission approved US$178

million in foreign investment, down from US$402 million in the same period

last year, which was down 50% from the first quarter 2021.

In FY2022-23, the first full fiscal year during which the current government

had control of the economy, Myanmar received only US$1.6 billion of foreign

investment with Singapore being the biggest investor. China and Thailand

were the second and third largest investors.

The reasons for the decline in FDI are said to be political instability,

management of the financial sector as well as infrastructure issues

especially power supplies.

The World Bank said in its Myanmar Economic Monitor that even though there

were signs of a pick-up in domestic investment in the second half of 2022

foreign investment remains weak and GDP for this year, while expanding a

modest 3%, would be 13% lower than it was in 2019.

See:

https://www.irrawaddy.com/business/economy/foreign-investment-in-myanmar-plunges-60-on-year-in-first-quarter.html

Micro finance lender withdrawing from Myanmar

Myanmar’s largest micro lender, Pact Global Microfinance Fund

(PGMF), is closing its operations in Myanmar saying demands by the

government had made it impossible to continue its efforts to serve

low-income households, including those with no access to the formal banking

system.

PGMF is the microfinance unit of PACT, an international nongovernmental

organisation. PGMF said new regulations, as well the demands of the regime

to hand over its assets, made it impossible to continue operating in

Myanmar.

PGMF announced its closure after forgiving more than US$156 million in

outstanding loans to 890,000 borrowers and setting aside money to repay

investors. The fund has been providing micro loans, primarily to women in

rural areas for more than 25 years.

See:

https://www.irrawaddy.com/news/burma/myanmar-junta-drives-largest-micro-lender-out-of-business.html

6.

INDIA

Innovation and worker productivity key

to growth

Goldman Sachs Research has produced long-term forecasts for India’s

economy saying the country has made stunning progress in innovation and

technology and while the country has demographics to drive growth that will

not be the only driver.

According to Goldman Sachs “innovation and increasing worker productivity

are going to be important for the world’s fifth-biggest economy. In

technical terms, that means greater output for each unit of labour and

capital in India’s economy”.

See:https://www.goldmansachs.com/intelligence/pages/how-india-could-rise-to-the-worlds-second-biggest-economy.html

and

https://www.goldmansachs.com/intelligence/index.html

India poised to sustain growth

The annual Economic Review for 2022-23, released by the Finance

Ministry points out the country’s impressive growth experienced in 2022-23

when most of the world economy was experiencing inflation and restrained by

monetary tightening.

The report says “Strong balance sheets and digital advancements could lead

to better credit decisions allowing India’s financial cycle to sustain for

longer periods before encountering the challenge of bad debts. Thus, India

appears poised to sustain its growth in a more durable way than before.”

The Review said that inflation emerged as the major challenge in 2022-23 for

India as it did for the rest of the world following the Russian invasion of

Ukraine and the impact of climate change.

See:

https://www.indiabudget.gov.in/economicsurvey/doc/eschapter/echap01.pdf

and

https://themeghalayan.com/strength-of-domestic-demand-works-for-economy-india-poised-to-sustain-growth-momentum-economic-review/

Indian furniture market drivers – two new reports

Two recent reports address furniture market trends in India. The

IMARC report suggests the construction industry and development of smart

city projects represent one factor influencing the furniture market. Also,

the integration of advanced technologies, such as artificial intelligence,

machine learning, internet of things, 3D printing, virtual reality and

augmented reality in furniture manufacturing could transform production.

Rising standards of living and the associated demand for quality furniture

will be another major factor along with expansion of the e-commerce sector.

See:https://www.imarcgroup.com/india-furniture-market

A media release from Mordor Intelligence on its report “Furniture industry

in India, size, share analysis - growth trends and forecasts (2023 - 2028)”

says the India furniture market size in 2023 is estimated at US$15.79

billion and is expected to reach US$26.85 billion by 2028.

Mordor points out that the Indian furniture market has changed, expanding

beyond chairs and tables to include designed interiors.

The growing middle-class, rising disposable income

and the growing number of urban homes contribute to the expansion of demand

for furniture.

Demand for furniture is also driven by the tourism and hospitality industry

and the corporate sector. The increasing number of hotels and business

offices further spurs demand for furniture in the country.

The pandemic had a serious impacted due to restrictions and lockdowns and

the manufacturing index drastically declined in early 2020, however, the

furniture industry bounced back in later half of 2020.

See:https://www.mordorintelligence.com/industry-reports/india-furniture-market

Rupee slips against the US dollar

The Indian rupee weakened early July on dollar demand from

importers. The rupee was at 82.51 to the US dollar in early July and this

has pushed up import costs. The weakness in the rupee was also in response

to the US Federal Reserve maintaining a hawkish stance on interest rates.

The rupee depreciated to Rs 82.51.

See:

https://www.bqprime.com/markets/indian-rupee-opens-weak-against-the-us-dollar-5

Home building for rural India

The latest United Nations (UN) report on population suggests that

India’s urban population will take over the rural population by the end of

2050. However, data on population distribution within the country shows that

the majority of Indians still live in rural areas (65%) despite increasing

rural-urban migration. It has been suggested that housing design and

building technologies suitable must be examined in terms of architecture

appropriate in rural areas.

See:https://www.archdaily.com/tag/united-nations

Forest clearing for infrasture development

Over the past five years India diverted over 88,903 hectares of

forest land – more than the areas of Mumbai and Kolkata put together – for

non-forestry purposes with the highest of 19,424 hectares being for road

construction followed by 18,847 hectares for mining, 13,344 hectares for

irrigation projects, 9,469 hectares for transmission lines and 7,630

hectares for defence projects, the government has said.

Junior Environment Minister, Ashwini Kumar Choubey said the Centre allowed

these diversions for various development works under the provision of the

Forest (Conservation) Act, 1980.

See:

https://timesofindia.indiatimes.com/india/89k-hectares-of-forest-land-diverted-for-development-projects-in-5-years/articleshow/99309089.cms

7.

VIETNAM

Wood and Wood product (W&WP) trade

highlights

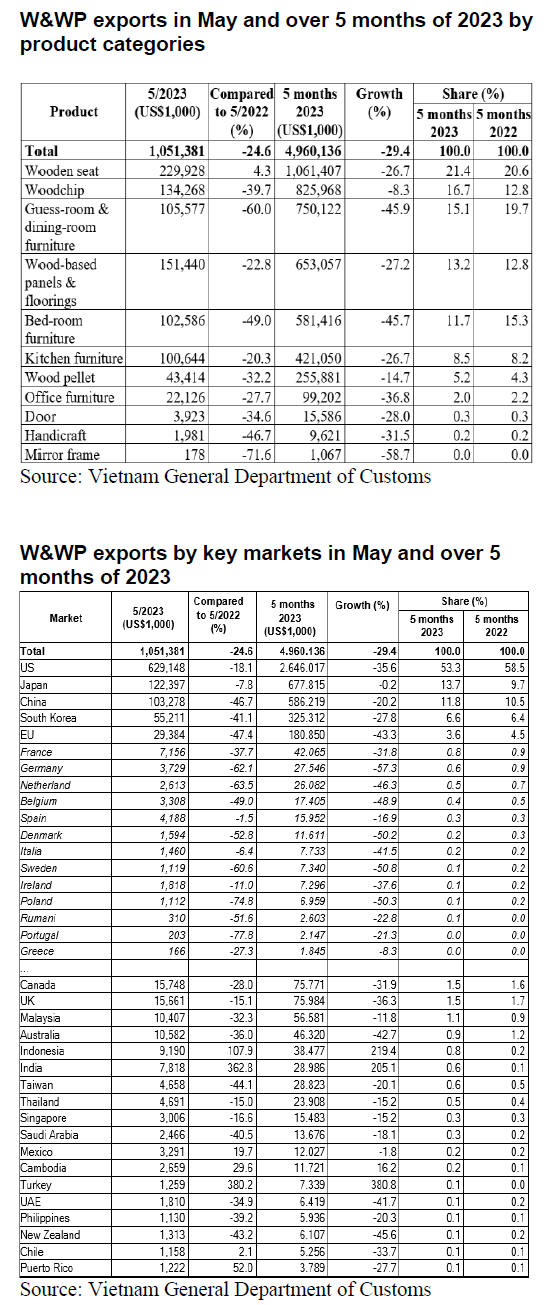

In June 2023 W&WP exports reached US$1.2 billion, up 14% compared

to May 2023 but down 15% compared to June 2022. WP exports, alone accounted

for US$868 million, up 14% compared to May 2023 but down 7% compared to June

2022.

In the first 6 months of 2023 W&WP exports totalled US$6.2 billion,

year-on-year down 27%. The export of WPs contributed US$4.2 billion, down

30% over the same period in 2022.

Vietnam's imports of logs and sawnwood in June 2023 amounted to 569,000 cu.m

worth US$199.2 million, up 25% in volume and 25% in value compared to May

2023. Compared to June 2022 imports were up 3% in volume but down 12% in

value.

In the first 6 months of 2023 imports of logs and sawnwood are estimated at

2,177 million cu.m, worth US$777.6 million, down 25% in volume and 31% in

value over the same period in 2022.

Vietnam's exports of NTFPs (rattan, bamboo and other minor NTFPs) in May

2023 reached US$61,835 million, down 1.5% compared to April 2023 and down

12% over the same period in 2022. Over the first 5 months of 2023, Vietnam's

NTFP exports totalled US$289.93 million, down 30% over the same period in

2022.

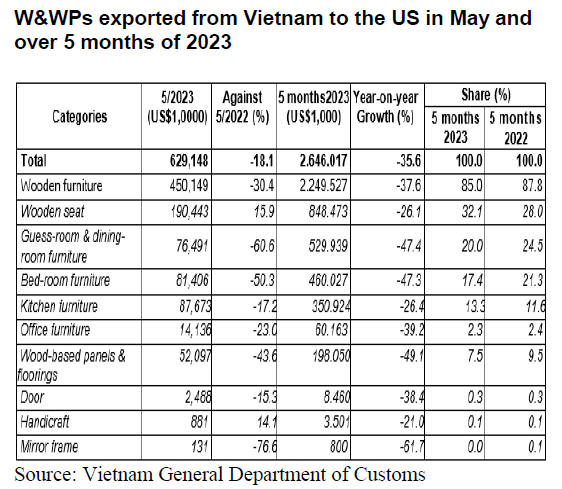

W&WP exports to the US in June 2023 reported at US$628.3 million, down 18%

compared to June 2022. In the first 6 months of 2023 W&WP exports to the US

are estimated at US$3.3 billion, down 33% over the same period in 2022.

In June 2023 exports of kitchen furniture stood at US$100.5 million, down

23% compared to June 2022. In the first 6 months of 2023 exports of kitchen

furniture totalled US$521.6 million, year-on-year down 26%.

Domestic wood harvest and reforestation

In the first 5 months of 2023 the newly planted forest area is

estimated at 97,900 ha, up 2.5% over the same period last year whilst the

number of newly planted scattered trees reached 41.7 million stems, up 5%.

The volume of wood harvested from concentrated commercial plantations is

reported at 6.6 million cu.m, up 3.3%.

In this period, 886.7 ha of forests have been destroyed, up 78% over the

same period last year. Of this, the area of forests damaged by illegal

cutting and clearing accounted for 444.5 ha, down 1.4%, while the area of

burnt forests is 422.2 ha, 11.7 times higher year-on-year.

Vietnam’s wood raw material suppliers

In the first 5 months of 2023 the volume of logs and sawnwood

imported from major sources such as EU, Cambodia, China, Thailand, Laos,

Chile, Brazil, New Zealand dropped against the same period in 2022, whilst

imports from other markets, including the US, Malaysia, Angola, Indonesia,

Canada, Namibia increased.

Imports from the EU accounted for 15% of total imports reaching 264,700 cu.m,

worth US$81.0 million, down 14% in volume and 20% in value over the same

period in 2022.

Imports of logs and sawnwood from Cameroon decreased by 2.5% in volume but

were up 3% in value over the same period in 2022, reaching 225,500 cu.m,

worth US$99.4 million, accounting for 13% of total imports.

Imports from Chinat decreased by 38% in volume and 45% in value over the

same period in 2022 reaching 203,000 cu.m, worth US$98.0 million and

accounted for 11% of total log and sawnwood imports.

Imports of logs and sawnwood from some suppliers decreased against the same

period in 2022 (from Thailand 10%; Laos by 19%; Chile by 30%; Brazil by 54%;

New Zealand by 24% and Congo by 32%).

However, imports of logs and sawnwood from the US market increased by 2.4%

in volume but down 9% in value over the same period in 2022 reaching 216,300

cu.m, worth US$93.0 million and accounted for 12% of total imports.

Increased imports in the first 5 months of 2023 came from Malaysia (34% up);

Angola (15% up); Indonesia (64% up); Canada (6%); Namibia (49%).

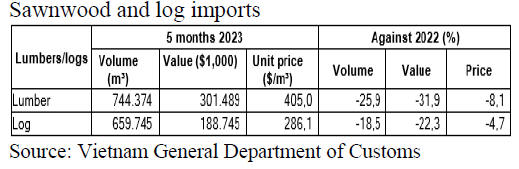

Fluctuation of import price

In the first 5 months of 2023 the price of logs and sawnwood

imported into Vietnam averaged at US$359.2/cu.m, down 6.7% over the same

period in 2022.

In particular, the price of logs and sawnwood from the EU decreased by 6.4%

over the same period in 2022, to US$306/cu.m; from the US prices fell 11% to

US$430.6/cu.m; from China 11%, to US$482.4/cu.m; Laos 11%, to US$479.6/cu.m.

Looking ahead

Vietnam's exports of wood and wood products in the first 6 months

of this year plummeted by 279% over the same period in 2022, with the total

export value falling to US$6.2 billion. The reasons behind the worsened

situation of Vietnam’s W&WP trade is attributed to the downturn of the

global economy, the impacts of inflation and rising interest rate in major

markets for wooden furniture from Vietnam.

Trade protection countermeasures (antidumping/subsidy and countervailing

investigations and possible duties imposed on W&WP exported from Vietnam)

has accelerated the hardship of Vietnamese entrepreneurs.

Due to the shortage of customer orders many Vietnamese wood operators have

to reduce production and reduced the workforce.

There are, however, signals of improvement. The growth rate of W&WP export

earnings from the US market in June is minus 18% instead of the minus 27%

over the first 6 months of 2023. The drop of W&WP exports seems to have

reached the bottom and Vietnamese wood businesses are expecting more orders

in the second half and into the beginning of next year.

Accelerated market promotion through trade fairs, technology innovation to

upgrade business efficiency, improved business governance, building capacity

to reduce trade protection risks, better utilisation of FTAs and a radical

shift towards green trade and green growth, are seen as key remedies to

overcome the current problems associated with global market weakness.

Vietnam’s W&WP exports to the US declining

The US has consistently accounted for around half of Vietnam’s W&WP

exports so the decline in US demand has impacted the entire wood sector in

Vietnam.

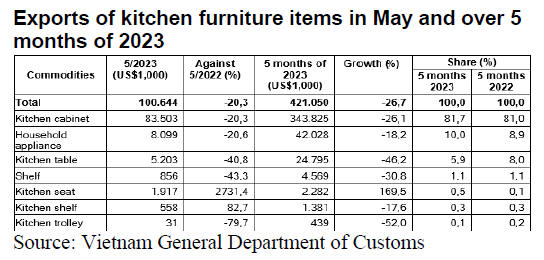

Exports of kitchen furniture plummeting

Although there are signs of recovery in the world economy and that

of key markets for made-in-Vietnam kitchen furniture there are still acute

problems. However, the kitchen furniture market is expected to recover from

the second half of 2023 as stocks in major consuming countries, especially

the US, are declining.

Export categories

In the first 5 months of 2023 amongst kitchen furniture categories

kitchen cabinets were the main product accounting for US$343.8 million, down

26% over the same period in 2022. Kitchen cabinets from Vietnam are mainly

exported to the US (94%) followed by Japan, Canada, UK and Australia.

Kitchen appliances are the second largest categories with exports at US$42

million, down 182% over the same period in 2022. Household appliances used

in the kitchen are mainly exported to Japan, USA, Korea and the EU.

In the first 5 months of 2023, along with above-mentioned items, there are a

number of kitchen items being exported including kitchen tables (US$24.8

million, down 46% over the same period in 2022); kitchen shelves (US$4.6

million, down 31%). In contrast exports of kitchen chairs surged to US$2.3

million.

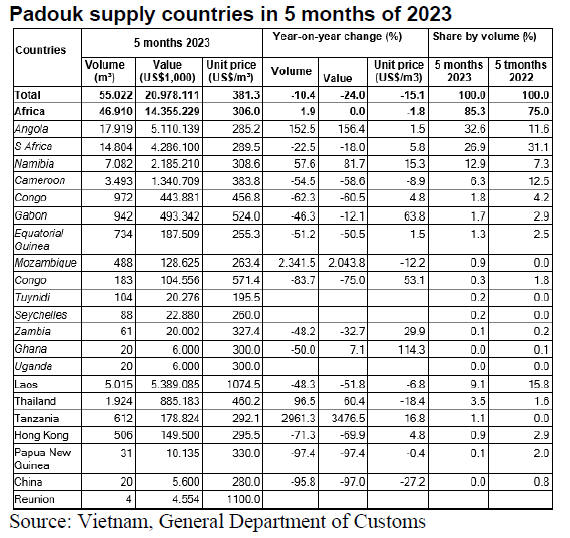

Africa the top supplier of padouk

Vietnam's padouk imports from Africa accounted for 85% of total

padouk imports in the first 5 months of 2023, up 1.9% in volume over the

same period in 2022, reaching 46,900 cu.m. worth US$14.4 million.

According to preliminary statistics, Vietnam's padouk imports in June 2023

reached 9,100 cu.m, worth US$4.0 million, up 0.5% in volume and 2% in value

compared to May 2023. Compared to June 2022 imports decreased by 2.5% in

volume and 0.3% in value.

Over the first 6 months of 2023, padouk imports amounted to 64,000 cu.m,

worth US$24.9 million, down 9.5% in volume and 21% in value over the same

period in 2022.

In the first 5 months of 2023 Vietnam imported 49,400 cu.m of padouk

sawnwood worth US$19.0 million, down 0.3% in volume and 18% in value over

the same period in 2022. Import volumes of padouk logs stood at 5,600 cu.m,

worth US$2.0 million, down 53% in volume and 55% in value over the same

period in 2022.

Price fluctuations

Statistics show that the average import price of padouk wood in the

first 5 months of 2023 stood at US$381./cu.m, down 15.1% over the same

period in 2022.

The import price of padouk wood from Africa dropped by 2% over the same

period in 2022 down to US$306/cu.m; from Laos down 7% to US$1.074.5/cu.m;

from Thailand down 18% to US$460.2/cu.m; from Papua New Guinea down 0.4% to

US$330.0/cu.m and from China down 27% to US$280.0/cu.m.

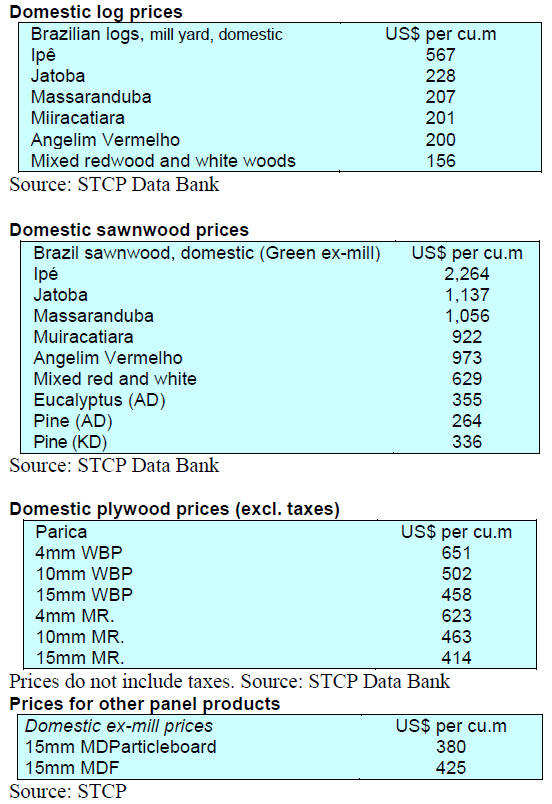

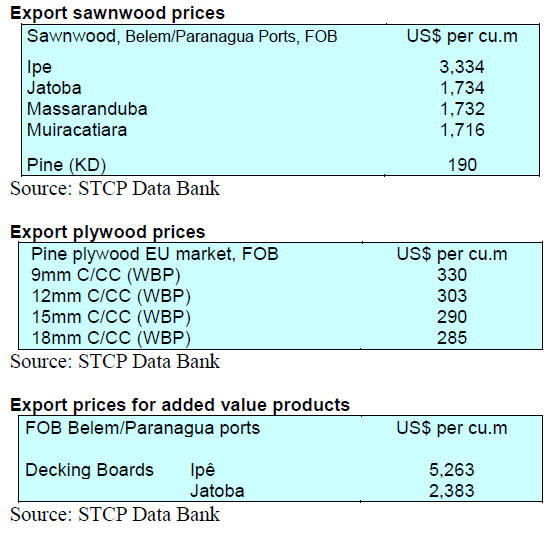

8. BRAZIL

New tools to track forest products

Deforestation in the Amazon reached 11,500 sq. km representing the

highest deforestation rate in 15 years despite several initiatives to combat

this including the development of tracking systems.

The new version of the Document of Forest Origin (DOF – Documento de Origem

Florestal) system, called "DOF+ Traceability," requires the issuance of

mandatory permits for the transport of forest products as well as the

registration of the industrial processing units.

The key objective is to enable traceability of wood products throughout the

production chain up to commercialisation and consumption to curb fraud and

ensure the legality. “DOF+ Traceability” is an auditable system that allows

users, research institutions and inspection/auditing agencies access to

information regarding the origin of timber.

Other technologies such as stable isotope analysis, near-infrared

spectroscopy and genomic identification are being developed to help in

tracing the origin of timber and products and ensure their legality.

Despite these efforts there are challenges in establishing a comprehensive

traceability system as document fraud can still occur and the sequential

numbering on logs can be counterfeited.

Additionally, it is necessary to address the sophisticated practices of

illegal loggers such as inflating timber credits and manipulating conversion

coefficients at sawmills. Therefore, it is crucial to combine different

tools and methodologies to ensure process transparency and improving

traceability procedures.

It is also important to invest in public policies that encourage the

commercial plantations of native timber species to reduce dependence on

extractivism and preserve the remaining forests.

See:

https://revistapesquisa.fapesp.br/novas-ferramentas-para-rastrear-produtos-florestais/

AI for forest management in the Amazon

Researchers in the Amazon region are utilising Artificial

Intelligence (AI) to facilitate ecological and forest management studies.

These new automated tools have been used to estimate forest biomass, carbon

and commercial timber volumes in tropical forests.

AI has proven to be effective in replacing repetitive and labour-intensive

tasks. The geo-referencing of areas in the Amazon is an example of a

successful application of AI which assists in arduous tasks. The use of

these technologies has also contributed to mapping the diversity and

distribution large trees providing crucial information for the conservation

and sustainable management of forest resources as well as helping in

combating illegal deforestation.

A researcher of the State University of Amapá has examined the use of AI for

ecological and forest management research in the Amazon. Using advanced

techniques such as Random Forest Machine Learning they have developed models

capable of mapping the diversity and density of large trees in the Amazon

biome. They also utilise AI algorithms to estimate forest biomass, carbon

and commercial timber volumes in tropical forests. These data are essential

to understand the dynamics of forest ecosystems and contribute to

conservation strategies and sustainable forest management.

One application is the use of AI in scenarios of climate change in the

Amazon. To predict the potential distribution of large trees or rare species

and their habitat according to IPPC global climate models researcher

investigated how tropical forests may be affected and how adaptive resources

management could be applied. This information is crucial for the development

of conservation strategies and mitigation of negative environmental impacts.

See:

https://g1.globo.com/ap/amapa/natureza/amazonia/noticia/2023/06/29/inteligencia-artificial-e-usada-por-pesquisadores-do-ap-em-estudos-de-ecologia-e-manejo-florestal-na-amazonia.ghtml

Fluctuations in furniture exports

Brazilian exports of furniture and mattresses fell by 15% in April

2023 compared to the previous month and were worth US$59.0 million according

to IEMI Market Intelligence.

Despite the decline the performance in April is still better than in January

and February, indicating a relative improvement in exports in recent months.

However, the positive results in March and April were not sufficient to

reverse the sector's year to date decline.

In the first four months of 2023 furniture exports

amounted to just over US$261 million, compared to US$302 million in the same

period of 2022.

Exports to the United States continue to stand out accounting for 33% of

total exports in April 2023 followed by Uruguay and Chile with 9.5% and 6.9%

respectively. The Brazilian Furniture Industry Association (ABIMÓVEL)

highlights the technical differentials of Brazilian furniture including the

quality of wood and other natural raw materials in addition to

sustainability concern and the design integrated into the national industry.

ABIMÓVEL also mentions the opportunities found in Europe with countries such

as the United Kingdom, France and the Netherlands being among the main

destinations for Brazilian exports.

The furniture sector is optimistic for the first half of 2023, driven by

external demand and the ability to offer competitive products but stresses

the importance of trade agreements, export incentive policies and customs

debureaucratisation to sustain the pace of exports.

See:

http://abimovel.com/flutuacoes-mensais-marcam-exportacoes-brasileiras-de-moveis-e-colchoes-em-2023/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

See:

https://www.itto-ggsc.org/static/upload/file/20230714/1689299252208888.pdf

9. PERU

ADEX proposes forest seed bank

Enrique Toledo, the Vice Pesident of the Association of Exporters

(ADEX) Timber Committee proposed the National Institute of Agrarian

Innovation (INIA) operate a forest seed bank for use in the reforestation of

degraded Amazonian land. Toledo suggested development of a seed bank must be

complemented with genetic research so that good ecological restoration will

be guaranteed.

Over the past 60 years around 10 million hectares of forests have been lost

due to migratory agriculture, cattle ranching, illegal coca cultivation and

illegal mining. Over time much of the land was abandoned due to a loss of

fertility causing ecological damage.

Private companies have reforested 40,000 hectares of the Peruvian jungle

according to ADEX.

The reforestation of 1 million hectares (land deforested and degraded by

migratory cultivation) could generate earnings of around US$1.5 billion from

wood product manufacturing according to ADEX. In addition, such an effort

would create around 400,000 direct and indirect jobs in forestry, forest

harvesting, timber industries and service sectors.

SERFOR and ADEX favor traceability

Officials and specialists from the National Forestry and Wildlife

Service (SERFOR) together with members of the Timber and Timber Industries

Committee of the Exporters Association (ADEX) exchanged experiences on the

processes of marketing, transformation, transportation, registration of

information and issuance of guides for forest transport and use of wood.

SEFOR announced progress in developing and operating the information system

related to the issuance of forest transport guides through the forest

transport guides (ER-GTF), a digital tool that is part of the Module of

Control of the National Forestry and Wildlife System (MC-SNIFFS).

The processes for issuing export permits for species included in the

Convention on International Trade in Endangered Species of Wild Fauna and

Flora (CITES) and the procedure for control and visual inspection of timber

products at posts were explained.

The main exporting companies of the timber industry together with the

representatives of ADEX expressed their optimism regarding the progress made

by SERFOR and the joint effort to strengthen the processes of the timber

export procedure included in CITES.

Approval of domestic panel products for school furniture

Wood product manufacturers in Ucayali have been informed that 16

wood based panel products have been approved for wooden school furniture

production as they comply with the quality standards and will now be adopted

in public tenders.

Representatives of the Regional Chamber of the Second Transformation of

Ucayali Wood (CRESETMU) and the Industrial Chamber of the Second

Transformation of Ucayali Wood (CISETMU) recorded their satisfaction with

this ruling. They offered suggestions on new school furniture designs which

will further encourage local businesses.

First regional forest control roundtable in

Ucayali

The Regional Governor of Ucayali, Manuel Gambini, was present at

the first meeting of the Regional Roundtable for Control and Surveillance of

Forestry and Wildlife and highlighted the work that has been carried out

against illegality and mentioned that it is necessary to sensitise

communities on this issue.

Reports on the loss of forest cover in the present year were presented at

the Regional Roundtable and its relationship with the National Forest and

Wildlife Control and Surveillance System (SNCVFFS) was explained.