|

Report from

North America

May housing starts encouraging

A press release for the US Census Bureau has reported

privately‐owned housing units authorised through building permits in May

were at a seasonally adjusted annual rate of 1,491,000. This is 5.2%

above the revised April rate of 1,417,000, but is 12.7% below the May

2022 rate of 1,708,000 units.

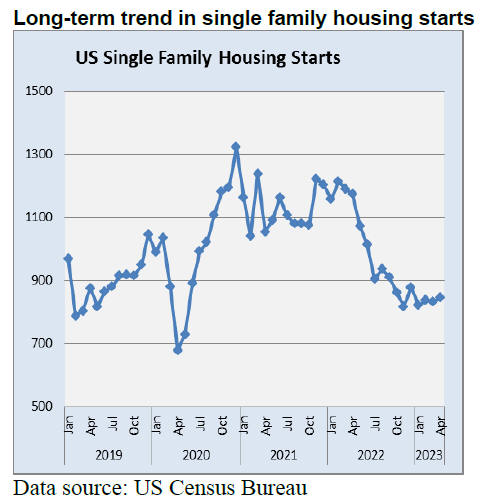

Single‐family authorisations in May were at a rate of 897,000; this is

4.8% above the revised April figure of 856,000. Authorisations of units

in buildings with five units or more were at a rate of 542,000 in May.

Housing starts in May were at a seasonally adjusted annual rate of

1,631,000. This is 21.7% above the revised April estimate of 1,340,000

and is 5.7 % above the May 2022 rate of 1,543,000.

Single‐family housing starts in May were at a rate of 997,000; this is

18.5 % above the revised April figure of 841,000. Housing completionsin

May were at a seasonally adjusted annual rate of 1,518,000. This is 9.5%

above the revised April estimate of 1,386,000 and is 5.0% above the May

2022 rate of 1,446,000.

Single‐family housing completions in May were at a rate of

1,009,000.This is 3.9% above the revised April rate of 971,000. Keen

interest from would-be home buyers is creating strong demand for new

homes. These buyers continue to face a lack of options in the resale

market. This is the second month in a row that starts are up. The pace

of construction was the highest since last April, when starts hit a 1.8

million pace. The surge in construction this spring was led by the

Midwest.

See: https://www.census.gov/construction/nrc/current/index.html

The Canadian housing market has gained strength since March of

this year and analysts anticipate the impact of these recent gains on

affordability to last for some time. Housing demand is particularly

strong in Canada as surging population growth, a tight labour market and

accumulated pandemic-era savings are driving demand according to a

Desjardins report.

However steam has been taken out of the market as the the Bank of Canada

raised its key interest rate on 7 June 7 and this has put downward

pressure on home prices which had rebounded faster than the Bank had

expected.

See:

https://www.mpamag.com/ca/mortgage-industry/market-updates/housing-market-recovery-likely-to-negatively-impact-affordability-desjardins/451017

In related news, US existing-home sales increased in May according to

the National Association of REALTORS. Sales were mixed among the four

major US regions with the South and West posting improvements and the

Northeast and Midwest experiencing pullbacks. All four regions

experienced year-over-year decline in sales.

New homes are selling at a pace as in pre-pandemic times because of

abundant inventory in that sector. However, existing home sales activity

is down as the inventory is roughly half the level of 2019.

Total existing-home sales1 – completed transactions that include

single-family homes, townhomes, condominiums and co-ops – rose 0.2% from

April to a seasonally adjusted annual.

See:

https://www.bls.gov/news.release/empsit.nr0.htm

Receding inflation worries lifts consumer sentiment

US consumer sentiment continued to improve through to the end

of June while short-term inflation expectations were at a two-year low.

The University of Michigan consumer sentiment survey for June showed a

9% surge in overall sentiment and an even stronger surge in expectations

for the future. Receding inflation worries are the main driver of this

change.

Consumer sentiment rose 9% in June across all demographic groups this

striking upswing reflects a recovery in attitudes generated by the

resolution of the debt ceiling crisis along with more positive feelings

over softening inflation.

Views of their own personal financial situation were unchanged, however,

as persistent high prices and expenses continued to weigh on consumers.

There are signs June was a turning point in consumer’s gloomy views of

the economic situation.

See:

https://www.axios.com/2023/06/30/us-consumer-sentiment-surge

and

http://www.sca.isr.umich.edu/

|